Summary Of the Markets Today:

- The Dow closed up 1.34% +431 points,

- Nasdaq closed up 2.76%,

- S&P 500 closed up 2.02%,

- WTI crude oil settled at 112.04, down 1.62%,

- USD $103.31 down 0.85%,

- Gold 1815 flat 0.00%,

- Bitcoin up 0.88% to $30,730,

- 10-year U.S. Treasury up 0.105% / 2.984%

Today’s Economic Releases

Retail sales continue at blockbuster rates according to US Census data. The April 2022 data shows year-over-year sales increased 6.7%. HOWEVER, when adjusted for inflation (as shown in FRED’s series RRSFS), this is the second month in a row that retail sales have declined year-over-year.

According to the Federal Reserve, April 2022 industrial production data continues to grow following the COVID recession of early 2020.

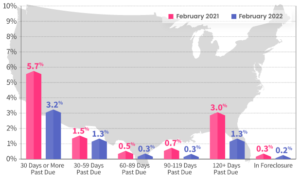

CoreLogic’s Loan Performance report for February 2022 shows loan delinquencies continued to decline relative to the period one year ago.

“Consumer confidence fell slightly in April, after a modest increase in March,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board.

A summary of headlines we are reading today:

- Steel Demand Is Taking A Beating As China Lockdowns Persist

- Walmart shares fall as higher costs, supply chain problems and inventories eat into profits

- United Airlines says FAA has cleared 52 Boeing 777s to fly again after they were grounded for engine failure

- JPMorgan Sees Gas Prices Hitting $6.20 By August

- The Margin: Free rapid at-home COVID tests: You can order a third round from the federal government

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Libyan Oil Deadlocked As Clashes Force PM-Designate Out of TripoliLibyan prime minister-designate Fathi Bashagha was forced out of the capital Tripoli on Tuesday by armed militias backed by current interim Prime Minister Adbdul Hamid Dbeibah, who refuses to step down and cede power as a significant amount of the country’s oil production capacity remains shut-in. Armed clashes shook Tripoli on Tuesday as Bashagha, backed by the eastern-based parliament, entered the capital to assume power from Dbeibah, forcing the prime minister-designate to leave the city only hours after entering. Clashes erupted when Bashagha Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyan-Oil-Deadlocked-As-Clashes-Force-PM-Designate-Out-of-Tripoli.html |

|

Steel Demand Is Taking A Beating As China Lockdowns PersistThe ascent for U.S. steel prices faltered as HRC, CRC, and HDG prices began to fall in early May. Plate prices also took a big dip. All in all, the Raw Steels Monthly Metals Index (MMI) fell by 8.9% from April to May. Iron Ore Slumps to 4-Month Low on Demand Concerns Iron ore prices fell to a 4-month low on mounting demand concerns due to China’s ongoing lockdowns. Meanwhile, iron ore fines fell to $131.90 on May 10, the lowest since Jan 31 and a 12.6% decline since the close of March. According to data from the National Bureau Read more at: https://oilprice.com/Metals/Commodities/Steel-Demand-Is-Taking-A-Beating-As-China-Lockdowns-Persist.html |

|

Putin: Europe Committing Economic Suicide With Energy SanctionsIf Europe were to ban crude oil and natural gas from Russia, it would be committing economic suicide, Russian President Vladimir Putin said on Tuesday. Putin added that attempting to reduce energy supplies from Russia would harm Europe, not Russia, and would raise inflation and send high energy prices even higher. Not only would such a move hurt Europe and not hurt Russia, but it would also actually add to Russias bottom line by increasing the price of crude oil that it exports, Putin said on Tuesday. Since Russia invaded Ukraine, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Europe-Committing-Economic-Suicide-With-Energy-Sanctions.html |

|

Oil Markets Are Bracing For A Slew Of Bullish NewsReader Update:Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week.Chart of the Week- Chinese refinery runs have dropped to their lowest in the country’s post-pandemic history, declining a whopping 1.2 million b/d month-on-month to a monthly average of 12.6 million b/d.- As the Shanghai lockdown was supplemented Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Are-Bracing-For-A-Slew-Of-Bullish-News.html |

|

United States To Release Venezuela From Some Oil SanctionsWashington will start to relax restrictions placed on U.S.-based oil company Chevron with regards to its crude business in sanctioned Venezuela. Chevron will soon be able to negotiate directly with the Venezuelan government and its state-run oil company, PDVSA, with the final details of the new arrangement expected to be complete as early as today. The move is thought to support the talks between Venezuela’s socialist government led by Nicolas Maduro and the Western-backed opposition government led by Juan Guaido, the Washington Post reported Read more at: https://oilprice.com/Latest-Energy-News/World-News/United-States-To-Release-Venezuela-From-Some-Oil-Sanctions.html |

|

U.S. Set To Suggest European Tariff On Russian Oil Instead Of EmbargoThe United States is considering proposing that European countries impose a tariff on Russian oil to allay concerns about the security of supply and surging oil prices, U.S. Treasury officials told Reuters on Tuesday. The proposal is expected to be suggested at the G7 finance summit in Brussels later this week, as the EU is still struggling to find a common position on a phased-out embargo on Russian oil imports by the end of the year. G7 members committed earlier this month to stop buying Russian oil, although they did not specify how and when Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Set-To-Suggest-European-Tariff-On-Russian-Oil-Instead-Of-Embargo.html |

|

Walmart shares fall as higher costs, supply chain problems and inventories eat into profitsThe discounter said the significant jump in fuel prices, higher labor costs and aggressive inventory levels weighed on the company’s profits. Read more at: https://www.cnbc.com/2022/05/17/walmart-wmt-earnings-q1-2023.html |

|

Netflix lays off 150 employees as the streaming service contends with big subscriber lossesNetflix is laying off around 150 employees across the company, CNBC confirmed Tuesday. Read more at: https://www.cnbc.com/2022/05/17/netflix-lays-off-150-employees-as-the-streaming-service-contends-with-big-subscriber-losses.html |

|

Flight attendants’ union backs Spirit-Frontier merger, clearing labor hurdleThe announcement clears a labor hurdle among the biggest worker groups at the airlines. Read more at: https://www.cnbc.com/2022/05/17/flight-attendants-union-backs-spirit-frontier-merger.html |

|

Home Depot raises full-year outlook as shoppers trade up to premium products and fuel record Q1 salesHome Depot on Tuesday raised its full-year outlook after reporting strong quarterly earnings, fueled by the company’s strongest first-quarter sales on record. Read more at: https://www.cnbc.com/2022/05/17/home-depot-hd-q1-2022-earnings.html |

|

U.S. traffic deaths reached a 16-year high in 2021, according to government estimatesMore people died on U.S. roadways last year than any year since 2005, according to new data released Tuesday by federal vehicle safety officials. Read more at: https://www.cnbc.com/2022/05/17/us-traffic-deaths-hit-16-year-high-in-2021-dot-says.html |

|

Homebuilder sentiment falls to 2-year low on declining demand and rising costs“Housing leads the business cycle, and housing is slowing,” said NAHB Chairman Jerry Konter, a builder and developer. Read more at: https://www.cnbc.com/2022/05/17/home-builder-sentiment-falls-to-2-year-low-on-declining-demand-rising-costs.html |

|

Ford-backed robotaxi start-up Argo AI is ditching its human safety drivers in Miami and AustinArgo’s driverless taxis won’t be carrying paying passengers yet, but they will be on city streets during business hours. Read more at: https://www.cnbc.com/2022/05/17/argo-ai-robotaxis-ditch-human-safety-drivers-in-miami-and-austin.html |

|

United Airlines says FAA has cleared 52 Boeing 777s to fly again after they were grounded for engine failureUnited plans to start flying the 52 Pratt & Whitney-powered 777s again this month. Read more at: https://www.cnbc.com/2022/05/17/united-airlines-says-faa-cleared-grounded-boeing-777s-to-fly-again.html |

|

JetBlue launches hostile takeover bid for Spirit AirlinesJetBlue wrote to Spirit shareholders Monday, offering $30 a share and encouraging them to vote against the Frontier deal. Read more at: https://www.cnbc.com/2022/05/16/jetblue-launches-hostile-takeover-bid-for-spirit-airlines.html |

|

How Carvana went from a Wall Street top pick to trading with meme stocksCarvana has gone from Wall Street’s preferred used car retailer to trading like a meme stock amid cost-cutting measures and layoffs. Read more at: https://www.cnbc.com/2022/05/16/how-carvana-went-from-a-wall-street-top-pick-to-meme-stock-trading.html |

|

Auction of Judy Garland ‘Wizard of Oz’ dress in jeopardy as judge sets hearing on ownership lawsuitA Wisconsin woman is suing Bonham’s auction house and The Catholic University of America over the dress, which was worn by Judy Garland in “The Wizard of Oz.” Read more at: https://www.cnbc.com/2022/05/16/auction-of-judy-garland-wizard-of-oz-dress-in-jeopardy-set-for-court-hearing.html |

|

McDonald’s says it will sell its Russia business after previously pausing operations due to Ukraine warMcDonald’s said it will sell its business in Russia, a little more than two months after it paused operations in the country due to its invasion of Ukraine. Read more at: https://www.cnbc.com/2022/05/16/mcdonalds-says-it-will-sell-its-russia-business-after-previously-pausing-operations-due-to-ukraine-war.html |

|

Stocks making the biggest moves midday: Walmart, Citigroup, Paramount and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/17/stocks-making-the-biggest-moves-midday-walmart-citigroup-paramount-and-more.html |

|

Voters Head To Polls In Pennsylvania To Decide Hotly-Contested Senate & Gubernatorial PrimariesVoters Head To Polls In Pennsylvania To Decide Hotly-Contested Senate & Gubernatorial PrimariesAuthored by Jeff Louderback via The Epoch Times, The polls opened on May 17 for the closely-watched primary elections for the U.S. Senate and the governor’s seat in Pennsylvania.

… Read more at: https://www.zerohedge.com/political/voters-head-polls-pennsylvania-decide-hotly-contested-senate-and-gubernatorial-primaries |

|

Stocks Surge, Bonds Purge As FedSpeak Offers Nothing NewStocks Surge, Bonds Purge As FedSpeak Offers Nothing NewA beat for retail sales and industrial production (both in nominal dollars, don’t forget) but a gut-wrenching miss for homebuilder sentiment (not in nominally inflated dollars) set the scene for another hyperactive day in the markets but it was FedSpeak that dominated as various talking heads “spoke much but said little”:

They said nothing new at all, as @knowledge_vital succinctly noted:

Equity markets were an virtuous combination o … Read more at: https://www.zerohedge.com/markets/stocks-surge-bonds-purge-fedspeak-offers-nothing-new |

|

Buchanan: Why Would US Give A War Guarantee… To Finland?Buchanan: Why Would US Give A War Guarantee… To Finland?Authored by Pat Buchanan, Seeing Russia invade Ukraine, historically neutral Finland has undergone a late conversion and decided to join NATO immediately. Why? Because NATO membership means the world’s strongest power, the United States, under Article 5 of NATO, would go to war against Russia, should it cross Finland’s border. Nervous about Russian President Vladimir Putin’s intentions, Finland wants America legally and morally bound to fight Russia on its behalf, should Putin invade Finland as he invaded Ukraine. From the Finnish point of view, this is perfectly understandable.

But why would the United States consent to go to war with Russia, the largest nuclear power on earth, for violating Finland’s frontiers? Finland is not Alaska; it is not Canada; it is 5,000 miles away. And no one ever asserted during the Cold War, or for th … Read more at: https://www.zerohedge.com/geopolitical/buchanan-why-would-us-give-war-guarantee-finland |

|

JPMorgan Sees Gas Prices Hitting $6.20 By AugustJPMorgan Sees Gas Prices Hitting $6.20 By AugustMoments ago we reported that for the first time in US history, gasoline in every single state is above $4/gallon, while the national average US retail gasoline price just topped $4.50 a gallon today, also for the first time. That’s up about 50 cents from a month ago, and a massive jump from $3.04 per gallon on the same day in 2021. While shocking, in just a few months, these numbers may seem quaint and quite low. With expectations of strong driving demand — the US summer driving season starts on Memorial Day, which lands this year on May 30, and lasts until Labor Day in early September — JPMorgan’s commodity strategist Natasha Kaneva warns that US retail prices could surge another 37% by August to a $6.20/gal national average. How is this possible? Well, as peak US summer driving season begins, record diesel pieces are about to take a back seat to gasoline. Toward the end of April, as the May NYMEX diesel contract climbed into expiry, US diesel prices peaked at a $1.63/gal premium to US gasoline, the highest diesel premium ever. Over the following two weeks, US gasoline prices climbed to close that gap and today gasoline is trading at a 15 cents per gallon premium to diesel Read more at: https://www.zerohedge.com/markets/jpmorgan-sees-gas-prices-hitting-620-august |

|

Petrol retailers told to pass on fuel duty cutThe government wants to ensure companies pass on tax cuts to motorists as diesel prices hit new highs. Read more at: https://www.bbc.co.uk/news/business-61484102?at_medium=RSS&at_campaign=KARANGA |

|

Job vacancies outpace unemployment for first timeThe unemployment rate falls to its lowest level for nearly 50 years between January and March. Read more at: https://www.bbc.co.uk/news/uk-61475720?at_medium=RSS&at_campaign=KARANGA |

|

Warning over shrinking school meals as prices riseSchool caterers will have to shrink portions or use cheaper ingredients, a major food wholesaler warns. Read more at: https://www.bbc.co.uk/news/business-61477584?at_medium=RSS&at_campaign=KARANGA |

|

ITC Q4 Preview: Cigarette, hotels, agri biz to drive up to 23% sales growthAnalysts at brokerage firm Share khan said cigarette business revenue is expected to increase by 12-13 per cent YoY with volume growth of 11 per cent. It expects the non-cigarette FMCG business to grow by 5 per cent due to lower volume growth. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/itc-q4-preview-cigarette-hotels-agri-biz-to-drive-up-to-23-sales-growth/articleshow/91618782.cms |

|

Trade Setup: Nifty may find resistance at 16,480-16,500 levels in the immediate near termWednesday is likely to see the levels of 16,330 and 16,485 acting as immediate resistance points. The supports come in at 16,160 and 16,030 levels. The trading range is likely to stay wider than usual. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-nifty-may-find-resistance-at-16480-16500-levels-in-the-immediate-near-term/articleshow/91623340.cms |

|

Sunil Singhania, other D-Street bigshots pick stake in IPO-bound EthosMukul Mahavir Agarwal increased his stake in the retailer via a rights issue and bought 23,145 equity shares for Rs 550 apiece. He upped his stake to 9,24,121 equity shares or 4.84 per cent, shows the company’s RHP filed on May 6, from 9,00,976 equity shares earlier. His stake in the company is valued at Rs 81.13 crore at the upper range of the price band. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/sunil-singhania-other-d-street-bigshots-pick-stake-in-ipo-bound-ethos/articleshow/91619885.cms |

|

: Americans have bet $125 billion on sports in the past four years as legalization push continuesSince 2018, betting changed from a taboo topic on sports television to the open discussion of gambling odds during halftime shows Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D55-3FFC47B81F4D%7D&siteid=rss&rss=1 |

|

The Margin: Free rapid at-home COVID tests: You can order a third round from the federal government — here’s howAmericans can order 8 more COVID-19 test kits from the USPS right now, the White House says, which will ship for free and come in two separate packages. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A44-6D8D72BBA295%7D&siteid=rss&rss=1 |

|

Walmart says consumers are trading down to private label for items like dairy and baconWalmart says it’s keeping an eye on the transition many consumers are making to private-label brands, an effort to control grocery costs during a period of high inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D5E-288F37BA5A3D%7D&siteid=rss&rss=1 |

Pennsylvania Republican U.S. Senate candidate Dr. Mehmet Oz joins former President Donald Trump onstage during a rally in support of his campaign at the Westmoreland County Fairgrounds in Greensburg, Penn., on May 6, 2022. Former President Trump endorsed Dr. Oz in the Pennsylvania Republican primary race for the U.S. Senate over his top opponent David McCormick. (Jeff Swensen/Getty Images)Pennsylvania Gov. Tom Wolf (D) is term-limited, and Sen. Pat Toomey (R) is retiring. Voters in the Keystone State will determine who meets in the general election to fill the seats.

Pennsylvania Republican U.S. Senate candidate Dr. Mehmet Oz joins former President Donald Trump onstage during a rally in support of his campaign at the Westmoreland County Fairgrounds in Greensburg, Penn., on May 6, 2022. Former President Trump endorsed Dr. Oz in the Pennsylvania Republican primary race for the U.S. Senate over his top opponent David McCormick. (Jeff Swensen/Getty Images)Pennsylvania Gov. Tom Wolf (D) is term-limited, and Sen. Pat Toomey (R) is retiring. Voters in the Keystone State will determine who meets in the general election to fill the seats.