Summary Of the Markets Today:

- The Dow closed up 91 points or 0.23%,

- Nasdaq closed up 1.14%,

- S&P 500 closed up 0.80%,

- Gold $2,093 up $38.80,

- WTI crude oil settled at $80 up $1.52,

- 10-year U.S. Treasury 4.184% down 0.068 points,

- USD index $103.89 down $0.26,

- Bitcoin $63,053 up $885 (1.43%),

- Baker Hughes Rig Count: U.S. +3 to 629 Canada unchanged at 231

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during January 2024 was 11.7% above January 2023. The private sector construction sector is up 9.5% year-over-year whilst public sector construction is up 20.1% year-over-year. Construction spending remains one of the bright spots in the economy.

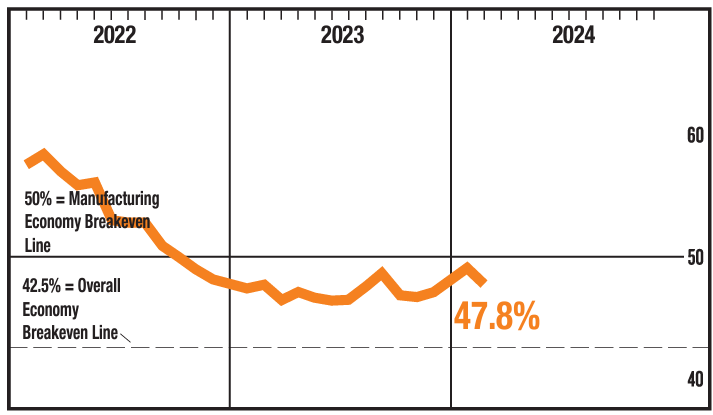

The Manufacturing PMI registered 47.8 percent in February 2024, down 1.3 percentage points from the 49.1 percent recorded in January. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index moved back into contraction territory at 49.2 percent, 3.3 percentage points lower than the 52.5 percent recorded in January. Manufacturing is in a recession in the U.S.

Here is a summary of headlines we are reading today:

- PEC Lifts Production in February

- U.S. Oil Drilling Gets Another Bump As WTI Soars To $80

- Cheap Spot Prices Boost China’s LNG Imports to Record High for February

- Red Sea Disruptions Push OECD Crude Inventories Lower

- Energy-Related Emissions Hit a Record High Last Year Despite Renewables Surge

- Nasdaq surges more than 1% to take out 2021 record, S&P 500 closes above 5100 for the first time: Live updates

- Wall Street is worried about NYCB’s loan losses and deposit levels as stock sinks below $4

- Boeing is in talks to buy back fuselage maker Spirit AeroSystems after spate of quality defects

- Elon Musk sues OpenAI and CEO Sam Altman over contract breach

- Bitcoin dips to start March after climbing 45% in February: CNBC Crypto World

- Health Officials Concerned Over Possible RSV Vaccine Link To Rare Neurological Condition

- Treasury yields end at roughly three-week lows after manufacturing, consumer-sentiment data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Mysterious Power Outage Paralyzes TajikistanEntire swathes of Tajikistan were left without electricity for around three hours on March 1 amid what appears to have been a major technical malfunction. Households in the capital, Dushanbe, reported power outages at around 11 a.m. local time. Electricity supplies were restored three hours later. Many homes were left without heating and hot water, both of which are supplied by means of a centralized system. After weeks of unseasonably warm weather, daytime temperatures in Dushanbe have in recent days slipped to near or below freezing. This has… Read more at: https://oilprice.com/Energy/Energy-General/Mysterious-Power-Outage-Paralyzes-Tajikistan.html |

|

OPEC Lifts Production in FebruaryOPEC raised its oil production in January despite voluntary production cuts that the group was supposed to be adhering to, according to new data published on Friday by Bloomberg. A new Bloomberg survey showed that OPEC’s production rose by 110,000 barrels per day to 26.68 million barrels per day—with Libya accounting for much of the increase as it brought production back online at its Sharara oilfield. Sharara has been closed due to unrest in the country. Iraq—a chronic overproducer, did lower its February production, but it is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Lifts-Production-in-February.html |

|

Russia’s Rosneft Moves to Sell its German Refinery AssetsRussia’s state-controlled oil giant Rosneft has launched a sales process seeking to divest its German assets, which include a majority stake in a major refinery that is currently under German trusteeship, a spokesperson for Germany’s economy ministry told Bloomberg on Friday. In September 2022, a few months after the Russian invasion of Ukraine, Germany put the local business of Russia’s Rosneft under trusteeship, handing control over the Schwedt refinery to the country’s energy market regulator. “With… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Rosneft-Moves-to-Sell-its-German-Refinery-Assets.html |

|

U.S. Oil Drilling Gets Another Bump As WTI Soars To $80The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday. The total rig count rose by 3 to 629 this week, compared to 749 rigs this same time last year. The number of oil rigs rose by 3 this week after falling by 1 in the week prior. Oil rigs now stand at 506–down by 86 compared to this time last year. The number of gas rigs fell again this week by 1 to 119, a loss of 35 active gas rigs from this time last year. Miscellaneous rigs rose by 1 to a total… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Drilling-Gets-Another-Bump-As-WTI-Soars-To-80.html |

|

Cheap Spot Prices Boost China’s LNG Imports to Record High for FebruaryChina imported in February a record volume of LNG for the month, as buyers took advantage of plummeting spot prices in Asia amid ample inventories and tepid demand. Chinese LNG imports last month – the highest-ever for February – topped 5.5 million tons, rising by 15% compared to February last year, ship-tracking data compiled by Bloomberg showed on Friday. In February 2024, Chinese LNG importers were on the lookout for cheaper supply of liquefied natural gas on the spot market as prices in North Asia halved… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cheap-Spot-Prices-Boost-Chinas-LNG-Imports-to-Record-High-for-February.html |

|

Exxon Threatens to Derail Chevron’s Acquisition of HessExxon’s challenge of Chevron’s acquisition of Hess could result in a windfall for Exxon shareholders, a new report from Reuters speculates. As we wrote earlier this week, Exxon is challenging Chevron’s acquisition of Hess by challenging the terms of a stake in a major Guyana oil field. Exxon said it could exercise pre-emptive rights that could block Chevron from acquiring a 30% stake in the field, which sits at the center of the potential Hess acquisition. MKP Advisors said in a note reviewed by Reuters that Exxon is “very possibly… Read more at: https://oilprice.com/Energy/Crude-Oil/Exxon-Threatens-to-Derail-Chevrons-Acquisition-of-Hess.html |

|

Oil Majors Frustrated by Nigeria’s Asset Sale DelaysNigeria has yet to approve the sales of onshore assets announced in recent years by international oil majors, much to the frustration of both buyers and sellers who say that the slow progress continues to hamper the rebound in Nigeria’s oil production. Majors including ExxonMobil, Shell, Eni, and Equinor are still waiting for government clearance for their sales of oil assets, mostly to local companies. The buyers and Nigeria’s domestic oil producers expect the approvals to give clarity to the companies and revive oil production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Majors-Frustrated-by-Nigerias-Asset-Sale-Delays.html |

|

WTI Soars Past $80 per Barrel as Oil Market TightensThe price of a WTI barrel soared to heights not seen since November as the market braces for an OPEC+ decision on oil production levels in April and beyond. WTI was trading at $80.04 per barrel at 10:42 am ET, an increase of $1.78 per barrel on the day, or 2.27%. Behind the rise in price is the market’s anticipation that OPEC+ will extend its voluntary production cuts for the next quarter and the volatility that could come from updated U.S. crude oil and crude products inventory data that will be released from the American Petroleum Institute… Read more at: https://oilprice.com/Energy/Crude-Oil/WTI-Soars-Past-80-per-Barrel-as-Oil-Market-Tightens.html |

|

BP to Drill First Deep Gas Production Well at Huge Azeri Field in H2BP expects to drill in the second half of 2024 the first production deep gas well at the Azeri-Chirag-Gunashli (ACG) oilfield, the largest oilfield in the Azerbaijan sector of the Caspian basin. “Last year, we drilled an appraisal well on ACG to explore the deep gas reservoirs under the producing oil field,” Katerina Papalexandri, vice president gas and low-carbon energy growth, Caspian at BP, said at an event in Baku, as carried by news agency Trend. “The data we have obtained from the well looks promising. This gives us… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-to-Drill-First-Deep-Gas-Production-Well-at-Huge-Azeri-Field-in-H2.html |

|

Red Sea Disruptions Push OECD Crude Inventories Lower1. Red Sea Disruptions Shrink OECD Crude Inventories Further – The price squeeze in the Atlantic Basin market has mostly stemmed from longer and costlier voyages of crude oil and products around the Cape of Good Hope, a direct consequence of Red Sea disruptions. – According to Kpler data, onshore inventories in developed nations have plunged to their lowest for this time of the year in post-pandemic history, with buyers failing to purchase enough to replenish stocks. – At the same time, the amount of oil that is sailing on water has risen to the… Read more at: https://oilprice.com/Energy/Energy-General/Red-Sea-Disruptions-Push-OECD-Crude-Inventories-Lower.html |

|

Oil Markets Await the Next OPEC+ AnnouncementOil prices remained stubbornly rangebound in February as signs of a recovering U.S. economy were countered by weaker economic data in both Europe and China.Friday, March 1st 2024Diverging macroeconomic news, with China and Europe continuing to struggle with below-expectations manufacturing activity while the United States is nearing the point of first interest rate cuts, failed to alter the trading patterns of February, keeping Brent around the $83 per barrel mark. The next big thing to happen to the oil markets will be OPEC+ announcing the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Await-the-Next-OPEC-Announcement.html |

|

Saudi Arabia Likely to Keep Oil Prices to Asia UnchangedSaudi Arabia is expected to announce in a few days little changes to the price of its crude going to Asia in April, amid a rise in Middle Eastern oil benchmarks, a Reuters survey of refiners showed on Friday. Saudi Aramco, the world’s top crude oil exporter, is set to keep the price of its flagship Arab Light grade for Asia for next month unchanged or raise it slightly by up to $0.20 per barrel over the Oman/Dubai average, the benchmark off which Middle Eastern crude exports to Asia are priced, the survey of six refining sources found. Saudi… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Likely-to-Keep-Oil-Prices-to-Asia-Unchanged.html |

|

Energy-Related Emissions Hit a Record High Last Year Despite Renewables SurgeDespite a decline in fossil fuel use in developed economies, global energy-related emissions rose last year to another record-high level as coal use rose in major developing markets hit by low hydropower generation, the latest emissions report by the International Energy Agency (IEA) showed on Friday. Global energy-related carbon dioxide (CO2) emissions grew by 1.1% in 2023, or by 410 million tons, to reach a new record high of 37.4 billion tons, the IEA said in its CO2 Emissions in 2023 report. The rise in emissions was lower… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Related-Emissions-Hit-a-Record-High-Last-Year-Despite-Renewables-Surge.html |

|

Could This Unknown Company Help Solve Europe’s Energy Crisis?Supergiants like Exxon are focused on big offshore venues like Guyana and Namibia, leaving behind prime onshore natural gas assets in Europe – a region that is now desperate for affordable domestic resources that aren’t controlled by Russian Gazprom. Prior to Russia’s invasion of Ukraine, Gazprom was calling the energy shots in Germany. Those days are over. But Germany, the European Union’s biggest economy, still needs natural gas, even if this winter’s storage is nearly full. It’s not full as a result… Read more at: https://oilprice.com/Energy/Energy-General/Could-This-Unknown-Company-Help-Solve-Europes-Energy-Crisis.html |

|

Chinese Oil Product Demand Could Peak by 2025Demand for petroleum products in China could peak before next year, the research unit of the China National Petroleum Corporation has forecast. The projection is based on expectations that the energy transition will continue gathering speed, eliminating oil product demand growth. “With new productive forces — which refer to technological innovation, data, smart or intelligent technologies and the like — driving an overall increase in productivity and enhancing new dynamics for economic growth, overall demand for petroleum is on an upward… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Oil-Product-Demand-Could-Peak-by-2025.html |

|

Nasdaq surges more than 1% to take out 2021 record, S&P 500 closes above 5100 for the first time: Live updatesThe Nasdaq notched a record high Friday, breaking its previous record from November 2021. Read more at: https://www.cnbc.com/2024/02/29/stock-market-today-live-updates.html |

|

Wall Street is worried about NYCB’s loan losses and deposit levels as stock sinks below $4NYCB restated recent quarterly earnings lower by $2.4 billion, formally replaced its CEO and delayed the release of a key annual report. Read more at: https://www.cnbc.com/2024/03/01/wall-street-worries-about-nycbs-loan-losses-and-deposit-levels.html |

|

Boeing is in talks to buy back fuselage maker Spirit AeroSystems after spate of quality defectsBoth companies have been scrambling to stamp out manufacturing flaws on Boeing’s top-selling plane. Read more at: https://www.cnbc.com/2024/03/01/spirit-aerosystems-boeing.html |

|

Elon Musk sues OpenAI and CEO Sam Altman over contract breachElon Musk has filed a lawsuit against OpenAI and CEO Sam Altman, among others, accusing them of breaching a contractual agreement. Read more at: https://www.cnbc.com/2024/03/01/elon-musk-sues-openai-and-ceo-sam-altman-over-contract-breach.html |

|

With the Nasdaq at record highs, these are the benchmark’s most beloved stocks that are expected to rallyThe tech-heavy index closed at its first record high in more than two years on Thursday. Read more at: https://www.cnbc.com/2024/03/01/the-nasdaqs-most-beloved-stocks-that-are-expected-to-rally.html |

|

Biden announces U.S. will airdrop food aid into GazaThe president reiterated that the U.S. is trying to push for an immediate cease-fire between Hamas and Israel in order to allow more aid into Gaza. Read more at: https://www.cnbc.com/2024/03/01/biden-announces-us-will-airdrop-food-aid-into-gaza.html |

|

NASA shuts down $2 billion satellite refueling project after Maxar is cited for poor performanceNASA is shutting down a $2 billion project to test satellite refueling in space, it announced on Friday, Read more at: https://www.cnbc.com/2024/03/01/nasa-shuts-down-maxar-led-osam-1-satellite-refueling-project.html |

|

Judge rejects AstraZeneca’s challenge to Medicare drug price negotiationsU.S. District Judge Colm Connolly’s decision comes one day before manufacturers have to respond to Medicare’s initial price offers for their drugs. Read more at: https://www.cnbc.com/2024/03/01/medicare-drug-price-negotiations-judge-rejects-astrazeneca-challenge.html |

|

Bitcoin dips to start March after climbing 45% in February: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Jack Mallers, the CEO of Strike, discusses February’s crypto rally and weighs in on the future of bitcoin. Read more at: https://www.cnbc.com/video/2024/03/01/bitcoin-dips-to-start-march-after-climbing-45percent-in-february-cnbc-crypto-world.html |

|

U.S. crude touches $80 for first time since November before OPEC+ decisionOil booked a second consecutive monthly gain as front-month futures contracts trade at a premium to later months, typically a sign of a tightening market. Read more at: https://www.cnbc.com/2024/03/01/crude-oil-today-wti-brent-jump-as-market-tightens.html |

|

Co-defendant in Sen. Bob Menendez corruption case pleads guiltySen. Bob Menendez, a New Jersey Democrat, is accused of having a corrupt relationship with three businessmen, and sharing secret information that helped Egypt. Read more at: https://www.cnbc.com/2024/03/01/co-defendant-in-sen-bob-menendez-corruption-case-pleads-guilty.html |

|

Death of shipping CEO Angela Chao under ‘criminal investigation,’ Texas sheriff saysSenate Minority Leader Mitch McConnell mentioned the death of his sister-in-law when announcing he would step down as Republican leader. Read more at: https://www.cnbc.com/2024/02/29/angela-chao-death-being-investigated-as-criminal-matter.html |

|

‘People didn’t see it coming’: What to know about this hot AI stock up nearly 800% in the past yearThere’s another little-known AI play investors have been betting on alongside Nvidia. Read more at: https://www.cnbc.com/2024/03/01/people-didnt-see-it-coming-what-to-know-about-this-hot-ai-stock-up-nearly-800percent-in-the-past-year.html |

|

Health Officials Concerned Over Possible RSV Vaccine Link To Rare Neurological Condition“Trust the science,” they told us… At a time when the largest mRNA Covid vaccine peer-reviewed study recently revealed increases in neurological, blood, and heart-related conditions, along with the pharma-industrial complex unleashing a ‘blitzkrieg’ of vaccine commercials across corporate media outlets, a new report has found that vaccines for respiratory syncytial virus could be causing a rare nervous system disorder in older adults. The New York Times has reported that new safety data for two RSV vaccines, presented at a meeting of scientific advisers to the Centers for Disease Control and Prevention on Thursday, indicates that Guillain-Barre syndrome – a rare condition where the immune system attacks nerve cells, leading to muscle weakness and paralysis – may have occurred in adults over 60 who received the vaccines. Two vaccines, Pfizer’s Abrysvo and GSK’s Arexvy, are currently available on the market. Read more at: https://www.zerohedge.com/medical/health-officials-concerned-over-possible-rsv-vaccine-link-rare-neurological-condition |

|

Blaze Journalist Arrested On 4 Charges Over Jan. 6 Presence At CapitolUpdate (1530ET): Steve Baker of The Blaze was arrested on Friday and charged with four misdemeanors related to his Jan. 6 coverage at the US Capital.

Steve Baker of Blaze Media speaks with radio host Glenn Beck about his Jan. 6 pipe bomb reporting on Feb. 15, 2024. (Blaze Media/Screenshot via The Epoch Times) He turned himself over to the FBI in Dallas. The charges are: Knowingly entering or remaining in any restricted building or grounds without lawful authority * * * Read more at: https://www.zerohedge.com/political/journalist-faces-arrest-4-charges-over-jan-6-presence-capitol |

|

Trump Will Remain On Illinois Ballot Pending Appeal, Virtue-Signaling Judge Clarifies In New OrderUpdate (1400ET): Less than 24 hours after she ordered Donald Trump removed from Illinois’ primary ballot (because ‘meh, insurrection’), Cook County Circuit Court Judge Tracie Porter clarified the duration of a stay she placed on her removal order on Wednesday when she ruled President Trump “disqualified” and that any votes for him would be void if the order went into effect. As The Epoch Times’ Caden Pearsen reports, Judge Porter had initially stayed that original removal order until March 1, anticipating an appeal to the Illinois Appellate Court, First District, or the Illinois Supreme Court, and/or pending a ruling by the U.S. Supreme Court in a case from Colorado.

|

|

Today Is A Good Day To DEI: In Huge Win For DeSantis, University Of Florida Fires All ‘Diversity, Equity & Inclusion’ StaffFollowing a mandate by the Florida Board of Governors, the University of Florida has fired all DEI (diversity, equity & inclusion) staff, effective immediately.

“To comply with the Florida Board of Governor’s regulation 9.016 on prohibited expenditures, the University of Florida has closed the Office of the Chief Diversity Officer, eliminated DEI positions and administrative appointments, and halted DEI-focused contracts with outside vendors,” reads a statement from Provost J. Scott Angle. “Under the direction of UF Human Resources, university employees whose positions were eliminated will receive UF’s standard twelve weeks of pay. Approximately $5 million in funds previously allocated to DEI initiatives will be reallocated into a faculty recruitment fund.

|

|

Asda billionaire boss: ‘I’ve not done bad’Mohsin Issa says he and his co-owner brother are “here for the long haul”, despite Asda’s £5bn debt. Read more at: https://www.bbc.co.uk/news/business-68436330 |

|

Price of first class stamp to rise againThis is the fourth rise in two years for first class stamps and the second class cost will rise too. Read more at: https://www.bbc.co.uk/news/business-68447820 |

|

Elon Musk sues OpenAI over Microsoft linksThe lawsuit accuses the firm of abandoning its founding principle of benefiting humanity. Read more at: https://www.bbc.co.uk/news/technology-68445981 |

|

Tech View: Nifty forms Marubozu candle on Day 1 of March series. What should traders do on SaturdayNifty has broken out of a Running Triangle pattern, indicating the start of a fresh leg of up move. The daily Bollinger bands have begun to expand and prices trading along the upper band indicate that there could be sharp trending moves on the upside. We expect Nifty to target 23,000 – 23,100 in the short-term. On the downside, the zone of 21,900 – 21,860 shall act as a crucial support zone. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-marubozu-candle-on-day-1-of-march-series-what-should-traders-do-on-saturday/articleshow/108141351.cms |

|

Zomato hits record high, bucking internet stocks’ sluggishnessZomato’s shares hit a record high as its profitability improves, making it India’s most valuable internet stock. Investor sentiment has reversed, and Zomato dominates the food delivery market. Blinkit, its quick commerce business, is expected to drive further growth. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zomato-hits-record-high-bucking-internet-stocks-sluggishness/articleshow/108134488.cms |

|

Technical Stock Pick: 30% rally in 3 months! Indus Tower breaks out from falling trendline resistance; time to buy?Indus Tower: Short-term traders can look to buy the stock on dips for a possible target of Rs 285 in the next 3-4 weeks, suggest experts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-stock-pick-30-rally-in-3-months-indus-tower-breaks-out-from-falling-trendline-resistance-time-to-buy/articleshow/108129159.cms |

|

My friend invited me to a concert at Carnegie Hall. After I agreed, he said, ‘What would be nice is if you took me to dinner.’ Is this normal?“I have invited him to the theater in the past and did not expect him to buy me dinner.” Read more at: https://www.marketwatch.com/story/my-friend-invited-me-to-a-concert-at-carnegie-hall-after-i-agreed-he-said-what-would-be-nice-is-if-you-took-me-to-dinner-is-this-normal-871be00e?mod=mw_rss_topstories |

|

Treasury yields end at roughly three-week lows after manufacturing, consumer-sentiment dataU.S. government debt rallied on Friday after a mixed batch of U.S. economic data, giving 2- and 10-year yields their biggest weekly declines in at least a month. Read more at: https://www.marketwatch.com/story/bond-yields-slip-ahead-of-ism-manufacturing-report-101dd047?mod=mw_rss_topstories |

|

Companies are pulling back on DEI. What will be lost in the process?If companies get rid of diversity, equity and inclusion programs, deep-seated biases will remain — “and DEI opponents have no solutions,” one DEI practitioner said. Read more at: https://www.marketwatch.com/story/companies-are-pulling-back-on-dei-what-will-be-lost-in-the-process-c2232e89?mod=mw_rss_topstories |