Summary Of the Markets Today:

- The Dow closed up 243 points or 0.64%,

- Nasdaq closed up 0.18%,

- S&P 500 closed up 0.53%,

- Gold $2,018 up $2.00,

- WTI crude oil settled at $77 up $2.18,

- 10-year U.S. Treasury 4.126% down 0.052 points,

- USD index $103.54 up $0.30,

- Bitcoin $39,686 up $46 (0.12%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

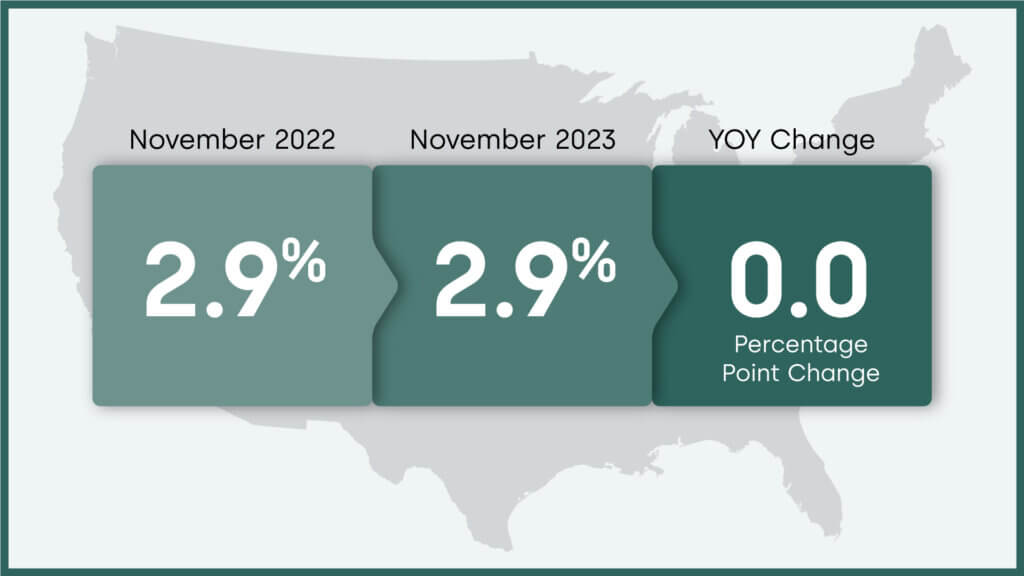

The CoreLogic Loan Performance Insights report on mortgage performance analysis through November 2023 shows 2.9% of mortgages were delinquent by at least 30 days or more including those in foreclosure. Molly Boesel, Principal Economist for CoreLogic stated:

U.S. job growth continued at a steady pace in the final quarter of 2023, and the unemployment rate ended the year just slightly higher than its 50-year low. The robust labor market is contributing to small mortgage delinquency numbers, with the overall delinquency rate remaining low and the serious delinquency rate at a record low. Mortgage performance should remain strong in 2024, as the job market is expected to remain healthy.

Real gross domestic product (GDP) increased 3.1% year-over-year for the advance estimate in fourth quarter of 2023. In the third quarter, real GDP increased 2.9% year-over-year. This GDP growth was stronger than expected with the consumer accounting for 58% of this GDP growth. For me, the surprise was the GDP implicit price indicator falling to 2.6% growth year-over-year which is just a touch over the Fed’s 2.0% inflation target.

New orders for manufactured durable goods in December 2023 was up 4.8% year-over-year – -0.8% inflation-adjusted. There was little change in dollar values from the previous month.

Sales of new single‐family houses in December 2023 4.4% pver December 2022. The median sales price of new houses sold in December 2023 was $413,200. The seasonally‐adjusted estimate of new houses for sale at the end of December was 453,000. This represents a supply of 8.2 months at the current sales rate. Even with the large backlog of homes for sale, new home sales is an economic bright spot.

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, moved down to –0.28 in December from –0.24 in November. The CFNAI is the most consistent of all coincident indicators. Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above –0.70 (red line on the graph below). However, this value is below zero which means the economy is expanding below the average rate of growth.

In the week ending January 20, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 202,250, a decrease of 1,500 from the previous week’s revised average. The previous week’s average was revised up by 500 from 203,250 to 203,750.

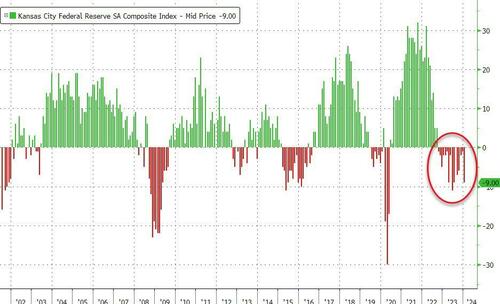

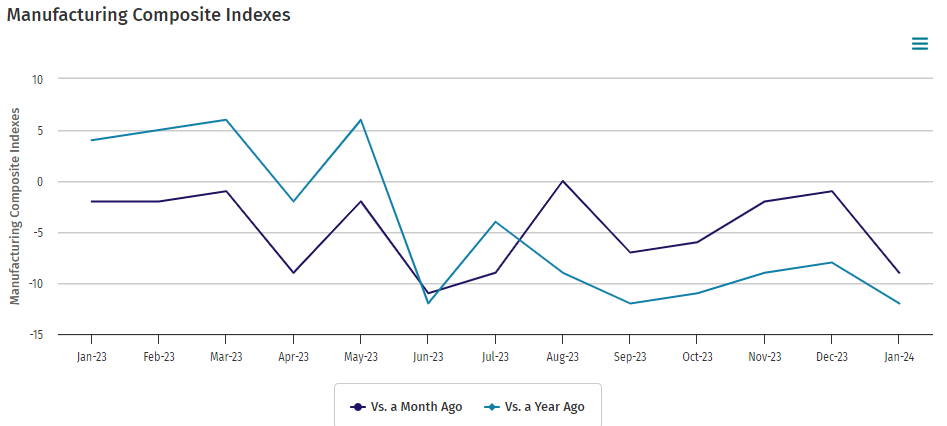

The Kansas City Fed manufacturing index declined moderately with the month-over-month composite index of -9 in January 2024, down from -1 in December and -2 in November. Manufacturing continues in a recession in the U.S.

Here is a summary of headlines we are reading today:

- U.S. Drivers Waiting For Lower Gasoline Prices Instead Told To “Buckle Up”

- High Energy Prices Weigh On European Steelmakers

- The U.S. Finally Started to Crack Down on Crypto in 2023

- Red Sea Disruptions Force Saudi Aramco to Slash Prices

- India Sees Fuel Demand Rising by 2.7% in 2024-2025 Fiscal Year

- Tesla shares close down 12% for worst day since 2020 after automaker warns of slowdown

- S&P 500 closes higher for a sixth day, powered by strong GDP data: Live updates

- This is what was behind the bitcoin sell-off and why JPMorgan thinks it could be ending

- The U.S. economy grew at blistering 3.3% pace in Q4 while inflation pulled back

- The US Has The Biggest Govt In The History Of The World… By A Very Wide Margin

- 2-year Treasury yield ends at lowest in a week despite surprisingly strong GDP report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Machine Learning: The Key to Efficient Fuel Cell DevelopmentResearchers at Kyushu University, in collaboration with Osaka University and the Fine Ceramics Center, have developed a framework that uses machine learning to speed up the discovery of materials for green energy technology. Using the new approach, the researchers identified and successfully synthesized two new candidate materials for use in solid oxide fuel cells – devices that can generate energy using fuels like hydrogen, which don’t emit carbon dioxide. Their findings, which were reported in the journal, Advanced Energy Materials,… Read more at: https://oilprice.com/Energy/Energy-General/Machine-Learning-The-Key-to-Efficient-Fuel-Cell-Development.html |

|

U.S. Drivers Waiting For Lower Gasoline Prices Instead Told To “Buckle Up”The lowest gasoline price days of the season are now in the rearview for drivers in the United States, with the spring surge in gasoline prices right around the corner, according to GasBuddy’s Patrick De Haan. “Buckle up,” GasBuddy’s head of petroleum analysis said in a Thursday morning Tweet, adding that the price lows were “nearly definitively behind us.” Gasoline prices hit the low of the season last week when prices hovered pennies above the $3 per gallon mark. De Haan had previously suggested that prices… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Drivers-Waiting-For-Lower-Gasoline-Prices-Instead-Told-To-Buckle-Up.html |

|

Oman Is Looking To Become a Green Energy HubLike other Gulf countries, Oman is dependent on oil and gas revenues for the major part of its export income, leaving it vulnerable to energy transition. It is therefore looking at large-scale production of carbon-free or ‘green’ hydrogen. With its magnificent renewable energy resources, huge areas of open land, and strategic location at the nexus of Arabia, Africa and South Asia, Oman enjoys natural advantages in its ambition to become a major hydrogen producer and exporter. And its plans are realistic, according to the… Read more at: https://oilprice.com/Energy/Energy-General/Oman-Is-Looking-To-Become-a-Green-Energy-Hub.html |

|

NextEra Energy Beats Wall Street’s Estimates On Lower Gas PricesThe world’s largest utility company, NextEra Energy Inc. (NYSE:NEE), has topped Wall Street’s revenue and earnings estimates for Q4 2023, helped in large part by lower natural gas prices. NextEra has reported Q4 Non-GAAP EPS of $0.52, $0.03 above the Wall Street consensus, while revenue of $6.87B (+11.5% Y/Y) beat by $550M. The electric utility, which generates most of its electricity from natural gas, received a big boost after gas prices fell about 14% in the quarter from the third quarter, on milder-than-expected winter and ample… Read more at: https://oilprice.com/Latest-Energy-News/World-News/NextEra-Energy-Beats-Wall-Streets-Estimates-On-Lower-Gas-Prices.html |

|

High Energy Prices Weigh On European Steelmakersia Metal Miner Workers at flats producer Liberty Steel Ostrava in the Czech Republic did not return to work on January 16, despite local media reports stating that workers agreed to resume working on this date. The Daily Denik noted that there were a couple of other “return dates” set for the steel manufacturing plant, including January 3 and January 9. “Employees at Liberty Ostrava continue to overcome so-called other obstacles by the employer until January 22, when we will inform them of further developments in the situation,”… Read more at: https://oilprice.com/Metals/Commodities/High-Energy-Prices-Weigh-On-European-Steelmakers.html |

|

South Africa’s Top Coal Terminal Sees Lowest Exports since 1992The largest coal-exporting terminal in South Africa, the world’s fifth-largest coal exporter, saw coal export volumes drop by 6.2% year over year in 2023 to the lowest level since 1992, as rail challenges choked transportation. The Richards Bay Coal Terminal (RBCT), South Africa’s largest, shipped 47.2 million tons of coal in 2023, chief executive Alan Waller told reporters in a media briefing. The decline in coal exports to more than a three-decade low was the result of continued… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africas-Top-Coal-Terminal-Sees-Lowest-Exports-since-1992.html |

|

The U.S. Finally Started to Crack Down on Crypto in 2023Crypto companies worldwide have carried out mining and trading activities relatively unchecked in recent years, as governments have dragged their feet in establishing adequate regulations to manage the sector. Meanwhile, many companies have been using vast amounts of energy to power the activities required to mine crypto, as demand for the digital currency has steadily increased. The U.S. is now taking legal steps to punish companies that have abused their position of economic power. However, the lack of regulation shows the need to develop a clear… Read more at: https://oilprice.com/Energy/Energy-General/The-US-Finally-Started-to-Crack-Down-on-Crypto-in-2023.html |

|

Oil Prices Rise as U.S. Stocks Decline and Red Sea Tensions IncreaseOil prices rose by more than 1% early on Thursday, buoyed by a larger-than-expected U.S. crude draw, Chinese stimulus, and continued attacks by the Houthis in and near the Red Sea. As of 10:50 a.m. ET on Thursday, the U.S. benchmark, WTI Crude, had risen by 1.53% to $76.00. The international benchmark, Brent Crude, was up by 1.36% at $80.95. Oil prices were supported early on Thursday by the Energy Information Administration’s inventory report from Wednesday, which showed a crude draw of 9.2 million barrels for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Rise-as-US-Stocks-Decline-and-Red-Sea-Tensions-Increase.html |

|

Red Sea Disruptions Force Saudi Aramco to Slash PricesLogistics have been pushed to the forefront of oil trade as Houthi missile and drone attacks continue to disrupt navigation through the Red Sea and the Suez Canal. The list of companies avoiding the Bab el Mandeb Strait and the Red Sea keeps on expanding with each passing day, ranging from oil majors like BP or Shell and all the way to Asian refiners such as the UAE’s ADNOC or India’s Reliance. Whilst the oil exports of Middle Eastern crude producers to Asia have not been impacted so far by any strikes, reaching the Atlantic Basin is… Read more at: https://oilprice.com/Energy/Oil-Prices/Red-Sea-Disruptions-Force-Saudi-Aramco-to-Slash-Prices.html |

|

EU Looks to Accelerate Development of Small Nuclear ReactorsThe European Commission is expected to unveil in February a new industrial alliance on small modular reactors (SMRs), aiming to deploy the first small nuclear projects in Europe early next decade. SMRs are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors, according to the International Atomic Energy Agency (IAEA). SMRs offer savings in cost and construction time, and they can be deployed incrementally to match increasing energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Looks-to-Accelerate-Development-of-Small-Nuclear-Reactors.html |

|

Explaining ExxonMobil’s Pre-Emptive Attack on Shareholder ActivistsWe should not have been surprised. Not in an era when people only watch MSNBC or Fox and college students avoid classes that might trigger discomfort by exposing them to beliefs contrary to their own. It happens in the oil business, too. Two activist investors, in December, filed a stockholder resolution for vote at the 2024 ExxonMobil annual meeting to encourage management to speed up its carbon emission reduction plans and expand the scope of emissions covered by its reduction plan. It’s a non-binding resolution. Meaning the company’s… Read more at: https://oilprice.com/Energy/Energy-General/Explaining-ExxonMobils-Pre-Emptive-Attack-on-Shareholder-Activists.html |

|

India Sees Fuel Demand Rising by 2.7% in 2024-2025 Fiscal YearIndia expects its fuel demand to continue growing and increase by 2.7% in the 2024-2025 fiscal year beginning on April 1, data from the petroleum ministry showed on Thursday. Gasoline consumption in India is set to increase by 5.4% and demand for diesel – the top-selling fuel in the world’s third-largest crude oil importer – is expected to grow by 2.7% in 2024-2025, according to the government data. Total fuel consumption in India, a proxy for oil demand, is forecast to increase to 238.954 million tons in 2024-2025, up from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Sees-Fuel-Demand-Rising-by-27-in-2024-2025-Fiscal-Year.html |

|

Five Energy Sector Predictions for 2024It is time to make my energy sector predictions for this year. The year promises to be challenging because there are more variables in play than normal. Russia’s ongoing invasion of Ukraine, the U.S. presidential elections, and the ongoing conflict in the Middle East are all factors that could have a major impact on the energy markets. As always, I try to balance realistic predictions with those that are too obvious. I consider the discussion behind the predictions to be more important than the predictions themselves. That’s why I provide… Read more at: https://oilprice.com/Energy/Energy-General/Five-Energy-Sector-Predictions-for-2024.html |

|

China’s Oil Giant CNOOC Raises Output and Capex Targets to Record HighsChina’s state-held oil and gas giant CNOOC Limited hiked on Thursday its oil and gas production targets and capital expenditures to record-high levels as it looks to boost reserves and production. CNOOC, whose net oil and gas production hit an all-time high of 675 million barrels of oil equivalent (boe) in 2023, now aims at an output of between 700 million and 720 million barrels of oil equivalent this year as it significantly raised its production targets in the 2024 business strategy and development plan. Of the targeted production levels… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Oil-Giant-CNOOC-Raises-Output-and-Capex-Targets-to-Record-Highs.html |

|

Fire Damages Rosneft Refinery in Suspected Ukrainian Drone AttackA large refinery of Russian state oil giant Rosneft in southern Russia was damaged in a fire early on Thursday in a suspected Ukrainian drone attack, in the latest incident at Russian energy export infrastructure over the past week. The 240,000 barrels-per-day refinery in Tuapse, southern Russia, was hit by a fire that was extinguished early on Thursday, local authorities said. “The vacuum unit was on fire. According to preliminary information, there were neither casualties nor injured,” Sergei Boiko, the head of the Tuapse district,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fire-Damages-Rosneft-Refinery-in-Suspected-Ukrainian-Drone-Attack.html |

|

Tesla shares close down 12% for worst day since 2020 after automaker warns of slowdownTesla said vehicle volume growth in 2024 “may be notably lower” than last year’s growth rate. Read more at: https://www.cnbc.com/2024/01/25/tesla-tsla-shares-fall-after-musks-ev-maker-warns-of-2024-slowdown.html |

|

S&P 500 closes higher for a sixth day, powered by strong GDP data: Live updatesThe broad index rose as investors focused on GDP report and corporate earnings. Read more at: https://www.cnbc.com/2024/01/24/stock-market-today-live-updates.html |

|

Paramount CEO announces layoffs as cost pressures, take-private talks buildParamount Global announced layoffs, as the company tries to cut costs while it faces acquisition interest. Read more at: https://www.cnbc.com/2024/01/25/paramount-ceo-bob-bakish-announces-layoffs.html |

|

Microsoft lays off 1,900 workers, nearly 9% of gaming division, after Activision Blizzard acquisitionThe Microsoft layoffs come a little more than three months after the company closed on its acquisition of video game maker Activison Blizzard. Read more at: https://www.cnbc.com/2024/01/25/microsoft-lays-off-1900-workers-nearly-9percent-of-gaming-division-after-activision-blizzard-acquisition.html |

|

This is what was behind the bitcoin sell-off and why JPMorgan thinks it could be endingOutflows from one bitcoin ETF should slow from here, according to a JPMorgan strategist. Read more at: https://www.cnbc.com/2024/01/25/this-is-what-was-behind-the-bitcoin-sell-off-and-why-jpmorgan-thinks-it-could-be-ending.html |

|

Probe into GM’s Cruise finds poor leadership, culture issues at center of accident responseThe report addresses controversy that has swirled around Cruise since an Oct. 2 accident in which a pedestrian was dragged 20 feet by a Cruise robotaxi. Read more at: https://www.cnbc.com/2024/01/25/gm-cruise-probe-finds-poor-leadership-at-center-of-incident-response.html |

|

SEC pushes back BlackRock’s spot ether ETF decision: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Zachary Bradford, the CEO of CleanSpark, explains how the bitcoin miner is preparing for the upcoming halving. Read more at: https://www.cnbc.com/video/2024/01/25/sec-pushes-back-blackrock-spot-ether-etf-decision-cnbc-crypto-world.html |

|

Retail CEO turnover soars, as fewer women hold top jobs in the industryCEO turnovers are spiking, and rising in the retail industry in particular — but the sector is very rarely hiring women for its top jobs. Read more at: https://www.cnbc.com/2024/01/25/retail-ceo-turnover-soars-fewer-women-hold-ceo-jobs.html |

|

The U.S. economy grew at blistering 3.3% pace in Q4 while inflation pulled backGDP was expected to grow at a 2% annualized rate in the fourth quarter of 2023, according to economists surveyed by Dow Jones. Read more at: https://www.cnbc.com/2024/01/25/gdp-q4-2023-the-us-economy-grew-at-a-3point3percent-pace-in-the-fourth-quarter.html |

|

Treasury chief Yellen touts GDP numbers as a boon to the middle classYellen said the U.S. has “avoided financial pain for most middle-class American families” due to a strong post-pandemic recovery. Read more at: https://www.cnbc.com/2024/01/25/treasurys-yellen-touts-favorable-gdp-numbers-as-boon-to-middle-class.html |

|

Trump warns he will blacklist Nikki Haley campaign donorsFormer U.S. President Donald Trump warned he will blacklist donors to the electoral campaign of Nikki Haley, his rival for the Republican nomination. Read more at: https://www.cnbc.com/2024/01/25/trump-warns-he-will-blacklist-nikki-haley-campaign-donors.html |

|

Hamptons mansion once listed for $150 million sells at auction for less than $90 millionThe property, once the most expensive listing the Hamptons, had been on and off the market since 2016. Read more at: https://www.cnbc.com/2024/01/25/hamptons-la-dune-mansion-once-listed-for-150-million-sells-at-auction.html |

|

Trump briefly testifies at E. Jean Carroll sex defamation trial, defense restsFormer President Donald Trump briefly testified in the civil sex defamation case against him by E. Jean Carroll in New York federal court. Read more at: https://www.cnbc.com/2024/01/25/trump-sex-defamation-trial-testimony-e-jean-carroll.html |

|

FDA’s New Rule Allows For Medical Research Without Informed ConsentAuthored by Amie Dahnke via The Epoch Times (emphasis ours), In an effort to encourage the discovery of more treatment and diagnostic options in the medical field, the U.S. Food and Drug Administration (FDA) has finalized a rule allowing certain clinical trials to operate without obtaining informed consent from participants.

The U.S. Food and Drug Administration (FDA) in White Oak, Md., on June 5, 2023. (Madalina Vasiliu/The Epoch Times) The hitch? The study cannot pose more than minimal risk to humans and must include appropriate safeguards to protect the rights, safety, and welfare of those involved. Read more at: https://www.zerohedge.com/medical/fdas-new-rule-allows-medical-research-without-informed-consent |

|

Biden Dispatches CIA Director To Negotiate Major Gaza Ceasefire DealOn Thursday The Washington Post is reporting a hugely unexpected development related to the Israel-Hamas war, writing that President Biden will send CIA Director William J. Burns in the coming days to help negotiate a ceasefire. Unnamed officials speaking to the publication described that “Burns is expected to travel to Europe for the talks and meet with the Israeli and Egyptian intelligence chiefs, David Barnea and Abbas Kamel, and Qatari Prime Minister Mohammed bin Abdulrahman bin Jassim Al Thani.” The news that Israel has offered a 2-month pause in fighting, which is being widely called the most significant and far-reaching ceasefire plan since the Gaza war began, emerged Monday and Tuesday. The multi-phase plan would involve the release of groups of Palestinian prisoners held in Israeli jails, safe passage for Hamas leaders to Gaza to other countries, and would in the end result in the release of all Israeli and foreign captives still held in the Strip. Read more at: https://www.zerohedge.com/geopolitical/biden-dispatches-cia-director-negotiate-major-gaza-ceasefire-deal |

|

The US Has The Biggest Govt In The History Of The World… By A Very Wide MarginAuthored by Michael Snyder via The Economic Collapse blog, How does it feel to have the largest government that the planet has ever seen? When I was growing up, I was taught that we had a capitalist system and that we had a limited federal government. Of course neither of those things has been true for a very long time. Today, the United States has the biggest government in the history of the world, and it gets even bigger with each passing year. Running that gigantic government requires more money than we actually have, and so we are going into staggering amounts of debt. But there is no way that our politicians will ever agree to reduce the size of the federal government to an appropriate size. So we are stuck with this system until the day when it finally collapses. Read more at: https://www.zerohedge.com/markets/us-has-biggest-govt-history-world-very-wide-margin |

|

Kansas City Griefs: Manufacturing Survey Screams Stagflation In JanuaryRegional factory activity in the Tenth District of the Kansas City Fed declined sharply in January, with production and new orders plunging but prices paid soaring. The headline index tumbled from -1 to -9 – a contraction was driven more by durable goods manufacturing, particularly nonmetallic mineral and primary metal manufacturers.

That was the 16th straight month without a positive (expansionary) print. Under the hood it was a bloodbath… Read more at: https://www.zerohedge.com/economics/kansas-city-griefs-manufacturing-survey-screams-stagflation-january |

|

Apple to allow rival app stores on iPhones in EUiPhone users in the EU will soon be able to download apps from places other than the App Store. Read more at: https://www.bbc.co.uk/news/technology-68096730?at_medium=RSS&at_campaign=KARANGA |

|

Lloyds to cut 1,600 jobs in major branch overhaulThe UK’s largest lender says it is making the cuts due to more people banking online. Read more at: https://www.bbc.co.uk/news/business-68096905?at_medium=RSS&at_campaign=KARANGA |

|

Warning EU border system has lasting “negative impacts”Ferry firms and Dover port warn business and communities would suffer from new EU border checks. Read more at: https://www.bbc.co.uk/news/business-68099482?at_medium=RSS&at_campaign=KARANGA |

|

There is a vertical growth in the capital market and money flow will become bigger as we go forward: Raamdeo AgrawalMotilal Oswal Group’s Chairman, Raamdeo Agrawal, discusses the strong performance of the capital market in October and November, with December being exceptionally high. He mentions the increase in returns, particularly in midcaps and smallcaps, which has attracted more people to the market. Agrawal highlights the vertical growth in the capital market, the influx of new investors, and the positive impact on the GDP growth of the country. He also talks about the expansion of the capital market business due to digital onboarding. Read more at: https://economictimes.indiatimes.com/markets/expert-view/there-is-a-vertical-growth-in-the-capital-market-and-money-flow-will-become-bigger-as-we-go-forward-raamdeo-agrawal/articleshow/107141492.cms |

|

Tech View: Nifty in sell-on-rise mode. What traders should do in Budget weekNifty on Thursday ended 101 points lower to form a small negative candle with a minor lower shadow on the daily charts, indicating a sell-on-rise opportunity in the market on monthly F&O expiry. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-in-sell-on-rise-mode-what-traders-should-do-in-budget-week/articleshow/107146984.cms |

|

Will Interim Budget be a non-event for D-Street or will it rejuvenate bulls? Here’s what history showsThe Union Budget tends to cause volatility in equity markets. Over the past 5-6 years, caution and apprehension have prevailed among investors in the week leading up to the budget presentation. The Sensex has experienced negative and flat returns during this period. However, the performance post the budget announcement has generally been better. In election-bound years like 2024, the budget is likely to focus on fiscal roadmap, capital investment-led expansion, rural growth, and populist measures. Experts believe that this year’s budget will be a non-event with no major policy changes expected. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/will-interim-budget-be-a-non-event-for-d-street-or-will-it-rejuvenate-bulls-heres-what-history-shows/articleshow/107133222.cms |

|

This late-January stock-trading pattern has been a winner in 30 of the past 38 yearsMutual-funds and institutional investors put cash into the market at the end of this month. Read more at: https://www.marketwatch.com/story/this-late-january-stock-trading-pattern-has-been-a-winner-in-30-of-the-past-38-years-48ce7e83?mod=mw_rss_topstories |

|

The S&P 500 is trading in record territory — but these other stock-market indexes are in the doldrumsThe large-cap index may be on track for a fifth-straight record close, but several other U.S. equity-market indexes are well removed from their all-time highs. Read more at: https://www.marketwatch.com/story/the-s-p-500-is-trading-in-record-territory-but-these-other-stock-market-indexes-are-in-the-doldrums-ddadcbc2?mod=mw_rss_topstories |

|

2-year Treasury yield ends at lowest in a week despite surprisingly strong GDP reportTreasury yields finished broadly lower on Thursday, as traders focused on the likelihood of falling inflation. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-as-traders-eye-u-s-data-dump-including-gdp-and-jobless-claims-5bacdae5?mod=mw_rss_topstories |