Summary Of the Markets Today:

- The Dow closed down 158 points or 0.42%,

- Nasdaq closed up 0.09%,

- S&P 500 closed down 0.15%,

- Gold $2,036 up $2.00,

- WTI crude oil settled at $72 up $1.39,

- 10-year U.S. Treasury 4,015% up 0.013 points,

- USD index $102.54 up $0.33,

- Bitcoin $46,716 down $50 (0.03%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

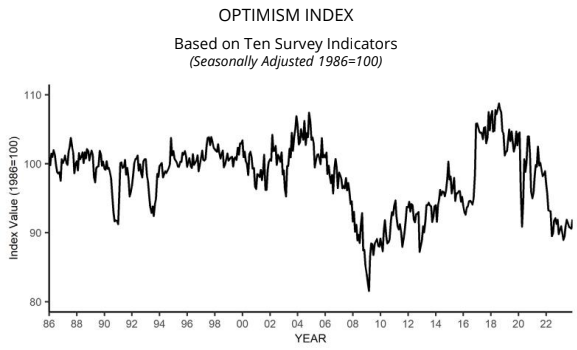

The NFIB Small Business Optimism Index increased 1.3 points in December to 91.9, marking the 24th consecutive month below the 50-year average of 98. Twenty-three percent of small business owners reported that inflation was their single most important problem in operating their business, up one point from last month, and replacing labor quality as the top concern. NFIB Chief Economist Bill Dunkelberg stated:

Small business owners remain very pessimistic about economic prospects this year. Inflation and labor quality have consistently been a tough complication for small business owners, and they are not convinced that it will get better in 2024.

November exports were up 5.6% year-over-year. November imports were up 1.5% year-over-year. November therefore saw a decrease in the goods and services deficit.

Here is a summary of headlines we are reading today:

- Scientists Present New Solid-State Lithium Battery That Lasts 6000 Cycles

- Big Three Automakers Rebound After Turbulent 2023

- China Sanctions 5 U.S. Defense Firms Ahead of Taiwan Election

- Azerbaijan Doubles Down on Its Domestic Oil Potential

- France Moves Away from Renewable Targets in Favor of Nuclear Power

- S&P 500 closes slightly lower as stocks’ early 2024 struggles linger: Live updates

- Defense Secretary Lloyd Austin treated for prostate cancer, severe infection: Pentagon

- Global economy set for its worst half-decade of growth in 30 years, World Bank says

- Bitcoin hovers at 21-month high ahead of imminent spot ETF decision by SEC: CNBC Crypto World

- tocks making the biggest moves midday: Unity Software, JetBlue, Juniper Networks and more

- Mortgages: Barclays and Santander cut rates as competition intensifies

- Dow snaps three-day winning streak as market awaits inflation data, earnings

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

EIA Sees U.S. Setting New Oil Production Record in 2025The EIA’s first outlook for 2025 shows forecasted U.S. crude oil production reading 13.4 million barrels per day—a new record for the country. The Energy Information Administration’s latest Short-Term Energy Outlook report published on Tuesday represents the first peek into predictions for 2025. Those predictions include the United States hitting 13.4 million bpd in crude oil production after continued production growth over the next two years “driven by increases in well efficiency.” The EIA pointed to slowing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EIA-Sees-US-Setting-New-Oil-Production-Record-in-2025.html |

|

Hungary Sets Course to Become EV Battery PowerhouseHungary plans $2 billion worth of infrastructure investment in its second-biggest city as the country looks to become a top manufacturing hub for EV batteries and vehicles in Europe. Hungary will invest 700 billion Hungarian forints, or around $2 billion, to improve road and transport infrastructure and water and waste management in and near Debrecen, the country’s second-largest city after the capital city Budapest, Hungarian Construction Minister Janos Lazar said at a press briefing on Tuesday, as carried by Bloomberg. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hungary-Sets-Course-to-Become-EV-Battery-Powerhouse.html |

|

Scientists Present New Solid-State Lithium Battery That Lasts 6000 CyclesHarvard’s John A. Paulson School of Engineering and Applied Sciences researchers have developed a new lithium metal battery that can be charged and discharged at least 6,000 times. That’s more than any other pouch battery cell – and can be recharged in a matter of minutes. The cycle count equals more than 16 years of daily charge /discharge cycles. The research not only describes a new way to make solid-state batteries with a lithium metal anode but also offers new understanding into the materials used for these… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Scientists-Present-New-Solid-State-Lithium-Battery-That-Last-6000-Cycles.html |

|

Big Three Automakers Rebound After Turbulent 2023Via Metal Miner While the index remained sideways for most of 2023, the automotive industry itself witnessed its fair share of shifts. For instance, the UAW strike forced numerous changes on the automotive industry while impacting automobile sales and production to varying degrees. Meanwhile, steel price hikes also caused the overall index to fluctuate and shift. All in all, the U.S. automotive industry witnessed numerous obstacles throughout 2023. By the end of the year, the Automotive MMI (Monthly Metals Index) rose 3.33%. A Turbulent Year for… Read more at: https://oilprice.com/Finance/the-Economy/Big-Three-Automakers-Rebound-After-Turbulent-2023.html |

|

Russia Honors OPEC+ Commitments with Reduced Oil ExportsRussian crude oil exports by sea in the first week of 2024 were aligned with the level Moscow has pledged to maintain as part of the OPEC+ agreement, tanker-tracking data monitored by Bloomberg showed on Tuesday. Russian crude oil shipments between January 1 and January 7 averaged 3.28 million barrels per day (bpd)—exactly 300,000 bpd below the observed exports by sea in May and June, which are used as reference levels for Russia’s promised reduction of 300,000 bpd of crude exports, according to the data… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Honors-OPEC-Commitments-with-Reduced-Oil-Exports.html |

|

China Sanctions 5 U.S. Defense Firms Ahead of Taiwan ElectionIn a major move by Beijing which appears timed to send a strong message just ahead of Taiwan’s presidential and parliamentary elections on January 13, China has unveiled sanctions against five American defense firms. The targeted companies are involved in recent and ongoing US arms deals and sales to the self-ruled island of Taiwan. They’ve been named in Chinese state media as BAE Systems Land and Armament, Alliant Techsystems Operation, AeroVironment, ViaSat and Data Link Solutions. A Sunday statement from the Chinese Foreign Ministry… Read more at: https://oilprice.com/Geopolitics/Asia/China-Sanctions-5-US-Defense-Firms-Ahead-of-Taiwan-Election.html |

|

Norway Approves Deep-Sea Mining for Critical MineralsEnvironmentalists received a blow this week as Norway’s parliament agreed to allow Arctic seabed exploration to mine for critical minerals as it attempted to shift away from its reliance on oil and gas. The decision could make Norway the first country in the world to commercialize deep-sea mining to harvest critical minerals as the electrification-of-everything push gets underway. Norway did not specify when exploration of the Arctic seabed would commence, but it did say that an application process would be used to assign exclusive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Approves-Deep-Sea-Mining-for-Critical-Minerals.html |

|

Azerbaijan Doubles Down on Its Domestic Oil PotentialNorway’s national oil company Equinor has announced that it has sold its shares in two Azerbaijani oil fields and the Baku Tbilisi Ceyhan oil pipeline to Azerbaijan’s state oil company SOCAR and will exit from Azerbaijan after 30 years in the country. “Equinor is in the process of reshaping its international oil and gas business, and the divestments in Azerbaijan are in line with our strategy to focus our international portfolio,” said Philippe Mathieu, Equinor’s executive vice-president for international exploration and production in a statement… Read more at: https://oilprice.com/Energy/Crude-Oil/Azerbaijan-Doubles-Down-on-Its-Domestic-Oil-Potential.html |

|

China’s Shale Exploration Yields Promising ResultsChina Petroleum & Chemical Corporation, or Sinopec, has found oil and gas at a shale exploration well in the Sichuan province in the southwest, estimating that the initial flows could lead to the discovery of around 100 million metric tons of hydrocarbons. The Xingye-9 exploration well in the Chongqing municipality tested a daily flow of 108.15 cubic meters of oil and 15,800 cubic meters of natural gas, Sinopec said on Tuesday in a statement carried by Reuters. The Sichuan province in southwestern China is estimated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Shale-Exploration-Yields-Promising-Results.html |

|

France Moves Away from Renewable Targets in Favor of Nuclear PowerAuthored by Mike Shedlock via MishTalk.com, Cheers to France if pending legislation passes as currently written. It effectively scraps most hard commitments and turns more towards nuclear power… Preliminary Bill relating to Energy Sovereignty Please consider a Google translation of a Preliminary Bill relating to Energy Sovereignty Four Key Things The wording of this preliminary bill relating to energy sovereignty is of course not final. It can still evolve between now and its presentation to the Council of Ministers and, then, during its discussion… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/France-Moves-Away-from-Renewable-Targets-in-Favor-of-Nuclear-Power.html |

|

EDF To Extend Life of UK Nuclear Power PlantsEDF will invest $1.65 billion (£1.3 billion) to extend the life of its nuclear power generating stations in the UK as it aims to keep UK nuclear output at current levels until at least 2026, the company said on Tuesday. EDF plans to invest the sum announced today in the UK’s five generating nuclear power stations over the 2024-26 period. The investment will help sustain nuclear power output at current levels, boosting energy security and reducing carbon emissions, EDF said. The company plans to to extend generating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EDF-To-Extend-Life-of-UK-Nuclear-Power-Plants.html |

|

India Hails First Oil Production from Long-Delayed Deepwater ProjectIndian state-run Oil and Natural Gas Corporation (ONGC) began this week oil production at a major deepwater oil and gas project, which is expected to boost domestic oil and gas production and help reduce India’s dependence on energy imports. ONGC said it had launched first oil production from deepwater block KG-DWN-98/2 in the Krishna Godavari basin in the Bay of Bengal, which would raise the company’s oil and gas production by 11% and 15%, respectively. The start-up of the deepwater project was also… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Hails-First-Oil-Production-from-Long-Delayed-Deepwater-Project.html |

|

Oil Jumps, but Another Downward Slide Seems LikelyWTI crude gained more than 2% on Tuesday morning, erasing some of Monday’s losses, but increasingly negative sentiment in oil remains a prime risk. Start to 2024 Oil Trading Looks Increasingly Bearish- Hedge funds and other money managers are increasingly bearish on the oil markets’ outlook, adding a combined 61,000 short positions in Brent and WTI crude in the week to January 2.- This marks the largest week-on-week increase in short positions since March and the second largest since mid-2017, brushing aside ongoing Red Sea shipping woes… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Jumps-but-Another-Downward-Slide-Seems-Likely.html |

|

Red Sea Oil Transport Uninterrupted Despite Regional UnrestDespite missile and drone attacks on container ships in the Red Sea from the Yemeni Houthis, tanker traffic remained stable in December, Reuters has reported, citing vessel tracking data. On a daily basis, the data showed there were 76 tankers carrying crude oil and fuels in the Red Sea. This, Reuters wrote, was just two tankers fewer than the average for November and three fewer than the average for the first eleven months of last year. “We haven’t really seen the interruption to tanker traffic that everyone was expecting,” Lloyd’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Red-Sea-Oil-Transport-Uninterrupted-Despite-Regional-Unrest.html |

|

Biden Admin Reviews LNG Approval ProcessThe Biden administration has launched a review into the approval criteria for new LNG production capacity, Politico has reported, citing unnamed sources in the know. According to the report, the review could lead to fewer approvals, hindering what has so far been a fast and furious expansion that turned the United States into the largest LNG exporter in the world. The review is being reported amid a surge in environmentalist opposition to new LNG facilities on the Gulf Coast. The specific focus of the opposition push is the CP2 project led by Venture… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Admin-Reviews-LNG-Approval-Process.html |

|

S&P 500 closes slightly lower as stocks’ early 2024 struggles linger: Live updatesThe S&P 500 trimmed an earlier decline Tuesday, boosted by tech shares, but still ended the session with modest losses. Read more at: https://www.cnbc.com/2024/01/08/stock-market-today-live-updates.html |

|

Honda teases new EVs with futuristic ‘Space-Hud’ and ‘Saloon’ concept carsHonda revealed two concept cars Tuesday at CES as a preview for a new lineup of global electrified vehicles that will begin arriving in North America in 2026. Read more at: https://www.cnbc.com/2024/01/09/honda-teases-new-evs-with-space-hud-saloon-concept-cars.html |

|

Defense Secretary Lloyd Austin treated for prostate cancer, severe infection: PentagonAustin’s failure to communicate his emergency hospitalization led some congressmembers to call for his resignation. Read more at: https://www.cnbc.com/2024/01/09/defense-secretary-lloyd-austin-treated-for-prostate-cancer-developed-severe-infection-pentagon-reveals.html |

|

Investors poured cash into these fixed income ETFs in 2023Last year was an extraordinary one for income-seeking investors. Read more at: https://www.cnbc.com/2024/01/09/investors-poured-cash-into-these-fixed-income-etfs-in-2023.html |

|

Global economy set for its worst half decade of growth in 30 years, World Bank saysThe global economy is on course to record its worst half decade of growth in 30 years, according to the World Bank. Read more at: https://www.cnbc.com/2024/01/09/global-economy-set-for-its-worst-half-decade-of-growth-in-30-years-world-bank.html |

|

Boeing to revise 737 Max 9 inspection instructions as planes remain grounded, FAA saysAlaska and United identified loose hardware on 737 Max 9s during preliminary checks. Read more at: https://www.cnbc.com/2024/01/09/faa-boeing-to-revise-737-max-9-inspection-instructions.html |

|

Bitcoin hovers at 21-month high ahead of imminent spot ETF decision by SEC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, 3iQ’s Mark Connors and eToro’s Callie Cox, discuss what could happen to crypto markets once a decision on spot bitcoin ETFs is revealed. Read more at: https://www.cnbc.com/video/2024/01/09/bitcoin-hovers-21-month-high-ahead-imminent-spot-etf-decision-by-sec-cnbc-crypto-world.html |

|

NFL offers buyouts to more than 200 employeesNews of the buyouts comes as the National Football League gears up for the playoffs. Read more at: https://www.cnbc.com/2024/01/09/nfl-offers-buyouts-to-more-than-200-employees.html |

|

NASA delays crewed Artemis moon missions into 2025 as companies navigate challengesNASA is pushing back the schedule for upcoming missions of its flagship Artemis lunar program by about a year. Read more at: https://www.cnbc.com/2024/01/09/nasa-delays-crewed-artemis-moon-missions.html |

|

American Airlines’ frequent flyer program is changing. Here’s what you need to knowAmerican made a host of changes to its lucrative frequent flyer program to encourage travelers to sign up. Read more at: https://www.cnbc.com/2024/01/09/american-airlines-frequent-flyer-changes-2024.html |

|

Biden slams Trump as ‘revealing twisted true colors’ after Trump says he hopes economy crashes in 2024The White House used Trump’s comments as an opportunity to tout Bidenomics victories. Read more at: https://www.cnbc.com/2024/01/09/biden-slams-trump-for-hoping-the-economy-crashes-in-2024.html |

|

Stocks making the biggest moves midday: Unity Software, JetBlue, Juniper Networks and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/01/09/stocks-making-the-biggest-moves-midday-u-jblu-jnpr.html |

|

National Park Service Scraps Plans To Remove William Penn Statue After Public OutcryWith Ivy League institutions finally revealed as Marxist, plagiarist echo chambers, it appears the public is also officially done with another “woke” ritual: removing statues. Just hours after the National Park Service announced they would be removing a statue of William Penn at Philadelphia’s Welcome Park, located in the Old City section of the city, the service swiftly reversed course. Though Zero Hedge can’t confirm that the outlet received significant pushback on the idea, social media was littered yesterday with objectors to the statue removal. As we noted yesterday, the modest-sized Penn statue is located at the site of of William Penn’s former home. The “Welcome Park” site was completed in its current form back in 1982, according to 6ABC, who said yesterday that park officials wanted to “reenvision the park and expand the interpretation of the Native American history of Philadelphia to make it more welcoming and inclusive for visitors.” Read more at: https://www.zerohedge.com/markets/national-park-service-scraps-plans-remove-william-penn-statue-after-public-outcry |

|

How To Navigate The Fed’s New Paradigm ShiftAuthored by Simon White, Bloomberg macro strategist, Will it come in March? Or the summer? When the Federal Reserve makes its first rate cut and when it tapers or ends quantitative tightening will in the first instance be a function of reserves, not the economy. It is through this prism that the Fed’s dovish conversion in December makes sense, and gives a practical framework for understanding its new de facto reaction function. Liquidity is everything in markets. At the base of the liquidity pyramid are central-bank reserves. These have always been key to understanding market functioning, but in the post-GFC regime of many central banks their volume, velocity and the variation in their ownership now play a pivotal role in driving market dynamics. To put it succinctly, the primary binding constraint on the Fed this year – and thus a key driver of the bank’s decision to pivot and when it cuts rates – is reserves. These are the frontline defense against a sharp drop in risk assets, dysfunctional funding markets, and thus a hard landing. A cut in rates therefore need not require a significant worsening in the economy, leaving a March rate reduction on the table. With -18 bps currently priced in for that month, the risk-reward is not currently attractive, but at around -7 bps or more that calculus changes. The liquidity backdrop for most of 2023 was benign as the Treasury skewed issuance towards bills which were scooped up by money market funds using idle liquidity parked at the Fed’s reverse repo facility (RRP). But the RRP is fall … Read more at: https://www.zerohedge.com/markets/how-navigate-feds-new-paradigm-shift |

|

Oil Supertanker Rates Are Soaring After Korean Shipper Sparks Market FrenzyLast week, when looking at the latest global container shipping rates, we observed a surge in prices for all legacy Red Sea routes such as US and Europe to China, while simple trans-Atlantic or trans-Pacific routes remained subdued.

However this surge pricing in container rates is also shifting over to tankers: as Bloomberg reports, the cost to ship crude oil from the US Gulf to China surged after a slew of vessel hires by a South Korean shipowner. A flurry of booking activity by Sinokor Merchant Marine in the past week rapidly tightened the availability of tankers, spurring what Bloomberg said was a “market frenzy.” While the transporters were booked for long-haul voyages, the motivation for the unusually large hiring spree was unclear. At least one vessel bound for the US to China route was chartered for just shy of $10 million, compared with about $7 to $8 million last week. Surprisingly, some of the tankers were booked with no underlying cargo. As a result of this booking spree, tanker rates have soared: the cost for VLCCs (or very-large crude carriers) from the US Gulf to Asia jumped by more than $1 million a day on Monday, the largest gain since … Read more at: https://www.zerohedge.com/markets/oil-supertanker-rates-are-soaring-after-korean-shipper-sparks-market-frenzy |

|

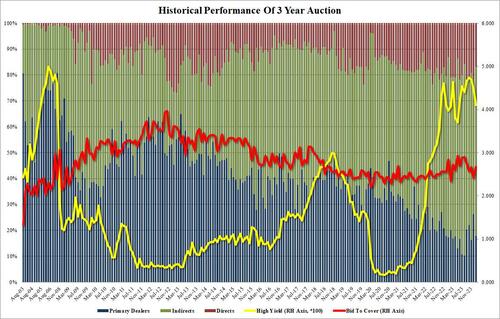

First Coupon Auction Of 2024 Is Stellar Sale Of 3Y PaperWhile not nearly as interesting as the upcoming long-duration 10Y and 30Y auction later this week, all eyes were on today’s sale of 3Y paper as it was the first coupon auction of the year. And despite some erroneous previews at competing publications, the auction was nothing short of stellar. Pricing at a high yield of 4.105%, down 38.5bps from the December yield of 4.490%, and the lowest 3Y high yield stop since May 2023, today’s auction stopped through the When Issued 4.116% by 1.1bps, the biggest stop through since Aug 2023. The bid to cover was 2.672, a solid jump from the 2.416 in December, and the highest since September. The internals were most impressive of all, however with Indirects awarded 65.3%, a big jump from last month’s 52.1%, and the highest since August (also well above the six-auction average of 62.3%). And with Directs awarded 16.8%, Dealers were left holding 17.8%, down from 26.2% last month and right on top of the recent average of 17.7%.

Overall, this was a stellar 3Y auction although since yiel … Read more at: https://www.zerohedge.com/markets/first-coupon-auction-2024-stellar-sale-3y-paper |

|

Fujitsu will be held accountable over Post Office scandal, says governmentThe firm behind the Horizon software is facing growing calls over its role in the Post Office scandal. Read more at: https://www.bbc.co.uk/news/business-67921298?at_medium=RSS&at_campaign=KARANGA |

|

Mortgages: Barclays and Santander cut rates as competition intensifiesTwo big lenders cut their mortgage rates as the battle for those seeking a new deal continues. Read more at: https://www.bbc.co.uk/news/business-67925256?at_medium=RSS&at_campaign=KARANGA |

|

Boohoo considers shutting factory after BBC investigationBoohoo opened the site in 2022 but is considering closing it after a BBC Panorama investigation. Read more at: https://www.bbc.co.uk/news/uk-england-leicestershire-67927678?at_medium=RSS&at_campaign=KARANGA |

|

These 7 Nifty companies can log over 40% YoY growth in PATAs many as seven companies from the Nifty50 pack could report a sharp growth in their bottomline for the quarter ended December 2023. ETMarkets shortlisted those companies that could see over 40% jumps in Q3 profits. Estimates are by Motilal Oswal: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/profit-churners-these-7-nifty-companies-can-report-over-40-yoy-growth-in-pat/earnings-watch/slideshow/106670974.cms |

|

Don’t expect recovery in FMCG before FY25: Abneesh RoyAbneesh Roy says: “In our view, in Q3, most of the companies will see flat to low-single digit volume growth in the rural areas while urban areas will be growing faster. Even in Q4, we do not see a big recovery in rural demand currently. Our sense is the recovery will happen in FY25, based on Rs 1 lakh crore election spending, government stimulus, freebies, etc.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/dont-expect-recovery-in-fmcg-before-fy25-abneesh-roy/articleshow/106664965.cms |

|

Tech View: Nifty forms Inside Bar candle on daily chart. What traders should do on Wednesday“Below 21,725/72,000, the weak sentiment is likely to continue. Below the same, the market could retest the level of 21,500/71,100. Further down side may also continue, which could drag the index till 21,435/70,850,” said Shrikant Chouhan of Kotak Securities Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-inside-bar-candle-on-daily-chart-what-traders-should-do-on-wednesday/articleshow/106670458.cms |

|

Dow snaps three-day winning streak as market awaits inflation data, earningsU.S. stocks ended mostly lower on Tuesday as investors rethink the chances of a interest-rate cut by the Federal Reserve in the near term and await new inflation data and earnings results later in the week. Read more at: https://www.marketwatch.com/story/s-p-500-futures-dip-as-samsung-warning-damps-technology-stocks-13e5a384?mod=mw_rss_topstories |

|

These traders bet on surprise blip higher in key December inflation readingInflation traders are positioning for a slightly bigger-than-expected blip higher in the annual headline rate of Thursday’s consumer price report for December. Read more at: https://www.marketwatch.com/story/inflation-traders-foresee-unexpected-blip-higher-in-decembers-cpi-inflation-rate-b8c6a0f7?mod=mw_rss_topstories |

|

‘Goldilocks thinking’ can set stock-market investors up for losses: Howard Marks‘Goldilocks’ rarely sticks around for long, warns investing legend Howard Marks in his latest memo. Read more at: https://www.marketwatch.com/story/goldilocks-thinking-can-set-stock-market-investors-up-for-losses-howard-marks-fc3a8136?mod=mw_rss_topstories |