Summary Of the Markets Today:

- The Dow closed up 575 points or 1.51%,

- Nasdaq closed down 0.01%,

- S&P 500 closed up 0.80,

- Gold $2,348 down $18.50,

- WTI crude oil settled at $77 down $0.80,

- 10-year U.S. Treasury 4.506 down 0.046 points,

- USD index $104.63 down $0.09,

- Bitcoin $67,651 down a change of -0.99% of over past 24 hours,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real (inflation adjusted) Disposable Personal Income (DPI) declined significantly from 1.3% year-over-year in March to 1.0% year-over-year in April 2024. Real Personal Consumption Expenditures (PCE) [view this as what builds GDP] declined from 2.8% year-over-year in March to 2.6% year-over-year in April 2024. The PCE price index [the preferred inflation metric of the Federal Reserve] as little changed at 2.7% year-over-year – this is not good news for those who believed inflation was going away. Overall, the economy seems to be going through a soft patch.

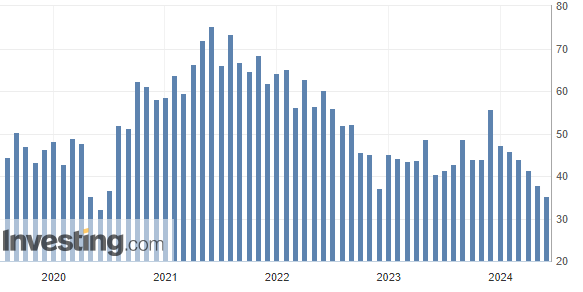

The latest Chicago Purchasing Manager’s Index (Chicago Business Barometer) fell to 35.4 in May 2024 from 37.9 in April. This is the sixth straight monthly decline and the lowest level for the index since May 2020. The Chicago PMI is viewed as a window to the national PMI which will be released next week.

Here is a summary of headlines we are reading today:

- Data Centers Set to Consume 9% of U.S. Electricity by 2030

- U.S. Oil, Gas Drillers Stuck In A Rut

- U.S. Gasoline Prices Continue to Drop

- EU Tariff Could Cost China Nearly $4 Billion in EV Sales

- Nigeria Needs $25 Billion in Annual Investment to Stabilize Oil Production

- Sweden Accuses Iran of Using Gangs to Target Israelis and Iranian Dissidents

- Dow closes more than 550 points higher to post best day in 2024, stocks wrap a winning May: Live updates

- The Fed’s preferred inflation measure rose 0.2% in April, as expected

- Salesforce is the most oversold stock on Wall Street amid a losing week for the markets

- It was a strong week for retail earnings. That doesn’t spell a consumer comeback

- Rate-Cut Hopes Resurrected As ‘Hard’ Data Slides: Stocks, Gold, Oil, & Crypto Dumped

- US equity funds hit by outflows on rising yields, rates uncertainty

- Treasury yields drop in May by most in five months after Fed’s preferred inflation indicator shows some signs of cooling

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Data Centers Set to Consume 9% of U.S. Electricity by 2030Over the past few years, dozens of pundits and industry experts have laid out prognostications that the ongoing Fourth Industrial Revolution will drive unprecedented electricity demand growth in the United States and globally. Last year, the power sector consulting firm Grid Strategies published a report titled “The Era of Flat Power Demand is Over,” which pointed out that United States grid planners—utilities and regional transmission operators (RTOs)—had nearly doubled growth projections in their five-year… Read more at: https://oilprice.com/Energy/Energy-General/Data-Centers-Set-to-Consume-9-of-US-Electricity-by-2030.html |

|

Chevron’s Gorgon LNG Resumes Full Production After Month-Long OutageChevron has successfully restored full production at its Gorgon liquefied natural gas (LNG) export terminal in Western Australia following a month-long outage. The mechanical fault in a turbine, which caused the disruption, has been resolved, allowing the affected production train to resume operations. Despite the outage, the remaining two production trains and the domestic gas plant continued to operate at full capacity, ensuring ongoing supply and mitigating broader market impacts. The outage at Gorgon LNG, one of the world’s largest LNG projects,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevrons-Gorgon-LNG-Resumes-Full-Production-After-Month-Long-Outage.html |

|

Vermont Makes Big Oil Pay for Climate Change Damage in Landmark LawThe state of Vermont has just enacted a law that would take on oil companies to require them to pay for damage caused by their emissions, in a first such legislation in a U.S. state. The bill, S.259, ‘An act relating to climate change cost recovery,’ became law without the signature of Vermont’s Republican Governor Philip B. Scott. The law stipulates that Vermont’s state treasurer, in consultation with the Agency of Natural Resources, assess the total cost to Vermonters and the state from the emission… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vermont-Makes-Big-Oil-Pay-for-Climate-Change-Damage-in-Landmark-Law.html |

|

Chinese Battery Makers Slam Brakes on German Expansion as EV Sales StallWith each day that goes by, there is more and more news indicating the EV market is saturated. First, it was manufacturers cutting back on EV investments, then a gradual shift back to hybrid vehicles – and now it’s China pulling out of investments in Germany due to lack of demand. Chinese electric vehicle battery producers are scaling back their expansion in Germany due to a drop in EV sales, according to Nikkei Asia. SVOLT Energy Technology, a spin-off from Great Wall Motor, announced the suspension of its planned battery cell plant… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-Battery-Makers-Slam-Brakes-on-German-Expansion-as-EV-Sales-Stall.html |

|

U.S. Oil, Gas Drillers Stuck In A RutThe total number of active drilling rigs for oil and gas in the United States saw no change this week, according to new data that Baker Hughes published on Friday. The total rig count stayed the same at 600 this week, compared to 696 rigs this same time last year. The number of oil rigs fell by one this week, after staying the same in the week prior. Oil rigs stand at 496–down by 59 compared to this time last year. The number of gas rigs rose by 1 this week to 100, a loss of 37 active gas rigs from this time last year. Miscellaneous rigs… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Gas-Drillers-Stuck-In-A-Rut.html |

|

U.S. Gasoline Prices Continue to DropU.S. gasoline prices continue to head lower after the Memorial Day weekend amid lower oil prices and tepid demand. The national average for a gallon of regular gasoline has fallen by a nickel since last week to $3.56 as of Thursday, the largest one-week drop so far this year, AAA said. As of May 31, 2024, the AAA national average showed $3.559 per gallon of regular gasoline. That’s down from $3.609 per gallon a week ago and $3.657 a month ago. At this time last year, Americans paid $3.576 per gallon for regular gasoline, per AAA… Read more at: https://oilprice.com/Energy/Gas-Prices/US-Gasoline-Prices-Continue-to-Drop.html |

|

Indonesia’s Delay of Its Ban on Copper Exports Could Weigh on PricesIndonesia, a major copper producer, has decided to postpone the start of a ban on its copper concentrate exports until the end of the year in a move that could deflate copper prices after they hit a record high in May. Indonesia wants its local copper miners to build smelters and start processing the raw material locally, to boost the economy and offer higher-value copper products that are crucial for clean energy equipment and grid upgrades. The top copper miners in Indonesia, Freeport Indonesia, and Amman Mineral, were expected to start copper… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indonesias-Delay-of-Its-Ban-on-Copper-Exports-Could-Weigh-on-Prices.html |

|

76% of Small Offshore Oil Companies at RiskAuthored by Pete McGinnis via RealClearPolicy, In June 2023, the Bureau of Ocean Energy Management proposed a rule that would require stricter financial assurance standards for oil companies operating in the Outer Continental Shelf. This costly rule became final on April 15, 2024, but in the 10 months since its initial proposal, BOEM did nothing to alleviate concerns for smaller companies that comprise of 76 percent of oil and gas operators in the Gulf. As a result, many of these companies could be forced out of business by extreme and unnecessary… Read more at: https://oilprice.com/Energy/Crude-Oil/76-of-Small-Offshore-Oil-Companies-at-Risk.html |

|

EU Tariff Could Cost China Nearly $4 Billion in EV SalesA potential EU tariff of 20% on China-made electric vehicles would cost China $3.8 billion worth of EV exports to the bloc, but it would also cost EU end-consumers “noticeably higher prices,” Germany’s Kiel Institute for the World Economy said in an analysis on Friday. The EU launched in October 2023 anti-subsidy investigations into EU imports of EVs from China to determine whether the value chains in China benefit from illegal subsidies. The findings of the investigation will establish whether it is in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Tariff-Could-Cost-China-Nearly-4-Billion-in-EV-Sales.html |

|

Nigeria Needs $25 Billion in Annual Investment to Stabilize Oil ProductionAfrica’s top oil producer, Nigeria, needs annual investments of $25 billion to reach and keep its output at around 2 million barrels per day (bpd), Nigerian oil industry executive Austin Avuru said this week. “We need to invest $25 billion annually to stabilize production at 2 million barrels per day,” said Avuru, who is executive chairman of AA Holdings. This investment level “is crucial to ensure the sustainability of the sector and its contribution to the national economy,” the executive added at an event in Nigeria,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Needs-25-Billion-in-Annual-Investment-to-Stabilize-Oil-Production.html |

|

Oil Prices Under Pressure Despite Expectations of an OPEC+ Deal ExtensionOil prices remain under pressure this week despite expectations that OPEC+ will agree to extend production cuts at this Sunday’s meeting.Friday, May 31st 2024The Memorial Day holidays, which usually trigger a bump in gasoline consumption, failed to drive a significant increase in fuel demand, adding downward pressure to oil prices. Overshadowing higher refinery runs in the U.S., concerns over this year’s consumption patterns loom large over the summer months. Heading into the weekend, all eyes will be on OPEC+ as it meets in Vienna,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-Expectations-of-an-OPEC-Deal-Extension.html |

|

The Pipeline Project Preparing for Canada’s Largest Ever Corporate Bond DealIn a landmark move for the Canadian financial markets, Coastal GasLink LP, partially owned by KKR & Co., is set to initiate the largest corporate bond deal in Canada’s history. The pipeline project, located in Western Canada, is preparing to issue up to C$4 billion ($2.9 billion) in bonds to refinance its existing construction debt. This unprecedented offering is scheduled for early June, according to sources familiar with the matter. The Coastal GasLink project, a 416-mile natural gas pipeline, has faced significant challenges since its inception… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Pipeline-Project-Preparing-for-Canadas-Largest-Ever-Corporate-Bond-Deal.html |

|

Heatwave Sends India’s Power Demand Soaring to All-Time High1. ConocoPhillips’ Takeover of Marathon Oil Creates 3rd Largest US Producer – ConocoPhillips agreed to purchase Marathon Oil in an all-stock transaction valued at $22.5 billion, a deal that would lift the US upstream firm’s production to 2.3 million boe/d, up by almost 400,000 boe/d. – The transaction will make ConocoPhillips the third largest US producer in the Lower 48, only behind ExxonMobil and Chevron/Hess, whilst surpassing TotalEnergies and BP. – ConocoPhillips will become the largest producer in Eagle Ford, with… Read more at: https://oilprice.com/Energy/Energy-General/Heatwave-Sends-Indias-Power-Demand-Soaring-to-All-Time-High.html |

|

Mixed Signals Spark Volatility in Oil Markets Ahead of Key EventsOil Market Weekly Recap and Next Week’s Outlook This week, oil prices experienced volatility driven by mixed signals from U.S. fuel demand data, expectations surrounding the OPEC+ meeting, and macroeconomic factors influencing investor sentiment. As the market prepares for crucial developments in the coming days, traders remain cautious yet optimistic about potential price movements. U.S. Fuel Demand and Inventory Reports Oil prices declined for the second consecutive session on Thursday due to weak U.S. fuel demand and unexpected increases in… Read more at: https://oilprice.com/Energy/Energy-General/Mixed-Signals-Spark-Volatility-in-Oil-Markets-Ahead-of-Key-Events.html |

|

Sweden Accuses Iran of Using Gangs to Target Israelis and Iranian DissidentsPolitics, Geopolitics & Conflict Azerbaijan’s strategic location and hydrocarbon wealth are propelling it to become a major player in energy and geopolitics beyond the South Caucasus. Leveraging partnerships with Turkey and developing pipelines like the Southern Gas Corridor, Azerbaijan aims to reshape Eurasian gas markets. The resolution of the Nagorno-Karabakh conflict has further unlocked opportunities for regional connectivity and economic development. However, uncertainties surrounding Armenia’s future and border demarcation pose challenges… Read more at: https://oilprice.com/Energy/Energy-General/Sweden-Accuses-Iran-of-Using-Gangs-to-Target-Israelis-and-Iranian-Dissidents.html |

|

Dow closes more than 550 points higher to post best day in 2024, stocks wrap a winning May: Live updatesIt is shaping up to be a winning May, with each of the major benchmarks set to register a sixth positive month in seven. Read more at: https://www.cnbc.com/2024/05/30/stock-market-today-live-updates.html |

|

The Fed’s preferred inflation measure rose 0.2% in April, as expectedThe personal consumption expenditures price index for April was expected to show an inflation rate of 2.7% over the past 12 months. Read more at: https://www.cnbc.com/2024/05/31/pce-inflation-april-2024-the-feds-preferred-inflation-measure-rose-0point2percent-in-april.html |

|

Bill Ackman selling stake in Pershing Square at $10.5 billion valuation, aiming for IPO one dayBillionaire investor Bill Ackman is selling a 10% stake in Pershing Square, aiming to eventually take his investment firm public. Read more at: https://www.cnbc.com/2024/05/31/ackman-selling-stake-in-pershing-square-at-10point5-billion-valuation-aiming-for-ipo.html |

|

Biden calls Trump response to guilty verdict ‘reckless,’ ‘dangerous’ at White HousePresident Joe Biden, who is set to face Donald Trump in November’s presidential election, spoke after Trump’s press conference on the verdict in New York. Read more at: https://www.cnbc.com/2024/05/31/biden-trump-verdict-at-white-house.html |

|

Salesforce is the most oversold stock on Wall Street amid a losing week for the marketsCNBC Pro screened for the most overbought and oversold names on Wall Street this week. Read more at: https://www.cnbc.com/2024/05/31/salesforce-is-the-most-oversold-stock-amid-a-losing-week-for-markets.html |

|

Ether soars 27% in May after SEC clears path for spot ether ETFs: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ripple CEO Brad Garlinghouse and Kraken’s Chief Legal Officer Marco Santori discuss crypto regulation from Consensus 2024. Read more at: https://www.cnbc.com/video/2024/05/31/ether-soars-27percent-in-may-as-sec-approves-rule-change-to-allow-creation-eth-etfs-cnbc-crypto-world.html |

|

FDA approves Moderna’s RSV vaccine for seniors, the company’s second-ever productThe decision is a win for Moderna, which needs another revenue source amid plunging demand for its Covid vaccine, its only commercially available product. Read more at: https://www.cnbc.com/2024/05/31/fda-approves-moderna-rsv-vaccine-for-seniors.html |

|

Warren Buffett is worried about potential for ‘huge losses’ in booming, but still tiny insurance marketWarren Buffett recently warned that cybersecurity insurance risks are getting overlooked as agents rush to sign up clients and ‘huge losses’ could be ahead. Read more at: https://www.cnbc.com/2024/05/31/warren-buffett-worried-about-huge-losses-in-booming-insurance-market.html |

|

It was a strong week for retail earnings. That doesn’t spell a consumer comebackConsumers are being far more selective in their shopping as they contend with inflation, high interest rates and an uncertain economy. Read more at: https://www.cnbc.com/2024/05/31/first-quarter-retail-earnings-dont-spell-consumer-comeback.html |

|

Trump campaign raises record $34.8 million in donations after guilty verdictThe Republican’s campaign said it raised $34.8 million from small-dollar donors in less than seven hours following the historic verdict Thursday afternoon. Read more at: https://www.cnbc.com/2024/05/31/trump-campaign-donations-record.html |

|

Nvidia’s billionaire founder: The No. 1 thing I believe today that my younger self wouldn’t understandNvidia CEO Jensen Huang says there’s “plenty of time” in any given day, if you prioritize what’s most important. His younger self would’ve disagreed, he says. Read more at: https://www.cnbc.com/2024/05/31/nvidia-ceo-what-he-believes-now-that-younger-self-would-disagree-on.html |

|

Jayson Tatum was just 19 years old when he learned this NBA money lessonThe 25-year-old is grateful for the players who came before him and learned the hard way that NBA fortunes can disappear. Read more at: https://www.cnbc.com/2024/05/31/jayson-tatum-was-just-19-when-he-learned-this-nba-money-lesson.html |

|

Mega backdoor Roth conversions can be a ‘no brainer’ for higher earners, expert saysMega backdoor Roth conversions can boost retirement savings for higher earners. Here’s what to know about the strategy. Read more at: https://www.cnbc.com/2024/05/31/mega-backdoor-roth-conversions.html |

|

Rate-Cut Hopes Resurrected As ‘Hard’ Data Slides: Stocks, Gold, Oil, & Crypto DumpedRate-Cut Hopes Resurrected As ‘Hard’ Data Slides: Stocks, Gold, Oil, & Crypto DumpedA weird week of weak ‘hard data, strong ‘soft’ data (macro), weak micro (ugly hints for software and consumer from earnings), and dovish-and-hawkish FedSpeak…

Source: Bloomberg Which prompted a resurgence in rate-cut hopes….

Source: Bloomberg But today’s Chicago PMI puke dominates any in-line PCE print and dragged stocks lower on the week, led by weakness in Nasdaq as Small Caps were the leat ugly hor … Read more at: https://www.zerohedge.com/markets/rate-cut-hopes-resurrected-hard-data-slides-stocks-gold-oil-crypto-dumped |

|

Time To Pay Satan: Canadian Asset Manager Blocks Cash Distributions On Private Credit FundsJust one day after JPMorgan CEO Jamie Dimon said private credit could spark turmoil if when the opaque sector of financial markets weakens, warning that “there could be hell to pay,” and adding that he has “seen a couple of these deals that were rated by a rating agency and, I have to confess, it shocked me what they got rated. So, it reminds me a little bit of mortgages”, Satan has just sent his first invoice to the banking industry.

After scaring his fellow bankers, perhaps in hopes of sparking another mini bank run and getting the FDIC to gift him with yet another bank, it turns out that perhaps Jamie Dimon was correct that “not all the people doing [private credit] are good,” and earlier today Bloomberg brought us the first notable example of a “bad” doer when it reported that Canadian investment manager Ninepoint Partners is “temporarily” suspending ca … Read more at: https://www.zerohedge.com/markets/time-pay-satan-canadian-asset-manager-blocks-cash-distributions-private-credit-funds |

|

‘Time For This War To End’: Biden’s Gaza Speech Aimed At Israeli HardlinersPresident Joe Biden’s Friday afternoon speech was all about pressuring Israel to end the war. He unveiled and endorsed the terms of an Israeli-led proposal that features a three-part roadmap which would result in release of all the hostages and a cessation of hostilities. “After intensive diplomacy carried out by my team, my many conversations with leaders of Israel, Qatar and Egypt, and other Middle Eastern countries, Israel has offered a comprehensive new proposal. It’s a road map to an enduring cease-fire and the release of all hostages,” Biden said.

“This is truly a decisive moment. Israel has made their proposal. Hamas says it wants a cease-fire. This deal is an opportunity to prove whether they really mean it. Hamas needs to take the deal,” he added, but cautioned Hamas had yet to accept it. Below is an outline of the three phases: Read more at: https://www.zerohedge.com/geopolitical/time-war-end-bidens-gaza-speech-aimed-israeli-hardliners |

|

Gain-of-Function May Explain Bird Flu Jump To Cows And HumansAuthored by Yuhong Dong, M.D., Ph.D. and Xiaoxu Sean Lin, M.D., Ph.D. via The Epoch Times,

(Illustration by The Epoch Times, Shutterstock) In the past six months, bird flu has surprised scientists at least twice. Bird flu viruses have circulated mainly in birds for a long time. However, in early December 2023, an outbreak occurred in U.S. dairy cows, even though cattle are not typically susceptible to avian influenza A, the bird flu virus. In late March, a U.S. dairy farm worker was infected by a H5N1 virus from a cow. On May 22, a Read more at: https://www.zerohedge.com/medical/gain-function-may-explain-bird-flu-jump-cows-and-humans |

|

UK house prices in surprise rise in MayNationwide building society says prices rose by 0.4% despite buyers facing “affordability pressures”. Read more at: https://www.bbc.com/news/articles/cw55v1e1ppzo |

|

Santander staff and ’30 million’ customers hackedTheir data is being sold online by the same gang who this week claimed to have hacked Ticketmaster. Read more at: https://www.bbc.com/news/articles/c6ppv06e3n8o |

|

Calls for action to boost living standardsSlow income growth should be tackled with policies to improve productivity, a report suggests. Read more at: https://www.bbc.com/news/articles/c7226wle322o |

|

These equity MFs failed to outperform their respective benchmarks in five yearsDown capture ratio is used to measure fund managers’ overall performance in down markets. Read more at: https://economictimes.indiatimes.com/mf/analysis/these-equity-mfs-failed-to-outperform-their-respective-benchmarks-in-five-years/slideshow/110600049.cms |

|

NSE launches Nifty500 Equal Weight index; base date April 1, 2005The index will serve as a benchmark for asset managers and a reference index for passive funds such as ETFs, index funds, and structured products, according to the release. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-launches-nifty500-equal-weight-index-base-date-april-1-2005/articleshow/110600903.cms |

|

US equity funds hit by outflows on rising yields, rates uncertaintyU.S. equity funds saw outflows for the first time four weeks in the seven days ended May 29, hit by rising bond yields and uncertainty over the timing and extent of Federal Reserve interest rate cuts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-equity-funds-hit-by-outflows-on-rising-yields-rates-uncertainty/articleshow/110600176.cms |

|

Treasury yields drop in May by most in five months after Fed’s preferred inflation indicator shows some signs of coolingRates on U.S. government debt posted the biggest monthly declines of 2024 on Friday after the monthly core reading from the Federal Reserve’s preferred inflation measure had its slowest increase of this year. Read more at: https://www.marketwatch.com/story/treasury-yields-creep-up-ahead-of-feds-preferred-inflation-indicator-f58a358b?mod=mw_rss_topstories |

|

Can a felon get a commercial real-estate loan?Donald Trump’s real-estate business has been dealt another blow by another guilty verdict in New York Read more at: https://www.marketwatch.com/story/can-a-felon-get-a-commercial-real-estate-loan-9038aaf3?mod=mw_rss_topstories |

|

‘He always managed to play golf’: My husband of 14 years never worked and now we’re divorcing. He wants half of my $1 million home. What can I do?“I made all the mortgage payments, in addition to paying for health coverage for both of us.” Read more at: https://www.marketwatch.com/story/he-found-excuse-after-excuse-not-to-work-yet-always-managed-to-play-golf-my-husband-wants-half-of-my-1-million-home-what-can-i-do-f365a7bd?mod=mw_rss_topstories |