Summary Of the Markets Today:

- The Dow closed down 330 points or 0.86%,

- Nasdaq closed down 1.08%,

- S&P 500 closed down 0.60%,

- Gold $2,361 down $2.20,

- WTI crude oil settled at $78 down $1.34,

- 10-year U.S. Treasury 4.548 down 0.076 points,

- USD index $104.77 down $0.330,

- Bitcoin $68,564 up, a change of 1.02% over past 24 hours

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic’s Loan Performance Insights for March 2024 measures early-stage delinquency rates. In March 2024, 2.8% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.2 percentage point change in the overall delinquency rate compared with March 2023. Molly Boesel, Principal Economist for CoreLogic stated:

The U.S. delinquency rate increased from a year earlier in March, driven by an uptick in early-stage delinquencies. Further, the early-stage delinquency rate remained flat from February to March this year, while it typically falls between those months, as many borrowers receive income tax refunds in March. While monthly changes in the early-stage delinquency rate can be volatile, this break from the seasonal trend comes at a time when household budgets are strained by still-high inflation.

Real gross domestic product (GDP) second estimate increased at an annual rate of 1.3% in the first quarter of 2024 – in the advance estimate, the increase in real GDP was 1.6%. I prefer to view the year-over-year change which is now up 2.9% year-over-year. The update primarily reflected a downward revision to consumer spending. In the fourth quarter of 2023, real GDP increased 3.4%. The price index for gross domestic purchases increased 3.0% in the first quarter, a downward revision of 0.1 percentage point from the previous estimate. The bottom line for the second estimate is the economy was weaker but inflation was improved.

In the week ending May 25, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 222,500, an increase of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 219,750 to 220,000. There is no indication of a slowing economy.

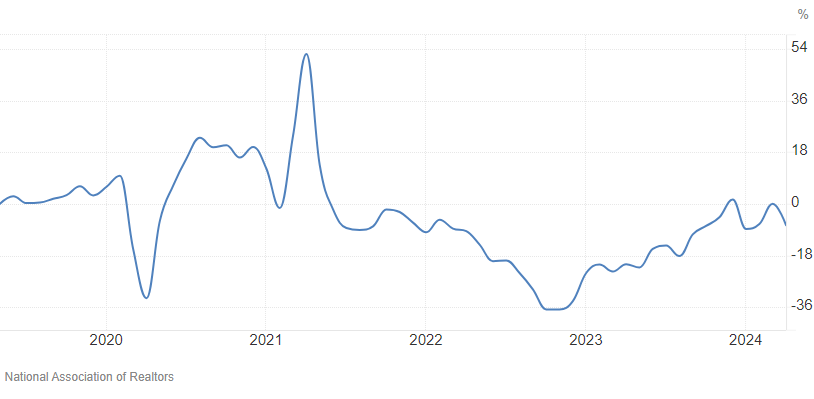

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 72.3 in April 2024. Year over year, pending transactions were down 7.4%. An index of 100 is equal to the level of contract activity in 2001. NAR Chief Economist Lawrence Yun added:

The impact of escalating interest rates throughout April dampened home buying, even with more inventory in the market. But the Federal Reserve’s anticipated rate cut later this year should lead to better conditions, with improved affordability and more supply.

Here is a summary of headlines we are reading today:

- BYD Unveils Hybrid Powertrain with 1,250-Mile Range

- Saudi Aramco Announces Secondary Public Offering of 1.545 Billion Shares

- Oil Slides as EIA Reports Crude Inventory Decline, Fuel Builds

- World’s Largest Nuclear Plant Remains Idle Despite Energy Crisis

- Stocks close lower, Dow falls more than 300 points as Salesforce plunges 20%: Live updates

- Salesforce shares tumble 20% in worst day since 2004

- Fed’s Williams says inflation is too high but will start coming down soon

- Fed’s favorite inflation gauge is expected to show very slow progress on Friday

- FAA won’t clear Boeing to increase 737 Max production for several months, agency head says

- Chinese National Arrested For Allegedly Operating “World’s Largest Botnet”

- A 13-year-old girl worked 60 hours a week making car parts for Hyundai in Alabama, Labor Department says

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

BYD Unveils Hybrid Powertrain with 1,250-Mile RangeRange anxiety with electric vehicles becomes less of a problem when switching to hybrids – a plan almost all of the auto industry is now embracing after finding out the economics of pure BEVs are a prohibitive nightmare. For example this week Bloomberg reported that BYD had unveiled a new “hybrid powertrain capable of traveling more than 2,000 kilometers (1,250 miles) without recharging or refueling”. The technology will be featured in two sedans priced below 100,000 yuan ($13,800) and capable of covering distances comparable to Singapore… Read more at: https://oilprice.com/Energy/Energy-General/BYD-Unveils-Hybrid-Powertrain-with-1250-Mile-Range.html |

|

What Does the Reimposition of U.S. Sanctions Mean for Venezuela’s Oil Industry?At the end of last year, the White House decided to ease sanctions on Venezuelan oil to stabilize oil prices and help the South American country improve its failing economy. The agreement to ease sanctions was dependent on President Nicolas Maduro allowing his political opposition to run in the upcoming elections. After a six-month ease, the U.S. has once again imposed sanctions on Venezuela due to the failure of Maduro to adhere to democratic principles. So, going forward, what will this mean for Venezuela’s already troubled oil industry?… Read more at: https://oilprice.com/Energy/Energy-General/What-Does-the-Reimposition-of-US-Sanctions-Mean-for-Venezuelas-Oil-Industry.html |

|

Saudi Aramco Announces Secondary Public Offering of 1.545 Billion SharesThe Government of the Kingdom of Saudi Arabia and Saudi Arabian Oil Company (Saudi Aramco) have announced the launch of a secondary public offering (SPO) of 1.545 billion ordinary shares, representing approximately 0.64% of the company’s issued shares. The offering is set to commence on Sunday, June 2, 2024, marking a significant event in the global energy market. The price range for the offered shares is expected to be between SAR 26.70 and SAR 29.00 per share. To cover potential short positions resulting from any over-allotments, the Government… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Announces-Secondary-Public-Offering-of-1545-Billion-Shares.html |

|

The UK Is Ramping Up Its Nuclear Energy AmbitionsThe U.K. government has ambitious plans for the rapid expansion of the country’s nuclear energy sector, with two nuclear plants slated for the next decade, and discussions around a third. EDF’s Hinkley Point C in Somerset and Sizewell C in Suffolk have both been approved by the government, expected to support the U.K.’s transition away from fossil fuels to greener alternatives in line with national climate pledges. The U.K. government has announced ambitious nuclear plans in recent years, aiming for the biggest expansion… Read more at: https://oilprice.com/Energy/Energy-General/The-UK-Is-Ramping-Up-Its-Nuclear-Energy-Ambitions.html |

|

Sources Warn of Potential OPEC+ ‘Plot Twist’ on SundayAhead of the OPEC+ Sunday meeting, Reuters has cited three unnamed cartel sources as saying that a rollover to the end of the year of the existing 2.2 million barrel-per-day voluntary oil production cuts is currently being discussed. Analysts have been expecting OPEC+ to maintain the status quo on Sunday, and Reuters’ Thursday report is in line with those expectations. The voluntary cuts expire at the end of JUne, and OPEC+ launches its meetings on Sunday at 1100 GMT. Through the end of this year, OPEC+ members have agreed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sources-Warn-of-Potential-OPEC-Plot-Twist-on-Sunday.html |

|

The Asia Pacific Region Is Emerging as a Carbon Capture and Storage HubThe Asia Pacific (APAC) region is rapidly emerging as a key player in the carbon capture and storage (CCS) sector. Asian countries are intensifying their decarbonization efforts, despite challenges for a number of countries in the region, such as unsuitable geological conditions for carbon capture, utilization, and storage (CCUS). Rystad Energy’s research highlights Australia, Malaysia, and Indonesia as emerging hubs in the APAC region, driven by the carbon dioxide (CO2) storage potential in their depleted oil and gas reservoirs and stricter environmental… Read more at: https://oilprice.com/Energy/Energy-General/The-Asia-Pacific-Region-Is-Emerging-as-a-Carbon-Capture-and-Storage-Hub.html |

|

Spanish Gas Lobby Calls for Urgent Support Amid Renewables BoomSpain should support its domestic natural gas-fired power plants to be available to provide electricity when needed, and such regulation is “urgent and necessary,” according to the president of Spanish gas industry association Sedigas. The so-called capacity mechanism would pay gas power plants to be available for generation when necessary, amid soaring shares of the intermittent solar and wind power generation. “We hope that the regulation enabling the deployment of capacity mechanisms can materialise… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spanish-Gas-Lobby-Calls-for-Urgent-Support-Amid-Renewables-Boom.html |

|

Oil Slides as EIA Reports Crude Inventory Decline, Fuel BuildsCrude oil prices sunk following the Energy Information Administration’s report of an estimated inventory decline of 4.2 million barrels for the week to May 24, as fuel inventories rose. The crude inventory figure compared with a modest increase of 1.8 million barrels for the previous week and American Petroleum Institute estimate for a 6.5-million-barrel inventory draw for the week to May 24 as reported on Wednesday. Gasoline inventories added 2 million barrels during the last week before the start of summer driving season, with production… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Slides-as-EIA-Reports-Crude-Inventory-Decline-Fuel-Builds.html |

|

Germany to Ditch Controversial Tax on Gas Transit in 2025Germany will abolish from 2025 a controversial levy on natural gas storage which countries in central Europe have had to pay to get gas piped through Germany. Countries in central Europe, including Austria, the Czech Republic, Hungary, and Slovakia are being charged by Germany with the so-called gas storage levy on exports of natural gas from Germany. The tax has raised tensions between the central European countries and Germany, with Germany’s neighbors saying that the tax makes their gas imports from Germany more expensive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-to-Ditch-Controversial-Tax-on-Gas-Transit-in-2025.html |

|

World’s Largest Nuclear Plant Remains Idle Despite Energy CrisisWe don’t think it’ll be long before nuclear power once again has a renaissance, as we’ve written about extensively. But for now, the world’s largest nuclear power plant, the Kashiwazaki Kariwa Nuclear Power Plant in Japan, is sitting idle even as the world’s energy needs continue to grow. Bloomberg reported this week that the Kashiwazaki Kariwa Nuclear Power Plant, recognized by Guinness World Records for its potential 8.2 gigawatt output, stands idle despite once being central to Japan’s goal of deriving 50% of its energy from nuclear… Read more at: https://oilprice.com/Energy/Energy-General/Worlds-Largest-Nuclear-Plant-Remains-Idle-Despite-Energy-Crisis.html |

|

Strong Indian Purchases Push Asia’s Crude Imports to One-Year HighRecord-high crude imports in India have pushed Asia’s oil arrivals in May to the highest level in a year, per data compiled by LSEG Oil Research and cited by Reuters columnist Clyde Russell. Asia, the key crude oil importing region and a gauge of oil demand trends, is set to welcome in May 27.81 million barrels per day (bpd) of crude oil volumes, nearly 1 million bpd higher than the April imports, per the LSEG Oil Research data. Most of the 920,000-bpd growth in Asia’s estimated crude oil imports this month has been… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Strong-Indian-Purchases-Push-Asias-Crude-Imports-to-One-Year-High.html |

|

BHP Abandons Anglo American Takeover TalksBHP has abandoned its pursuit of Anglo American today after the London-listed firm refused to offload its South African iron ore business prior to a deal and declined to extend takeover talks. The news brings a close to a fractious bidding process in which BHP has failed to budge on the original terms of its bid, which required Anglo to carve-off its South Africa-based Kumba business. Any deal would have marked the biggest mining merger in over a decade but the condition has proved a sticking point and irked Anglo’s biggest shareholder, the… Read more at: https://oilprice.com/Energy/Energy-General/BHP-Abandons-Anglo-American-Takeover-Talks.html |

|

Chevron Close to Signing Natural Gas Exploration Deal With AlgeriaAlgeria’s state-owned energy firm Sonatrach expects to sign in the coming days an agreement with Chevron that is set to boost the country’s natural gas production, Algerian Energy Minister Mohamed Arkab has said. The deal with the U.S. supermajor will be signed “within the next few days,” Arkab told state television in an interview carried by Bloomberg. Algeria, the North African OPEC producer, is looking to raise its natural gas production and exports and will remain a key provider of gas to Europe, the minister… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Close-to-Signing-Natural-Gas-Exploration-Deal-With-Algeria.html |

|

EU Finalizes Decision to Quit Energy Treaty Over Climate IssuesThe European Union member states formally adopted on Thursday a decision to withdraw from a 1990s energy pact that allows oil companies to sue governments over their climate policies. The Council’s decision today gave the final green light for the EU and Euratom to withdraw from the Energy Charter Treaty after the European Parliament approved it during its last plenary session in April 2024, the EU said in a statement. The Energy Charter Treaty (ECT), signed in 1994 and in force since 1998, was originally designed to promote… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Finalizes-Decision-to-Quit-Energy-Treaty-Over-Climate-Issues.html |

|

Saudi Aramco Set to Announce Secondary Share SaleSaudi Arabia is expected to launch as soon as Sunday a secondary share sale in its oil giant Aramco, Reuters reported on Thursday, quoting sources familiar with the plans. The landmark new share offering needs final approval from Saudi Crown Prince Mohammed bin Salman, according to Reuters’ sources. Last week, reports started emerging that Saudi Aramco planned to sell more shares as soon as next month. The news about a planned sale was exclusively reported last Friday by Reuters, which cited two unnamed sources as… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Set-to-Announce-Secondary-Share-Sale.html |

|

Stocks close lower, Dow falls more than 300 points as Salesforce plunges 20%: Live updatesStocks fell Thursday, as shares of Salesforce slid on a quarterly revenue miss and soft guidance. Read more at: https://www.cnbc.com/2024/05/29/stock-market-today-live-updates.html |

|

Salesforce shares tumble 20% in worst day since 2004Salesforce stock fell Thursday after the company released weaker-than-expected fiscal first-quarter results on Wednesday. Read more at: https://www.cnbc.com/2024/05/30/salesforce-stock-fall-earnings-revenue-miss.html |

|

Fed’s Williams says inflation is too high but will start coming down soonWith markets on edge over the direction of monetary policy, Williams offered no clear indication of where he is leaning with possible interest rate cuts. Read more at: https://www.cnbc.com/2024/05/30/feds-williams-says-inflation-is-too-high-but-will-start-coming-down-soon.html |

|

Fed’s favorite inflation gauge is expected to show very slow progress on FridayThe Commerce Department’s measure of personal consumption expenditures prices is expected to show inflation in April running at a 2.7% annual rate. Read more at: https://www.cnbc.com/2024/05/30/feds-favorite-inflation-gauge-is-expected-to-show-very-slow-progress-on-friday.html |

|

The small-cap slump is getting historically long. Here’s what needs to change for a reboundThe Russell 2000 has gone more than 600 trading days without a record high, dating back to November 2021. Interest rates and earnings growth are key factors. Read more at: https://www.cnbc.com/2024/05/30/the-slump-for-small-cap-stocks-is-getting-historically-long.html |

|

Bank of America CEO says U.S. consumers and businesses have turned cautious on spendingConsumers and businesses are wrestling with inflation and borrowing costs that remain higher than they are accustomed to. Read more at: https://www.cnbc.com/2024/05/30/bank-of-america-ceo-consumer-spending.html |

|

Trump trial jury resumes New York hush money case deliberations after rehearing David Pecker testimony: Live updatesDonald Trump says criminal charges at his hush money trial in New York are “rigged” and designed to harm his election chances against President Joe Biden. Read more at: https://www.cnbc.com/2024/05/30/trump-trial-verdict-watch-hush-moneyhtml.html |

|

FAA won’t clear Boeing to increase 737 Max production for several months, agency head saysBoeing’s CEO and other top leaders met with the Federal Aviation Administration to present its safety plan. Read more at: https://www.cnbc.com/2024/05/30/boeing-faa-safety-plan.html |

|

BlackRock’s IBIT becomes largest spot bitcoin ETF, surpassing Grayscale’s GBTC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Lynn Martin, president of NYSE Group, explains a new collaboration with CoinDesk Indices and Katherine Dowling, general counsel & CCO at Bitwise Asset Management, discusses crypto ETFs from Consensus 2024. Read more at: https://www.cnbc.com/video/2024/05/30/blackrocks-ibit-becomes-largest-spot-bitcoin-etf-surpassing-grayscale-gbtc-cnbc-crypto-world.html |

|

Texas Instruments CEO open to activist Elliott’s free cash flow proposalTexas Instruments CEO Haviv Ilan signaled an openness to speak with activist investor Elliott and suggested that the company might adopt some of its proposals. Read more at: https://www.cnbc.com/2024/05/30/texas-instruments-txn-activist-elliott-fcf-alignment.html |

|

The Chicago-area house from ‘Home Alone’ is on the market for $5.25 million—take a look insideThe “Home Alone” house is located in the Chicago suburbs of Winnetka, Illinois. Read more at: https://www.cnbc.com/2024/05/30/home-alone-house-illinois-sale.html |

|

Amazon Prime now includes a Grubhub food-delivery subscriptionAmazon has added to its stable of Prime program benefits as it looks to attract and retain members. It’s now adding Grubhub food delivery as a permanent perk. Read more at: https://www.cnbc.com/2024/05/30/amazon-prime-grubhub-subscription.html |

|

For the first time in 323 years, Yale has elected a woman as its permanent presidentMcInnis is stepping into the role at a complicated time in higher education, which has been rattled by on-campus protests over the Israel-Hamas war. Read more at: https://www.cnbc.com/2024/05/30/yale-names-maurie-mcinnis-university-president.html |

|

Chinese National Arrested For Allegedly Operating “World’s Largest Botnet”Authored by Frank Fang via The Epoch Times, A Chinese national has been arrested for allegedly running a botnet of 19 million infected IP addresses in nearly 200 countries, amassing at least $99 million by leasing his network to criminals for cybercrimes including COVID-19 pandemic relief scams.

The Department of Justice (DOJ) said Wang Yunhe, 35, offered customers to use his network of compromised IP addresses for a fee from 2014 until July 2022, according to a press release issued on May 29. The service, named “911 S5,” allowed cybercriminals to conceal their digital footprint when engaging in nefarious online activities. Those offenses included financial crimes, stalking, transmitting bomb threats and threats of harm, illegal exportation of goods, and receiving and sending child exploitation materials … Read more at: https://www.zerohedge.com/technology/chinese-national-arrested-allegedly-operating-worlds-largest-botnet |

|

McDonald’s Top US Exec ‘McFact-Checks’ Social Media Buzz Around $18 Big MacsA top-level McDonald’s executive was fed up with social media users complaining about out-of-control ‘Mcflation,’ more precisely, $18 Big Macs, and wanted to set the record straight. The exec called “viral social posts” about burger inflation “poorly sourced.” This comes as the burger chain is preparing to reintroduce the $5 meal deal to retain consumers as failed Bidenomics crushes the working poor, resulting in a price war between other burger chains (read here). “Recently, we have seen viral social posts and poorly sourced reports that McDonald’s has raised prices significantly beyond inflationary rates. This is inaccurate,” Joe Erlinger, president of McDonald’s USA, wrote in an open letter. Erlinger said, “Americans across the country are making tough calls about where to spend their hard-earned money,” adding, “And while we’ve been working hard to make sure our fans have great reasons to visit us, it’s clear that we — together with our franchisees — must remain laser-focused on value and affordability.” Erlinger is addressing these X posts…

|

|

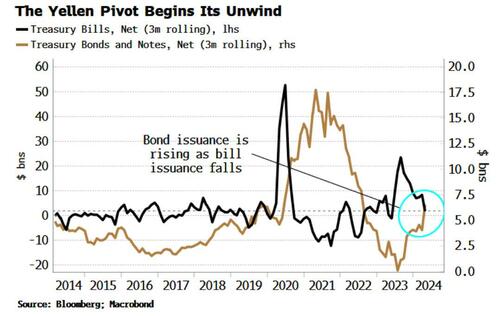

Yellen Pivot Is Fading: Liquidity Drains From The System As Treasury Issues Fewer BillsBy Simon White, Bloomberg Markets Live reporter and strategist Risk assets will face a less-easy ride as Treasury bill issuance falls and coupon (notes and bonds) issuance rises, weighing on central-bank reserves. Nothing lasts forever. The Treasury tilted issuance towards bills last year – the Yellen pivot – which allowed the market to continue to rally despite the inundation of government debt. After reaching 23% in March, the bills proportion of total debt fell back to 22.2% in April, the biggest monthly drop since March 2023. The Yellen pivot is fading. But the largest peacetime fiscal deficit still needs funding. That means good old-fashioned bond issuance is starting to take up the slack as bill issuance falls back.

Reserves have started to decline again, draining liquidity from the system. Quantitative tightening may have been in operation for almost two years, and the Federal Reserve’s balance sheet falling … Read more at: https://www.zerohedge.com/markets/yellen-pivot-fading-liquidity-drains-system-treasury-issues-fewer-bills |

|

“There Have Not Been Any Discussions”: Musk Denies Report Of Trump Admin Advisory RoleUpdate (1400ET): Musk denied today’s report that he’s been in discussions about a possible advisory role in a future Trump administration. “There have not been any discussions of a role for me in a potential Trump Presidency,” Musk posted on X in response to user Herbert Ong, who posted a CNBC segment discussing the report.

* * * In a notable shift from past acrimony, Donald Trump, the presumptive Republican nominee, has engaged in discussions with Elon Musk about a possible advisory role for the Tesla mogul should Trump retake the White House, the Wall Street Journal reports. The move could see Musk influencing policies on border security and the economy. Read more at: https://www.zerohedge.com/political/trump-and-musk-discussing-advisory-role-next-administration-report |

|

Labour and Tories confirm income tax squeezeBoth parties say a freeze on tax thresholds will remain for three years if they win the election. Read more at: https://www.bbc.com/news/articles/crggz000lz7o |

|

Home Office says Eurostar e-gate issue fixedEurostar said there was a technical problem with UK Border Force e-gates at Gare du Nord. Read more at: https://www.bbc.com/news/articles/c511x9nk29lo |

|

Faisal Islam: Election tax row is a phony warPromises by the Conservatives and Labour on tax are similar but reality will emerge after 4 July. Read more at: https://www.bbc.com/news/articles/cw55vxlyd29o |

|

Election Jitters! A 15-20% correction is okay, look beyond June 4: ExpertsMotilal Oswal Financial Services Chairman & Co-Founder Raamdeo Agrawal said that post-election will be a “very interesting time though things may have extended a little bit and it is quite possible that the next quarter or two could be slow. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/election-jitters-a-15-20-correction-is-okay-look-beyond-june-4-experts/articleshow/110562076.cms |

|

TPG Asia sells entire stake in RR Kabel in Rs 958 crore block dealMarquee funds, including Edelweiss MF, Tata MF, Goldman Sachs, Citigroup, Morgan Stanley, ICICI Pru MF, Blackstone Aqua, Reliance Nippon Life, and HDFC Standard Life, among others, bought stakes in the transaction. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tpg-asia-sells-entire-stake-in-rr-kabel-in-rs-958-crore-block-deal/articleshow/110569495.cms |

|

Tech View: Nifty slips below 21EMA. What traders should do on FridayNifty declined 216.05 points 1% at 22,488.65 on Thursday, led by strong selling pressure in most sectors. It has now reached the support cluster of 22,460–22,500, where support parameters in the form of the 20-day moving average and the 50% Fibonacci retracement level are placed. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-slips-below-21ema-what-traders-should-do-on-friday/articleshow/110567674.cms |

|

‘I’m a mother in my 40s and I’m financially independent’: I’m about to inherit $850,000. What should I do with my windfall?‘I make about $100,000 annually, and I have $50,000 in savings and stocks.” Read more at: https://www.marketwatch.com/story/im-inheriting-850-000-im-a-mother-and-have-always-been-financially-independent-what-should-i-do-with-my-windfall-a3c2a476?mod=mw_rss_topstories |

|

A 13-year-old girl worked 60 hours a week making car parts for Hyundai in Alabama, Labor Department saysLawsuit alleges that a supplier for the South Korean car giant broke child-labor laws so egregiously that it “shocks the conscience.” Read more at: https://www.marketwatch.com/story/a-13-year-old-girl-worked-60-hours-a-week-making-car-parts-for-hyundai-in-alabama-labor-department-says-94c2932d?mod=mw_rss_topstories |

|

Bulletproof to bust: Top AAA bonds tarnished by a Blackstone office deal’s blow upInvestors in a Blackstone-financed property recently took a loss on AAA bonds, the first of this cycle Read more at: https://www.marketwatch.com/story/bulletproof-to-bust-top-aaa-bonds-tarnished-by-a-blackstone-office-deals-blow-up-43e8ed96?mod=mw_rss_topstories |