Summary Of the Markets Today:

- The Dow closed up 54 points or 0.14%,

- Nasdaq closed down 0.03%,

- S&P 500 closed up 0.04%,

- Gold $2,077 down $16.50,

- WTI crude oil settled at $72 down $2.20,

- 10-year U.S. Treasury 3.844% up 0.055 points,

- USD Index $101.24 up $0.25,

- Bitcoin $42,521 down $977 ( 2.25% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

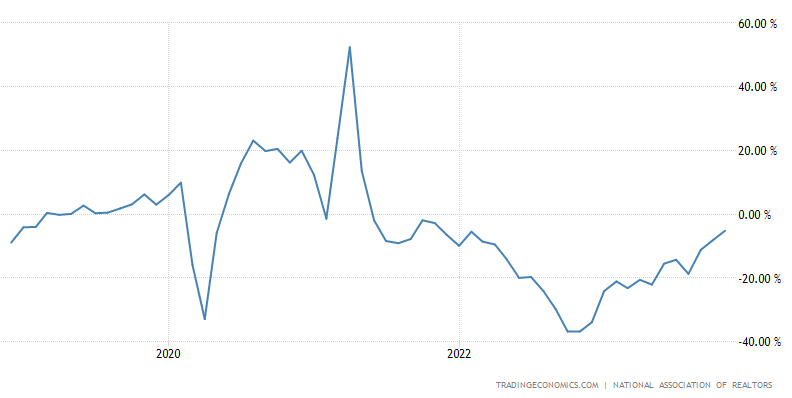

The Pending Home Sales Index – a forward-looking indicator of home sales based on contract signings –year over year, pending transactions were down 5.2% – an improvement from last month’s -8.2%.. Lawrence Yun, NAR chief economist stated:

Although declining mortgage rates did not induce more homebuyers to submit formal contracts in November, it has sparked a surge in interest, as evidenced by a higher number of lockbox openings.

In the week ending December 23, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,000, a decrease of 250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 212,000 to 212,250.

- GasBuddy: Gasoline and Diesel Prices To Fall In 2024

- Record Global Gasoline Consumption Defies IEA Forecast

- Aerospace Industry Eyes Full Recovery by 2025

- Cheap Imports Threaten India’s Steel Sector

- Houthi Attacks Fail to Stop Middle East’s Pricing Problem

- S&P 500 closes little changed Thursday, struggles to reach record: Live updates

- Startup bubble fueled by Fed’s cheap money policy finally burst in 2023

- Could a bitcoin ETF approval be a sell-the-news event? What investors are expecting on the big day

- November pending home sales were unchanged, despite a sharp drop in mortgage rates

- Boeing Urges Airlines To Inspect 737 Max After “Possible Loose Bolt” For Rudder System

- Treasury yields extend bounce after weak 7-year note auction in final full trading day of 2023

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Subsea Power Cables: The Future of Global Energy TransportAs countries worldwide develop their renewable energy capacity, governments are exploring innovative ways to transport electricity across borders to promote energy sharing. One way that’s becoming increasingly popular is the undersea cable, which is used to transport electricity under the sea from one country or region to another. There are several large-scale projects already underway in Europe and we can expect this technology to soon extend to other parts of the world, supporting a global green transition. Recent estimates suggest… Read more at: https://oilprice.com/Energy/Energy-General/Subsea-Power-Cables-The-Future-of-Global-Energy-Transport.html |

|

GasBuddy: Gasoline and Diesel Prices To Fall In 2024U.S. drivers are expected to pay 2% less for gasoline next year, according to GasBuddy’s 2024 Fuel Outlook report published on Friday. The average price for a gallon of regular gasoline in the United States could still fall below $3 per gallon this winter, according to GasBuddy, before rising in late February, eventually creeping towards $4 per gallon as we head into the summer months. U.S. drivers could spend $446.9 billion on gasoline next year, with average spending falling to $2,407 for the year—that would be down 2%… Read more at: https://oilprice.com/Latest-Energy-News/World-News/GasBuddy-Gasoline-and-Diesel-Prices-To-Fall-In-2024.html |

|

Next-Gen Solar Cells: Smaller, Cheaper, More EfficientUniversity of Ottawa engineers, together with national and international partners, have achieved a world first by manufacturing the first back-contact micrometric photovoltaic cells. The cells, with a size twice the thickness of a strand of hair, have significant advantages over conventional solar technologies, reducing electrode-induced shadowing by 95% and potentially lowering energy production costs by up to three times. The reporting paper has been published in the journal Cell Reports Physical Science. The technological breakthrough… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Next-Gen-Solar-Cells-Smaller-Cheaper-More-Efficient.html |

|

Record Global Gasoline Consumption Defies IEA ForecastGlobal gasoline consumption hit a record 26.9 million barrels per day (bpd) this year, exceeding the 2019 peak and defying estimates that the last pre-pandemic year was the time when gasoline demand worldwide would peak. The data, reported by Bloomberg Opinion columnist Javier Blas, shows the latest figures from the International Energy Agency (IEA). The same agency, which has been strongly advocating for a faster energy transition for years, had predicted just this year that 2019 was the peak demand for gasoline globally. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Record-Global-Gasoline-Consumption-Defies-IEA-Forecast.html |

|

Why January Could Be a Good Month for GoldVia SchiffGold.com, If history is any indication, January will be a good month for gold. According to analysis by the World Gold Council, gold tends to perform well in the first month of the year. Since 1971, gold has had an average return of 1.79% in January. That’s nearly three times the long-term monthly average. Over that same period, gold has charted positive returns in January almost 60% of the time. Going back to 2000, gold has gained in 70% of Januaries. The World Gold Council points to three factors that may boost gold’s… Read more at: https://oilprice.com/Metals/Gold/Why-January-Could-Be-a-Good-Month-for-Gold.html |

|

Global Shippers Bypass Suez Canal As Security Concerns PersistThe threat of attacks in the Red Sea has prompted half of the container fleet usually transiting the Suez Canal route to divert away from that route, with the number of vessels now traveling around Africa instead doubling from last week, according to data from Flexport Inc reported by Bloomberg. This week, the number of container vessels that have already changed route or plan to alter course is double from a week earlier. The total of 4.3 million containers those ships can carry account for around 18% of global container capacity, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Global-Shippers-Bypass-Suez-Canal-As-Security-Concerns-Persist.html |

|

Aerospace Industry Eyes Full Recovery by 2025A combination of soaring demand for travel and supply chain delays saw a record-breaking backlog of airplanes on order in November, according to new aviation industry figures. The global aircraft order backlog reached nearly 15,000 last month, a 354 percent year-on-year increase and marking a fourth consecutive record high, according to the aerospace sector’s UK trade body, the ADS Group. It estimates the total value of aircraft on order to be worth around £234bn. Some 2,657 aircraft orders have been placed so far this year. Single-aisle… Read more at: https://oilprice.com/Energy/Energy-General/Aerospace-Industry-Eyes-Full-Recovery-by-2025.html |

|

Qatar Signs Its First-Ever Five-Year Crude Supply Deal with ShellQatarEnergy has signed a deal with Shell under which the state firm of the tiny Gulf oil and gas producer will deliver up to 18 million barrels of crude annually to the supermajor, in the first-ever five-year crude sales agreement for the Qatari company. QatarEnergy will start supplying Shell International Eastern Trading Company in Singapore with up to 18 million barrels per year of Qatar Land and Qatar Marine crudes, beginning in January 2024. “We are delighted to sign our first ever five-year crude sales agreement,” said… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Signs-Its-First-Ever-Five-Year-Crude-Supply-Deal-with-Shell.html |

|

Russia’s Refined Oil Exports Hit Seven-Month HighRussia’s exports of refined oil products rose to their highest level in over seven months in the four weeks to December 24, as Russian refiners boosted petroleum processing, data from Vortexa compiled by Bloomberg showed on Thursday. During the four weeks to December 24, the four-week average exports of fuels out of Russia stood at around 2.6 million barrels per day (bpd), an increase of around 157,000 bpd from the four-week average to December 17, according to the data. However, the more inconsistent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Refined-Oil-Exports-Hit-Seven-Month-High.html |

|

Cheap Imports Threaten India’s Steel SectorVia Metal Miner Imports seem to be the biggest bugbear for the Indian steel industry. Cheap steel from China, Vietnam, and several other countries flooded the domestic market for months, putting Indian steel companies at a significant disadvantage. The problem is now so severe that representatives from the steel sector and the Indian Steel Ministry met earlier this month to discuss the issue. Meanwhile, the government is conducting some stocktaking following concerns about imported steel and unfair trade advantage. In the December… Read more at: https://oilprice.com/Metals/Commodities/Cheap-Imports-Threaten-Indias-Steel-Sector.html |

|

Sinopec: China’s Oil Consumption Will Peak by 2030China’s oil consumption is expected to peak at some point later this decade, between 2026 and 2030, due to an acceleration of EV adoption, the country’s largest refiner, China Petroleum & Chemical Corporation, or Sinopec, said in a long-term outlook on Thursday. Oil consumption in China – the world’s largest importer of crude oil and the second-biggest oil consumer after the United States – is set to peak at around 16 million barrels per day (bpd) in the period 2026 through 2030, according to Sinopec’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sinopec-Chinas-Oil-Consumption-Will-Peak-by-2030.html |

|

Oil Rises on Inventory DrawCrude oil prices moved higher today after the Energy Information Administration reported an estimated inventory decline of 6.9 million barrels for the week to December 22. This compared with a sizeable build in crude oil stocks for the previous week, at 2.9 million barrels. A day earlier, the American Petroleum Institute estimated crude oil inventories had added 1.84 million barrels in the week to December 22. In fuels, the authority reported inventory mixed inventory changes for the week to December 22. Gasoline stocks shed 600,000 barrels in… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Rises-on-Inventory-Draw.html |

|

Iraq Forges Ahead On Greater Integration With ChinaGiven the festive time of year, it is perhaps fitting that senior Iraqi politicians are again pushing for the full activation of the ‘Iraq-China Framework Agreement’, which is akin to turkeys voting for Christmas. The Agreement, signed in December 2021, will enable China to complete its long-term strategy of sequestrating all of Iraq’s key oil, gas, and petrochemical assets to its own ends, as it sees fit. The similarly all-encompassing ‘Iran-China 25-Year Comprehensive Cooperation Agreement’ did exactly… Read more at: https://oilprice.com/Energy/Crude-Oil/Iraq-Forges-Ahead-On-Greater-Integration-With-China.html |

|

Fifth of Global Oil Trade Used Non-Dollar Currencies in 2023A fifth of global oil trade this year was settled in currencies different from the U.S. dollar as countries such as Russia and China move away from the petrodollar. This is according to JP Morgan’s head of global commodities strategy, Natasha Kaneva, who spoke to the Wall Street Journal and said sanctions have been a major motivator for Russia and Iran to start doing their oil business in non-dollar currencies. “The U.S. dollar is getting some competition in commodities markets,” Kaneva said, just a day after news broke that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fifth-of-Global-Oil-Trade-Used-Non-Dollar-Currencies-in-2023.html |

|

Houthi Attacks Fail to Stop Middle East’s Pricing ProblemHouthi missile attacks on tankers transiting the Red Sea and the Bab-el-Mandeb strait have lifted oil prices, allowing OPEC+ heavyweights such as Saudi Arabia or the United Arab Emirates to save face after the most recent meeting of the oil group actually prompted another sell-off rather than persuading the oil markets that Riyadh, Moscow and the others could manage the pitfalls of declining demand. However, even with Dubai moving back to the $80 per barrel mark, sentiment has been weak across the Asian market, aggravated by China’s unsettling… Read more at: https://oilprice.com/Energy/Oil-Prices/Houthi-Attacks-Fail-to-Stop-Middle-Easts-Pricing-Problem.html |

|

S&P 500 closes little changed Thursday, struggles to reach record: Live updatesThe S&P 500 rose slightly Thursday as the benchmark closed in on a new all-time high. Read more at: https://www.cnbc.com/2023/12/27/stock-market-today-live-updates-dec2728-2023.html |

|

Startup bubble fueled by Fed’s cheap money policy finally burst in 2023In 2023, numerous tech startups that had raised big rounds at premium valuations before and during the pandemic finally ran out of cash Read more at: https://www.cnbc.com/2023/12/28/startup-bubble-fueled-by-fed-cheap-money-policy-finally-burst-in-2023.html |

|

Boeing urges inspections of 737 Max planes for ‘possible loose bolt’Boeing recommended the inspections after “an international operator discovered a bolt with a missing nut,” the FAA said in a statement Thursday. Read more at: https://www.cnbc.com/2023/12/28/boeing-urges-inspections-of-737-max-planes-for-possible-loose-bolt.html |

|

Affirm’s stock quintupled this year, beating all tech peers, on buy now, pay later boomIn 2023, Affirm outperformed all U.S. tech companies valued at $5 billion or more. Read more at: https://www.cnbc.com/2023/12/28/affirms-stock-quintupled-this-year-beating-all-tech-peers.html |

|

Could a bitcoin ETF approval be a sell-the-news event? What investors are expecting on the big dayA bitcoin ETF approval is expected in the coming weeks, but the market may be a little overheated. Here’s what to expect of it happens. Read more at: https://www.cnbc.com/2023/12/28/could-a-bitcoin-etf-approval-be-a-sell-the-news-event-what-investors-are-expecting-on-the-big-day.html |

|

Cathie Wood’s ARK invests in ProShares Bitcoin Strategy ETF after exiting GBTC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, legal experts weigh in on what region is winning the race when it comes to crypto regulation. Read more at: https://www.cnbc.com/video/2023/12/28/cathie-woods-ark-invests-proshares-bitcoin-strategy-etf-after-exiting-gbtc-cnbc-crypto-world.html |

|

Cheddar News sold by Altice USA to media company ArchetypeTerms of the deal were not officially disclosed, but a person familiar with the matter told CNBC it is structured as a so-called “earn out” deal. Read more at: https://www.cnbc.com/2023/12/28/cheddar-news-sold-by-altice-usa-to-media-company-archetype.html |

|

A ‘significant objection’ to 529 college savings plans will go away Jan. 1. ‘This is a big deal,’ expert saysStarting in 2024, savers can roll unused money from a 529 plan over to a Roth individual retirement account free of income tax or tax penalties. Read more at: https://www.cnbc.com/2023/12/28/a-major-barrier-to-529-plans-goes-away-in-2024-thanks-to-secure-2point0-.html |

|

November pending home sales were unchanged, despite a sharp drop in mortgage ratesThe average rate on the 30-year fixed mortgage soared over 8% in mid-October but then dropped sharply to 7.5% in the first week of November. Read more at: https://www.cnbc.com/2023/12/28/november-pending-home-sales-unchanged.html |

|

Stocks making the biggest moves midday: Iovance, The New York Times, Penn Entertainment, JD and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2023/12/28/stocks-making-the-biggest-moves-midday-iovance-new-york-times-penn-entertainment-jdcom-and-more.html |

|

There’s still time to reduce your 2023 tax bill with these last-minute movesYou can still reduce your 2023 taxes or boost your refund with these last-minute moves, but the deadline is Dec. 31. Here’s what taxpayers need to know. Read more at: https://www.cnbc.com/2023/12/28/you-can-still-lower-your-2023-tax-bill-with-these-last-minute-moves.html |

|

Investors have faith in the Fed in 2024, see bank stock comeback, CNBC survey shows300 investors weigh in on where they want to be and what concerns them in 2024 in a new CNBC Delivering Alpha stock survey Read more at: https://www.cnbc.com/2023/12/28/investors-in-2024-a-new-cnbc-delivering-alpha-stock-survey.html |

|

January typically brings gains in certain small caps. Bank of America screened for names that could rally this timeThe firm found high-beta small caps that could be in for gains. Read more at: https://www.cnbc.com/2023/12/28/january-typically-brings-gains-in-certain-small-caps-bank-of-america-screened-for-names-that-could-rally-this-time.html |

|

Kansas School Approves ‘Satan Club’ Over Objections Of Students, ParentsAuthored by Samantha Flom via The Epoch Times, “High School Satan Club” will now be included among the extracurricular offerings at Olathe Northwest High School in Kansas after the school district gave the greenlight for its creation.

The club’s approval comes amid growing opposition from other students and parents with concerns about kids being encouraged to worship Satan. A petition to stop the club had garnered more than 7,800 signatures at the time of publishing.

|

|

Boeing Urges Airlines To Inspect 737 Max After “Possible Loose Bolt” For Rudder SystemThe clowns running the Boeing 737 Max program face another quality control issue: “A possible loose bolt in the rudder control system,” according to a statement released by the Federal Aviation Administration on Thursday morning. “Boeing recommended the inspections after an international operator discovered a bolt with a missing nut while performing routine maintenance on a mechanism in the rudder-control linkage. The company discovered an additional undelivered aircraft with a nut that was not properly tightened,” the FAA said.

Boeing has issued a Multi-Operator Message to all airlines operating the newer single-aisle jet to inspect rudder movement for possible loose hardware. CNBC pointed out Alaska Airlines has already begun inspecting Max jets. Each inspe … Read more at: https://www.zerohedge.com/markets/boeing-urges-airlines-inspect-737-max-after-possible-loose-bolt-rudder-system |

|

Closing Out 2023 With A Very Ugly, Tailing 7Y AuctionIt’s only appropriate that a year which saw 10Y rates soar above 5%, the most in 16 years, before sliding on fears of an imminent recession and/or Fed easing cycle, that the final coupon auction of the year was a dog with a capital D. Yesterday’s far stronger than expected 5Y auction surprised many: not only was there no concession with yields tumbling all day, but there was no tangible reason for the burst in demand that lead to one of the strongest stop-throughs on record, besides perhaps a big squeeze overhang as shorts sought to cover in the year’s last trading hours. Well, moments ago we did get confirmation that yesterday’s strength was indeed technically-driven because the $40BN in 7Y paper that was just sold by the Treasury could be described by just one word: ugly. The high yield of 3.859% was a sharp drop from the 4.399% last month and was also the lowest since June’s 3.839%… to be expected in the post-Fed pivot environment. But more importantly, the high yield tailed the 3.837% When Issued by 2.2bps, worse than last month’s 2.1bps tail and the worst showing since November 2022 when the 7Y tailed by 2.7bps. Read more at: https://www.zerohedge.com/markets/closing-out-2023-very-ugly-tailing-7y-auction |

|

Argentina’s President Javier Milei Signs Decree Slashing 5,000 Government JobsAuthored by Katabellla Roberts via The Epoch Times (emphasis ours), Argentina’s new president, Javier Milei, has revealed plans to lay off an estimated 5,000 state employees hired this year before he took office, as part of wider efforts to slash government spending amid the backdrop of the country’s troubled economy.

Read more at: https://www.zerohedge.com/geopolitical/argentinas-president-javier-milei-signs-decree-slashing-5000-government-jobs |

|

Recycling electrical goods could be done at kerbside and drop-off points in shopsUK households could put old toasters and hairdryers on the kerbside for pick-up under the proposals. Read more at: https://www.bbc.co.uk/news/uk-67830798?at_medium=RSS&at_campaign=KARANGA |

|

Post Office cash withdrawals reach record high before ChristmasMore than £62m was withdrawn on the Friday before Christmas according to the Post Office. Read more at: https://www.bbc.co.uk/news/business-67832733?at_medium=RSS&at_campaign=KARANGA |

|

UK vinyl sales at the highest level since 1990Sales of vinyl LPs continued to rise, with Taylor Swift’s 1989 becoming this year’s best-selling record. Read more at: https://www.bbc.co.uk/news/business-67828891?at_medium=RSS&at_campaign=KARANGA |

|

Forget FOMO, Dinshaw Irani would avoid chemical stocks. Here’s whyDinshaw Irani says: “Among the commodity players, we do not like the cement space. We think there is enough capacity and beyond, just because of the price discipline that they have, they are managing to go ahead and we have seen that. There have been pullbacks in prices and all that. It is not a comfortable space to be in or the players are fairly stretched on valuations. Read more at: https://economictimes.indiatimes.com/markets/expert-view/forget-fomo-dinshaw-irani-would-avoid-chemical-stocks-heres-why/articleshow/106337207.cms |

|

Working target for Nifty@22,300; focus on 5 sectors now: Gautam ShahGautam Shah says: “As things stand, things are a little euphoric. I think we have reached a phase of exuberance. And there is this feeling in the marketplace that this will continue forever. But I do believe that as we get into the month of January, be prepared for some volatility, some weakness, some correction. But I think it is going to be rotational in nature.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/working-target-for-nifty22300-focus-on-5-sectors-now-gautam-shah/articleshow/106348646.cms |

|

Ratan Tata to sell all his 77,900 shares in FirstCry IPOThe average cost of acquisition of shares by Tata comes to Rs 84.72 per share, shows FirstCry’s draft red herring prospectus (DRHP) filed with the market regulator Securities and Exchange Board of India (Sebi). His total investment in the company, therefore, comes to about Rs 66 lakh. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/ratan-tata-to-sell-all-his-77900-shares-in-firstcry-ipo/articleshow/106347340.cms |

|

FlyExclusive stock drops in debut after completing merger with blank-check companyFlyExclusive Inc.’s stock fell 42% on Thursday as the flight-charter company began trading under the symbol FLYX on the NYSE American exchange, after closing its acquisition with blank check company EG Acquisition Corp. Read more at: https://www.marketwatch.com/story/flyexclusive-stock-drops-in-debut-after-completing-merger-with-blank-check-company-f983f30b?mod=mw_rss_topstories |

|

Treasury yields extend bounce after weak 7-year note auction in final full trading day of 2023Treasury yields moved higher Thursday, extending their rise after a weakly received sale of 7-year notes in the final full trading session of 2023. Read more at: https://www.marketwatch.com/story/10-year-treasury-yield-ticks-higher-after-falling-to-5-month-low-8c66131f?mod=mw_rss_topstories |

|

Oil prices ends sharply lower as Red Sea worries fadeOil futures ended lower Thursday as traders put worries over the potential for shipping disruptions in the Red Sea on the back burner, with the market failing to get a lift from data showing a drop in U.S. crude inventories last week. Read more at: https://www.marketwatch.com/story/oil-prices-extend-pullback-as-red-sea-worries-fade-a6892aeb?mod=mw_rss_topstories |

Argentine President-elect Javier Milei addresses supporters after winning Argentina’s runoff presidential election, in Buenos Aires, Argentina, on Nov. 19, 2023. (Agustin Marcarian/Reuters)Mr. Milei, an economist, signed a decree on Dec. 26 stating that his government won’t renew contracts for the thousands of government workers hired since Jan. 1, according to

Argentine President-elect Javier Milei addresses supporters after winning Argentina’s runoff presidential election, in Buenos Aires, Argentina, on Nov. 19, 2023. (Agustin Marcarian/Reuters)Mr. Milei, an economist, signed a decree on Dec. 26 stating that his government won’t renew contracts for the thousands of government workers hired since Jan. 1, according to