Summary Of the Markets Today:

- The Dow closed down 24 points or 0.06%,

- Nasdaq closed up 0.88%, (Closed at 18,188, New Historic high 18,188)

- S&P 500 closed up 0.51%, (Closed at 5,537, New Historic high 5,539)

- Gold $2,365 up $31.10,

- WTI crude oil settled at $84 up $0.99,

- 10-year U.S. Treasury 4.354 down 0.081 points,

- USD index $105.35 down $0.37,

- Bitcoin $59,862 down $2,178 or 3.51%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private sector employment increased by 150,000 jobs in June 2024 and annual pay was up 4.9% year-over-year, according to the ADP® National Employment Report. I know some are spinning this as a low number – the facts are that 150,000 employment gains supports economic growth; If anything, the ADP numbers are slightly trending up; And overall both ADP and the BLS’s numbers are showing adequate employment growth. Nela Richardson, chief economist, ADP adds:

Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.

U.S.-based employers announced 48,786 cuts in June 2024, down 23.6% from the 63,816 cuts announced one month prior. It is 19.8% higher than the 40,709 cuts announced in the same month in 2023. Andrew Challenger, Senior Vice President and workplace expert for Challenger, Gray & Christmas, Inc. stated:

June is typically a low month for job cut announcements, as most companies are midyear or at the end of their fiscal years. The months following fiscal year ends tend to have a spike in cuts, as those plans are implemented. Over the last decade, job cuts have primarily been announced during the first half of the year. Prior to 2013, major announcements would bookend the year.

The US trade balance was improving until March 2023 but recently the trade balance has been deteriorating. The deficit increased from $74.5 billion in April (revised) to $75.1 billion in May 2024, as exports decreased more than imports. The graph below shows imports are growing much faster than exports.

New orders for manufactured goods in May 2024 was up 0.9% year-over-year (down 0.3% year-over-year inflation adjusted). Manufacturing remained in a recession in May.

In the week ending June 29, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,500, an increase of 2,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,000 to 236,250.

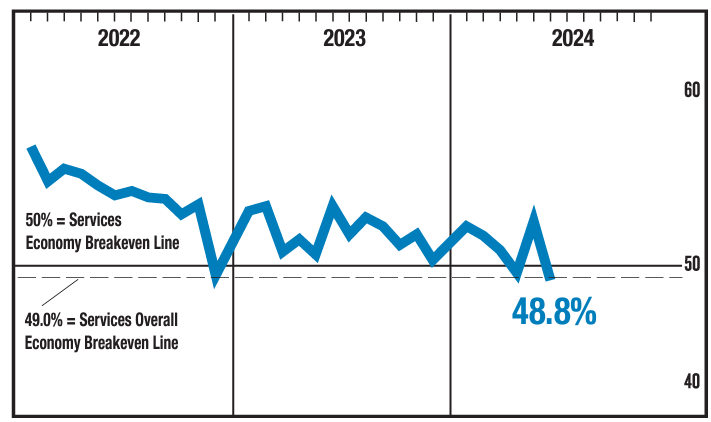

In June 2024, the Services Purchasing Manager Index registered 48.8%, 5 percentage points lower than May’s figure of 53.8%. The reading in June was a reversal compared to May and the second in contraction territory in the last three months. Before April, the services sector grew for 15 straight months following a composite index reading of 49 percent in December 2022; the last contraction before that was in May 2020 (45.4 percent). The Business Activity Index registered 49.6 percent in June, which is 11.6 percentage points lower than the 61.2 percent recorded in May and the first month of contraction since May 2020. The New Orders Index contracted in June for the first time since December 2022; the figure of 47.3 percent is 6.8 percentage points lower than the May reading of 54.1 percent. The takeaway here is that the services industry entering contraction territory is a recession flag.

The Minutes of the Federal Open Market Committee for June 11–12, 2024 shows significant discussion on inflation and the federal funds rate which pundits want reduced. Highlights of the minutes which I think are significant are detailed below:

In their discussion of inflation developments, participants noted that after a significant decline in inflation during the second half of 2023, the early part of this year had seen a lack of further progress toward the Committee’s 2 percent objective. Participants judged that although inflation remained elevated, there had been modest further progress toward the 2 percent goal in recent months … participants suggested that a number of developments in the product and labor markets supported their judgment that price pressures were diminishing. In particular, a few participants emphasized that nominal wage growth, though still above rates consistent with price stability, had declined, notably in labor-intensive sectors.

… Participants remarked that demand and supply in the labor market had continued to come into better balance. Participants observed that many labor market indicators pointed to a reduced degree of tightness in labor market conditions. These included a declining job openings rate, a lower quits rate, increases in part-time employment for economic reasons, a lower hiring rate, a further step-down in the ratio of job vacancies to unemployed workers, and a gradual uptick in the unemployment rate.

… Several participants also suggested that the [BLS] establishment survey may have overstated actual job gains.

… Participants generally observed that continued labor market strength could be consistent with the Committee achieving both its employment and inflation goals, though they noted that some further gradual cooling in the labor market may be required.

… Participants observed that a lower rate of output growth this year could aid the disinflation process while also being consistent with a strong labor market. Participants generally viewed the Committee’s restrictive monetary policy stance as having a restraining effect on growth in consumption and investment spending and as contributing to a gradual slowing in the pace of economic activity. A couple of participants particularly stressed that the Committee’s past policy tightening had contributed to higher rates for home mortgage loans and other longer-term borrowing, which were moderating spending and production, including households’ discretionary purchases and residential construction activity.

… Some participants highlighted reasons why inflation could remain above 2 percent for longer than expected. These participants pointed to risks that inflation could stay elevated as a result of worsening geopolitical developments, heightened trade tensions, more persistent shelter price inflation, financial conditions that might be or could become insufficiently restrictive, or U.S. fiscal policy becoming more expansionary than expected; the latter two scenarios were also seen as implying upside risks to economic activity.

… In discussing the outlook for monetary policy, participants noted that progress in reducing inflation had been slower this year than they had expected last December. They emphasized that they did not expect that it would be appropriate to lower the target range for the federal funds rate until additional information had emerged to give them greater confidence that inflation was moving sustainably toward the Committee’s 2 percent objective.

… Some remarked that the continued strength of the economy, as well as other factors, could mean that the longer-run equilibrium interest rate was higher than previously assessed, in which case both the stance of monetary policy and overall financial conditions may be less restrictive than they might appear. A couple of participants noted that the longer-run equilibrium interest rate was a better guide for determining where the federal funds rate may need to move over the longer run than for assessing the restrictiveness of current policy. Participants noted the uncertainty associated with the economic outlook and with how long it would be appropriate to maintain a restrictive policy stance.

Here is a summary of headlines we are reading today:

- Google’s Emissions Have Surged Nearly 50% Due to AI Energy Demand

- Shell Begins Perdido Evacuation As Hurricane Beryl Threatens Operations

- Tech Giants’ Power Needs Could Jeopardize U.S. Grid Reliability

- Oil Prices Rise As EIA Confirms Huge Crude Draw

- Oil Prices Surge as Geopolitical Risk and Crude Demand Both Rise

- Red States Win Legal Battle Against Biden’s LNG Export Restrictions

- New Field Starts Oil Production in U.S. Gulf of Mexico

- Fed says it’s not ready to cut rates until ‘greater confidence’ inflation is moving to 2% goal

- S&P 500, Nasdaq close at fresh records as investors look past soft economic data: Live updates

- 10-year Treasury yield tumbles after weak economic data

- FOMC Minutes Show “Vast Majority” Expect Economy To Cool, See Deflationary Effects Of AI

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Xi Jinping and Putin Strengthen Eurasian Influence at SCO SummitChinese leader Xi Jinping, Russian President Vladimir Putin, and other leaders who are members of the Shanghai Cooperation Organization (SCO) will kick off a two-day summit in Kazakhstan starting on July 3 as the bloc is poised to grow again. But where does this club of mostly illiberal states fit into Beijing and Moscow’s wider plans? Finding Perspective: The SCO is helmed by China and Russia, but also includes India, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Uzbekistan, and Tajikistan as members. This year’s summit is headlined by the… Read more at: https://oilprice.com/Geopolitics/International/Xi-Jinping-and-Putin-Strengthen-Eurasian-Influence-at-SCO-Summit.html |

|

Google’s Emissions Have Surged Nearly 50% Due to AI Energy DemandGoogle’s greenhouse gas emissions have climbed over 48% since 2019, with the search giant’s increasing dependency on AI in its data centers dramatically increasing its power consumption. In the company’s 2024 Environmental Report, Google has now conceded that there’s “significant uncertainty” around reaching its target, saying it “won’t be easy” to reach its “extremely ambitious” goal of achieving net zero emissions by 2030. Back in 2020, Google parent Alphabet… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Googles-Emissions-Have-Surged-Nearly-50-Due-to-AI-Energy-Demand.html |

|

India’s Steel Industry Battles Cheap Chinese ImportsVia Metal Miner With a new government in place following the recent general elections, Indian steel manufacturing firms are again clamoring for the imposition of more import duties and other measures to curb cheap steel imports from China. India ended up being a net importer of steel during the April-March 2024 period. According to provisional government data, this trend persisted, with finished steel imports reaching a five-year high in April and May. Following the renewed demands for import curbs, rumors say that Indian steel… Read more at: https://oilprice.com/Energy/Energy-General/Indias-Steel-Industry-Battles-Cheap-Chinese-Imports.html |

|

Shell Begins Perdido Evacuation As Hurricane Beryl Threatens OperationsShell announced on Wednesday that it had safely paused some drilling operations in the Gulf of Mexico as Hurricane Beryl was preparing to deliver a massive blow to Jamaica, Reuters reported, noting that so far no impact on GOM production had been noted. On Wednesday, Shell said it had begun evacuating non-essential crew at its Perdido asset in the Gulf of Mexico, as it launched the process of shutting in oil production under the threat of Hurricane Beryl, which reached a Category 5 level earlier in the day, according to Reuters. After… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Begins-Perdido-Evacuation-As-Hurricane-Beryl-Threatens-Operations.html |

|

Tech Giants’ Power Needs Could Jeopardize U.S. Grid ReliabilitySoaring power demand for data centers is prompting Big Tech to seek a reliable 24/7 electricity supply from zero-emission sources to keep their green pledges intact. One source in America fits that bill—nuclear power generation. Some large technology corporations have already secured supplies from nuclear power plants in behind-the-meter agreements. And they are looking for more. The increased contracting of nuclear power from plants could strain the power grid and jeopardize its reliability at a time when electricity demand in the… Read more at: https://oilprice.com/Energy/Energy-General/Tech-Giants-Power-Needs-Could-Jeopardize-US-Grid-Reliability.html |

|

Russia’s Oil Revenues Jumped 50% Year-on-Year in JuneHigher prices for Russia’s flagship crude grade Urals boosted the Russian government’s revenues from oil in June with proceeds rising by nearly 50% from a year earlier, Bloomberg estimated on Wednesday in calculations based on data from the Russian finance ministry. The annual jump in Russia’s revenues from the oil industry suggests that Russian producers have adapted to the Western sanctions and are selling their crude to willing buyers at higher prices. In June, oil-related taxes for the Russian budget surged to $6.67 billion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Revenues-Jumped-50-Year-on-Year-in-June.html |

|

Oil Prices Rise As EIA Confirms Huge Crude DrawCrude oil prices moved higher today after the U.S. Energy Information Administration reported an inventory decline of 12.2 million barrels for the week to June 28. The inventory change compared with an inventory build of 3.6 million barrels estimated for the previous week, when the EIA also saw fuel inventories rising, which weighed on oil prices. For the last week of June, the EIA estimated draws in fuel inventories. Gasoline inventories shed 2.2 million barrels in the week to June 28, which compared with a build of 2.7 million… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Rise-As-EIA-Confirms-Huge-Crude-Draw.html |

|

Kazakhstan Exceeded Its OPEC+ Oil Output Quota in JuneEditor’s Note: Price data on Kazakhstan’s CPC crude grade can now be found on our oil prices pageNon-OPEC producer Kazakhstan, which is part of the OPEC+ output deal, raised its oil production in June, exceeding its quota under the alliance’s agreements, Reuters calculations based on data from sources showed on Wednesday. Kazakhstan’s giant oilfield Tengiz has completed planned maintenance, which raised the country’s production in June compared to May. According to Reuters calculations of output data, Kazakhstan produced… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Exceeded-Its-OPEC-Oil-Output-Quota-in-June.html |

|

Oil Prices Surge as Geopolitical Risk and Crude Demand Both RiseCrude Oil Market: Key Drivers Behind This Week’s Price Surge Light crude oil futures have climbed 2.12% this week, driven by a mix of bullish factors. Geopolitical tensions in the Middle East, an unexpectedly large draw in U.S. crude inventories, and optimistic forecasts for summer fuel demand have all contributed to pushing prices higher. As traders assess these developments against the backdrop of OPEC+ supply management and steady U.S. production growth, the oil market remains finely balanced between supply constraints and recovering demand.… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Surge-as-Geopolitical-Risk-and-Crude-Demand-Both-Rise.html |

|

An Israeli Invasion of Lebanon Could Boost the Russia-Iran AlliancePolitics, Geopolitics & Conflict If Israel invades Lebanon, Washington fears it will hasten a Russia-Iran alliance, with one geographical part of that scenario already underway in Yemen. U.S. intelligence claims (according to a Middle East news outlet) that Putin had already approached the Saudis for permission to arm the Houthis with anti-ship cruise missiles. Two unexpected outcomes in France this week after snap parliamentary elections. The far-right won a record number of votes in French snap parliamentary elections, leaving Macron’s… Read more at: https://oilprice.com/Energy/Energy-General/An-Israeli-Invasion-of-Lebanon-Could-Boost-the-Russia-Iran-Alliance.html |

|

How Worried Should Venezuela’s Maduro Be?With less than a month before Venezuelan elections, on July 28, incumbent President Nikolas Maduro has told Washington that he is now willing to restart direct talks. If Maduro wins, helped along by the banning and arrest of opposition figures, it will give him six more years to rule. According to Maduro, negotiations will start this week already, presumably looking for a pre-election win in the form of some sentiment that crippling economic sanctions will be eased. Of the nine opposition candidates, the one that everyone pays attention… Read more at: https://oilprice.com/Energy/Energy-General/How-Worried-Should-Venezuelas-Maduro-Be.html |

|

Red States Win Legal Battle Against Biden’s LNG Export RestrictionsA federal court halted President Biden’s war on America’s energy independence by reversing a temporary moratorium on permitting new licenses for liquified natural gas (LNG) exports. This is a major blow to radical climate warriors in the White House ahead of the November presidential elections. Late Monday, US District Judge James D. Cain Jr. in Louisiana ruled in favor of Louisiana and 15 other red states that had challenged the “temporary pause” on new LNG export licenses. Donald Trump appointed Judge Cain, who wrote that the pause “is… Read more at: https://oilprice.com/Energy/Energy-General/Red-States-Win-Legal-Battle-Against-Bidens-LNG-Export-Restrictions.html |

|

Talent Shortage Threatens Europe’s Nuclear RenaissanceAs many countries in Europe look to boost their nuclear power capacities and build more reactors, companies face a workforce challenge as many of the skilled force are retiring while younger generations choose energy jobs in solar and wind. European countries and companies planning major expansion in nuclear fleets are struggling to fill in thousands of skilled engineering jobs that would support the construction of nuclear reactors, which take years to complete. Companies in France are hiring back retirees and are collaborating with colleges… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Talent-Shortage-Threatens-Europes-Nuclear-Renaissance.html |

|

Nigeria Declares Oil Sector Emergency Amid Efforts to Boost ProductionNigeria’s national oil company NNPC Ltd has declared a state of emergency on production in Nigeria’s oil and gas industry as Africa’s largest oil producer struggles to boost output. NNPC believes that Nigeria needs to take urgent action to address the challenges that have plagued the oil and gas industry for years, NNPC Group Chief Executive Officer, Mele Kyari, said at an industry event this week. Raising oil production has been a key priority for the Nigerian federal government, which aims to thus boost revenues and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Declares-Oil-Sector-Emergency-Amid-Efforts-to-Boost-Production.html |

|

New Field Starts Oil Production in U.S. Gulf of MexicoThe Winterfell development in the U.S. Gulf of Mexico has started up oil production, one of the partners in the oilfield, Kosmos Energy, said on Wednesday. Winterfell, located in the Green Canyon area in the Gulf of Mexico, was discovered in 2021 at a water depth of approximately 5,400 feet (about 1,600 meters). The field has been developed via a 13-mile subsea tieback to the host platform. Houston-based Beacon Offshore Energy is the project’s operator, while the other partners include Kosmos Energy, Westlawn Americas Offshore,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Field-Starts-Oil-Production-in-US-Gulf-of-Mexico.html |

|

Fed says it’s not ready to cut rates until ‘greater confidence’ inflation is moving to 2% goalThe Federal Reserve on Wednesday released minutes from its June 11-12 meeting. Read more at: https://www.cnbc.com/2024/07/03/fed-minutes-fomc-not-ready-to-cut-rates-until-greater-confidence-inflation-is-moving-to-2percent-goal.html |

|

Vice President Kamala Harris’ past donors privately strategize in case Biden drops outVice President Kamala Harris’ allies discuss scenarios in the event that President Joe Biden decides not to keep his reelection campaign going. Read more at: https://www.cnbc.com/2024/07/03/kamala-harris-allies-strategize-in-case-biden-drops-out.html |

|

Southwest Airlines adopts ‘poison pill’ to fend off activist Elliott ManagementSouthwest adopted a shareholder rights plan to fend off an effort from activist Elliott Management to oust CEO Bob Jordan and Chairman Gary Kelly. Read more at: https://www.cnbc.com/2024/07/03/southwest-luv-activist-elliott-poison-pill.html |

|

Biden tells ally he’s weighing whether to stay in the race: ReportsThe reported conversation with the ally came amid the fallout from Biden’s devastating presidential debate with Trump. Read more at: https://www.cnbc.com/2024/07/03/-biden-tells-ally-hes-weighing-whether-to-stay-in-race-reports.html |

|

UBS sees ‘attractive’ opportunities in real estate. These dividend-yielding names are on its buy listReal estate companies are the only one of the main groups in the S&P 500 to have fallen in 2024. Read more at: https://www.cnbc.com/2024/07/03/ubs-sees-attractive-openings-in-dividend-paying-real-estate-stocks.html |

|

S&P 500, Nasdaq close at fresh records as investors look past soft economic data: Live updatesThe S&P 500 and the Nasdaq Composite closed at fresh records on Wednesday. Read more at: https://www.cnbc.com/2024/07/02/stock-market-today-live-updates.html |

|

How an approval of spot ether ETFs could impact crypto prices: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, John Glover, chief investment officer of Ledn, weighs in on what’s driving crypto prices right now and how the potential approval of spot ether ETFs could impact markets. Read more at: https://www.cnbc.com/video/2024/07/03/how-approval-spot-ether-etfs-could-impact-crypto-prices-cnbc-crypto-world.html |

|

Microsoft reaches settlement in California over claims it punished employees for taking protected time offMicrosoft has agreed to pay $14.4 million to settle claims that the company unfairly treated California employees who took protected time off. Read more at: https://www.cnbc.com/2024/07/03/microsoft-to-settle-case-on-protected-leave-for-california-employees.html |

|

Is inflation Biden’s or Trump’s fault? The answer isn’t so simple, economists sayBiden and Trump traded barbs on the state of the U.S. economy during their first debate. But who or what is really responsible for inflation? Read more at: https://www.cnbc.com/2024/07/03/is-inflation-bidens-or-trumps-fault-the-answer-isnt-so-simple.html |

|

10-year Treasury yield tumbles after weak economic dataThe benchmark 10-year yield, used to price everything from mortgages to credit cards, slipped for another session. Read more at: https://www.cnbc.com/2024/07/03/us-treasurys-ahead-of-key-economic-data-fed-meeting-minutes-.html |

|

This ‘bucket strategy’ could lower your taxes in retirement — here’s how to maximize itMost Americans aren’t planning to reduce taxes on retirement income. Here’s how the “bucket strategy” could help, experts say. Read more at: https://www.cnbc.com/2024/07/03/lower-your-taxes-in-retirement.html |

|

Gen Zers and millennials are ‘quiet vacationing’ during 4th of July week instead of taking PTOYounger employees are “quiet vacationing” during the summer months to cope with constraints on PTO and increased feelings of burnout, according to new research. Read more at: https://www.cnbc.com/2024/07/03/gen-zers-millennials-quiet-vacation-during-fourth-of-july-week.html |

|

The America trade: These stocks highly exposed to the U.S. are primed to outperformThese stocks with strong exposure could have further room to run, analysts say. Read more at: https://www.cnbc.com/2024/07/03/the-america-trade-these-stocks-highly-exposed-to-the-us-are-primed-to-outperform.html |

|

Fact-Checking The ‘Fact-Checking’ New York TimesAuthored by Daniel Oliver via American Greatness, “They” just can’t let Donald Trump go. For them, Donald Trump is Evil personified. But not for the rest of the world.

Here are some of the New York Times’s fact-check charges against Trump; here is why people no longer trust the New York Times. Social Security Trump said: “But Social Security, he’s [Biden’s] destroying it because millions of people are pouring into our country and they are putting them onto Social Security.” The Times: “Mr. Trump has this backward. Undocumented workers often pay taxes that help fund Social Security. But, as the nonpartisan Congressional Budget Office once noted, ‘Most unauthorized immigrants are prohibited from receiving many of the benefits that the federal government provides th … Read more at: https://www.zerohedge.com/political/fact-checking-fact-checking-new-york-times |

|

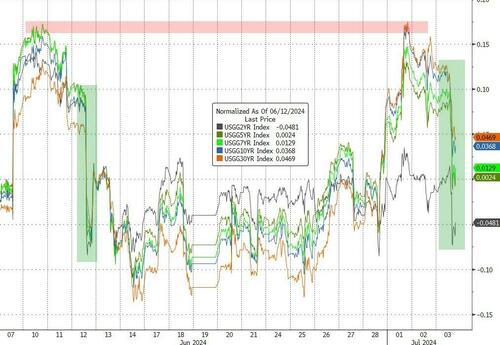

FOMC Minutes Show “Vast Majority” Expect Economy To Cool, See Deflationary Effects Of AISince the last FOMC statement on June 12, oil, gold, stocks, the dollar, and even some of the bond market are higher (in price)…

Source: Bloomberg The shorter-end of the curve is now lower in yield since the last FOMC, but the long-end still higher (even with today’s yield tumble)…

Source: Bloomberg The US macro picture has deteriorated even more significantly relative to expectations, now at its weakest since Dec … Read more at: https://www.zerohedge.com/markets/fomc-minutes-show-vast-majority-expect-economy-cool-see-deflationary-effects-ai |

|

“I Almost Fell Asleep Onstage” – Biden Blames Debate-Debacle On Jet-Lag, But…Desperately trying to outrace a growing wave of pleas to abandon his reelection campaign, President Biden on Tuesday dubiously blamed his terrible debate performance on exhaustion from a busy June travel schedule. However, as he was speaking, the New York Times was firing yet another torpedo at his presidency, publishing an article in which various US and foreign officials said his mental lapses have grown more frequent and pronounced in recent months. Speaking at a campaign fundraiser in McLean, Virginia, Biden struck an apologetic tone as he acknowledged widespread Democratic disappointment in his Thursday debate with Donald Trump. He also tried to blame his performance — characterized by long pauses, garbled answers, a weak, raspy voice and slack-jawed staring when it wasn’t his turn to speak — on his June travel schedule.

|

|

Americans Are More Likely To Go To War With The Government Than Submit To The DraftAuthored by Brandon Smith via Alt-Market.us, In a national poll last month Americans were asked if they believed a new civil war was likely to happen within their lifetime. The establishment media was shocked to report that 47% of the population said yes. Those of us in the liberty media were not so surprised; I believe according to the evidence that we were already a short step away from civil war in 2021-2022.

There were A LOT of guys (millions) getting ready for the possibility of vaccine passport enforcement. Gun ownership in the US hit record highs during that time period and conservative/patriot groups saw a spike in public interest. As it turned out, the “conspira … Read more at: https://www.zerohedge.com/political/americans-are-more-likely-go-war-government-submit-draft |

|

Over 20,000 Tesco staff to split £30m from share schemesThe supermarket says most staff in line to receive a share of the windfall work on the shop floor. Read more at: https://www.bbc.com/news/articles/c2e4nee6v8jo |

|

Ex-Post Office chair denies hiding key Horizon reportTim Parker says he did not share a report with the Post Office board following advice from lawyers. Read more at: https://www.bbc.com/news/articles/cyr7kz30jnpo |

|

Water firms could be sued over sewage after rulingOwners of adjacent waterways or even members of the public could now bring action over sewage pollution. Read more at: https://www.bbc.com/news/articles/cv2gmx8d51xo |

|

Bajaj Finance Q1 Update: New loans rise 10% YoY; AUM jumps 31% to Rs 3,54,100 croreIn its quarterly update announced on Wednesday after market hours, Bajaj Finance stated that it has resumed loan sanctions and disbursals under the ‘eCOM’ and ‘Insta EMI Card’ programs, as well as the issuance of EMI cards, following the RBI’s removal of restrictions on these activities on May 2, 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/bajaj-finance-q1-update-new-loans-rise-10-yoy-aum-jumps-31-to-rs-354100-crore/articleshow/111465189.cms |

|

Grasim, Reliance among top 10 Nifty stocks trading at premium of over 30%According to analysis by domestic brokerage firm Motilal Oswal, nearly half of the Nifty constituents are trading above their historical average prices. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/grasim-reliance-among-top-10-nifty-stocks-trading-at-premium-of-over-30/slideshow/111456762.cms |

|

Tech View: Nifty needs a decisive move above 24,400. Here’s how to trade on ThursdayNifty ended Wednesday’s session with a gain of 163 points to form a small negative candle but broke out of a sideways consolidation movement on the daily chart ahead of Thursday’s expiry. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-needs-a-decisive-move-above-24400-heres-how-to-trade-on-thursday/articleshow/111461462.cms |

|

Oil prices end higher on light trading volume as supply drops more than expectedOil prices settled higher Wednesday, on light trading volume ahead of the Independence Day holiday, after official U.S. data revealed a drop of more than 12 million barrels in crude inventories and a weekly rise in implied gasoline demand. Read more at: https://www.marketwatch.com/story/oil-prices-steady-after-industry-data-shows-large-drop-in-u-s-crude-inventories-85a6c691?mod=mw_rss_topstories |

|

Koss shares skyrocket as meme-stock chatter again swirls around headphone makerKoss shares saw their biggest daily percentage gain in over three years amid a frenzy fueled by the return of “Roaring Kitty” to social media. Read more at: https://www.marketwatch.com/story/koss-surges-as-meme-stock-chatter-again-swirls-around-the-headphone-maker-3179a47e?mod=mw_rss_topstories |

|

Buy this retailer’s stock as an AI play, analyst saysD.A. Davidson’s Michael Baker points to one retailer that stands to get a big AI boost in the coming months. Read more at: https://www.marketwatch.com/story/buy-this-retailers-stock-as-an-ai-play-analyst-says-bf3c81bd?mod=mw_rss_topstories |