Summary Of the Markets Today:

- The Dow closed up 490 points or 1.43%,

- Nasdaq closed up 2.37%,

- S&P 500 closed up 1.91%,

- Gold $1966 up $17,

- WTI crude oil settled at $78 down $0.01,

- 10-year U.S. Treasury 4.455% down 0.178 points,

- USD index $104.08 up $0.08,

- Bitcoin $31,177 down $1.55

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index for All Urban Consumers (CPI-U) declined from 3.7% year-over-year to 3.2% year-over-year. This decline was a surprise to me – and was driven by a significant decline in gasoline prices. The price of West Texas Intermediate crude oil is down 4.1% on 30 October 2023 year-over-year. I believed oil prices would rise for the rest of the year. The decline in inflation year-over-year is positive news for the markets as THEY believe it signals the Federal Reserve that inflation is coming under control – and no further federal funds rate increases are needed.

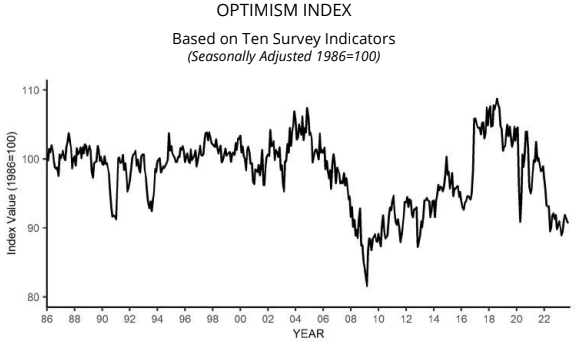

The NFIB Optimism Index decreased 0.1 points in October 2023 to 90.7, marking the 22nd month below the 50-year average. The last time the Optimism Index was at or above the average was December 2021. NFIB Chief Economist Bill Dunkelberg stated:

The October data shows that small businesses are still recovering, and owners are not optimistic about better business conditions. Small business owners are not growing their inventories as labor and energy costs are not falling, making it a gloomy outlook for the remainder of the year.

Here is a summary of headlines we are reading today:

- Israel’s Natural Gas Flow To Egypt To Return To Normal Next Week

- Aluminum Prices Struggle As Demand Dwindles

- Russia’s Oil Export Revenue Slips In October

- The U.S. Just Recorded Its Highest Oil Production Month In History

- Russia Claims It Will Continue To Adapt To Oil Sanctions

- S&P 500 notches best day since April, Dow leaps nearly 500 points on soft inflation report: Live updates

- Cooler monthly inflation report pushes mortgage rates even lower

- Stocks Soar, Yields And Dollar Crash As Fed’s Tightening Cycle Dies, Countdown To Cuts Begins

- Google sends a third of Safari ad revenue to Apple

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Turkmenistan’s Pipeline Plans Face Headwinds As Regional Tensions EscalateThe return of the Taliban in Kabul looked fatal for the fortunes of Turkmenistan’s dream to build a trans-Afghan natural gas pipeline. With an internationally proscribed militant group in charge of Afghanistan, the idea of raising credit from any major global financial institution to fund work on the TAPI pipeline became remote. But there are indications that Ashgabat is working behind the scenes to change that. Karachi-based news website Business Recorder reported on November 11 that the Turkmenistan-based head of the TAPI consortium, Muhammetmyrat… Read more at: https://oilprice.com/Geopolitics/International/Turkmenistans-Pipeline-Plans-Face-Headwinds-As-Regional-Tensions-Escalate.html |

|

Geothermal’s Growing Role In The Global Energy MixThe U.K. has long had big plans for geothermal energy, having assessed the potential of converting old coal plants into geothermal facilities in recent years. But now other parts of the world are catching up, including several European states and some countries across Africa. As governments seek to diversify their green energy portfolios, many are now looking to geothermal energy as a potential alternative energy source to fossil fuels and already well-established renewable options, such as wind and solar power. In Yorkshire, in the U.K.,… Read more at: https://oilprice.com/Energy/Energy-General/Geothermals-Growing-Role-In-The-Global-Energy-Mix.html |

|

Israel’s Natural Gas Flow To Egypt To Return To Normal Next WeekNatural gas supply from Israel to Egypt is expected to return early next week to normal levels after an Israeli gas field resumed production suspended in the wake of the Hamas attack in early October, Bloomberg reported on Tuesday, quoting a source with knowledge of Egypt’s gas import levels. Low Israeli gas supplies to Egypt also mean low or none Egyptian LNG exports to Europe, which rely on a growing number of cargoes to replace the pipeline gas supply from Russia, most of which was cut off last year after the Russian invasion of Ukraine.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Israels-Natural-Gas-Flow-To-Egypt-To-Return-To-Normal-Next-Week.html |

|

Aluminum Prices Struggle As Demand DwindlesVia Metal Miner Although they fell 4.29% throughout October, aluminum prices remain trapped within a sideways trend established back in July. Prices retraced from their late-September spike but failed to create a lower low. Therefore, they continue to move within a tight range. Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a modest 0.72% decline from October to November. Aluminum Prices: Global Aluminum Premiums Move Lower Amid Demand Challenges The aluminum market remains largely unchanged at the midway point of Q4.… Read more at: https://oilprice.com/Metals/Commodities/Aluminum-Prices-Struggle-As-Demand-Dwindles.html |

|

Russia’s Oil Export Revenue Slips In OctoberRussia’s oil export revenues declined by $25 million to $18.34 billion in October amid lower international oil prices, the International Energy Agency (IEA) said on Tuesday. The lower benchmark crude prices more than offset a shrinking discount for Russia’s crude grades versus North Sea Dated, the agency said in its latest Oil Market Report published today. In volumes, total Russian oil exports dropped by 70,000 barrels per day (bpd) in October compared to September, and averaged 7.5 million bpd last month, due to lower refined… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Export-Revenue-Slips-In-October.html |

|

Floating Cities And Climate Visas: Solutions To The Looming Climate Crisis?You’ll remember the image: Tovalu’s climate minister Simon Kofe rolling up his trousers to give up a recorded speech for the Glasgow Cop26 climate conference standing knee-deep in seawater symbolising his nation’s vulnerability to the climate crisis in an appeal for help. These nations are literally sinking into the sea – leaving their residents imperilled over the future of their homes. But it’s not just small island states – the climate crisis could force over 1bn people from their homes by 2050. Some 150m… Read more at: https://oilprice.com/The-Environment/Global-Warming/Floating-Cities-And-Climate-Visas-Solutions-To-The-Looming-Climate-Crisis.html |

|

Guyana Seeks To Stop Venezuelan Vote On Disputed Oil-Rich AreaGuyana asked on Tuesday the International Court of Justice to order Venezuela to stop a planned referendum on a potentially oil-rich territory which the two neighbors have disputed for over a century. The dispute between Venezuela and Guyana regarding the Essequibo region is a long-running one, stemming from an arbitration decision from 1899, which gave control over Essequibo to the then-British colony Guyana. Venezuela has not accepted the arbitration and recently moved to reinforce its claim over the territory with the referendum… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Guyana-Seeks-To-Stop-Venezuelan-Vote-On-Disputed-Oil-Rich-Area.html |

|

The U.S. Just Recorded Its Highest Oil Production Month In HistoryRecently a friend sent me a YouTube video from the Climate Town channel called Who Actually Controls Gas Prices? I must say that the guy in the video is accurate on most of the issues. He assigns cause and effect where it belongs. However, near the end of the video, he complained that after the Covid-19 pandemic and subsequent stay-at-home orders crashed oil prices, oil companies stopped drilling. He said that they would rather withhold production to make more money. Outside of the irony of a climate change activist complaining that not enough… Read more at: https://oilprice.com/Energy/Crude-Oil/The-US-Just-Recorded-Its-Highest-Oil-Production-Month-In-History.html |

|

Production Begins At ExxonMobil’s Latest Guyana ProjectExxonMobil began production today from its Payara project offshore Guyana, according to a company statement on its website. Payara is located in the coveted Stabroek Block and will increase Guyana’s crude oil production to 620,000 barrels of oil per day. Exxon’s third FPSO, Prosperity, has started up ahead of schedule and will add 220,000 bpd, Exxon said. The original deadline for the FPSO was the first half of next year as new wells came online. “Each new project supports economic development and access to resources that will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Production-Begins-At-ExxonMobils-Latest-Guyana-Project.html |

|

UAMPS Cancels Planned NuScale ReactorOn Wednesday November 8, NuScale and the Utah Associated Municipal Power Systems (UAMPS) announced their mutual decision to cancel the proposed 462 mw small modular reactor dubbed the Carbon Free Power Project. The obstacle cited was the co-op’s inability to sign up more customers for the already expensive power. The terms of their agreement specified that UAMPS would attempt to find subscribers for 80% of the power produced from the reactor. If they failed to do so by late January of next year, they retained the right to cancel the reactor and… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/UAMPS-Cancels-Planned-NuScale-Reactor.html |

|

Nigeria Looks To Attract Saudi Investment In Downstream SectorNigeria expects to see “significant investment flow immediately” from Saudi Arabia after the top crude producer in the Middle East and Africa’s largest oil producer signed investment and cooperation agreements in the energy sector at a summit in Riyadh last week. Nigeria has been looking to attract foreign investment in its upstream and downstream sectors, while Saudi Arabia has recently launched its “Empowering Africa” initiative to bring cleaner energy, connectivity, e-health, and e-education solutions to African countries. … Read more at: https://oilprice.com/Energy/Energy-General/Nigeria-Looks-To-Attract-Saudi-Investment-In-Downstream-Sector.html |

|

TotalEnergies CEO Says LNG Volatility Here To Stay Until New Supply Kicks InThe LNG market will continue to see volatility until there is new supply, TotalEnergies CEO Patrick Pouyanne said on Tuesday at a Wood MacKenzie Gas and LNG Future of Energy Conference. In the longer term, “from 2026, 2027 we will have more margin to read the price,” Pouyanne said. Some may look at the LNG market as in a state of status quo after Europe was able to secure enough gas in storage to fill its facilities to 99.49 percent. This does manage to insulate Europe from typical supply shocks seen in the winter months, and most view… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-CEO-Says-LNG-Volatility-Here-To-Stay-Until-New-Supply-Kicks-In.html |

|

Oil Prices Move Higher As OPEC And The IEA Forecast Demand GrowthOil prices moved higher on Tuesday as both OPEC and the IEA released reports pointing to strengthening global oil demand growth.Chart of the Week- Two weeks before the start of the COP28 summit in the United Arab Emirates, market watchers are bracing for tough talks as even the creation of a World Bank-led climate disaster fund turned out to be too difficult for participating states. – In the Middle East itself, the energy transition is a distant dream as a mere 1% of power generation in Saudi Arabia, Qatar, or Oman comes from renewable sources.… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Move-Higher-As-OPEC-And-The-IEA-Forecast-Demand-Growth.html |

|

Russia Claims It Will Continue To Adapt To Oil SanctionsRussia is adapting to the increasingly stricter U.S. sanctions on trade with Russian oil and is acting in accordance with its own interests, Kremlin spokesman Dmitry Peskov said on Tuesday, commenting on reports that the United States was looking into punishing more vessels breaching the G7 price cap on Russia’s crude. The price cap mechanism set by the G7 and the EU says that Russian crude shipments to third countries can use Western insurance and financing if cargoes are sold at or below the $60-a-barrel ceiling. The measure took effect… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Claims-It-Will-Continue-To-Adapt-To-Oil-Sanctions.html |

|

Chinese Giant CNOOC Starts Production At New Offshore Gas FieldChinese state-controlled oil and gas giant CNOOC has started production from the first development phase of its Bozhong 19-6 offshore condensate gas field, the company said on Tuesday. The field in the central Bohai Sea offshore eastern China has an average water depth of around 20 meters (66 ft). The main production facilities include one newly-built central processing platform, three unmanned wellhead platforms, and one gas process terminal, said the company, which plans a total of 65 development wells, including 42 production wells, 20… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Giant-CNOOC-Starts-Production-At-New-Offshore-Gas-Field.html |

|

S&P 500 notches best day since April, Dow leaps nearly 500 points on soft inflation report: Live updatesStocks surged Tuesday as investors cheered the latest U.S. consumer price index report. Read more at: https://www.cnbc.com/2023/11/13/stock-market-today-live-updates.html |

|

Here’s the inflation breakdown for October 2023 — in one chartThe consumer price index continued a steady decline in October on the back of lower gasoline prices. Read more at: https://www.cnbc.com/2023/11/14/heres-the-inflation-breakdown-for-october-2023-in-one-chart.html |

|

Alphabet pays Apple 36% of Safari search revenue, Sundar Pichai confirmsAlphabet CEO Sundar Pichai on Tuesday confirmed that Google pays Apple 36% of Safari search revenue, under the terms of a default search agreement. Read more at: https://www.cnbc.com/2023/11/14/google-pays-apple-36percent-of-safari-search-revenue-sundar-pichai.html |

|

Here’s why the UAW’s record deals with GM, Ford and Stellantis aren’t getting full supportThe deals, which were recommended for ratification by UAW leaders, are each currently on pace to pass. Yet they’ve received notable rejections at Ford and GM. Read more at: https://www.cnbc.com/2023/11/14/why-many-uaw-members-oppose-gm-ford-stellantis-deals.html |

|

CNBC Pro Talks: Bitcoin bull Cathie Wood breaks down outlook on digital currency amid new ETF hypeBitcoin and crypto equities have outperformed the major stock averages and commodities this year, but should it be part of your portfolio, and how? CNBC’s Tanaya Macheel speaks with Cathie Wood, CEO of ARK Invest, about different ways to get exposure to crypto and what’s driving the market now and what may be ahead in the coming months. Read more at: https://www.cnbc.com/video/2023/11/14/cnbc-pro-talks-cathie-woods-outlook-on-digital-currency-amid-etf-hype.html |

|

How Disney can save the Marvel Cinematic Universe“The Marvels” just posted the worst opening of a Marvel Cinematic Universe film in the 15-year history of the franchise. Read more at: https://www.cnbc.com/2023/11/14/how-disney-can-save-marvel-cinematic-universe.html |

|

ARK launches new crypto-focused ETFs in 21Shares partnership: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Spencer Dinwiddie, NBA athlete and co-founder of Calaxy, and Solo Ceesay, co-founder and CEO of Calaxy, discuss the latest for the web3-focused app. In the exclusive interview, Dinwiddie and Ceesay explain the new feature for sending crypto or NFTs on the app, discuss digital asset markets and provide their 2024 outlook for web3. Read more at: https://www.cnbc.com/video/2023/11/14/ark-launches-new-crypto-focused-etfs-in-21shares-partnership-cnbc-crypto-world.html |

|

Israel-Hamas war live updates: March for Israel draws thousands to D.C.; Speaker Johnson says cease-fire demands are ‘outrageous’The Israeli Defense Forces have denied that Al-Shifa is under siege and said it would help evacuate babies from the hospital. Read more at: https://www.cnbc.com/2023/11/14/israel-hamas-war-live-updates-latest-news-from-gaza.html |

|

Snap shares jump on deal with Amazon that lets users buy products without changing appsSnap shares rose on Tuesday, underscoring investor enthusiasm over a new online advertising deal with Amazon Read more at: https://www.cnbc.com/2023/11/14/snap-shares-jump-on-advertising-deal-with-amazon-.html |

|

Cooler monthly inflation report pushes mortgage rates even lowerMortgage rates have started to dip after climbing to their highest in more than two decades. Read more at: https://www.cnbc.com/2023/11/14/cooler-monthly-inflation-report-pushes-mortgage-rates-even-lower.html |

|

House Speaker Mike Johnson endorses Trump, defends ‘stolen election’ claimsTrump had not officially endorsed Johnson when he became the GOP’s fourth nominee for speaker during an effort to replace Speaker Kevin McCarthy, R-Calif. Read more at: https://www.cnbc.com/2023/11/14/speaker-mike-johnson-endorses-trump-defends-false-election-claims.html |

|

GOP Sen. Mullin challenges Teamsters boss to fight at Senate hearing: ‘Stand your butt up’Sanders, I-Vt., chairman of the Senate HELP Committee, broke up the fight between Sen. Markwayne Mullin, R-Okla., and Teamsters President Sean O’Brien. Read more at: https://www.cnbc.com/2023/11/14/stand-your-butt-up-gop-sen-mullin-challenges-teamsters-boss-to-fight-at-senate-hearing.html |

|

Michael Burry reveals new bet against chip stocks after closing out winning market shortThe hedge fund manager of “The Big Short” fame shook up his bets during the third quarter. Read more at: https://www.cnbc.com/2023/11/14/michael-burry-reveals-new-bet-against-chip-stocks-after-closing-out-winning-market-short.html |

|

Stocks Soar, Yields And Dollar Crash As Fed’s Tightening Cycle Dies, Countdown To Cuts BeginsStocks soared, and bond yields tumbled after the October CPI report showed an unexpected slowdown in inflation across the board, with core inflation dropping to its lowest level in two years. This led to Fed swaps pricing in 50 basis points in rate cuts for the July 2024 FOMC meeting, while the dollar was clubbed like a baby seal, down 1%, its most significant decline in a year. Shortly after the release of today’s CPI data, Nick Timiraos, often called “Nikileaks,” shared a post on social media platform X that confirms the Fed has concluded its hiking cycle.

US equity futures erupted after the CPI print – sending S&P500 and Nasdaq futures up as much as 2%. Dow Jones futures were up 1.5%. All three equity futures indexes have traded in a lateral range from 1000 ET (as noted in the graphic). Read more at: https://www.zerohedge.com/markets/stocks-soar-yields-and-dollar-crash-feds-tightening-cycle-dies-countdown-cuts-begins |

|

Manslaughter Arrest Made In Horrific On-Ice Death Of Professional Hockey PlayerOn Tuesday the South Yorkshire Police in England announced an arrest related to the death of Minnesota native Adam Johnson, the American professional ice hockey forward whose throat was slashed in a horrifying mid-game incident on Oct. 28, when his Nottingham Panthers played the Sheffield Steelers in a game which was part of the Elite Ice Hockey League. Sheffield hockey player Matt Petgrave had been filmed careening into Johnson at a high rate of speed with his leg lifted high in the air just at the moment of impact, delivering a sharp skate directly to the neck of Johnson. Johnson was soon pronounced dead after he held his hand to his neck, which was gushing blood onto the ice in a rare horrifying injury which shocked the hockey world and gained worldwide media attention. Some fans were left wondering why Petgrave wasn’t arrested on the spot given many speculated it was an intentional, heinous attack. Others have said it was a freak accident.

But now, 17 days af … Read more at: https://www.zerohedge.com/political/manslaughter-arrest-made-horrific-ice-death-professional-hockey-player |

|

Michael Burry Liquidates “Big Short” After Suffering Big Loss; Doubles Down With Bet Against SemiconductorsSix months ago, when looking at Michael Burry’s Q1 13F which in turn followed just a few months after the famous permabear admitted he had been wrong to urge his followed to sell…

… we found that the Big Short had continued the trend of rapidly rotating his entire portfolio and in the first quarter, Burry liquidated the rest of his legacy 2022 holdings, dumping his entire stake in companies like Black Knight, Wolverine World Wide, MGM Resorts and Qurate, and also trimmed his formerly largest holding, private prison operator GEO group, and had reallocated the proceeds in three ways:

|

|

The New Barbarians: Pundits Raise Alarm Over The Sacking Of The Beltway By Good IntentionsAuthored by Jonathan Turley via jonathanturley.org,

There is a palpable level of panic that seems to have taken hold of Washington this week. Establishment figures are raising the alarm over the rise of dangerous figures as if they are the barbarians at the gate before the sacking of Rome in 410. The threat is coming from both parties in the form of the new Speaker Mike Johnson and Democratic presidential candidate Robert Kennedy Jr. They may be the worst type of barbarians because they came to this city with the best of intentions. For some in Washington, there may be nothing more unnerving than the best of inten … Read more at: https://www.zerohedge.com/political/new-barbarians-pundits-raise-alarm-over-sacking-beltway-good-intentions |

|

McDonald’s faces up to two sex abuse claims a weekThe chain’s UK boss tells MPs more than 400 people have made complaints since a BBC investigation in July. Read more at: https://www.bbc.co.uk/news/business-67399801?at_medium=RSS&at_campaign=KARANGA |

|

The Body Shop changes hands again for £200mThe ethical soaps and scrubs brand is being sold after Brazilian owner Natura failed to turn around its fortunes. Read more at: https://www.bbc.co.uk/news/business-67417591?at_medium=RSS&at_campaign=KARANGA |

|

Google sends a third of Safari ad revenue to AppleNew detail on how much Google is willing to pay to be a go-to search engine has slipped out in court. Read more at: https://www.bbc.co.uk/news/business-67417987?at_medium=RSS&at_campaign=KARANGA |

|

Tata Technologies IPO: 10 things to know ahead of issue opening on November 22Tata Technologies has reserved a 10% quota for Tata Motors’ eligible shareholders. Under the OFS, parent Tata Motors will sell 4.62 crore shares, Alpha TC Holdings will offload 97.1 lakh shares and Tata Capital Growth Fund will give up 48 lakh shares. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/tata-technologies-ipo-10-things-to-know-ahead-of-issue-opening-on-november-22/articleshow/105206897.cms |

|

Govt of Singapore, GQG Partners among the 10 biggest FIIs on Dalal StreetFIIs are the largest non-promoter shareholders in the Indian market and their investment decisions have a huge bearing on the stock prices and overall direction of the market. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/govt-of-singapore-gqg-partners-among-the-10-biggest-fiis-on-dalal-street/slideshow/105205632.cms |

|

Samvat 2080: 5 market mavens share money-making mantra for the new yearThe Hindu accounting year began with an upgrade from global brokerage Goldman Sachs which said India is expected to see “the best structural growth prospects in the region” with mid-teens earnings growth over the next two years. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/samvat-2080-5-market-mavens-share-money-making-mantra-for-the-new-year/articleshow/105200947.cms |

|

Hedge-fund billionaire Leon Cooperman takes Manchester United stakeHedge-fund billionaire Leon Cooperman has taken a stake in iconic English soccer club Manchester United. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729A-02AD10CAD4C9%7D&siteid=rss&rss=1 |

|

Economic Report: Inflation flat in October thanks to cheaper gas, CPI shows. U.S. prices not rising as fast.The cost of living was unchanged in October as cheaper gas took the edge off inflation, pointing to incremental progress in the Federal Reserve’s effort to get prices under control. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7297-ABE742B29509%7D&siteid=rss&rss=1 |

|

Outside the Box: Nvidia is pushing to stay ahead of Intel, AMD in a high-stakes, high-performance computing raceAI and gaming giant is leaving no gap for competitors. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7299-0E70B3C5CACE%7D&siteid=rss&rss=1 |