Summary Of the Markets Today:

- The Dow closed down 411 points or 1.06%,

- Nasdaq closed down 0.58%,

- S&P 500 closed down 0.74,

- Gold $2,337 down $19.90,

- WTI crude oil settled at $79 down $0.79,

- 10-year U.S. Treasury 4.614 up 0.072 points,

- USD index $105.13 up $0.520,

- Bitcoin price is $67,209.30, a change of -1.69% over the past 24 hours as of 4:02 p.m.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

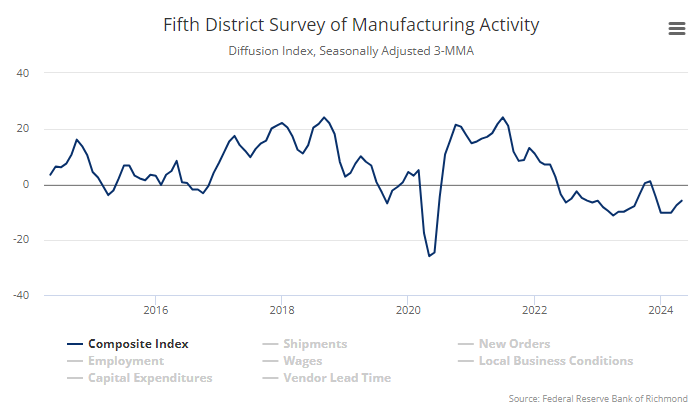

The Richmond Fed Manufacturing Survey shows manufacturing activity improved but remained sluggish in May 2024. The diffusion manufacturing index increased from −10 in April to -6 in May. Note that the one month manufacturing index improved from -7 to 0 – of its three component indexes, shipments increased from −10 to 13, new orders increased from −9 to −6, and employment fell from −2 to −6. Manufacturing in the U.S. remains in a recession.

The May 2024 Beige Book (which is an anecdotal post on current economic conditions in each Federal Reserve District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources) said only that the economy “continued to expand” – and did not give many reasons to be optimistic about the direction of the economy. The summary paragraph read as follows:

National economic activity continued to expand from early April to mid-May; however, conditions varied across industries and Districts. Most Districts reported slight or modest growth, while two noted no change in activity. Retail spending was flat to up slightly, reflecting lower discretionary spending and heightened price sensitivity among consumers. Auto sales were roughly flat, with a few Districts noting that manufacturers were offering incentives to spur sales. Travel and tourism strengthened across much of the country, boosted by increased leisure and business travel, but hospitality contacts were mixed in their outlooks for the summer season. Demand for nonfinancial services rose, and activity in transportation services was mixed, as port and rail activity increased whereas reports of trucking and freight demand varied. Nonprofits and community organizations cited continued solid demand for their services, and manufacturing activity was widely characterized as flat to up, though two Districts cited declines. Tight credit standards and high interest rates continued to constrain lending growth. Housing demand rose modestly, and single-family construction increased, though there were reports of rising rates impacting sales activity. Conditions in the commercial real estate sector softened amid supply concerns, tight credit conditions, and elevated borrowing costs. Energy activity was largely stable, whereas agricultural reports were mixed, as drought conditions eased in some Districts, but farm finances/incomes remained a concern. Overall outlooks grew somewhat more pessimistic amid reports of rising uncertainty and greater downside risks.

Here is a summary of headlines we are reading today:

- China’s Oil Demand to Peak Before 2027, Says Sinopec

- Wall Street Sees Ethereum Hitting $14,000 in 2025

- Ukraine’s Drones Are Hammering Russian Oil Refineries

- The True Cost of Abandoning the Gold Standard

- Hess Shareholders Approve $53 Billion Chevron Deal

- S&P 500 posts 1st losing day in 3 as Nvidia’s climb fails to lift market, Dow drops 400 points: Live updates

- American shares tumble 15% after sales strategy backfires; carrier cuts growth

- Abercrombie & Fitch shares surge 25% as retailer’s torrid growth shows no signs of slowing

- Bitcoin drops to $67,000 level, and Gemini returns more than $2 billion to users: CNBC Crypto World

- McDonald’s exec says average menu item costs 40% more than 2019

- Ugly Beige Book: “Negligible Job Gains”, “Lower Discretionary Spending”, “More Pessimistic Outlook”

- How Big Macs and Chick-fil-A sandwiches became America’s hot new status symbols

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Oil Demand to Peak Before 2027, Says SinopecChina Petroleum & Chemical Corporation, or Sinopec, expects oil demand in China to peak before 2027, according to the 2024 edition of the China Energy Outlook 2060 that the world’s biggest refiner published on Wednesday. In its previous outlook last year, Sinopec said that China’s oil consumption is expected to peak at some point later this decade, between 2026 and 2030, due to an acceleration of EV adoption. In the latest outlook out today, Sinopec says that China’s coal consumption, which anchors… Read more at: https://oilprice.com/Energy/Crude-Oil/Chinas-Oil-Demand-to-Peak-Before-2027-Says-Sinopec.html |

|

Europe’s Steel Industry Set for Major ShakeupVia Metal Miner Liberty Steel recently triggered a review of its downstream flat rolling assets in Western Europe. The firm’s parent company, GFG Alliance, said the potential steel industry shakeup stems from an expression of interest from several interested parties. “The review will evaluate Liberty’s assets in Liège (Belgium), Dudelange (Luxembourg), and Piombino (Italy) and will be facilitated by specialist global investment bankers Jefferies,” the holding company said on May 15. GFG Alliance noted that the primary… Read more at: https://oilprice.com/Metals/Commodities/Europes-Steel-Industry-Set-for-Major-Shakeup.html |

|

Wall Street Sees Ethereum Hitting $14,000 in 2025A month and a half after we first observed that the world’s largest bitcoin fund, Grayscale’s GBTC, had lost more than half of its assets since the approval of spot bitcoin ETFs in January in what was the year’s first, and far less memorable “halving” event… … and just over a week after Grayscale CEO Michael Sonnenschein unexpectedly resigned amid persistent, relentless outflows (courtesy of GBTC’s 1.5% in fees), the flipping has officially taken place. With today’s ETF flows now in the books, the inevitable has finally happened, and after… Read more at: https://oilprice.com/Finance/the-Markets/Wall-Street-Sees-Ethereum-Hitting-14000-in-2025.html |

|

Libyan Oil Minister Cleared of Smuggling, Mismanagement AllegationsLibyan Oil and Gas Minister Mohamed Aoun has resumed his position after being removed from duty in early April pending an investigation into oil smuggling and mismanagement allegations, the Libyan Herald reports, citing the Ministry’s social media accounts. “His Excellency the Minister of Oil and Gas Eng. Mohamed Mohamed Aoun began this morning his duties at the Ministry of Oil and Gas’’, the Ministry said in its announcement, adding that the investigation into Aoun’s activities had been concluded. Aoun… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyan-Oil-Minister-Cleared-of-Smuggling-Mismanagement-Allegations.html |

|

Are Community Energy Projects More Than Just a Pipe Dream?The SNP doesn’t want to govern the UK. But it might have a big influence on the next government’s policies. With some polls (albeit somewhat questionably) predicting a hung parliament, Sir Keir Starmer could find himself relying on SNP votes for a majority. So, what would the SNP ask for in return? Setting aside the obvious (another independence referendum, which Labour has said it won’t grant), the SNP has long prioritised renewable energy. A particular favourite is community energy projects – these… Read more at: https://oilprice.com/Energy/Energy-General/Are-Community-Energy-Projects-More-Than-Just-a-Pipe-Dream.html |

|

Iran to Launch $4.6 Billion Worth of Oil ProjectsIran will soon launch 32 oil industry projects worth a total investment of $4.6 billion, Iranian Petroleum Minister Jawad Owji said on Wednesday. Iran has also begun work on 50 new oil projects worth a total of over $50 billion, Iranian media quoted Owji as saying. Since 2021, Iran has boosted its oil production by 60%, the oil minister said earlier in May. In the latest Iranian calendar year to March 19, 2024, the Islamic Republic boosted its oil and gas production by 20% compared to the previous Iranian year, Owji added. Iran has signed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-to-Launch-46-Billion-Worth-of-Oil-Projects.html |

|

Ukraine’s Drones Are Hammering Russian Oil RefineriesOn May 19, a Ukrainian drone slammed into the 70,000-barrel-a-day Slavyansk oil refinery in southern Russia’s Krasnodar region, sending a fireball into the sky, according to videos circulating on social media. It was the third time in two months that Ukrainian forces hit the relatively small plant located several hundred kilometers from the front, dodging Russian air defense systems. The latest strike forced Slavyansk to temporarily shut down until the damage could be repaired. The hits on the refinery were part of a campaign of drone strikes… Read more at: https://oilprice.com/Geopolitics/International/Ukraines-Drones-Are-Hammering-Russian-Oil-Refineries.html |

|

Norway Holds Firm on Oil Drilling Ban in Protected RegionNorway will keep the Nordland county area of the stunning Lofoten and Vesterålen islands off limits for oil and gas exploration and production, Energy Minister Terje Aasland said on Wednesday. A series of left and right-wing Norwegian governments have been protecting the area from oil and gas drilling for more than 20 years. “We won’t open that area, there are more than enough other areas available to develop the oil and gas industry in a responsible way,” Aasland told Norway’s Parliament today, as carried by Reuters. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Holds-Firm-on-Oil-Drilling-Ban-in-Protected-Region.html |

|

The True Cost of Abandoning the Gold StandardAuthored by Charles Hugh Smith via OfTwoMinds blog, We all know the problem with fiat currency: the temptation to print more currency is irresistible, but ultimately destructive. Money in all its forms attracts quasi-religious beliefs and convictions. This makes it difficult to discuss with anything resembling objectivity. But given the centrality of money (and its sibling, greed) in human affairs, let’s press on and ask: would returning to the Gold Standard (i.e. gold as money / gold-backed currency) resolve our most pressing monetary problems?… Read more at: https://oilprice.com/Metals/Gold/The-True-Cost-of-Abandoning-the-Gold-Standard.html |

|

Germany Repurposes Underground Gas Storage for Green HydrogenGermany’s government approved on Wednesday a draft law to enable faster development of hydrogen projects and infrastructure by fast-tracking permitting and environmental checks for hydrogen production, storage, and transportation, government sources told Reuters. The so-called Hydrogen Acceleration Law will give hydrogen projects priority in approvals, simplify permitting, and fast-track environmental impact assessments. Germany, which aims to become a carbon-neutral economy by 2045 – five years ahead of the EU and other… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Repurposes-Underground-Gas-Storage-for-Green-Hydrogen.html |

|

AngloAmerican Dumps Coal, Platinum and Diamonds to Focus on Core BusinessVia Metal Miner AngloAmerican plans to divest several assets under its plans to simplify its portfolio, including coking coal. The move follows the company’s 2023 asset review, but also serves to rebuff a takeover takeover bid from Australia’s BHP. “Each asset was assessed for competitiveness and performance optimization potential and for its role in the portfolio,” AngloAmerican said in a May 14 announcement. Divestment and demerger plans are to cover steelmaking coking coal, platinum, nickel, and the De Beers diamond subsidiary,… Read more at: https://oilprice.com/Metals/Commodities/AngloAmerican-Dumps-Coal-Platinum-and-Diamonds-to-Focus-on-Core-Business.html |

|

Signs of Weakening Oil Demand in China MultiplySigns of emerging weakness in crude oil demand in the world’s biggest importer of the commodity, China, are casting a shadow over the success of OPEC+ to prop up prices. According to a Bloomberg report, the decline in the housing market is one sign of this weakness, with eleven consecutive months of declines in home sales. This has in turn affected construction activity, which is a major driver of energy and fuel demand, the report also said, noting a decline in China’s apparent consumption of crude in April, which was the first… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Signs-of-Weakening-Oil-Demand-in-China-Multiply.html |

|

Hess Shareholders Approve $53 Billion Chevron DealHess Corporation’s shareholders approved Chevron’s $53-billion all-stock acquisition proposal, marking a significant milestone in the merger process. This approval comes despite the ongoing arbitration between ExxonMobil and Chevron over Exxon’s claimed right of first refusal (ROFR) for Hess’s stake in the Stabroek block, a key asset in Guyana’s prolific oil fields. Chevron’s proposal to acquire Hess has faced scrutiny from regulators and politicians, with Exxon asserting its right to pre-emptively match Chevron’s offer due to its 30% stake in… Read more at: https://oilprice.com/Energy/Energy-General/Hess-Shareholders-Approve-53-Billion-Chevron-Deal.html |

|

ConocoPhillips to Buy Marathon Oil in $22.5-Billion All-Stock DealConocoPhillips said on Wednesday it would buy Marathon Oil in an all-stock deal with an enterprise value of $22.5 billion, including $5.4 billion of net debt, in the latest merger transaction in the U.S. shale industry. Under the terms of the definitive agreement, Marathon Oil shareholders will receive 0.2550 shares of ConocoPhillips common stock for each share of Marathon Oil common stock, representing a 14.7% premium to the closing share price of Marathon Oil on May 28, 2024, and a 16.0% premium to the prior 10-day volume-weighted average… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-to-Buy-Marathon-Oil-in-225-Billion-All-Stock-Deal.html |

|

ConocoPhillips in Talks to Buy Marathon Oil in All-Stock DealConocoPhillips is in an advanced stage of discussions to acquire Marathon Oil in an all-stock transaction, the Financial Times reported on Wednesday, quoting sources briefed on the issue. A potential deal, which looked imminent on Tuesday night, is expected to value Marathon Oil at just over its current market capitalization of $15 billion, according to FT’s sources. Still, there is still a risk that the talks could fall apart or another buyer outbids ConocoPhillips for Marathon Oil, the UK business newspaper noted. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-in-Talks-to-Buy-Marathon-Oil-in-All-Stock-Deal.html |

|

S&P 500 posts 1st losing day in 3 as Nvidia’s climb fails to lift market, Dow drops 400 points: Live updatesStocks slid Wednesday as choppiness in artificial intelligence darling Nvidia put one of the last few bright spots for traders at risk. Read more at: https://www.cnbc.com/2024/05/28/stock-market-today-live-updates.html |

|

American shares tumble 15% after sales strategy backfires; carrier cuts growthAmerican cut its profit and unit revenue forecast for the second quarter, which coincides with some of the busiest travel periods of the year. Read more at: https://www.cnbc.com/2024/05/29/american-airlines-growth-sales-strategy.html |

|

Former OpenAI board member explains why CEO Sam Altman got fired before he was rehiredFormer OpenAI board member Helen Toner said board members learned about ChatGPT from Twitter and didn’t know CEO Sam Altman owned the OpenAI startup fund. Read more at: https://www.cnbc.com/2024/05/29/former-openai-board-member-explains-why-ceo-sam-altman-was-fired.html |

|

Trump trial jury asks to rehear testimony of Michael Cohen, David PeckerDonald Trump, the presumptive Republican presidential nominee, faces charges related to a payoff to porn star Stormy Daniels before the 2016 election. Read more at: https://www.cnbc.com/2024/05/29/trump-hush-money-jury-to-start-deliberations-in-new-york-court.html |

|

These dividend stocks top Thornburg’s list — and they are trading at a discountInvestors searching for income can find some bargains in dividend stocks, according to Ben Kirby, co-head of investments at Thornburg Investment Management. Read more at: https://www.cnbc.com/2024/05/29/these-dividend-stocks-top-thornburgs-list-and-they-are-trading-at-a-discount-.html |

|

Abercrombie & Fitch shares surge 25% as retailer’s torrid growth shows no signs of slowingAbercrombie & Fitch is building on its blockbuster 2023 by growing Hollister and adding new categories to its namesake banner, such as the A&F Wedding Shop. Read more at: https://www.cnbc.com/2024/05/29/abercrombie-fitch-anf-earnings-q1-2024.html |

|

Stellantis CEO says $25,000 Jeep EV coming to the U.S. ‘very soon’The importance of an affordable EV has grown more apparent as Chinese automakers such as BYD and Nio grow their sales outside of China. Read more at: https://www.cnbc.com/2024/05/29/stellantis-affordable-jeep-ev.html |

|

Bitcoin drops to $67,000 level, and Gemini returns more than $2 billion to users: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, James Davies, co-founder of Crypto Valley Exchange, explains why crypto winter was the right time to start his exchange and discusses what he’s hearing from attendees at Consensus 2024. Read more at: https://www.cnbc.com/video/2024/05/29/bitcoin-drops-to-67000-level-and-gemini-returns-more-than-2-billion-to-users-cnbc-crypto-world.html |

|

CrowdStrike is defying Wall Street negativity on software, says Cramer. What he expects from earningsCrowdStrike is the one software company that CrowdStrike “seems to be immune” to Wall Street’s negativity, Jim Cramer said. Read more at: https://www.cnbc.com/2024/05/29/crowdstrike-is-defying-wall-street-negativity-on-software-says-cramer-what-he-expects-from-earnings.html |

|

Walgreens announces price cuts on 1,300 items amid ongoing consumer spending fatigueSigns of a “K”-shaped economic recovery continue to emerge, with more well-off Americans able to sustain higher levels of spending than lower-income ones. Read more at: https://www.cnbc.com/2024/05/29/walgreens-announces-price-cuts-on-1300-items-amid-ongoing-consumer-spending-fatigue.html |

|

Supreme Court Justice Alito rejects calls to recuse from Trump, Jan. 6 casesSupreme Court Justice Samuel Alito said his wife was “solely responsible” for flying “a wide variety of flags over the years.” Read more at: https://www.cnbc.com/2024/05/29/supreme-courts-alito-rejects-calls-to-recuse-from-trump-jan-6-cases.html |

|

Mother of Jan. 6 officer Michael Fanone swatted after he called Trump ‘authoritarian’Fanone was abducted by the mob on Jan. 6 and nearly killed when a MAGA-hatted rioter who believed Donald Trump’s lies about the 2020 election drove a stun gun into his neck. Read more at: https://www.cnbc.com/2024/05/29/mother-of-jan-6-officer-michael-fanone-swatted-after-he-called-trump-authoritarian.html |

|

McDonald’s exec says average menu item costs 40% more than 2019President of McDonald’s USA clarified McDonald’s price inflation in a press release in response to 100% price increase claims by House Republicans among others. Read more at: https://www.cnbc.com/2024/05/29/mcdonalds-cost-increases.html |

|

Trouble In Paradise: Zelensky Insults Biden Over Absence At Peace SummitUkraine’s President Volodymyr Zelensky has increasingly of late lashed out publicly at the proverbial hand that feeds him. He and his top officials have long complained that the billions in approved Western defense aid and shipments have been much too slow to reach Ukraine, giving the superior-armed Russians a clear advantage. But now as things get more desperate especially in the Kharkiv region where Russian forces are fast advancing, Zelensky is going after President Biden himself. There’s a major Ukraine-backed peace summit in Switzerland set for next month, and it’s looking very unlikely that Biden will attend, leaving Zelensky deeply unhappy. During a visit to Belgium on Tuesday, Zelensky told reporters that it would not be “a strong decision” if Biden failed to attend the summit, which is to take place June 15-16 outside Lucerne. He went so far as to say it would be tantamount to a standing ovation for Putin.

Source: Xinhua Read more at: https://www.zerohedge.com/geopolitical/trouble-paradise-zelensky-insults-biden-over-possible-absence-peace-summit |

|

Is Hyper-Inflation That Destroys A Currency A “Solution”?Authored by Charles Hugh Smith via OfTwoMinds blog, When predicting the future, we’re best served by following “what benefits the wealthy and powerful,” as that is the likeliest outcome.

This contrarian sees a strong consensus around the notion that hyper-inflation is the inevitable end-game of nation-states / central banks issuing fiat currencies, i.e. currencies that are not restrained by being pegged to tangible assets such as gold reserves. The temptation to issue (via “printing” or borrowing new currency into existence by selling sovereign bonds) more currency becomes irresistible to politicians and central bankers alike. as the means to mollify every constituency, from elites to the military to commoners dependent on state-funded bread and circuses. This unrestrained creation of new money far in excess of the expansion of goods and services (i.e. the … Read more at: https://www.zerohedge.com/personal-finance/hyper-inflation-destroys-currency-solution |

|

Ugly Beige Book: “Negligible Job Gains”, “Lower Discretionary Spending”, “More Pessimistic Outlook”Extending the dismal pace of US economy growth (if not outright contraction) observed in last month’s Beige Book, which was validated by the sharp drop in Q1 GDP growth which tumbled to just 1.6% from more than 3% in Q4 and is expected to slide further to 1.3% tomorrow, moments ago the Fed published its latest Beige Book, which found that while economic activity expanded from early April to mid-May “as conditions varied across industries and Districts”, just like last month, most Districts reported “slight or modest growth”, while “two noted no change in activity.” That’s the good news. The bad news was far more extensive and worrisome and can be summarized as follows: “Negligible Job Gains”, “Lower Discretionary Spending”, “More Pessimistic Outlook.” Here are the highlights:

|

|

US-Made Bombs Used In Deadly Strike On Rafah Tent CampA fresh CNN report has concluded that Israel used American-made bombs in Sunday’s attack on a refugee tent encampment in Rafah which killed 45 people, including women and children. The attack on the displacement camp has driven global outrage also given the grim footage and images which surfaced in the aftermath, including of a headless child. Over 200 more were injured. Israeli leader Benjamin Netanyahu on Monday blamed a “tragic mistake” for the attack, while the Biden administration said it did not cross the president’s ‘red line’.

Read more at: https://www.zerohedge.com/geopolitical/us-made-bombs-used-deadly-strike-rafah-tent-camp |

|

BHP pulls out of Anglo American mining mega-mergerThe £39bn mega-merger between the two international mining giants collapses after a frantic back and forth. Read more at: https://www.bbc.com/news/articles/c977g96vll1o |

|

Insulation scandal: ‘I have to scrape mould off the walls every two weeks’The BBC can reveal insulation fitted under government schemes could have failed in hundreds of thousands of homes. Read more at: https://www.bbc.com/news/articles/cxwwr7vyrj0o |

|

Royal Mail owners agree to £5bn takeover offerDaniel Kretinsky said that potentially owning the business would come with huge responsibility. Read more at: https://www.bbc.com/news/articles/c4nn0n93zj4o |

|

Technical Breakout Stocks: How to trade JSW Infrastructure, Coromandel International & Power Finance Corporation on ThursdayThe S&P BSE Sensex fell over 600 points while the Nifty50 closed at 22,704. Buying was seen in utilities, power, healthcare, and telecom stocks while IT, oil & gas and banks saw some selling. JSW Infrastructure rose over 2% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-jsw-infrastructure-coromandel-international-power-finance-corporation-on-thursday/articleshow/110540683.cms |

|

Telecom among top 5 sectors that led FPI inflows since JanuaryTrendlyne data shows that telecom cornered the biggest chunk of FII inflows from January 2024 till May 15, 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/telecom-among-top-5-sectors-that-led-fpi-inflows-since-january/slideshow/110537310.cms |

|

Tech View: Dark cloud pattern seen on Nifty charts. What traders should do on Thursday expiryNifty on Wednesday ended 183 points lower near the 22,700 level as the index formed a dark cloud cover candlestick pattern on the daily chart. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-dark-cloud-pattern-seen-on-nifty-charts-what-traders-should-do-on-thursday-expiry/articleshow/110537855.cms |

|

How Big Macs and Chick-fil-A sandwiches became America’s hot new status symbolsThe once humble combo value meal is, increasingly, a habit of well-heeled diners who are also looking for ways to spend less as prices rise. In this economy, being high-income isn’t what it used to be. Read more at: https://www.marketwatch.com/story/how-fast-food-became-americas-hot-new-status-symbol-ef3a0186?mod=mw_rss_topstories |

|

I’m a millennial mom. Why are world leaders looking at me to fix the birth-rate problem?The panic about falling birthrates is divorced from the realities of raising kids in today’s world. Read more at: https://www.marketwatch.com/story/im-a-millennial-mom-why-are-world-leaders-looking-at-me-to-fix-the-birth-rate-problem-4eab8181?mod=mw_rss_topstories |

|

The elder-care crisis crushes workers. Employers now offer benefits to help.A growing number of businesses are taking steps to help the one in five U.S. workers who are also caregivers for parents, in-laws, spouses, partners and siblings. Read more at: https://www.marketwatch.com/story/the-elder-care-crisis-crushes-workers-employers-now-offer-benefits-to-help-fd939e23?mod=mw_rss_topstories |

“Small diameter bombs” via USAF file image

“Small diameter bombs” via USAF file image