Summary Of the Markets Today:

- The Dow closed up 126 points or 0.33%,

- Nasdaq closed down 0.30%,

- S&P 500 closed down 0.09%,

- Gold $2,034 down $4,40,

- WTI crude oil settled at $77 up $0.23,

- 10-year U.S. Treasury 4.166% down 0.021 points,

- USD index $104.12 up $0.01,

- Bitcoin $50,226 up $2,216 (4.62%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

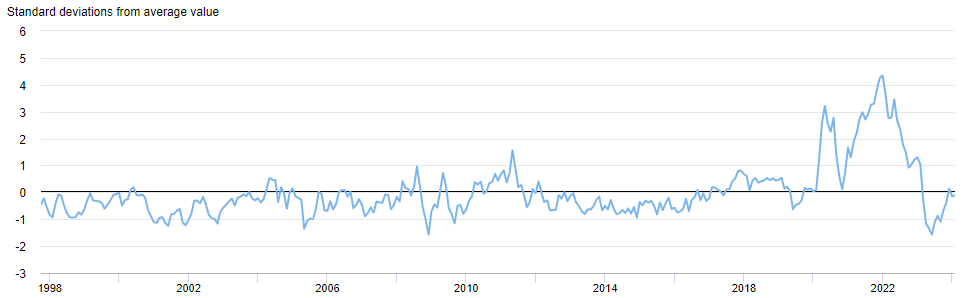

Global Supply Chain Pressure Index (GSCPI) for February 2024 rose to -0.11 in January, up from -0.15 in December. GSCPI readings measure standard deviations from the index’s historical average. This index uses input from the Baltic Dry Index (BDI) and the Harpex index, as well as airfreight cost indices from the U.S. Bureau of Labor Statistics. These current readings show the supply chain is not under stress and is near the historical average despite the disruptions in the Red Sea.

Here is a summary of headlines we are reading today:

- How Fracking Helped the U.S. Become the World’s Top Oil Producer

- Trinidad & Tobago Declares National Emergency after Ghost Ship Oil Spill

- Houthis Strike Greek Ship in Red Sea Due to ‘American’ NASDAQ Listing

- Plunging Oil and Gas Sales Drag Russia’s Exports to Europe Down by 68%

- Dow rises more than 100 points to close at a record: Live updates

- Bitcoin extends its gains, breaking through the $50,000 level

- JetBlue resets with new CEO, industry veterans to run airline on time, and profitably

- Trump’s NATO comments stir up a political storm as Russia keeps quiet

- Jeff Bezos just sold $2 billion in Amazon stock. That doesn’t mean you should sell too.

- The AI machines are not coming for your job

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Fracking Helped the U.S. Become the World’s Top Oil ProducerOver the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia. This infographic, via Visual Capitalist’s Omri Wallach, illustrates the rise of the U.S. as the biggest oil producer, based on data from the U.S. Energy Information Administration (EIA). U.S. Takes Lead in 2018 Over the last three decades, the United States, Saudi Arabia, and Russia have alternated as the top crude producers, but always by small margins. During the 1990s, Saudi Arabia dominated crude… Read more at: https://oilprice.com/Energy/Crude-Oil/How-Fracking-Helped-the-US-Become-the-Worlds-Top-Oil-Producer.html |

|

Uzbekistan’s Trade Deficit with China DeepensUzbekistan wants to develop an “all-weather strategic partnership” with China. But trade statistics for 2023 indicate the developing relationship between Tashkent and Beijing is far from one of equals. Uzbek President Shavkat Mirziyoyev traveled to China in late January, meeting with Chinese leader Xi Jinping. The two countries signed an array of agreements during Mirziyoyev’s visit that a presidential statement said would “enrich the content” of their strategic partnership. The bilateral documents signed in… Read more at: https://oilprice.com/Geopolitics/International/Uzbekistans-Trade-Deficit-with-China-Deepens.html |

|

Norwegian Intelligence Warns of Risk of Attack from RussiaA British warship departed for Norway on Monday to take part in NATO war exercises, as Norway’s security chief told Reuters that the country’s oil and gas installations were at risk of attack by Russia. “I am concerned about dependency, and there is no doubt that Europe has become more dependent on Norwegian gas,” Lars Christian Aamodt, head of the National Security Authority, told Reuters. “As soon as the dependency increases, so will the threat and the risk,” he said. Furthermore, the Norwegian security chief predicted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norwegian-Intelligence-Warns-of-Risk-of-Attack-from-Russia.html |

|

Economist Warns of AI Bubble in U.S. Equity MarketHigher interest rates are unlikely to cause a major systemic risk but anxious investors should be wary of the continued AI-fuelled exuberance in the US stock market. In a note published yesterday, Paul Dales, chief UK economist at Capital Economics, said it was “too early” to be sure that higher rates would not cause further fractures in the financial system. Nevertheless, “the chances of a systemic financial event are diminishing,” he argued. Interest rates were near zero for over a decade following the financial crisis… Read more at: https://oilprice.com/Finance/the-Markets/Economist-Warns-of-AI-Bubble-in-US-Equity-Market.html |

|

Trinidad & Tobago Declares National Emergency after Ghost Ship Oil SpillThe prime minister of Trinidad and Tobago has declared a “national emergency” following a large offshore oil spill in the eastern Caribbean. “This is a national emergency and therefore it will have to be funded as an extraordinary expense,” Rowley said. “We don’t know the full scope and scale of what is going to be required,” the prime minister added. The oil spill was caused when a vessel overturned near Tobago last week, with the cause of the accident still under investigation, with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trinidad-Tobago-Declares-National-Emergency-after-Ghost-Ship-Oil-Spill.html |

|

Rapid EV Adoption Risks Tying U.S. to Chinese InterestsAuthored by James Marks via RealClear Wire, Normally a new year brings a renewed focus on getting things done in Washington. But with Congress accomplishing little in 2023 and attentions now shifting to the November elections, it is more prudent than ever that the policy agenda of our nation’s leaders reflect what’s best for our collective future, not politics. Take this administration’s campaign to spread electric-vehicle (EV) technologies. There is no doubt that EVs will be part of America’s future. But decisions made… Read more at: https://oilprice.com/Energy/Energy-General/Rapid-EV-Adoption-Risks-Tying-US-to-Chinese-Interests.html |

|

Aramco’s CEO Says Shareholders to Decide on Further Stock SaleShareholders in Saudi Aramco will decide whether the world’s largest oil firm will proceed with a new share offering this year, Aramco’s chief executive Amin Nasser said on Monday, as carried by Reuters. Currently, the Kingdom of Saudi Arabia owns just over 98% of Aramco after selling 1.7% in the initial public offering (IPO) in December 2019. Of the 98% held by the Kingdom, the Saudi government owns 90% of Aramco, while the sovereign wealth fund owns the other 8%. Reports emerged last month that Saudi Arabia was working… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aramcos-CEO-Says-Shareholders-to-Decide-on-Further-Stock-Sale.html |

|

Houthis Strike Greek Ship in Red Sea Due to ‘American’ NASDAQ ListingYemen’s Iran-backed Houthis fired two missiles at a Greek-operated vessel reportedly carrying corn to Iran through the Red Sea on Monday, causing damage to the vessel but no casualties. The vessel, the Star Iris, failed to escape Houthi attacks near the Bab el-Mandeb Strait in the Red Sea despite the fact that its cargo was bound for Iran, with the Houthis describing the vessel as American-owned. The ultimate owner of the vessel is Greek-based Star Bulk Carriers Corp, which is traded on the New York-based NASDAQ stock market. … Read more at: https://oilprice.com/Energy/Energy-General/Houthis-Strike-Greek-Ship-in-Red-Sea-Due-to-American-NASDAQ-Listing.html |

|

Barclays Looks to Avoid Greenwashing While Financing the Energy TransitionUK banking giant Barclays is looking to avoid claims of greenwashing with a new set of guidelines about what ‘transition finance’ is and how its new transition finance team should apply it. The bank, which has just published its ‘Barclays Transition Finance Framework’, says in the document that “As there is no universal consensus as to how to define “transition” activities, for purposes of financings included in our Target, Barclays has developed its own definition of transition finance.” Per Barclays’… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Barclays-Looks-to-Avoid-Greenwashing-While-Financing-the-Energy-Transition.html |

|

Russia’s Gazprom Awarded Iraq’s Huge Nasiriyah Oil DevelopmentRussian gas giant Gazprom has been awarded the development contract for the supergiant Nasiriyah oil field in Iraq’s strategic southern eastern region close to the main export terminal of Al Fao in Basra. At around the same time, it was announced that China Petroleum Engineering and Construction Corp (CPECC) and PetroChina will complete the critically important Halfaya gas project by the end of Q1 this year. The Halfaya field lies 175 kilometres to the northeast of the Nasiriyah oil field and, together with Basra to the south, form a triangle… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Gazprom-Awarded-Iraqs-Huge-Nasiriyah-Oil-Development.html |

|

Plunging Oil and Gas Sales Drag Russia’s Exports to Europe Down by 68%Russia’s exports to Europe plunged by 68% last year, compared to 2022, dragged down by significantly lower EU imports of oil and gas from Russia, according to official Russian data. The value of Russian exports to Europe plummeted by 68% year-on-year to $84.9 billion in 2023, Agence France Presse (AFP) quoted a report from the Russian news agency Interfax based on data by the Russian federal customs agency. Since the invasion of Ukraine, Russia has stopped publishing trade data with individual countries and is not reporting the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Plunging-Oil-and-Gas-Sales-Drag-Russias-Exports-to-Europe-Down-by-68.html |

|

90,000 NATO Troops Mobilize in “Biggest Exercise” Since Cold WarIn late January, NATO began what it has called its “largest military exercise since the Cold War.” Steadfast Defender 24 involves 90,000 troops from all 31 alliance members as well as NATO invitee Sweden for four months of maneuvers by land, sea, and air. You have to go all the way back to 1988 for the last NATO exercise that involved more troops: Reforger with 125,000. In between, the Trident Juncture exercise in 2018 included 50,000 personnel. While official NATO documents don’t say outright that they’re training against… Read more at: https://oilprice.com/Geopolitics/International/90000-NATO-Troops-Mobilize-in-Biggest-Exercise-Since-Cold-War.html |

|

Iraq Remains Committed to OPEC+ Deal to Cap Oil Output at 4 Million BpdOPEC’s second-largest producer, Iraq, is committed to its voluntary cut in the OPEC+ agreement and will produce no more than 4 million barrels per day (bpd) of crude oil, Iraq’s Oil Minister Hayan Abdel-Ghani said on Monday. Iraq, which pumped 4.292 million bpd in December, per OPEC’s secondary sources, is one of several OPEC+ producers who pledged at the end of November to make voluntary cuts to their crude oil production in the first quarter of 2024. Iraq announced a production cut of 223,000 bpd between January 1… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-Remains-Committed-to-OPEC-Deal-to-Cap-Oil-Output-at-4-Million-Bpd.html |

|

Austria Looks to Cut Its Dependence on Russian Natural GasAustria, one of the few EU countries still receiving Russian natural gas by pipeline, is looking to reduce its dependence on Moscow, including by seeking to end a long-term deal that Austria-based energy giant OMV has with Gazprom, Austrian Energy Minister Leonore Gewessler said on Monday. “Austria has become massively dependent on Russian gas in recent decades. Despite government efforts, the share of Russian natural gas in Austria’s gas import mix remains too high,” said Gewessler, who is part of the Green party, a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Austria-Looks-to-Cut-Its-Dependence-on-Russian-Natural-Gas.html |

|

Saudi Arabia Says Energy Transition Drove Decision to Halt Capacity ExpansionThe decision of Saudi Arabia to abandon plans to expand its crude oil production capacity is a result of the energy transition, Saudi Energy Minister, Prince Abdulaziz bin Salman, said on Monday. At the end of last month, Saudi Arabia surprised the oil market by announcing a shift in production capacity strategy. State oil giant Aramco said it was ordered by the Kingdom’s leadership to stop work on expanding its maximum sustainable capacity to 13 million barrels per day, instead keeping it at 12 million bpd. The world’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Says-Energy-Transition-Drove-Decision-to-Halt-Capacity-Expansion.html |

|

Dow rises more than 100 points to close at a record: Live updatesThe Down Jones Industrial Average rose on Monday ahead of a week full of key economic data releases. Read more at: https://www.cnbc.com/2024/02/11/stock-market-today-live-updates.html |

|

Arm shares jump 25% as post-earnings rally extends to second weekArm’s strong growth forecast has led investors to declare it an artificial intelligence darling. Read more at: https://www.cnbc.com/2024/02/12/arm-stock-up-25percent-extending-rally-to-second-week.html |

|

Bitcoin extends its gains, breaking through the $50,000 levelBitcoin extended its gains from last week, breaking through the key psychological level of $50,000. Read more at: https://www.cnbc.com/2024/02/12/crypto-market-today.html |

|

Jeff Bezos will save over $600 million in taxes by moving to MiamiBezos plans to unload 50 million shares of Amazon before Jan. 31, 2025. Posting those sales in Florida will save him millions. Read more at: https://www.cnbc.com/2024/02/12/jeff-bezos-move-to-miami-will-save-him-over-600-million-in-taxes.html |

|

Look out above and below. These stocks are expected to see the biggest moves this weekSeveral consumer and technology companies are among those forecast to score the biggest moves after reporting quarterly results this week. Read more at: https://www.cnbc.com/2024/02/12/dont-look-now-these-stocks-may-see-the-biggest-moves-this-week.html |

|

Super Bowl 2024 ads recap: DoorDash, DunKings, Beyoncé and the most-talked about commercialsThe Super Bowl is advertising’s biggest stage, with companies jockeying for a limited supply of spots to get their products in front of millions of consumers. Read more at: https://www.cnbc.com/2024/02/11/super-bowl-ads-2024-live-updates.html |

|

Trump Georgia election judge may force D.A. to testify in disqualification hearingDonald Trump and more than a dozen others are charged with crimes related to trying to overturn his 2020 election loss in Georgia to President Joe Biden. Read more at: https://www.cnbc.com/2024/02/12/georgia-da-in-trump-election-case-may-have-to-testify-at-hearing.html |

|

Bitcoin inches toward $50,000 as spot ETF inflows accelerate: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alex Miller, the CEO of Hiro, explains what’s driving bitcoin’s moves higher. Hiro is a company building development tools for Stacks, which aims to bring Ethereum-like capabilities to Bitcoin. Miller also explains how programmability is being brought to the bitcoin ecosystem and the implications for adoption. Read more at: https://www.cnbc.com/video/2024/02/12/bitcoin-inches-toward-50000-as-spot-etf-inflows-accelerate-cnbc-crypto-world.html |

|

JetBlue resets with new CEO, industry veterans to run airline on time, and profitablyJetBlue is struggling with reliability and controlling costs. Its new CEO and veteran executives are hoping to get back to basics. Read more at: https://www.cnbc.com/2024/02/12/jetblue-resets-with-new-ceo-joanna-geraghty-airline-veterans.html |

|

This construction ETF is breaking out with no sell signals on the horizon, according to the chartsThe Global X US Infrastructure Development ETF (PAVE) has been a source of strength over the past few years. Read more at: https://www.cnbc.com/2024/02/12/this-construction-etf-is-breaking-out-with-no-sell-signals-on-the-horizon-according-to-the-charts.html |

|

Biden has forgiven $136 billion in student debt. More relief is on the wayMore than 3.7 million borrowers have gotten their student debt forgiven while President Joe Biden is in office. With more relief expected, here’s what to know. Read more at: https://www.cnbc.com/2024/02/12/biden-has-forgiven-136-billion-in-student-debt.html |

|

Trump’s NATO comments stir up a political storm as Russia keeps quietTrump’s comments have thrust the Republican front-runner into the center of a political storm and sent shockwaves throughout the Western military alliance. Read more at: https://www.cnbc.com/2024/02/12/russia-keeps-quiet-as-trumps-nato-comments-stir-up-a-political-storm.html |

|

Trading CPI: Where JPMorgan traders see the market going, based on these scenariosInvestors are hoping a downward trend in inflation means the Federal Reserve can start to cut interest rates. Read more at: https://www.cnbc.com/2024/02/12/trading-cpi-where-jpmorgan-traders-see-the-market-going-based-on-these-scenarios.html |

|

NATO Chief Shocks With Prediction Of ‘Decades-Long Confrontation’ With RussiaNATO Secretary General Jens Stoltenberg issued some shocking words over the weekend which the Kremlin will likely take as a threat. “NATO is not looking for war with Russia. But we have to prepare ourselves for a confrontation that could last decades,” he told German daily Welt am Sonntag on Saturday. His words also reflect a new emphasis and drive among NATO planners for European countries to urgently invest more heavily in defense and domestic weapons production, as is happening for example in Germany and France. So far, defense leaders and officials from NATO countries have tended to speak about a time frame of the conflict lasting “years” – but to hear Stoltenberg tell the West it must brace for a war going on for “decades” is somewhat unprecedented. “If Putin wins in Ukraine, there is no guarantee that Russian aggression will not spread to other countries,” Stoltenberg continued, echoing an assumption that’s been a persistent talking point out of Zelensky and his Western backers. Read more at: https://www.zerohedge.com/geopolitical/nato-chief-shocks-prediction-decades-long-confrontation-russia |

|

Meet Dr. Kathleen Hicks – SecDef Austin’s Presumptive Replacement Woke Deep-StaterAuthored by Bob Bishop via Sonar21.com, Lloyd Austin underwent an invasive surgical procedure called a prostatectomy for his prostate cancer. He was readmitted to the ICU ward of Walter Reed National Military Medical Center seven days later, on January 1st, due to complications caused by a severe infection. It appears he was septic. He concealed his inability to carry out his duties from Biden, Congress, the Pentagon, and his Deputy Secretary, Dr. Kathleen Hicks. On January 4th, finally becoming aware of Austin’s hospitalization, security adviser Jake Sullivan notified Hicks, who was on vacation in Puerto Rico.

Even though Biden continued to back Austin, Austin was already politically skating on cracked thin ice due to the colossal failure of the Afghanistan military withdrawal. Predictably, he will resign. His presumptive replacement is Hicks. Few are aware of Hicks’s woke, deep-state bac … Read more at: https://www.zerohedge.com/political/meet-dr-kathleen-hicks-secdef-austins-presumptive-replacement-woke-deep-stater |

|

Biden Rejects Putin’s Offer For Negotiations On Ukraine Issued In Tucker Carlson InterviewLast week in the wake of the Tucker Carlson interview with Russia’s President Putin, we highlighted that Putin’s offer to the West to negotiate the end of the Ukraine war appeared genuine. “We are willing to negotiate,” Putin told Carlson in the lengthy interview. Importantly he said in reference to the US government: “You should tell the current Ukrainian leadership to stop and come to the negotiating table.” We further noted that Russian media is touting the widely watched interview as the first time Putin has offered ‘concrete conditions’ which can lead to settlement. “I think the most important message in Putin’s interview is that Russia is ready for for a political or diplomatic solution of the Ukraine conflict,” said Dmitry Suslov, deputy director of the Center for European and International Studies at Russia’s Higher School of Economics, to Russia’s Sputnik. “But it requires a political will from the United States.” he said. The overture’s significance also lies in the fact that Russia is winning the war, and thus has less reason to enter negotiations at this moment of having the clear upper hand. This fact alone means Putin’s words could represent a significant and authentic invitation to start serious talks. But perhaps to be expected, … Read more at: https://www.zerohedge.com/geopolitical/biden-rejects-putins-offer-negotiations-ukraine-issued-tucker-carlson-interview |

|

Kirby Cornered Over Biden-TikTok Push, While Migrants Continue To Use App For Border MalarkeyIt hasn’t gone unnoticed that Joe Biden’s Sunday announcement that he’s joined TikTok contradicts the administration’s stance on the app, which remains banned on government devices. When asked during a Monday presser about the announcement, White House spox John Kirby said that the concerns over the app are more over the “preservation of data and the potential misuse of that data and privacy information by foreign actors.” Watch:

|

|

Deliveroo and Uber Eats riders strike on Valentine’s DayThe action, affecting firms such as Deliveroo and Uber Eats, is in a dispute over pay and conditions. Read more at: https://www.bbc.co.uk/news/business-68274158?at_medium=RSS&at_campaign=KARANGA |

|

Three apologises as thousands without mobile service across UKThe firm said its engineers were working hard to fix the issues affecting its network. Read more at: https://www.bbc.co.uk/news/technology-68243283?at_medium=RSS&at_campaign=KARANGA |

|

Wylfa: UK government in talks to buy nuclear site – reportThe UK government says Wylfa is one of many “potential sites” that could host nuclear projects. Read more at: https://www.bbc.co.uk/news/uk-wales-68273910?at_medium=RSS&at_campaign=KARANGA |

|

ETMarkets Fund Manager Talk: This fund manager sees investment opportunities in 6 sectors during a rate-cut cycleSiddharth Voraa says: “Within this broader landscape, while Indian equities do reflect steeper valuations, they continue to be supported by robust domestic macros and fundamentals. Despite indications of elevated valuations based on various fundamental and technical metrics, historical trends suggest that premium valuations and euphoric sentiment in markets can persist for 3-6 months on an average before normalizing.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-fund-manager-talk-this-fund-manager-sees-investment-opportunities-in-6-sectors-during-a-rate-cut-cycle/articleshow/107613179.cms |

|

Premji Invest-backed Gold Plus Glass files DRHP for IPO; fresh issue size Rs 500 croreThe IPO comprises a fresh issue of shares worth Rs 500 crore, and an offer for sale of 1.57 crore shares by two promoters – Suresh Tyagi and Jimmy Tyagi – besides Premji Invest-owned PI Opportunities Fund I, and Kotak Special Situations Fund. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/premji-invest-backed-gold-plus-glass-files-drhp-for-ipo-fresh-issue-size-rs-500-crore/articleshow/107635649.cms |

|

Tech View: Nifty may remain on sell-on-rise mode. What traders should do on TuesdayThe momentum indicator aligns with this bearish outlook, displaying a crossover. Nifty might remain in sell-on-rise mode as long as it remains below 21,850. On the downside, support is situated at 21,500, Rupak De of LKP Securities said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-may-remain-on-sell-on-rise-mode-what-traders-should-do-on-tuesday/articleshow/107632439.cms |

|

Growth stocks are outperforming value by widest margin on record. Why that could soon change.Value stocks haven’t been this cheap relative to growth stocks in more than 30 years. Read more at: https://www.marketwatch.com/story/growth-stocks-are-outperforming-value-by-widest-margin-on-record-why-that-could-soon-change-34d35ab9?mod=mw_rss_topstories |

|

Jeff Bezos just sold $2 billion in Amazon stock. That doesn’t mean you should sell too.The Amazon founder’s past sales “have not been good predictors” of stock performance, notes an expert. Read more at: https://www.marketwatch.com/story/jeff-bezos-just-sold-2-billion-in-amazon-stock-that-doesnt-mean-you-should-sell-too-6f0248a2?mod=mw_rss_topstories |

|

The AI machines are not coming for your jobAI will transform the way we work, but there is no reason to be fearful. Read more at: https://www.marketwatch.com/story/the-ai-machines-are-not-coming-for-your-job-e536d5a6?mod=mw_rss_topstories |