Summary Of the Markets Today:

- The Dow closed up 63 points or 0.17%,

- Nasdaq closed up 1.37%,

- S&P 500 closed up 0.80%,

- Gold $2,046 down $1.70,

- WTI crude oil settled at $70 up $0.30,

- 10-year U.S. Treasury 4.146% up 0.023 points,

- USD Index $103.61 down $0.550,

- Bitcoin $43,260 down $529 ( 1.21% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

October 2023 sales of merchant wholesalers were down 0.4% from the revised October 2022 level. Total inventories of merchant wholesalers were down 2.3% from the revised October 2022 level. The October inventories/sales ratio for merchant wholesalers was 1.34. The October 2022 ratio was 1.37. As I have been saying, I know the wholesaling sector is in flux – and IMO you cannot say the sector is contracting as the scope is different. The sales-to-inventory levels (green line on the graph below) do not indicate an inventory build which historically has been an indicator of a pending recession.

U.S.-based employers announced 45,510 job cuts in November 2023, a 24% increase from the 36,836 cuts >announced one month prior. It is 41% lower than the 76,835 cuts announced in the same month in 2022, and marks the first time cuts were lower than the corresponding month a year ago since July. So far this year, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period last year. It is the highest January-November total since 2020, when 2,227,725 cuts were recorded. Andrew Challenger, labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The job market is loosening, and employers are not as quick to hire. The labor market appears to be stabilizing with a more normal churn, though we expect to continue to see layoffs going into the New Year.

In the week ending December 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,750, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 220,000 to 220,250.

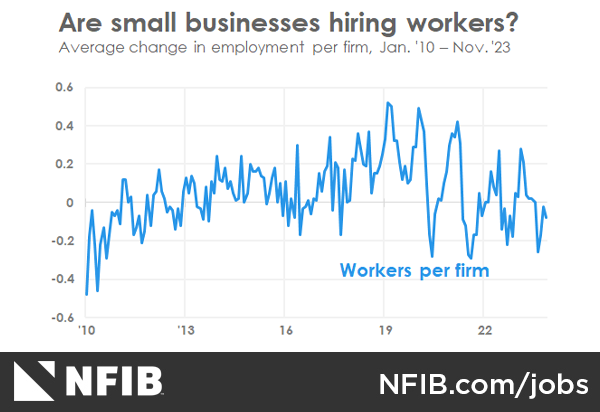

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down three points from October. The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 24%. Labor costs reported as the single most important problem for business owners decreased one point to 8%, five points below the highest reading of 13% reached in December 2021. NFIB Chief Economist Bill Dunkelberg stated:

Despite the slight decline in November, small business job openings remain stuck in historical territory. For owners across the country, there are not enough workers to maintain current operations for small businesses, much less chase new opportunities. As we near the end of the year, small business owners continue to raise compensation in order to attract and retain qualified employees.

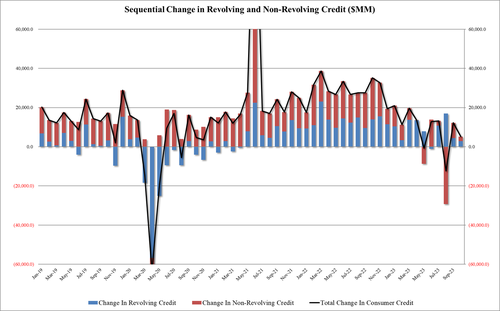

In October 2023, the Federal Reserve’s headline consumer credit increased at a seasonally adjusted annual rate of 1.2 percent. Revolving credit increased at an annual rate of 2.7 percent, while nonrevolving credit increased at an annual rate of 0.7 percent. I hate interpreting the volatile extrapolation of a single month’s change – and prefer to look at year-over-year change. The year-over-year growth in consumer credit was 3.1% which is the blue line on the graph below (1.6% inflation-adjusted – red line on the graph below). The bottom line is that consumer credit growth is slowing – and this is usually associated with a slowing economy.

Here is a summary of headlines we are reading today:

- Global Airlines To See Record Revenues This Year

- New Supercrystals Set World Record for Solar Hydrogen Production

- U.S. Natural Gas Inventories Highest at Winter’s Start Since 2020

- U.S. Cements Position as Energy Superpower with Soaring Oil Exports

- Nasdaq closes 1% higher, Dow and S&P 500 snap 3-day losing streak: Live updates

- Biden administration asserts power to seize drug patents in move to slash high prices

- Google shares pop 5% after company announces Gemini AI model

- PayPal shares slide after Amazon drops Venmo as payment option

- Consumer Credit Expansion Slowed Dramatically In October

- Predictably, The Rush To Electric Cars Is Imploding

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Global Airlines To See Record Revenues This YearThe International Air Transport Association released new profitability forecasts for global airlines, indicating that despite high interest rates slowing down developed and emerging market economies, carriers are projected to achieve record revenues this year and in 2024. The net profits of the airline industry are forecasted to hit $25.7 billion in 2024, equating to a net profit margin of 2.7%. This marks an improvement from 2023, where a net profit of $23.3 billion is expected, representing a 2.6% net profit margin. IATA said… Read more at: https://oilprice.com/Energy/Energy-General/Global-Airlines-To-See-Record-Revenues-This-Year.html |

|

New Supercrystals Set World Record for Solar Hydrogen ProductionLudwig-Maximilians-Universität München researchers have developed new high-performance nanostructures, a material that holds a new world record for green hydrogen production with sunlight. When Emiliano Cortés goes hunting for sunlight, he doesn’t use gigantic mirrors or solar farms. Quite the contrary, the professor of experimental physics and energy conversion at LMU dives into the nanocosmos. “Where the high-energy particles of sunlight meet atomic structures is where our research begins,” Cortés said.… Read more at: https://oilprice.com/Energy/Energy-General/New-Supercrystals-Set-World-Record-for-Solar-Hydrogen-Production.html |

|

Maduro Arrests Opposition Figures as Oil-Rich Guyana Readies for InvasionVenezuelan President Nicolas Maduro has issued arrest warrants for opposition politicians who are challenging a move to annex oil-rich Essequibo in a last-minute ploy to ensure his chances of maintaining the presidency against wildly falling popularity. Maduro has officially placed the disputed territory of oil-rich Essequibo under military jurisdiction, putting oil exploration and production operations of Exxon and Chevron at risk. Following a Sunday referendum, Venezuelan President Nicolas Maduro has declared the return of Essequibo,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Maduro-Arrests-Opposition-Figures-as-Oil-Rich-Guyana-Readies-for-Invasion.html |

|

Azerbaijan and Armenia Discuss border amid Stagnant Peace TalksArmenia and Azerbaijan continue to discuss the delimitation of their mutual borders as part of wider talks on a peace treaty that show little sign of progress. On November 30, the state commissions of Armenia and Azerbaijan on border delimitation met for the fifth time at the Ijevan (Armenia) – Gazakh (Azerbaijan) section of their border. The commissions are chaired by deputy prime ministers Mher Grigoryan from Armenia and Shahin Mustafayev from Azerbaijan. After the meeting, the foreign ministries of the two countries released… Read more at: https://oilprice.com/Geopolitics/Asia/Azerbaijan-and-Armenia-Discuss-border-amid-Stagnant-Peace-Talks.html |

|

Suriname Prepares for South America’s Next Big Oil BoomAfter grappling with a lengthy political and economic crisis the government of Suriname pinned hopes of an economic recovery on a massive offshore oil boom. French supermajor TotalEnergies and APA Corporation have made five high-quality oil discoveries since 2020 in Suriname’s offshore Block 58. The discoveries ignited dreams of a transformational oil boom for the former Dutch colony. Two years ago, Paramaribo’s vision for replicating neighboring Guyana’s colossal offshore oil boom, responsible for the economy growing threefold… Read more at: https://oilprice.com/Energy/Energy-General/Suriname-Prepares-for-South-Americas-Next-Big-Oil-Boom.html |

|

U.S. Natural Gas Inventories Highest at Winter’s Start Since 2020The United States is entering the winter heating season with the highest natural gas in storage since 2020, the U.S. Energy Information Administration (EIA) said on Thursday. The Lower 48 United States ended the natural gas injection season at 3,776 billion cubic feet (Bcf), according to estimates based on data from EIA’s Weekly Natural Gas Storage Report. The Lower 48 states are thus entering the winter heating season, which runs from November 1 through March 30, with the most natural gas in storage since 2020. Moreover, the U.S.… Read more at: https://oilprice.com/Energy/Natural-Gas/US-Natural-Gas-Inventories-Highest-at-Winters-Start-Since-2020.html |

|

Australian Firms in Merger Talks to Create $52-Billion Energy GiantAustralian oil and gas producers Woodside Energy and Santos confirmed on Thursday they are in talks regarding a potential merger that would create a giant energy group with a market capitalization of around $52.6 billion (AUS$80 billion). “In response to recent media speculation, Woodside confirms it is in discussions regarding a potential merger with Santos Ltd,” Woodside said in a brief statement on Thursday. “Discussions remain confidential and incomplete, and there is no certainty that the discussions will lead to a transaction,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australian-Firms-in-Merger-Talks-to-Create-52-Billion-Energy-Giant.html |

|

EU Says Nuclear Energy Is Clean After AllNuclear power is indeed a strategic net-zero technology that the European Union should endorse on the bloc’s way toward reducing greenhouse gas emissions, EU member governments agreed on Thursday. 27 EU member ministers agreed at a meeting this week that nuclear power—and sustainable alternative fuels that include e-fuels—should be included in the list of acceptable strategic technologies. The council’s position on the matter was announced on Thursday and was made to allow EU industry to compete with Chinese and U.S. competitors… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/EU-Says-Nuclear-Energy-Is-Clean-After-All.html |

|

Russia Vows to Provide More Oil Data Following OPEC+ Calls for TransparencyRussia has promised oil-flow tracking companies and price reporting agencies to provide data about its production, inventories, and fuel output after OPEC+ asked Moscow for more transparency in tracking its compliance with the cuts, Reuters reported on Thursday, citing sources at OPEC+ and ship-tracking consultancies. Since the invasion of Ukraine, Russia has classified its oil production and export data, saying it would not provide detailed information about its oil sector which could be used by the West to track down and clamp down on Russia’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Vows-to-Provide-More-Oil-Data-Following-OPEC-Calls-for-Transparency.html |

|

U.S. Cements Position as Energy Superpower with Soaring Oil ExportsFor those who are confused why the US has spent tens of billions to keep the Ukraine-Russia war going on and on (setting aside of course money-laundering by the Biden crime family) here is your answer: as FreightWaves’ Greg Miller reports, the unstated mission of the US military-industrial complex in the lead up and following the Ukraine war, was to unseat and replace Russia as the largest source of European energy, both crude and nat gas, and in the process push US crude exports to record highs, driven by a surge in European… Read more at: https://oilprice.com/Energy/Energy-General/US-Cements-Position-as-Energy-Superpower-with-Soaring-Oil-Exports.html |

|

Saudi Arabia Admits for First Time to Delays in Some Vision 2030 ProjectsFor the first time, Saudi Arabia acknowledges that some of the projects of its Vision 2030 plan to diversify its economy away from oil are being delayed to avoid pressures on the economy. The Kingdom, the world’s top crude oil exporter, needs more time to “build factories, build even sufficient human resources,” Finance Minister Mohammed Al Jadaan told Bloomberg on Thursday. “The delay or rather the extension of some projects will serve the economy,” the minister added. “There are strategies that have been postponed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Admits-for-First-Time-to-Delays-in-Some-Vision-2030-Projects.html |

|

Russia and Saudi Arabia Call On OPEC+ Members to Join Production CutsRussia and Saudi Arabia are calling on all other OPEC+ producers to join the production cuts, the Kremlin said after Russian President Vladimir Putin met with Saudi Crown Prince Mohammed bin Salman in Riyadh. The two leaders of the top OPEC+ producers stressed “the need for all participating countries to join to the OPEC+ agreement, in a way that serves the interests of producers and consumers and supports the growth of the global economy,” according to a statement from the Kremlin in Russian, carried by Reuters. The Russian version… Read more at: https://oilprice.com/Energy/Energy-General/Russia-and-Saudi-Arabia-Call-On-All-OPEC-Members-to-Join-Production-Cuts.html |

|

Russia’s Flagship Crude Oil Falls Below the $60 Price CapThe price of Russia’s flagship crude, Urals, has dropped below the $60 per barrel price cap for the first time in months amid plunging international benchmarks. The price of Urals crude loaded from Russia’s Baltic Sea port of Primorsk fell to $56.15 a barrel, while the price of Urals at the Novorossiysk port in the Black Sea slumped to $56.55, Bloomberg reported on Thursday citing data from Argus Media. The data is used to inform G-7 policy on the price cap. Brent Crude prices fell below $75 per barrel on Wednesday, settling at… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Flagship-Crude-Oil-Falls-Below-the-60-Price-Cap.html |

|

China’s Oil Imports Slump to First Annual Decline Since AprilChinese crude oil imports dropped by 9.2% year-over-year in November, marking the first annual decline in crude arrivals since April, and potentially signaling weakening demand. China imported 10.33 million barrels per day (bpd) of crude oil last month, down from October’s imports by more than 1 million bpd, per data from the General Administration of Customs released on Thursday. The Chinese crude arrivals in November were the lowest since July this year and saw the first year-on-year decline since April. In October, stronger… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Oil-Imports-Slump-to-First-Annual-Decline-Since-April.html |

|

Russian Fuel Exports Bounced Back in NovemberRussia saw its fuel exports tick higher in November, with the daily average rising to 2.2 million barrels, according to data from Vortexa, cited by Bloomberg. The rebound followed the end of diesel export bans and the end of maintenance season at refineries. Stormy weather in the Black Sea, however, affected outbound fuel shipments towards the end of the month and in early December. Per the Vortexa data, diesel and gasoil exports rose by 12% from October to November, with the bulk of shipments going to Africa and South America. The bulk of the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Fuel-Exports-Bounced-Back-in-November.html |

|

Facing fines, cluttered aisles and late-night mockery, Dollar General’s returning CEO tries to drive a turnaroundThe retailer said it will put more workers in the front of the stores, slow down store openings and step up efforts to keep merchandise in stock. Read more at: https://www.cnbc.com/2023/12/07/dollar-general-tries-to-drive-a-turnaround-after-safety-violations.html |

|

Nasdaq closes 1% higher, Dow and S&P 500 snap 3-day losing streak: Live updatesThe S&P 500 rose Thursday, as it snapped a three-day slide, with traders looking ahead to Friday’s all-important jobs report loomed. Read more at: https://www.cnbc.com/2023/12/06/stock-market-today-live-updates.html |

|

GameStop’s potential new strategy: Let Ryan Cohen buy other stocks with company cashThe Chewy co-founder and investor is gaining even more power at GameStop, which was at the center of the meme stock craze of 2021. Read more at: https://www.cnbc.com/2023/12/07/-gamestops-potential-new-strategy-let-ryan-cohen-buy-other-stocks-with-company-cash.html |

|

Amazon tests grocery subscription service for Prime membersAmazon is betting members of its $139-a-year Prime program will want to pay a separate monthly fee for unlimited grocery delivery on some orders. Read more at: https://www.cnbc.com/2023/12/07/amazon-tests-grocery-subscription-service-for-prime-members.html |

|

Biden administration asserts power to seize drug patents in move to slash high pricesThe Biden administration unveiled a new framework outlining the factors federal agencies should consider in determining whether to use march-in rights. Read more at: https://www.cnbc.com/2023/12/07/biden-administration-asserts-power-to-seize-drug-patents.html |

|

It’s never been easier to get 5% yields. How to soften the tax hit on your big income payersInterest on cash will cost you at tax time. Read more at: https://www.cnbc.com/2023/12/07/its-easy-to-get-5percent-yields-how-to-soften-the-tax-hit-on-your-big-income-payers.html |

|

Google shares pop 5% after company announces Gemini AI modelGoogle shares jumped Thursday after the company announced its latest artificial intelligence model called Gemini. Read more at: https://www.cnbc.com/2023/12/07/google-shares-pop-after-company-announces-gemini-ai-model.html |

|

Sen. Elizabeth Warren pushes to update banking laws to include crypto: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Brock Pierce, chairman of the Bitcoin Foundation, discusses the recent rally for the cryptocurrency. Read more at: https://www.cnbc.com/video/2023/12/07/sen-elizabeth-warren-pushes-update-banking-laws-include-crypto-crypto-world.html |

|

Trading the jobs report: What Goldman traders see happening Friday based on these scenariosEconomists polled by Dow Jones expect the U.S. Bureau of Labor Statistics to report that employers added 190,000 jobs last month. Read more at: https://www.cnbc.com/2023/12/07/trading-the-jobs-report-what-goldman-traders-see-happening-friday-based-on-these-scenarios.html |

|

Exxon CEO dismisses worries FTC could hold up Pioneer deal, does not see competition concernsExxon CEO Darren Woods said the Pioneer deal is small in the context of the broader market. Read more at: https://www.cnbc.com/2023/12/07/exxon-ceo-dismisses-worries-ftc-could-hold-up-pioneer-deal-does-not-see-competition-concerns.html |

|

PGA Tour star Jon Rahm gearing up to join Saudi-backed LIV GolfJon Rahm, the defending Masters champion, is gearing up to leave the PGA Tour for Saudi-backed LIV Golf. Read more at: https://www.cnbc.com/2023/12/07/pga-tour-star-jon-rahm-gearing-up-to-join-saudi-backed-liv.html |

|

Ferrari’s $400,000 Purosangue is a dream to drive. Just don’t call it an SUVThe Purosangue, its name meaning “pure blood” or “thoroughbred” in Italian, comes with a 7.5 liter, V-12 engine. Read more at: https://www.cnbc.com/2023/12/07/ferrari-purosangue-review-a-dream-to-drive-but-not-an-suv.html |

|

PayPal shares slide after Amazon drops Venmo as payment optionAmazon announced last October it would add Venmo as a payment method at checkout, giving shoppers more options to pay for their purchases. Read more at: https://www.cnbc.com/2023/12/07/paypal-shares-slide-after-amazon-drops-venmo-as-payment-option.html |

|

Consumer Credit Expansion Slowed Dramatically In OctoberThe latest data on consumer credit data for October confirmed the slowdown seen in September, as total debt increased by just $5.13 billion (below consensus estimates of $8.5 billion). This is a clear regime shift lower from recent months when the monthly increase was in the $20/$30BN range.

Looking at the composition, both revolving and non-revolving credit were weak. Starting with the former, in October, credit card debt rose by just $2.9 billion, which with the exception of June’s freak negative revolving credit print, was the lowest monthly increase since April 2021 (amid the COVID lockdown crisis). Read more at: https://www.zerohedge.com/personal-finance/consumer-credit-expansion-slowed-dramatically-october |

|

Russia Vows To Provide More Oil Data Following OPEC+ Calls for TransparencyBy Charles Kennedy of OilPrice.com Russia has promised oil-flow tracking companies and price reporting agencies to provide data about its production, inventories, and fuel output after OPEC+ asked Moscow for more transparency in tracking its compliance with the cuts, Reuters reported on Thursday, citing sources at OPEC+ and ship-tracking consultancies.

Since the invasion of Ukraine, Russia has classified its oil production and export data, saying it would not provide detailed information about its oil sector which could be used by the West to track down and clamp down on Russia’s oil exports, or oil revenues. During a recent call with six oil- … Read more at: https://www.zerohedge.com/markets/russia-vows-provide-more-oil-data-following-opec-calls-transparency |

|

“I’m Angry!” – NYC Mayor Adams Travels To DC To Seek Federal Funds Amid Migrant CrisisNew York City Mayor Eric Adams flew to Washington, DC, on Thursday afternoon (not really climate-friendly, eh?), expected to meet with progressive lawmakers and members of the Biden administration to discuss federal assistance to address the worsening migrant crisis across the Big Apple. The left-wing mayor said he would be speaking to lawmakers about the migrant crisis in the metro area. He said he will “send a strong message – we need help.” “It’s clear New Yorkers are angry – I am angry. I know we should not be using our taxpayers on a national problem,” Adams continued.

New data from The New York Times shows NYC has been flooded with over 150,000 illegal migrants since the spring of 2022. This is primarily due to President Biden’s disastrous open southern border policies.

|

|

Predictably, The Rush To Electric Cars Is ImplodingAuthored by Levi Russell via RealClear Wire, My appreciation for our freedom of movement was re-ignited recently when I finished up an engine swap into my rare-but-not-collectable 1995 Ford Thunderbird. It had blown a head gasket and had far more than 200,000 miles on it, so in went a junkyard-fresh 4.6L V8 with only 40,000 miles on the clock, or so said the yard I bought it from. My use of the term “freedom of movement” on this site goes back to my article in March of 2022, where I pointed out that the Biden administration is hell-bent on forcing us into a mass-transit-heavy society, in part through regulations and restrictions that made it Read more at: https://www.zerohedge.com/energy/predictably-rush-electric-cars-imploding |

|

Shopping with cash rises for first time in a decadePeople are using notes and coins as a way of budgeting while prices rise, says the British Retail Consortium. Read more at: https://www.bbc.co.uk/news/business-67636571?at_medium=RSS&at_campaign=KARANGA |

|

McDonald’s unveils US CosMc’s trial and global expansionThe fast-food giant pilots CosMc’s and plans to open about 10,000 McDonald’s globally by 2027. Read more at: https://www.bbc.co.uk/news/business-67644926?at_medium=RSS&at_campaign=KARANGA |

|

Anger as Nationwide orders workers back to officeNationwide – which has its HQ in Swindon – tells staff to work in offices at least two days a week. Read more at: https://www.bbc.co.uk/news/uk-england-wiltshire-67650437?at_medium=RSS&at_campaign=KARANGA |

|

LIC reclaims Rs 5 lakh cr market cap; stock hits 52-week highWith Thursday’s jump in LIC shares, the second-largest PSU by market cap, surged another 19 per cent this week. During the day, LIC shares hit a 52-week high of Rs 800 on the NSE and Rs 799.90 BSE, breaching the Rs 5 lakh crore market cap of the state-owned insurer. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/lic-reclaims-rs-5-lakh-cr-market-cap-stock-hits-52-week-high/articleshow/105819755.cms |

|

Duds of 2023! UPL among 5 stocks that disappointed investorsSensex and Nifty have hit all-time high levels in 2023, but these 5 stocks have disappointed investors and fared unlike their return potential at the start of the year. Take a look (Source: ETNOW) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/duds-of-2023-these-5-stocks-disappointed-d-street-investors-the-most/market-flops/slideshow/105817994.cms |

|

Warburg Pincus offloads 1.3% stake in IDFC First Bank for Rs 790 croreAs of September-end, Dayside Investment held 1.3% in the company. Cloverdell Investment, another affiliate of Warburg Pincus, also holds a 2.74% stake in IDFC First Bank. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/warburg-pincus-offloads-1-3-stake-in-idfc-first-bank-for-rs-790-crore/articleshow/105818620.cms |

|

Robert Powell’s Retirement Portfolio: Vacations, cars, and roof repairs? You may be surprised by how much you spend in retirementHow to prepare for spending volatility in retirement Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AA-36291A3CC638%7D&siteid=rss&rss=1 |

|

In One Chart: November’s rally just erased two months of Fed tightening, economist saysFinancial conditions are now looser than in September, says economist. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AA-ABF8F47AF686%7D&siteid=rss&rss=1 |

|

Lawrence G. McMillan: Resistance is expected but futile: Stocks are geared for a year-end rallyYet all bets are off if the S&P 500 closes below 4400. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AA-CD9F2E857638%7D&siteid=rss&rss=1 |