Summary Of the Markets Today:

- The Dow closed down 476 points or 1.27%,

- Nasdaq closed down 1.50%,

- S&P 500 closed down 1.47%,

- Gold $2,045 down $7.40,

- WTI crude oil settled at $74 down $0.14,

- 10-year U.S. Treasury 3.851% down 0.071 points,

- USD Index $102.49 up $0.330,

- Bitcoin $43,520 up $1,2970 ( 3.02% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Total existing-home sales fell 7.3% year-over-year in November 2023. The median existing-home price for all housing types in November was $387,600, an increase of 4.0% from November 2022. The inventory of unsold existing homes slid 1.7% from the previous month, or the equivalent of 3.5 months’ supply at the current monthly sales pace. NAR Chief Economist Lawrence Yun added:

The latest weakness in existing home sales still reflects the buyer bidding process in most of October when mortgage rates were at a two-decade high before the actual closings in November. A marked turn can be expected as mortgage rates have plunged in recent weeks.

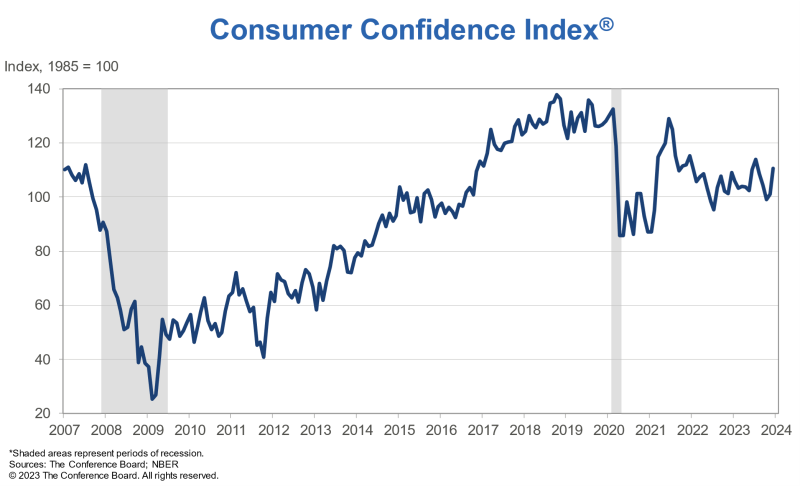

The Conference Board Consumer Confidence Index® increased in December to 110.7 (1985=100), up from a downwardly revised 101.0 in November. Dana Peterson, Chief Economist at The Conference Board stated:

December’s increase in consumer confidence reflected more positive ratings of current business conditions and job availability, as well as less pessimistic views of business, labor market, and personal income prospects over the next six months. While December’s renewed optimism was seen across all ages and household income levels, the gains were largest among householders aged 35-54 and households with income levels of $125,000 and above. December’s write-in responses revealed the top issue affecting consumers remains rising prices in general, while politics, interest rates, and global conflicts all saw downticks as top concerns. Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months abated in December to the lowest level seen this year—though two-thirds still perceive a downturn is possible in 2024.

Here is a summary of headlines we are reading today:

- Will the COP28 Consensus Keep Fossil Fuels in the Ground?

- 5 Million Barrels of Russian Oil Stuck En Route to India

- Sodium-Ion: A Game-Changer in the Global Battery Market

- Brent Breaks Past $80 Barrier As Houthis Attack Red Sea

- Putin Orders Asset Seizures From Austrian and German Energy Giants

- Putin Seizes Multi-Billion-Dollar OMV and Wintershall Stakes in Russian Ventures

- Dow closes more than 470 points lower Wednesday to snap 9-day win streak: Live updates

- Billions are on the line for lenders as White House finalizes credit card late fee cap

- Bitcoin bounces back above $43,000: CNBC Crypto World

- Most Large Container Ships Abandon Red Sea As Key Trade Route Freezes

- Dow Jones ends 475 points lower after 9-day winning streak

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Big Problem With Electrifying EverythingThe UN-sponsored COP28 climate conference has issued a number of proposals for reducing CO2 emissions, some criticized as too weak, others as too radical. But looking at energy data what struck us is the enormity of that task of reducing carbon emissions and how little has actually changed over the past fifty years with respect to fossil fuel usage (the data we’re looking at begins in 1965), even though the first warnings about fossil fuel emissions date to Lyndon Johnson’s administration in the 1960s. Starting in 1965, fossil fuel… Read more at: https://oilprice.com/Energy/Energy-General/The-Big-Problem-With-Electrifying-Everything.html |

|

China Explores Major Infrastructure Projects in Caspian PortsA Chinese company, Shipbuilding Industry Corp., is exploring the possibility of building container facilities at the Kazakh port cities of Aktau and Kuryk, according to Kazakhstan’s Ministry of Transport. A ministry statement added that China Railways Group Ltd. has “expressed interest in projects to modernize existing [routes] and build new railway lines.” Discussions have so far yielded no specific deals. In neighboring Kyrgyzstan, representatives of Kyrgyz Railways (KTZ) say freight rail traffic in the country experienced… Read more at: https://oilprice.com/Geopolitics/International/China-Explores-Major-Infrastructure-Projects-in-Caspian-Ports.html |

|

Will the COP28 Consensus Keep Fossil Fuels in the Ground?The consensus agreement reached in Dubai last week evoked a mixture of triumph and angst. In the world’s warmest year on record, the world’s nations for the first time agreed to ‘transition away’ from fossil fuels. But the path to transition looks to be a long one. COP28 saw the paradox of a big oil company CEO shepherding through a final agreement that calls for a ‘transition away from fossil fuels’ – the first ever such statement in a COP communique. It also saw, in the same final session,… Read more at: https://oilprice.com/Energy/Energy-General/Will-the-COP28-Consensus-Keep-Fossil-Fuels-in-the-Ground.html |

|

5 Million Barrels of Russian Oil Stuck En Route to IndiaNearly five million barrels of Sokol grade crude oil from Russia is languishing en route to Indian refiners, caught in a sanctions trap for a month, Bloomberg News reported on Wednesday. According to Bloomberg, citing tanker tracker data, one tanker, the NS Century, remains stuck near Sri Lanka due to U.S. Treasury Department sanctions on the vessel. Now, two other tankers, both owned by Sovocomflot, are stuck in the same place. All three tankers are carrying Russian Sokol grade crude. Bloomberg suggests that the tankers are stuck due… Read more at: https://oilprice.com/Latest-Energy-News/World-News/5-Million-Barrels-of-Russian-Oil-Stuck-En-Route-to-India.html |

|

Sodium-Ion: A Game-Changer in the Global Battery MarketResearchers from Chalmers University of Technology in Sweden have shown that the sodium-ion battery has an equivalent climate impact as their lithium-ion competitors – without the risk of running out of raw materials. The transition to a society without fossil fuels means that the need for batteries is increasing at a rapid pace. At the same time, the increase will mean a shortage of the metals lithium and cobalt, which are key components in the most common battery types. One option is a sodium-ion battery, where table salt and biomass from… Read more at: https://oilprice.com/Energy/Energy-General/Sodium-Ion-A-Game-Changer-in-the-Global-Battery-Market.html |

|

Chinese Banks Lead $120 Billion Global Financing for Coal ProjectsChinese lenders arranged three-fourths of all the $120 billion in global financing for coal projects last year, new research from BloombergNEF showed on Wednesday. Chinese banks accounted for a massive 76%, or $93 billion, of the arranged financing for coal projects last year, followed by U.S. banks, which were at a distant second with $10 billion worth of coal project financing, BNEF’s report found. According to BNEF’s researchers, the share of coal financing is still too high and not aligned in any way with a path… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Banks-Lead-120-Billion-Global-Financing-for-Coal-Projects.html |

|

Turkey Uses Sweden’s NATO Bid as Leverage in International DealsIt’s now widely perceived that Turkey will continue holding up final formal approval for Sweden’s entry into NATO as retaliation for the West’s support for Israel as it continues assaulting Gaza. Turkish President Recep Tayyip Erdogan added further items to the list of grievances in Tuesday remarks suggesting he’ll continue to block Sweden’s membership bid if certain demands aren’t met. He said the ball lies in the US and Canada’s court. “Positive developments both on [the acquisition of US] F-16s and Canada’s promises [on lifting its arms… Read more at: https://oilprice.com/Geopolitics/International/Turkey-Uses-Swedens-NATO-Bid-as-Leverage-in-International-Deals.html |

|

Nigeria Looks to Attract Investments by Cutting Costs for Oil FirmsNigeria is reducing the costs for oil companies willing to sign new production contracts as OPEC’s largest African producer looks to attract firms in its oil and gas industry again, the head of the oil regulator told Bloomberg in an interview published on Wednesday. Nigeria plans to replace the so-called signature bonuses that companies owe to the government at the signing of contracts with lump sums for production, Gbenga Komolafe, chief executive of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), said. Lower costs… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Looks-to-Attract-Investments-by-Cutting-Costs-for-Oil-Firms.html |

|

Brent Breaks Past $80 Barrier As Houthis Attack Red SeaBrent crude oil broke past the $80 resistance level on Wednesday, as tensions in the Middle East continued to rise and as Houthi attacks on Red Sea shipping showed no signs of easing, prompting concerns of price-impacting disruptions to the energy trade. At 10:38 a.m. ET on Wednesday, Brent was trading at $80.20, up 1.22% on the day, while West Texas Intermediate (WTI) was trading at $74.96, up 1.38% on the day. On Tuesday, Brent grabbed another 1% price hike when companies began to divert vessels away from the Red Sea, while the U.S.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Breaks-Past-80-Barrier-As-Houthis-Attack-Red-Sea.html |

|

EIA Reports Significant Build in Oil and Fuel StocksCrude oil prices moved lower today after the U.S. Energy Information Administration reported an estimated inventory increase of 2.9 million barrels for the week to December 15. This followed a weekly inventory decline of 4.3 million barrels for the previous week. The estimate also came out a day after the American Petroleum Institute reported its own inventory estimate, which saw oil stocks adding close to a million barrels over the week to December 15. In fuels, the EIA estimated inventory builds. Gasoline inventories added 2.7 million barrels… Read more at: https://oilprice.com/Energy/Crude-Oil/EIA-Reports-Significant-Build-in-Oil-and-Fuel-Stocks.html |

|

Red Sea Attacks Could Spark Spike in Gasoline PricesOil prices have spiked and could remain elevated as companies try and find alternative cargo routes following vessel attacks in the Red Sea. International benchmark Brent crude has shot up to $79.35/bbl as of this morning, having opened on Monday at $77.24/bbl. The attacks, which have been occurring daily since Monday, are believed to have been perpetrated by Houthi rebels in Yemen. Major shippers such as Maersk and Evergreen and Norwegian gas giant Equinor have implemented re-routing plans, while oil firm BP became the first among peers to pause… Read more at: https://oilprice.com/Energy/Gas-Prices/Red-Sea-Attacks-Could-Spark-Spike-in-Gasoline-Prices.html |

|

Challenging New Discoveries Could Slow China’s Oil Production GrowthChina could see its oil production growth taper off in the coming years as the recent new discoveries could prove challenging to develop while output at mature fields declines, according to analysts and forecasters. Since 2019, China has boosted its crude oil production every year, by around 2% per year, as the state-owned oil giants have endorsed the official government policy to ramp up exploration and production to make China – the world’s top crude oil importer – less dependent on imports. In the first nine months… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Challenging-New-Discoveries-Could-Slow-Chinas-Oil-Production-Growth.html |

|

Putin Orders Asset Seizures From Austrian and German Energy GiantsWestern sanctions on the Russian oil and gas sector and entities have not yet been as functional as expected by most. Still, Moscow’s energy stranglehold on Europe’s energy sectors has been broken by Western actions. Until now, Russian President Vladimir Putin has not been hitting back with a vengeance, but that looks like it’s about to change. Putin has ordered the seizure of Austria’s OMV and Germany’s Wintershall DEA assets in Russia. The main aim is clearly to hit back at the West while also cementing control of the… Read more at: https://oilprice.com/Energy/Energy-General/Putin-Orders-Asset-Seizures-From-Austrian-and-German-Energy-Giants.html |

|

Russia’s Oil Exports to China and India SurgeRussia has increased significantly its crude oil exports to China and India this year, with volumes to China hitting 100 million tons annually, or around 2 million barrels per day, Nikolay Tokarev, the head of Russian oil pipeline monopoly Transneft, told Russian media on Wednesday. “Export volumes to China and India have increased significantly; many times over. I can say that about 70 million tonnes of oil were supplied to India this year, while about 100 million tonnes of oil went to China,” Russian news agency Interfax quoted Tokarev… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Exports-to-China-and-India-Surge.html |

|

Putin Seizes Multi-Billion-Dollar OMV and Wintershall Stakes in Russian VenturesGermany’s Wintershall Dea and Austria’s OMV are being stripped of their multi-billion-dollar stakes in joint ventures developing natural gas projects in Russia under a decree by Vladimir Putin. The Russian president has signed a decree ordering that the shares of the two Western energy companies in the Yuzhno-Russkoye field and in the Achimov projects in Russia’s Arctic be transferred to newly set up Russian firms. OMV and Germany’s BASF and its joint venture with LetterOne, Wintershall Dea, held minority stakes in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Seizes-Multi-Billion-Dollar-OMV-and-Wintershall-Stakes-in-Russian-Ventures.html |

|

Dow closes more than 470 points lower Wednesday to snap 9-day win streak: Live updatesInvestors cashed in some profits following the market’s recent hot streak. Read more at: https://www.cnbc.com/2023/12/19/stock-market-today-live-updates.html |

|

Citigroup to close global distressed-debt business as part of CEO Jane Fraser’s overhaulCitigroup is exiting businesses with poor returns to bolster the bank’s odds of hitting Fraser’s performance targets. Read more at: https://www.cnbc.com/2023/12/20/citigroup-to-close-global-distressed-debt-unit.html |

|

Big M&A and Bob Iger’s future: 13 media executives make their anonymous 2024 predictionsIt’s the third annual anonymous media predictions list: 13 media, sports and entertainment executives make their best 2024 industry-shaking predictions. Read more at: https://www.cnbc.com/2023/12/20/13-media-executives-make-2024-predictions.html |

|

Big yields can invite risk. How to find the right dividend fund for your portfolioDon’t fixate too much on rich yields as you shop for dividend funds. Read more at: https://www.cnbc.com/2023/12/20/big-yields-can-invite-risk-how-to-find-the-right-dividend-fund-for-your-portfolio-.html |

|

How Tesla rose to retail investor stardom: ‘It’s always in people’s minds’The electric vehicle maker is poised to see the highest net inflows from retail traders of any security this year. Read more at: https://www.cnbc.com/2023/12/20/how-tesla-rose-to-retail-investor-stardom-its-always-in-peoples-minds.html |

|

Billions are on the line for lenders as White House finalizes credit card late fee capThe Consumer Financial Protection Bureau is facing banks, credit unions and credit card companies in its push to limit late fees. Read more at: https://www.cnbc.com/2023/12/20/billions-on-the-line-for-lenders-banks-credit-union-with-biden-credit-late-fee-cap.html |

|

Over a half-billion dollars in railroad freight stuck at Texas border crossings amid migrant battleUnion Pacific, BNSF say the battle over migrants at U.S.-Mexico border key crossings is holding up hundreds of millions of dollars in freight. Read more at: https://www.cnbc.com/2023/12/20/over-a-half-billion-dollars-in-rail-freight-stuck-at-texas-border.html |

|

IRS to waive $1 billion in penalties. Here’s who qualifies and how much taxpayers may getThe IRS is waiving roughly $1 billion in late-payment penalties for millions of taxpayers with balances under $100,000 from returns filed in 2020 and 2021. Read more at: https://www.cnbc.com/2023/12/20/irs-offers-1-billion-in-penalty-relief-what-taxpayers-need-to-know.html |

|

Bitcoin bounces back above $43,000: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, PitchBook’s Robert Le takes a look back at crypto venture capital funding in 2023 and provides his outlook for 2024. Read more at: https://www.cnbc.com/video/2023/12/20/bitcoin-bounces-back-above-43000-cnbc-crypto-world.html |

|

With Aquaman sequel’s release, one DC movie era ends and another begins“Aquaman and the Lost Kingdom” opens this weekend, and it’s expected to gross less than its surprise-hit predecessor. Read more at: https://www.cnbc.com/2023/12/20/aquaman-and-the-lost-kingdom-marks-end-of-era-for-dc.html |

|

These are the 10 highest-grossing movies of 2023: ‘Barbie’ and ‘Oppenheimer’ are in the top 3Of the 10 highest-grossing films of the year, half are sequels. Read more at: https://www.cnbc.com/2023/12/20/the-10-highest-grossing-movies-of-2023-oppenheimer-is-no-3.html |

|

U.S. swaps Maduro ally for ‘Fat Leonard’ in Venezuela prisoner exchangeVenezuela for years has sought the release of Alex Saab, an ally of President Nicolas Maduro, from the United States, as he awaited a money launder trial. Read more at: https://www.cnbc.com/2023/12/20/us-releases-maduro-ally-alex-saab-to-venezuela-for-americans.html |

|

General Mills Says “Value-Seeking” Consumers Complicate OutlookGeneral Mills shares fell at the beginning of the US cash session after the package food company reported a decline in quarterly sales. It slashed its annual organic sales forecast to flat because of softening demand for snacks and breakfast foods. The maker of Cheerios and Cocoa Puffs reported Wednesday that second-quarter sales for the three months ended Nov. 26 were $5.14 billion, down 2% from a year ago and below the Bloomberg estimate of $5.35 billion. Here’s the second quarter earnings snapshot (courtesy of Bloomberg):

Net sales $5.14 billion, -1.6% y/y, estimate $5.35 billion

Organic sales volume -4.0 pts, … Read more at: https://www.zerohedge.com/markets/general-mills-warns-value-seeking-consumers-plague-outlook |

|

“Inaction Is Unacceptable” – California Lawmakers Create First Retail Theft Committee Amid Surging CrimeAuthored by Travis Gillmore via The Epoch Times, While videos of smash-and-grab robberies in California circulating on social media are attracting attention worldwide, lawmakers say finding solutions to stop the crimes is challenging.

Though acknowledging action is needed, some say viral clips are distorting reality and suggest that retail theft crimes are difficult to count.

Complicating understanding is a lack of consistent repor … Read more at: https://www.zerohedge.com/political/inaction-unacceptable-california-lawmakers-create-first-retail-theft-committee-amid |

|

Two Former Green Berets Among Americans Freed In Rare Venezuela DealMajor deal-making between Washington and the government of President Nicolas Maduro, long under US sanctions, has clearly been progressing. It follows on the heels of intensified Biden admin efforts to free up Venezuela oil as an alternative energy source amid the Russia-Ukraine war, having recently lifted oil-focused sanctions on a temporary basis months ago. The Biden administration has just conducted what amounts to a rare prisoner swap with Venezuela. The US agreed to release a “close ally” of President Maduro in exchange for jailed Americans, the Associated Press reports Wednesday.

The pair of former Green Berets was captured in May 2020 along with six Venezuelan nationals in a boat carrying weapons off the coast. That high-profile Maduro ally is Alex Saab, who has been in US detention since his arrest in 2020 for money laundering. He was freed on Wednesday. There are reports that in exchange, some … Read more at: https://www.zerohedge.com/geopolitical/two-former-green-berets-among-group-americans-freed-rare-venezuela-deal |

|

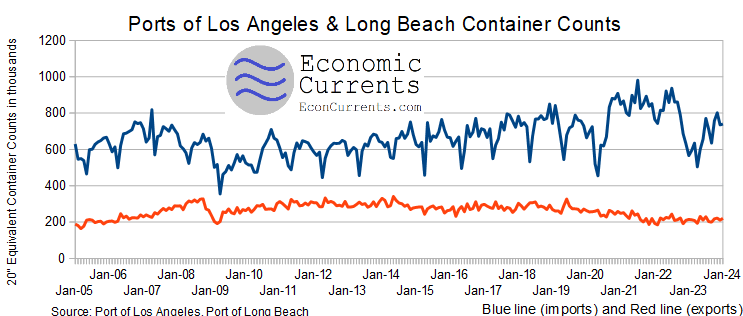

Most Large Container Ships Abandon Red Sea As Key Trade Route FreezesUpdate (1424ET): Tracking the supply chain mess unfolding across the Red Sea is a post on X showing container ships with 8,000 or more twenty-foot equivalent unit container capacity have mostly diverted from the critical maritime trade route. “Every containership over 8,000TEUs, except for one, have turned from the Bab el-Mandeb,” X user Sal Mercogliano wrote.

Mercogliano continued, “This means that all the major ocean container lines have abandoned the region even after the @DeptofDefense and @CENTCOM have announced Op Prosperity Guardian.”

|

|

UK tipped for speedier rate cut after surprise inflation fallCheaper fuel prices meant price rises were 3.9% in the 12 months to November, their lowest level for two years. Read more at: https://www.bbc.co.uk/news/business-67769782?at_medium=RSS&at_campaign=KARANGA |

|

Public pay must reflect rises, ministers sayGovernment letters to pay review bodies say pay rises should be reflected when setting pay in 2024 Read more at: https://www.bbc.co.uk/news/business-67780948?at_medium=RSS&at_campaign=KARANGA |

|

Why is inflation higher in UK than other countries?Despite recent falls, prices are still rising faster in Britain than other parts of the world. Read more at: https://www.bbc.co.uk/news/business-65037292?at_medium=RSS&at_campaign=KARANGA |

|

These 5 PSU stocks shelled out highest dividends in last one year. Do you own any?Investors are often attracted to stocks that can pay them high dividends. Here are five such PSU stocks that have the highest dividend yields in the last 12 months. (Source: Axis Securities) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-psu-stocks-shelled-out-highest-dividends-in-last-one-year-do-you-own-any/solid-payouts/slideshow/106154777.cms |

|

Domestic growth play on D-Street turns 100 stocks multibaggers in these 5 sectors in 2023Automobiles, infrastructure, capital goods, industrials, and realty were the best performing sectors in 2023, driven by the strong domestic demand, capex push by the government, and growing discretionary consumption. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/domestic-growth-play-on-d-street-turns-100-stocks-multibaggers-in-these-5-sectors-in-2023/articleshow/106141246.cms |

|

Tech View: Nifty forms bearish engulfing candle. What traders should do on Thursday expiryFurther downsides are likely once the immediate support of 21,087 is broken. We believe that the Nifty could play down towards the next major support at 21,026-20,769 in the coming sessions Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-engulfing-candle-what-traders-should-do-on-thursday-expiry/articleshow/106156311.cms |

|

Dow Jones ends 475 points lower after 9-day winning streakU.S. stocks ended lower after a strong year-end rally lost momentum on Wednesday, putting an end to a string of record finishes for the Dow Jones Industrial Average and a pause on the S&P 500’s push toward an all-time closing high. Read more at: https://www.marketwatch.com/story/s-p-500-futures-dip-with-fresh-record-in-sight-9225094c?mod=mw_rss_topstories |

|

A broadening stock-market rally just led to this ‘fairly uncommon’ occurrenceInvestors don’t see this often. Read more at: https://www.marketwatch.com/story/a-broadening-stock-market-rally-just-led-to-this-fairly-uncommon-occurrence-33982735?mod=mw_rss_topstories |

|

Treasury yields end at lowest levels in five months or more as U.K. inflation deceleratesGovernment-bond yields in the U.S. and the U.K. finish lower on Wednesday. Read more at: https://www.marketwatch.com/story/ten-year-treasury-dips-below-3-9-as-u-k-inflation-falls-to-slowest-pace-in-two-years-9cfe817e?mod=mw_rss_topstories |