Summary Of the Markets Today:

- The Dow closed down 69 points or 0.18%,

- Nasdaq closed down 1.16%,

- S&P 500 closed down 0.65%,

- Gold $2,185 up $19.70,

- WTI crude oil settled at $78 down $1.05,

- 10-year U.S. Treasury 4.079% down 0.013 points,

- USD index $102.74 down $0.080,

- Bitcoin $69,225 up $1,822 (2.69%), New Historic high 70,136.33

- Baker Hughes Rig Count: U.S. -7 to 622 Canada -6 to 225

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

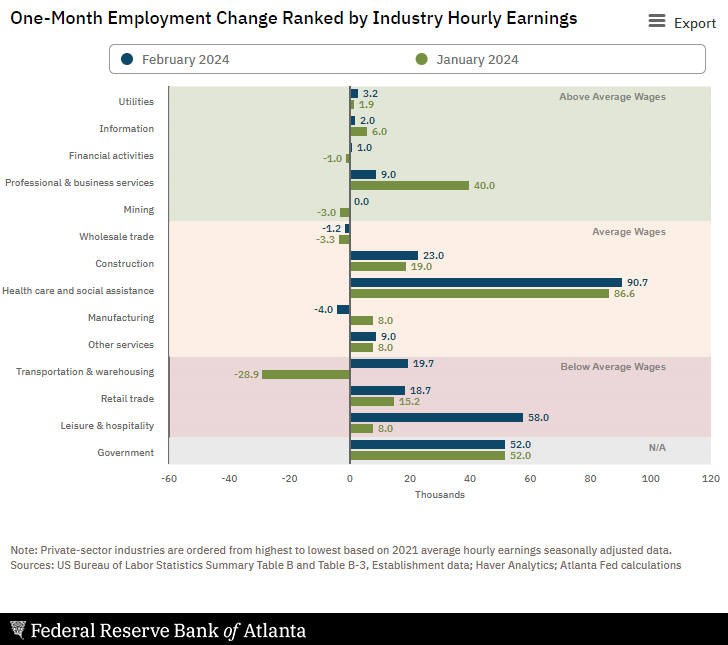

Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Significant job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing. Note that the aggregate weekly hours worked is only 1% higher than one year ago while non-farm total employment is up 1.8%. There is a huge discrepancy between the household survey (which shows employment dropped by 184,000) whilst the establishment survey (which showed the headlines’s 275,000 employment gain). The household survey is used to determine the unemployment rate, so the result of a drop in the employment level combined with the 150,000 gain in the workforce is the reason for the rise in the unemployment rate. Yah just cannot look to closely at the employment report because the disconnects will drive you crazy. Overall, the trend of smaller employment gains every month remains in play.

Here is a summary of headlines we are reading today:

- Iran’s Revolutionary Guards Capture Oil Tanker Amid Sanctions Dispute

- U.S. Oil, Gas Drilling Activity Dips

- State Utility Expects China’s Coal Imports to Stay Flat This Year

- Oil Prices Remain Rangebound Despite Extension of OPEC+ Cuts

- Nasdaq drops 1% Friday as Nvidia tumbles, Dow closes out worst week since October: Live updates

- TikTok takes center stage in 2024 elections as candidates try to ban app while some are using it

- Nvidia is one of the most overbought stocks on Wall Street after this week’s massive rally

- Bitcoin briefly rises above $70,000 to another new all-time high: CNBC Crypto World

- What Dollarization Says About Returning To The Gold Standard

- US jobless rate hits highest in two years

- Oil prices end lower after U.S. jobs report, posting a loss for the week

- Bitcoin bulls eye $100,000 as the next level before its halving. Here’s what’s driving the crypto’s rally.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iran’s Revolutionary Guards Capture Oil Tanker Amid Sanctions DisputeWhen Iran seized a Marshall Islands-flagged oil tanker last year, Tehran said the transporter had collided with and damaged an Iranian vessel in the Gulf of Oman. Now, nearly one year later, Tehran said it will confiscate the cargo of the Advantage Sweet, which was transporting oil from Kuwait to the U.S. state of Texas, in retaliation for crippling American sanctions against the Islamic republic.The Mizan news agency, which is affiliated with Iran’s judiciary, reported on March 6 that a Tehran court had ruled in favor of confiscating the oil,… Read more at: https://oilprice.com/Energy/Crude-Oil/Irans-Revolutionary-Guards-Capture-Oil-Tanker-Amid-Sanctions-Dispute.html |

|

Germany Still Hasn’t Ruled Out Expropriation of Rosneft’s AssetsGermany could still expropriate Rosneft’s German assets, the country’s economy ministry said on Friday, in a warning to the Russian oil giant to propose potential buyers of its assets. Germany extended its trusteeship over Rosneft’s assets in Germany for the third time earlier this week, but new signs that Rosneft could be open to finding a buyer for its assets in Germany stopped the Energy Ministry from moving to expropriate the assets. Germany said it would need to approve possible buyers to ensure they conform to the Foreign… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Still-Hasnt-Ruled-Out-Expropriation-of-Rosnefts-Assets.html |

|

Guinea Greenlights Major Iron Ore Project with Global GiantsVia Metal Miner The West African state of Guinea recently approved a joint development deal between the government, Rio Tinto/Simfer, and the Winning Consortium Simandou (WCS) consortia to develop the Simandou iron ore mining project. The National Transition Council (NTC), Guinea’s legislative body under the interim regime, announced the deal’s approval on February 3. “In short, this agreement provides for…the construction of railway and port infrastructure, no later than December 31, 2025 and the start of iron ore production… Read more at: https://oilprice.com/Metals/Commodities/Guinea-Greenlights-Major-Iron-Ore-Project-with-Global-Giants.html |

|

U.S. Oil, Gas Drilling Activity DipsThe total number of active drilling rigs for oil and gas in the United States fell this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 7 to 622 this week, compared to 746 rigs this same time last year. The number of oil rigs fell by 2 this week after rising by 3 in the week prior. Oil rigs now stand at 504–down by 86 compared to this time last year. The number of gas rigs fell again this week by 4 to 115, a loss of 38 active gas rigs from this time last year. Miscellaneous rigs fell by 1 to a total… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drilling-Activity-Dips.html |

|

Petrobras Skimps on Dividend, Market Value Plummets By $14 BillionBrazil’s state-run oil company, Petrobras, saw its shares crash on Friday after it skimped on its dividend, with the ramifications spilling beyond Petrobras and into the wider Brazilian stock market. Petrobras’ market value tumbled on Friday by $14 billion after the company’s fourth-quarter results—published on Thursday—disappointed investors with a reduced dividend. Investors and analysts had expected an extraordinary dividend between $3 and $4 billion for the quarter, on top of the $2.9 billion regular dividend.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Skimps-on-Dividend-Market-Value-Plummets-By-14-Billion.html |

|

Saudi Arabia and UAE Look To Extract Lithium from Oilfield BrineSaudi Aramco and Abu Dhabi National Oil Company (ADNOC), the state oil giants of two of OPEC’s top producers, are in very early stages of working to extract lithium from the brine in their huge oilfields in the Middle East, Reuters reported on Friday, citing three anonymous sources with knowledge of the plans. The two major Gulf oil producers have been seeking to diversify their revenues streams and tap other profitable operations apart from oil, to fund their massive state programs and, in Saudi Arabia’s case, the Vision… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-and-UAE-Look-To-Extract-Lithium-from-Oilfield-Brine.html |

|

Norway’s Energy Major Equinor Starts Up Solar Plant in BrazilEquinor has put into operation a 531-megawatt solar plant in Brazil, which boosts its power production in the South American country by 30%, the Norwegian major said on Friday. The 531-MW Mendubim solar plant will produce 1.2 terawatts per hour (TWh) of power annually, of which some 60% will be sold on a 20-year US-dollar-denominated power purchase agreement (PPA) with Alunorte, one of the world’s leading suppliers of alumina for the aluminum industry. The remaining power production from Mendubim will be sold in the power market… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Energy-Major-Equinor-Starts-Up-Solar-Plant-in-Brazil.html |

|

BP Awards New Chief £8 Million After Stellar 2023 PerformanceThe head of UK supermajor BP paid chief executive Murray Auchincloss £8m for 2023 on the back of a better-than-expected year. Figures published by the oil supermajor today showed Auchincloss’s base pay for the year was £1.6m with a variable performance-based top-up of £6.5m. Auchincloss served as the firm’s chief financial officer for the majority of 2023. He took over as the interim chief of the company between September 2023 and January of this year after former head Bernard Looney’s departure. Auchincloss… Read more at: https://oilprice.com/Energy/Energy-General/BP-Awards-New-Chief-8-Million-After-Stellar-2023-Performance.html |

|

State Utility Expects China’s Coal Imports to Stay Flat This YearChinese coal imports this year are expected at around the record levels of 2023, according to an executive at China’s state-run utility Guangdong Energy Group. China’s coal imports jumped last year by 62% to a record high of 474.42 million metric tons, driven by high demand, lower-quality domestic coal, and higher domestic prices. This year, imports are expected to be between 450 million and 500 million metric tons this year, Reuters quoted Wu Wenbin, head of coal management at Guangdong Energy Group, as saying… Read more at: https://oilprice.com/Latest-Energy-News/World-News/State-Utility-Expects-Chinas-Coal-Imports-to-Stay-Flat-This-Year.html |

|

Oil Prices Remain Rangebound Despite Extension of OPEC+ CutsOil prices have remained largely rangebound over the last month as bullish and bearish factors continue to counterbalance each other. Friday, March 8th 2024The flatlining of oil prices continued this week despite positive trade data coming out of China and impressive Indian oil demand, with a continued build-up in US crude inventories and skepticism vis-à-vis OPEC+’s extended voluntary cuts offsetting that positive momentum. The last time ICE Brent futures settled outside of the $80-85 per barrel bandwidth was on February… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Rangebound-Despite-OPEC-Cuts.html |

|

Biden’s Pause on New LNG Export Permits Could Last for MonthsThe U.S. Administration’s pause on approvals of new LNG export projects could last for several months until the U.S. Department of Energy reviews the grounds for authorizations, a DOE official told Bloomberg in an interview on Friday. At the end of January, the Biden Administration said it was pausing all pending decisions on U.S. LNG export projects until the Department of Energy can update the underlying analyses for authorizations. During the temporary pause – which is expected to affect four planned LNG export projects… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bidens-Pause-on-New-LNG-Export-Permits-Could-Last-for-Months.html |

|

Iran’s Oil Production Rises Despite Sanctions1. Guyana Takes Over European Oil Markets – Guyanese crude exports to Europe hit an all-time high in February, moving to 432,000 b/d, as the continent’s buyers mopped up additional barrels coming from the recently launched Payara Gold stream. – With the increasing flow of Guyanese cargoes, Europe’s own medium sour grade Johan Sverdrup, the largest producing field across the continent, has seen an unprecedented decline in its prices. – Sverdrup differentials soared to multi-dollar premiums at the end of last year as Red Sea disruptions… Read more at: https://oilprice.com/Energy/Energy-General/Irans-Oil-Production-Rises-Despite-Sanctions.html |

|

The U.S. Is Ready to Reimpose Sanctions on VenezuelaVenezuela has announced an election date – July 28 – and Maduro is the only candidate, with a return of U.S. sanctions at stake. Maduro banned the only opposition candidate, Maria Corina Machado, from running in what the opposition says are politically motivated allegations of financial misconduct. Washington has so far resisted a reinstatement of sanctions, even as Maduro has attempted to create an international incident by declaring the takeover of Guyana’s oil-rich Essequibo region, and even after banning the opposition in contravention… Read more at: https://oilprice.com/Energy/Energy-General/The-US-Is-Ready-to-Reimpose-Sanctions-on-Venezuela.html |

|

Israel Expects to Remain in Gaza for 10 YearsPolitics, Geopolitics & Conflict Lithuanian intelligence summarized by the Institute for the Study of War assessed that Russia is capable of maintaining its current momentum in the near term and is unlikely to give up on any of its objectives. With elections looming on March 24, a Putin victory will be his final vote for the legitimacy of the war on Ukraine, and once he has secured the presidency, he may proceed with unpopular decisions that he can’t afford during campaign time (such as mobilization). Additionally, Lithuanian intelligence… Read more at: https://oilprice.com/Energy/Energy-General/Israel-Expects-to-Remain-in-Gaza-for-10-Years.html |

|

OPEC+ Boosts Oil Prices But Downside Risk RemansApril West Texas Intermediate (WTI) crude oil futures have seen varied movements in the past week, influenced by a range of global factors. The interplay of U.S. crude inventories, OPEC+ production decisions, fluctuating demand from China, Middle East tensions, the U.S. dollar’s value, and anticipations of the Federal Reserve’s policy have all played roles in shaping crude oil prices. OPEC+ Production Strategy OPEC+, with Saudi Arabia and Russia at the forefront, has extended its voluntary oil output reduction of 2.2 million barrels per day into… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Boosts-Oil-Prices-But-Downside-Risk-Remans.html |

|

Nasdaq drops 1% Friday as Nvidia tumbles, Dow closes out worst week since October: Live updatesStocks gyrated as Nvidia moved into the red. Read more at: https://www.cnbc.com/2024/03/07/stock-market-today-live-updates.html |

|

Here’s where the jobs are for February 2024 — in one chartJob growth rose by 275,000 in February, a concurrent uptick in the unemployment rate indicated potential signs of cooling. Read more at: https://www.cnbc.com/2024/03/08/heres-where-the-jobs-are-for-february-2024-in-one-chart.html |

|

TikTok takes center stage in 2024 elections as candidates try to ban app while some are using itPresident Joe Biden’s election campaign is active on TikTok at the same time lawmakers are urging ByteDance to divest the app or to ban it. Read more at: https://www.cnbc.com/2024/03/08/ahead-of-elections-candidates-debate-whether-to-ban-tiktok-or-use-it.html |

|

Microsoft begins blocking some terms that caused its AI tool to create violent, sexual imagesMicrosoft has made changes to its AI guardrails after a staff AI engineer wrote to the FTC of his concerns about Copilot’s image generation. Read more at: https://www.cnbc.com/2024/03/08/microsoft-blocking-terms-that-cause-its-ai-to-create-violent-images.html |

|

Nvidia is one of the most overbought stocks on Wall Street after this week’s massive rallyNvidia shares may be due for a pullback after another red hot start to the year, according to this closely watched indicator. Read more at: https://www.cnbc.com/2024/03/08/nvidia-is-one-of-the-most-overbought-stocks-on-wall-street-after-this-weeks-massive-rally.html |

|

Novo Nordisk’s Wegovy wins FDA approval for cutting heart disease risks, in move that could expand insurance coverageThat decision could widen insurance coverage for the drug and similar treatments for obesity, which has been a major barrier to access for patients. Read more at: https://www.cnbc.com/2024/03/08/novo-nordisks-wegovy-wins-fda-approval-for-heart-health-benefits-in-move-that-could-expand-insurance-coverage.html |

|

Family offices have tripled since 2019, creating a new gold rush on Wall StreetExperts say family offices now manage $6 trillion or more, and their ranks are growing. Read more at: https://www.cnbc.com/2024/03/08/family-offices-tripled-creating-a-new-gold-rush-on-wall-street.html |

|

Bitcoin briefly rises above $70,000 to another new all-time high: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bobby Zagotta, U.S. CEO and Chief Commercial Officer at Bitstamp, provides his outlook for crypto investors as bitcoin reaches fresh records. Read more at: https://www.cnbc.com/video/2024/03/08/bitcoin-briefly-rises-above-70000-to-another-new-all-time-high-cnbc-crypto-world.html |

|

Google fires employee who protested Israel tech event, as internal dissent mountsGoogle fired an employee who protested this week at an Israeli tech event, and also shuttered an internal discussion board that filled up with dissent. Read more at: https://www.cnbc.com/2024/03/08/google-fires-employee-who-protested-israel-tech-event-shuts-forum.html |

|

Novo Nordisk CEO says experimental weight loss pill could become a best-in-class drugLars Fruergaard Jørgensen’s remarks came one day after Novo Nordisk impressed investors with early-stage trial data on amycretin. Read more at: https://www.cnbc.com/2024/03/08/novo-nordisk-ceo-weight-loss-pill-could-become-a-best-in-class-drug.html |

|

Biden vows to protect Social Security, Medicare and ‘make the wealthy pay their fair share,’ in State of the UnionDuring the State of the Union on Thursday, President Joe Biden said he opposes Social Security and Medicare benefit cuts, as well as raising the retirement age. Read more at: https://www.cnbc.com/2024/03/08/state-of-the-union-biden-says-wealthy-should-pay-fair-share-to-social-security.html |

|

Trump posts $91.6 million bond as he appeals E. Jean Carroll defamation verdictThe appeal came days before Trump faced a deadline to pay $83.3 million in damages to writer E. Jean Carroll for defaming her. Read more at: https://www.cnbc.com/2024/03/08/trump-posts-91point6-million-bond-appeals-e-jean-carroll-verdict.html |

|

Oil prices post weekly loss as China demand weighs on marketTraders on Friday studied February nonfarm payrolls data to assess where interest rates — and oil demand — may go. Read more at: https://www.cnbc.com/2024/03/08/crude-oil-prices-today.html |

|

Millennials Have To Work Twice As Much As Boomers Did To Pay Off College, But There’s A Catch…Authored by Sam Bourgi via CrediTnews.com, Most Americans intuitively know that higher education has become disproportionately expensive for younger generations—thanks to millions of graduates trapped in student debt.

But are education costs really so out of reach for younger generations, considering new career opportunities and wage inflation? Creditnews Research put that theory to the test by comparing the college tuition costs of Baby Boomers and Millennials against what both generations earned after graduation. Our analysis revealed a stark difference in the “purchasing power” of a college degree in the 1980s and today, driven by the growing disparity between tuition costs and wages. Even though Baby Boomers had it much easier back in the day, student debt is c … Read more at: https://www.zerohedge.com/personal-finance/millennials-have-work-twice-much-boomers-did-pay-college-theres-catch |

|

What Dollarization Says About Returning To The Gold StandardVia SchiffGold.com, Everyone’s heard of Javier Milei, the new president of Argentina, called by Fox News the world’s first libertarian president. He has been in the news for his denunciation of leftism, Marxism, and the sprawling bureaucracy that has trapped Argentina in debt. He’s also taken aim at run-away inflation in Argentina. Inflation in the last year was over 200% in Argentina, a rate that the United States hasn’t reached, even with Biden-levels of inflation. But what might surprise some, given Milei’s libertarian leanings, is that he promised to get his country to use the American dollar. Why and what does it say about the future of fiat currency? Read more at: https://www.zerohedge.com/markets/what-dollarization-says-about-returning-gold-standard |

|

US Embassy In Russia Issues Curiously Timed Alert Over ‘Extremist Attacks’The US embassy in Russia has issued an unusual and somewhat mysterious warning over violent plots by ‘extremists’ that will potentially target gatherings of people in Moscow. “The Embassy is monitoring reports that extremists have imminent plans to target large gatherings in Moscow, to include concerts, and U.S. citizens should be advised to avoid large gatherings over the next 48 hours,” the U.S. embassy said in a Thursday alert.

Via Fox News The alert offered no further details or speculation as to the expected nature of the attack or who could be behind such plotting. The embassy further advised Americans to “be aware of your surroundings” and monitor local media. Very soon after Russia’s invasion of Ukraine over two years ago, the State Department warned all Americans to exit Russia, given they could … Read more at: https://www.zerohedge.com/geopolitical/us-embassy-russia-issues-curiously-timed-alert-over-extremist-attacks |

|

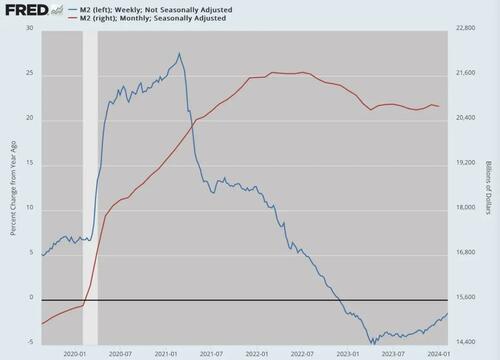

The Financial Crisis BeginsAuthored by Jeffrey Tucker via The Epoch Times, By some miracle – actually, by the printing of $5.4 trillion that has shown itself in persistent inflation – the United States has so far avoided a financial crisis. That’s the one sector that so far the establishment has been able to protect from disaster.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker) How long can this be forestalled? Read more at: https://www.zerohedge.com/markets/financial-crisis-begins |

|

TV star shaken after Jaguar brakes fail during driveCraig Phillips describes “terrifying feeling” when brakes failed on his Jaguar I-Pace Read more at: https://www.bbc.co.uk/news/technology-68514718 |

|

HelloFresh shares plunge 40% after earnings warningThe meal-maker says it has changed its earnings forecast due to a “different operating environment”. Read more at: https://www.bbc.com/news/articles/cgevn1kkjwzo |

|

US jobless rate hits highest in two yearsThe US also recorded solid hiring in an “all over the place” Labor Department report. Read more at: https://www.bbc.co.uk/news/business-68514528 |

|

Smart Talk: FY25 Strategy! Deploy 80% of equity allocation through weekly STP over next 8-10 weeks: Kshitiz Mahajan“Fixed income is expected to yield capital gains from rate cuts over the next 1-1.5 years, potentially offering double-digit pre-tax returns. Parking debt allocations in gilt/debt funds with a modified duration exceeding 7 years could be lucrative, providing both coupon and capital gains. This differs from fixed deposits, where gains are solely from interest income.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/etmarkets-smart-talk-fy25-strategy-deploy-80-of-equity-allocation-through-weekly-stp-over-next-8-10-weeks-kshitiz-mahajan/articleshow/108332674.cms |

|

Unveiling Myths, Embracing Success: Shibani Kurian’s guide to financial empowerment this Women’s Day“Women are leaders everywhere you look – from the CEO to the housewife who raises her children and runs her household. They are surely gaining their rightful place on the global map and leaving footprints for the younger generation to follow. One factor for success that is often overlooked is mentorship.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/unveiling-myths-embracing-success-shibani-kurians-guide-to-financial-empowerment-on-this-womens-day/articleshow/108326624.cms |

|

Tata MF’s Meeta Shetty tells why consistent investment & financial independence are important for womenShetty has more than 16 years of industry experience and she manages assets worth more than Rs 12,400 crore at Tata MF across three strategies – Tata Digital India Fund, Tata India Pharma & Healthcare Fund, and Tata Focused Equity Fund. She has been overseeing Tata Digital India Fund and Tata India Pharma fund since November 2018. Read more at: https://economictimes.indiatimes.com/markets/expert-view/tata-mfs-meeta-shetty-tells-why-consistent-investment-financial-independence-are-important-for-women/articleshow/108317150.cms |

|

Oil prices end lower after U.S. jobs report, posting a loss for the weekOil futures decline for the week, pressured by concerns over demand. Read more at: https://www.marketwatch.com/story/oil-prices-trade-lower-ahead-of-u-s-jobs-report-4e173d48?mod=mw_rss_topstories |

|

Bitcoin bulls eye $100,000 as the next level before its halving. Here’s what’s driving the crypto’s rally.Some crypto bulls are now eyeing $100,000 as bitcoin’s next level, after the leading cryptocurrency on Friday briefly topped $70,000 for the first time in its history. Read more at: https://www.marketwatch.com/story/bitcoin-bulls-eye-100-000-as-the-next-level-before-its-halving-heres-whats-driving-the-cryptos-rally-046b1e42?mod=mw_rss_topstories |

|

Complaints about stock market’s ‘bad breadth’ are overblown. Here’s why.Market gurus love to complain about the fact that the performance of indexes like the S&P 500 is increasingly being driven by a small cadre of megacap stocks. Read more at: https://www.marketwatch.com/story/complaints-about-stock-markets-bad-breadth-are-overblown-heres-why-ef4e052e?mod=mw_rss_topstories |