Summary Of the Markets Today:

- The Dow closed down 97 points or 0.25%,

- Nasdaq closed up 0.37%,

- S&P 500 closed up 0.17%,

- Gold $2,040 up $0.03,

- WTI crude oil settled at $79 up $1.12,

- 10-year U.S. Treasury 4.309% up 0.010 points,

- USD index $103.83 down $0.01,

- Bitcoin $56,970 up $2,5246 (4.64%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies hit 194 to start 2024, down 5% from the 204 CEO exits recorded in December 2023. It is a 73% increase from the 112 CEO exits that occurred in the same month one year prior.

New orders for manufactured durable goods in January 2024 declined 0.8% year-over-year. There was a general weakness across the board with the worst performance in civilian aircraft. As I continue to point out, there is a recession underway in the manufacturing sector.

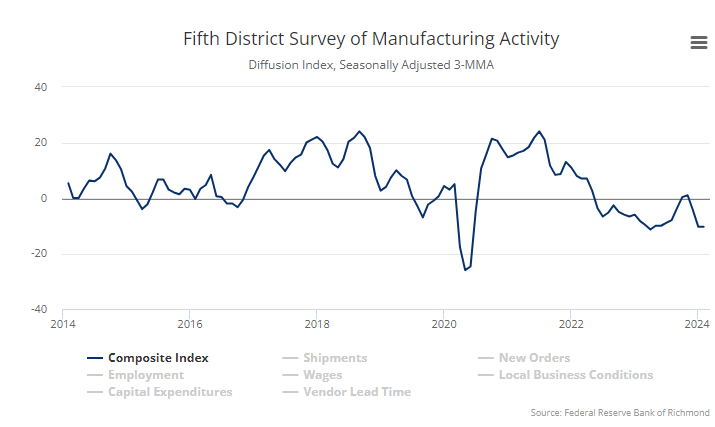

Richmond Fed Manufacturing Survey increased from −15 in January to −5 in February 2024. Of its three component indexes, shipments remained solidly negative at −15, new orders increased from −16 to −5, and employment rose notably, from −15 to 7. More evidence of a recessionary manufacturing sector.

The S&P CoreLogic Case-Shiller 20 cities composite home price index shows a 6.1% increase year-over-year in December 2023. CoreLogic Chief Economist Dr. Selma Hepp added:

While CoreLogic S&P Case-Shiller National Index rose by 5.5% year over year, the stress of high mortgage rates at the end of 2023 continued to depress prices, which were down 0.4% compared to November – the second month of lower prices. Nevertheless, Miami and Las Vegas – joined by Los Angeles – continued to see strengthening of home prices despite higher rates. Miami overall ranked as the strongest appreciating market in 2023, up 6% for the year, compared to national appreciation of 2%. In 2022, Tampa and Miami were the strongest appreciating markets at almost 30% increase in home prices. In contrast, markets in the West – San Francsico, Seattle, Las Vegas, Phoenix, and Portland – are still catching up with 2022 price peaks. But with strong recent price rebounds in Las Vegas and Phoenix in 2023, these two markets are likely to see annual appreciation in 2024.

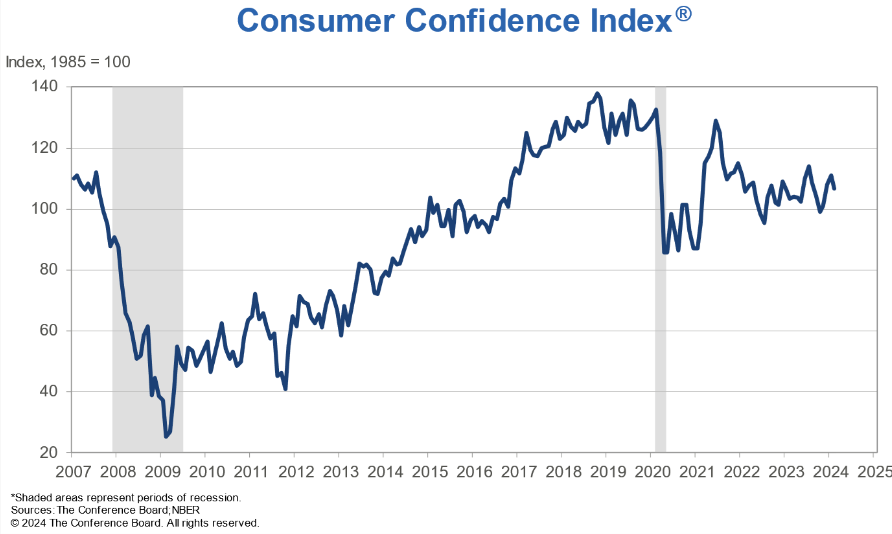

The Conference Board Consumer Confidence Index fell in February to 106.7 (1985=100), down from a revised 110.9 in January. February’s decline in the Index occurred after three consecutive months of gains. However, as January was revised downward from the preliminary reading of 114.8, the data now suggest that there was not a material breakout to the upside in confidence at the start of 2024. Dana Peterson, Chief Economist at The Conference Board stated:

The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy. The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000. Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54.

Here is a summary of headlines we are reading today:

- Simulated Star Collision Leads to Breakthrough in Nuclear Waste Treatment

- Supply Chain Woes Could Derail Biden’s Electric Vehicle Agenda

- Kremlin Warns of Escalation if NATO Troops Fight in Ukraine

- Short Sellers in Trouble As Physical Oil Market Defies Data

- Red Sea Disruptions Spark Oil Tanker Shortfall

- S&P 500, Nasdaq Composite close higher on Tuesday: Live updates

- Warner Bros. Discovery halts merger talks with Paramount Global, sources say

- Bitcoin’s all-time high is in sight after the crypto breached $57,000, chart analysts say. Here’s what to expect

- Bitcoin surges past $57,000 to highest level since December 2021: CNBC Crypto World

- For Black workers, progress in the workplace but still a high hill to climb

- Stock Bull Market Might Just Be Getting Started, But…

- Are U.S. stocks in a bubble? History says no.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Simulated Star Collision Leads to Breakthrough in Nuclear Waste TreatmentNewly released University of Tokyo research reveals a method to more accurately measure, predict and model a key part of the process to make nuclear waste more stable. This could lead to improved nuclear waste treatment facilities and also to new theories about how some heavier elements in the universe came to be. Simulation of neutron star collision. Detections of gravitational waves from merging neutron stars tipped off researchers here on Earth that it should be possible to predict how neutrons interact with atomic nuclei. ©2024 NASA’s… Read more at: https://oilprice.com/Energy/Energy-General/Simulated-Star-Collision-Leads-to-Breakthrough-in-Nuclear-Waste-Treatment.html |

|

Kazakhstan Targets Fintech to Boost Revenue and Curb Tax EvasionAfter Kurmet, a hairdresser in Kazakhstan’s business capital, Almaty, finished a cut earlier this month, the customer reached for his phone to pay. This has been a standard scene for years. Kazakhs young and old have embraced banking apps with a passion. But things are changing. Kurmet had to say no on this occasion. “Sorry, brother, only cash, you understand, now it’s like that everywhere,” Kurmet told the client, a regular at his salon. The customer had to go out to the nearest ATM to pick up some cash to pay. “This… Read more at: https://oilprice.com/Finance/the-Economy/Kazakhstan-Targets-Fintech-to-Boost-Revenue-and-Curb-Tax-Evasion.html |

|

Supply Chain Woes Could Derail Biden’s Electric Vehicle AgendaColor us not surprised, but another one of the Biden administration’s “visions” for forcing people to own electric vehicles isn’t working out exactly as planned. This time it deals with supply chain logistics, with Bloomberg reporting this week that in the year and a half since passing the Inflation Reduction Act, automakers are finding out the hard way that the rigorous criteria for manufacturing batteries using materials from the United States and its free-trade allies could render them cost-inefficient compared to global competitors. Companies… Read more at: https://oilprice.com/Energy/Energy-General/Supply-Chain-Woes-Could-Derail-Bidens-Electric-Vehicle-Agenda.html |

|

Red Sea Disruptions set to Continue Throughout 2024Shipping giant Maersk is warning that container shipping through the Red Sea could continue to cause disruptions into the second half of the year, with the company expecting shipping delays as vessels take the long way around the Cape of Good Hope instead of through the dangerous waters of the Red Sea. “Be prepared for the Red Sea situation to last into the second half of the year and build longer transit times into your supply chain planning, Maersk’s head of North America, Charles van der Steene, said in a Tuesday statement carried… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Red-Sea-Disruptions-set-to-Continue-Throughout-2024.html |

|

Kremlin Warns of Escalation if NATO Troops Fight in UkraineThe Kremlin has warned Kyiv’s European allies that sending troops to fight in Ukraine would lead to the “inevitability” of war between Russia and NATO after France said that, despite a current lack of consensus, “nothing,” including sending Western forces to fight on the Ukrainians’ side, should be ruled out in terms of preventing a Russian victory in Ukraine. Speaking after a summit of continental leaders in Paris on February 26, French President Emmanuel Macron said there was a “broad consensus to do more and quicker” for Ukraine as participants… Read more at: https://oilprice.com/Geopolitics/International/Kremlin-Warns-of-Escalation-if-NATO-Troops-Fight-in-Ukraine.html |

|

Oil Rises Ahead of Weekly Inventory DataOil prices continue to trade in a very narrow bandwidth with ICE Brent still hovering around the $83 per barrel mark, with traders anticipating potentially impactful US economy data coming in later this week – first the US personal consumption expenditures readings, followed up by European inflation figures and Chinese PMI developments reflecting the Chinese Lunar New Year. Ukraine’s Drone Strikes Bring Russian Refining Down – As the United States edges closer to this year’s spring break, usually a high-demand season for… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Rises-Ahead-of-Weekly-Inventory-Data.html |

|

U.S. Shale Drives Global Upstream M&A Value To Highest since 2017The value of global upstream mergers and acquisitions has already hit this quarter the highest first-quarter level since 2017, driven by frenzied consolidation in the U.S. shale patch, analysts have told Reuters. In January and February, as much as $58 billion worth of upstream M&As have been announced globally, of which the U.S. deals represent more than 80% of total value, according to data from Rystad Energy cited by Reuters. The January-February tally of global upstream deal value, with one month to go until the end of the quarter,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Shale-Drives-Global-Upstream-MA-Value-To-Highest-since-2017.html |

|

Short Sellers in Trouble As Physical Oil Market Defies DataSomething odd is taking place in the oil market. While on one hand “data” dissembled by Biden’s Dept of Energy and specifically its statistical arm, the Energy Information Administration, has done everything it could to indicate there is a glut of oil, which is understandable – there is nothing Biden’s handlers fear more than an inflationary surge in oil and gasoline prices ahead of the November elections and will do everything in their power to mandate a dataset that has the most adverse impact on oil prices, the physical market is sending just… Read more at: https://oilprice.com/Energy/Crude-Oil/Short-Sellers-in-Trouble-As-Physical-Oil-Market-Defies-Data.html |

|

Canada’s Oil and Gas Firms To Boost Upstream Capex To $30 Billion in 2024Canada’s oil and natural gas sector is set to boost upstream capital expenditures to around US$30 billion (C$40.6 billion) in 2024, up slightly from an estimated actual investment of US$28.8 billion (C$39 billion) for 2023, the Canadian Association of Petroleum Producers (CAPP) said in an estimate on Tuesday. “There is room for cautious optimism with current Canadian oil production at record levels in anticipation of the Trans Mountain expansion completion in the second quarter,” CAPP president and CEO Lisa Baiton said.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadas-Oil-and-Gas-Firms-To-Boost-Upstream-Capex-To-30-Billion-in-2024.html |

|

EU Proposes Member States Maintain Measures to Reduce Natural Gas DemandThe European Commission proposed on Tuesday that EU member states continue taking voluntary measures to maintain a collective 15% gas demand reduction compared to the five-year average to March 2022, as the bloc looks to continue stabilizing its energy and gas supply. “With the emergency legislation due to expire on 31 March, and the situation more stable than it has been for the past two years, the Commission is now proposing the adoption of a Council Recommendation on continued gas demand reduction measures,” the European… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Proposes-Member-States-Maintain-Measures-to-Reduce-Natural-Gas-Demand.html |

|

Red Sea Disruptions Spark Oil Tanker ShortfallThe Red Sea shipping crisis has been an explosive mess for the international shipping community and the global economy. With oil tankers increasingly steering clear of the southern Red Sea and the Bab el Mandeb Strait, shipping capacity has rapidly tightened, pressuring daily rates higher. Bloomberg reports only two new supertankers will join the global fleet in 2024, the fewest additions in forty years and about 90% below the yearly average over the last two decades. “The impact of the diversions can be seen every day in shipping in… Read more at: https://oilprice.com/Energy/Crude-Oil/Red-Sea-Disruptions-Spark-Oil-Tanker-Shortfall.html |

|

Europe’s Heat Pump Sales Drop for the First Time in a DecadeWithdrawal of government support, lower natural gas prices, and high interest rates led to the first annual drop in European sales of heat pumps in a decade, data from the European Heat Pump Association showed on Tuesday. In 14 European counties, heat pump sales dropped by around 5% last year compared to 2022, from 2.77 million to 2.64 million units. This reverses the trend of the last decade, where combined sales increased annually, the association said. Sales of heat pumps fell in France, Italy, Sweden, Finland, Poland, Denmark, Austria,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Heat-Pump-Sales-Drop-for-the-First-Time-in-a-Decade.html |

|

Energy Midstream Firm Delek Logistics Misses Earnings EstimatesTennessee-based midstream energy master limited partnership Delek Logistics reported on Tuesday revenues and earnings per share for the fourth quarter that missed consensus estimates, due to higher interest expense and a goodwill impairment. Delek Logistics Partners, LP (NYSE: DKL) booked a net income attributable to all partners of $22.1 million, or $0.51 per diluted common limited partner unit. This compares to a net income attributable to all partners of $42.7 million, or $0.98 per diluted common limited partner unit, in the fourth… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Midstream-Firm-Delek-Logistics-Misses-Earnings-Estimates.html |

|

New Expansion Project Could Give Qatar 25% Share of Global LNG SupplyQatar could squeeze out rival LNG supply, including from the current top exporter, the United States, and could end up controlling 25% of the global LNG supply by 2030 after it announced a new major expansion project days ago, analysts told Reuters. On Sunday, QatarEnergy, the state company of one of the world’s biggest LNG exporters, said it was adding another major LNG expansion project to its two ongoing projects, aiming to raise its total LNG export capacity by 85% from current levels by 2030. QatarEnergy is proceeding… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Expansion-Project-Could-Give-Qatar-25-Share-of-Global-LNG-Supply.html |

|

Russia to Suspend Gasoline Exports From MarchRussia will suspend gasoline exports for six months beginning in March to ensure supply for the domestic market in peak demand season. The information comes from an unnamed source close to the government who spoke to business daily RBC. The report recalls Deputy Prime Minister Alexander Novak calling for a temporary suspension of gasoline exports with a letter to the prime minister earlier this month. This would be the second gasoline export ban Russia has enacted in less than six months. Last September, the government also suspended gasoline… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-to-Suspend-Gasoline-Exports-From-March.html |

|

S&P 500, Nasdaq Composite close higher on Tuesday: Live updatesThe Dow declined 100 points Tuesday as the market rally took another breather, with investors looking ahead to key data slated for release later this week. Read more at: https://www.cnbc.com/2024/02/26/stock-market-today-live-updates.html |

|

Apple reportedly cancels plans to build an electric carApple will wind down its team working on electric cars, called Special Projects Group, according to a report from Bloomberg News. Read more at: https://www.cnbc.com/2024/02/27/apple-car-project-canceled-report.html |

|

Warner Bros. Discovery halts merger talks with Paramount Global, sources sayWarner Bros. Discovery has paused merger discussions with Paramount Global as the company trades at a 52-week low, sources told CNBC. Read more at: https://www.cnbc.com/2024/02/27/warner-bros-discovery-halts-paramount-global-merger-talks.html |

|

Macy’s will close about 150 department stores, but open new locations of better performing chainsMacy’s plans to close some namesake stores and open new Bloomingdale’s and Bluemercury locations that reflect what’s working at the retailer. Read more at: https://www.cnbc.com/2024/02/27/macys-will-close-150-stores-open-new-bloomingdales-bluemercury.html |

|

Bitcoin’s all-time high is in sight after the crypto breached $57,000, chart analysts say. Here’s what to expectBitcoin’s all-time high is in clear view after the cryptocurrency surpassed $57,000 on Tuesday. Read more at: https://www.cnbc.com/2024/02/27/bitcoins-all-time-high-is-in-view-after-it-breached-57000-analysts-say.html |

|

Hims & Hers soars 31% on rapid growth in mental health, weight loss and dermatology treatmentsShares of Hims & Hers Health popped Tuesday after the company reported better-than-expected quarterly results. Read more at: https://www.cnbc.com/2024/02/27/hims-hers-hims-q4-earnings-report.html |

|

Bitcoin surges past $57,000 to highest level since December 2021: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Doug Schwenk, the CEO of Digital Asset Research, weighs in on what’s driving the current crypto rally and breaks down the data from the firm’s recent update on crypto ETFs. Read more at: https://www.cnbc.com/video/2024/02/27/bitcoin-surges-past-57000-highest-level-since-december-2021-cnbc-crypto-world.html |

|

OpenAI alleges New York Times ‘hacked’ ChatGPT for lawsuit evidenceOpenAI asked a judge to dismiss parts of The New York Times’ lawsuit against it, alleging that the media company “paid someone to hack OpenAI’s products.” Read more at: https://www.cnbc.com/2024/02/27/openai-alleges-new-york-times-hacked-chatgpt-for-lawsuit-evidence.html |

|

Ukraine war updates: Russia claims to have inflicted massive losses on Ukraine as defense ministry hails gains in eastFrench President Emmanuel Macron said Monday that the sending of Western troops to Ukraine has not been “ruled out” by the country’s allies. Read more at: https://www.cnbc.com/2024/02/27/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Cava stock pops after blunder leads to early earnings releaseThe Mediterranean chain topped Wall Street’s estimates for both its earnings and revenue. Read more at: https://www.cnbc.com/2024/02/27/cava-stock-pops-after-blunder-leads-to-early-earnings-release.html |

|

For Black workers, progress in the workplace but still a high hill to climbLooking at the state of Black employment in America tells a mixed story. Read more at: https://www.cnbc.com/2024/02/27/for-black-workers-progress-in-the-workplace-but-still-a-high-hill-to-climb.html |

|

House GOP’s budget ‘poison pills’ could force spending cuts, rattle economyCongress is scrambling to negotiate a spending deal to avert a full government shutdown on March 8. Read more at: https://www.cnbc.com/2024/02/27/house-gop-poison-pills-may-force-spending-cuts-rattle-economy.html |

|

Viking stock doubled Tuesday. Here’s where the next moves in the obesity space could come fromAnti-obesity drugmakers Novo Nordisk and Eli Lilly have a huge lead on their competition, but it’s coming. Read more at: https://www.cnbc.com/2024/02/27/viking-stock-doubled-tuesday-heres-where-the-next-moves-in-the-obesity-space-could-come-from.html |

|

What Happens When The VIX Spikes, But Traders Aren’t “Actually” Worried?SpotGamma invites readers to please join them tonight at 8pm EST for a free webinar on the VIX and the coming March option expiration, to learn how the fear gauge actually works – click here for the Free VIX Webinar The S&P500 looks like it is entering into a digestion phase into the key March OPEX, which could result in the VIX breaking back down to year-to-date lows. Into Thursday’s (2/22) record SPX close near 5,100, 1-month SPX skew showed that upside strikes (i.e. calls) had relatively higher IV’s than at any time vs last several months, as shown by the skew plot (below, green line) being above the shaded cone (red box). However, the IV’s for upside strikes did not increase into Thursday’s 2% SPX rally, which is shown by the current skew (green line) staying flat to Tuesday’s close (gray line). This signals that S&P call buyers didn’t chase strikes >5,100 into Thursday’s record move. Read more at: https://www.zerohedge.com/markets/what-happens-when-vix-spikes-traders-arent-actually-worried |

|

Houthis Deny Israeli Media Reports They Sabotaged Internet Cables Under Red SeaUpdate(1440ET): The Houthi military spokesman has explicitly denied any intention to knock out undersea regional internet cables in a fresh Tuesday statement, however, he reiterated that the Iran-linked group’s top goal is to block commercial shipping and supplies to Israel. The full statement is as follows, cited in Al Mayadeen news: “We are keen to spare all cables and their services from any risks and to provide the necessary facilities for their maintenance. The decision to prevent the passage of Israeli ships does not include ships belonging to international companies licensed to carry out marine cable work.” Over the past two days there were widespread reports that up to four undersea telecoms cables in the Red Sea area between the Saudi city of Jeddah and the state of Djibouti were damaged. As we reported below, the operator Seacom reported connectivity problems, following reports which originated in Israeli media sources. Sky News Arabia had also picked up on the reports Monday. For months there has been speculation that Red Sea waters, which has been scene of daily Houthi attacks on international shipping as well as Western coalition warships, could be subject to sabotage of global fiber optics lines. However, such a sabotage campaign would be difficult to carry out, given it would likely require submarine or deep water equipment and capabilities, which the Houthis likely lack. Read more at: https://www.zerohedge.com/geopolitical/houthis-have-knocked-out-several-undersea-internet-cables-report |

|

“I’m Done With Google”: Wholesale Loss Of Trust After “Unbelievably Irresponsible” Racist AI Goes Mask-OffThe fact that Google’s Gemini AI is a complete woke mess comes as no surprise to anyone who’s been paying attention.

Between Google’s internal culture, and the fact that large language models (LLMs) are largely a reflection of their creators, Gemini is was the predictable digital poster-child for racist, anti-white, anti-conservative, historical revisionist culture – as opposed to the neutral purveyors of information they claim to be. Mask-off, as they say. In fact, we couldn’t sum it up better than Mario Juric, director of the DiRAC Institute at the University of Washington, Seattle. In a lengthy post on X, Juric says that despite known “many good individuals working there,” he’s “done with @Google.”

|

|

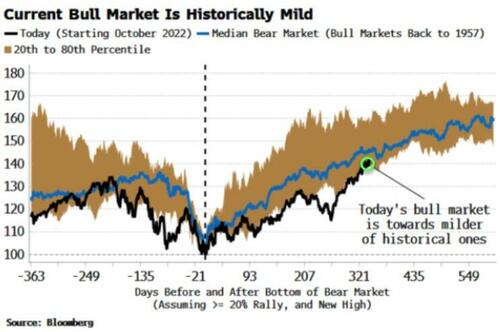

Stock Bull Market Might Just Be Getting Started, But…Authored by Simon White, Bloomberg macro strategist, The rally in equities might have much further to go, based on the positive outlook for liquidity. It might not seem like it after a seemingly relentless advance and fevered speculation, but the new bull market is comparatively mild versus the postwar past.

Yet that could change. Excess liquidity – the difference between real money growth and economic growth – shows that the stock rally could have much further to go, turning a so-far historically below-par bull market into one that’s above the past average. There are many reasons why this might not transpire… As a natural cynic, I’m more comfortable when the outlook is pessimistic (no room for disappointment) versus when it is optimistic (plenty of opportunity to end up with egg on your face when things do go wrong after all). But sometimes the data just isn’t there to support a downbeat view. … Read more at: https://www.zerohedge.com/markets/stock-bull-market-might-just-be-getting-started |

|

Post Office boss under investigation, claims ex-chairHenry Staunton makes shock allegation under oath to MPs in hearing about postmasters’ compensation. Read more at: https://www.bbc.co.uk/news/business-68411615?at_medium=RSS&at_campaign=KARANGA |

|

Hunt considers National Insurance cuts at BudgetNews of the possible move comes as a leading think tank says the case for cutting taxes is “weak”. Read more at: https://www.bbc.co.uk/news/business-68406450?at_medium=RSS&at_campaign=KARANGA |

|

Currys rejects second takeover offer from US firm ElliottThe electronics chain says US company Elliot’s £757m offer “significantly undervalued” it. Read more at: https://www.bbc.co.uk/news/business-68416951?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms bullish engulfing chart as expiry nears. What traders should do on WednesdayThe near-term uptrend status of Nifty remains positive and bullish chart patterns like higher tops and bottoms are also intact. At the same time, the market is not gaining strength to witness an upside breakout of 22,200-22,300 levels decisively. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bullish-engulfing-chart-as-expiry-nears-what-traders-should-do-on-wednesday/articleshow/108045263.cms |

|

Technical Stock Pick: 20% rally in 3 months! This pharma stock breaks out from a rounding bottom pattern; time to buy?Short-term traders can look to buy the stock now for a target of Rs 590 in the next 3 months, suggest experts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-stock-pick-20-rally-in-3-months-this-pharma-stock-breaks-out-from-a-rounding-bottom-pattern-time-to-buy/articleshow/108032074.cms |

|

Bitcoin tops $57,000 mark for first time since late 2021The digital asset added as much as 4.4% to reach $57,039 before paring some of the jump to trade at $56,473 as of 10:22 a.m. Tuesday in Singapore. Bitcoin’s price has increased 33% since the turn of the year, extending a prolonged rally that has also stoked speculative appetite for smaller tokens like Ether and BNB. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/bitcoin-tops-53000-to-reach-highest-in-more-than-two-years/articleshow/108026172.cms |

|

Are U.S. stocks in a bubble? History says no.The S&P 500’s torrid and top-heavy advance over the past year has convinced some bearish investors that U.S. stocks are in a bubble. But history says otherwise. Read more at: https://www.marketwatch.com/story/are-u-s-stocks-in-a-bubble-history-says-no-0f958beb?mod=mw_rss_topstories |

|

Bitcoin-related stocks, ETFs rise as the crypto approaches new record highBitcoin-related stocks and funds rose on Tuesday, as the cryptocurrency’s price climbed above $57,000 to the highest level seen since it hit an all-time high in November 2021. Read more at: https://www.marketwatch.com/story/bitcoin-related-companies-funds-rise-as-the-crypto-approaches-new-record-high-1a5ec9b5?mod=mw_rss_topstories |

|

Long-term Treasury yields end higher for second day ahead of PCE inflation data this weekTreasury yields finished mixed on Tuesday as traders look ahead to this week’s U.S. inflation data. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-as-traders-eye-important-inflation-data-0bca568e?mod=mw_rss_topstories |