Summary Of the Markets Today

- The Dow up 0.2%,

- Nasdaq up 10.2%,

- S&P 500 up 0.5%,

- WTI crude oil down $22.24 to $102.91,

- gold up $3 to $1,866,

- Bitcoin down 2.1% to $37,659,

- 10-year U.S. Treasury down 2 basis points to 2.98%

Today’s Economic Releases

According to Corelogic, home price growth jumped to over 20% in March, marking the 14th straight month of double-digit price gains. However, annual gains are projected to slow to around 6% by next March, as rising mortgage rates and higher home prices hamper affordability for some home shoppers.

The BLS March 2022 Job Openings and Labor Turnover (JOLTS) shows job openings and hires were little changed at 11.5 million and 6.7 million respectively.

Other Economic News

As usual, we have included below the headlines and news summaries moving the markets today including:

- Shale Producers Face $42 Billion In Hedging Losses

- New Lockdowns In China Are Hindering Global Steel Supply

- Putin Publishes New Sanctions Against The West

- NASA chief says competition is making space exploration cheaper, in dramatic shift on contracts

- Russia beats final deadline to avoid debt default

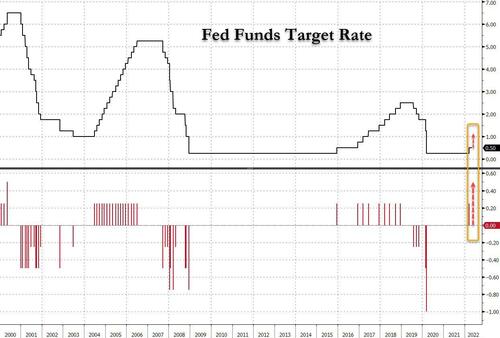

- How high can the Fed hike interest rates before a recession hits? This chart suggests a low threshold.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Shale Producers Face $42 Billion In Hedging LossesWith earnings season underway, Americas shale producers are expected, almost across the board, to report stellar earnings, but as Bloomberg reports, theyll also be taking huge losses from hedging against falling oil prices. In total, BloombergNEF estimates that through next year, U.S. shale companies will face $42 billion in oil and gas hedging losses, based on 2021 data. That means that while balance sheets might remain intact, companies will spend big to exit positions. BloombergNEF notes that Hess Corp found itself Read more at: https://oilprice.com/Energy/Crude-Oil/Shale-Producers-Face-42-Billion-In-Hedging-Losses.html |

|

The Calm Before The Storm In Oil MarketsThe first week of May could have brought us a much-awaited paradigm shift, however the markets still appraise the impact of Chinas COVID lockdowns amidst the mass-testing taking place in Beijing and the probability of a comprehensive European embargo on Russian oil. With no clear way out for either of those, Brent futures remained range bound, closing Tuesday around $106 per barrel. Amid Faltering Demand Prospects – Whilst OPEC+ is widely expected to agree to another monthly increase of 432,000 b/d, the widening gap between the oil groups Read more at: https://oilprice.com/Energy/Crude-Oil/The-Calm-Before-The-Storm-In-Oil-Markets.html |

|

EU Prepares New, Imminent Sanctions Against RussiaMinutes after Russian President Vladimir Putin authorized a new decree on retaliatory sanctions against the West, the European Union has announced a lineup of new sanctions on Russia targeting banking, oil imports and disinformation campaigns, Reuters reports. “We are working on the sixth package of sanctions which aims to de-SWIFT more banks, list disinformation actors and tackle oil imports,” Josep Borrell, head of the foreign policy unit at the EU’s executive European Commission, said in a tweet. The EU adopted its fifth round of sanctions Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Prepares-New-Imminent-Sanctions-Against-Russia.html |

|

New Lockdowns In China Are Hindering Global Steel SupplyIts first-year economics: everything comes down to supply and demand. Historically, the push and pull between these two massive market forces are cyclical, and that includes steel. When you have more demand than supply, prices go up. Eventually, the prices get so high that people stop buying. After a while, the steel supply builds up, and prices plummet, leading to a surge in demand once again. Its a familiar dance at least, it used to be. That was before the war in Ukraine, Chinas ongoing lockdowns, and global supply Read more at: https://oilprice.com/Metals/Commodities/New-Lockdowns-In-China-Are-Hindering-Global-Steel-Supply.html |

|

Analysts Expect Crude Inventories To Fall Again This WeekAhead of todays API inventory data and official EIA data to be released on Wednesday, a Wall Street Journal survey shows analysts and traders expecting another drop in U.S. crude oil stockpiles for the week ended April 29th. Analysts and traders surveyed by WSJ anticipate a 200,000 fall in U.S. oil inventories and a 300,000 barrel drop in gasoline stockpiles. Of the 11 analysts surveyed by WSJ, seven are predicting a decrease and four, an increase in crude oil inventories. They also expect distillates to record a decrease Read more at: https://oilprice.com/Latest-Energy-News/World-News/Analysts-Expect-Crude-Inventories-To-Fall-Again-This-Week.html |

|

Russia Retaliates: Putin Publishes New Sanctions Against The WestRussian President Vladimir Putin has threatened to terminate exports and deals with the West and add certain individuals and entities to the Kremlins sanctions list in retaliation for sanctions imposed by the United States and the European Union. Russian President Vladimir Putin introduced a package of economic measures on Tuesday to retaliate against international sanctions placed on Moscow. The decree, published on the Kremlin website, was in connection with the unfriendly actions of the United States and its allies Read more at: https://oilprice.com/Geopolitics/International/Russia-Retaliates-Putin-Publishes-New-Sanctions-Against-The-West.html |

|

NASA chief says competition is making space exploration cheaper, in dramatic shift on contractsNelson’s emphasis on competition likely represents a boon for the growing swath of space companies looking to provide low-cost services to NASA Read more at: https://www.cnbc.com/2022/05/03/nasas-nelson-competitive-contracts-are-making-space-exploration-cheaper.html |

|

If Supreme Court reverses Roe v. Wade, up to half of U.S. expected to ban or severely restrict abortionThe Supreme Court confirmed the authenticity of a draft opinion that would eliminate the federal right to abortion. But Roe v. Wade remains the law of the land for now. Read more at: https://www.cnbc.com/2022/05/03/supreme-court-ruling-undoing-roe-abortion-case-would-spark-state-bans.html |

|

Starbucks revenue tops estimates as U.S. sales growth offsets declines in ChinaIt’s Howard Schultz’s first earnings report since taking back the top job at Starbucks in early April. Read more at: https://www.cnbc.com/2022/05/03/starbucks-sbux-q2-2022-earnings.html |

|

Southwest to offer free Wi-Fi on some flights as it tests service upgradesThe free Wi-Fi on Southwest will be available from May 4 through June 10 on certain flights in the western U.S. Read more at: https://www.cnbc.com/2022/05/03/southwest-offers-free-wi-fi-on-some-flights-to-test-service-upgrades.html |

|

Water is so low in the Colorado River, feds are holding some back so one dam can keep generating powerThe decision will keep more water in Lake Powell, the reservoir located at the Glen Canyon Dam in northern Arizona. Read more at: https://www.cnbc.com/2022/05/03/lake-powell-glen-canyon-dam-water-release-delayed-due-to-drought.html |

|

Paxlovid prescriptions to treat Covid increased tenfold in U.S. since late February, Pfizer saysCEO Albert Bourla said Paxlovid prescriptions in the U.S. increased to 80,000 patients for the week ending April 22, up from 8,000 patients in late February. Read more at: https://www.cnbc.com/2022/05/03/pfizer-paxlovid-prescriptions-to-treat-covid-increased-tenfold-in-us-since-late-february.html |

|

Tim Hortons’ comeback takes hold as coffee chain forecasts another year of Canadian same-store sales growthTim Hortons is anticipating Canadian same-store sales growth in the mid-to-high single digits in 2022 as its turnaround takes hold in its home market. Read more at: https://www.cnbc.com/2022/05/03/tim-hortons-forecasts-another-year-of-canadian-same-store-sales-growth.html |

|

Stocks making the biggest moves midday: Chegg, Expedia, BP and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/03/stocks-making-the-biggest-moves-midday-chegg-expedia-bp-and-more.html |

|

Here’s where I bonds may work in your portfolio, according to financial advisorsI bonds are currently paying 9.62% annual interest through October, which is an opportunity for a range of goals, according to financial experts. Read more at: https://www.cnbc.com/2022/05/03/heres-where-financial-advisors-say-i-bonds-may-work-in-your-portfolio.html |

|

Office demand comes roaring back as stocks in the space play catch-upAfter a five-month lull due to the omicron variant, office demand is surging back again, albeit slowly for the office stocks. Read more at: https://www.cnbc.com/2022/05/03/office-demand-comes-roaring-back-as-stocks-in-the-space-play-catchup.html |

|

Trump Organization, inaugural committee must pay DC attorney general $750K over claims of misspent nonprofit fundsThe Trump Organization settled a lawsuit involving the inaugural committee for Donald Trump, but he and the company face legal challenges on other fronts. Read more at: https://www.cnbc.com/2022/05/03/trump-organization-presidential-inaugural-committee-settle-dc-lawsuit-.html |

|

Natural gas surges as much as 9% to highest level since 2008 as Russia’s war roils energy marketsU.S. natural gas prices have more than doubled this year as Russia’s war in Ukraine wreaks havoc on global energy markets. Read more at: https://www.cnbc.com/2022/05/03/natural-gas-surges-9percent-to-highest-level-since-2008-as-russias-war-roils-energy-markets.html |

|

Getting an inheritance or winning the lottery can create serious emotional and financial challengesComing into sudden wealth can create emotional and financial challenges for people who have not had a lot of money in their lives. Read more at: https://www.cnbc.com/2022/05/03/sudden-wealth-can-come-with-serious-emotional-and-financial-challenges.html |

|

Bonds Bid, Stocks Skid Ahead Of Fed As US NatGas Soars To 2008 HighsBonds Bid, Stocks Skid Ahead Of Fed As US NatGas Soars To 2008 HighsAnother day, another illiquid chopfest in stocks… Small Caps outperformed on the day but late day weakness took The Dow, S&P, and Nasdaq red before a last second bid lifted them green…

Interestingly energy stocks rallied today, despite oil prices sliding significantly, Staples continued to lag…

Source: Bloomberg VIX continue to be pressured lower into tomorrow’ … Read more at: https://www.zerohedge.com/markets/bonds-stocks-bid-ahead-fed-natgas-soars-2008-highs |

|

Barrage Of Cruise Missiles Rock Western Ukraine, Plunging Lviv Into DarknessBarrage Of Cruise Missiles Rock Western Ukraine, Plunging Lviv Into DarknessOn Tuesday multiple media correspondents reporting from the western Ukrainian city of Lviv said they heard several large blasts in the evening hours. It has since emerged that railway power substations are coming under attack, after the Kremlin last week indicated its military would ramp up efforts to thwart Western arms deliveries into Ukraine. Ukrainian Railways has announced Tuesday night that a number of trains are delayed after the blasts. “In particular, trains have been detained at the entrance to Lviv, information is being updated,” a statement from the rail authority quoted by CNN said. The attacks, which are being called the biggest cruise missile strikes on Lviv and perhaps across Ukraine since the war’s start, have knocked out power and internet to parts of the city. Vital power and train stations have also been hit in other key areas of the country Tuesday night (local time).

Read more at: https://www.zerohedge.com/geopolitical/barrage-cruise-missiles-rock-western-city-lviv-sections-plunged-darkness |

|

Global Manufacturers Lose Momentum As Inflation Worsens: KempGlobal Manufacturers Lose Momentum As Inflation Worsens: KempBy John Kemp, senior market analyst at Reuters Global manufacturing growth has started to decelerate as supply chain problems, the rising cost of energy and raw materials, and the conflict between Russia and Ukraine take their toll. Slower growth in manufacturing output and freight transport is inevitable after the recovery from the pandemic, when consumer spending shifted to merchandise from services. As quarantines and other social-distancing restrictions are lifted, spending is being redirected back towards services such as transport, tourism and hospitality, sapping some of the demand for goods. Slower manufacturing and freight growth will be quietly welcomed by policymakers since it is likely to ease supply chain bottlenecks and take some of the heat out of energy prices and inflation. But as the sector loses momentum, it will become more vulnerable to shocks or policy errors that could turn a mid-cycle slowdown into a cycle-ending recession. The range of possible outcomes for growth and inflation is wide and the room for policy errors is very narrow. FADING MOMENTUM U.S. manufacturers reported another fairly widespread expansion in business activity last month but fewer firms are reporting growth compared with 2021. The Institute for Supply Management’s purchasing managers’ index slipped to 55.4 in April from 57.1 in March and 60.6 at the same point last year. Read more at: https://www.zerohedge.com/markets/global-manufacturers-lose-momentum-inflation-worsens-kemp |

|

Previewing The Fed’s Decision To Kick Off A Record Tightening Cycle Right Into A RecessionPreviewing The Fed’s Decision To Kick Off A Record Tightening Cycle Right Into A RecessionAt the conclusion of tomorrow’s FOMC meeting, consensus expects the Committee to raise the target range for the federal funds rate by 50bp to 0.75% to 1.0%, the first “double” rate hike since May 2000 (when the Fed definitively burst the dot com bubble)…

… and to announce the start of the reduction of the size of the Fed’s balance sheet, in line with the parameters set out in the March FOMC minutes, somewhere to the tune of $95BN-$100BN per month in bond maturities without active sales (for now). As shown below, while a 50bps rate hike is fully priced in (and in fact, markets are pricing in a modest probability of a 75bps rate hike), rates traders price a roughly 35% chance of a 75bps rate hike in the June meeting. Overall, markets are expecting just over 10 rate hikes by year-end and just under 11 rate hikes through February 2023, at which point the Fed is expected to halt its tightening cycle and start easing. Read more at: https://www.zerohedge.com/markets/previewing-feds-decision-kick-record-tightening-cycle-right-recession |

|

Energy firms face deadline in review of direct debit hikesSome companies have three weeks to respond to accusations they have set direct debits too high. Read more at: https://www.bbc.co.uk/news/business-61309576?at_medium=RSS&at_campaign=KARANGA |

|

Amazon ends Android shopping app digital downloadsThe move is in response to Google’s app store policies, under which it takes 30% commission on all sales. Read more at: https://www.bbc.co.uk/news/technology-61297322?at_medium=RSS&at_campaign=KARANGA |

|

Russia beats final deadline to avoid debt defaultRussia has drawn on US dollar reserves in order to make payments to international investors. Read more at: https://www.bbc.co.uk/news/business-61313296?at_medium=RSS&at_campaign=KARANGA |

|

When can FIIs return? Fed’s previous tightening cycle drops some cluesFII money will come back much sooner than Fed’s timeline for unwinding. Not only it will be sooner, but it will be much larger than what went out. This is one reason why some seasoned investors are expecting a melt-up (bull-run) for Indian markets next year (2023). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/when-can-fiis-return-feds-previous-tightening-cycle-drops-some-clues/articleshow/91284603.cms |

|

FPIs raise wager on metal & mining stocks amid rising commodity pricesAided by higher commodity prices, the Nifty Metal index has outperformed the benchmark Nifty 50 by 17% since the beginning of 2022. The metal index trades at a trailing price-earnings (P/E) multiple of 6.9 compared with the Nifty 50’s P/E of 22. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fpis-raise-wager-on-metal-mining-stocks-amid-rising-commodity-prices/articleshow/91289186.cms |

|

Trade setup: Nifty to remain range-bound; defensive approach advisedWednesday is likely to see the levels of 17,135 and 17,220 acting as potential resistance levels. The supports come in at 17,000 and 16,910 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-nifty-to-remain-range-bound-defensive-approach-advised/articleshow/91285308.cms |

|

Wayfair stock jumps after Way Day event, but analysts warn about quarterly earningsWayfair stock has advanced more than 16% for the week with the company scheduled to announce earnings, but analysts are cautious. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CBB-997542429026%7D&siteid=rss&rss=1 |

|

In One Chart: How high can the Fed hike interest rates before a recession hits? This chart suggests a low threshold.The Federal Reserve is expected to raise its policy rate by 50 basis points on Wednesday, potentially kicking off a series of outsized hikes this summer. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CBF-1CEBEA04BEF1%7D&siteid=rss&rss=1 |

|

Airbnb surpasses 100 million nights booked in a quarter for the first time, stock jumps after earnings beatAirbnb Inc. on Tuesday reported results that show continued recovery from the effects of the coronavirus pandemic — and then some. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CA2-28971E4B8A80%7D&siteid=rss&rss=1 |