Summary Of the Markets Today:

- The Dow closed down 395 points or 1.00%,

- Nasdaq closed down 0.95%,

- S&P 500 closed down 0.72%,

- Gold $2,297 up $40.00,

- WTI crude oil settled at $85 up $1.45,

- 10-year U.S. Treasury 4.355% up 0.026 points,

- USD index $104.78 down $0.240,

- Bitcoin $66,028 down $3,404 (4.90%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured goods in February 2024 was up 3.6% year-over-year (versus the Federal Reserve’s IP which was down 0.5% year-over-year). Does this mean the manufacturing recession is ending – it will take a few months more of data to know for sure.

The number of job openings changed little at 8.8 million on the last business day of February 2024 – and as this number has been little changed over the last 5 months, one would expect little change in the rate of growth for employment. Over the month, the number of hires and total separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, quits (3.5 million) and layoffs and discharges (1.7 million) changed little.

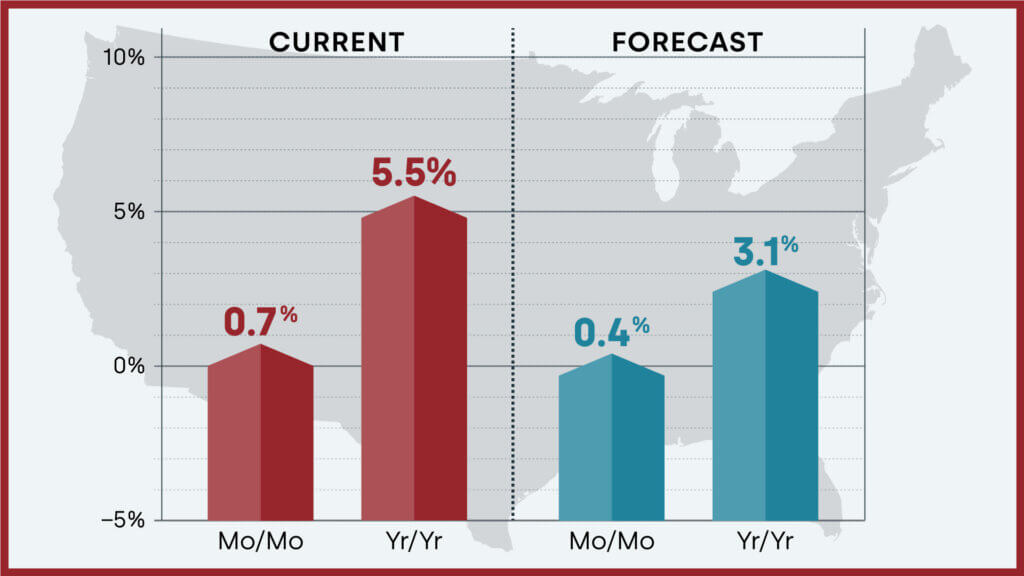

U.S. annual home price growth remained mostly consistent with numbers seen since last fall in February but finally slowed as the residual impact of comparing gains with weak 2022 home prices wore off. CoreLogic projects that year-over-year home price gains will continue to rise at a slower pace for the rest of 2024, which suggests more certainty for potential homebuyers who have been waiting to get a foot in the door. Dr. Selma Hepp, chief economist for CoreLogic noted:

Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded. As a result, the U.S. should begin to see slowing annual home price gains moving forward. Nevertheless, with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.

Here is a summary of headlines we are reading today:

- Geopolitical Risk Looms Over Commodity Markets

- Russia’s Oil Exports By Sea Hit New 2024 Record

- Princeton Scientists Unveil Breakthrough in Fusion Reactor Technology

- Brent Closes in on $90 as Geopolitical Risk Climbs

- Ukrainian Drones Hit Russia’s Third-Largest Oil Refinery

- Dow tumbles nearly 400 points, falling for a second day in rough start to new quarter: Live updates

- Fed officials still expects rate cuts this year, but not anytime soon

- U.S. crude oil cracks $85 to hit highest level since October as geopolitical tensions mount

- Bitcoin slides 5% as Treasury yields spike to highest level since November: CNBC Crypto World

- Hey NASA! ISS Space Junk May Have Ripped Through South Florida Home

- Tesla ‘disaster’ with fewest deliveries since 2022

- 10-, 30-year Treasury yields end at highest levels since November on strength of U.S. data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Geopolitical Risk Looms Over Commodity MarketsVia Metal Miner The start of this year presented mixed signals for the global economy. Prices witnessed the continuation of a strong rally from late February going into March. This helped create a lot of positivity in the metals market and market in general, boosting sentiment regarding a strong, healthy U.S. economy. Markets such as the SP500 and the NASDAQ, saw modest gains week over week to deliver the indices’ best February performance since 2015. February economic data, such as payroll figures, GDP, and retail sales, also came in stronger… Read more at: https://oilprice.com/Metals/Commodities/Geopolitical-Risk-Looms-Over-Commodity-Markets.html |

|

Chinese EV Makers Offer Incentives to Woo Tesla CustomersThe competition in China’s EV world continues to heat up, as the market becomes more and more saturated. The country’s automakers are aggressively trying to take advantage of Tesla’s recent price hikes by offering incentives, while at the same time gearing up to compete with the “disruptive” entry of Xiaomi into the market, Bloomberg reported this week. The report notes that on April 1, Shanghai-based Nio unveiled an incentive plan worth up to 1 billion yuan ($186.4 million) to encourage gasoline vehicle owners to switch, offering perks… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-EV-Makers-Offer-Incentives-to-Woo-Tesla-Customers.html |

|

Russia’s Oil Exports By Sea Hit New 2024 RecordRussia’s crude oil exports by sea reached the highest point yet this year in the last week of March, as weather conditions at Russia’s Pacific Port improved. Bloomberg tanker tracking data shows that four-week average seaborne crude exports in the period to March 31 reached their highest level since November. Russia agreed to cut crude oil exports throughout the first quarter as part of its role in OPEC+, which has been trying to keep control of the oil market. Under the agreement, Russia agreed to cut 300,000 bpd of crude oil exports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Exports-By-Sea-Hit-New-2024-Record.html |

|

Central Asia’s Air Quality Among Worst in the WorldThe air quality in Central Asian states is among the worst in the world, according to corporate study that measured pollution in over 130 countries around the world. The 2023 World Air Quality Report, compiled by Swiss-based IQAir, measured air-borne harmful particles, known as PM2.5, in over 7,800 locations. The findings showed that Central Asia trailed behind South Asian and Gulf states as having the some of worst regional air quality in the world. Bangladesh, Pakistan and India ranked one, two three in the report’s table of countries… Read more at: https://oilprice.com/The-Environment/Global-Warming/Central-Asias-Air-Quality-Among-Worst-in-the-World.html |

|

Princeton Scientists Unveil Breakthrough in Fusion Reactor TechnologyPrinceton Plasma Physics Laboratory researchers found the promise of coating the inner surface of the vessel containing a fusion plasma in liquid lithium guides them toward the best practices for fueling their plasmas. The research, which is featured in a new paper in Nuclear Fusion, includes observations, numerical simulations and analysis from their experiments inside a fusion plasma vessel called the Lithium Tokamak Experiment-Beta (LTX-β). (Please note, there is a dearth of attention grabbing media available for this post, however, the… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Princeton-Scientists-Unveil-Breakthrough-in-Fusion-Reactor-Technology.html |

|

Europe Makes It To the Other Side of Winter With Record Levels of Natural GasEurope has managed to make it through this winter season with record levels of natural gas in storage, setting it up to head into next winter on solid ground. With the end of March essentially wrapping up the typical winter season, natural gas stores in Europe remain 58.7% full, Gas Infrastructure Europe’s data shows—a new record. The previous record was set last winter when Europe ended with about 56% of natural gas stores filled. Europe will now begin the process of refilling its natural gas stores—it’s already fairly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Makes-It-To-the-Other-Side-of-Winter-With-Record-Levels-of-Natural-Gas.html |

|

Qatar Prepares To Dominate The LNG Export MarketQatar is backing up its massive LNG expansion plans with new orders to charter dozens of new ships as the tiny Gulf gas producer aims to solidify its dominance in the global LNG export market. Last year, the United States overtook Qatar as the world’s largest LNG exporter, but Qatar has a huge expansion program underway to boost its export capacity by 85% from current levels by 2030. As the U.S. paused permit approvals for new LNG export projects earlier this year, adding uncertainty about the outlook for U.S. supply from… Read more at: https://oilprice.com/Energy/Natural-Gas/Qatar-Prepares-To-Dominate-The-LNG-Export-Market.html |

|

SLB Announces $8-Billion Deal as Mergers Extend to Oilfield SectorSLB, the world’s top oilfield services provider, announced on Tuesday a definitive agreement to buy smaller competitor ChampionX Corporation in an all-stock deal valued at $7.75 billion, as the energy sector consolidation extends to the oilfield services segment. SLB and ChampionX announced the agreement whose terms stipulate that ChampionX shareholders will receive 0.735 shares of SLB common stock in exchange for each ChampionX share. At the closing of the transaction ChampionX shareholders will own around 9% of SLB’s outstanding… Read more at: https://oilprice.com/Latest-Energy-News/World-News/SLB-Announces-8-Billion-Deal-as-Mergers-Extend-to-Oilfield-Sector.html |

|

Bullish Bets on Gasoline Reach Four-Year HighThe latest surge in gasoline prices at the pump, something we detailed last week (read: here), could begin to impact the Biden administration’s reelection outlook unless the White House unleashes market interventions to arrest surging prices and prevent the national average cost of gas from breaching the critical level of $4/gallon. Let’s begin with hedge fund positioning: These traders have pushed their bullish bets on gasoline futures in New York to the highest level in four years. New data from the Commodities Futures Trading Commission… Read more at: https://oilprice.com/Energy/Gas-Prices/Bullish-Bets-on-Gasoline-Reach-Four-Year-High.html |

|

Venezuela’s Maduro Set to Visit Russia SoonRussia is preparing to welcome Venezuela’s President Nicolas Maduro on an official visit soon, the Kremlin said on Tuesday, as the oil-producing countries Russia and Venezuela continue to maintain close ties in defiance of the Western powers. Maduro’s visit is in the works, with the dates currently being discussed, Vladimir Putin’s spokesman Dmitry Peskov told reporters in Moscow on Tuesday. “Yes, it [the visit] is being prepared,” Peskov said, as quoted by Russian news agency TASS. Russia and Venezuela are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuelas-Maduro-Set-to-Visit-Russia-Soon.html |

|

Brent Closes in on $90 as Geopolitical Risk ClimbsA combination of rising geopolitical risk and supply disruptions has pushed oil prices higher, with Brent looking increasingly likely to break the $90 mark.- Energy stocks have started to outperform the wider stock market as Brent is nearing 89 per barrel this week, with energy leading the S&P 500’s eleven market sectors in March thanks to a 10% rise.- The oil markets are anticipating the OPEC monitoring meeting on April 3, looking for potential clues on the directionality of pricing, with JPMorgan already predicting Brent to be in the… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Closes-in-on-90-as-Geopolitical-Risk-Climbs.html |

|

Shell Claims Court Ruling on Emissions Will Slow the Energy TransitionThe landmark ruling of a Dutch court that ordered Shell to slash its emissions could obstruct the role the supermajor can play in the energy transition and could slow the fight against climate change, Shell’s lawyers argued on Tuesday in the hearing of the company’s appeal against the ruling. Back in 2021, the District Court in The Hague ordered the oil supermajor to slash its carbon emissions by 45% by 2030 in a landmark ruling in a climate case brought by environmentalists that could set precedents for other oil companies.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Claims-Court-Ruling-on-Emissions-Will-Slow-the-Energy-Transition.html |

|

OPEC+ Panel Unlikely to Propose Policy Changes as Oil Prices Hit 2024 HighThe Joint Ministerial Monitoring Committee (JMMC) of OPEC+ is unlikely to propose any changes to oil production policy when it meets on April 3, numerous sources in the alliance have told Reuters. The JMMC, the panel that takes stock of oil market developments and proposes courses of action to the ministers of the OPEC+ group, is meeting on Wednesday, just as oil prices hit their highest level so far this year – and the highest in five months – amid renewed geopolitical tensions in the Middle East and signs of tightening oil supply.… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Panel-Unlikely-to-Propose-Policy-Changes-as-Oil-Prices-Hit-2024-High.html |

|

Ukrainian Drones Hit Russia’s Third-Largest Oil RefineryUkrainian drones hit the primary refining unit of Russia’s third-largest refinery southeast of Moscow more than 800 miles from the front line, Reuters reported on Tuesday. The Taneco refinery of Russian company Tatneft in Tatarstan, an industrialized region southeast of Moscow, was attacked by Ukrainian drones in the latest such attack from Ukraine on Russian refining infrastructure. The refinery has a capacity to process 340,000 barrels per day (bpd) of crude. Its primary refining unit, with a capacity to process about 155,000… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukrainian-Drones-Hit-Russias-Third-Largest-Oil-Refinery.html |

|

Russia’s Sokol Crude Starts to Move to India Again via TradersDespite stricter enforcement of the U.S. sanctions against Russian oil exports, some tankers loaded with Russia’s Sokol crude grade are near India signaling Indian ports as their destinations, vessel-tracking data compiled by Bloomberg showed on Tuesday. After more than a year of gorging on cheaper Russian crude, Indian refiners began to avoid Sokol shipments at the end of last year and avoid taking delivery of crude loaded on tankers of Russian state fleet owner Sovcomflot, following the ramp-up of U.S. sanctions on Russia.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Sokol-Crude-Starts-to-Move-to-India-Again-via-Traders.html |

|

Dow tumbles nearly 400 points, falling for a second day in rough start to new quarter: Live updatesThe Dow Jones Industrial Average fell for a second day, continuing Wall Street’s lackluster start to the quarter. Read more at: https://www.cnbc.com/2024/04/01/stock-market-today-live-updates.html |

|

Tesla shares fall after deliveries drop 8.5% from a year agoTesla just reported first-quarter vehicle production and deliveries for 2024. Read more at: https://www.cnbc.com/2024/04/02/tesla-tsla-q1-2024-vehicle-delivery-and-production-numbers.html |

|

Fed officials still expects rate cuts this year, but not anytime soonThe central bank official noted progress made on inflation while the economy has continued to grow. Read more at: https://www.cnbc.com/2024/04/02/feds-mester-still-expects-rate-cuts-this-year-but-rules-out-may.html |

|

Disney versus Nelson Peltz vote hinges on Vanguard, State Street, institutional investorsThe Disney proxy fight pits Trian Partners’ Nelson Peltz against the board and CEO Bob Iger. Read more at: https://www.cnbc.com/2024/04/02/disney-board-fight-hinges-on-vanguard-other-institutional-investors.html |

|

These stocks offer growth at a reasonable price as the second quarter kicks offGrowth at a reasonable price, or GARP, opportunities exist across a variety of stock groups, CNBC found. Read more at: https://www.cnbc.com/2024/04/02/these-stocks-offer-growth-at-a-reasonable-price-as-the-second-quarter-kicks-off.html |

|

U.S. crude oil cracks $85 to hit highest level since October as geopolitical tensions mountOil prices on Tuesday rose to their highest level since October as investors closely monitored fresh supply threats. Read more at: https://www.cnbc.com/2024/04/02/oil-prices-climb-to-five-month-high-on-escalating-middle-east-tensions.html |

|

Intel discloses financials for foundry businessIntel plans to spend $100 billion on building or expanding chip factories in four U.S. states. Read more at: https://www.cnbc.com/2024/04/02/intel-discloses-financials-for-foundry-business.html |

|

GM U.S. vehicle sales fall 1.5% during the first quarter, underperforming other major automakersThe Detroit automaker said the decline was largely due to a 22.9% year-over-year decline in sales to fleet customers. Read more at: https://www.cnbc.com/2024/04/02/gm-first-quarter-us-vehicle-sales.html |

|

Bitcoin slides 5% as Treasury yields spike to highest level since November: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Austin Alexander, co-founder of LayerTwo Labs, reacts to bitcoin’s declines and shares his outlook for the second quarter of 2024. Read more at: https://www.cnbc.com/video/2024/04/02/bitcoin-slides-5percent-as-treasury-yields-spike-to-highest-level-since-november-cnbc-crypto-world.html |

|

Private equity firm Silver Lake to take entertainment company Endeavor private at $27.50 a sharePrivate equity firm Silver Lake announced Tuesday that it’s acquiring entertainment company Endeavor Group Holdings for $27.50 a share. Read more at: https://www.cnbc.com/2024/04/02/private-equity-firm-silver-lake-to-take-entertainment-company-endeavor-private-at-27point50-a-share.html |

|

Here’s what upgrading to a nicer home could cost you, and why it’s locking up the marketThe average homeowner with a near record-low mortgage rate would see their monthly payment shoot up 132% in order to move up to a 25% more expensive home. Read more at: https://www.cnbc.com/2024/04/02/cost-of-upgrading-to-a-nicer-home-locking-up-the-housing-market.html |

|

Health insurer stocks slide as final Medicare Advantage rates disappointThe rate adds more pressure on insurers already grappling with high medical costs and uncertainty after the cyberattack on UnitedHealth Group’s tech unit. Read more at: https://www.cnbc.com/2024/04/02/health-insurer-stocks-slide-as-medicare-advantage-rates-disappoint.html |

|

30 Year Old Man Stabbed To Death On North Philadelphia Subway PlatformIt’s the latest in what can only be described as a disturbing string of violent attacks on and around Philadelphia-area SEPTA’s mass transit stops. On Monday morning this week a man was stabbed to death on the platform at North Philadelphia’s Somerset Station on the city’s Market-Frankford line, according to KYW Philadelphia. By the time police had responded to the call at the station on Kensington Avenue, the 30 year old suspect had suffered a stab wound to the chest. The victim died after being taken to the hospital, the report says. Transit police are looking for a suspect who “was last seen wearing a gray Nike hoodie and red gloves, and carrying a light blue backpack.”

Less than a week ago we wrote about a shooting at a bus stop in Northeast Philadelphia. The shooting t … Read more at: https://www.zerohedge.com/markets/30-year-old-man-stabbed-death-north-philadelphia-subway-platform |

|

RFK Jr. Says He Will Pardon Whistleblower Edward Snowden If Elected PresidentAuthored by Stephen Katte via The Epoch Times, Independent presidential candidate Robert F. Kennedy, Jr., claims he would pardon whistleblower Edward Snowden on his first day as president if elected and “investigate the corruption and crimes he exposed.”

Mr. Snowden is a former National Security Agency (NSA) contractor who leaked information about the agency’s widespread domestic surveillance operations during the Obama administration. He fled from the United States in 2013 amid possible espionage charges that could have seen him imprisoned for 30 years or more. According to an April 1 video statement from Mr. Kennedy, Mr. Snowden performed a “critical public service by revealing to Americans for the first time … Read more at: https://www.zerohedge.com/political/rfk-jr-says-he-will-pardon-whistleblower-edward-snowden-if-elected-president |

|

Hey NASA! ISS Space Junk May Have Ripped Through South Florida HomeIn early March, Jonathan McDowell of the Harvard–Smithsonian Center for Astrophysics posted on social media platform X that space junk from the International Space Station “reentered” the Earth’s atmosphere between “Cancun and Cuba.”

Days later, an X user named “Alejandro Otero” said some of that space junk “tore through the roof and went thru 2 floors” of his Naples, Florida home.

Read more at: https://www.zerohedge.com/technology/hey-nasa-iss-space-junk-may-have-ripped-through-south-florida-home |

|

Two Weeks To Flatten Became Eight Months To Change The ElectionVia The Brownstone Institute, In 1845, Congress established Election Day as the Tuesday after the first Monday of November. The Act sought “to establish a uniform time” for Americans to cast their ballots for president. Historically, voters needed to provide a valid reason – such as illness or military service – to qualify for absentee ballots. But Covid served as a pretext to overturn that tradition. Just 25% of votes in 2020 occurred at the polls on Election Day. Mail-in voting more than doubled. Key swing states eliminated the need to provide a valid reason to cast absentee ballots. The virus and racial justice became justifications to disregard verification methods like signature requirements. Rejection rates for absentee ballots plummeted by more than 80% in some states as the Covid regime welcomed an unprecedented increase in mail-in voting. Politicians and media outlets ignored rampant voter fraud in the months leading up to the election. They treated concerns surrounding absentee voting as obscure conspiracy theories despite a bipartisan commission describing it as “the largest source of potential voter fraud” just a decade earlier. It is now clear that the overhaul of our election system was a deliberate initiative from the outset of the pandemic response. In March 2020, when the Government’s official policy was still “two weeks to flatten the curve,” the administrative state began instituting the infrastructure to hij … Read more at: https://www.zerohedge.com/political/two-weeks-flatten-became-eight-months-change-election |

|

Taylor Swift joins world’s billionaire listThe singer is one of a record number of 2,781 billionaires with a collective wealth of $14.2 trillion. Read more at: https://www.bbc.co.uk/news/business-68711921 |

|

Tesla ‘disaster’ with fewest deliveries since 2022Elon Musk’s electric vehicle company is contending with major challenges, as rivals make gains. Read more at: https://www.bbc.co.uk/news/business-68715906 |

|

Falls in chocolate and jam prices slow food inflationStrong competition in March drove down some retail prices, but Easter treats were more expensive. Read more at: https://www.bbc.co.uk/news/business-68711912 |

|

Money-making Ideas: ICICI Bank, BoB among Axis Securities’ top largecap stock picks for AprilAxis Securities shares top largecap bets for April Read more at: https://economictimes.indiatimes.com/markets/stocks/news/money-making-ideas-icici-bank-bob-among-axis-securities-top-largecap-stock-picks-for-april/slideshow/108970955.cms |

|

These 5 midcaps with lower than industry P/E turn outperformers. Time to buy?These five BSE midcap stocks outperformed their specific industries Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-midcaps-with-lower-than-industry-p/e-turn-outperformers-time-to-buy/slideshow/108979758.cms |

|

Tech View: Nifty forms two successive Doji candles. What traders should do on WednesdayThe short-term trend of Nifty is positive. Though it is placed at the crucial overhead resistance around 22,500 levels, there is no confirmation of any reversal pattern unfolding at the highs. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-two-successive-doji-candles-what-traders-should-do-on-wednesday/articleshow/108976171.cms |

|

This is how the Port of Baltimore will bounce back after bridge collapseThe Port of Baltimore has enough “natural advantages” to help it recover after the collapse of the Francis Scott Key Bridge, according to former White House port envoy and Maryland transportation secretary John D. Porcari. Read more at: https://www.marketwatch.com/story/this-is-how-the-port-of-baltimore-will-bounce-back-after-bridge-collapse-6dbd208e?mod=mw_rss_topstories |

|

Banker sees healthy M&A, IPO deal pipeline as private-equity firms look to deploy cashCitizens Financial’s Don McCree says optimism has returned to the market as interest rates have stabilized. Read more at: https://www.marketwatch.com/story/banker-sees-healthy-m-a-ipo-deal-pipeline-as-private-equity-firms-look-to-deploy-cash-dddf9cae?mod=mw_rss_topstories |

|

Tax Day could put a strain on money markets. Here’s what Fed will be watching.Tax day later this month could put a strain on money markets. The Fed will be watching, a Wall Street analyst says. Read more at: https://www.marketwatch.com/story/april-tax-deadline-could-strain-u-s-banking-system-if-americans-owe-more-than-usual-f9b541b5?mod=mw_rss_topstories |