Summary Of the Markets Today:

- The Dow closed up 217 points or 0.58%,

- Nasdaq closed up 2.20%,

- S&P 500 closed up 1.41%,

- Gold $2,033 down $16.80,

- WTI crude oil settled at $71 down $2.75,

- 10-year U.S. Treasury 4,006% down 0.036 points,

- USD index $102.25 down $0.16,

- Bitcoin $46,813 up $2,655 (6.01%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

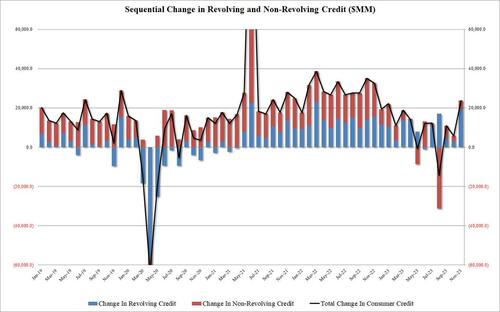

According to the Federal Reserve, in November 2023 total consumer credit increased at a seasonally adjusted annual rate of 5.7% with revolving credit increased at an annual rate of 17.7% and nonrevolving credit increased at an annual rate of 1.5%. Using my preferred year-over-year analysis – total consumer credit increased by 2.8% (blue line on the graph below and 1.4% inflation-adjusted red line on the graph below). This credit expansion is low for times of economic growth. Non-revolving credit is mostly student and personal loans – and is barely growing year-over-year whilst revolving credit (say credit cards) is growing 9.6% year-over-year (but slowly moderating).

Here is a summary of headlines we are reading today:

- 3 Catalysts That Could Push Gold Prices Even Higher

- Equinor Sells Off Azerbaijan Oil Assets

- Iran’s Dark Fleet: The High Cost of Clandestine Oil Exports

- Affordability Crisis Weigh on Automobile Sector

- Traders Most Bearish on Oil Since March 2023

- Oil Prices Slump by 4% As Demand Concerns Trump Supply Risks

- United Airlines inspections find loose bolts on several Boeing 737 Max 9 aircraft after grounding

- Nasdaq Composite closes 2% higher Monday as tech stocks’ revival lifts major averages: Live updates

- Mortgage rate decline pulls buyers back into the housing market

- Bitcoin touches highest level in nearly two years as deadline for spot ETFs looms: CNBC Crypto World

- Consumer Credit Shocker: November Debt Soars After Second Biggest Surge In Credit Card Debt On Record

- Dow ends higher with third day of gains, as bond yields pull back

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

3 Catalysts That Could Push Gold Prices Even HigherAuthored by Mike Maharrey via Money Metals, There are three factors driving gold bulls as we move into the new year – the demand factor, the Fed factor, and the January factor. Gold just wrapped up its best year since 2020 with a 13 percent gain, and the yellow metal has new records in its crosshairs as we move into 2024. Gold faced significant headwinds throughout most of 2023 with dollar strength and a higher interest rate environment. But as the markets began to anticipate an end to the Federal Reserve’s inflation fight, gold rallied… Read more at: https://oilprice.com/Metals/Gold/3-Catalysts-That-Could-Push-Gold-Prices-Even-Higher.html |

|

American Gasoline Prices Could Plunge Below $3 A GallonThe U.S. national average price per gallon of gasoline could decline to under $3 for the first time since 2021, amid sluggish demand, GasBuddy’s Patrick De Haan said on Monday. Gasoline prices have fallen for the second straight week, down 3.8 cents from a week ago to $3.03 per gallon as of Sunday. Compared to a month ago, the average price per gallon is down 12.2 cents, while prices are down 22 cents compared to a year ago, according to GasBuddy data. “With a record rise in gasoline inventories last week as demand was anemic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/American-Gasoline-Prices-Could-Plunge-Below-3-A-Gallon.html |

|

Equinor Sells Off Azerbaijan Oil AssetsNorway’s national oil company Equinor has announced that it has sold its shares in two Azerbaijani oil fields and the Baku Tbilisi Ceyhan oil pipeline to Azerbaijan’s state oil company SOCAR and will exit from Azerbaijan after 30 years in the country. “Equinor is in the process of reshaping its international oil and gas business, and the divestments in Azerbaijan are in line with our strategy to focus our international portfolio,” said Philippe Mathieu, Equinor’s executive vice-president for international exploration and production in a statement… Read more at: https://oilprice.com/Energy/Energy-General/Equinor-Sells-Off-Azerbaijan-Oil-Assets.html |

|

Statkraft Plans $6.6 Billion Investment in Wind and HydropowerNorwegian company Statkraft, Europe’s largest generator of renewable energy, plans a record investment of up to $6.6 billion (6 billion euros) in Norway’s wind and hydropower generation. Up to $3.3 billion (3 billion euros) will go to upgrades and transformations of Norwegian hydroelectric power plants, and another up to $2.2 billion (2 billion euros) is earmarked for rehabilitation of dams and modernization of older power plants, Statkraft said on Monday. Around $1.1 billion (1 billion euros) is allocated to the renewal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Statkraft-Plans-66-Billion-Investment-in-Wind-and-Hydropower.html |

|

BRICS’ Expansion in the Global SouthIran, Saudi Arabia, Egypt, Ethiopia and the United Arab Emirates formally joined the BRICS group of major emerging economies on January 1, 2024, expanding the bloc’s footprint in the Global South and growing its economic and political clout on the world stage, establishing a real counterweight to the Western-dominated G7. You will find more infographics at Statista In August, the bloc had announced that it would be admitting six new members, including Argentina. However, as Statista’s Felix Richter reports, the South American… Read more at: https://oilprice.com/Geopolitics/International/BRICS-Expansion-in-the-Global-South.html |

|

The Netherlands To Turn On Groningen Gas Output amid Cold SnapThe Dutch government has decided to temporarily extract minimal amounts of natural gas from two sites at the Groningen gas field that was closed last year, as a deep freeze is moving into northwest Europe, boosting demand for space heating and electricity. The Groningen gas fields would be turned off on October 1, 2023, and permanently close next October, the government of the Netherlands said last summer. The fields were expected to remain in operational status for another year just in case the country finds itself on the energy backfoot… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Netherlands-To-Turn-On-Groningen-Gas-Output-amid-Cold-Snap.html |

|

Iran’s Dark Fleet: The High Cost of Clandestine Oil ExportsMore than 6,000 kilometers from Tehran, in treacherous waters off the shores of Singapore, a “dark fleet” of oil tankers waits to offload the precious cargo that helps keep Iran’s economy afloat — a dependency that could also sink it. The fleet has grown steadily over the past five years, delivering Iranian crude to China as the countries work in concert to circumvent international sanctions that target Tehran’s lucrative oil exports. But while the clandestine trade has buoyed Iran’s budget, it also comes at tremendous cost and risk to Tehran.… Read more at: https://oilprice.com/Energy/Crude-Oil/Irans-Dark-Fleet-The-High-Cost-of-Clandestine-Oil-Exports.html |

|

Shale Tycoon Harold Hamm Wants to Lure Gen Z to the Oil IndustryShale tycoon Harold Hamm and U.S. and European supermajors are looking to support university courses in petroleum engineering and related disciplines in a bid to attract young talent to the industry that’s not viewed favorably by Millennials and Generation Z. Harold Hamm, the U.S. shale pioneer who founded Continental Resources, has donated to establish the Hamm Institute for American Energy at Oklahoma State University. At the end of 2021, the Harold Hamm Foundation and Continental Resources announced a combined $50 million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shale-Tycoon-Harold-Hamm-Wants-to-Lure-Gen-Z-to-the-Oil-Industry.html |

|

Affordability Crisis Weigh on Automobile SectorVehicle sales started to slow at the end of last year as “sticker shock” has been taking its toll on would-be U.S. consumers, according to Bloomberg. Potential buyers are now “balking” at the idea of 10% interest rates on car loans, the report says. The average price of a vehicle now sits at about $48,000 and sales fell to an SAAR of 15.4 million vehicles for the last month of 2023, the report says. This number is down from 15.5 million the previous two quarters. Jonathan Smoke, chief economist for researcher Cox Automotive told Bloomberg:… Read more at: https://oilprice.com/Finance/the-Markets/Affordability-Crisis-Weigh-on-Automobile-Sector.html |

|

Traders Most Bearish on Oil Since March 2023Hedge funds and other portfolio managers ended the last week of 2023 with the most new bearish positions in futures and options contracts since March and the second-largest jump in weekly short additions since 2017. Money managers added some 61,000 short positions in Brent Crude and WTI Crude combined in the week to January 2, per data from the exchanges handling the trades. The latest Commitment of Traders reports show that speculators reduced their net long position – the difference between bullish and bearish bets –… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Traders-Most-Bearish-on-Oil-Since-March-2023.html |

|

Unrest In Libya Remains Major Obstacle To Higher Oil ProductionGiven that Libya still has 48 billion barrels of proved crude oil reserves – the largest in Africa – recent comments from National Oil Corporation (NOC) chairman Farhat Bengdara that it is on track to rise oil production from the circa-1.2 million bpd seen in recent months to 2 million bpd within the next three years at the earliest might appear well-founded. So too might his comment that the NOC is also planning major bidding rounds for oil exploration blocks this year. However, politically-driven problems emerging last week at the… Read more at: https://oilprice.com/Energy/Energy-General/Unrest-In-Libya-Remains-Major-Obstacle-To-Higher-Oil-Production.html |

|

What to Expect from Shell’s Fourth Quarter Earnings ReportShell’s fourth-quarter results will include impairment charges of up to $4.5 billion, which would be partly offset by a strong gas trading business, the UK-based supermajor said on Monday. Shell expects non-cash post tax impairments – which will be reported as identified items – of between $2.5 billion and $4.5 billion for the fourth quarter, “primarily driven by macro & external developments as well as portfolio choices, including the Singapore Chemicals & Products assets.” In addition,… Read more at: https://oilprice.com/Energy/Energy-General/What-to-Expect-from-Shells-Fourth-Quarter-Earnings-Report.html |

|

Oil Prices Slump by 4% As Demand Concerns Trump Supply RisksOil prices plunged by nearly 4% early on Monday after Saudi Arabia signaled potentially weaker demand ahead by cutting the price of its oil across the board. As of 9:22 a.m. ET on Monday, the U.S. benchmark, WTI Crude, was down by 3.75% to $70.83. The international benchmark, Brent Crude, had slumped by 3.53% on the day, at $75.87. The move lower was triggered by Saudi Arabia, the world’s top crude oil exporter, which cut the official selling prices (OSPs) for its crude loading in February to all regions. The cut… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Slump-by-4-As-Demand-Concerns-Trump-Supply-Risks.html |

|

Ex Goldman Analyst Currie Expects Bumper Year for CommoditiesCommodities, including crude oil, are set for a good year, which could turn into “fantastic” if planned interest rate cuts materialize, according to veteran analyst Jeff Currie, who left Goldman Sachs last year after nearly 30 years at the helm of the bank’s commodity research division. All commodities are set for bullish moves in 2024 amid low inventories and record-high demand for raw materials, Currie, who is often bullish on the sector, told Bloomberg television in an interview on Monday. “The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ex-Goldman-Analyst-Currie-Expects-Bumper-Year-for-Commodities.html |

|

India Fuel Demand Hits 7-Month Peak in DecemberFuel demand in India reached the highest level in seven months in December 2023, topping 20 million tons in total, oil ministry data cited by Reuters shows. On a monthly basis, demand was up by 6.2%, while on an annual basis, the increase stood at 2.6%. Among fuels, all but gasoline booked increases in demand. India is widely seen as one of the two biggest drivers of global oil demand, alongside China. The subcontinent is the third-largest oil consumer globally. Its economy is growing faster than the global average and so is its energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Fuel-Demand-Hits-7-Month-Peak-in-December.html |

|

United Airlines inspections find loose bolts on several Boeing 737 Max 9 aircraft after groundingPlane manufacturer Boeing earlier Monday sent instructions to airlines to begin conducting the inspections of the Max 9s in their fleets. Read more at: https://www.cnbc.com/2024/01/08/united-airlines-737-max-9-inspections-turn-up-loose-bolts.html |

|

Tiger Woods ends Nike partnership after 27 yearsMark Steinberg, Woods’ longtime agent, told CNBC that the golfer made a business decision to not renew with Nike. Read more at: https://www.cnbc.com/2024/01/08/tiger-woods-ends-nike-partnership-after-27-years.html |

|

Nasdaq Composite closes 2% higher Monday as tech stocks’ revival lifts major averages: Live updatesThe S&P 500 and tech-heavy Nasdaq rose Monday after the major averages kicked off 2024 with a down week, as traders kept an eye on falling yields. Read more at: https://www.cnbc.com/2024/01/07/stock-market-today-live-updates.html |

|

National Association of Realtors president says she is resigning after blackmail threatThe National Association of Realtors has see two presidents quit in less than six months, and its CEO steop down on the heels of a bombshell civil judgement. Read more at: https://www.cnbc.com/2024/01/08/national-association-of-realtors-president-says-she-is-resigning-after-blackmail-threat.html |

|

Here are JPMorgan’s top picks for each industry in 2024The firm compiled compelling ideas across corners of the stock market. Read more at: https://www.cnbc.com/2024/01/08/here-are-jpmorgans-top-picks-for-each-industry-in-2024.html |

|

Mortgage rate decline pulls buyers back into the housing marketThe spring housing market may be getting underway a little early this year. Read more at: https://www.cnbc.com/2024/01/08/mortgage-rate-decline-pushes-buyers-back-into-the-housing-market.html |

|

Top Goldman Sachs analyst says the world is moving into a new super cycleThe world economy is moving into a new so-called super-cycle, with AI and decarbonization being driving factors, a Goldman Sachs analyst says. Read more at: https://www.cnbc.com/2024/01/08/goldman-sachs-analyst-says-the-world-is-moving-into-a-new-super-cycle.html |

|

Used car prices expected to stabilize in 2024 after two years of decreases from record highsCox Automotive expects wholesale used car prices to end the year up 0.5% from December 2023. Read more at: https://www.cnbc.com/2024/01/08/used-car-prices-high-but-expected-to-be-stable-in-2024.html |

|

OpenAI responds to New York Times lawsuit, says ‘regurgitation’ of content is a ‘rare bug’The New York Times recently sued the artificial intelligence startup over alleged copyright infringement. Read more at: https://www.cnbc.com/2024/01/08/openai-responds-to-new-york-times-lawsuit.html |

|

Bitcoin touches highest level in nearly two years as deadline for spot ETFs looms: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ben McMillan, CIO of IDX Digital Assets, breaks down what a spot bitcoin ETF in the U.S. could mean for retail investors. Read more at: https://www.cnbc.com/video/2024/01/08/bitcoin-hits-highest-level-nearly-two-years-deadline-spot-etf-looms-cnbc-crypto-world.html |

|

Nintendo is expected to launch the ‘Switch 2’ console this year. Here’s what to expectBut there are signs that Switch sales are starting to slow — and Nintendo needs something new. Read more at: https://www.cnbc.com/2024/01/08/nintendo-switch-2-console-coming-in-2024-analysts-say.html |

|

What travelers need to know about the Boeing 737 Max 9 groundingThe Federal Aviation Administration grounded dozens of Boeing Max 9 planes after a door plug blew out early in an Alaska Airlines flight last week. Read more at: https://www.cnbc.com/2024/01/08/boeing-737-max-9-grounding-what-travelers-need-to-know.html |

|

Consumer prices are cooling, but BlackRock bets on inflation-protected bonds for the long term. Here’s whyWith inflation-protected bonds, the principal portion of the securities rises and falls alongside the movement in the consumer price index. Read more at: https://www.cnbc.com/2024/01/08/blackrock-is-betting-on-inflation-protected-bonds-for-the-long-term.html |

|

Peter Schiff: The Fed Will Bank On Biden In 2024Via SchiffGold.com, The Federal Reserve will play a pivotal role in the upcoming election and aim to boost President Biden or another Democratic candidate.

Peter states:

The President has the power to nominate the Federal Reserve chair, making this authority a crucial factor in shaping the Fed’s decisions. As a result, the Fed chairman, in this case, … Read more at: https://www.zerohedge.com/markets/peter-schiff-fed-will-bank-biden-2024 |

|

Consumer Credit Shocker: November Debt Soars After Second Biggest Surge In Credit Card Debt On Record[EconCurrents Note: We strongly disagree with this analysis – see our review above of economic releases] We, and many others, were wondering how it was possible that US consumers – already tapped out beyond a breaking point, with collapsing savings and declining real wages – were able to push holiday spending which started in November and continued until the end of the year – to record nominal highs. Now we know: according to the latest monthly consumer credit report from the Fed, in November, consumer credit exploded higher by $24.75BN, blowing away expectations of a “modest” $9BN increase after the surprisingly subdued $5.8BN (upward revised from $.5.1BN) in October and the $4.3BN average of the past 6 months. This was the biggest monthly increase since last November, and was the first $20BN+ print since Jan 2023.

When looking into the details we find something remarkable: while non-revolving credit rose a modest $4.6BN… Read more at: https://www.zerohedge.com/markets/consumer-credit-shocker-november-debt-soars-after-second-biggest-surge-credit-card-debt |

|

Modern Monetary University Plagiarism TheorySubmitted by QTR’s Fringe Finance The bad news is that it has taken decades to expose the rot that has been making its way through Ivy League institutions in our country. The good news is that with such glaring examples as the multiple university presidents who humiliated themselves in front of Congress talking about the response to the Israel-Palestine conflict on their campuses, it is now impossible for even the most lobotomized groupthinkers to ignore said rot. Read more at: https://www.zerohedge.com/markets/modern-monetary-university-plagiarism-theory |

|

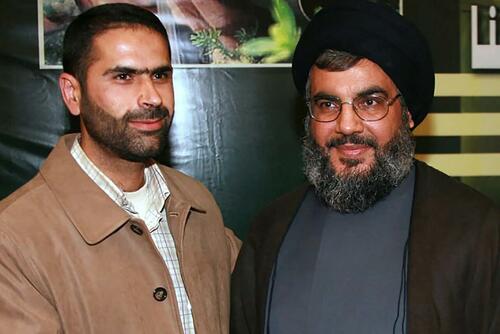

Israeli Airstrike Kills Senior Hezbollah Special Operations CommanderOn Monday a high-ranking Hezbollah commander was killed by an Israeli strike on southern Lebanon, the paramilitary group backed by Iran confirmed in a statement. The slain commander, Wissam Hassan Al-Tawil, was reportedly deputy head of the group’s Radwan elite forces, which is a special operations unit with the mission of infiltrating Israeli territory. His car was reportedly hit in an airstrike as it was traveling in the village of Majdal Selm, Reuters details based on statements.

Wissam Hassan Al-Tawil, left, with the group’s leader, Hassan Nasrallah, in an undated photo. Hezbollah media office/AFPThis is part of a steady and rising escalation and tit-for-tat, given that on Sunday at least seven Hezbollah members were killed as Israel goes after the Radwan unit in particular. The day prior to that, Hezbollah had launched Read more at: https://www.zerohedge.com/geopolitical/israeli-airstrike-kills-senior-hezbollah-special-operations-commander |

|

Post Office scandal explained: What the Horizon saga is all aboutThe background to the cases of sub-postmasters whose convictions were based on evidence from faulty IT. Read more at: https://www.bbc.co.uk/news/business-56718036?at_medium=RSS&at_campaign=KARANGA |

|

Tiger Woods and Nike end 27-year partnershipWoods, who was first sponsored by Nike in 1996, thanked the company on social media on Tuesday. Read more at: https://www.bbc.co.uk/news/business-67916788?at_medium=RSS&at_campaign=KARANGA |

|

Barclays bank cut 5,000 jobs in cost-saving driveThe reduction is much higher than previously reported and a quarter of the cuts will take place in the UK. Read more at: https://www.bbc.co.uk/news/business-67916634?at_medium=RSS&at_campaign=KARANGA |

|

SBI among 5 Nifty cos that may log over 15% YoY fall in Q3 PATThe December quarter earnings season is set to kick off this week for Nifty50 companies. TCS, Infosys, HCL Tech and Wipro are the ones slated to post their Q3 numbers between Thursday and Friday, with most analysts pencilling in a weak show. Here’s a look at the Nifty50 companies that may post an over 15% year-on-year (YoY) decline in Q3 PAT, according to estimates by Motilal Oswal: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sbi-among-5-nifty-companies-that-may-clock-over-15-yoy-fall-in-q3-pat/q3-laggards/slideshow/106642338.cms |

|

Bloomberg proposes India gilts inclusion in EM Local Currency Index; seeks feedbackAs a result, the Indian FAR bonds will be included in the EM Local Currency indices with an initial weight of 20% of their full market value in September. The weight of FAR bonds will then be increased in increments of 20% of their full market value every month over the 5-month period ending in January 2025, when they will be weighted at their full market value (100%) in the indices, Bloomberg said. Read more at: https://economictimes.indiatimes.com/markets/bonds/bloomberg-proposes-india-gilts-inclusion-in-em-local-currency-index-seeks-feedback/articleshow/106644039.cms |

|

Tech View: Nifty forms bearish engulfing candle. What should traders do on TuesdayOpen Interest (OI) data showed that the call side displayed the highest OI at the 48,000 level, closely followed by 48,500 strike prices. Conversely, on the put side, the highest OI was observed at the 47,000 strike price. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-engulfing-candle-what-should-traders-do-on-tuesday/articleshow/106639428.cms |

|

Dow ends higher with third day of gains, as bond yields pull backStocks closed higher on Monday as tech stocks were lifted by a pullback in Treasury yields. Read more at: https://www.marketwatch.com/story/boeing-drags-down-dow-futures-as-investors-fret-over-fed-trajectory-020d48a9?mod=mw_rss_topstories |

|

Financial markets may be overlooking ‘one remaining ember’ that could reignite inflationInvestors confident about the likelihood of easing U.S. inflation may be failing to put enough emphasis on one key component of last Friday’s surprisingly strong jobs report for December. Read more at: https://www.marketwatch.com/story/financial-markets-may-be-overlooking-one-remaining-ember-that-could-reignite-inflation-bb6f75b0?mod=mw_rss_topstories |

|

America and democracy are on the ballot as billions worldwide vote in 2024Gains for far-right, anti-immigrant candidates could foreshadow November’s U.S. election results. Read more at: https://www.marketwatch.com/story/america-and-democracy-are-on-the-ballot-as-billions-worldwide-vote-in-2024-9ce7fc43?mod=mw_rss_topstories |