Summary Of the Markets Today:

- The Dow closed down 3.57% +1,165 points,

- Nasdaq closed down 4.73%,

- S&P 500 closed down 4.04%,

- WTI crude oil settled at 109.28, down 3.79%,

- USD $103.85 down 0.54%,

- Gold 1816 flat 0.00%,

- Bitcoin up 0.20% to $29242,

- 10-year U.S. Treasury down 0.081% / 2.889%

Today’s Economic Releases

The Global Supply Chain Pressure Index (GSCPI) increased for the first time since December 2021. The authors of this index believe there is “potential for heightened geopolitical tensions to stoke supply chain pressures in the near term.”

April 2022 new residential construction starts declined according to US Census. However, year-over-year growth improved from last month.

“Many companies are making changes at the top to address rising costs for both business and consumers,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.

It should come as no surprise that the NFIB’s Small Business Optimism Index declined to the lowest level since the COVID recession.

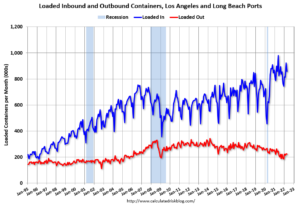

At the Ports of Long Beach and Los Angeles, April 2022 imports continue to run at a near record pace (year-over-year) whilst exports declined 7% year-over-year. Generally speaking, a recession is unlikely when imports are in expansion year-over-year.

A summary of headlines we are reading today:

- Gasoline Prices Top $6 In California, $9 In Parts Of Europe

- Here’s what Walmart, Target, Home Depot, and Lowe’s tell us about the state of the American consumer

- Target shares sink 25% after company says high costs, inventory woes hit profits

- Stocks & Bond Yields Crater As The ‘American Consumer Is Strong’ Narrative Implodes

- The Fed: Fed will keep raising interest rates until it is ‘confident’ inflation is moving down, Harker says

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why Record-High Prices won’t Drive A Recovery For U.S. CoalSimilar to oil and gas prices, U.S. coal prices have hit multi-year highs as Russia’s war in Ukraine and an economic rebound from the pandemic has upended international energy markets and driven up demand for fossil fuels. Indeed, U.S. coal prices surged to an all-time high of $439 per metric ton in March before pulling back to $331/ton, still good for a nearly 140% increase in the year-to-date. In comparison, crude prices have increased 45% YTD while natural gas has jumped 133%. Stocks of leading coal producers have outperformed Big Oil stocks, Read more at: https://oilprice.com/Energy/Energy-General/Why-Record-High-Prices-Wont-Drive-A-Recovery-For-US-Coal.html |

|

Is The Global Debt Bubble About To Burst?The years between 1981 and 2020 were very special years for the world economy because interest rates were generally falling: Figure 1. Yields on 10-year and 3-month US Treasuries, in a chart made by the Federal Reserve of St. Louis, as of May 10, 2022. In some sense, falling interest rates meant that debt was becoming increasingly affordable. The monthly out-of-pocket expense for a new $500,000 mortgage was falling lower and lower. Automobile payments for a new $30,000 vehicle could more easily be accommodated into a person’s budget. A business Read more at: https://oilprice.com/Energy/Energy-General/Is-The-Global-Debt-Bubble-About-To-Burst.html |

|

Gasoline Prices Top $6 In California, $9 In Parts Of EuropeGas prices in both the United States and Europe hit new highs Wednesday, with average prices per gallon in California topping $6, compared to over $9 in Norway and Denmark as Russia’s war on Ukraine plays out in the global energy sector. On Wednesday, the U.S. national average at the pump rose to $4.567, up from $4.523 yesterday, and up from $3.043 a year ago, according to AAA. That’s a more than 50% rise in gas prices in a year. In California, gasoline hit an average Wednesday of $6.05, up from $6.021 yesterday, and $4.135 a Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gasoline-Prices-Top-6-In-California-9-In-Parts-Of-Europe.html |

|

U.S. LNG Is Quickly Becoming The Worlds Hottest CommodityJapan is reportedly actively considering extending financial support to the US to boost liquefied natural gas (LNG) production. Incidentally, the US is already the worlds 3rd largest exporter of LNG behind Qatar and Australia. However, the country is set to play an even bigger role in global LNG production and export as the Russian market withers in the wake of the Ukraine crisis. Japan and China Turning to the US According to a report in Nikkei, Japan has been actively trying to reduce energy dependence on Russia following Moscow’s Read more at: https://oilprice.com/Energy/Natural-Gas/US-LNG-Is-Quickly-Becoming-The-Worlds-Hottest-Commodity.html |

|

Oil, Gas Employment Will Take Five Years To Recover From Covid: RystadOil and gas sector employment is on the road to recovery in the United States after the significant job shedding that took place during the pandemic era. But a full recovery won’t be seen for another five years, a new analysis from Rystad Energy showed on Wednesday. The U.S. oil and gas industry lost 200,000 jobs during the pandemic, according to Rystad calculations. This represented 20% of the total workforce in the sector. In 2020 alone, 100,000 oil and gas jobs were lost in the United States mostly in the drilling tools and services segment. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Gas-Employment-Will-Take-Five-Years-To-Recover-From-Covid-Rystad.html |

|

Sweden And Finland Have Formally Applied To Join NATOFinland and Sweden formally applied to join NATO on Wednesday in Brussels, driven by the Russia-Ukraine conflict to step out of their neutrality maintained during and since the Cold War. NATO Secretary-General Jens Stoltenberg said it was a historic moment and that he warmly welcomed the two nations into the world’s biggest military alliance, a move considered to be one of the most significant adjustments to Europes security architecture in decades. You are our closest partners, and your membership in NATO Read more at: https://oilprice.com/Geopolitics/International/Sweden-And-Finland-Have-Formally-Applied-To-Join-NATO.html |

|

Here’s what Walmart, Target, Home Depot and Lowe’s tell us about the state of the American consumerFour major retailers — Walmart, Target, Home Depot and Lowe’s — reported quarterly financial results this week. Read more at: https://www.cnbc.com/2022/05/18/what-walmart-target-home-depot-and-lowes-tell-us-about-the-economy.html |

|

Weekly mortgage demand from homebuyers tumbles 12%, as higher interest rates take their tollHigher mortgage interest rates are hitting homebuyer affordability hard, and that is showing up in a sharp drop in mortgage applications. Read more at: https://www.cnbc.com/2022/05/18/weekly-mortgage-demand-from-homebuyers-tumbles-12percent.html |

|

Hasbro slams activist investor’s proposed board directors as proxy battle heats upHasbro is going on the offensive against an activist investor wants to add new members to the company’s board and spin-off its lucrative Wizards of the Coast. Read more at: https://www.cnbc.com/2022/05/18/hasbro-slams-activist-investors-proposed-board-directors-amid-proxy-battle.html |

|

Target shares sink 25% after company says high costs, inventory woes hit profitsThe big-box retailer said it saw a healthy customer, but a shift to experience-based purchases, such as toys for birthday parties and luggage for trips. Read more at: https://www.cnbc.com/2022/05/18/target-tgt-q1-2022-earnings.html |

|

Lowe’s sales decline as cool spring weather weighs on demand for outdoor productsThe home improvement retailer’s profit topped Wall Street estimates for the quarter, even as sales missed the mark. Read more at: https://www.cnbc.com/2022/05/18/lowes-low-earnings-q1-2022.html |

|

Netflix lays off 150 employees as the streaming service contends with big subscriber lossesNetflix is laying off around 150 employees across the company, CNBC confirmed Tuesday. Read more at: https://www.cnbc.com/2022/05/17/netflix-lays-off-150-employees-as-the-streaming-service-contends-with-big-subscriber-losses.html |

|

EV battery costs could spike 22% by 2026 as raw material shortages drag onE Source estimates battery cell prices will surge 22% from 2023 through 2026, peaking at $138 per kilowatt-hour. Read more at: https://www.cnbc.com/2022/05/18/ev-battery-costs-set-to-spike-as-raw-material-shortages-drags-on.html |

|

Just 2% of the richest Americans had their taxes audited in 2019, down from 16% in 2010The main reason for the decline in the audit rate is a lack of IRS funding, according to a GAO report. Read more at: https://www.cnbc.com/2022/05/17/super-wealthy-irs-tax-audits-plunge-over-decade-government-report-says.html |

|

Op-ed: Investors need to keep their emotions under control in this volatile marketAlthough no one can predict what is going to happen next, there are strategies that investors can consider to help manage their portfolios through volatility. Read more at: https://www.cnbc.com/2022/05/18/investors-need-to-keep-emotions-under-control-in-this-volatile-market.html |

|

Flight attendants’ union backs Spirit-Frontier merger, clearing labor hurdleThe announcement clears a labor hurdle among the biggest worker groups at the airlines. Read more at: https://www.cnbc.com/2022/05/17/flight-attendants-union-backs-spirit-frontier-merger.html |

|

Musk Vs. Soros: “I Can No Longer Support Democrats, Will Vote Republican”Musk Vs. Soros: “I Can No Longer Support Democrats, Will Vote Republican “Update (1600ET): Elon Musk confirmed comments made on Monday that he would be voting Republican in the next election, tweeting on Wednesday: “In the past I voted Democrat, because they were (mostly) the kindness party. “But they have become the party of division & hate, so I can no longer support them and will vote Republican,” he said, adding “Now, watch their dirty tricks campaign against me unfold …” (which we presume will include George Soros and associated tentacles).

On Tuesday, Musk responded to a clip of a Twitter official mocking him as mentally handicapped and “special.”

|

|

Stocks & Bond Yields Crater As The ‘American Consumer Is Strong’ Narrative ImplodesStocks & Bond Yields Crater As The ‘American Consumer Is Strong’ Narrative ImplodesYep, we went there and unleashed the ‘deer in headlights’ image…

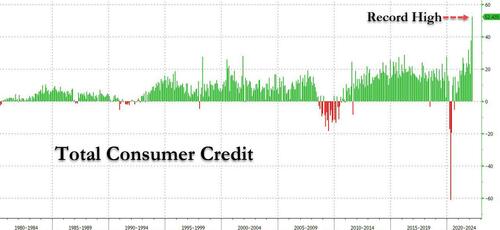

While most blinkered investors ignored last week’s record surge in revolving consumer credit (i.e. credit card spending), this week’s Walmart and Target earnings brought it home to the rest of the country that the “American consumer is strong” or “consumer has best balance sheet ever” narrative imploded, crashing on the shores of a gigantically lopsided and divided national aggregate that hides the reality that most of America is unable to pay the ‘cost of living’ under Bidenomics 40-year-high inflation without resorting to the plastic … Read more at: https://www.zerohedge.com/markets/american-consumer-strong-narrative-implodes-stocks-bond-yields-crater |

|

Goldman Economist Warns US Consumers Maxing Out Credit Cards Will Lead To Late 2022 Spending CollapseGoldman Economist Warns US Consumers Maxing Out Credit Cards Will Lead To Late 2022 Spending CollapseA little over a week ago, when looking at the latest consumer credit data from the Federal Reserve, we were shocked to learn that in March, credit card debt soared by a record $52.4 billion, the biggest monthly increase on record and more than double the expected change.

Summarizing our views on this historic surge in credit-fueled purchases, we said that “while this unprecedented rush to buy everything on credit at a time when there were no notable Hallmark holidays should not come as much of a surprise, after all we have repeatedly shown that for the middle class any “excess savings” are now gone, long gone… Read more at: https://www.zerohedge.com/markets/goldman-economist-warns-us-consumers-maxing-out-credit-cards-will-lead-late-2022-spending |

|

China Mulls Extending EV Subsidies Amidst Surging Raw Material CostsChina Mulls Extending EV Subsidies Amidst Surging Raw Material CostsIn a move that could have profound effects for the EV market in China, Beijing is reportedly reconsidering its EV subsidy, which it had previously planned to end this year. The country’s Ministry of Information and Industrial Technology, along with government officials, are mulling the idea over with automakers, Reuters reported, citing 3 people familiar with the matter. Terms of a potential extension haven’t been finalized, but such an extension would be a drastic shot in the arm for the EV industry after Beijing had been posturing for months that the subsidy would definitely be coming to an end. Recall, last month, we published an article on how China was seeking to control the global EV supply chain. That came weeks after we wrote about how Chinese EV manufacturers – like U.S. automakers – were grappling with rising raw material costs. Read more at: https://www.zerohedge.com/markets/china-mulls-extending-ev-subsidies-amidst-surging-raw-material-costs |

|

Rishi Sunak warns of tough few months as inflation soarsThe chancellor says it won’t be easy to tackle cost of living crisis as inflation hits 40-year high. Read more at: https://www.bbc.co.uk/news/business-61497660?at_medium=RSS&at_campaign=KARANGA |

|

Oil and gas industry pushes back over windfall taxOil and gas producers say they are already paying more tax and an extra levy would damage confidence. Read more at: https://www.bbc.co.uk/news/business-61487871?at_medium=RSS&at_campaign=KARANGA |

|

Martin Shkreli ‘Pharma bro’ released early from prisonMr Shkreli was convicted in 2017 of defrauding investors. Read more at: https://www.bbc.co.uk/news/business-61497816?at_medium=RSS&at_campaign=KARANGA |

|

Preferred 50 bps rate hike in May, not clear why most in panel sought 40: MPC’s Varma“The majority of the MPC is in favour of 40 basis points for reasons which are not very clear to me. Whatever symbolic or psychological benefit there may be from keeping the hike below 50 basis points is outweighed by the simplicity and clarity of moving in round multiples of 25 basis points,” read his statement in the minutes. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/preferred-50-bps-rate-hike-in-may-not-clear-why-most-in-panel-sought-40-mpcs-varma/articleshow/91646581.cms |

|

Should you invest in MCX despite drop in Q4 profit? Here’s what analysts sayDecline in future turnover is being replaced by strong traction in options, they said, adding that nonlinear growth in option volume may aid business and earnings growth. On Monday, the scrip rose 5.45 per cent to hit a high of Rs 1,276.90. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/should-you-invest-in-mcx-despite-drop-in-q4-profit-heres-what-analysts-say/articleshow/91643840.cms |

|

Ukraine war has altered inflation dynamics, needed to hike rates swiftly: MPC minutesAs predicted by the head of the RBI, the Consumer Price Index-based inflation print for April was indeed elevated – jumping to an eight-year high of 7.79 per cent. As such, the MPC is widely expected to further raise the repo rate from its current level of 4.40 per cent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ukraine-war-has-altered-inflation-dynamics-needed-to-hike-rates-swiftly-mpc-minutes/articleshow/91646104.cms |

|

The Fed: Fed will keep raising interest rates until it is ‘confident’ inflation is moving down, Harker saysThe U.S. central bank will continue to raise interest rates at a measured pace until policymakers are confident that inflation is moving down toward the 2% annual rate goal, said Philadelphia Fed President Patrick Harker on Wednesday Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D77-8764D3883F6C%7D&siteid=rss&rss=1 |

|

Key Words: Goldman Sachs CEO sees a ‘30% chance of recession’ within the next 12 to 24 monthsDavid Solomon said that ‘you have to be looking through a lens with a little bit more caution right now’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D72-CE566407633F%7D&siteid=rss&rss=1 |

|

Market Extra: A ‘summer of pain’? The Nasdaq Composite could plunge 75% from peak, S&P 500 skid 45% from its top, warns Guggenheim’s Scott Minerd.Minerd envisions the possibility of a summer of pain for bulls Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D74-34393B9FCF5E%7D&siteid=rss&rss=1 |