Summary Of the Markets Today:

- The Dow closed up 138 points or 0.36%,

- Nasdaq closed up 0.32%,

- S&P 500 closed up 0.22%,

- Gold $2,022 down $7.20,

- WTI crude oil settled at $75 up $1.60,

- 10-year U.S. Treasury 4.103% down 0.043 points,

- USD index $103.33 up $0.05,

- Bitcoin $40,123 down $1,504 (3.61%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

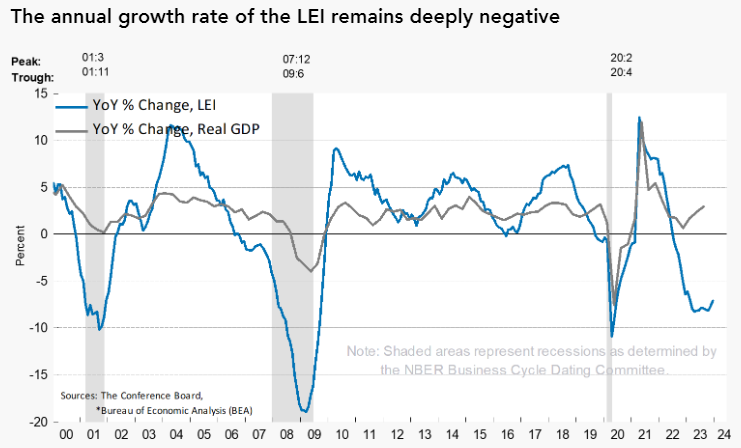

The Conference Board Leading Economic Index (LEI) for the U.S. fell by 0.1 percent in December 2023 to 103.1 (2016=100), following a 0.5 percent decline in November. The LEI contracted by 2.9 percent over the six-month period between June and December 2023, a smaller decrease than its 4.3 percent contraction over the previous six months. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The US LEI fell slightly in December, continuing to signal underlying weakness in the US economy. Despite the overall decline, six out of ten leading indicators made positive contributions to the LEI in December. Nonetheless, these improvements were more than offset by weak conditions in manufacturing, the high interest-rate environment, and low consumer confidence. As the magnitude of monthly declines has lessened, the LEI’s six-month and twelve-month growth rates have turned upward but remain negative, continuing to signal the risk of recession ahead. Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year.

Here is a summary of headlines we are reading today:

- Canada’s Uranium Is Fueling the World’s Nuclear Energy Boom

- Gasoline Shipping Day Rates Triple Under Houthi Attack

- The Strategic Implications of Iran’s Recent Missile and Drone Attacks

- WTI Oil Soars Nearly 2.6% as Geopolitics Overtakes Fundamentals

- Copper and Gold: Key Indicators for Predicting Economic Trends

- Russia And Iran Finalize 20-Year Deal That Will Change The Middle East Forever

- Sunoco to Buy NuStar Energy in $7.3 Billion Deal

- Dow rises more than 100 points to close above 38,000 for the first time ever: Live updates

- Spirit Airlines shares extend rebound after it appeals ruling blocking JetBlue merger

- Terraform Labs files for Chapter 11 bankruptcy protection in the U.S.: CNBC Crypto World

- Bitcoin was up 155% in 2023—but should you invest? Here’s what experts say

- Dow closes above 38,000 for first time as S&P 500 scores back-to-back records

- 2- and 10-year Treasury yields slip from 2024 highs as Fed’s blackout period gets under way

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Canada’s Uranium Is Fueling the World’s Nuclear Energy BoomUranium production in Cigar Lake, Canada is the highest-grade in the world. Since 2014, the site has mined 105 million pounds of the radioactive metal, which is naturally occurring on Earth. It is the largest uranium mine on the planet. For context, an egg-sized amount of uranium fuel can generate as much electric power as 88 tonnes of coal. Given its vast uranium deposits, Canada has produced the most uranium worldwide since 1945. This graphic, via Visual Capitalist’s Marcus Lu shows cumulative uranium production by country in modern history,… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Canadas-Uranium-Is-Fueling-the-Worlds-Nuclear-Energy-Boom.html |

|

Gasoline Shipping Day Rates Triple Under Houthi AttackDay rates for shipping gasoline from Europe to the U.S. have tripled since the beginning of the year, Bloomberg reports, citing data from the Baltic Exchange on Monday, as Yemen’s Iran-backed Houthis continue their relentless attack on vessels traversing the Red Sea. The day rate for a single cargo of gasoline heading from northwestern Europe to the east coast of the United States reached nearly $38,000 per day on Monday, Bloomberg reported. That represents a tripling of day rates since the beginning of the year. Cargoes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gasoline-Shipping-Day-Rates-Triple-Under-Houthi-Attack.html |

|

Milei Forced To Backtrack on Argentina State Oil Co. PrivatizationArgentina’s newly elected president, Libertarian Javier Milei, has been forced to make concessions in his radical market reform package, shelving plans to privatize state-run oil company YPF SA, Bloomberg reports. On Monday, the omnibus bill currently before Congress did not include YPF privatization plans, with negotiations having led to certain concessions in Milei’s radical market liberalization plans. Milei had proposed the privatization of 41 state-owned companies, including YPF, the country’s nuclear energy… Read more at: https://oilprice.com/Energy/Energy-General/Milei-Forced-To-Backtrack-on-Argentina-State-Oil-Co-Privatization.html |

|

Saudi Arabia’s Crude Oil Exports Hit 5-Month High in NovemberSaudi Arabia’s crude oil exports inched up in November from October to reach a five-month high, data from the Joint Organizations Data Initiative (JODI) showed on Monday. Crude oil exports from the world’s top crude exporter rose by 39,000 barrels per day (bpd) to around 6.34 million in November, up from October’s 6.3 million bpd level, according to the latest available data in JODI, which compiles self-reported data from many countries. Yet, Saudi crude oil production fell in November by 122,000 bpd to 8.82 million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Crude-Oil-Exports-Hit-5-Month-High-in-November.html |

|

The Strategic Implications of Iran’s Recent Missile and Drone AttacksIran has showcased its advancing missile and drone capabilities in a demonstration of the lengths it can take to strike perceived threats. But in targeting extremist groups and an alleged spy base in neighboring countries, Tehran also showed there are limits to how far it is willing to go for now.The strikes launched by the Islamic Revolutionary Guards Corps (IRGC) on January 15 and 16 made use of sophisticated missiles, violated the territorial sovereignty of Iraq, Syria, and Pakistan, and were clearly intended to send a message.”We are a missile… Read more at: https://oilprice.com/Metals/Commodities/The-Strategic-Implications-of-Irans-Recent-Missile-and-Drone-Attacks.html |

|

WTI Oil Soars Nearly 2.6% as Geopolitics Overtakes FundamentalsWest Texas Intermediate (WTI) climbed over 2.3% on Monday as rising tensions in two conflict zones outweighed supply and demand fundamentals that should have put downward pressure on crude prices. At 12:37 p.m. ET on Monday, WTI was up 2.59%, trading at $75.31, for a $1.90 gain on the day, while Brent crude was up 1.90%, trading at $80.05, for a $1.49 gain on the day. Overall, weakening demand and slowing economic growth have kept oil prices from soaring on geopolitical developments, Wednesday’s gains reflect an intensification… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Oil-Soars-Nearly-26-as-Geopolitics-Overtakes-Fundamentals.html |

|

Copper and Gold: Key Indicators for Predicting Economic TrendsVia SchiffGold.com, In the realm of institutional asset management, the copper/gold ratio (blue line) has served as a key indicator for some, providing insights into the potential trajectory of 10-year Treasury yields (red line). There are unique dynamics at play between these two metals, with copper being an industrial necessity and gold serving as a stable safe-haven. While the absolute level of the copper/gold ratio may not be crucial, its directionality holds significance. Broadly speaking, the copper/gold ratio becomes an indicator of the… Read more at: https://oilprice.com/Metals/Commodities/Copper-and-Gold-Key-Indicators-for-Predicting-Economic-Trends.html |

|

Australia Secures More Natural Gas Supply for its Domestic MarketAustralia has secured two supply deals for its domestic market to power east coast gas-fired stations, the government said on Monday, hoping to ease some of the concerns about the domestic supply of gas and the reliability of the energy system. Australia plans to retire a lot of its coal fleet by 2033 and to bet on renewable energy, but it faces power shortages if it rushes the energy transition, analysts and the Australian Energy Market Operator (AEMO) have warned. Despite being a major LNG exporter, Australia has faced… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-Secures-More-Natural-Gas-Supply-for-its-Domestic-Market.html |

|

China’s Monetary Policy: A Tightrope Walk by the PBoCThe People’s Bank of China (PBoC) kept its loan prime rates unchanged on Monday, despite concerns about a potential downturn in the property sector, a slowing economy, and subdued investor sentiment. As per the PBoC‘s announcement, both the one-year and five-year lending rates are set to remain unchanged at 3.45% and 4.2%, respectively. This decision aligned closely with expectations, with almost all market watchers predicting that the rates would hold steady. This decision follows last week’s unexpected move… Read more at: https://oilprice.com/Finance/the-Economy/Chinas-Monetary-Policy-A-Tightrope-Walk-by-the-PBoC.html |

|

Dozens of Firms Interested in US Auction of Citgo’s Parent CompanyA court-ordered auction of the shares of the parent company of Venezuela-owned U.S. oil refiner Citgo Petroleum has attracted dozens of companies interested in the data and the auction process, sources with knowledge of the matter told Reuters on Monday. “There are multiple pockets of capital” looking at Citgo’s parent company PDV Holding and its assets, one of the sources told Reuters. The sale process was launched by a Delaware court in October 2023. As the bidding round is drawing to a close, dozens of energy firms… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Dozens-of-Firms-Interested-in-US-Auction-of-Citgos-Parent-Company.html |

|

Copper Supply Disruptions Fuel Market UncertaintyVia Metal Miner Copper prices saw a 1.90% increase during the final month of the year. By late December, this managed to bring them to their highest level since August, leading to mixed copper price forecasts for 2024. However, prices began to retrace from their 5-month peak by the start of 2024. By mid-January, they remained trapped within their long-term sideways trend (get weekly updates on copper market fluctuations with MetalMiner’s weekly newsletter). Overall, the Copper Monthly Metals Index (MMI) moved sideways, with a 1.34% increase… Read more at: https://oilprice.com/Metals/Commodities/Copper-Supply-Disruptions-Fuel-Market-Uncertainty.html |

|

China Overtakes Europe in Clean Energy Tech ResearchChina has become a powerhouse in clean energy, and has overtaken the EU on clean technology research, a paper prepared for the European Commission has shown. “China has caught up with the EU in R&D expenditure. While Chinese R&D intensity more than doubled since 2000, EU R&D intensity grew much slower. As a result, China caught up with the EU while the US keeps a consistent lead,” according to the brief on the EU-China exposure in trade, investment, and technology. “China is increasingly becoming… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Overtakes-Europe-in-Clean-Energy-Tech-Research.html |

|

Russia And Iran Finalize 20-Year Deal That Will Change The Middle East ForeverIran’s Supreme Leader, Ali Khamenei, gave his official approval on 18 January to a new 20-year comprehensive cooperation deal between the Islamic Republic of Iran and Russia, according to a senior energy source in Iran and a senior source in the European Union’s (E.U.) energy security complex, exclusively spoken to by OilPrice.com last week. The 20-year deal – ‘The Treaty on the Basis of Mutual Relations and Principles of Cooperation between Iran and Russia’ – was presented for his consideration… Read more at: https://oilprice.com/Energy/Energy-General/Russia-And-Iran-Finalize-20-Year-Deal-That-Will-Change-The-Middle-East-Forever.html |

|

Sunoco to Buy NuStar Energy in $7.3 Billion DealGas station owner Sunoco LP will buy pipeline and liquids terminal operator NuStar Energy in an all-equity transaction valued at around $7.3 billion, including debt, the companies said on Monday in the latest merger deal in the U.S. energy sector. Under the terms of the definitive agreement, NuStar common unitholders will receive 0.400 Sunoco common units for each NuStar common unit, implying a 24% premium based on the 30-day VWAP’s of both NuStar and Sunoco as of January 19, 2024. Sunoco has secured a $1.6-billion one-year bridge term loan to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sunoco-to-Buy-NuStar-Energy-in-73-Billion-Deal.html |

|

TotalEnergies Set to Restart Tyra Gas Field in Denmark in MarchTyra, the largest natural gas field offshore Denmark, is currently on schedule to resume production in March after years of redevelopment, the field’s operator TotalEnergies said on Monday. TotalEnergies and partners are progressing preparations to restart the Tyra field as planned, the French oil and gas supermajor said in a statement. The field was temporarily closed for redevelopment in 2019. The status of the redevelopment project currently indicates that March 31, 2024, remains the restart date, but “depending on the progress of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Set-to-Restart-Tyra-Gas-Field-in-Denmark-in-March.html |

|

Dow rises more than 100 points to close above 38,000 for the first time ever: Live updatesStocks rose Monday as investors built on the previous session’s historic move to record highs. Read more at: https://www.cnbc.com/2024/01/21/stock-market-today-live-updates.html |

|

Wall Street opposition to Trump collapses, as ‘pipe dream’ of primary defeat endsExecutives on Wall Street have no plans to try to stop Donald Trump as he surges to the Republican nomination. Read more at: https://www.cnbc.com/2024/01/22/wall-street-opposition-to-trump-collapses-as-pipe-dream-of-primary-defeat-ends.html |

|

AMD’s stock surge in past year leads analyst to a ‘heck if we know’ ratingElevated expectations for AI chip growth has led one analyst to admit he has know idea how AMD should be valued. Read more at: https://www.cnbc.com/2024/01/22/amds-stock-surge-leads-analyst-to-a-heck-if-we-know-rating.html |

|

Watchdog report is critical of former Fed officials in stock trading controversyA review into market trading from two former high-ranking officials criticizes their actions but does not accuse either of doing anything illegal. Read more at: https://www.cnbc.com/2024/01/22/watchdog-report-is-critical-of-former-fed-officials-in-stock-trading-controversy.html |

|

Goldman says these stocks with increasing profitability will beat the market this yearGoldman Sachs’ David Kostin expects headwinds from taxes and borrowing costs to subside this year, driving higher profitability for a wider group of stocks. Read more at: https://www.cnbc.com/2024/01/22/goldman-says-these-stocks-with-increasing-profitability-will-beat-the-market-this-year.html |

|

Spirit Airlines shares extend rebound after it appeals ruling blocking JetBlue mergerSpirit shares are down about 50% since a U.S. District Court judge blocked the merger. Read more at: https://www.cnbc.com/2024/01/22/spirit-airlines-stock-rebounds-after-appeal-of-jetblue-merger-block.html |

|

Trump sex assault defamation trial postponed after juror calls in sickA lawyer for Donald Trump wants to have him testify Wednesday at the trial for the suit by E. Jean Carroll, a day after the New Hampshire Republican primary. Read more at: https://www.cnbc.com/2024/01/22/trump-sex-defamation-trial-day-postponed-in-new-york.html |

|

Meta’s retreat from news accelerated in 2023, leaving publishers scrambling for trafficMeta has been de-emphasizing news across Facebook’s feed, upending many publishers that had come to rely on referral traffic. Read more at: https://www.cnbc.com/2024/01/22/metas-retreat-from-news-accelerated-in-2023-leaving-media-scrambling.html |

|

Gilead stock falls after lung cancer study results disappointGilead will discuss the results with regulators and identify whether certain lung cancer patients may still benefit from the drug, known as Trodelvy. Read more at: https://www.cnbc.com/2024/01/22/gilead-stock-falls-after-disappointing-lung-cancer-study-results.html |

|

Terraform Labs files for Chapter 11 bankruptcy protection in the U.S.: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Sui Chung, CEO of CF Benchmarks, discusses bitcoin’s sell-off after the launch of spot bitcoin ETFs in the U.S.. Read more at: https://www.cnbc.com/video/2024/01/22/terraform-labs-chapter-11-bankruptcy-protection-us-crypto-world.html |

|

This scenic town in Croatia is selling houses for just 13 cents—but there’s a catchLegrad, Croatia borders Hungary and has seen its population dwindle since the collapse of the Austro-Hungarian empire in 1918. Read more at: https://www.cnbc.com/2024/01/22/croatia-town-selling-homes-cents.html |

|

Russia strikes back at Ukraine for ‘monstrous act of terrorism’ after market, oil terminals attackedRussia and Ukraine traded retaliatory strikes at the weekend after another Russian oil terminal was attacked Sunday, as were Donetsk and nine Ukrainian regions. Read more at: https://www.cnbc.com/2024/01/22/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Bitcoin was up 155% in 2023—but should you invest? Here’s what experts sayBitcoin was up 155% in 2023 in anticipation of ETF approval. Now that the funds are here, here’s what you can expect. Read more at: https://www.cnbc.com/2024/01/22/bitcoin-is-now-a-good-time-to-invest.html |

|

Politicians Perpetuating Power Is The Path To The West’s DestructionAuthored by Daniel Lacalle, Milei Exposes The Path of Destruction For The West Big corporations and global leaders adhere to and assume the growing interventionism and the advance of socialism because, for politicians, it is an excellent way of perpetuating their power and control over citizens, while multinationals tolerate it because they have enough financial muscle and size to absorb the pernicious effects of the massive rise in public debt and monetary imbalances, public spending, taxes, barriers to trade, and progress. They all know that the burden of interventionism falls entirely on small businesses and families, destroying the middle class in the process. The wealthy can escape the negative impact of monetary debasement and confiscatory taxes. People with salaries and small entrepreneurs cannot. Who suffers the constant erosion of real disposable income from those gigantic and wrongly called government “stimulus plans” that never stimulate anything but bureaucracy, leaving a massive trail of debt and impoverishment caused by increased inflation and ever-increasing taxes? The middle classes and small businesses. Why do global leaders accept a rising trend in destructive policies that they know will fail? There is a perverse incentive. Business leaders who should value the success of productive investment and free markets are afraid that the interventionist cancelling crowd will attack them and, therefore, prefer to … Read more at: https://www.zerohedge.com/political/politicians-perpetuating-power-path-wests-destruction |

|

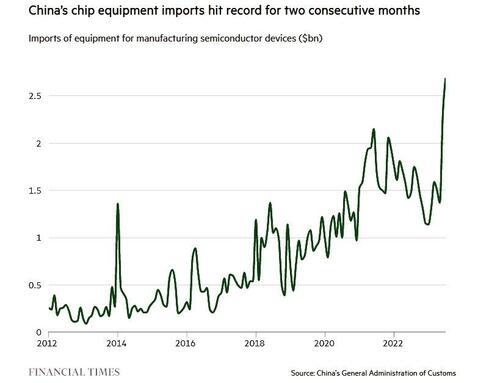

Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export CurbsIt’s not the first time the market has been fooled by a burst of Chinese chip buying (to frontrun US sanctions), and extrapolating a new golden age in semiconductors. Last summer, both the Nasdaq and the SOX exploded higher after the March bank failures and peaked on August 1 before rolling over and tumbling to a 5 months low in October. August 1 was also the date that the FT reported what was really happening behind the scenes:

|

|

Exxon Sues Activist Investors To Block Climate Petitions At Shareholder MeetingBy Tsvetana Paraskova of OilPrice.com ExxonMobil is suing two activist investor groups in a Texas district court, aiming to block their climate proposals from going to a vote at the annual shareholder meeting later this year in the first such direct complaint to court instead of to the SEC.

Exxon filed late on Sunday a lawsuit at the U.S. District Court for the Northern District of Texas against U.S. activist investor Arjuna Capital and shareholder activist group Follow This. Those two investors have filed a proposal for Exxon’s shareholders to vote at the annual general meeting on May 29 to have Exxon commit to further emissions reductions, including Scope 3 – emissions from the product it sells. Exxon is seeking fo … Read more at: https://www.zerohedge.com/markets/exxon-sues-activist-investors-block-climate-petitions-shareholder-meeting |

|

“Diverse But Incompetent”: Comedian Rob Schneider Pens Open Letter Calling Out ‘Drag Queen’ CEO Of United AirlinesDEI started to (finally) make its way into the public’s crosshairs following the embarrassing testimony of several Ivy League college professors about the events in Israel on October 7th. The discussion was ratcheted up a notch after a door from an Alaska Airlines plane detached mid-air, leading many to raise questions about whether or not DEI hiring standards at Boeing were negatively affecting the company’s output. Even more recently, United’s CEO Scott Kirby was accused of being a drag queen and additional questions were raised about how the airline prioritizes safety for its passengers and employees.

One person not waiting around for answers from the airline is actor and (former) United 1K frequent flyer Rob S … Read more at: https://www.zerohedge.com/markets/diverse-incompetent-comedian-rob-schneider-pens-open-letter-calling-out-drag-queen-ceo |

|

LNER train drivers call off five days of strikesThe drivers’ union will not go ahead with a fresh run of walkouts that were due to begin next month. Read more at: https://www.bbc.co.uk/news/business-68054064?at_medium=RSS&at_campaign=KARANGA |

|

Energy prices predicted to fall by 16% in AprilDomestic gas and electricity bills are expected to drop sharply just as the better weather arrives. Read more at: https://www.bbc.co.uk/news/business-68055884?at_medium=RSS&at_campaign=KARANGA |

|

H&M pulls school uniform advert after being accused of sexualising childrenFashion giant removes an advert for school uniforms and says it is “deeply sorry” for offence caused. Read more at: https://www.bbc.co.uk/news/business-68054060?at_medium=RSS&at_campaign=KARANGA |

|

Technical Breakout Stocks: How to trade Bharti Airtel, L&T and Titan Company on Tuesday?Indian headline indices ended in the red on Saturday conceding their morning gains amid selling pressure in FMCG, IT and pharma sectors despite a good show by banks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-bharti-airtel-lt-and-titan-company-on-monday/articleshow/107053983.cms |

|

Nifty@22K: How should investors safeguard portfolios in 2024As the financial markets venture into 2024, investors face market opportunities and heightened volatility. Nishit Master advises investing in good-quality companies with consistent positive cash flows to shield against anticipated turbulence. Mohit Ralhan recommends a comprehensive portfolio review, rebalancing allocations to align with risk tolerance. He cautions against poor-quality companies and suggests implementing stop-loss mechanisms to protect profits. Alok Agarwal advises against timing the market, emphasizing disciplined rebalancing and asset allocation. Varun Saboo recommends strategic allocation with a focus on large caps for stability and growth potential. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty22k-how-should-investors-safeguard-portfolios-in-2024/articleshow/107046233.cms |

|

Dow closes above 38,000 for first time as S&P 500 scores back-to-back recordsU.S. stocks advanced on Monday, building off a record finish as fourth-quarter earnings season begins to ramp up. Read more at: https://www.marketwatch.com/story/s-p-500-futures-rise-after-key-index-finished-at-record-high-dc5f0388?mod=mw_rss_topstories |

|

2- and 10-year Treasury yields slip from 2024 highs as Fed’s blackout period gets under wayTreasury yields pulled back from some of their highest levels of the year on Monday, a day in which there was limited new information about the economy. Read more at: https://www.marketwatch.com/story/jpmorgan-and-morgan-stanley-recommend-buying-5-year-note-ahead-of-auction-0b3b471b?mod=mw_rss_topstories |

|

A key Tesla metric is ‘under threat.’ Wall Street will soon learn more.Tesla’s price cuts have led Wall Street to lower estimates for the electric-vehicle maker’s profit, and to question its prospects. Read more at: https://www.marketwatch.com/story/a-key-tesla-metric-is-under-threat-wall-street-will-soon-learn-more-40edd533?mod=mw_rss_topstories |