Summary Of the Markets Today:

- The Dow closed down 217 points or 0.55%,

- Nasdaq closed up 0.59%, (Closed at 17,020, New Historic high 17.033)

- S&P 500 closed up 0.02%,

- Gold $2,358 up $24.40,

- WTI crude oil settled at $80 up $2.45,

- 10-year U.S. Treasury 4.542 up 0.069 points,

- USD index $104.60 up $0.001,

- Bitcoin price is $68,354.36, a change of -1.45% over the past 24 hours as of 4:05 p.m.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

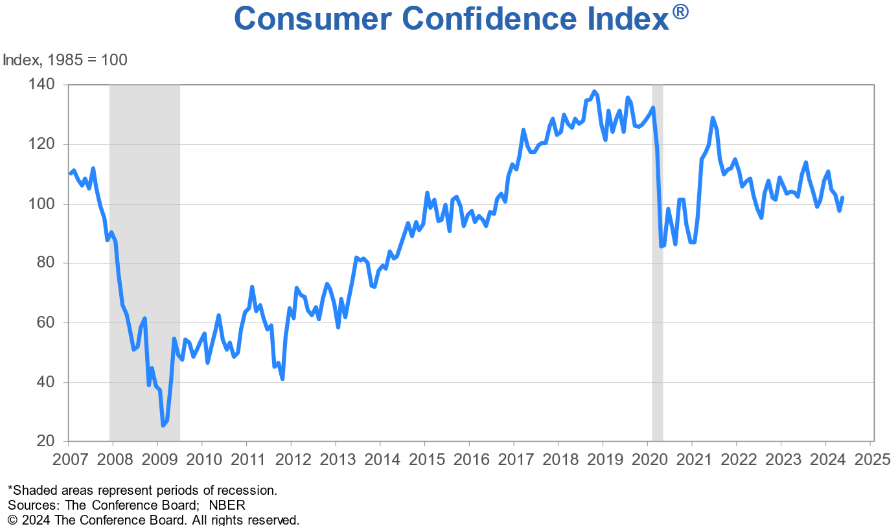

The Conference Board’s Consumer Confidence Index rose in May to 102.0 (1985=100) from 97.5 in April. It is interesting that the University of Michigan Consumer Sentiment remains well below 1985 levels whilst this Consumer Confidence Index is now above that level. The Consumer Confidence Survey reflects prevailing business conditions and likely developments for the months ahead. Dana M. Peterson, Chief Economist at The Conference Board stated:

Confidence improved in May after three consecutive months of decline. The survey also revealed a possible resurgence in recession concerns. The Perceived Likelihood of a US Recession over the Next 12 Months rose again in May, with more consumers believing recession is ‘somewhat likely’ or ‘very likely’. This contrasts with CEO assessments of recession risk: according to our CEO Confidence survey, only 35 percent of CEOs surveyed in April anticipated a recession within the next 12 to 18 months. Consumers were nonetheless upbeat about the stock market, with 48.2 percent expecting stock prices to increase over the year ahead, compared to 25.4 percent expecting a decrease and 26.4 expecting no change.

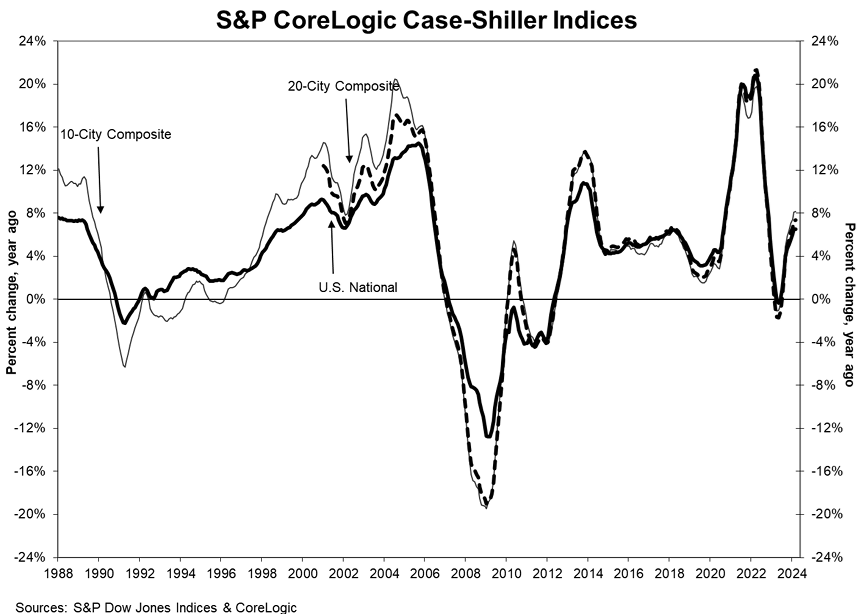

The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index posted a slight year-over-year in March 2024 increase to 7.4%, up from a 7.3% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities. Denver, holds the lowest rank this month for the smallest year-over-year growth, with a 2.1% annual increase in March. CoreLogic Chief Economist Dr. Selma Hepp added:

Continued home price resiliency amid surging borrowing costs highlights headwinds for the housing market reflected in slow sales activity, namely affordability challenges for potential homebuyers as cost of homeownership continue to skyrocket, particularly homeowners’ insurance and property tax increases. While these costs are driving some sellers and investors to let go of homes, and improving inventory shortages, buyers are maintaining the wait-and-see approach in anticipation of lower rates down the road. Nevertheless, it will be important to see how these non-mortgage costs affect potential homebuyers and existing homeowners longer term, particularly homeowners with fixed incomes. Weakness in low tier home prices in Tampa highlight some of the potential challenges. In contrast, markets in proximity to major employment centers, such as Seattle, Boston, and New York which have benefited from strong labor markets and ensuing wage and wealth gains are helping drive the demand while lack of homes for sale and new construction are putting pressure on prices in these markets.

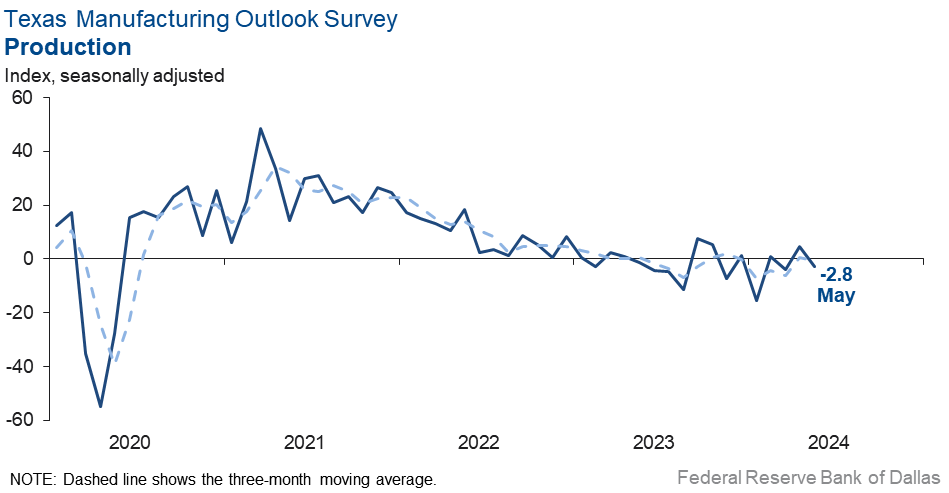

Texas Manufacturing Outlook Survey edged down in May 2024. The production index, a key measure of state manufacturing conditions, slipped from 4.8 to -2.8. The negative reading signals a slight decline in output from April. Other measures of manufacturing activity also suggested weaker activity this month. The new orders index remained negative, though it inched up to -2.2. The capacity utilization and shipments indexes slipped back into negative territory after turning positive last month, coming in at -2.0 and -3.0, respectively. My position remains that manufacturing in the U.S. continues in a recession.

Here is a summary of headlines we are reading today:

- Mega-Batteries Key in the Electrification of Heavy Industry

- Surging Commodity Prices Re-Ignite Inflation Fears

- What’s Behind the Recent Rally in Copper Prices?

- Gasoline Prices Surge as Summer Driving Season Heats Up

- Oil Prices Remain Rangebound Despite Rising Gasoline Demand

- Nasdaq closes above 17,000 for the first time, Dow slides more than 200 points: Live updates

- Market crash indicator with spotty track record ‘Hindenburg Omen’ triggered last week

- Former FTX exec sentenced, and bitcoin miner Riot pursues takeover of Bitfarms: CNBC Crypto World

- NVDA Sucks All The Oxygen Out Of The Market Again…

- Room for gold, oil and copper to rise, keeping commodity rally alive, UBS says

- 10-year Treasury yield logs biggest daily jump in a month after weak auctions

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Mega-Batteries Key in the Electrification of Heavy IndustryDespite declining interest in electric passenger vehicles, some companies are pushing forward with the electrification of a much more challenging segment of the transport industry: heavy machinery. Electrifying trucks, bulldozers, tractors, and excavators is tricky because of the amount of fuel they currently use to do their job. And yet, some companies say they are doing it—with lots and lots of batteries. The Financial Times recently profiled one such company, based in Ireland, which makes battery packs for… Read more at: https://oilprice.com/Energy/Energy-General/Mega-Batteries-Key-in-the-Electrification-of-Heavy-Industry.html |

|

Oil and Gas Investments in Norway Set for Record-High in 2024Companies are expected to spend a record-high level of investment on oil and gas extraction and pipeline transportation in 2024 offshore Norway, thanks to higher expected spending on exploration and field developments, Statistics Norway said on Tuesday. Investments in oil and gas extraction and pipeline transportation for 2024 are now estimated at $23.6 billion (247 billion Norwegian crowns), “which is historically the highest nominal estimate given since this statistic was created,” Norway’s statistics office… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-and-Gas-Investments-in-Norway-Set-for-Record-High-in-2024.html |

|

Georgia’s EU Aspirations Jeopardized by Controversial New LawEU foreign ministers will discuss the situation in Georgia when they assemble in Brussels on May 27. Brussels is still hoping that the country’s controversial “foreign agent” law, which is expected to be finally passed this week, will be withdrawn or sufficiently watered down. The bill has been heavily criticized by Western countries and rights groups for creating a framework to clamp down on civil society and free media. Until the law is adopted, the EU is unlikely to do anything. But what then are the bloc’s options? The European Commission will… Read more at: https://oilprice.com/Geopolitics/International/Georgias-EU-Aspirations-Jeopardized-by-Controversial-New-Law.html |

|

India’s Largest Refinery Inks Russian Oil DealIndia’s private refiner Reliance Industries has signed a one-year agreement with Russia’s top oil producer Rosneft to buy at least two cargoes of Urals crude in Russian rubles per month, Reuters reported on Tuesday, citing four sources familiar with the matter. Reliance, which operates the Jamnagar refinery in India, the world’s largest and most complex single-site refinery, has signed the deal effective from April 1 to buy two cargoes of around 1 million barrels of Russia’s Urals crude each… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Largest-Refinery-Inks-Russian-Oil-Deal.html |

|

Surging Commodity Prices Re-Ignite Inflation FearsBy Garfield Reynolds, Bloomberg Markets Live reporter and strategist Surging commodity prices are threatening to bring inflation back through a door that investors thought central banks had slammed shut. That’s bringing yields higher, but the structural boost to fiscal spending that is helping drive demand for raw materials threatens to create a vicious circle for bond investors assuming that 2023 marked the start of a fresh bull run. Commodities this year already erased much of 2023’s declines, perhaps the most obvious sign that the… Read more at: https://oilprice.com/Metals/Commodities/Surging-Commodity-Prices-Re-Ignite-Inflation-Fears.html |

|

What’s Behind the Recent Rally in Copper Prices?The price of copper has surged to an all-time high this week, and in doing so, it broke the $11,000-per-ton mark for the first time ever. The landmark moment is the culmination of a months-long rally driven by financial speculators who predicted that a supply shortage would push up prices. Copper futures – which allow investors who never actually use the metal to bet on the commodity’s price – have risen by 31 percent in the past year and 25 percent year to date, turning heads beyond the niche world of commodity traders.… Read more at: https://oilprice.com/Metals/Commodities/Whats-Behind-the-Recent-Rally-in-Copper-Prices.html |

|

Gasoline Prices Surge as Summer Driving Season Heats UpAs the summer driving season kicks into high gear, the national average price for a gallon of regular gasoline has seen a notable increase in the United States, reflecting both seasonal demand and broader market dynamics, according to recent data from GasBuddy, a leading fuel price tracking service. Patrick De Haan, Head of Petroleum Analysis at GasBuddy, was optimistic that gasoline prices were starting off on the right foot. “June tends to be a month of smooth sailing, where we see gas prices decline in most areas, and that’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gasoline-Prices-Surge-as-Summer-Driving-Season-Heats-Up.html |

|

Ukraine and Spain Sign €1 Billion Security DealUkrainian President Volodymyr Zelenskiy and Spanish Prime Minister Pedro Sanchez have signed a bilateral security agreement that provides for Madrid to provide Ukraine with 1 billion euros ($1.08 billion) in military aid this year. The announcement was made at a joint news conference in Madrid, where Zelenskiy arrived on May 27 for talks with the head of the Spanish government and King Felipe VI. “For the period up to 2027, Ukraine will get 5 billion euros from Spain through the European Peace Fund,” Zelenskiy told the news conference. Ahead of… Read more at: https://oilprice.com/Geopolitics/International/Ukraine-and-Spain-Sign-1-Billion-Security-Deal.html |

|

Hess Shareholders Head for Crucial Vote on Acquisition Proposal by ChevronHess Corporation’s shareholders are set to vote on Tuesday on Chevron’s proposal to buy the company in a vote that’s too close to call amid a growing number of shareholders urging for postponement of the vote or saying they would abstain. Chevron has proposed a $53-billion all-stock transaction to buy Hess, which is a minority partner of Exxon in Guyana’s prolific Stabroek block with a 30% stake. Chevron’s proposal to buy Hess is getting increased scrutiny from regulators and politicians, while… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hess-Shareholders-Head-for-Crucial-Vote-on-Acquisition-Proposal-by-Chevron.html |

|

Oil Prices Remain Rangebound Despite Rising Gasoline DemandOil prices have been rangebound for the last four weeks with demand concerns being canceled out by expectations of an OPEC+ production cut extension.- The latest forecast from the US National Oceanic and Atmospheric Administration (NOAA) confirmed that this year’s Atlantic hurricane season is expected to be above normal, with the potential for 17 to 25 named storms from June to November.- With 8 to 13 of those storms likely to develop into hurricanes, almost double the past year’s average, 2024 might see heightened risks for production… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Rangebound-Despite-Rising-Gasoline-Demand.html |

|

TotalEnergies and VERBUND Explore Green Hydrogen Production in TunisiaTotalEnergies and Austria’s electricity company VERBUND will study the feasibility of producing green hydrogen in Tunisia for export to central Europe via pipelines, the French supermajor said on Tuesday. TE H2, an 80/20 joint-venture formed by TotalEnergies and EREN Groupe, and VERBUND have signed a Memorandum of Understanding with Tunisia to study the implementation of a large green hydrogen project, H2 Notos, in the North African country for export to Central Europe through pipelines. H2 Notos is expected to produce green… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-and-VERBUND-Explore-Green-Hydrogen-Production-in-Tunisia.html |

|

Global Oil Market on Edge Ahead of OPEC+ MeetingBy Jake Lloyd-Smith, Bloomberg Markets Live reporter and strategist The global oil market is in OPEC+ walk-up mode. That should keep prices supported this week ahead of the (now online) gaggle, which falls on June 2. After that, price direction hinges on the immediate fallout from the meeting, plus bets about the market’s 2H trajectory. Conventional wisdom points to an extension of the cartel’s current curbs, especially as weakening near-term timespreads suggest that physical conditions aren’t quite as tight as they have been… Read more at: https://oilprice.com/Energy/Crude-Oil/Global-Oil-Market-on-Edge-Ahead-of-OPEC-Meeting.html |

|

UK Wind Farm to Pay $42 Million for Breaching Market RulesThe operator of a large offshore wind farm in Scotland will pay $42.4 million (£33.14 million) to the UK’s energy market regulator for breaching rules after overcharging for having to reduce wind generation when required. Electricity generator Beatrice Offshore Windfarm Limited (BOWL) has accepted that it breached one of its license conditions and will make a redress payment of $42.4 million (£33.14 million) as a result, the regulator Ofgem said in a statement on Tuesday. An Ofgem review found that BOWL had charged “excessive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Wind-Farm-to-Pay-42-Million-for-Breaching-Market-Rules.html |

|

Saudi Arabia Begins New Bond Sale to Plug Budget DeficitSaudi Arabia has mandated banks to arrange the placing of three-part bonds as the world’s largest crude oil exporter is looking to raise more money to plug a budget deficit and fund its program to diversify from oil. The Saudis have mandated banks to help it sell three-, six- and 10-year notes, which could yield 85-110 basis points more than comparable U.S. Treasuries, an anonymous source with knowledge of the matter told Bloomberg on Tuesday. The latest bond sale from Saudi Arabia would come a few months after the Kingdom tapped… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Begins-New-Bonds-Sale-to-Plug-Budget-Deficit.html |

|

Canada Could Lose $55 Billion in Oil Investment if Emissions Cap Is ImplementedCanada’s oil and gas industry could lose US$55 billion (C$75 billion) in upstream investment by 2035 if the federal government implements a stringent 40% emissions cap from 2030, the Canadian Association of Petroleum Producer (CAPP) says, citing a report by S&P Global Commodity Insights it had commissioned. At the end of last year, Canada’s federal government introduced a draft framework to cap pollution from the oil and gas sector to reduce emissions. The plan proposes to cap 2030 emissions at 35% to 38% below 2019… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canada-Could-Lose-55-Billion-in-Oil-Investment-if-Emissions-Cap-Is-Implemented.html |

|

Nasdaq closes above 17,000 for the first time, Dow slides more than 200 points: Live updatesStocks are on track to end May on a strong note after softer inflation data and better-than-expected quarterly earnings reports lifted sentiment. Read more at: https://www.cnbc.com/2024/05/27/stock-market-today-live-updates.html |

|

FTX exec who turned on Sam Bankman-Fried sentenced to 7.5 years in prisonFormer top FTX exec Ryan Salame who turned on Sam Bankman-Fried sentenced to 90 months in prison and ordered to pay more than $11 million. Read more at: https://www.cnbc.com/2024/05/28/ftx-ryan-salame-sentenced.html |

|

HubSpot shares jump on talks of potential Google dealHubSpot shares rose Tuesday after CNBC’s David Faber reported that Alphabet is in talks about an all-stock bid for the company. Read more at: https://www.cnbc.com/2024/05/28/hubspot-shares-jump-on-talks-of-potential-google-deal-.html |

|

Market crash indicator with spotty track record ‘Hindenburg Omen’ triggered last weekThe bearish signal fired up as investors are concerned that poor market breadth could spell weakness for stocks that are at all-time highs. Read more at: https://www.cnbc.com/2024/05/28/market-crash-indicator-with-spotty-track-record-hindenburg-omen-triggered-last-week.html |

|

These robust companies may be primed to start offering a dividend, Wolfe saysMeta Platforms and Alphabet announced dividends earlier this year. Wolfe highlights a few companies that may join their ranks. Read more at: https://www.cnbc.com/2024/05/28/these-companies-may-be-primed-to-start-offering-a-dividend-wolfe-says.html |

|

Trump prosecutor says catch and kill might ‘be what got President Trump elected’Donald Trump says he did not have sex with porn star Stormy Daniels, who was paid before the 2016 election to keep quiet about an alleged tryst. Read more at: https://www.cnbc.com/2024/05/28/trump-trial-closing-arguments-begin-in-new-york-hush-money-case.html |

|

T-Mobile to acquire most of U.S. Cellular in $4.4 billion deal; U.S. Cellular shares surgeU.S. Cellular shares soared Tuesday after T-Mobile announced it will acquire most of the company in a deal worth $4.4 billion. It plans to use the wireless company to improve coverage in rural areas. Read more at: https://www.cnbc.com/2024/05/28/t-mobile-to-acquire-most-of-us-cellular-in-4point4-billion-deal.html |

|

Former FTX exec sentenced, and bitcoin miner Riot pursues takeover of Bitfarms: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Sergey Nazarov, co-founder of Chainlink Labs, discusses the collaboration between DTCC, Chainlink and ten financial institutions on a pilot program aimed at bringing Net Asset Value (NAV) data on-chain. Read more at: https://www.cnbc.com/video/2024/05/28/former-ftx-exec-sentenced-and-bitcoin-miner-riot-pursues-takeover-of-bitfarms-cnbc-crypto-world.html |

|

OpenAI former safety leader Jan Leike joins rival AI startup AnthropicJan Leiker joined Amazon-backed Anthropic shortly after resigning from OpenAI. Read more at: https://www.cnbc.com/2024/05/28/openai-safety-leader-jan-leike-joins-amazon-backed-anthropic.html |

|

Hess shareholders approve $53 billion Chevron deal amid dispute with Exxon over Guyana assetsThe Chevron-Hess deal was originally slated to close in the first half of 2024, but that timeline has been delayed due to a dispute with Exxon Mobil. Read more at: https://www.cnbc.com/2024/05/28/hess-shareholders-to-vote-on-chevron-deal-amid-guyana-dispute-with-exxon.html |

|

Porsche reveals first-ever 911 hybrid sports car, starting at $164,900The 2025 911 Carrera GTS hybrid marks a significant update to the iconic German sports car amid the automotive industry’s focus on electrified vehicles. Read more at: https://www.cnbc.com/2024/05/28/porsche-911-hybrid-sports-car.html |

|

‘This can no longer be justified’: International outcry over Rafah attack piles more pressure on IsraelIsraeli Prime Minister Benjamin Netanyahu described the attack as a tragic incident. Read more at: https://www.cnbc.com/2024/05/28/international-outcry-over-rafah-attack-piles-more-pressure-on-israel-.html |

|

Med tech stock Semler Scientific takes bitcoin play from MicroStrategy’s book, surges 37%Semler Scientific saw its shares surge Tuesday after it said it has adopted bitcoin as its primary treasury reserve asset. Read more at: https://www.cnbc.com/2024/05/28/med-tech-stock-semler-scientific-surges-on-new-bitcoin-treasury-strategy.html |

|

NVDA Sucks All The Oxygen Out Of The Market Again…Two words – F**king NVDA – sum up today as the AI giant accelerated on the back of a gamma-squeeze…

Source: SpotGamma …which created these gains…

…to within $100 Billion of AAPL’s market cap… Read more at: https://www.zerohedge.com/markets/nvda-sucks-all-oxygen-out-stocks-again |

|

No, Corporate Greed Is Not The Cause Of InflationAuthored by Lance Roberts via RealInvestmentAdvice.com, Corporate greed is not causing inflation, despite the claims of many on the political left who failed to understand the very basics of economic supply and demand.

Yes, prices have certainly gone up due to inflation. However, that wasn’t the fault of corporations. The surge in inflation directly resulted from the supply-to-demand imbalance caused by shutting down the economy (supply) and increasing household purchasing power by sending them checks (demand). For the majority of Americans who now get their “news” from social media, the uneducated masses now have a new target of hatred for their financial woes – corporate greed. A Claim Of AbsurdityThe problem, as with many of the narratives ramping up the ire of Americans on social media, is it is patently false. As Read more at: https://www.zerohedge.com/markets/no-corporate-greed-not-cause-inflation |

|

NATO’s Newest Member OKs Ukraine Using Its Weapons To Strike Deep In Russian TerritoryCalls are growing for escalation in Ukraine, with EU foreign policy chief Josep Borrell on Tuesday joining in the chorus of Western leaders urging allowing Kiev to attack Russian territory with West-supplied weaponry. Borrell said that Ukraine has a right to strike back: “According with the law of war, it is perfectly possible and there is no contradiction,” he said in a meeting with European Union defense ministers. Sweden agrees with him.

So far Washington, which has recently supplied the US Army’s ATACMS with a max range of 190 miles, has not officially overturned its prohibition … Read more at: https://www.zerohedge.com/geopolitical/natos-newest-member-oks-ukraine-using-its-weapons-strike-deep-russian-territory |

|

Bond Traders’ Angst Around Election Time Higher Than For StocksAuthored by Garfield Reynolds via Bloomberg, Even in an environment where implied volatility readings are grinding lower, there’s some noticeable angst appearing around the November US elections. Bond traders look much more uncertain about the outlook for six months ahead than they do for the coming month, which underscores the potential for turmoil with both presidential candidates leaning toward increased spending. There’s also speculation that Donald Trump would follow through after his comments earlier this year that he wouldn’t reappoint Jerome Powell as Fed Chair if he wins the US election. The so-called fear gauges for Treasuries are showing the widest gap since 2014 between expectations for yields swings six months from now and the expectations for a month ahead. That’s similar to the picture for a range of currencies – the yuan’s 6 month-1 month volatility gap is the widest since 2016. Equities look far less concerned, with the similar spread for the VIX only around the highest this year. Read more at: https://www.zerohedge.com/markets/bond-traders-angst-around-election-time-higher-stocks |

|

Royal Mail owners to back £5bn takeover offerCzech entrepreneur and billionaire Daniel Kretinsky will firm up an offer of £5bn for the company. Read more at: https://www.bbc.com/news/articles/c4nn0n93zj4o |

|

Labour says it won’t announce any more tax risesIn her first major campaign speech, the shadow chancellor said all policies will be “fully costed”. Read more at: https://www.bbc.com/news/articles/ce990eg3rq2o |

|

Ousted WeWork boss drops effort to returnAdam Neumann had proposed to buy WeWork after it declared bankruptcy last year. Read more at: https://www.bbc.com/news/articles/cnlljlrzjwgo |

|

Grasim promotor Birla Group hikes stake by 4.09% to 23.18% in companyThere has been no change in the promoter/promoter group’s total holding in the company, which remains at 43.06%. Shares of Grasim Industries closed at Rs 2,435.10 on the NSE on Tuesday, rising by Rs 44.45 or 1.86%. A part of the Aditya Birla Group, Grasim reported a 39% increase in its consolidated net profit for the quarter ended March 2024, excluding exceptional items. The net profit rose to Rs 1,908 crore, compared to Rs 1,369 crore in the same quarter last year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/grasim-promotor-birla-group-hikes-stake-by-4-09-to-23-18-in-company/articleshow/110505834.cms |

|

Tech View: Nifty consolidating around Mt 23k for 3 days. What traders should doAnalysis of OI data reveals that the call side exhibited the highest OI at the 23,000 strike price, followed by 23,500 strike prices, whereas on the put side, the highest OI was observed at the 22,500 strike price. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-consolidating-around-mt-23k-for-3-days-what-traders-should-do/articleshow/110501213.cms |

|

Room for gold, oil and copper to rise, keeping commodity rally alive, UBS saysCommodity prices still have room to rally, according to UBS Global Wealth Management. Read more at: https://www.marketwatch.com/story/room-for-gold-oil-and-copper-to-rise-keeping-commodity-rally-alive-ubs-says-c52d7fcd?mod=mw_rss_topstories |

|

10-year Treasury yield logs biggest daily jump in a month after weak auctionsLonger U.S. Treasury yields post biggest daily jump in a month on tepid demand for new supply and after Fed President Kashkari didn’t rule out further rate hikes. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-as-investors-look-ahead-to-pce-inflation-report-7fe0df85?mod=mw_rss_topstories |

|

Brent oil ends at May high as investors await weekend OPEC+ meetingOil futures finish higher Tuesday, with most traders expecting the Organization of the Petroleum Exporting Countries and its Russia-led allies to roll over voluntary production cuts into the third quarter when they meet this weekend. Read more at: https://www.marketwatch.com/story/oil-prices-bounce-as-traders-look-ahead-to-opec-decision-on-production-cuts-1dcd5d76?mod=mw_rss_topstories |

EPA-EFE”I could retaliate or I could fight against the one who fights against me from his territory,” Borrell said, adding: “You have to balance the risk of escalation and the need for Ukrainians to defend.”

EPA-EFE”I could retaliate or I could fight against the one who fights against me from his territory,” Borrell said, adding: “You have to balance the risk of escalation and the need for Ukrainians to defend.”