Summary Of the Markets Today:

- The Dow closed down 38 points or 0.10%,

- Nasdaq closed down 0.26%,

- S&P 500 closed down 0.21%,

- Gold $2,384 down $10.80,

- WTI crude oil settled at $79 up $0.66,

- 10-year U.S. Treasury 4.377% down 0.021 points,

- USD index $104.51 up $0.17,

- Bitcoin $63,127 up $1,675,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production was little changed in April 2024 with total industrial production 0.4 percentage point lower than its year-earlier level. Capacity utilization moved down to 78.4 percent in April, a rate that is 1.2 percentage points below its long-run (1972–2023) average. Industrial production component manufacturing was down 0.5% year-over-year, mining was down 1.3%, and utilities were up 2.3%. Manufacturing remains in a recession and is a drag on economic growth.

Molly Boesel from CoreLogic discussed the increasing consumer debt and how it might impact housing foreclosures:

Mortgage debt is larger, but the delinquencies on mortgages are very low right now, and they’ve remained low. But as consumers are building other debt, the delinquencies on that other debt are starting to go up. So, specifically, credit card debt and auto loan debt has been increasing.

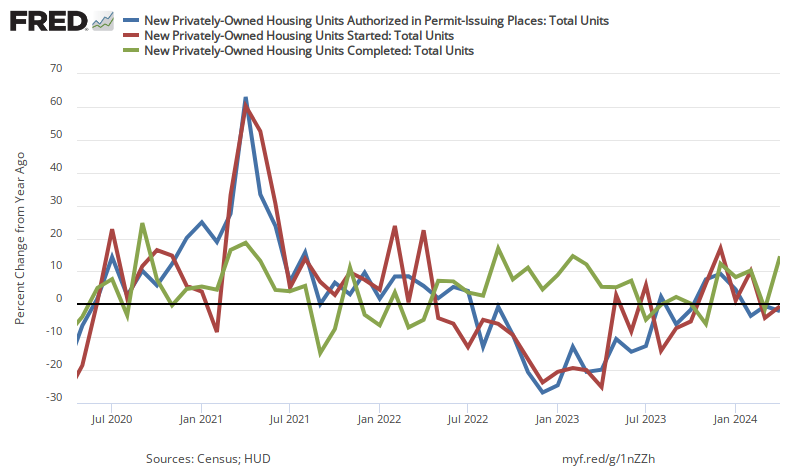

Privately‐owned housing units authorized by building permits in April 2024 were 2.0% below April 2023. Privately‐owned housing starts were 0.6% below April 2023. Privately‐owned housing completions were 14.6% above April 2023. Housing completions are near record highs. Housing construction is a bright spot in the economy. The reason permits and starts are so low is that there is a huge backlog of housing units under construction which are tied for all time highs of 1975.

Import prices increased 1.1% year-over-year in April 2024 whilst export prices decreased 1.0% year-over-year. This is well within the 2% inflation target set by the Federal Reserve but the trend lines are upward. Following the current trend lines, within one year inflation would exceed 6% in this sector.

The Philly Fed Manufacturing Business Outlook Survey weakened overall. The diffusion index for current general activity remained positive but declined 11 points to 4.5 in May, mostly undoing its increase from last month. The survey’s indicators for new orders, and shipments all declined, with the latter two turning negative. The employment index suggests declines in employment overall. Both price indexes indicate overall increases in prices but remain below their long-run averages.

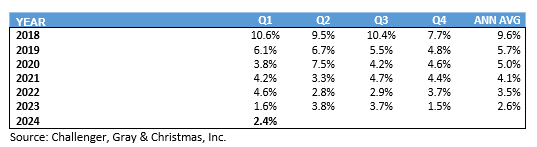

In the week ending May 11, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 217,750, an increase of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 215,000 to 215,250.

Here is a summary of headlines we are reading today:

- U.S. Fast-Tracks $2 Billion Military Aid for Ukraine

- Putin Meets With Xi Jinping As Sanctions Weigh on Russian Economy

- Russia’s Shadow Oil Tanker Fleet Causes 50 Maritime Accidents

- Existing Foreign Oil Producers in Venezuela May Get Licenses Despite Sanctions

- Are High Commodity Prices Becoming a Problem for the Fed?

- Refinery Repairs Drag Down Russia’s Oil Product Exports in April

- Walmart surges to all-time high as earnings beat on high-income shopper, e-commerce gains

- Walmart says more diners are buying its groceries as fast food gets pricey

- US Spy Balloon Crashes In Northeast Syria

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Fast-Tracks $2 Billion Military Aid for UkraineThe United States is fast-tracking $2 billion in military aid for embattled Ukrainian forces, U.S. Secretary of State Antony Blinken said, as they struggle to stave off a Russian advance in the northeastern Kharkiv region. Blinken, who made the announcement at a news conference in Kyiv on May 15 with Ukrainian Foreign Minister Dmytro Kuleba, said the funds, which are part of a recently approved $61-billion U.S. military aid package for Kyiv, are earmarked “to provide weapons today” for the outgunned and outmanned Ukrainian troops.The package was… Read more at: https://oilprice.com/Geopolitics/International/US-Fast-Tracks-2-Billion-Military-Aid-for-Ukraine.html |

|

ADNOC Eyes U.S. Trading Expansion in Strategic Global PushAbu Dhabi National Oil Company (ADNOC) is poised to establish a trading desk in the United States, marking a significant step in its strategic global expansion. Sources with knowledge of the plan revealed to Reuters that the UAE-backed oil and gas giant is actively seeking senior energy traders to spearhead this initiative. The move aligns with ADNOC’s broader objective to diversify revenue streams beyond its traditional base in the Gulf. Since 2018, ADNOC has been ramping up its trading operations, and this latest endeavor is a continuation of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOC-Eyes-US-Trading-Expansion-in-Strategic-Global-Push.html |

|

The Space Race Desperately Needs to Be RegulatedThe government will make sure Britain sets the global standard for regulating space technology and exploration, giving this growing sector the clarity and certainty it needs to thrive, says Andrew Griffith As humanity’s quest for knowledge and exploration extends beyond the confines of Earth, we stand on the edge of a new era – one where the boundless expanse of space beckons us with promise. From the historic launch from UK soil to our improved connectivity across the country, we are witnessing the rapid expansion of a vibrant space… Read more at: https://oilprice.com/Energy/Energy-General/The-Space-Race-Desperately-Needs-to-Be-Regulated.html |

|

Putin Meets With Xi Jinping As Sanctions Weigh on Russian EconomyRussian President Vladimir Putin will visit China for a two-day state visit where he’s set to press Chinese leader Xi Jinping for more support to sustain his country’s sanctions-hit economy and war machine in Ukraine. The May 16-17 visit is Putin’s first foreign trip since he was sworn in for a fifth presidential term one week ago and comes as Beijing continues to extend a key economic lifeline to Moscow to help soften the blow of Western economic sanctions that have limited Russian access to global supply chains and international… Read more at: https://oilprice.com/Geopolitics/International/Putin-Meets-With-Xi-Jinping-As-Sanctions-Weigh-on-Russian-Economy.html |

|

Lula Pressures New Petrobras CEO to Accelerate Refinery and Gas InvestmentsBrazilian President Luiz Inacio Lula da Silva has appointed Magda Chambriard as the new CEO of Petroleo Brasileiro SA (Petrobras), pushing her to accelerate investments in refineries and natural gas expansion, according to anonymous sources who spoke to Bloomberg. This leadership change follows Lula’s dismissal of former CEO Jean Paul Prates amid dissatisfaction with his handling of the company’s strategic plan. Chambriard’s appointment raises concerns among investors about increased government intervention in Petrobras as Lula’s administration… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lula-Pressures-New-Petrobras-CEO-to-Accelerate-Refinery-and-Gas-Investments.html |

|

CME To Shake Up Bitcoin Market with Spot Trading LaunchThe Chicago Mercantile Exchange (CME), the world’s largest futures exchange, is planning to offer spot bitcoin trading on its platform, according to a Financial Times report. This move would provide major hedge funds and institutional traders with a regulated venue to trade Bitcoin. As Vivek Sun reports via Bitcoin Magazine, CME is already the global leader in Bitcoin futures trading. By adding spot bitcoin, it can offer clients an integrated platform that includes both spot and derivatives markets. This enables complex trading strategies like… Read more at: https://oilprice.com/Finance/the-Economy/CME-To-Shake-Up-Bitcoin-Market-with-Spot-Trading-Launch.html |

|

Russia’s Shadow Oil Tanker Fleet Causes 50 Maritime AccidentsA report from Allianz SE highlights the serious environmental and safety risks posed by a burgeoning “shadow fleet” of oil tankers carrying sanctioned Russian crude. Over the past three years, as international sanctions on Russian oil and gas exports have tightened due to its invasion of Ukraine, a significant number of older, under-regulated vessels have emerged to maintain the flow of these exports. These tankers, often operating without proper insurance and outside international regulatory frameworks, present substantial hazards in key maritime… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Shadow-Oil-Tanker-Fleet-Causes-50-Maritime-Accidents.html |

|

Asian Refiners Diversify Away from Middle Eastern OilAsian refiners are reducing their intake of Middle Eastern oil in favor of crude from the United States and Brazil. The move comes amid shrinking margins and rising Saudi oil prices—even as international benchmarks remain largely range-bound. Yet the diversification is, for the time being, quite moderate, with Saudi Arabia still the top supplier to Asia as a whole, far ahead of both the United States and Brazil. Whether this would turn into a trend is uncertain because there are all those barrels of relatively cheap Russian crude, too. Reuters’s… Read more at: https://oilprice.com/Energy/Crude-Oil/Asian-Refiners-Diversify-Away-from-Middle-Eastern-Oil.html |

|

Existing Foreign Oil Producers in Venezuela May Get Licenses Despite SanctionsAfter reestablishing sanctions against Venezuela, Washington is gearing up to issue restricted licenses to certain companies that already have oil-producing operations in the country, Reuters said in an exclusive report on Thursday, citing two unnamed sources close to discussions. According to Reuters’ sources, priority will be given to those already operating in Venezuela, including Chevron, Spain’s Repsol, Italian Eni, French Maurel & Prom, and Shell, all of whom have existing oil production in Venezuela. At the same time,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Existing-Foreign-Oil-Producers-in-Venezuela-May-Get-Licenses-Despite-Sanctions.html |

|

Banks Remain Financially Committed to Oil Despite Transition ShiftThere is no large international bank without a net-zero plan. These plans invariably include curbs in lending to the oil and gas industry. Yet despite these plans. Most of the world’s top lenders continue doing business with the oil industry—and they’ve been doing more of it lately. The revelation comes from the 15th annual Banking on Climate Chaos report authored by an organization called Oil Change International, part of a group of climate NGOs committed to putting an end to the oil and gas industry. According… Read more at: https://oilprice.com/Energy/Crude-Oil/Banks-Remain-Financially-Committed-to-Oil-Despite-Transition-Shift.html |

|

Crescent Energy to Buy SilverBow as U.S. Shale Mergers ContinueCrescent Energy will buy SilverBow Resources in a deal valued at $2.1 billion to create a major player in the Eagle Ford shale formation as the U.S. oil and gas mergers continue in the second quarter of the year. Under the terms of the transaction, SilverBow shareholders will receive 3.125 shares of Crescent Class A common stock for each share of SilverBow common stock, with the option to elect to receive all or a portion of the proceeds in cash at a value of $38 per share, subject to possible pro ration with a maximum total cash consideration… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Crescent-Energy-to-Buy-SilverBow-as-US-Shale-Mergers-Continue.html |

|

Are High Commodity Prices Becoming a Problem for the Fed?About a month ago, HSBC Global Research noted a forecast for a “weak” bull market in commodities. New data shows that the US Consumer Price Index (CPI) for April rose by .3% from the previous month and by 3.4% year-over-year. Although inflation is still increasing, it is doing so at a slower pace. Meanwhile, in Asia, Beijing is working to stabilize its economy. Amid these developments, commodity prices, tracked by Bloomberg, have reached their highest level in a year. This poses a serious threat for Fed Chair Powell’s efforts to combat the inflation… Read more at: https://oilprice.com/Metals/Commodities/Are-High-Commodity-Prices-Becoming-a-Problem-for-the-Fed.html |

|

Chevron Set to Exit UK North SeaChevron is preparing to launch a sale process to divest all its remaining operations in the UK North Sea as it looks to focus on the most profitable assets in its portfolio and finalize the $53-billion acquisition of Hess Corporation. With the planned divestment of its UK assets, Chevron would exit the basin after 55 years, the U.S. supermajor told Reuters in a statement on Thursday, confirming the plans. Chevron, which has been active in the UK North Sea for more than 55 years, holds a 19.4% non-operated working interest in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Set-to-Exit-UK-North-Sea.html |

|

Trump Wants the IEA to Refocus on Fossil Fuels and Energy SecurityIf Donald Trump wins the presidential election, he is expected to push the International Energy Agency (IEA), for which the United States provides about a quarter of the funding, back to energy security and fossil fuel supply, Reuters reported on Thursday, quoting sources with knowledge of the matter. [if !supportLineBreakNewLine] [endif] The Paris-based IEA was created to ensure the security of supply to developed economies in the aftermath of the Arab oil embargo in the 1970s. In recent years, however, the agency has shifted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Wants-the-IEA-to-Refocus-on-Fossil-Fuels-and-Energy-Security.html |

|

Refinery Repairs Drag Down Russia’s Oil Product Exports in AprilRussia’s fuel shipments dipped by 14.6% in April compared to March, as refinery repairs, seasonal maintenance, and a gasoline export ban weighed on Moscow’s petroleum product exports last month, according to Reuters calculations and data Reuters obtained from industry sources. In April, Russia exported a total of 8.415 million metric tons of oil products by sea, down by 14.6% from March. Russia has had higher-than-expected maintenance and repairs at its refiners in recent months after Ukraine stepped up early this year its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Refinery-Repairs-Drag-Down-Russias-Oil-Product-Exports-in-April.html |

|

Dow closes lower Thursday after briefly topping 40,000 for first time: Live updatesThe Dow Jones Industrial Average rose above 40,000 for the first time as a banner year on Wall Street continued. Read more at: https://www.cnbc.com/2024/05/15/stock-market-today-live-updates.html |

|

After Adobe collapse, Figma deal allows employees to sell shares at $12.5 billion valuationFigma on Thursday announced a tender offer that will allow current and former employees to sell shares at a valuation of $12.5 billion. Read more at: https://www.cnbc.com/2024/05/16/figma-tender-offer-values-company-at-12point5-billion.html |

|

Walmart surges to all-time high as earnings beat on high-income shopper, e-commerce gainsWalmart, the nation’s largest retailer and private employer, is often seen as a bellwether for the U.S. economy and saw sales jump 6% in the quarter. Read more at: https://www.cnbc.com/2024/05/16/walmart-wmt-q1-2025-earnings-.html |

|

The NBA is picking its next TV partners — and a deal hinges on Warner Bros. Discovery’s next moveWarner Bros. Discovery’s latest talks with the NBA could turn into a legal battle if the league decides to sign an agreement with NBCUniversal, sources said. Read more at: https://www.cnbc.com/2024/05/16/nba-tv-rights-deal-hinges-on-warner-bros-discovery.html |

|

Dan Loeb’s Third Point adds to megacap tech holdings in first quarter — with one notable exceptionThe hedge fund put money to work in tech stocks, while pulling back on one large position. Read more at: https://www.cnbc.com/2024/05/16/dan-loebs-third-point-adds-to-megacap-tech-holdings-in-q1-with-one-exception.html |

|

Walmart says more diners are buying its groceries as fast food gets priceyCustomers across incomes are looking for cheaper meals, Walmart’s chief financial officer said. Read more at: https://www.cnbc.com/2024/05/16/walmart-earnings-grocery-sales-rise-as-fast-food-prices-increases.html |

|

Wayfair to open its first large store, as physical locations make a comebackWhat “retail apocalypse”? Wayfair and other digitally native companies are turning to physical stores for growth as e-commerce profits become more challenging. Read more at: https://www.cnbc.com/2024/05/16/wayfair-to-open-first-large-store-outside-of-chicago.html |

|

Here’s the deflation breakdown for April 2024 — in one chartDeflation is the opposite of inflation: It’s when prices decline. That has largely occurred for goods such as furniture, appliances and cars in the past year. Read more at: https://www.cnbc.com/2024/05/16/deflation-cpi-april-2024-in-one-chart.html |

|

Morgan Stanley discloses $270 million investment in Grayscale Bitcoin ETF: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s episode, Tiago Sada, head of product, engineering, and design at Worldcoin parent company Tools for Humanity, discusses the foundation’s new data protection system. Read more at: https://www.cnbc.com/video/2024/05/16/morgan-stanley-discloses-270-million-investment-grayscale-bitcoin-etf-crypto-world.html |

|

Here are the perks Trump’s top donors would receive during the Republican National ConventionDonald Trump’s top donors are set to be rewarded with perks if they raise or give a certain amount of money in support of the former president. Read more at: https://www.cnbc.com/2024/05/16/trump-rnc-top-donors.html |

|

Supreme Court rules Consumer Financial Protection Bureau funding structure is legalThe Supreme Court decision protects the CFPB from the potentially crippling risk that Republicans in Congress will block annual funding for the agency. Read more at: https://www.cnbc.com/2024/05/16/supreme-court-rules-consumer-financial-protection-bureau-funding-structure-is-legal.html |

|

How much money the U.S. spends on warAmerican military spending reached $916 billion in 2023, which accounts for more than a third of the world’s total military expenditure. Read more at: https://www.cnbc.com/2024/05/16/how-much-money-the-us-spends-on-war.html |

|

Boeing supplier Spirit AeroSystems lays off workers, citing lower plane delivery ratesSpirit makes fuselages at the plant for Boeing’s best-selling 737 Max plane, deliveries of which have slowed in the wake of a door panel blowout. Read more at: https://www.cnbc.com/2024/05/16/spirit-aerosystems-layoffs.html |

|

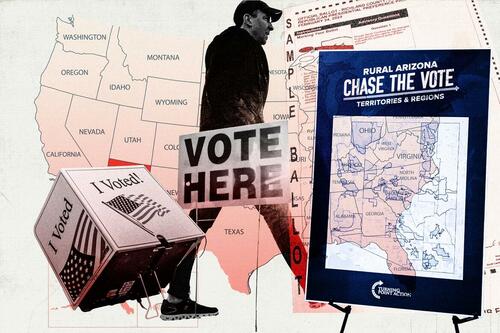

The ‘Super Chase’ Strategy That Conservative Activists Hope Will Win The 2024 ElectionAuthored by Nathan Worcester via The Epoch Times (emphasis ours),

He pointed out important areas of Arizona and Wisconsin—“super chase” jurisdictions scattered throughout the two battleground states. Behind him, a few other Turning Point Action staffers were working at a bank of computers. In the organization’s Phoenix headquarters, the workforce skewed young, in keeping with Turning Point’s focus on organizing and activating young conservatives. Mr. Martinez, a leader of the “Chase the Vote … Read more at: https://www.zerohedge.com/political/super-chase-strategy-conservative-activists-hope-will-win-2024-election |

|

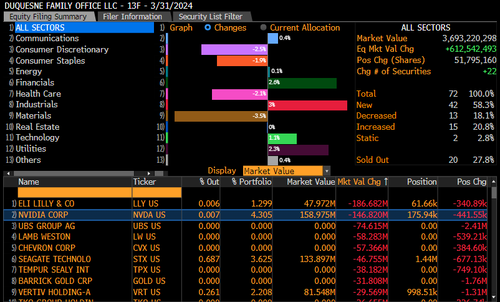

“We’ve Had A Hell Of A Run”: Stanley Druckenmiller Sells 441,000 Shares Of NvidiaBillionaire investor Stanley Druckenmiller, head of the Duquesne Family Office, sees the artificial intelligence bubble as overextended. He has slashed some of his holdings in “Magnificent Seven” technology stocks, including Nvidia. He’s not alone. Other notable fund managers and company insiders are jumping ship and unloading their shares. A recent 13F filing reveals that Druckenmiller’s family office sold over 441,000 shares of Nvidia Corp. in the first quarter, reducing its stake to only 176,000 shares, or worth just about $158 million. Since 13F filings are backward-looking, the firm may have further divested or adjusted those holdings since the first quarter.

We suspect Druckenmiller has not added to his Nvidia holdings. Early last week, the billionaire investor appeared on CNBC’s “Squawk Box,” explaining that his exposure to Nvidia was reduced after it went from $150 per share to $900 in just over a year. Read more at: https://www.zerohedge.com/markets/weve-had-hell-run-stanley-druckenmiller-sells-441000-shares-nvidia |

|

US Spy Balloon Crashes In Northeast SyriaVia The Cradle A sizable surveillance aerostat owned by the US military crashed on Wednesday near the town of Rmelan in Syria’s northeastern Al-Hasakah province. Footage on social media showed the aerostat descending from the sky and, subsequently, its debris on the ground close to Rmelan, which was also near a US base. Allegedly, US fighter jets were seen flying over the vicinity during the event.

The US maintains several illegal bases in Syria, including the one in Rmelan, primarily in the northeastern provinces of Al-Hasakah and Deir Ezzor, as well as Al-Tanf in the southeast, purportedly to combat ISIS remnants. Several local sources said the spy balloon crashed due to a technical malfunction, while others indicate that unidentified culprits shot down the aerostat. The Pentagon has yet to comment. The US initially introduced aerostats to its Syrian bases years ago, although they were considerab … Read more at: https://www.zerohedge.com/geopolitical/us-spy-balloon-crashes-northeast-syria |

|

Goldbugs Waited Years For A Massive Comex Short Squeeze, And Finally Got It… Just In The Wrong MetalFor much of the past decade, gold bugs religiously tracked the physical gold inventory located in the various gold vaults that make up the Comex system, eagerly awaiting the day when there would be more deliverables (via paper shorting of gold) than physical in storage, sparking a historic, Volkswagen-like short squeeze. Well, the day of a historic Comex short squeeze finally arrived… only it wasn’t in gold but in the far less precious metal that is copper. It all started one month ago, when we reported that in an attempt to enforce sanctions against Russia that actually worked (as opposed to the joke that is the western “oil embargo” now openly breached by absolutely everyone), the “US, UK Banned Deliveries Of Russian Copper, Nickel And Aluminum To Western Metals Exchanges.” There, in our conclusion, we wrote that “history has taught us that the market will price in some “full-sanction” risk premium which when combined with the current macro bid (reflation narrative, electrification, “copper is the first AI commodity” etc.) means we expect a complex wide rally.” Little did we know how truly historic said rally would be just one month later. As anyone who has been following the recent moves in the price of copper – which is hitting daily record highs – knows by now, a massive dislocation between the prices for copper traded in New York and other commodity exchanges has rocked the global market for the metal and … Read more at: https://www.zerohedge.com/commodities/goldbugs-waited-years-massive-comex-short-squeeze-and-they-finally-got-it-just-wrong |

|

Ex-Post Office IT boss blocked Vennells’ numberLesley Sewell tells the Horizon inquiry she was “not comfortable” being contacted by the former chief. Read more at: https://www.bbc.com/news/articles/cm5454yypxxo |

|

Backlash as Morrisons trials sale of New Zealand lambIt says the move is due to customer demand for cheaper prices in the wake of the cost of living crisis. Read more at: https://www.bbc.com/news/articles/cjewewxzypro |

|

Reality TV stars charged over investment plugsLauren Goodger, from The Only Way is Essex, is among those accused of promoting the unauthorised scheme on Instagram. Read more at: https://www.bbc.com/news/articles/crgyg62wn7po |

|

Nestle, Jio Financial among top 10 large cap stocks sold by mutual funds in AprilMutual funds buy and sell securities to actively manage their portfolios. Read more at: https://economictimes.indiatimes.com/mf/analysis/nestle-jio-financial-among-top-10-large-cap-stocks-sold-by-mutual-funds-in-april/slideshow/110182993.cms |

|

Tech View: Nifty forms small Hanging Man candle. What traders should do on FridayOn the call side, there are notable OI concentrations at the 22,500 and 22,900 levels, suggesting these as resistance levels to watch, with the 22,900 level approaching all-time highs. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-hanging-man-candle-what-traders-should-do-on-friday/articleshow/110182536.cms |

|

Info Edge Q4 PAT rises 18% YoY to Rs 211 crore, revenue up 8%Info Edge’s Q4 profit rose 18% to Rs 211 crore with revenue at Rs 608.3 crore. Operating profit margins at 37%. Final dividend of Rs 12 per share announced. Cash balance at Rs 4,191 crore. CFO highlighted 13.2% growth in cash from operations Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/info-edge-q4-results-pat-rises-18-yoy-to-rs-211-crore-revenue-up-8/articleshow/110175366.cms |

|

Why the post-Fed stock-market rally is raising fresh inflation questionsThe issue is whether Fed Chair Jerome Powell’s post-meeting remarks on May 1 — in which he said the central bank’s next move is “unlikely” to be a rate hike — are now easing financial conditions by so much that this ends up stalling progress on inflation. Read more at: https://www.marketwatch.com/story/why-the-post-fed-stock-market-rally-is-raising-fresh-inflation-questions-d8c6d03c?mod=mw_rss_topstories |

|

‘They are upset that they received nothing’: My mother excluded her late husband’s grandchildren from her will.“‘Instead of my mother’s step-grandchildren receiving half of the estate, everything in the estate fell to me.” Read more at: https://www.marketwatch.com/story/our-children-dont-have-the-discipline-to-manage-their-own-money-my-wife-and-i-have-4-5-million-saved-for-retirement-how-long-will-this-last-20ebd4ad?mod=mw_rss_topstories |

|

These behavioral trends drove the GameStop and AMC meme-stock rallyThe meme-stock rally that lifted shares of GameStop Corp. and AMC Entertainment Holdings Inc. this week tapped into a range of human behaviors, according to behavioral finance expert Victor Ricciardi. Read more at: https://www.marketwatch.com/story/these-behavioral-trends-drove-the-gamestop-and-amc-meme-stock-rally-3e7ed0ab?mod=mw_rss_topstories |

(Illustration by The Epoch Times, Nathan Worcester/The Epoch Times, Getty Images)PHOENIX, Ariz—Matthew Martinez bounded from map to map, a broad smile on his face.

(Illustration by The Epoch Times, Nathan Worcester/The Epoch Times, Getty Images)PHOENIX, Ariz—Matthew Martinez bounded from map to map, a broad smile on his face.