Summary Of the Markets Today:

- The Dow closed down 63 points or 0.18%,

- Nasdaq closed down 0.59%,

- S&P 500 closed down 0.20%, High 4,319: 4,200 = critical resistance level)

- Gold $2,001 up $20.70,

- WTI crude oil settled at $78 down $0.01,

- 10-year U.S. Treasury 4.406% down 0.016 points,

- USD Index $103.60 up $0.160,

- Bitcoin $36,869 down $574 ( 1.53% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic’s Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas shows annual U.S. single-family rent growth dropped to the lowest level in three years in September, but the 2.6% increase is down only slightly from the pre-pandemic average. Molly Boesel, principal economist for CoreLogic stated:

Single-family rent growth eased again in September and is now back to the rate recorded before the pandemic. While low-tier rental gains are slowing, they have still surpassed those of their higher-priced counterparts since early 2020. Slowing month-over-month rent growth in September reflects typical seasonal patterns, but indications are that annual gains will remain positive through the rest of 2023.

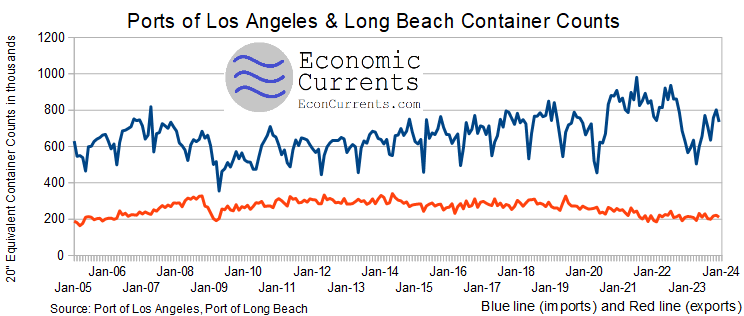

The Ports of Los Angeles and Long Beach (who handle over 40% of container freight traffic in the US) had another good month in October 2023 with imports up 17.0% year-over-year and exports unchanged YoY. Rising import data generally signals an improving US economy.

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, decreased to –0.22 in October from a neutral value in September. I believe the CFNAI is the best coincident indicator which is saying that the economy has slowed. Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above –0.70.

Existing-home sales dropped in October 2023 with year-over-year sales tumbling 14.6%. The median existing-home price for all housing types in October was $391,800, an increase of 3.4% from October 2022 ($378,800). NAR Chief Economist Lawrence Yun added:

Prospective home buyers experienced another difficult month due to the persistent lack of housing inventory and the highest mortgage rates in a generation. Multiple offers, however, are still occurring, especially on starter and mid-priced homes, even as price concessions are happening in the upper end of the market.

Highlights of the minutes of the Federal Open Market Committee held on October 31–November 1, 2023:

… Participants noted that real GDP had expanded at an unexpectedly strong pace in the third quarter, boosted by a surge in consumer spending … Participants assessed that while labor market conditions remained tight, they had eased since earlier in the year, partly as a result of recent increases in labor supply.

… some participants remarked that the finances of some households—especially those in the low- and moderate-income categories—were increasingly coming under pressure amid high prices for food and other essentials as well as tight credit conditions. Several participants added that delinquencies on auto loans and credit cards had risen for these households.

… Participants observed that, notwithstanding the moderation of inflation so far, inflation remained well above the Committee’s 2 percent longer-run objective and that elevated inflation was continuing to harm businesses and households, particularly low-income households. Participants stressed that they would need to see more data indicating that inflation pressures were abating to be more confident that inflation was on course to return to 2 percent over time.

… Participants noted that in recent months, financial conditions had tightened significantly because of a substantial run-up in longer-term Treasury yields, among other factors. Higher Treasury yields contributed to an increase in 30-year mortgage rates to levels not seen in many years and led to higher corporate borrowing rates. Many participants observed that a range of measures suggested that the rise in longer-term yields had been driven primarily or substantially by a rise in the term premiums on Treasury securities. Participants generally viewed factors such as a fiscal outlook that suggested greater future supply of Treasury securities than previously thought and increased uncertainty about the economic and policy outlooks as likely having contributed to the rise in the term premiums.

… Participants commented on the significant tightening in financial conditions in recent months, driven by higher longer-term yields, with many noting that it was uncertain whether this tightening of financial conditions would persist and to what extent it reflected expectations for tighter policy or other factors. Amid these economic conditions, all participants judged it appropriate to maintain the target range for the federal funds rate at 5¼ to 5½ percent at this meeting. Participants judged that maintaining this restrictive stance of policy at this meeting would support further progress toward the Committee’s goals while allowing more time to gather additional information to evaluate this progress.

… But with inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see upside risks to inflation. These risks included the possibility that the imbalance of aggregate demand and supply could persist longer than expected and slow the progress on inflation, geopolitical tensions and risks emanating from global oil markets, the effects of a tight housing market on shelter inflation, and the potential for more limited declines in goods prices.

Here is a summary of headlines we are reading today:

- Is Elon Musk’s Social Media Drama Hurting Tesla?

- Thanksgiving Travel Underway With Gasoline Demand Jumping 7.6%

- Ford Scales Back Capacity Of New Battery Plant By 42%

- Copper Prices Inch Higher on Shifting Sentiment

- Trillion Dollar Bailout: What Xi Really Wants From Biden

- Fed gave no indication of possible rate cuts at last meeting, minutes show

- The S&P 500 is starting to form a ‘cup and handle’ pattern. How to watch for the potential breakout ahead

- ‘Funflation’ drives sporting event ticket prices up a whopping 25%

- High-End Retailers Face Downturn As Wealthy Americans Cut Back On Spending

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Elon Musk’s Social Media Drama Hurting Tesla?Last December, I wrote Why Tesla’s Market Share Is Set To Plunge In 2023. My logic was straightforward. After buying Twitter, Elon Musk began to alienate the very people most likely to buy a Tesla. Those who were happiest about Musk’s actions were the least likely to buy a Tesla. I did indicate that Tesla had a couple of advantages working for it. One is that competitors are racing to catch up, so even consumers who might want an alternative might have trouble finding one. Further, Tesla orders have historically been backlogged, so… Read more at: https://oilprice.com/Energy/Energy-General/Is-Elon-Musks-Social-Media-Drama-Hurting-Tesla.html |

|

Iran’s Middle East Strategy: Arming Allies for Long-Term ConflictIran’s strategy in the Middle East is essentially a take on an old proverb: Give your proxies and partners weapons and you can sustain their battles for a day. Teach them to make weapons and they can fight your enemies for a lifetime.With Iranian-backed militant groups taking the charge in the Islamic republic’s fight against Israel and the United States, Tehran is seeing its effort to help them acquire their own weapons-manufacturing capabilities pay off.”Iran has established a network of allies and partners throughout the Middle East, from the… Read more at: https://oilprice.com/Geopolitics/International/Irans-Middle-East-Strategy-Arming-Allies-for-Long-Term-Conflict.html |

|

Thanksgiving Travel Underway With Gasoline Demand Jumping 7.6%Thanksgiving travel is underway with millions of Americans hitting the road and U.S. gasoline demand jumping on Monday by 7.6% compared to last week’s Monday, Patrick De Haan, head of petroleum analysis at GasBuddy, said on Tuesday. Gasoline demand in America was 6.4% higher on November 20, the start of the Thanksgiving week, compared with the average of the last four Mondays. Last year, the 2022 run-up to Thanksgiving saw Monday gasoline demand rising by 1.8% week-on-week and up by 3.4% from the average of the previous four Mondays,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Thanksgiving-Travel-Underway-With-Gasoline-Demand-Jumping-76.html |

|

The Battle for America’s Energy Future: Oil, Gas, and National SecurityFifty years ago this week, legislation authorizing construction of the Trans-Alaska Pipeline passed both houses of Congress and was signed into law by President Richard Nixon. The whole process took all of five days. Not only was the timeline unprecedented, but so was the fact that the act specifically halted all legal challenges against the planned pipeline. Furthermore, it prohibited federal and state agencies from regulating the construction of the project. The legislation led to a flurry of construction, and since the first oil flowed… Read more at: https://oilprice.com/Energy/Crude-Oil/The-Battle-for-Americas-Energy-Future-Oil-Gas-and-National-Security.html |

|

Ford Scales Back Capacity Of New Battery Plant By 42%Ford is reneging on its ambitious plans to open a battery plant near Marshall, Michigan, a company spokesman said, scaling back both its investments in the EV battery facility and jobs as EV adoption is slower than expected. Ford will reduce its commitment to the battery plant by more than $1 billion and 800 jobs, reducing the planned capacity of the plant by 42%. While the plans have been scaled back considerably, Ford still plans to open the new plant by 2026. “We’ve been studying this project for the past couple of months. I think… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ford-Scales-Back-Capacity-Of-New-Battery-Plant-By-42.html |

|

LPG Demand Surge Triggers Price Hike in KazakhstanAs motorists in Kazakhstan grow increasingly partial to running their cars on liquified petroleum gas, or LPG, officials are warning that shortages of the fuel will inevitably lead to price rises. This is a troubling prospect in a country that saw a wave of political unrest sparked in early 2022 by a spike in the cost of that very same fuel. On November 20, deputy Energy Minister Alibek Zhamauov told reporters that from the start of 2024, prices for LPG will be allowed to increase at six-month intervals over the coming three years. The fuel is… Read more at: https://oilprice.com/Energy/Energy-General/LPG-Demand-Surge-Triggers-Price-Hike-in-Kazakhstan.html |

|

Indonesia Kicks Off $20B Renewable Energy PlanIndonesia kicked off a plan to unleash $20 billion in global financing to help decarbonize its power sector, Reuters reported on Tuesday, and to increase the role that renewables plays in its overall energy mix. The $20 billion in funds from lenders, including the United States and Japan, will be disbursed with immediate effect and will help Indonesia move forward with its plan to cut carbon emissions to 250 million metric tons for its on-grid power sector by the end of this decade. Without the funds, Indonesia’s carbon emissions would likely… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indonesia-Kicks-Off-20B-Renewable-Energy-Plan.html |

|

Copper Prices Inch Higher on Shifting SentimentCopper prices have started to gradually nudge higher on the expectation that demand from China will pick up in the future. Copper prices nudged up one percent up today to $8,347.50 a ton after Chinese officials vowed to roll out more support for private and state-owned property developers – a market which has been in turmoil following the downfall of Evergrande and Country Garden. This follows wider measures announced in October by the Chinese state to try and kick start its lagging economy back into gear. Its sluggish post-pandemic recovery… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Economic-Optimism-Boosts-Copper-Market.html |

|

IEA Expects Oil Market Surplus Even If OPEC+ Extends Production CutsThe current oil market deficit will turn into a slight surplus next year even if OPEC+ leaders Saudi Arabia and Russia extend their production and export cuts into 2024, Toril Bosoni, the Head of Oil Industry and Markets Division at the International Energy Agency (IEA), told Reuters on Tuesday. Global oil stocks are currently falling “at a fast rate”, Bosoni told Reuters on the sidelines of an industry event in Norway. Just last week, the IEA raised its global oil demand forecasts for 2023 and 2024, as consumption… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Expects-Oil-Market-Surplus-Even-If-OPEC-Extends-Production-Cuts.html |

|

Oil Markets on Edge Ahead of Critical OPEC+ MeetingOil markets are now fully focused on the upcoming OPEC+ meeting, with reports that the group may deepen cuts being counteracted by an apparent lack of unity amongst OPEC members on the issue.Chart of the Week- As OPEC+ prepares for its meeting on November 26, African producers are tacitly lamenting the oil group’s recalibration of 2024 production targets that will curb the maximum amount Nigeria or Angola can produce.- Following tense negotiations in June, all African countries agreed they would be subjected to lower 2024 quotas unless they… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-on-Edge-Ahead-of-Critical-OPEC-Meeting.html |

|

The U.S. And France Will Seek to Halt Private Funding for Coal Plants at COP28Supported by the United States, France will propose at the COP28 climate summit in Dubai an exit of private financing for coal-fired power plants, Reuters reported on Tuesday, citing sources with knowledge of the talks. According to Indian officials who spoke to Reuters, France has discussed with India – a large coal consumer – a plan for private banks and insurers to phase out funding for coal plants under the so-called ‘New Coal Exclusion Policy’. India and China are opposed to any halt of financing to coal, on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-And-France-Will-Seek-to-Halt-Private-Funding-for-Coal-Plants-at-COP28.html |

|

Trillion Dollar Bailout: What Xi Really Wants From BidenCommunist Party of China (CCP) General Secretary Xi Jinping is now starkly aware that he is facing the end of his rule, and has turned to US Pres. Joe Biden to save him. Specific reports are emerging as to the driving forces which made Xi act, in seeming desperation, to kowtow to US Pres. Joe Biden at the summit held on the sidelines of the Asia-Pacific Economic Conference (APEC) in San Francisco between November 13 and 17,2023. Xi’s Government of the People’s Republic of China (PRC) had, for at least two weeks before the summit, started… Read more at: https://oilprice.com/Geopolitics/Asia/Trillion-Dollar-Bailout-What-Xi-Really-Wants-From-Biden.html |

|

European Natural Gas Prices Seesaw as Cold Snap ArrivesEuropean natural gas prices were having a nervous trading session early on Tuesday as traders weighed higher heating demand amid colder weather with still nearly full EU inventories. The front-month Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were down by 1.7% to $49.30 (45 euros) per megawatt-hour (MWh) as of 12:54 p.m. in Amsterdam. Prices had gained nearly 2% on Monday as weather forecasts for Europe pointed to a cold snap this week with temperatures well below the average for this time of year. Most of Europe… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Natural-Gas-Prices-Seesaw-as-Cold-Snap-Arrives.html |

|

Iran Sees Its Oil Production Rising to 3.6 Million Barrels per Day by March 2024Iran expects its oil production to rise to 3.6 million barrels per day (bpd) by the end of the current Iranian year in March 2024, from around 3.3 million bpd now, Iran’s Oil Minister Javad Owji has said. The minister talked about Iranian oil production during a visit by Iran’s President Ebrahim Raisi to the headquarters of the Ministry of Oil, Iranian media reported. Iran has recently signed six contracts for the development of oil and gas fields in the past months, including deals to develop joint fields in the west of Karun, such… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Sees-Its-Oil-Production-Rising-to-36-Million-Barrels-per-Day-by-March-2024.html |

|

Steel-Making Giant Seeks U.S. LNG to Secure Gas for European OperationsArcelorMittal, the world’s second-largest steelmaker, is looking to sign an agreement with a U.S. LNG exporter as it aims to secure stable supply of natural gas following last year’s energy crisis in Europe, the Financial Times reported on Tuesday, quoting sources with knowledge of the plans. Industrial giants in Europe have recently signed LNG supply deals with U.S. companies after the industry was forced to curtail or shut down operations last year as natural gas prices skyrocketed in the wake of the Russian invasion of Ukraine. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Steel-Making-Giant-Seeks-US-LNG-to-Secure-Gas-for-European-Operations.html |

|

Fed gave no indication of possible rate cuts at last meeting, minutes showThe Federal Reserve on Tuesday released minutes from its Oct. 31-Nov. 1 policy meeting. Read more at: https://www.cnbc.com/2023/11/21/fed-minutes-november-2023.html |

|

Nvidia set to report earnings after the bellAnalysts foresee Nvidia nearly tripling its revenue as demand for the underlying technology for generative artificial intelligence still outstrips supply. Read more at: https://www.cnbc.com/2023/11/21/nvidia-nvda-q3-earnings-report-2024.html |

|

Binance CEO Changpeng Zhao pleads guilty to federal charges, steps downThe U.S. Department of Justice has brought criminal charges against Binance and its billionaire founder and CEO, Changpeng Zhao. Read more at: https://www.cnbc.com/2023/11/21/binance-ceo-changpeng-zhao-to-plead-guilty-to-federal-charges-step-down.html |

|

Ford to scale back plans for $3.5 billion Michigan battery plant as EV demand disappoints, labor costs riseFord is scaling back production capacity and expected employment at the battery plant in Michigan. Read more at: https://www.cnbc.com/2023/11/21/ford-scales-back-ev-battery-plant-in-michigan.html |

|

Israel-Hamas war live updates: Tentative deal reached on release of hostages held by Hamas, sources tell NBC NewsA senior U.S. official and a source familiar with the talks told NBC News that a tentative deal had been reached on the release of hostages held by Hamas. Read more at: https://www.cnbc.com/2023/11/21/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

The S&P 500 is starting to form a ‘cup and handle’ pattern. How to watch for the potential breakout aheadA bullish stock trading pattern forming in the S&P 500 could spell all-time highs for the broader index. Read more at: https://www.cnbc.com/2023/11/21/the-sp-500-is-starting-to-form-a-cup-and-handle-pattern-how-to-watch-for-the-potential-breakout-ahead.html |

|

‘Funflation’ drives sporting event ticket prices up a whopping 25%The price of attending sporting events rose 25.1% from October 2022 to October 2023, according to government data. Read more at: https://www.cnbc.com/2023/11/21/funflation-drives-sporting-event-ticket-prices-up-a-whopping-25percent.html |

|

Binance’s Changpeng Zhao to step down as part of $4.3 billion DOJ settlement: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kevin Worth, CEO of CoinDesk, discusses Bullish’s acquisition of the crypto news outlet. Read more at: https://www.cnbc.com/video/2023/11/21/binances-changpeng-zhao-to-step-down-as-part-of-4point3-billion-doj-settlement-cnbc-crypto-world.html |

|

Jeff Bezos ‘aggressive’ again Tuesday selling more Amazon stock after unloading shares last week, sources sayJeff Bezos is expected to be “aggressive” in dumping more shares of Amazon on Tuesday, sources told CNBC’s David Faber. Read more at: https://www.cnbc.com/2023/11/21/bezos-aggressive-again-tuesday-selling-more-amazon-stock-sources.html |

|

Microsoft exec says OpenAI employees can join with same compensationMicrosoft CTO Kevin Scott offered to match the compensation of OpenAI employees considering a departure from the company. Read more at: https://www.cnbc.com/2023/11/21/microsoft-exec-says-openai-employees-can-join-with-same-compensation.html |

|

NFL committed to X partnership as Elon Musk’s social platform gets heat for hate speechAdvertisers such as Disney and Apple have paused advertising on X over concerns about hate speech and antisemitism. Read more at: https://www.cnbc.com/2023/11/21/nfl-x-hate-speech-musk.html |

|

This is the No. 1 global city where expats thriveA port city in the southern part of Spain has some of the happiest expats in the world. Read more at: https://www.cnbc.com/2023/11/21/this-is-the-no-1-global-city-where-expats-thrive-says-new-report.html |

|

These bond funds are among the top performers in 2023 – Here’s what investors should do nextFunds that were willing to take a little credit risk and keep their duration short managed to stand out this year. Read more at: https://www.cnbc.com/2023/11/21/bond-funds-are-among-2023s-top-performers-whats-next-for-investors.html |

|

Nvidia Earnings Preview: Extremely Crowded Positioning, Extremely High ExpectationsAhead of today’s Nvidia earnings, which according to many will be the most important number of Q3 earnings season because, as DB’s Jim Reid reminds us, “Nvidia’s Q1 earnings in May was probably the event that catapulted AI into the stratosphere in terms of being an important macro topic so the pace of their success will be a key driver in how rapidly AI infiltrates our daily lives”, positioning is extremely high… so are expectations. Below we excerpt several trading desk previews of what to expect, starting with UBS trader Ryan Cobb:

|

|

US Says Iran Complicit In Ship Hijacking By Yemeni Rebels, Mulls Houthi Terror DesignationUpdate(1507ET): The Biden White House is threatening to slap an official terror designation on Yemen’s Houthi militia after it seized an Israel-linked cargo vessel in the Red Sea (details below). On Tuesday, as 25 international crew are still being held hostage after Houthi militants boarded the vessel by helicopter Sunday, National Security Council spokesman John Kirby told reporters that “in light of … the piracy of a ship in international waters, we have begun a review of potential terrorist designations and we’ll be considering other options together with our allies and partners as well.” Importantly, Kirby also directly alleged that Iran was complicit. The Houthis have expressly said that the seizure was in retaliation for Israel’s onslaught on Gaza, which has killed some 13,000 Palestinians – mostly civilians. Per a White House press briefing:

The Houthis earlier this month declared war on Israel, and have sent several drones and missiles toward southern Israel at this point. At least two of these projectiles have been interce … Read more at: https://www.zerohedge.com/geopolitical/houthis-release-dramatic-video-ship-hijacking-promise-beginning |

|

Russia Will Fight To Protect Its Key Weapon In The Global Energy RaceAuthored by Simon Watkins via OilPrice.com,

At the core of Russia’s hydrocarbon-centric geopolitical strategies for the future are its huge Arctic oil and gas reserves. And while global tensions stay high in the aftermath of 2022’s invasion of Ukraine and the ongoing Israel-Hamas War, the key emergency energy source remains liquefied natural gas (LNG). LNG requires much less infrastructure to be delivered than oil or gas sent through pipelines, so it is generally cheaper overall for sellers to develop and to expand their market share. Given this, it is also quicker and cheaper to increase or decrease delivery amounts at very short notice, as and when buyers require. In short, after massive Russian oil and gas supplies were sanctioned following the 24 February 2022 invasion of Ukraine, LNG firmly became the world’s key swing energy supply. When Russia was contemplating its f … Read more at: https://www.zerohedge.com/energy/russia-will-fight-protect-its-key-weapon-global-energy-race |

|

High-End Retailers Face Downturn As Wealthy Americans Cut Back On SpendingAs Black Friday looms, a concerning trend has emerged: Affluent Americans are cutting back on spending – a shift which signals potential trouble for an economy reliant on robust consumer expenditure to ward off recession. According to Bloomberg Second Measure Data of debit/credit card transactions by US consumers, in the three months leading to the holiday season, a collection of retailers serving the upper middle class, such as Apple, Coach, and Nordstrom, experienced their steepest sales decline in two years. This data, derived from Bloomberg Second Measure, also reflects a downturn in affluent mall traffic, contradicting the general uptick in retail sales figures.

|

|

Minimum wage to rise to £11.44 per hourThe new rate will apply to those aged 21 and over for the first time, the chancellor says. Read more at: https://www.bbc.co.uk/news/business-67484102?at_medium=RSS&at_campaign=KARANGA |

|

Bank of England governor says don’t underestimate inflationThe governor of the Bank of England says inflation might not fall as quickly as some are hoping. Read more at: https://www.bbc.co.uk/news/business-67474899?at_medium=RSS&at_campaign=KARANGA |

|

Deliveroo not forced by law to engage with unions, Supreme Court rulesThe ruling at the Supreme Court is the latest in a long-running legal dispute. Read more at: https://www.bbc.co.uk/news/business-67484101?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How to trade RattanIndia, KEI Industries and PCBL on WednesdaySectorally, buying was seen in consumer durables, realty, healthcare and auto stocks while energy, public sector and oil & gas stocks saw some selling pressure on Tuesday. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-to-trade-rattanindia-kei-industries-and-pcbl-on-wednesday/articleshow/105392356.cms |

|

Why MOSL’s Santosh Singh has higher cash holding in portfolioI am bullish on financials, but not lenders because the fund is quite underweight on lenders. I am bullish on all other parts of the financials. So we have a large exposure to insurance, we have large exposure to capital markets through Bombay Stock Exchange. IT is another sector where I am quite positive.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/contra-thinkers-not-market-we-are-bullish-on-a-number-of-stockssays-santosh-kumar-singh/articleshow/105373255.cms |

|

How shares of Gandhar Oil, Flair Writing and Fedbank Financial stacked up in the grey market?In the grey market, Flair Writing is fetching a premium of Rs 60 ahead of the issue opening. This compares with the upper price band of Rs 304. The IPO comprises fresh issue of Rs 292 crore and an OFS of Rs 301 crore. Under the OFS segment, Khubilal Jugraj Rathod will offload shares worth Rs 76 crore, Vimalchand Jugraj Rathod will sell up to Rs 57 crore. Other selling shareholders include Nirmala Khubilal Rathod, Manjula Vimalchand Rathod. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/how-shares-of-gandhar-oil-flair-writing-and-fedbank-financial-stacked-up-in-the-grey-market/articleshow/105391198.cms |

|

The Ratings Game: Nvidia’s stock falls ahead of earningsNvidia’s stock has been on a monster run this year. Can the rally keep going after Tuesday afternoon’s earnings report? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729D-77E23753D5F5%7D&siteid=rss&rss=1 |

|

Front Office Sports: ESPN Bet’s grand vision: A 20% market share of U.S. online sports bettingDespite the existing competition, ESPN Bet’s backers project they can attain 20% market share by 2027, but many think that goal will be difficult to reach. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729F-D28BEDEC50BD%7D&siteid=rss&rss=1 |

|

Nvidia stock options ready for some fireworks after earningsThe options market is ready for Nvidia ‘s stock to post a bigger-than-average move after the chip maker and AI play’s earnings report due after Tuesday’s close. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729F-6FA072BFDB0D%7D&siteid=rss&rss=1 |