Summary Of the Markets Today:

- The Dow closed down 202 points or 0.51%,

- Nasdaq closed down 0.18%, (Closed at 16,802, New Historic high 16.855)

- S&P 500 closed down 0.27,

- Gold $2,381 down $46.60,

- WTI crude oil settled at $77 down $1.34,

- 10-year U.S. Treasury 4.422 up 0.008 points,

- USD index $104.94 up $0.280,

- Bitcoin $69,619 up $147 (0.21%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

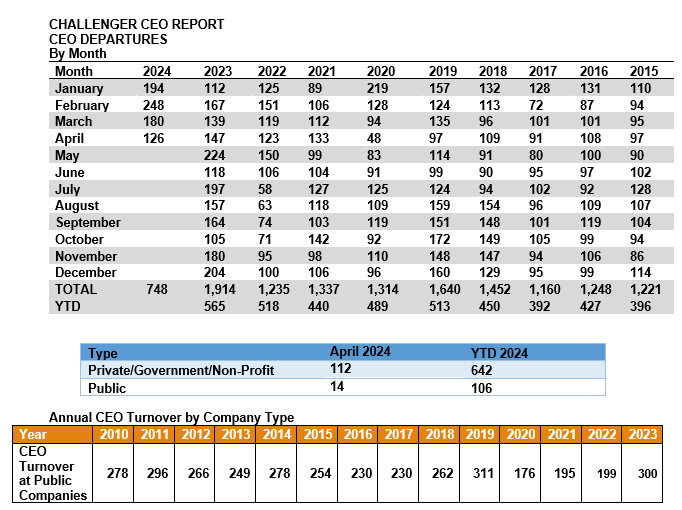

The number of CEO changes at U.S. companies fell 30% to 126 in April, from 180 in March. It is down 14% from 147 CEO exits recorded in the same month last year. April’s total marks the first time in 14 months that CEO exits were lower than the corresponding month a year earlier. So far this year, 748 CEOs have announced their departures, the highest year-to-date total on record. It is up 32% from 565 exits that occurred during the same period last year, which was the previous year-to-date record. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

Existing-home sales receded in April 2024. Total existing-home sales fell 1.9% year-over-year. Total housing inventorywas up 16.3% from one year ago. Unsold inventory sits at a 3.5-month supply at the current sales pace, up from 3.2 months in March and 3.0 months in April 2023. For homes priced $1 million or more, inventory and sales increased by 34% and 40%, respectively, from a year ago. The median existing-home price for all housing types in April was $407,600, an increase of 5.7% from the previous year ($385,800). All four U.S. regions registered price gains. NAR Chief Economist Lawrence Yun added:

Home sales changed little overall, but the upper-end market is experiencing a sizable gain due to more supply coming onto the market. Home prices reaching a record high for the month of April is very good news for homeowners. However, the pace of price increases should taper off since more housing inventory is becoming available.

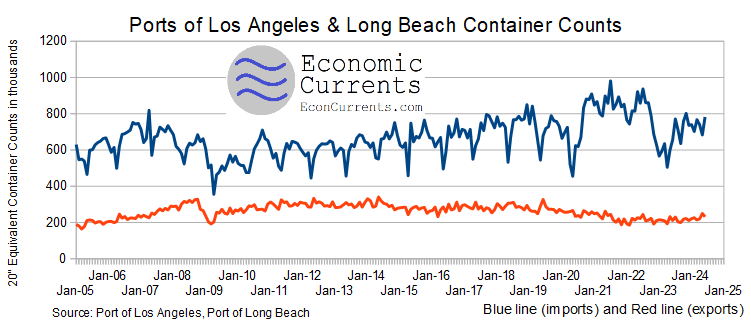

LA area ports handle about 40% of the nation’s container port traffic. In April 2024, container imports are up 19% year-over-year whilst exports are up 9% year-over-year. Still, container traffic remains slightly below pre-pandemic levels – but container traffic appears to be on a slightly improving trend line.

Much time was spent discussing inflation, according to the 01May2024 Federal Open Market Committee (FOMC) meeting minutes. Highlights of the meeting minutes:

… Participants observed that while inflation had eased over the past year, in recent months there had been a lack of further progress toward the Committee’s 2 percent objective. The recent monthly data had showed significant increases in components of both goods and services price inflation. In particular, inflation for core services excluding housing had moved up in the first quarter compared with the fourth quarter of last year, and prices of core goods posted their first three-month increase in several months.

… Participants noted that they continued to expect that inflation would return to 2 percent over the medium term. However, recent data had not increased their confidence in progress toward 2 percent and, accordingly, had suggested that the disinflation process would likely take longer than previously thought.

… Participants assessed that demand and supply in the labor market, on net, were continuing to come into better balance, though at a slower rate.

… High interest rates appeared to weigh on consumer durables purchases in the first quarter, and growth of business fixed investment remained modest. Despite the high interest rates, residential investment grew more strongly in the first quarter than its modest pace in the second half of last year.

… Participants noted the important influence of productivity growth for the economic outlook. Some participants suggested that the recent increase in productivity growth might not persist because it reflected one-time adjustments to the level of productivity or reflected continued elevated volatility in the data over the past several years. A few participants commented that higher productivity growth might be sustained by the incorporation of technologies such as artificial intelligence into existing business operations or by high rates of new business formation in the technology sector.

… A number of participants judged that consumption growth was likely to moderate this year, as growth in labor income was expected to slow and the financial positions of many households were expected to weaken. Many participants noted signs that the finances of low- and moderate-income households were increasingly coming under pressure, which these participants saw as a downside risk to the outlook for consumption.

… Participants discussed the risks and uncertainties around the economic outlook. They generally noted their uncertainty about the persistence of inflation and agreed that recent data had not increased their confidence that inflation was moving sustainably toward 2 percent. Some participants pointed to geopolitical events or other factors resulting in more severe supply bottlenecks or higher shipping costs, which could put upward pressure on prices and weigh on economic growth. The possibility that geopolitical events could generate commodity price increases was also seen as an upside risk to inflation.

… participants who commented noted vulnerabilities to the financial system that they assessed warranted monitoring. Participants discussed a range of risks emanating from the banking sector, including unrealized losses on assets resulting from the rise in longer-term yields, high CRE exposure, significant reliance by some banks on uninsured deposits, cyber threats, or increased financial interconnections among banks.

Here is a summary of headlines we are reading today:

- China’s Rapid Nuclear Expansion Is Threatening U.S. Dominance in the Sector

- Oil Prices Maintain Losing Streak on Inflation Confusion

- The Harsh Truth About Space Mining and Direct Air Capture

- EIA Confirms Small Crude Inventory Build, Gasoline Draw

- Oil Prices Remain Rangebound as Demand Concerns Mount

- Federal Reserve minutes indicate worries over lack of progress on inflation

- GM all-electric Chevy Equinox goes on sale as the latest test for EV production and demand

- Why Target and McDonald’s are cutting prices and offering deals

- Average U.S. vehicle age hits record 12.6 years as high prices force people to keep them longer

- Illegals Believe Trump Is Going To Win So They’re Surging The Border Now; Report

- ‘Hawkish’ FOMC Minutes Show ‘Various’ Members Willing To Tighten More, Fear Financial Conditions ‘Too Easy’

- Inflation rate falls to lowest in almost three years

- 2-year Treasury yield ends at three-week high after Fed minutes raise possibility of another rate hike

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Rapid Nuclear Expansion Is Threatening U.S. Dominance in the SectorChina’s runaway nuclear energy expansion has competitors biting their fingernails. As nuclear energy regains traction around the world as a promising baseload power source for a decarbonized future, it’s also become more and more of a geopolitical battleground. As countries scramble to keep a strategic foothold in a rapidly changing energy landscape, becoming a nuclear energy powerhouse is suddenly important for world superpowers. And China seems to be winning this race. While the United States has been the biggest nuclear… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Chinas-Rapid-Nuclear-Expansion-Is-Threatening-US-Dominance-in-the-Sector.html |

|

Moscow Withdraws Draft That Proposed Expanding its Territorial WatersRussia has withdrawn without explanation a Defense Ministry draft that proposed revising Moscow’s maritime border in the eastern Baltic Sea and expanding its territorial waters that raised the ire of littoral NATO members Finland, Sweden, Lithuania, and Estonia. The draft, dated May 21, was initially published on an official Russian portal of legal drafts. It proposed expanding Russia’s territorial waters in the Gulf of Finland and around the Kaliningrad exclave near the maritime borders with Finland, Estonia, and Lithuania. Since Russia… Read more at: https://oilprice.com/Geopolitics/Europe/Moscow-Withdraws-Draft-That-Proposed-Expanding-its-Territorial-Waters.html |

|

EIA Warns Severe Hurricane Season Could U.S. Disrupt Oil & GasUp to 25 named storms for this year’s hurricane season could wreak more havoc on the American oil and gas industry than ever before, the Energy Information Administration (EIA) said on Wednesday in an in-depth analysis of weather’s effects on supply and demand. “The potential for a stronger hurricane season suggests heightened risk for weather-related production outages in the U.S. oil and natural gas industry,” the EIA warned, as meteorologists forecast a “particularly intense” Atlantic hurricane season… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EIA-Warns-Severe-Hurricane-Season-Could-US-Disrupt-Oil-Gas.html |

|

Oil Prices Maintain Losing Streak on Inflation ConfusionThe U.S. crude oil benchmark, West Texas Intermediate (WTI) has fallen well below the $80 mark it surpassed at the beginning of the week, with Brent crude also losing ground around $82 per barrel as inflation concerns once again took center stage. At 1:45 p.m. ET on Wednesday, WTI was trading down 0.92% on the day, trading at $77.94, while Brent crude was trading down 0.81% at $82.21 per barrel. On Tuesday, the Federal Reserve put the brakes on oil prices when it suggested waiting months longer before implementing any rate cuts… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Maintain-Losing-Streak-on-Inflation-Confusion.html |

|

Why Kinder Morgan is Targeting This Texas Oil FieldAmerican oilfield services provider and pipeline operator Kinder Morgan has acquired nearly 12,000 acres of Texas oil and gas producing assets in its quest to take advantage of carbon capture incentives designed to boost output from producing fields, Reuters reported on Wednesday, citing unnamed sources familiar with the deal. According to Reuters, the Kinder acquisition indicates the attractive nature of incentives laid out in the U.S. Inflation Reduction Act, which offers a tax credit for carbon sequestration of $60 per metric ton. That… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Why-Kinder-Morgan-is-Targeting-This-Texas-Oil-Field.html |

|

The Harsh Truth About Space Mining and Direct Air CaptureThe dictionary doesn’t quite do justice to the word “boondoggle” according to author Dmitri Orlov, best known for his book Reinventing Collapse. A contemporary boondoggle must not only be wasteful, it should, if possible, also create additional problems that can only be addressed by yet more boondoggles. (This does NOT preclude boondoggles from being profitable for certain insiders.) In Orlov’s universe, such boondoggles dissipate the wealth and vitality of a society until it collapses. But if executed properly, boondoggles… Read more at: https://oilprice.com/Energy/Energy-General/The-Harsh-Truth-About-Space-Mining-and-Direct-Air-Capture.html |

|

Shell Plans Major Work at Its Largest German Oil-Processing ComplexShell is planning extensive work and a turnaround at the Energy and Chemicals Park Rheinland near Cologne, Germany’s biggest oil-refining complex, in the autumn of 2024, Bloomberg reported on Wednesday, quoting sources with knowledge of the plans. The turnaround means that the crude processing unit would be offline for at least a few weeks and supply to the market from the refinery would be reduced. The Godorf section of the Rheinland complex will undergo a turnaround in the autumn, while Wesseling, the other part of the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Plans-Major-Work-at-Its-Largest-German-Oil-Processing-Complex.html |

|

EIA Confirms Small Crude Inventory Build, Gasoline DrawWTI crude oil traded below $78 today after the U.S. Energy Information Administration reported an estimated inventory increase of 1.8 million barrels for the week to May 17. This compared with a draw of 2.5 million barrels for the previous week that pushed benchmarks higher last week as it came after an API estimate that also pointed to a draw and it was the second weekly draw in a row, suggesting demand picking up. A day before the EIA released its report, the American Petroleum Institute estimated sizeable builds in crude and fuels for the week… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Falls-on-Small-Crude-Inventory-Build.html |

|

Europe Needs to Double Energy Grid Investments to Keep Net-Zero in SightEurope needs to double its annual investments in grids to keep net zero in sight by enabling electrification of transport, heating, and industry, and integrating rising renewable energy sources, Eurelectric, the federation of the European electricity industry, said in a report on Wednesday. Europe’s investments in distribution grids should jump to as much as $72.5 billion (67 billion euros) per year from 2025 to 2050, up from a current annual average investment of $36 billion (33 billion euros), Eurelectric’s Grids for Speed study… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Needs-to-Double-Energy-Grid-Investments-to-Keep-Net-Zero-in-Sight.html |

|

Time Running Out for BHP’s Anglo American BidThe clock is counting down on BHP’s takeover swoop for Anglo American today as the Australian miner is left with just hours to table an improved offer or walk away. BHP has been hiking its bids for Anglo American over the past month after making an initial unsolicited $31bn offer for the firm in April, which was rejected. Last week, the Sydney-listed miner lifted that to £34bn but retained its condition that Anglo American carve off its iron ore and platinum business, in an offer that was roundly rebuffed as… Read more at: https://oilprice.com/Energy/Energy-General/Time-Running-Out-for-BHPs-Anglo-American-Bid.html |

|

Oil Prices Remain Rangebound as Demand Concerns MountWeakening demand is keeping crude oil prices stuck in a range that they can’t break above. Ample supply is helping. In even worse news for oil bulls, the chances of this state of affairs changing anytime soon are slim. The perception that demand is weakening comes from traders and analysts who spoke to Reuters this week, saying refiners in some big markets were buying less crude. As for the reason for this lower buying, it was twofold and nothing new. Inflation and interest rates—this is what is driving oil prices lower or… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Rangebound-as-Demand-Concerns-Mount.html |

|

OMV Warns Russia’s Gazprom May Halt Natural Gas Supply to AustriaRussian state giant Gazprom could halt natural gas supply to Austria’s OMV due to a foreign court ruling that could interrupt OMV payments to Gazprom Export, the Austrian firm said in an urgent market message. OMV’s unit OMV Gas Marketing & Trading GmbH (OGMT) has learned about a foreign court decision obtained by a major European energy company which, if enforced in Austria against OGMT, would require OGMT to make payments under its gas supply contract with Gazprom Export to such European energy company, instead of Gazprom… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OMV-Warns-Russias-Gazprom-May-Halt-Natural-Gas-Supply-to-Austria.html |

|

ADNOC Continues LNG Expansion With Stake in Mozambique ProjectAbu Dhabi’s national oil company ADNOC has acquired a 10% interest in an LNG project offshore Mozambique as it continues to expand its international natural gas operations. ADNOC has bought the 10% stake in the Area 4 concession of the Rovuma basin in Mozambique held by Portugal’s Galp. The deal will entitle ADNOC to a share of the LNG production from the concession, which has a combined production capacity exceeding 25 million tonnes per annum (mtpa), the state energy firm of the United Arab Emirates (UAE) said on Wednesday.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOC-Continues-LNG-Expansion-With-Stake-in-Mozambique-Project.html |

|

China’s Coal Industry Group Revises Down 2024 Output ForecastChinese coal production this year will vary by between a 1% annual decline and 1% growth this year, a major industry association said on Wednesday, revising down its previous forecast of a 1% increase in coal production. China’s top producing region, Shanxi, is likely to miss its coal production target for 2024, Li Xuegang, deputy chairman of the China Coal Transportation and Distribution Association (CCTD), said on Wednesday, as carried by Reuters. Shanxi, the coal county in the world’s top coal producer, will find it “extremely… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Coal-Industry-Group-Revises-Down-2024-Output-Forecast.html |

|

U.S. Set to Secure Critical Domestic Rare Earths Supply Chain by 2027The United States is on track to meet its goal to have by 2027 a domestic supply chain of rare earth elements for its defense needs, according to a senior official at the Department of Defense. The U.S. looks to cut its reliance on Chinese rare earth materials and has classified close allies Australia, Canada, and the UK as a ‘domestic’ source of critical mineral supply. “We are on track to meet our goal of a sustainable mine to magnet supply chain capable of supporting U.S. defence requirements by 2027,” Laura Taylor-Kale,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Set-to-Secure-Critical-Domestic-Rare-Earths-Supply-Chain-by-2027.html |

|

Federal Reserve minutes indicate worries over lack of progress on inflationThe Federal Reserve on Wednesday released minutes from its April 30-May 1 policy meeting. Read more at: https://www.cnbc.com/2024/05/22/fed-minutes-may-2024-.html |

|

Fintech nightmare: ‘I have nearly $38,000 tied up’ after Synapse bankruptcySynapse is as a middle-man between customer-facing fintech brands and FDIC-backed banks, but it’s had disagreements about how much in customer balances it owed. Read more at: https://www.cnbc.com/2024/05/22/synapse-bankruptcy-customer-funds.html |

|

GM all-electric Chevy Equinox goes on sale as the latest test for EV production and demandAffordable entry-level EV pricing has long been a goal for GM, Tesla and others as Chinese rivals like BYD and Nio grow their sales beyond China. Read more at: https://www.cnbc.com/2024/05/22/gm-chevy-equinox-ev.html |

|

Nvidia reports first-quarter earnings after the bellNvidia has grown from being a fairly niche developer of 3D gaming hardware a decade ago to the chipmaker at the heart of the AI boom. Read more at: https://www.cnbc.com/2024/05/22/nvidia-nvda-earnings-report-q1-2025-.html |

|

AI darling Nvidia reports after the bell. What Wall Street is watchingHere’s what Wall Street is closely watching when Nvidia reports after the bell Wednesday. Read more at: https://www.cnbc.com/2024/05/22/ai-darling-nvidia-reports-after-the-bell-what-wall-street-is-watching-.html |

|

Why Target and McDonald’s are cutting prices and offering dealsTarget’s weak results show the fierce battle between retailers trying to outmatch each other on deals. Read more at: https://www.cnbc.com/2024/05/22/target-walmart-mcdonalds-price-cuts-deals.html |

|

Pfizer aims to save $1.5 billion by 2027 in first wave of new cost cutsPfizer is also carrying out another $4 billion cost-cutting effort, which it announced last year as demand for its Covid vaccine and drug Paxlovid slumped. Read more at: https://www.cnbc.com/2024/05/22/pfizer-announces-new-cost-cutting-program.html |

|

Judge rules Exxon can sue activist shareholder over climate proposalA federal judge in Texas said Exxon Mobil’s lawsuit to bar a climate change proposal from activist investor Arjuna Capital can proceed. Read more at: https://www.cnbc.com/2024/05/22/judge-rules-exxon-can-sue-activist-shareholder-over-climate-proposal-.html |

|

White House signals Biden will sign crypto market bill if it passes Congress: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Michael Novogratz, founder and CEO of Galaxy Digital, discussed political crypto sentiment, portfolio allocation and ETFs from CNBC’s Financial Advisor Summit, which brings together advisory firms to explore the state of markets. Read more at: https://www.cnbc.com/video/2024/05/22/biden-opposes-passage-crypto-market-structure-bill-cnbc-crypto-world.html |

|

These are the 3 big risks to the stock market, economist saysFederal Reserve policy, a surprise recession and disappointing future earnings for companies like Nvidia could rein in the stock euphoria, one analyst said. Read more at: https://www.cnbc.com/2024/05/22/3-big-risks-to-the-stock-market-economist-says.html |

|

Average U.S. vehicle age hits record 12.6 years as high prices force people to keep them longerCars, trucks and SUVs in the U.S. keep getting older as people hang on to their vehicles largely because new ones cost so much. Read more at: https://www.cnbc.com/2024/05/22/aging-cars-trucks-suvs.html |

|

New Covid FLiRT variants spark concerns of a summer spikeNew strains of Covid-19 are spreading globally, raising concerns among health professionals about a possible summer spike in cases. Read more at: https://www.cnbc.com/2024/05/22/new-covid-flirt-variants-spark-concerns-of-a-summer-spike.html |

|

This unexpected corner of the market offers quality dividend payers, Bank of America saysThe Russell 2000’s performance in 2024 has been underwhelming compared to its large-cap peers, but there are solid income payers within the index. Read more at: https://www.cnbc.com/2024/05/22/buy-these-under-the-radar-quality-dividend-stocks-bank-of-america-says.html |

|

Israeli Hostage Families Release Shocking Clip Of Female Troops’ Abduction“The world must look at this cruel atrocity. Those who care about women’s rights must speak out. All those who believe in freedom must speak out, and do everything possible to bring all of the hostages home now,” Israeli President Isaac Herzog has said in a statement, reacting to the Wednesday release of footage showing the abduction of five female IDF soldiers by Hamas terrorists on October 7. The women are still being held captive somewhere in the Gaza Strip. The families of the hostages agreed to release the raw, shocking clip with an aim to revive efforts to free them. It also comes as the European nations of Spain, Norway, and Ireland earlier the same day declared they are formally recognizing a Palestinian state. Watch the video published by Israeli sources below:

Prime Minister Benjamin Netanyahu called the move by the th … Read more at: https://www.zerohedge.com/geopolitical/israeli-hostage-families-release-shocking-clip-female-troops-abduction |

|

Illegals Believe Trump Is Going To Win So They’re Surging The Border Now; ReportAuthored by Steve Watson via Modernity.news, Illegal immigrants are surging the border now because they believe Donald Trump is going to win the election in November and enforce security, according to a report quoting the illegals themselves.

The New York Post reports that the migrants “fear President Biden could lose re-election in November and Donald Trump will shut the border.” Two brothers from Columbia who had crossed into the US and had eventually been put on a flight to New Jersey stated “We think with the elections, it will be harder,” adding “We don’t want Trump.” Read more at: https://www.zerohedge.com/political/illegals-believe-trump-going-win-so-theyre-surging-border-now-report |

|

‘Hawkish’ FOMC Minutes Show ‘Various’ Members Willing To Tighten More, Fear Financial Conditions ‘Too Easy’Since the last FOMC statement on May 1st, bonds, stocks, and gold have rallied strongly while crude prices have declined with a small drop in the dollar…

Source: Bloomberg Rate-cut expectations have dovishly increased (but are well off the post-CPI spike highs)..

Source: Bloomberg With US Macro data serially surprising to the downside (with both ‘hard’ and ‘soft’ data deterioratin … Read more at: https://www.zerohedge.com/markets/fomc-16 |

|

CIA Prevented Hunter’s Hollywood Tax Sugar Daddy From Becoming Federal Witness: WhistleblowerA trove of new whistleblower documents provided to House GOP investigators reveal, among other things, that the CIA prevented federal investigators from pursuing Hollywood lawyer Kevin Morris as a witness in their investigation of Hunter Biden.

Photo: Valerie Plesch for The New York Times Morris, a Hollywood entertainment lawyer who has ‘long supported’ Hunter (and why?) has loaned the First Son more than $6.5 million, according to a January letter to the House oversight committee. We’ve known about the CIA connection since March, when the Chairmen of the House Judiciary and Oversight Committees, Jim … Read more at: https://www.zerohedge.com/markets/cia-prevented-hunters-hollywood-tax-sugar-daddy-becoming-federal-witness-whistleblower |

|

Inflation rate falls to lowest in almost three yearsPrices rose at 2.3% in the year to April, down from 3.2% the month before, official figures said. Read more at: https://www.bbc.com/news/articles/c511m7jgyl3o |

|

Ex-Post Office boss cries as she admits incorrect evidencePaula Vennells broke down several times during her evidence to the Horizon IT scandal inquiry. Read more at: https://www.bbc.com/news/articles/cq550449zwyo |

|

What went wrong for online car retailer Cazoo?As Cazoo enters administration, we look at the rise and fall of the online used car retailer. Read more at: https://www.bbc.com/news/articles/cjq55333xg9o |

|

Warburg Pincus exits Apollo Tyres by offloading Rs 1,072 crore worth stakeThe leading global PE firm offloaded about 3.5% stake or 2.24 crore shares. Goldman Sachs, Morgan Stabley, Mirae Asset MF, Societe Generale, Citigroup, ICICI Pru MF bought stakes. Mutual funds have a significant 16.77% stake and foreign investors hold about 17.61% stake as of March 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/warburg-pincus-exits-apollo-tyres-by-offloading-rs-1072-crore-worth-stake/articleshow/110338531.cms |

|

Tech View: Nifty inching closer to record high. What should traders do on Thursday expiryNifty closes 69 points higher, forming a bullish candle with strong buying interest. Holding above 22,590, it may reach 22,750, supported by 22,500. Analysts anticipate further uptrend, with key support at 22,500 and resistance at 22,800. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-inching-closer-to-record-high-what-should-traders-do-on-thursday-expiry/articleshow/110336993.cms |

|

Pickleball, ads and Taylor Swift: Here are the little things Target says are working, even as sales fallTarget Corp. on Wednesday reported results for yet another quarter marked by a hesitant consumer — but at least it has pickleball, advertisers and Taylor Swift. Read more at: https://www.marketwatch.com/story/pickleball-ads-and-taylor-swift-here-are-the-little-things-target-says-are-working-even-as-sales-fall-972889e3?mod=mw_rss_topstories |

|

Moderna, CureVac, other vaccine stocks jump as new human bird-flu cases reported in U.S., AustraliaVaccine-related stocks moved sharply higher Wednesday as new human bird-flu cases were reported in the U.S. and Australia. Read more at: https://www.marketwatch.com/story/moderna-curevac-other-vaccine-stocks-jump-after-new-human-bird-flu-case-reported-in-australia-2f5a7f1a?mod=mw_rss_topstories |

|

2-year Treasury yield ends at three-week high after Fed minutes raise possibility of another rate hikeRates on U.S. government debt finished mostly higher on Wednesday after minutes of the Federal Reserve’s latest policy meeting put a spotlight on inflation risks. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-ahead-of-fed-minutes-and-after-sticky-u-k-inflation-data-5d432c36?mod=mw_rss_topstories |