Summary Of the Markets Today:

- The Dow closed down 35 points or 0.09%,

- Nasdaq closed up 1.53%, (Closed at 17,608, New Historic high 17,345)

- S&P 500 closed up 0.85%, (Closed at 5,421, New Historic high 5,447)

- Gold $2,335 up $8.80,

- WTI crude oil settled at $78 up $0.43,

- 10-year U.S. Treasury 4.332 down 0.007 points,

- USD index $104.75 down $0.49,

- Bitcoin $67,534 up 217 or 0.32%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.3% year-over-year in May 2024 – down slightly from last month’s 3.4% year-over-year. The all items less food and energy index rose 3.4% over the last 12 months. In looking at the internals, gasoline declined whilst shelter and food increased. Although the CPI marginally declined, it remains a long way from from the Fed’s 2.0% target.

The Federal Reserve’s FOMC meeting concluded today with no change to the federal funds rate of 5-1/4 to 5-1/2% as expected. Their statement begins:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective.

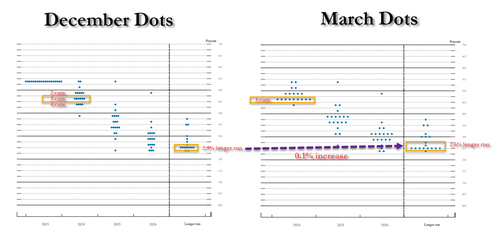

The question always remains when will the Fed reduce the federal funds rate. The following shows the FOMC participants’ assessments of what they GUESS the midpoint of target range or target level for the federal funds rate would be over time. This new set of “guesses” is more hawkish (meaning the potential reductions are further in the future). The numbers in the columns represent the number of participants projecting the midpoint of target range or target level. For 2024, 4 participants anticipate NO reduction to the federal funds rate while 7 believe there will be one rate reductions and 8 think there will be two reductions.

| Midpoint of target range or target level (Percent) | 2024 | 2025 | 2026 | Longer run |

|---|---|---|---|---|

| 5.500 | ||||

| 5.375 | 4 | 1 | ||

| 5.250 | ||||

| 5.125 | 7 | |||

| 5.000 | ||||

| 4.875 | 8 | 1 | 1 | |

| 4.750 | ||||

| 4.625 | ||||

| 4.500 | ||||

| 4.375 | 4 | |||

| 4.250 | ||||

| 4.125 | 9 | 1 | ||

| 4.000 | ||||

| 3.875 | 2 | |||

| 3.750 | 1 | |||

| 3.625 | 1 | 3 | 1 | |

| 3.500 | 2 | |||

| 3.375 | 3 | |||

| 3.250 | ||||

| 3.125 | 7 | 1 | ||

| 3.000 | 4 | |||

| 2.875 | 1 | 2 | ||

| 2.750 | 3 | |||

| 2.625 | 1 | 1 | ||

| 2.500 | 5 | |||

| 2.375 | 1 | 1 | ||

| 2.250 |

Note: Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.

Here are some of headlines we are reading today:

- Inflation in China is Finally Beginning to Stabilize

- 300 New Sanctions for Russia as US Looks to Tighten the Noose

- The New Trucking Trend Transforming Chinese Oil Demand

- Citi Says Oil Could Crash to Sub-$60 Level

- Oil Drops on Inventory Build

- Chinese EV Stocks Tank on Tariff Drama

- Quality Concerns Could Hurt Demand for Trans Mountain Crude on US West Coast

- Fed recap: Chair Powell explains why the central bank isn’t ready yet to cut rates

- Inflation slows in May, with consumer prices up 3.3% from a year ago

- S&P 500 closes above 5,400 for the first time as Fed notes ‘modest’ inflation progress: Live updates

- Top Southwest shareholder signals support for Elliott Management’s activist campaign

- Apple briefly surpasses Microsoft as world’s most valuable company after unveiling AI plans

- FOMC Holds Rates As Expected, Dot-Plot Shifts More Hawkish In 2024

- 2-year Treasury yield has biggest drop since May after cooler CPI data and Fed update

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Matador Resources to Buy More Permian Assets in $1.9B DealAs American shale patch mergers and acquisitions continue in the consolidation frenzy, oil producer Matador Resources Co has struck a deal to buy EnCap Investments’ Permian basin assets for $1.9 billion in cash. In the deal, Matador will acquire new oil and gas producing properties in New Mexico and West Texas currently under the ownership of Ameredev II Parent LLC, according to a Wednesday press release, as well as a 19% stake in Piñon Midstream LLC’s New Mexico pipeline and compression assets.“As much as people… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Matador-Resources-to-Buy-More-Permian-Assets-in-19B-Deal.html |

|

Inflation in China is Finally Beginning to StabilizeChina’s consumer inflation remained stable in May, while the decline in producer prices showed signs of easing, indicating sluggish demand amid a prolonged property downturn in the world’s second-largest economy. China’s consumer price index (CPI) grew by 0.3 percent year-on-year in May, matching April’s figure and falling slightly short of economists’ expectations. However, on a monthly basis, there was a marginal decline of 0.1 percent in the CPI. This stability in consumer prices comes amidst a backdrop… Read more at: https://oilprice.com/Finance/the-Economy/Inflation-in-China-is-Finally-Beginning-to-Stabilize.html |

|

Uzbekistan’s Bid for WTO Membership Hinges on Major Trade ReformsThe Uzbek government appears willing to loosen its control over the flow of information within Central Asia’s most populous nation as part of a comprehensive reform initiative to enhance its membership qualifications for the World Trade Organization. President Shavkat Mirziyoyev has expressed a desire for Uzbekistan to gain WTO membership as soon as 2026. WTO membership status is granted after a lengthy negotiation process overseen on the organization’s side by what is known as a “working party.” A working party was established… Read more at: https://oilprice.com/Geopolitics/International/Uzbekistans-Bid-for-WTO-Membership-Hinges-on-Major-Trade-Reforms.html |

|

300 New Sanctions for Russia as US Looks to Tighten the NooseAhead of a meeting later this week with Ukrainian President Volodymyr Zelensky at the Group of 7 nations leadership summit, the Biden administration has slapped 300 new sanctions on Russia in a further attempt to squeeze the war coffers as Moscow continues to circumvent sanctions most significantly, via China. Sanctions announced by the U.S. Department of Treasury on Wednesday added approximately 300 new sanctions on individuals and entities helping the Kremlin continue its war against Ukraine and enabling sanctions evasion. “We… Read more at: https://oilprice.com/Latest-Energy-News/World-News/300-New-Sanctions-for-Russia-as-US-Looks-to-Tighten-the-Noose.html |

|

European Officials Discuss Plans to Keep Russia-Ukraine Gas Pipeline OperationalIt is somewhat surprising (but also not surprising given energy scarcity fears) that after two-and-a-half years of war, hundreds of thousands of lives tragically lost, and brutal grinding warfare which has also killed many civilians on both sides… that the oldest and biggest economic link between Russia and Europe is still in place: the transit of Russian gas through Ukrainian territory. A five-year agreement which is set to expire by the end of 2024 has remained uninterrupted, though the share of Russia’s pipeline gas in EU imports has… Read more at: https://oilprice.com/Energy/Crude-Oil/European-Officials-Discuss-Plans-to-Keep-Russia-Ukraine-Gas-Pipeline-Operational.html |

|

The New Trucking Trend Transforming Chinese Oil DemandPassenger electric vehicles are not the only alternative in the transportation sector that are poised to displace part of China’s oil demand. LNG-fueled heavy-duty vehicles are also set to limit diesel use for transport, especially now that LNG is cheaper than diesel. Chinese sales of LNG trucks have been booming in recent months, as global and Asian LNG prices are much lower than the record highs seen at the peak of the energy crisis in the summer of 2022. A surge in LNG trucking is set to eat into Chinese oil demand for transportation… Read more at: https://oilprice.com/Energy/Energy-General/The-New-Trucking-Trend-Transforming-Chinese-Oil-Demand.html |

|

U.S. LNG Shipped to Asia Is Still Cleaner Than CoalThe value-chain emissions of liquified natural gas (LNG) are lower on average than for coal-fired power generation, even when the fuel is shipped over long distances, according to new research from Rystad Energy. Natural gas that is produced and liquified in the US and shipped to Asia on return journeys of about 23,000 miles could emit up to 50% less than even the cleanest coal power plants. However, there are significant variations between US LNG sources, coal sources and types, and power plants, as well as uncertainties regarding methane emissions… Read more at: https://oilprice.com/Energy/Energy-General/US-LNG-Shipped-to-Asia-Is-Still-Cleaner-Than-Coal.html |

|

Citi Says Oil Could Crash to Sub-$60 LevelCiti analysts have painted a bleak picture for the oil market, forecasting a significant price drop by 2025. According to their latest note, they anticipate a decline to $60 per barrel for Brent crude, marking a decrease of over 20% compared to current market expectations. The report suggests that while short-term volatility may lead to some upside risks, the long-term trend is bearish. The expected surplus in the global oil market by 2025, despite efforts by OPEC+ to curtail production, is cited as the main reason behind the pessimistic outlook.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Citi-Says-Oil-Could-Crash-to-Sub-60-Level.html |

|

Oil Drops on Inventory BuildCrude oil prices moved lower today, after the U.S. Energy Information Administration reported an estimated inventory increase of 3.7 million barrels for the week to June 7. The change compared with a weekly build of 1.2 million barrels for the previous week that was also accompanied by builds in fuel inventories, pressuring benchmarks. Last week, the EIA estimated more builds in gasoline and middle distillate inventories. In gasoline, the authority reported an inventory build of 2.6 million barrels for the seven days to June… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Drops-on-Inventory-Build.html |

|

ADNOC Moves Ahead With Huge LNG Export Project in UAEAbu Dhabi’s national oil company ADNOC has taken the final investment decision to move forward with the Ruwais LNG project, which will more than double the existing LNG production capacity in the United Arab Emirates. ADNOC took on Wednesday the FID for the Ruwais LNG project, which will consist of two 4.8 million metric tons per annum (mmtpa) LNG liquefaction trains with a total capacity of 9.6 mmtpa. This would more than double ADNOC’s existing UAE LNG production capacity to around 15 mmtpa, as the company builds its international… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOC-Moves-Ahead-With-Huge-LNG-Export-Project-in-UAE.html |

|

Chinese EV Stocks Tank on Tariff DramaLast week, the CEO of BYD Company Ltd (OTCBB: BYDDY) Wang Chuanfu scoffed at Western nations adopting a protectionist stance against China’s clean energy sector, suggesting they are “afraid” of Chinese EVs, “If you are not strong enough, they will not be afraid of you,” he declared. Well, it’s probably China’s turn to be afraid. Stocks of leading electric vehicle manufacturers are selling off after Turkey imposed 40% tariffs on EV imports from the Middle Kingdom. NIO Inc. (NYSE:NIO)… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-EV-Stocks-Tank-on-Tariff-Drama.html |

|

IEA Sees Massive Oil Supply Glut at the End of This DecadeOil demand growth is set to slow in the coming years and global demand will peak in 2029, while rising production will lead to a major glut this decade, the International Energy Agency (IEA) said in its new medium-term oil outlook on Wednesday. The clean energy transition and the “stellar growth” in global EV sales are expected to lead to slowing oil demand growth with worldwide consumption set to peak in 2029 and begin falling the following year, according to the IEA’s report Oil 2024, the agency’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Sees-Massive-Oil-Supply-Glut-at-the-End-of-This-Decade.html |

|

Quality Concerns Could Hurt Demand for Trans Mountain Crude on US West CoastSome U.S. West Coast refiners have flagged concerns about the high sulfur and acidity content and high vapor pressure of the initial crude flows through the expanded Trans Mountain pipeline in Canada, Reuters reported on Wednesday, citing sources with knowledge of the issue. Demand has not been hit yet, but refiners, including Canadian Natural Resources as well as U.S. firms Valero and Chevron, filed complaints last month with the Canada Energy Regulator (CER) asking the limits to the Total Acid Number (TAN) and vapour pressure specifications… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Quality-Concerns-Could-Hurt-Demand-for-Trans-Mountain-Crude-on-US-West-Coast.html |

|

Europe’s Natural Gas Prices Jump on Uncertainty Over Russian SupplyEurope’s benchmark natural gas prices jumped by 3% on Wednesday morning after German energy giant Uniper terminated its Russian gas supply contracts, leaving the market concerned about the remaining flows of gas from Russia to Europe. Uniper said today it had decided to terminate its long-term Russian gas supply contracts and thus legally ended the long-term gas supply relationship with the Russian state-owned company Gazprom Export. The decision was made possible after an arbitration tribunal last week awarded Uniper the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Natural-Gas-Prices-Jump-on-Uncertainty-Over-Russian-Supply.html |

|

EU Set to Slap Up to 25% Additional Tariffs on China’s EVsFrom July, the European Union is set to impose additional tariffs of up to 25% on imports of China-made electric vehicles as part of its investigation into anti-competitive Chinese subsidies for EVs, the Financial Times reported on Wednesday, quoting sources familiar with the European Commission’s decision. The Commission plans to slap provisional tariffs on imports of EVs made in China, depending on the car manufacturer and the extent of the competition-undermining subsidies the EU has identified in its ongoing investigation,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Set-to-Slap-Up-to-25-Additional-Tariffs-on-Chinas-EVs.html |

|

Fed recap: Chair Powell explains why the central bank isn’t ready yet to cut ratesCentral bank policymakers kept rates steady, as expected. They also noted that there has been “modest” progress on inflation. Read more at: https://www.cnbc.com/2024/06/12/fed-meeting-today-live-updates-on-june-fed-rate-decision.html |

|

Inflation slows in May, with consumer prices up 3.3% from a year agoThe consumer price index was expected to increase 0.1% on a month basis and 3.4% from a year ago. Read more at: https://www.cnbc.com/2024/06/12/cpi-report-june-inflation.html |

|

Here’s the inflation breakdown for May 2024 — in one chartInflation declined to a 3.3% annual rate in May 2024, according to the consumer price index. Read more at: https://www.cnbc.com/2024/06/12/cpi-inflation-may-2024-in-one-chart.html |

|

S&P 500 closes above 5,400 for the first time as Fed notes ‘modest’ inflation progress: Live updatesMay’s consumer price index reading came in lower than expected, boosting the equity market. Read more at: https://www.cnbc.com/2024/06/11/stock-market-today-live-updates.html |

|

Sallie Mae hikes yield on 1-year CDs as Fed stays in rate policy holding patternAs the market awaits expected Fed rate cuts, one consumer finance company has raised the APY on its one-year certificates of deposit. Read more at: https://www.cnbc.com/2024/06/12/sallie-mae-hikes-yield-on-1-year-cds-as-fed-stays-in-rate-holding-pattern.html |

|

Sony Pictures is buying Alamo Drafthouse, becoming the first studio in 75 years to own a theater chainSony Pictures has acquired Alamo Drafthouse, the seventh-largest movie theater chain in North America. Read more at: https://www.cnbc.com/2024/06/12/sony-pictures-buys-alamo-drafthouse.html |

|

Top Southwest shareholder signals support for Elliott Management’s activist campaignElliott is seeking to oust the airline’s CEO, Bob Jordan, and executive chairman, Gary Kelly, which Artisan also signaled support for. Read more at: https://www.cnbc.com/2024/06/12/southwest-elliott-artisan-ceo-change.html |

|

Keith Gill has some tough choices to make on his GameStop options with Wall Street ready to pounceRoaring Kitty might be pondering on what to do with his massive options position against GameStop and he could have some tough choices to make. Read more at: https://www.cnbc.com/2024/06/12/roaring-kitty-has-some-tough-choices-to-make-on-his-gamestop-options-.html |

|

Oil prices rise as supply-demand balance expected to tighten in third quarterThe Department of Energy sees an oil supply deficit this year. Read more at: https://www.cnbc.com/2024/06/12/crude-oil-prices-today.html |

|

Apple briefly surpasses Microsoft as world’s most valuable company after unveiling AI plansApple reclaimed the title of the world’s largest company by market cap after an artificial intelligence-heavy conference sparked investor enthusiasm. Read more at: https://www.cnbc.com/2024/06/12/apple-aapl-most-valuable-company-in-world.html |

|

The Federal Reserve holds interest rates steady — here’s what that means for your moneyThe Federal Reserve will keep rates where they are, for now — here’s what that means for your credit card, mortgage rate, auto loan and savings account. Read more at: https://www.cnbc.com/2024/06/12/federal-reserve-holds-interest-rates-steady-what-that-means-for-you.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting. Read more at: https://www.cnbc.com/2024/06/12/fed-decision-heres-what-changed-in-the-new-fed-statement.html |

|

Larry Ellison is $18 billion richer after Oracle shares rally the most since 2021Larry Ellison’s 42% stake in Oracle has made him one of the richest people in the world, and his value continues going up as stock shares hit a record. Read more at: https://www.cnbc.com/2024/06/12/larry-ellison-is-billions-richer-as-oracle-rallies-most-since-2021.html |

|

FOMC Holds Rates As Expected, Dot-Plot Shifts More Hawkish In 2024Since the last FOMC statement (on May 1st), stocks and bonds have outperformed (with the former at record highs), gold is flat while the dollar is down modestly. Amid all that, oil is down significantly…

Source: Bloomberg These market moves have been prompted by a ‘bad news is good news’ regime as US macro data has serially disappointed…

Source: Bloomberg …adding significantly to hopes for a more … Read more at: https://www.zerohedge.com/markets/fomc-17 |

|

Elliott Management May Force Southwest To Abandon ‘Bags Fly Free’ PolicyWith activist hedge fund Elliott Management in the pilot’s seat at Southwest Airlines, the budget airline’s popular “bags fly free” policy is under scrutiny. If Paul Singer gets his way, the airline’s popular “bags fly free” policy could end. This policy is a huge value proposition for customers when choosing a carrier to fly across the US. According to Bloomberg…

Southwest’s policy clearly stated on its website: “Each Customer is allowed two free checked bags.” Read more at: https://www.zerohedge.com/markets/elliot-management-may-force-southwest-abandon-bags-fly-free-policy |

|

FOMC Preview: From Three Rate Cuts To TwoComing just hours after the May CPI print, tomorrow’s – and the month’s – main event is the FOMC decision due at 2pm ET, when the Fed is widely expected to leave rates on hold at 5.25-5.50%, and the statement will likely also largely be reiterated after slight tweaks in the May statement. Attention will fall on the Summary of Economic projections, and more specifically, the Dot Plot, where the number of projected rate cuts in 2024 will be trimmed from 3 to 2. After a string of hot inflation reports in Q1, the Fed has been stressing that the luxury of a strong economy gives the Fed time to be patient before acting, and the hot NFP released (assuming of course that a drop of 625,000 full-time jobs is viewed as “strong”), last week only gives the Fed more time. Therefore, it is likely the 2024 median FFR will be revised up from the 4.6% – or equivalent to 3 rate cuts over the remainder of 2024 – pencilled in at the March meeting.

Indeed, money markets curren … Read more at: https://www.zerohedge.com/economics/fomc-preview-three-rate-cuts-two |

|

MSNBC’s Maddow Says She’s Worried Trump Will Put Her In A Concentration CampAuthored by Steve Watson via Modernity.news, MSNBC performative hack Rachel Maddow has declared that she is worried that if Donald Trump becomes the president again he’s going to round her up and throw her in a concentration camp with all her leftist friends.

Yes, really. Maddow teamed up with CNN’s resident mole man and former Brain Stelter acolyte Oliver Darcy for a super best friends ‘we hate Trump’ interview in which she made the comments.

|

|

UK economy fails to grow during wet AprilThe main political parties disagree about what the data suggests about longer-term economic health. Read more at: https://www.bbc.com/news/articles/clmmvnpr8n8o |

|

Airport bosses criticise sudden liquids U-turnAirport bosses have criticised the lack of notice they were given for re-introducing 100ml liquids limits. Read more at: https://www.bbc.com/news/articles/c9885p925rno |

|

EU threatens China EVs with tariffs of up to 38%The decision comes as an investigation continues into what the EU calls China’s “unfair subsidisation”. Read more at: https://www.bbc.com/news/articles/cd11ze1k9r0o |

|

Jaypee Infratech Delisting: Suraksha Realty to pay exit price to retail shareholders, sets June 21 as record dateThe successful resolution applicant of Jaypee Infratech will pay on a par with the liquidation value of the company to its shareholders holding about 542 million equity units while delisting the company from the stock exchanges. The company said that the existing public shareholders shall be given an aggregate exit at a price of Rs 14 lakh, which is not less than the liquidation value. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/jaypee-infratech-delisting-suraksha-realty-to-pay-exit-price-retail-shareholders-sets-june-21-as-record-date/articleshow/110945882.cms |

|

Tech View: Nifty facing hurdle at 23,400-23,500. Here’s how to trade on Thursday expiryNifty’s hourly momentum indicator has a negative crossover and so the rallies are short-lived and failing to persist at higher levels. Traders should opt for buy-on-a-dip strategy around 23,150 – 23,100. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-facing-hurdle-at-23400-23500-heres-how-to-trade-on-thursday-expiry/articleshow/110944557.cms |

|

Free course from Sebi, NISM for stock market investors. How to enrol?Indian capital markets regulator the Securities and Exchange Board of India (Sebi) launched a free, voluntary online investor certification examination on Tuesday, with an aim to help individuals, especially beginners, gain comprehensive knowledge about stock market investing. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/free-course-from-sebi-nism-for-stock-market-investors-how-to-enrol/articleshow/110939690.cms |

|

Fed’s $1 trillion pile of paper losses are turning into actual losses — with more in sightThe Federal Reserve’s roughly $1 trillion pile of paper losses stemming from its underwater securities holdings have begun to turn into more than $100 billion in actual losses, with no relief in sight. Read more at: https://www.marketwatch.com/story/feds-1-trillion-pile-of-paper-losses-are-turning-into-actual-losses-with-more-in-sight-acf7ae79?mod=mw_rss_topstories |

|

PayPal’s competitive challenges are back in the spotlight, BofA saysRecent announcements in the world of payments underscore the challenges facing PayPal, according to an analyst. Read more at: https://www.marketwatch.com/story/paypals-competitive-challenges-are-back-in-the-spotlight-bofa-says-fc2cd9a4?mod=mw_rss_topstories |

|

2-year Treasury yield has biggest drop since May after cooler CPI data and Fed updateRates on U.S. government debt finished lower on Wednesday for the eighth time in the past 10 sessions after a cooler-than-expected consumer-price index report for May and the Federal Reserve’s policy update. Read more at: https://www.marketwatch.com/story/treasury-yields-little-changed-as-traders-await-cpi-data-and-fed-policy-decision-431bdd27?mod=mw_rss_topstories |