Summary Of the Markets Today:

- The Dow closed down 191 points or 0.49%,

- Nasdaq closed down 0.95%,

- S&P 500 closed down 0.65%,

- Gold $2,160 down $7.40,

- WTI crude oil settled at $81 down $0.25,

- 10-year U.S. Treasury 4.308% up 0.010 points,

- USD index $103.44 up $0.080,

- Bitcoin $68,630 down $1,080 (1.68%), – Historic high 73,798.25

- Baker Hughes Rig Count: U.S. +7 to 629 Canada -18 to 207

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production remained down 0.2% year-over-year in February 2024. Manufacturing subindex continued in negative territory at -0.4% year-over-year. Utilities subindex increased to 0.8% gain year-over-year, and the mining subindex declined but was still up 1.4% year-over-year. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average. Manufacturing remains in a recession in the USA.

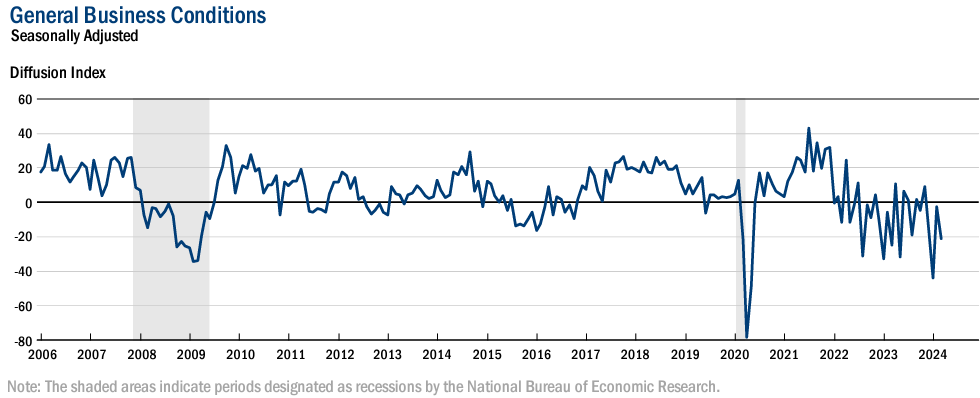

The New York Fed’s Empire State Manufacturing Survey for March 2024 showed the headline general business conditions index fell nineteen points to -20.9. Manufacturing remains in a recession in the USA.

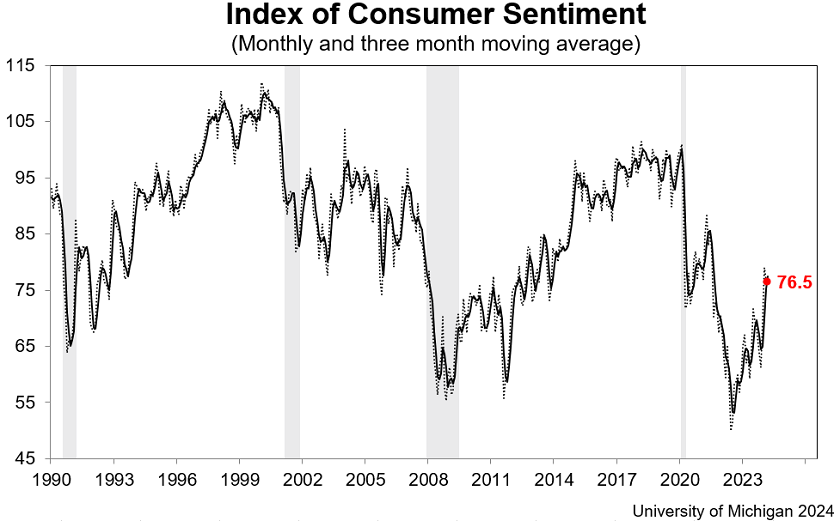

Michigan Consumer sentiment moved little this month with a 0.4 index point decrease that is well within the margin of error, and thus sentiment has been steady and essentially unchanged since January 2024. Sentiment remained almost 25% above November 2023 and is currently halfway between the historic low reached during the peak of inflation in June 2022 and pre-pandemic readings. Small improvements in personal finances were offset by modest declines in expectations for business conditions. After strong gains between November 2023 and January 2024, consumer views have stabilized into a holding pattern; consumers perceived few signals that the economy is currently improving or deteriorating. Indeed, many are withholding judgment about the trajectory of the economy, particularly in the long term, pending the results of this November’s election.

U.S. import prices declined 0.8% year-over-year in February 2024. Prices for U.S. exports declined 1.8% year-over-year.

Here is a summary of headlines we are reading today:

- Bloomberg Survey: Brent To Exceed $80 By Year’s End

- U.S. Oil, Gas Activity Picks Up But Slow Start to the Year

- Bitcoin’s Success May Be Its Downfall

- Court Halts New Mining Permits in Argentina’s Key Lithium Region

- EU Warns of Heightened Somali Piracy Threat to Shipping

- S&P 500 closes lower on inflation worries, notches second straight weekly loss: Live updates

- Bitcoin falls below $70,000 in overnight sell-off: CNBC Crypto World

- Alaska’s ice road oil truckers are in a boom, and causing a backlash

- Fisker Shares Surge On Talks With Large Automaker Following Bankruptcy Fears

- McDonald’s blames global outage on third party

- 10-year Treasury yield sees biggest weekly advance since October after hot U.S. data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Bloomberg Survey: Brent To Exceed $80 By Year’s EndThe Brent crude oil benchmark is set to exceed $80 per barrel by the end of this year, according to a new Bloomberg Intelligence oil price survey. The survey showed that the majority of respondents—53%–see Brent crude oil prices above $80 per barrel at the end of 2024. A much smaller percentage—5%–see crude oil prices exceeding $100 per barrel. The new Bloomberg Intelligence survey also showed that nearly a quarter of respondents see peak oil demand to hit prior to 2030—that’s down from 50% of those surveyed in 2022 who saw… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bloomberg-Survey-Brent-To-Exceed-80-By-Years-End.html |

|

Poland to Sink $16 Billion In Energy Grid to Handle RenewablesPoland is set to spend $16 billion on upgrading and expanding its power grid to accommodate additional renewable and nuclear capacity, the country’s power grid operator said on Friday. Grid operator PSE said that its draft investment plan includes more than 3,000 miles of 400 kV transmission lines in a push to hasten the transition of the country’s energy sources from coal to cleaner energy. In its current state, Poland’s grid is capable of accommodating the country’s energy usage through coal-fired power—the country’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Poland-to-Sink-16-Billion-In-Energy-Grid-to-Handle-Renewables.html |

|

U.S. Mills Hike Steel Prices to Halt Bearish TrendVia Metal Miner The Raw Steels Monthly Metals Index (MMI) moved sideways amid bearish steel prices, with a modest 1.75% increase from February to March. U.S. flat rolled steel prices stayed bearish over the past few weeks. Meanwhile, HRC prices remained 22% beneath their peak at the close of 2023 as they search for a new bottom. However, plate prices continued to diverge from flat rolled steel, remaining sideways. Prices appear to have found enough support to see at least a short-term pause in their slight downside bias since peaking in April 2022.… Read more at: https://oilprice.com/Metals/Commodities/US-Mills-Hike-Steel-Prices-to-Halt-Bearish-Trend.html |

|

U.S. Oil, Gas Activity Picks Up But Slow Start to the YearThe total number of active drilling rigs for oil and gas in the United States rose by 6 this week, according to new data that Baker Hughes published on Friday, bringing the total rigs gained this year to 7. The total rig count rose by 7 to 629 this week, compared to 754 rigs this same time last year. The number of oil rigs rose by 6 this week after falling by 2 in the week prior. Oil rigs now stand at 510–down by 79 compared to this time last year. The number of gas rigs rose this week by 1 to 116, a loss of 46 active gas rigs from this time last… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Activity-Picks-Up-But-Slow-Start-to-the-Year.html |

|

Ukrainian Drone Attacks Knock Down 370,500 Bpd of Russia’s Refining CapacityUkrainian drone attacks on Russian oil refineries have knocked down as much as 370,500 barrels per day (bpd) of Russia’s refining capacity so far into the first quarter of the year, or 7% of the total, according to Reuters calculations. Since the beginning of 2024, Ukraine has intensified attacks with drones on Russian refining and other energy infrastructure, including fuel depots and fuel export terminals. Attacks have also intensified this week, ahead of the Russian presidential election this weekend, in which Vladimir Putin… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukrainian-Drone-Attacks-Knock-Down-370500-Bpd-of-Russias-Refining-Capacity.html |

|

Bitcoin’s Success May Be Its DownfallBitcoin faces a “sell-side liquidity crisis” by September if institutional inflows continue, an industry analyst says. In a thread on X on March 12, Ki Young Ju, founder and CEO of on-chain analytics platform CryptoQuant, predicted a BTC supply watershed “within six months.” Ki: Bitcoin bears “can’t win” while ETF flows continue Bitcoin as an institutional investment allocation is only just getting started, industry participants have said, as United States-based spot Bitcoin exchange-traded funds (ETFs)… Read more at: https://oilprice.com/Finance/the-Economy/Bitcoins-Success-May-Be-Its-Downfall.html |

|

Court Halts New Mining Permits in Argentina’s Key Lithium RegionA local court in Argentina has suspended new lithium mining permits in the Catamarca province in the northwest, home to many lithium projects, due to environmental concerns, the court ruling seen by Reuters showed. The ruling affects the issuance of new mining permits for the key battery metal, but is not expected to impact current lithium production in Catamarca, industry sources told Reuters. The ruling was handed after an environmental complaint was filed in 2021 by a chief of the Atacameños Native Community, alleging that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Halts-New-Mining-Permits-in-Argentinas-Key-Lithium-Region.html |

|

U.S. Uranium Producers Reviving Abandoned Mines Amid Supply SqueezeAs the AI craze continues to hog the limelight, another asset class has been enjoying a similar boom, albeit under the radar. Over the past couple of years, uranium and shares in companies that mine it have gone on a tear amid a spike in demand and looming shortages. After being ostracized for decades as the black sheep of the alternative energy industry, nuclear energy is back in fashion as the global energy and climate crisis are forcing policymakers to return to the drawing board. Last year’s COP28 held in the United Arab Emirates… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/US-Uranium-Producers-Reviving-Abandoned-Mines-Amid-Supply-Squeeze.html |

|

Ukrainian Drones Attack Another Russian RefineryUkrainian drones attacked early on Friday a small privately-owned refinery 40 miles from Moscow’s outskirts, a source at the Ukrainian intelligence services told Reuters. The refinery in the Kaluga region, which has a capacity to process some 24,000 barrels per day (bpd) of crude, was damaged, according to a Reuters’ source. Ukraine’s military intelligence agency, HUR, carried out the attack, a source at the agency confirmed to the Kyiv Independent. The extent of damage is being verified. Four drones were shot down,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukrainian-Drones-Attack-Another-Russian-Refinery.html |

|

Bullish Sentiment Finally Breaks Out in Oil MarketsIt appears that bullish sentiment has finally broken out in oil markets, helped along by geopolitical uncertainty and an increasingly optimistic demand outlook.Friday, March 15th 2024Brent futures have broken through the $85 per barrel for the first time since November, indicating that the gradually improving sentiment, further buoyed by Ukrainian drone strikes on Russian refineries this week and declining US inventories, is here to stay. White House Signals Discontent with US Steel Takeover. The Biden administration is rumored to have expressed… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Finally-Breaks-Out-in-Oil-Markets.html |

|

EU Warns of Heightened Somali Piracy Threat to ShippingCommercial vessels face increased threats from Somali pirates off the coast of the East African country, the European Union’s Naval Force in the region said in an update. “Ships sailing off the Somalian coasts, in the Somali basin are urged to maintain a heightened state of vigilance in light of the recent escalation in piracy threats,” the EU naval force said, noting a recent upsurge in reported incidents. The end of the monsoon period is expected to further facilitate piracy activities in the region, said the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Warns-of-Heightened-Somali-Piracy-Threat-to-Shipping.html |

|

The Hunt for White Hydrogen Has Begun1. US Natural Gas Production Is Suffering but Hopes for a Swift Rebound in 2025 – Cash prices of Henry Hub plunged to their lowest since the early 1990s as mild weather and high gas inventory levels sent the US benchmark spiraling down, with next-day prices moving around $1.24-1.25 per mmBtu this week. – With the prompt physical market also seeing deviations such as Waha spot prices trading negative again, futures prices saw only a minor downside and rebounded later in the week to $1.75 per mmBtu. – A number of gas producers is increasing their… Read more at: https://oilprice.com/Energy/Energy-General/The-Hunt-for-White-Hydrogen-Has-Begun.html |

|

Bullish Sentiment Builds After the IEA Boosts Demand OutlookIEA’s Influence on Oil Demand and Price Trends The International Energy Agency (IEA) is playing a pivotal role in shaping the bullish sentiment in the May West Texas Intermediate (WTI) crude oil market. Thursday’s upward revision for 2024 oil demand growth, marking the fourth adjustment since November, forecasts a tighter market with a demand rise of 1.3 million barrels per day. This revised outlook, coupled with the impact of Houthi attacks disrupting Red Sea shipping, underscores the IEA’s significant sway on market trends. U.S. Demand… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Builds-After-the-IEA-Boosts-Demand-Outlook.html |

|

Venezuela Braces for the Return of U.S. SanctionsPolitics, Geopolitics & Conflict Offshore Yemen, in the Red Sea shipping lane, it was status quo this week, with the Houthis launching a close-range ballistic missile targeting the USS Laboon, but missing the mark, while U.S. and allied forces continued to strike Houthi targets. At the same time, reports emerged of backdoor talks between Washington and Tehran, during which the former appealed to the latter to step in and convince the Houthis to cease and desist. Maduro is in trouble, and waiting to see if the U.S. will renew full-on oil and… Read more at: https://oilprice.com/Energy/Energy-General/Venezuela-Braces-for-the-Return-of-US-Sanctions.html |

|

Is It Time To Give Tesla Another Chance?Back in the middle of January, I wrote a piece here explaining why after years of maintaining a base position in TSLA off of which I had traded, often quite profitably, I was selling my entire holding and getting out. In that article, I laid out the two main reasons for that decision. First, the business climate had not turned out as many expected, with subsidized overseas competition in the EV space developing quickly, forcing Tesla to cut their previously enviable margins. Then there was the “Musk factor”. Elon had been talking about… Read more at: https://oilprice.com/Energy/Energy-General/Is-It-Time-To-Give-Tesla-Another-Chance.html |

|

S&P 500 closes lower on inflation worries, notches second straight weekly loss: Live updatesThe S&P 500 was lower on Friday as investors tried to wrap up a volatile week after a string of fresh inflation data. Read more at: https://www.cnbc.com/2024/03/14/stock-market-today-live-updates.html |

|

CEO of Hapag-Lloyd, one of world’s top ocean shippers, says the outlook has changed for the global economyRolf Habben Jansen, CEO of Hapag-Lloyd, says the latest read on demand shows that inventories are depleted and the second half of 2024 should see a bump. Read more at: https://www.cnbc.com/2024/03/15/ceo-of-top-ocean-freight-carrier-hapag-lloyd-on-global-economy-demand.html |

|

Home buyers and sellers to be spared automatic broker commissions under $418 million settlementConsumer advocates say the National Association of Realtors’ legal agreement, if approved, could save buyers and sellers thousands of dollars and lead many buyers to forgo agents entirely. Read more at: https://www.cnbc.com/2024/03/15/home-buyers-and-sellers-to-be-spared-automatic-broker-commissions-under-418-million-settlement.html |

|

Trump Georgia election special prosecutor quits, salvaging case after judge’s orderThe news followed bombshell revelations that DA Fani Willis and prosecutor Nathan Wade were engaged in a romantic relationship. Read more at: https://www.cnbc.com/2024/03/15/trump-georgia-election-case-can-proceed-if-da-or-prosecutor-removes-themselves.html |

|

This utility stock is the standout of its sector and it’s raising its dividend. Here’s what Wall Street says is nextA rosy 2024 outlook, a dividend boost and an additional buyback have helped lift this stock more than 40% this year. Read more at: https://www.cnbc.com/2024/03/15/this-utility-stock-is-the-standout-of-its-sector-and-its-raising-its-dividend.html |

|

Bitcoin falls below $70,000 in overnight sell-off: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Thomas Perfumo, Kraken’s head of strategy, weighs in on what’s behind bitcoin’s moves lower after hitting new records over the past two weeks. Read more at: https://www.cnbc.com/video/2024/03/15/bitcoin-falls-below-70000-overnight-sell-off-cnbc-crypto-world.html |

|

McDonald’s suffers global tech outage forcing some restaurants to halt operationsMcDonald’s suffered a system failure on Friday that left many customers in many parts of the world unable to order food. Read more at: https://www.cnbc.com/2024/03/15/mcdonalds-suffers-global-tech-outage-forcing-some-restaurants-to-halt-operations.html |

|

Sam Bankman-Fried deserves 40-50 years in prison for FTX fraud, prosecutors saySam Bankman-Fried should spend between 40 and 50 years in prison after being convicted for stealing $8 billion from customers of his now-bankrupt FTX cryptocurrency exchange, prosecutors said on Friday. Read more at: https://www.cnbc.com/2024/03/15/sam-bankman-fried-deserves-40-50-years-in-prison-for-ftx-fraud-prosecutors-say.html |

|

White House targets ‘junk fees’ on student loans and other higher education costsThe White House touted its actions to reduce the expenses burdening students, including moving to end origination fees on student loans. Read more at: https://www.cnbc.com/2024/03/15/white-house-plans-to-slash-junk-fees-on-student-loans.html |

|

Biden’s ‘billionaire tax’ takes aim at the super-rich — but can a wealth tax work in reality?Calls for a wealth tax on the world’s super-rich are once again gaining attention after U.S. President Joe Biden said he would impose a new “billionaire tax.” Read more at: https://www.cnbc.com/2024/03/15/bidens-billionaire-tax-hits-the-super-rich-can-a-wealth-tax-work.html |

|

Alaska’s ice road oil truckers are in a boom, and causing a backlashThere is no sign of the massive freight trucking recession in Alaska, where a boom in new energy projects is leading trucker pay well into six figures. Read more at: https://www.cnbc.com/2024/03/15/alaskas-ice-road-oil-truckers-are-in-a-boom-and-causing-a-backlash.html |

|

Tesla to pay $42 million for employee crash that injured motorcyclistTesla and an employee were found partially liable for a 2017 crash involving a company-owned truck, which led to a motorcyclist’s traumatic brain injury. Read more at: https://www.cnbc.com/2024/03/15/tesla-to-pay-42-million-for-employee-crash-that-injured-motorcyclist.html |

|

Fisker Shares Surge On Talks With Large Automaker Following Bankruptcy FearsTroubled EV maker Fisker saw its shares in New York implode on Thursday after The Wall Street Journal reported it had hired restructuring advisors to assist with a possible bankruptcy filing. Late Thursday, Fisker executives said in a statement that the company does not generally comment on “market rumors and speculation.” However, they noted that the company “often” works with third-party advisers to manage the business and assist in developing and executing strategies.

“Fisker is focused on raising additional capital and engaging in a strategic partnership with a large automaker,” the EV maker said. Fisker shares were halved on Thursday after the WSJ report. In a roller coaster move, shares jumped 31% in premarket trading on news of potential strategic partnerships. Read more at: https://www.zerohedge.com/markets/fisker-shares-surge-talks-large-automaker-following-bankruptcy-fears |

|

‘Affirmation At All Costs’: What Internal Files Reveal About Transgender CareAuthored by Jennifer Galardi via The Epoch Times (emphasis ours), The battle over transgender care continues as a new report published by Environmental Progress (EP) highlights the potential dangers of “gender-affirming” medical care, based on internal files from the World Professional Association for Transgender Health (WPATH).

Read more at: https://www.zerohedge.com/medical/affirmation-all-costs-what-internal-files-reveal-about-transgender-care |

|

Copper Soars, Iron Ore Tumbles As Goldman Says “Copper’s Time Is Now”After languishing for the past two years in a tight range despite recurring speculation about declining global supply, copper has finally broken out, surging to the highest price in the past year, just shy of $9,000 a ton as supply cuts hit the market; At the same time the price of the world’s “other” most important mined commodity has diverged, as iron ore has tumbled amid growing demand headwinds out of China’s comatose housing sector where not even ghost cities are being built any more.

Copper surged almost 5% this week, ending a months-long spell of inertia, as investors focused on risks to supply at various global mines and smelters. As Bloomberg adds, traders also warmed to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables. Yet the commodity crash of recent years is hardly over, as signs of the headwinds in traditional industrial sectors are still all too obvious in the iron ore market, where f … Read more at: https://www.zerohedge.com/markets/copper-soars-iron-ore-tumbles-goldman-says-coppers-time-now |

|

Consequences Minus TruthAuthored by James Howard Kunstler via Kunstler.com,

The rewards of civilization have come to seem rather trashy in these bleak days of late empire; so, why even bother pretending to be civilized? This appears to be the ethos driving our politics and culture now. But driving us where? Why, to a spectacular sort of crack-up, and at warp speed, compared to the more leisurely breakdown of past societies that arrived at a similar inflection point where Murphy’s Law replaced the rule of law.

The US Military Academy at West point decided to “upgrade” its mission statement this week by deleting the phrase Duty, Honor, Country that summarized its essential moral orientation. They replaced it with an oblique reference to “Army Values,” without spelling out what these values are, exactly, wh … Read more at: https://www.zerohedge.com/political/consequences-minus-truth |

|

McDonald’s blames global outage on third partyCompany says the worldwide issue happened during a ‘configuration change’ but was not cyber-related. Read more at: https://www.bbc.co.uk/news/business-68573106 |

|

Boeing tells pilots to check seats after plane dropsIt comes during an ongoing investigation into how a Latam flight suddenly dropped injuring 50 people. Read more at: https://www.bbc.co.uk/news/business-68580950 |

|

Norfolk County Council beats Apple in iPhone rowThe local authority – and others – had accused the tech giant of misleading shareholders. Read more at: https://www.bbc.co.uk/news/technology-68580235 |

|

Tech View: Nifty momentum indicators blink red. What traders should do next weekThe short-term and the near-term trends of Nifty remain weak. A decisive move below 21,900 could open sharp weakness down to the next lower support of 21,500 levels in the near term. Immediate resistance is at 22,200 levels, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-momentum-indicators-blink-red-what-traders-should-do-next-week/articleshow/108526879.cms |

|

MFs cut holdings in 14 PSU stocks in February; seven of them see double-digit fallSome public sector stocks faced corrections in mutual fund holdings, impacting companies like Indian Railway Finance Corporation and SJVN. Analysts caution against herd mentality, emphasizing valuation metrics over sector trends. However, defense and banking sectors show potential for growth. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mfs-cut-holdings-in-14-psu-stocks-in-february-seven-of-them-see-double-digit-fall/articleshow/108513026.cms |

|

Mahadev betting app scam: 19 smallcap stocks crash up to 37% this monthSmallcap investors suffered losses due to the Mahadev Online Book scam involving entities like Hari Shankar Tibrewala. Several listed stocks linked to the scam saw significant value depreciation, causing panic in the stock market. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mahadev-betting-app-scam-19-smallcap-stocks-crash-up-to-37-this-month/articleshow/108512593.cms |

|

10-year Treasury yield sees biggest weekly advance since October after hot U.S. dataTreasury yields finished mostly higher on Friday, handing the 10-year rate its biggest weekly advance in almost five months. Read more at: https://www.marketwatch.com/story/bond-yields-steady-after-big-surge-following-ppi-0868d653?mod=mw_rss_topstories |

|

Why Bank of Japan may shake up financial markets before Fed’s next interest-rate decisionJapan — the world’s last bastion of negative interest rates — appears ready to tighten its monetary policy next Tuesday, raising the potential for a mild to more forceful reaction in financial markets a day ahead of the Federal Reserve’s own policy update. Read more at: https://www.marketwatch.com/story/why-bank-of-japan-may-shake-up-financial-markets-before-feds-next-interest-rate-decision-8247370f?mod=mw_rss_topstories |

|

TikTok is teaching young people about money — for better or worse. A ban could bring that to an end.From loud budgeting to girl math, TikTok has spurred discussion of finances. Now what? Read more at: https://www.marketwatch.com/story/tiktok-is-teaching-young-people-about-money-for-better-or-worse-a-ban-could-bring-that-to-an-end-614866a2?mod=mw_rss_topstories |

An activist on behalf of transgenderism holds up a flag at an event in Atlanta, Ga., on Oct. 12, 2019. (AP Photo/Robin Rayne, file)Michael Shellenberger, independent journalist and founder of EP, posted on X that WPATH’s internal files “reveal that its members know they are creating victims and …

An activist on behalf of transgenderism holds up a flag at an event in Atlanta, Ga., on Oct. 12, 2019. (AP Photo/Robin Rayne, file)Michael Shellenberger, independent journalist and founder of EP, posted on X that WPATH’s internal files “reveal that its members know they are creating victims and …