Summary Of the Markets Today:

- The Dow closed down 232 points or 0.62%,

- Nasdaq closed down 0.19%,

- S&P 500 closed down 0.37%,

- Gold $2,032 down $19.50,

- WTI crude oil settled at $72 down $0.68,

- 10-year U.S. Treasury 4.068% up 0.116 points,

- USD index $103.36 up $0.96,

- Bitcoin $43,236 up $346 (0.81%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

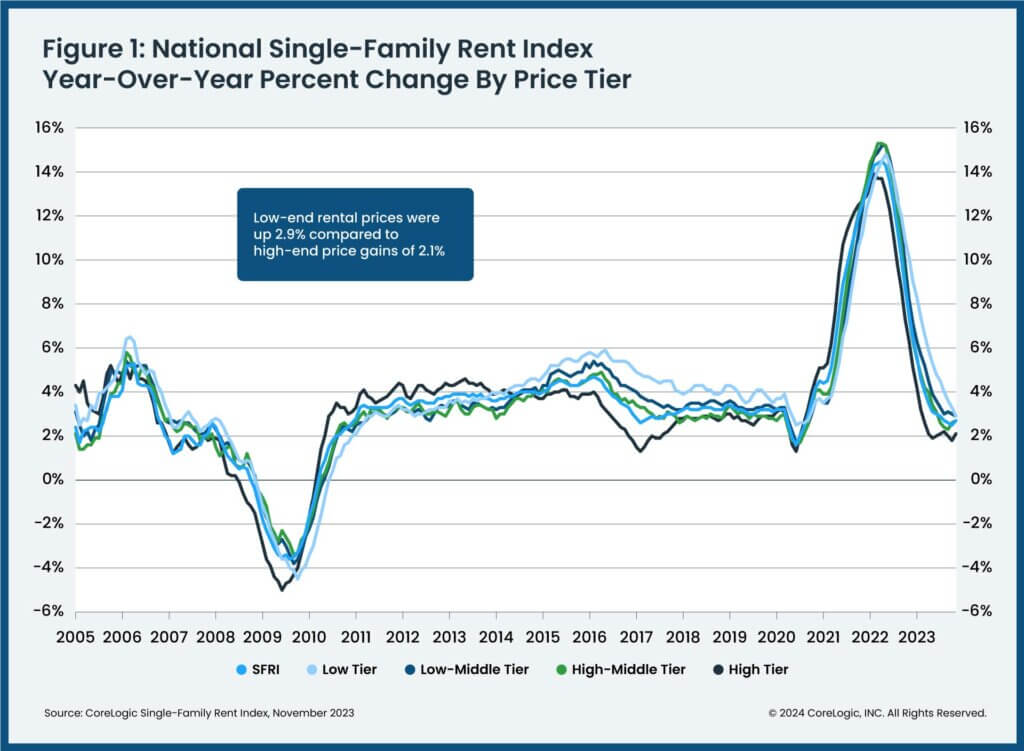

CoreLogic Single-Family Rent Index (SFRI) shows national single-family rent growth remained stable in November 2023. As in the past few months, rental demand is picking up in pricier coastal areas of the U.S., with the Boston, New York, San Diego, and San Francisco metros all ranking in the top five for annual gains in November. Molly Boesel, principal economist for CoreLogic stated:

More than three years of increasing U.S. single-family rents and the rising costs of other goods have made many renters sensitive to the cost of living. Many renters are renewing their current leases, and others who are moving are seeking lower-priced alternatives.

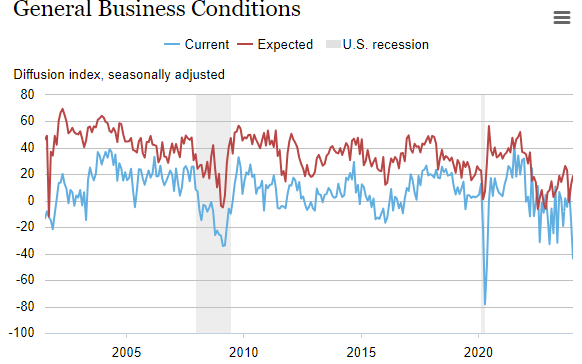

The January 2024 Empire State Manufacturing Survey shows the headline general business conditions index fell twenty-nine points to -43.7, its lowest reading since May 2020. New orders and shipments also posted sharp declines. Unfilled orders continued to shrink significantly, and delivery times continued to shorten. Inventories edged lower. Employment and the average workweek declined modestly. Even though I am not a fan of surveys, this one is extremely recessionary. Manufacturing as a sector has been in recession for over one year.

Here is a summary of headlines we are reading today:

- The World’s Top 50 Power-Hungry Data Center Markets

- North Dakota Oil Output Down Up to 650,000 BPD in Severe Storm

- Navy SEALs Seize Vessel with Iranian Missile Parts Bound for Houthis

- Shell To Sell its Onshore Oil Business in Nigeria

- Shell Halts All Red Sea Shipments as Tensions Rise

- Qatar Halts Red Sea LNG Shipments As Regional Tensions Escalate

- Dow closes more than 200 points lower Tuesday after 10-year Treasury yield tops 4%: Live updates

- AMD shares jump 7% and head for highest close since 2021 on AI chip demand

- UBS raises S&P 500 target for 2024, sees nearly 8% gain from here

- Hush Money: JP Morgan Pays $18 Million Fine For Violating Whistleblower Protection Rules

- No rate cuts in 2024? Why investors should think about the ‘unthinkable.’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The World’s Top 50 Power-Hungry Data Center MarketsWe live in an information-abundant digital world, where data is the new currency, and data centers are the vaults that protect and power it. The amount of data created each year has skyrocketed from 2 zettabytes in 2010 to 44 zettabytes (44 trillion gigabytes) in 2020. This has surged demand for data storage and processing, leading to the construction of massive data centers around the world. So, where are the biggest data centers? In this graphic,Visual Capitalist’s Julie Peasley uses 2023 data from Cushman & Wakefield to shed light on the… Read more at: https://oilprice.com/Energy/Energy-General/The-Worlds-Top-50-Power-Hungry-Data-Center-Markets.html |

|

North Dakota Oil Output Down Up to 650,000 BPD in Severe StormSevere weather conditions have cut oil production significantly in the American shale patch, with power outages, refinery shutdowns and production stoppages taking hundreds of thousands of barrels offline. The winter storm has significantly impacted TotalEnergy’s Port Arthur, Texas, refinery, which was shut down last Friday due to a malfunction on the gasoline-producing fluidic catalytic cracker (FCC). On Tuesday, Reuters reported that the winter storm has now led to a full power outage at the 238,000 barrel-per-day… Read more at: https://oilprice.com/Latest-Energy-News/World-News/North-Dakota-Oil-Output-Down-Up-to-650000-BPD-in-Severe-Storm.html |

|

Turkmenistan Looks To Woo Investors at EU-Central Asia Transport ForumLater this month, senior representatives of Central Asian governments and European Union peers will meet in Brussels for an Investors Forum for EU-Central Asia Transport Connectivity. At the January 12 Cabinet meeting, Mammetkhan Chakiyev, the head of Turkmenistan’s state agency for transport and communications, delivered a briefing on ongoing preparations for the event. President Serdar Berdymukhamedov stressed that he sees the forum as an opportunity to tout the investment appeal of the country’s transport sector. An EU-commissioned… Read more at: https://oilprice.com/Geopolitics/International/Turkmenistan-Looks-To-Woo-Investors-at-EU-Central-Asia-Transport-Forum.html |

|

Lawsuit Accuses U.S. Shale of Cartel BehaviorA lawsuit in a U.S. court is accusing American oil and gas producers, including Hess, Pioneer Natural Resources and Occidental Petroleum, of price-fixing by conspiring to reduce production. A total of nine companies are listed in the lawsuit filed by residents of Nevada, Hawaii and Maine, Reuters reports. The lawsuit was filed in a federal court in Las Vegas. The lawsuit alleges that these companies have for years “collectively coordinated their production decisions, leading to production growth rates lower than… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lawsuit-Accuses-US-Shale-of-Cartel-Behavior.html |

|

India-U.S. Trade Deal Eases Export Duties for Steel and AluminumVia Metal Miner India-US trade is primed to shift. Both countries seem eager to enter a new period of trade harmony, as India’s Ministries of Mines and Steel, along with the Department for Promotion of Industry and Internal Trade (DPIIT), recently set up an in-house system to oversee the export of steel and aluminum products to the United States at reduced duties. News articles indicate that the Department of Commerce recently completed the terms of reference concerning the Joint Monitoring Mechanism (JMM). The Department intends the mechanism… Read more at: https://oilprice.com/Metals/Commodities/India-US-Trade-Deal-Eases-Export-Duties-for-Steel-and-Aluminum.html |

|

Navy SEALs Seize Vessel with Iranian Missile Parts Bound for HouthisThe U.S. military has seized a vessel transporting Iranian missile parts to Yemen’s Houthi rebels, military officials said on Tuesday. The raid was conducted last week in the Arabian Sea but only made public on Tuesday, with the U.S. Navy SEALs conducting the maritime operation amid a mounting crisis in Red Sea shipping lanes that have come under constant attack by Houthi rebels. In the raid, Navy SEALs uncovered components for cruise missiles and ballistic missiles, including warheads, according to U.S. Central Command. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Navy-SEALs-Seize-Vessel-with-Iranian-Missile-Parts-Bound-for-Houthis.html |

|

NATO Allies Unite to Demine the Black SeaA Panama-flagged cargo ship navigating the Black Sea on its way to a Danube River port to load grain, a crucial export commodity for war-hit Ukraine, was jolted by an explosion in late December that threw the vessel off course, sparked a fire on deck, and left two crew members injured. The Ukrainian military, which dispatched tugs to the site, said on December 28 that the ship had hit a Russian mine in the Black Sea, the second such incident in as many months in the major trade route. Since the start of Russia’s full-scale invasion of neighboring… Read more at: https://oilprice.com/Geopolitics/International/NATO-Allies-Unite-to-Demine-the-Black-Sea.html |

|

Shell To Sell its Onshore Oil Business in NigeriaShell will exit Nigeria’s onshore oil and gas after agreeing to sell its onshore assets in the largest African OPEC producer, the UK-based supermajor said on Tuesday, adding that it would remain a major investor in Nigeria’s energy sector through its deepwater and Integrated Gas businesses. Shell has reached an agreement to sell its Nigerian onshore subsidiary, The Shell Petroleum Development Company of Nigeria Limited (SPDC), to Renaissance, a consortium of five companies—four exploration and production companies based… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-To-Sell-its-Onshore-Oil-Business-in-Nigeria.html |

|

Occidental’s CEO Sees Oil Supply Crunch from 2025The world would find itself short of oil from 2025 onwards as exploration for longer-producing crude reserves is set to lag demand growth, Vicki Hollub, chief executive of Occidental Petroleum, said at the Davos forum on Tuesday. For most of the second half of the 20th century, oil companies were finding more crude than global consumption, around five times the demand volumes, Hollub said, as carried by Reuters. The ratio of discovered resources versus demand has dropped in recent decades and is now at around 25%. “In the… Read more at: https://oilprice.com/Energy/Crude-Oil/Occidentals-CEO-Sees-Oil-Supply-Crunch-from-2025.html |

|

Shell Halts All Red Sea Shipments as Tensions RiseShell has suspended indefinitely all its shipments via the Red Sea/Suez Canal route amid rising tensions in the region and fears of escalating Houthi attacks on commercial shipping, The Wall Street Journal reported on Tuesday, citing sources with knowledge of the supermajor’s decision. An oil tanker that Shell had chartered to ship jet fuel out of India was targeted by a drone and harassed by boats of the Iran-backed Houthis in December, shipping officials have told the Journal. Shell is the latest major firm that has decided to halt tanker… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Halts-All-Red-Sea-Shipments-as-Tensions-Rise.html |

|

Europe Stands Divided on U.S.-Led Bombing Campaign of YemenBy The Cradle Europe is divided over the US-UK bombing of Yemen, one of the world’s poorest countries, as Italy, Spain, and France have refused to take part in the operation… Washington and London carried out late-night strikes on Yemen Thursday evening, which targeted several areas of the country, including the capital, Sanaa. The US and UK are seeking to target Yemen’s Ansarallah-led forces for their efforts to target Israeli-linked ships in the Red Sea in response to Israel’s brutal bombing campaign in Gaza, which many view as genocide.… Read more at: https://oilprice.com/Geopolitics/Middle-East/Europe-Stands-Divided-on-US-Led-Bombing-Campaign-of-Yemen.html |

|

Uranium Energy Restarts Wyoming ProductionU.S.-based Uranium Energy Corp said on Tuesday it would restart uranium production at its fully permitted site in Wyoming as the resurgence in nuclear power has led to a new bull market in uranium. Uranium Energy will resume 100% unhedged uranium production at its fully permitted, and past producing, Christensen Ranch In-Situ Recovery (ISR) operations in Wyoming. The recovered uranium will be processed at the fully operational Irigaray Central Processing Plant with a current licensed capacity of 2.5 million pounds U3O8 per year, the company… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Uranium-Energy-Restarts-Wyoming-Production.html |

|

Qatar Halts Red Sea LNG Shipments As Regional Tensions EscalateThe US and British bombing campaigns of Iran-backed Houthis in Yemen marks a significant intensification of the Middle East crisis. This development comes as the region is already dealing with heightened tensions due to the three-month war between Israel and Hamas in Gaza, suggesting a move towards a broader regional conflict. Shipping disruptions across the Red Sea threaten global trade after major shippers, such as Maersk and others, have rerouted vessels to the Cape of Good Hope following a series of drone and missile attacks on commercial… Read more at: https://oilprice.com/Energy/Natural-Gas/Qatar-Halts-Red-Sea-LNG-Shipments-As-Regional-Tensions-Escalate.html |

|

China Awarded Major Contract By Iraq For Supergiant Oil And Gas FieldThere are two key reasons why China, Russia, and the U.S. have long been scrambling to secure control over Iraq’s gas sector, and these are its massive potential size and its huge geopolitical importance. Last week’s awarding of the major build-own-operate-transfer contract to a subsidiary of Chinese flagship gas firm PetroChina to develop the Nahr bin Umar onshore gas field is a clear signal of how this competition is going. Even more so, as it follows the previous week’s takeover by PetroChina from the U.S. ExxonMobil… Read more at: https://oilprice.com/Energy/Energy-General/China-Awarded-Major-Contract-By-Iraq-For-Supergiant-Oil-And-Gas-Field.html |

|

China Looks to Take Advantage of the Recent Slide in Oil PricesIncentivized by below $80 a barrel Brent oil prices, Chinese refiners are looking to import more crude to build up stocks at relatively low prices early this year, expecting strong demand for fuels in the latter part of 2024, analysts and trading sources told Reuters. International oil prices and China’s crude import quota policies early this year have made refiners more certain of planning their purchases. Brent Crude has traded below $80 a barrel since early December, having dropped from a 2023 high of $95 at the end of September. In addition,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Looks-to-Take-Advantage-of-the-Recent-Slide-in-Oil-Prices.html |

|

Dow closes more than 200 points lower Tuesday after 10-year Treasury yield tops 4%: Live updatesStocks fell Tuesday as rates ticked higher and Wall Street pored through the latest batch of fourth quarter earnings. Read more at: https://www.cnbc.com/2024/01/15/stock-futures-are-lower-to-start-shortened-trading-week-live-updates.html |

|

Judge blocks JetBlue-Spirit merger after DOJ’s antitrust challengeJetBlue’s proposed $3.8 billion purchase of discounter Spirit would have produced the country’s fifth-largest airline. Read more at: https://www.cnbc.com/2024/01/16/jetblue-spirit-merger-block-in-win-for-bidens-justice-department.html |

|

Microsoft CEO Satya Nadella says global consensus on AI is emergingMicrosoft CEO Satya Nadella said there is a need for global coordination on AI and agreeing a set of standards and appropriate guardrails for the technology. Read more at: https://www.cnbc.com/2024/01/16/microsoft-ceo-satya-nadella-says-global-consensus-on-ai-is-emerging.html |

|

AMD shares jump 7% and head for highest close since 2021 on AI chip demandAMD is one of two major producers of graphics processing units, which were created for advanced computer games and are now key to artificial intelligence. Read more at: https://www.cnbc.com/2024/01/16/amd-shares-rise-jump-7percent-and-head-for-highest-close-since-2021.html |

|

UBS raises S&P 500 target for 2024, sees nearly 8% gain from hereThis year’s more dovish Federal Reserve policy supports higher valuations and above-trend EPS revisions, according to strategist Jonathan Golub. Read more at: https://www.cnbc.com/2024/01/16/ubs-raises-sp-500-target-for-2024-sees-nearly-8percent-gain-from-here.html |

|

Fed’s Christopher Waller advocates moving ‘carefully’ with rate cutsThe comments, delivered during a speech in Washington, D.C., seemed to counter market anticipation for aggressing easing this year. Read more at: https://www.cnbc.com/2024/01/16/feds-christopher-waller-advocates-moving-carefully-with-rate-cuts.html |

|

Nikki Haley under pressure from donors to defeat Donald Trump in New Hampshire after Iowa caucus lossNikki Haley is under pressure from some of her wealthiest donors to beat Donald Trump in the New Hampshire primary, or risk losing their support. Read more at: https://www.cnbc.com/2024/01/16/haley-pressured-by-donors-to-beat-trump-in-new-hampshire-after-iowa-loss.html |

|

Corporate debt defaults soared 80% in 2023 and could be high again this year, S&P saysThe number of companies that failed to make required payments on their debt totaled 153 for 2023, up from 85 the year before. Read more at: https://www.cnbc.com/2024/01/16/corporate-debt-defaults-soared-80percent-in-2023-and-could-be-high-again-this-year-sp-says.html |

|

Red Sea risk to oil ‘very real,’ prices could change rapidly if supply disrupted, Chevron CEO says“It’s a very serious situation and seems to be getting worse,” Chevron CEO Michael Wirth said of the crisis in the Red Sea. Read more at: https://www.cnbc.com/2024/01/16/red-sea-crisis-poses-very-real-risk-to-oil-chevron-ceo-says.html |

|

Bipartisan tax deal could boost child tax credit for 2023. What it means for families this tax seasonThe bipartisan tax deal could boost the child tax credit for 2023. Here’s how it could affect taxpayers this season, according to experts. Read more at: https://www.cnbc.com/2024/01/16/bipartisan-tax-deal-could-boost-child-tax-credit-for-2023.html |

|

Four predictions for 2024: Brian Sullivan’s outlook for the new yearComing off a wonderfully surprising stock market global boom of 2023, this year could be anybody’s guess. Read more at: https://www.cnbc.com/2024/01/16/four-predictions-for-2024-brian-sullivans-outlook-for-the-new-year.html |

|

Even with interest rate cuts, 2024 will be ‘a very good year for savers,’ expert says — how to ‘lock in now’As interest rate cuts loom on the horizon, experts say now may be the time to lock in the best rates with a CD. Read more at: https://www.cnbc.com/2024/01/16/why-2024-will-be-very-good-year-for-savers-particularly-with-cds.html |

|

CD rates are coming down. Here’s where you can lock in yields of nearly 5% for 2 yearsAfter the Federal Reserve’s rate hikes spurred a yield bonanza for cash holdings, banks are dialing back the yields they pay on certificates of deposit. Read more at: https://www.cnbc.com/2024/01/16/cd-rates-are-coming-down-heres-where-you-can-lock-in-yields-of-nearly-5percent-for-2-years.html |

|

Federal Judge Rejects Jack Smith’s Request To Force Trump To Reveal Key StrategyAuthored by Jack Phillips via The Epoch Times (emphasis ours), The federal judge overseeing the classified documents case against former President Donald Trump rejected a request from federal special prosecutor Jack Smith to force the former president to reveal a portion of his legal strategy.

(Left) Special Counsel Jack Smith delivers remarks in Washington on Aug. 1, 2023. (Right) Former President Donald Trump attends his trial in New York State Supreme Court in New York City on Dec. 7, 2023. (Drew Angerer, David Dee Delgado/Getty Images) Several weeks ago, Mr. Smith’s team attempted to compel the former president to disclose to the prosecutors whether he intends to use an “advice-of-counsel” de … Read more at: https://www.zerohedge.com/political/federal-judge-rejects-jack-smiths-request-force-trump-reveal-key-strategy |

|

Missing Seals Were On Secret Mission That Intercepted Iranian Missile Components Bound For HouthisThe Pentagon on Tuesday revealed more information about the two missing US Navy Seals, who disappeared off the cost of Somalia in the Gulf of Aden on Thursday after they “fell into the water during a nighttime boarding mission” according to US military officials. A search and rescue operation has continued, and the US Department of Defense has yet to formally declare them dead. The US has revealed additional information about their secretive mission, saying their team intercepted a shipment of Iranian missile components bound for Houthis in Yemen.

Recovered missile components, photograph by US Navy/CENTCOMThe nighttime raid was conducted against a dhow, or a small sailing boat, which was found to have contained several advanced weapons components on board, according to … Read more at: https://www.zerohedge.com/military/missing-seals-were-secret-mission-intercepted-iranian-missile-components-bound-houthis |

|

Why The Market Is Gunning For An Early Fed Rate-CutAuthored by Simon White, Bloomberg macro strategist, The high degree of certainty the Federal Reserve will deliver an early rate cut – which is a fait accompli historically when pricing is as skewed as it is today – is a sign the market perceives financial-instability risks are rising, and that a near-term reduction in rates is required to help prevent liquidity and funding issues from developing. The curious case of the March rate-cut rumbles on. Several theories have been put forward for why the market is ascribing such a high probability to it, such as more dovish economic data, or large yield-curve steepening positions skewing front-end rate pricing. None really pass muster when you look more closely at them. But under the lens of reserves and financial-stability risks, things start to make more sense.

This is controversial. A shibboleth of central banking is the “separation principle,” the id … Read more at: https://www.zerohedge.com/markets/why-market-gunning-early-fed-rate-cut |

|

Hush Money: JP Morgan Pays $18 Million Fine For Violating Whistleblower Protection RulesHush Money: JP Morgan Pays $18 Million Fine For Violating Whistleblower Protection RulesWhile Elizabeth Warren continues to espouse the anti-crypto movement, citing corruption and money laundering, her pal in loathing bitcoin, Jamie Dimon at JP Morgan, has started off a new week with yet another settlement with the government for regulatory infractions. Without admitting or denying charges by the U.S. Securities and Exchange Commission, the bank paid an $18 million fine this week for violating whistleblower protection rules with its confidentiality agreements over the course of a 3 year period, according to Morningstar and MarketWatch. An SEC press release stated: “According to the SEC’s order, from March 2020 through July 2023, JPMS regularly asked retail clients to sign confidential release agreements if they had been issued a credit or settlement from the firm of more than $1,000.” It continued:

|

|

Fujitsu admits it has a ‘moral obligation’ to compensate Post Office victimsBosses including the global CEO of the firm behind the faulty Horizon IT system apologise to victims. Read more at: https://www.bbc.co.uk/news/business-67993493?at_medium=RSS&at_campaign=KARANGA |

|

Boeing seeks Ryanair support with checks after mid-air blowoutRyanair boss Michael O’Leary told the BBC that it was asked to send engineers to oversee quality checks. Read more at: https://www.bbc.co.uk/news/business-67994140?at_medium=RSS&at_campaign=KARANGA |

|

Avanti sorry after leaked presentation cheers ‘free money’The management slides described performance-related payments for staff as “too good to be true”. Read more at: https://www.bbc.co.uk/news/business-67997916?at_medium=RSS&at_campaign=KARANGA |

|

Technical Breakout Stocks: How to trade Aster DM Healthcare, ITI and IRFC on Wednesdayster DM is currently trading at 430 level, having recently experienced a robust breakout above the 423 level, marked by a significant runaway gap. This breakout was accompanied by strong volumes, indicating substantial strength in the stock. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-aster-dm-healthcare-iti-and-irfc-on-wednesday/articleshow/106900593.cms |

|

TCS, Wipro and 5 other cos that spent highest on buybacks in past decade48 companies spent Rs 48,079 crore on buying back their stocks in 2023, according to data from Prime Database. Like Apple in the US, IT giant TCS in India has spent the most on buying back its shares over the past decade. Most firms that have gone for buybacks are typically from the cash-generating and low capex sectors such as IT, FMCG and pharma. Here’s a look at companies that spent the highest amount on buying back their shares: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/over-2-lakh-crore-tcs-wipro-and-5-other-companies-that-spent-highest-on-buybacks-in-past-decade/top-spenders/slideshow/106899781.cms |

|

Tech View: Nifty facing resistance around Mt 22K. What traders should do on WednesdayFor a sustained upward movement towards 22,300, Nifty needs to decisively break above 22,150. On the downside, the immediate support is located at 21,950 levels and a clear break below this level could trigger further corrections towards the 21,800 mark. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-facing-resistance-around-mt-22k-what-traders-should-do-on-wednesday/articleshow/106900962.cms |

|

Dow ends over 200 points lower after Fed’s Waller sees no rush on 2024 rate cutsU.S. stocks ended lower Tuesday as investors weigh corporate earnings and new comments from a Federal Reserve hawk suggesting interest-rate cuts could happen this year, but with no urgency on the timeline. Read more at: https://www.marketwatch.com/story/s-p-500-futures-slip-as-treasury-yields-rise-and-traders-eye-earnings-71c7d5b3?mod=mw_rss_topstories |

|

No rate cuts in 2024? Why investors should think about the ‘unthinkable.’One major Wall Street bank is weighing in on what it calls “an extreme scenario” in which no Group-of-10 central bank cuts interest rates this year due to sticky inflation, strong growth, or fresh shocks that push price gains higher. Read more at: https://www.marketwatch.com/story/bank-of-america-considers-unthinkable-scenario-of-no-irate-cuts-this-year-f1daacaa?mod=mw_rss_topstories |

|

Bipartisan tax deal could lead to 200,000 new affordable rental units. It’s a ‘modest and important’ effort, expert says.“Americans are getting clobbered by rising rents and home prices,” said Sen. Ron Wyden, an Oregon Democrat and the chair of the Senate Finance Committee. Read more at: https://www.marketwatch.com/story/bipartisan-tax-deal-could-lead-to-200-000-new-affordable-rental-units-its-a-modest-and-important-effort-expert-says-3b5fe0a6?mod=mw_rss_topstories |