Summary Of the Markets Today:

- The Dow closed up 512 points or 1.40%,

- Nasdaq closed up 1.38%,

- S&P 500 closed up 1.37%,

- Gold $2,036 up $42.70,

- WTI crude oil settled at $70 up $1.14,

- 10-year U.S. Treasury 4.018% down 0.188 points,

- USD Index $102.92 down $0.950,

- Bitcoin $42,787 up $1,480 ( 3.56% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

This year, 64.4% of companies report they are having in-person holiday parties, up from 57% who reported this last year and 27% who held in-person parties in 2021. This is the highest percentage of companies holding in-person holiday parties since 75% of companies reported they held parties in 2019. Another nearly 4% will hold virtual events this year, up from 2% who reported holding virtual events in 2022, likely due to the adoption of remote and hybrid work. Of those holding parties, 4% reported they will include COVID modifications.

The Producer Price Index for final demand increased 0.9% for the 12 months ending in November 2023 (blue line on the graph below) – down from 1.2% last month. It is Final demand services (green line) which is continuing to elevate the Producer Price Index. However overall, producer prices are not driving inflation.

The Federal Reserve’s FOMC decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent – and stated only “Inflation has eased over the past year but remains elevated”. There was little change in this FOMC meeting statement compared to the previous meeting statement.

Here is a summary of headlines we are reading today:

- Fed Keeps Rates Unchanged, Forecast Series Of Cuts In 2024

- Tesla Recalls 2 Million Vehicles in U.S. over Autopilot Safety Flaw

- U.S. Warship Takes Down Houthi Drone After Attack On Tanker

- Oil Inches Up on Crude Inventory Draw

- OPEC Production Falls While U.S. Oil Output Hits New High

- Fed holds rates steady, indicates three cuts coming in 2024

- Dow rallies more than 500 points to record, closes above 37,000 for the first time: Live updates

- 10-year Treasury yield drops to lowest level since August as Fed forecasts easing rates 3 times next year

- SpaceX valuation climbs to $180 billion

- The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reeling

- Federal Reserve signals interest rate cuts next year

- Bond Report: Treasury yields plummet after Fed pencils in 2024 rate cuts

- Market Snapshot: Dow Jones heads for record close after Fed leaves interest rates unchanged, signals pivot ahead

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Disgraced BP Chief Won’t Receive £32m Pay Package after ‘Serious Misconduct’Former BP chief executive Bernard Looney will not receive a £32.4m salary and bonuses package after “serious misconduct”. In a press release circulated this evening, the company said: “following careful consideration, the board has concluded that, in providing inaccurate and incomplete assurances in July 2022, Mr Looney knowingly misled the board. “The board has determined that this amounts to serious misconduct, and as such Mr Looney has been dismissed without notice effective on 13 December 2023,”… Read more at: https://oilprice.com/Energy/Energy-General/Disgraced-BP-Chief-Wont-Receive-32m-Pay-Package-after-Serious-Misconduct.html |

|

Exxon Reportedly To Mirror Peers with Cash Bonuses for Risk TradersAs ExxonMobil (NYSE:XOM) moves to expand its trading operations, risk-on traders will be awarded with new cash bonuses starting in December 2024, Bloomberg reports, citing unnamed sources familiar with the structural changes.Exxon will categorize traders as “system traders” on one hand, and those who take risk to boost company profits on the other and cash performance bonuses will be distributed only to the risk-takers. “We strive to deliver competitive pay that will attract, reward and retain talented employees in support… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Reportedly-To-Mirror-Peers-with-Cash-Bonuses-for-Risk-Traders.html |

|

Fed Keeps Rates Unchanged, Forecast Series Of Cuts In 2024The Federal Reserve has concluded its two-day meeting on Wednesday by leaving interest rates unchanged and signaling strongly that there will be a less hawkish stance next year, with the potential for three rate cuts across 2024. Interest rates were left unchanged at 5.25% to 5.5%, though they remain at their highest in two years. Since March 2022, the Fed has raised interest rates by 525 basis points. The move was in line with expectations. Earlier on Wednesday, Treasury Secretary Janet Yellen stated that “inflation is meaningfully… Read more at: https://oilprice.com/Energy/Energy-General/Fed-Keeps-Rates-Unchanged-Forecast-Series-Of-Hikes-In-2024.html |

|

Australia’s Iron Ore Exports Face Uncertain FutureAn expected slowdown in China’s uptake and a world that is increasingly moving toward “green” iron ore and steel will be two crucial drivers affecting the future of iron production. This is especially true for Australia, one of the world’s largest miners of raw iron ore. Should demand change or iron ore prices shift dramatically, it would have significant repercussions throughout the country. Demand from China, Australia’s biggest customer since the turn of this century, continues to cool. Though it looks to remain… Read more at: https://oilprice.com/Metals/Commodities/Australias-Iron-Ore-Exports-Face-Uncertain-Future.html |

|

Marshall Islands Shuts Down Insurer of “Dark Fleet” Oil TankerThe Marshall Islands, one of the most popular flag states for oil tankers, has shut down an insurance company that has been offering insurance services to oil tankers part of the growing “dark fleet” that skirts sanctions and carries Russian, Venezuelan, or Iranian oil, Bloomberg reported on Wednesday, citing International Registries. The insurer, the Continental Steamship Owners Mutual Protecting & Indemnity Association Ltd, was “forcibly dissolved” by the Marshall Islands, according to International… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marshall-Islands-Shuts-Down-Insurer-of-Dark-Fleet-Oil-Tanker.html |

|

Why Venezuela Is Escalating the Essequibo DisputeThe more than century-long dispute over the resource-rich Essequibo region in Guyana has intensified. Venezuela’s autocratic President Nicolas Maduro asserts, in one of the few issues it agrees on with the opposition, that the 1,450 square mile territory belongs to Caracas. The Essequibo, which makes up two-thirds of Guyana’s territory, was awarded to the then-British colony in 1899. Venezuela has long opposed the judgment, arguing it was invalidated by a 1966 agreement, made after Guyana’s independence, to resolve the dispute.… Read more at: https://oilprice.com/Energy/Energy-General/Why-Venezuela-Is-Escalating-the-Essequibo-Dispute.html |

|

Tesla Recalls 2 Million Vehicles in U.S. over Autopilot Safety FlawTesla is recalling more than 2 million vehicles fitted with Autopilot systems it has sold in the United States to fix a flaw that may not ensure that drivers pay attention when the driver-assistance system is engaged. The National Highway Traffic Safety Administration (NHTSA) said on Wednesday that 2,031,220 vehicles are involved in the safety recall. The vehicles to be recalled include certain model year 2012-2023 Model S that are equipped with Autosteer and were produced between October 5, 2012, and December 7, 2023, and all model… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Recalls-2-Million-Vehicles-in-US-over-Autopilot-Safety-Flaw.html |

|

U.S. Warship Takes Down Houthi Drone After Attack On TankerThere’s been a fresh attack on commercial shipping in the Red Sea on Wednesday, which reportedly resulted in a US warship intervening and firing on an inbound drone believed launched by Yemen’s Houthi rebels. The American warship had responded to reports that the oil and chemical tanker Marshall Islands-flagged Ardmore Encounter had come under attack. The Ardmore Encounter had been traveling north toward the Suez Canal in the Red Sea from India at the time. Ardmore Encounter, via VesselJoin The vessel, which had a security crew aboard, reported… Read more at: https://oilprice.com/Energy/Energy-General/US-Warship-Takes-Down-Houthi-Drone-After-Attack-On-Tanker.html |

|

Houthis Target Fuel Tanker Headed for Suez CanalThe Iran-aligned Houthi rebels on Wednesday fired two missiles from a territory they hold in Yemen, targeting – but missing – a commercial tanker near the Bab el-Mandeb Strait that was carrying jet fuel from India and was headed toward the Suez Canal via the Red Sea, a U.S. official told The Associated Press. The Ardmore Encounter tanker had departed from Mangalore, India, and was traveling north toward the Suez Canal in the Red Sea, according to satellite tracking data analyzed by AP. The ship had armed security crew aboard it, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Houthis-Target-Fuel-Tanker-Headed-for-Suez-Canal.html |

|

Oil Inches Up on Crude Inventory DrawCrude oil prices reversed their decline today, after the U.S. Energy Information Administration reported an estimated inventory draw of 4.3 million barrels for the week to December 8. This compared with a draw of 4.6 million barrels for the previous week, which, however, combined with builds in gasoline and middle distillate inventories to put a lid on prices. A day earlier, the American Petroleum Institute estimated a draw in crude oil inventories of 2.35 million barrels for the week to December 8, along with a robust build in gasoline inventories… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Inches-Up-on-Crude-Inventory-Draw.html |

|

OPEC Maintains Oil Demand Outlook Amid Resilient Economic GrowthOPEC kept on Wednesday its oil demand growth forecasts for this year and next, citing better-than-expected economic performance so far this year and blaming “exaggerated concerns about oil demand growth” for the recent slump in oil prices. In its closely-watched Monthly Oil Market Report (MOMR) out on Wednesday, OPEC kept its forecast for world oil demand growth in 2023 unchanged from last month’s assessment at 2.5 million barrels per day (bpd). In the November report, OPEC had said that oil market fundamentals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Maintains-Oil-Demand-Outlook-Amid-Resilient-Economic-Growth.html |

|

Al Jaber Hails ‘Transformational’ Agreement Delivered in DubaiSultan Al Jaber, President of COP28, brought down the gavel today on a final agreement of the UN’s two-week climate conclave. The Global Stocktake – the principal document – was adopted by 198 nations. “You have put common interest ahead of self-interest,” said Al Jaber. “We have the basis for transformational change.“ The document, calling for an ‘orderly’ transition away from fossil fuels, was accepted by all of the world’s major oil producing nations except Iran, which left the summit… Read more at: https://oilprice.com/Energy/Energy-General/Al-Jaber-Hails-Transformational-Agreement-Delivered-in-Dubai.html |

|

OPEC Production Falls While U.S. Oil Output Hits New HighOPEC’s crude oil production fell in November for the first time in months, while U.S. oil output continued to reach new highs, OPEC said in its monthly report on Wednesday. Total OPEC-13 crude oil production averaged 27.84 million barrels per day (bpd) in November 2023, down by 57,000 bpd from October, amid lower production from Iraq, Angola, and Nigeria, OPEC’s Monthly Oil Market Report (MOMR) showed. Venezuela and Libya, which are exempted from the OPEC+ deal, saw their crude oil production rise month-on-month, as did Kuwait,… Read more at: https://oilprice.com/Energy/Crude-Oil/OPEC-Production-Falls-While-US-Oil-Output-Hits-New-High.html |

|

Investors Turn Bearish on European Natural Gas Amid Eased Supply FearsAmple inventories and muted demand so far this winter heating season have turned portfolio managers bearish on European natural gas for the first time since September and benchmark prices are now down to a four-month low. At the end of last week, hedge funds and other money managers held a net short position in the Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, according to data from exchanges released on Wednesday and reported by Bloomberg. High inventories, eased fears of supply shortages, weak demand, and increased… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Investors-Turn-Bearish-on-European-Natural-Gas-Amid-Eased-Supply-Fears.html |

|

Final COP28 Deal References Transition Away From Fossil FuelsThe COP28 climate summit, which ran one day into extra time amid heated debates on the future of fossil fuel use and production, ended early on Wednesday with a compromise text referencing for the first time a call to all parties to transition away from fossil fuels. The summit host, the United Arab Emirates, which is also one of OPEC’s top producers and exporters, hailed “the UAE consensus” as a historic deal to reduce emissions. The final text adopted by the countries references for the first time in such summit declarations… Read more at: https://oilprice.com/Energy/Energy-General/Final-COP28-Deal-References-Transition-Away-From-Fossil-Fuels.html |

|

Fed holds rates steady, indicates three cuts coming in 2024The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. Read more at: https://www.cnbc.com/2023/12/13/fed-interest-rate-decision-december-2023.html |

|

Dow rallies more than 500 points to record, closes above 37,000 for the first time: Live updatesInvestors will parse through Fed Chair Jerome Powell’s commentary Wednesday for clues into how soon rate cuts can be expected. Read more at: https://www.cnbc.com/2023/12/12/stock-market-today-live-updates.html |

|

10-year Treasury yield drops to lowest level since August as Fed forecasts easing rates 3 times next yearTreasury yields dropped on Wednesday after the Federal Reserve held rates steady for a third consecutive meeting and set the stage for three cuts in 2024. Read more at: https://www.cnbc.com/2023/12/13/us-treasury-yields-investors-look-to-fed-rate-decision.html |

|

Here’s why bringing down inflation has been different this time, according to Jerome PowellThe Federal Reserve signaled in its latest economic projections that it will cut interest rates in 2024 even with the economy still growing. Read more at: https://www.cnbc.com/2023/12/13/why-bringing-down-inflation-has-been-different-this-time-according-to-jerome-powell.html |

|

Crypto has had a stellar year, but regulatory uncertainty may lurk beneath the surface through 2024There are many reasons it seems like bitcoin may be about to rocket, but the industry is still stuck in a regulatory gray area. Read more at: https://www.cnbc.com/2023/12/13/crypto-has-had-a-stellar-year-but-regulatory-uncertainty-may-lurk-beneath-the-surface-through-2024.html |

|

Etsy stock falls after company lays off 11% of its staff, citing ‘very challenging’ environmentEtsy is laying off 11% of its workforce and restructuring its business amid a “very challenging” macro and competitive environment. Read more at: https://www.cnbc.com/2023/12/13/etsy-laying-off-11percent-of-staff-citing-competitive-environment.html |

|

OpenAI and Axel Springer strike unprecedented deal to offer news in ChatGPTOpenAI and Axel Springer, the global news publisher, have struck an unprecedented deal allowing ChatGPT to summarize news stories. Read more at: https://www.cnbc.com/2023/12/13/openai-and-axel-springer-strike-unprecedented-deal-to-offer-news-in-chatgpt.html |

|

Hunter Biden defies subpoena, defends business recordHunter Biden lashed out at Republicans pursuing an impeachment inquiry as he defied a congressional subpoena for a closed-door deposition. Read more at: https://www.cnbc.com/2023/12/13/hunter-biden-defends-business-record-as-he-defies-subpoena.html |

|

SpaceX valuation climbs to $180 billionThe valuation of Elon Musk’s SpaceX hit $180 billion based on an ongoing secondary share sale, CNBC confirmed Wednesday. Read more at: https://www.cnbc.com/2023/12/13/spacex-value-climbs-to-180-billion-higher-than-boeing-verizon.html |

|

How to stop Dropbox from sharing your personal files with OpenAIIf you’ve used any of Dropbox’s AI tools, some of your documents and files may have been shared with OpenAI. Read more at: https://www.cnbc.com/2023/12/13/how-to-stop-dropbox-from-sharing-your-personal-files-with-openai.html |

|

The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reelingThe Federal Reserve’s period of policy tightening may be over, but household budgets have taken a hit since March 2022. Read more at: https://www.cnbc.com/2023/12/13/the-federal-reserve-held-rates-steady-heres-what-that-means-for-you.html |

|

Why Tesla’s Cybertruck is so hard to mass produceThe Cybertruck is finally here, but Elon Musk has repeatedly emphasized how difficult building it has been, and tempered expectations around scaling production. Read more at: https://www.cnbc.com/2023/12/13/why-the-cybertruck-is-so-hard-to-manufacture.html |

|

Here’s where deflation was in November 2023 — in one chartDeflation is the opposite of inflation: it’s when prices fall instead of rise. Some sectors have seen deflation over the past year. Read more at: https://www.cnbc.com/2023/12/13/deflation-inflation-november-2023-in-one-chart.html |

|

Jim Grant: We’ve Yet To Feel The Full Consequences Of The “Era Of Free Money”Via SchiffGold.com, In a recent interview with Forbes, economic commentator and historian Jim Grant warned that we haven’t fully felt the inevitable fallout from the “free money era.”

Grant traces the root of today’s problems back to 2008 when the Federal Reserve became “completely irrational.” The central bank pumped trillions of liquidity into the economy with three rounds of quantitative easing. During the pandemic, the Fed doubled down on this extraordinary monetary policy. It … Read more at: https://www.zerohedge.com/markets/jim-grant-weve-yet-feel-full-consequences-era-free-money |

|

Biden Meets With Families Of 8 American Captives Still Held In GazaPresident Biden says he’s looking to restart Israel-Hamas negotiations in order to gain the freedom of the several Americans still in captivity. However, all signs point to this as an unlikely scenario anytime soon. The president met with relatives of American citizens still being held hostage in Gaza at the White House on Wednesday. Most or all of the captives are dual citizens. There are still 135 captives in total being held, though some might be feared dead – and of the total seven are American citizens and one is a US Green Card holder. The prior seven-day truce saw over 100 captives freed, including some Americans.

The family members that attended included Yael and Adi Alexander, Ruby and Roy Chen, Ronen and Orna Neutra, Jona … Read more at: https://www.zerohedge.com/geopolitical/biden-meets-families-8-american-captives-still-held-gaza |

|

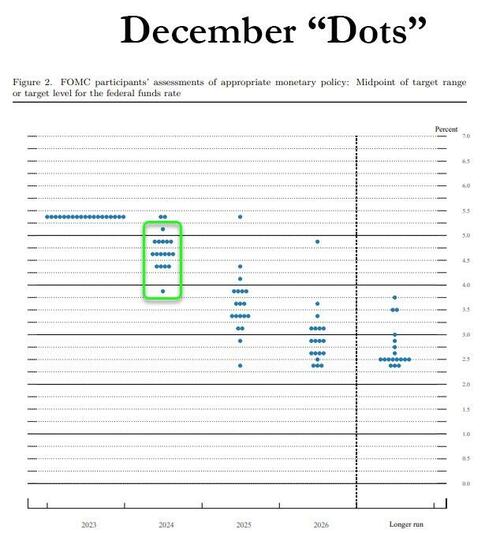

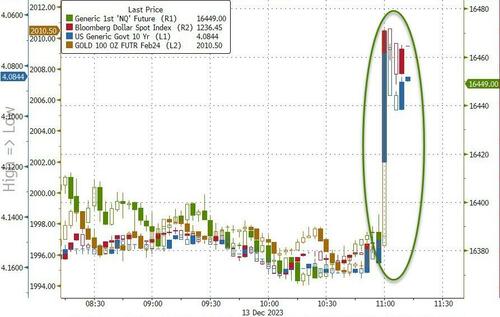

Fed ‘Dovish Pivot’ Sparks Panic-Bid In Bonds, Stocks, & GoldBetween the ‘dovish’ dots and the optimistic inflationary comments (and SEP), The Fed delivered more than the doves could have hoped… Looking at the distribution of 2024 dots:

This is the most confused “year ahead” FOMC we have seen in years

Stocks soared… Read more at: https://www.zerohedge.com/markets/fed-dovish-pivot-sparks-panic-bid-bonds-stocks-gold |

|

Watch Live: Will Fed Chair Powell Unleash The Hawknado?So, as expected, The Fed did nothing on rates, adjusted its dots dovishly (more than expected), and the market kneejerked exuberantly… Gold, bonds, and stocks all soaring (and dollar dumping)…

George Goncalves at MUFG says:

Now it’s Powell’s turn to tamp down that excitement:

|

|

Ex-BP boss to lose £32m after ‘serious misconduct’Mr Looney is dismissed without notice after BP finds he misled board over colleague relationships. Read more at: https://www.bbc.co.uk/news/business-67709815?at_medium=RSS&at_campaign=KARANGA |

|

Federal Reserve signals interest rate cuts next yearThe US central bank hints of lower rates in the future as it kept its key interest rate unchanged. Read more at: https://www.bbc.co.uk/news/business-67708832?at_medium=RSS&at_campaign=KARANGA |

|

UK economy falls unexpectedly in October as higher rates biteHigher interest rates and bad weather hold back growth as the economy continues to stagnate. Read more at: https://www.bbc.co.uk/news/business-67690287?at_medium=RSS&at_campaign=KARANGA |

|

Nithin Kamath on the potential dangers of deep fake in financial services industryWhile sharing a deep fake video of his, Nithin Kamath said it will only become harder over time to validate if the person on the other side is real or AI-generated. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nithin-kamath-on-the-potential-dangers-of-deep-fake-in-financial-services-industry/articleshow/105963015.cms |

|

Tech View: Nifty forms Doji candle ahead of Fed meet outcome. What traders should do on Thursday expiryThe upside recovery of Wednesday from the immediate supports signals chances of further upside for the Nifty in the short term. There is a higher possibility of Nifty moving again into all-time highs of 21040+ levels in the near term. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-ahead-of-fed-meet-outcome-what-traders-should-do-on-thursday-expiry/articleshow/105964975.cms |

|

Nifty Bank closes lower for two days in a row; support seen at 46,800The index closed flat but with a negative bias. It did manage to hold on to 47,000 levels towards the close of the trade, which is a positive sign. The Nifty50 closed with gains of nearly 20 points. Read more at: https://economictimes.indiatimes.com/markets/options/nifty-bank-closes-lower-for-two-days-in-a-row-support-seen-at-46800/articleshow/105963455.cms |

|

Realtor.com: Kendrick Lamar scoops up $8.6 million Brooklyn penthouseRapper Kendrick Lamar is the new owner of a four-bedroom, 3.5-bath penthouse in Brooklyn, NY. Check out the photos. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AE-B501D51E225E%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yields plummet after Fed pencils in 2024 rate cutsTreasury yields fell sharply Wednesday afternoon, led by a decline in the policy-sensitive 2-year rate, after Federal Reserve officials penciled in three quarter-point rate cuts for 2024. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AE-100724770025%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow Jones heads for record close after Fed leaves interest rates unchanged, signals pivot aheadU.S. stock indexes jumped Wednesday after the Federal Reserve kept rates steady and mapped out a fresh path for rates in 2024. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AE-0F3349ED4C8C%7D&siteid=rss&rss=1 |