Summary Of the Markets Today:

- The Dow closed down 99 points or 0.26%,

- Nasdaq closed up 0.36%,

- S&P 500 closed up 0.08%,

- Gold $2,013 down $12.90,

- WTI crude oil settled at $75 up $0.97,

- 10-year U.S. Treasury 4.180% up 0.038 points,

- USD index $103.31 down $0.31,

- Bitcoin $39,520 up $514 (1.32%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

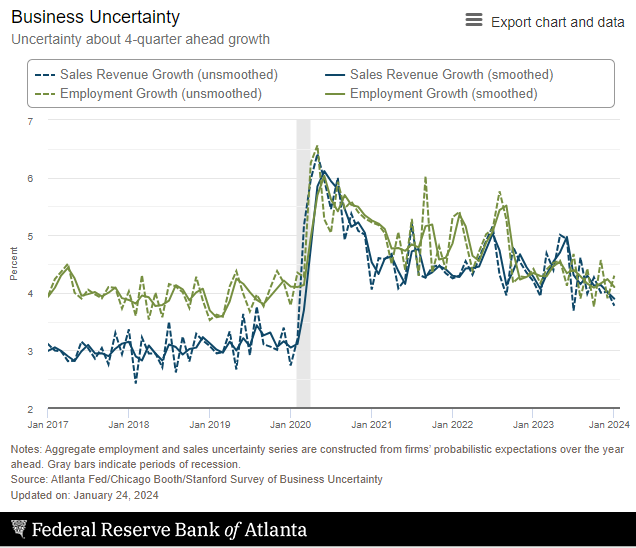

The Survey of Business Uncertainty continues to show a deterioration in sales revenue growth.

Here is a summary of headlines we are reading today:

- IEA To Expedite 2025 Oil Demand Forecast in OPEC Competition

- Toyota Chairman Questions EV Market Future

- Increased U.S. Natural Gas Production Driving Emissions Reduction

- Russia Builds Out Arctic Oil Route As Middle East Tensions Escalate

- Oil Ticks Higher on Significant Inventory Draw

- Russia Says New Discoveries Fully Replaced Its Oil and Gas Reserves in 2023

- Japan’s LNG Imports Drop to 14-Year Low

- Nasdaq, S&P 500 close higher for fifth straight day as Netflix shares surge: Live updates

- Amazon’s Ring will stop allowing police to request doorbell video footage from users

- Thursday’s GDP report expected to show the U.S. economy at a crossroads

- Bitcoin wrestles with $40,000 as it tries to recover recent losses: CNBC Crypto World

- Treasury yields end at highest levels in at least 6 weeks after PMI data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Economic Overhaul: A Blueprint for Renewable DominanceThe Chinese economy is changing, and the aftershocks of its tectonic shift will be felt around the world. After decades of growth and massive infrastructural buildout, the capacity for further additions is diminishing. As a result, China’s economy is slowing down, the nationwide property bubble is bursting, and unemployment rates are punishing. A record high of 11.79 million students are expected to graduate from university this year in China, at which point they will join legions of jobseekers, many of whom have been… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Economic-Overhaul-A-Blueprint-for-Renewable-Dominance.html |

|

IEA To Expedite 2025 Oil Demand Forecast in OPEC CompetitionThe International Energy Agency (IEA) has announced that it will publish its 2025 oil demand forecast report in April, about three months earlier than its former schedule after OPEC expedited its equivalent report by six months. Last week, OPEC released its 2025 oil demand forecast wherein it maintained its earlier prediction of robust demand growth in 2024 and 2025 led by China and the Middle East. OPEC has forecast that oil demand will grow by 1.85 mb/d in 2025 to hit 106.21 million bpd. For the current year, OPEC maintained its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-To-Expedite-2025-Oil-Demand-Forecast-in-OPEC-Competition.html |

|

Toyota Chairman Questions EV Market FutureToyota’s chairman and former CEO, Akio Toyoda, is at it again: providing the public with a dose of reality that electric vehicles will never dominate the global car market. Toyoda, grandson of the founder of the world’s largest car manufacturer, expressed at a business event this month, as reported by The Telegraph, that EVs will never capture 30% of global market share. He explained that petrol-burning vehicles and hybrids, along with hydrogen fuel cell vehicles, will dominate. Toyoda made the point: How can EVs be the future when… Read more at: https://oilprice.com/Energy/Energy-General/Toyota-Chairman-Questions-EV-Market-Future.html |

|

New Superlubricity Research Could Turbocharge Industrial Energy EfficiencyUniversity of Leicester scientists have made an insight into superlubricity, where surfaces experience extremely low levels of friction. This could benefit future technologies by reducing energy lost to friction by moving parts. As many of us are stepping carefully to avoid a slip and fall in the frosty weather, scientists led by the University of Leicester have been investigating how to make surfaces even slicker. They reported solving a conundrum in the principles of superlubricity – a state in which two surfaces experience little to almost… Read more at: https://oilprice.com/Energy/Energy-General/New-Superlubricity-Research-Could-Turbocharge-Industrial-Energy-Efficiency.html |

|

Increased U.S. Natural Gas Production Driving Emissions ReductionThe United States recorded a 1.9% drop in C02 emissions in 2023, thanks in large part to substituting natural gas for more emissions-intensive coal. According to nonpartisan research provider Rhodium Group, emissions from power generation fell 8% while those for residential and commercial buildings dropped 4%; however, the transport sector saw emissions increase 1.6% due to a rebound in air travel and increased driving. The drop is even more impressive considering that it came in a year when the economy was expanding, a trend that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Increased-US-Natural-Gas-Production-Driving-Emissions-Reduction.html |

|

Investment Mishap Triggers Leadership Shake-Up in Energy TrustThe Asian Energy Impact trust is seeking to restore its London listing after publishing delayed annual and interim results, following months of controversy around the trust. In April, the trust’s shares were suspended after an issue was identified with its 2022 annual results, leading to ‘material uncertainty’ over the fair value of some of its assets and liabilities. The trust owned a 200 MW construction-ready asset owned by SolarArise, a Delhi-based renewable energy platform owned by ThomasLloyd, which had been valued at $13.9m… Read more at: https://oilprice.com/Energy/Energy-General/Investment-Mishap-Triggers-Leadership-Shake-Up-in-Energy-Trust.html |

|

OPEC+ Spare Capacity To Keep Oil Prices In CheckHSBC Global Research has predicted that Brent crude prices will remain range-bound at $75 per barrel to $85 per barrel in the mid-term as with spare production capacity by OPEC+ enough to offset any geopolitical risks. According to HSBC, OPEC+ will see its spare production capacity increase to 4.5 million b/d at the end of 2024, up from 4.3 million b/d at the end of 2023, which should be enough to dampen price spikes. “Trade disruptions in the Red Sea add only a marginal premium to oil prices and no physical supplies have been lost… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Spare-Capacity-To-Keep-Oil-Prices-In-Check.html |

|

Russia Builds Out Arctic Oil Route As Middle East Tensions EscalateThis year will see a major push by Russia to ensure that the Northern Sea Route (NSR), which is vital for shipping minerals, oil, and liquefied natural gas (LNG) from its huge Arctic operations, remains fully functional all year round, according to a senior Moscow-based oil analyst exclusively spoken to by OilPrice.com last week. Given the hostile climate in the region, ships have been unable to sail at all during March, April, and May, and have struggled to do so at other times as well. This new impetus comes as Russia faces new sanctions… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Builds-Out-Arctic-Oil-Route-As-Middle-East-Tensions-Escalate.html |

|

Asia and Africa Oil Imports Jump to Record High on Cheap Russian CrudeAsia and Africa, which replaced Europe as the primary destinations of Russian crude oil, rushed last year to import cheaper crudes from Russia, boosting Asian and African overall crude oil imports to record highs, according to tanker-tracking data from Kpler cited by Reuters. After the EU and G7 embargoes and sanctions came into effect, Russia managed last year to divert most of its crude exports away from Europe and onto Asia and Africa. While Russian crude exports to Europe crashed in 2023, Russia’s shipments to Asia surged… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Asia-and-Africa-Oil-Imports-Jump-to-Record-High-on-Cheap-Russian-Crude.html |

|

Turkey Greenlights Sweden’s NATO MembershipAfter nearly two years of delays, Turkey’s parliament finally agreed to ratify Sweden’s NATO membership bid on Tuesday, clearing the biggest remaining hurdle to expanding the Western military alliance following the Ukraine war. Turkey’s general assembly, where President Tayyip Erdogan’s ruling alliance holds a majority, voted 287-55 to approve the application that Sweden first made in 2022 to boost its security in response to “fear” that Russia would invade it, when in reality Russia invaded Ukraine in response to the encroaching NATO expansion… Read more at: https://oilprice.com/Geopolitics/International/Turkey-Greenlights-Swedens-NATO-Membership.html |

|

Oil Ticks Higher on Significant Inventory DrawCrude oil prices today inched higher after the Energy Information Administration reported an inventory draw of 9.2 million barrels for the week to January 19. This compared with a draw of 2.5 million barrels for the previous week, whose effect on prices was muted, however, because of another round of substantial inventory builds in gasoline and middle distillates. For the week to January 19, the EIA reported mixed changes in fuel inventories. Gasoline stocks added 4.9 million barrels, according to the authority, with production averaging 8.3 million… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Ticks-Higher-on-Significant-Inventory-Draw.html |

|

Australian Coal Export Ports Threatened by CycloneTropical cyclone Kirrily is tracking toward the state of Queensland in northeastern Australia, making coal port operators nervous about operations and exports. Cyclone Kirrily is expected to make landfall on Queensland’s coast and islands late on January 24 or early on January 25. Coal ports near the Bowen Basin, which contains the largest coal reserves in Australia, are expected to be most affected by the path of the cyclone, according to Argus. The Abbot Point, Dalrymple Bay (DBCT), and Hay Point terminals are on the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australian-Coal-Export-Ports-Threatened-by-Cyclone.html |

|

UK Firms Have Insured Over €120 Billion in Russian OilA former Cabinet minister has called on the insurance industry to think on its obligations after it was revealed that UK firms have insured over €120bn worth of Russian oil. From March 2022, just after Russia’s invasion of Ukraine, until the end of November 2023, the UK insured €120.6bn worth of Russian oil, according to an analysis by the Centre for Research on Energy and Clean Air (CREA). The CREA analysis is focused on the months between March 2022 and November 2023. It is not illegal to transport Russian oil, or insure it, as… Read more at: https://oilprice.com/Energy/Crude-Oil/UK-Firms-Have-Insured-Over-120-Billion-in-Russian-Oil.html |

|

Russia Says New Discoveries Fully Replaced Its Oil and Gas Reserves in 2023Russia replaced its oil and natural gas reserves last year, thanks to new large discoveries, according to a state commission. New reserves of crude oil and gas condensate amounted to 550 million metric tons in 2023, the State Reserves Commission said, as quoted by Reuters. At the same time, Russia’s oil production was 523 million tons, equal to 10.46 million barrels per day (bpd), last year, according to the commission. Natural gas reserves were also fully replaced in 2023, as new reserves stood at 705 billion cubic meters, while gas production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Says-New-Discoveries-Fully-Replaced-Its-Oil-and-Gas-Reserves-in-2023.html |

|

Japan’s LNG Imports Drop to 14-Year LowLiquefied natural gas imports in Japan, one of the world’s top LNG buyers, slumped in 2023 to the lowest level in 14 years, after falling by 8% compared to 2022, official Japanese data showed on Wednesday. Last year, Japan imported 66.15 million metric tons of LNG, down by 8.1% year-on-year and the lowest import volumes since 2009, according to provisional data from the Japanese Ministry of Finance. The value of the imports in Japanese yens slumped by 22.6% last year, amid lower imports and a decline in spot LNG prices, especially at the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Japans-LNG-Imports-Drop-to-14-Year-Low.html |

|

Nasdaq, S&P 500 close higher for fifth straight day as Netflix shares surge: Live updatesStocks rose Wednesday after Netflix reported its subscriber count reached a new record in the fourth quarter. Read more at: https://www.cnbc.com/2024/01/23/stock-market-today-live-updates.html |

|

Reid Hoffman pauses Nikki Haley funding after New Hampshire loss, source saysHoffman, co-founder of LinkedIn, said in December that while he backs Biden, he believed Haley had the best chance at beating Trump in the primary. Read more at: https://www.cnbc.com/2024/01/24/source-reid-hoffman-pauses-haley-funding-after-new-hampshire-loss.html |

|

Tesla set to report fourth-quarter earnings after the bellTesla is making its first financial report since the Cybertruck went on sale late last year. Read more at: https://www.cnbc.com/2024/01/24/tesla-tsla-earnings-q4-2023.html |

|

United Auto Workers union endorses President Joe Biden for reelection over TrumpUAW President Shawn Fain said in May the union would withhold a reelection endorsement for Biden until the UAW’s concerns about EVs were addressed. Read more at: https://www.cnbc.com/2024/01/24/uaw-endorses-biden-over-trump-in-2024-election.html |

|

How BlackRock’s Rick Rieder generates outperformance and attractive yield for his Flexible Income ETFBlackRock’s actively managed Flexible Income ETF boasts a 5.49% 30-day SEC yield. Read more at: https://www.cnbc.com/2024/01/24/blackrocks-rick-rieder-generates-outperformance-and-attractive-yield-for-his-income-etf.html |

|

Amazon’s Ring will stop allowing police to request doorbell video footage from usersRing plans to discontinue its “Request for Assistance” tool, which allowed law enforcement to submit requests for users’ footage in the Neighbors app. Read more at: https://www.cnbc.com/2024/01/24/amazons-ring-will-stop-letting-police-request-doorbell-video-footage.html |

|

Thursday’s GDP report expected to show the U.S. economy at a crossroadsThe consensus outlook for the fourth quarter is that gross domestic product grew at a 2% seasonally adjusted annualized pace. Read more at: https://www.cnbc.com/2024/01/24/thursdays-gdp-report-expected-to-show-the-us-economy-at-a-crossroads.html |

|

Bitcoin wrestles with $40,000 as it tries to recover recent losses: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Core Scientific CEO Adam Sullivan discusses the company’s reorganization and re-listing of shares on the Nasdaq. Read more at: https://www.cnbc.com/video/2024/01/24/bitcoin-wrestles-with-40000-as-it-tries-to-recover-recent-losses-cnbc-crypto-world.html |

|

Boeing CEO meets with lawmakers as 737 Max 9 scrutiny buildsBoeing’s CEO was on Capitol Hill on Wednesday meeting with senators amid the company’s 737 Max 9 crisis. Read more at: https://www.cnbc.com/2024/01/24/boeing-ceo-meets-with-lawmakers-as-737-max-9-scrutiny-builds.html |

|

Biden guest at State of the Union will be Texas abortion case momPresident Joe Biden and first lady Jill Biden spoke Sunday with Kate Cox, the mother whose abortion was blocked by the Texas Supreme Court. Read more at: https://www.cnbc.com/2024/01/24/biden-state-of-union-guest-is-texas-abortion-case-mom.html |

|

British billionaire Joe Lewis pleads guilty to insider trading, securities fraudBritish billionaire Joseph Lewis through a family trust controls a majority ownership stake in the English Premier League soccer team Tottenham Hotspur. Read more at: https://www.cnbc.com/2024/01/24/british-billionaire-joe-lewis-pleads-guilty-to-insider-trading.html |

|

Hedge fund billionaire Bill Ackman and wife Neri Oxman buy nearly 5% stake in Tel Aviv Stock ExchangeHedge fund billionaire Bill Ackman and his wife Neri Oxman are buying a nearly 5% stake in the Tel Aviv Stock Exchange, the exchange reported in a press release Wednesday. Read more at: https://www.cnbc.com/2024/01/24/bill-ackman-and-wife-neri-oxman-buy-stake-in-tel-aviv-stock-exchange.html |

|

A new iPhone feature can help keep your money safe—here’s how to turn it onApple released the Stolen Device Protection as part of the iOS 17.3 update. Read more at: https://www.cnbc.com/2024/01/24/how-to-turn-on-iphone-stolen-device-protection.html |

|

Tesla Earnings Preview: 2024 Guide, Mass Model Rumors, Musk’s Musings And MarginsAll eyes are going to be on Tesla after the bell today, with the company slated to report earnings and update its shareholders on numerous new developments as the stock continues slumping to start 2024. First, what the street expects from Q4. According to Bloomberg forecasts, Tesla is anticipated to announce a revenue of $25.87 billion, marking a 6.4% increase from the previous year. Analysts are looking for EPS of $0.73, amounting to an adjusted net income of $2.61 billion, a 36.4% decrease from the same period last year. As Bloomberg noted yesterday, the company’s margins are going to be an obvious focus as Tesla continues to slash prices in order to help move volume: For Q4, Tesla announced it had “produced approximately 495,000 vehicles and delivered over 484,000 vehicles”, putting up numbers in line with adjusted estimates for the quarter. Production beat estimates of about 482,336, per Bloomberg’s estimates. The company noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for the year. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company m … Read more at: https://www.zerohedge.com/markets/tesla-earnings-preview-2024-guide-mass-model-rumors-musks-musings-and-margins |

|

Arizona GOP Chair Busted For Attempted Bribe Resigns After Kari Lake Threatens “More Damaging” RecordingUpdate (1445ET): That didn’t take long. One day after the Daily Mail published a leaked recording of Arizona GOP Chairman Jeff DeWit trying to bribe Trump ally Kari Lake to stay out of politics for two years, DeWit resigned.

“This morning, I was determined to fight for my position,” he said in a statement reported by Just the News. “However, a few hours ago, I received an ultimatum from Lake’s team: resign today or face the release of a new, more damaging recording. I am truly unsure of its contents, but considering our numerous past open conversations as friends, I have decided not to take the risk. I am resigning as Lake requested, in the hope that she will honor her commitment to cease her attacks, all … Read more at: https://www.zerohedge.com/political/kari-lake-demands-resignation-corrupt-gop-chair-caught-trying-bribe-her |

|

US Warship Intercepted Houthi Missiles Launched At US-Flagged ShipUpdate(1446ET): US Central Command has confirmed the attack incident on the US container ship, but has provided further key details saying that one of the no less than three Navy warships accompanying the US-flagged Maersk vessel intercepted most of the inbound anti-ship missiles fired from Yemen:

The fact that the Houthis launched the missiles despite the presence of a warship group is a testament to the fact that the Western naval coalition has not served as an effective deterrent.

|

|

Mexico’s $10 Billion Lawsuit Against US Gun Manufacturers To Proceed, Appeals Court RulesAuthored by Naveen Athrapully via The Epoch Times, A $10 billion lawsuit by Mexico against U.S. gunmakers, alleging that the companies “deliberately” enabled firearms trafficking into the country, can move forward, an appeals court has ruled.

The lawsuit, filed by the Mexican government against seven American manufacturers and a distributor in 2021, alleged that the companies “deliberately facilitate gun trafficking” into Mexico, according to the Jan. 22 ruling issued by the U.S. Court of Appeals for the 1st Circuit. The complaint was initially filed at the federal district court in Massachusetts, which dismissed the lawsuit after deciding that U.S. gun companies were protected by the Protection of Lawful Commerce in Arms Act (PLCAA) against Mexican claims. The PLCAA proh … Read more at: https://www.zerohedge.com/geopolitical/mexicos-10-billion-lawsuit-against-us-gun-manufacturers-proceed-appeals-court-rules |

|

HS2: Mayors to meet minister about alternativesWest Midlands mayor Andy Street said the plan could involve a dedicated line between the cities. Read more at: https://www.bbc.co.uk/news/business-68087768?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail could deliver on three days, regulator saysA report from the regulator has laid out options to save the UK’s postal service money. Read more at: https://www.bbc.co.uk/news/business-68067702?at_medium=RSS&at_campaign=KARANGA |

|

Boeing boss faces Washington grilling after blow-outA whistleblower calls Boeing manufacturing a “rambling, shambling, disaster waiting to happen”. Read more at: https://www.bbc.co.uk/news/business-68082728?at_medium=RSS&at_campaign=KARANGA |

|

Not nibbling now, expect deeper corrections in Nifty & Sensex: Dipan MehtaDipan Mehta expects a deep correction in the stock market, possibly as much as 10-12% on the Nifty and the Sensex. Corporate results have been disappointing, with growth rates of 10-12% but not enough to encourage buying at current valuations. Profit margins have expanded due to commodity prices, but this trend may level off. The next six months could see very disappointing earnings seasons. Banks are also facing challenges, with concerns about NPAs and slower growth in advances due to cautious lending and a war for deposits. Read more at: https://economictimes.indiatimes.com/markets/expert-view/not-nibbling-now-expect-deeper-corrections-in-nifty-sensex-dipan-mehta/articleshow/107104288.cms |

|

Tech View: Nifty forms bullish piercing candle. What traders should do on Thursday expiryThe short-term trend of Nifty seems to have reversed up, but the uncertainty remains in the market at the highs. The market could encounter strong resistance around 21,500-21,600 levels in the coming session. Immediate support is at 21,220 level, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bullish-piercing-candle-what-traders-should-do-on-thursday-expiry/articleshow/107117790.cms |

|

IT stocks at inflection point? Both FIIs, mutual funds up stake in Q3FIIs and mutual funds increase their shareholding in IT stocks as growth momentum may bottom out, leading to a return to growth in CY24. MF holding in Tech Mahindra rises to 14.24% in Q4. FIIs and MFs raise stake in Wipro. FIIs show faith in HCL Technologies and LTI Mindtree. MFs pare stake in Infosys, while FII ownership increases. TCS sees no change in shareholding. BNP Paribas says revenue and margin of top IT companies exceed expectations. Companies’ guidance and positive tilt indicate a recovery. Nifty IT index rallies in November, December, and January. BNP Paribas picks Infosys, TCS, and HCL Tech as preferred picks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/it-stocks-at-inflection-point-both-fiis-mutual-funds-up-stake-in-q3/articleshow/107102253.cms |

|

Treasury yields end at highest levels in at least 6 weeks after PMI dataTreasury yields finished mostly higher on Wednesday, with 10- and 30-year rates at their highest levels in at least six weeks, after data showed U.S. businesses experienced a strong upturn in activity at the start of the year. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-ahead-of-u-s-pmi-reports-7ec06278?mod=mw_rss_topstories |

|

Here’s how long Haley’s big donors could keep funding her 2024 campaignNikki Haley is dismissing calls for her to drop out of the 2024 Republican presidential primary after her loss to Donald Trump in New Hampshire on Tuesday, but will her big donors stick with her? Read more at: https://www.marketwatch.com/story/heres-how-long-haleys-big-donors-could-keep-funding-her-2024-campaign-5eda03a1?mod=mw_rss_topstories |

|

Missed the boat on AMD’s stock surge? Why this analyst says you’re not too late.AMD shares have shot up 140% over the past year, but an analyst at New Street Research says there’s still time to jump on the bull train. Read more at: https://www.marketwatch.com/story/missed-the-boat-on-amds-stock-surge-why-this-analyst-says-youre-not-too-late-a934dbaa?mod=mw_rss_topstories |