Summary Of the Markets Today:

- The Dow closed up 57 points or 0.17%,

- Nasdaq closed up 0.09%,

- S&P 500 closed up 0.28%,

- Gold $1976 down $13.10,

- WTI crude oil settled at $77 down $3.35,

- 10-year U.S. Treasury 4.577% down 0.083 points,

- USD index $105.55 up $0.33,

- Bitcoin $35,658 up $598

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The goods and services deficit was $61.5 billion in September, up $2.9 billion from $58.7 billion in August, revised. September exports were up 4.6% year-over-year inflation-adjusted. September imports were down 0.9% year-over-year inflation-adjusted. The bottom line is that the deficit has been moderation for a year-and-a-half, imports have been declining, while exports have been growing. Economically, it appears the global economy appears to continue growing whilst declining imports generally signal a moderation of US economic growth.

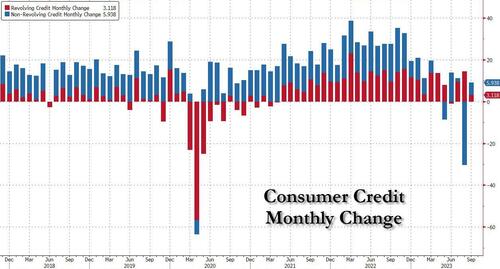

According to the Federal Reserve’s Consumer Credit G-19 release:

Consumer credit increased at a seasonally adjusted annual rate of 0.4 percent during the third quarter. Revolving credit increased at an annual rate of 8.6 percent, while nonrevolving credit decreased at an annual rate of 2.4 percent. In September, consumer credit increased at an annual rate of 2.2 percent.

I extremely dislike the way the Fed headlines consumer credit – as the month-over-month change is too volatile and is misleading. Using their own data, consumer credit expanded 3.5% year-over-year (1.6% year-over-year inflation-adjusted – red line on the graph below). Non-revolving credit expanded at 1.5% year-over-year and revolving credit (mostly credit cards) is up 10.3% year-over-year. No question consumer credit growth is slowing.

Here is a summary of headlines we are reading today:

- WTO Ruling Reignites U.S.-China Trade Spat

- Fed Raises Interest Rates By Half Percentage Point

- Fed interest rate hike sends business loans to steepest cost since 2007, breaking 10% sticker shock level

- Another Big Reversal FOMC Day: Markets Call Hawkish Fed’s Bluff

- Powell Opens The Door To Higher Inflation Target “As Part Of A Longer-Term Project”

- Deportations Plunge Under Biden In US Interior: Data

- Fed hikes rates again and warns of more rises

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

European Commission To Assess 10 Countries For EU MembershipThe European Commission’s long-awaited annual enlargement report is set to be released on November 8. The release has been constantly postponed, as the report was originally expected to come out in early October. The delay was due to a number of factors. Firstly, there was a wish from EU member states that the enlargement report wouldn’t be released ahead of the EU summit in Brussels on October 26-27, with fears that it could “hijack” discussions on other issues such as the bloc’s budget and migration. Secondly, the enlargement report is huge,… Read more at: https://oilprice.com/Geopolitics/International/European-Commission-To-Assess-10-Countries-For-EU-Membership.html |

|

Suriname’s Staatsolie Opens Bidding For 11 Offshore BlocksSuriname’s state-run energy company Staatsolie has opened up bidding for 11 offshore areas in the country, according to a statement made on the company’s website. Staatsolie Hydrocarbon Institute N.V. (SHI) announced on Tuesday a round of competitive bidding for 11 new offshore blocks known as SHO 2 Bid Round 2023-2024. The blocks are in nearshore to shallow areas, with water depths up to 150 meters. The area up for grabs lies south of the recent deepwater discoveries that were made in Block 58. After those discoveries were made, it… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Surinames-Staatsolie-Opens-Bidding-For-11-Offshore-Blocks.html |

|

LNG And Offshore Energy Projects Face Delays As Nickel Prices SoarA vigorous recovery from the global aerospace industry has increased demand for nickel, a key aircraft component prized for its corrosion resistance, high strength and exceptional mechanical properties. This could inadvertently complicate or delay new energy infrastructure developments by diverting metal supply from critical sectors such as upstream, offshore and liquefied natural gas (LNG) terminals, which use nickel for various equipment applications in extreme environments. Aerospace customers procuring high volumes at premium prices are… Read more at: https://oilprice.com/Energy/Energy-General/LNG-And-Offshore-Energy-Projects-Face-Delays-As-Nickel-Prices-Soar.html |

|

Solid-State Battery Breakthrough Promises Safer Energy StorageResearchers announced a major breakthrough in the field of next-generation solid-state chloride-based solid electrolyte batteries. It is believed that their new findings will enable the creation of batteries that exhibit exceptional ionic conductivity. The researchers led by Professor Kisuk Kang of the Center for Nanoparticle Research within the Institute for Basic Science (IBS), announced the major breakthrough with a research paper published in the journal Science. A pressing concern with current commercial batteries their reliance on liquid… Read more at: https://oilprice.com/Energy/Energy-General/Solid-State-Battery-Breakthrough-Promises-Safer-Energy-Storage.html |

|

OPEC Says Door Is Open for Brazil To Join Oil GroupOPEC’s door is open should Brazil wish the join the oil exporting group, OPEC’s Secretary General HE Haitham al-Ghais said at this week’s Argus European Crude Conference. “Today, Brazil has become one of the biggest exporters and they’ve stopped buying up crude. So the door is open,” al-Ghais said. For OPEC, it makes sense to bring Brazil into the fold, with its oil and gas production hitting record highs in July of 4.48 million boe/d. Oil output was up 18.6% year over year according to ANP data, reaching 3.51… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Says-Door-Is-Open-for-Brazil-To-Join-Oil-Group.html |

|

Azerbaijan Softens Stance On Zangezur Corridor As Peace Deal NearsOver the past week Prime Minister Nikol Pashinyan and other Armenian officials have been hinting that a peace deal with Azerbaijan could be imminent. They say the sides have reached agreement on three core principles of a deal while “details” remain to be settled. Pashinyan told parliament on October 30 that a peace deal is “realistic” if the sides remain faithful to the principles of mutual recognition of territorial integrity, delimitation/demarcation of the shared border based on the 1991 Almaty declaration and the opening of transport… Read more at: https://oilprice.com/Geopolitics/International/Azerbaijan-Softens-Stance-On-Zangezur-Corridor-As-Peace-Deal-Nears.html |

|

Switzerland To Keep Nuclear Plants Operating For Longer Than PlannedSwitzerland’s nuclear power plant operators plan to keep the facilities operational for longer than initially planned, spokespeople for the large Swiss utilities Axpo Holding and Alpiq Holding told Bloomberg on Tuesday. Switzerland has four nuclear reactors, which generate up to 40% of its electricity, according to the World Nuclear Association. The Swiss voted in a 2017 referendum to phase out nuclear power but Switzerland has not set a deadline for this and it’s up to operators to decide how long they… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Switzerland-To-Keep-Nuclear-Plants-Operating-For-Longer-Than-Planned.html |

|

Oil Falls Below $80 On Mixed Data From ChinaOil prices have nearly erased all year-to-date gains as shrinking refining margins signal weaker demand for oil.Chart of the Week- At least 48 VLCC tankers are sailing towards the United States to collect oil for exports, the highest in six years, as US exports are set to reach new all-time highs over the winter months. – According to Kpler data, US crude exports in November are expected to come in around 4.35 million b/d, only slightly below the all-time high of 4.45 million b/d reached in March 2023. – The weakening of US gasoline… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Falls-Below-80-On-Mixed-Data-From-China.html |

|

French Utility Giant: European Natural Gas Demand Is Unlikely To RecoverEurope’s natural gas demand continues to be weak after last year’s energy crisis and most of the demand destruction will likely be permanent, according to France’s utility giant Engie. European gas demand has slumped since the end of 2021 due to skyrocketing prices, the Russian invasion of Ukraine, and the cut-off of a large part of Russia’s pipeline gas supply to Europe. Governments have called for energy savings and industries have been using lower gas volumes due to the high prices and weakening activity. “Depending… Read more at: https://oilprice.com/Latest-Energy-News/World-News/French-Utility-Giant-European-Natural-Gas-Demand-Is-Unlikely-To-Recover.html |

|

France Races To Diversify Its Uranium Supply Away From RussiaFrench President Emmanuel Macron spent last week in Central Asia, courting trade relations with Kazakhstan and Uzbekistan in the interest of boosting France’s energy security. Both Kazakhstan and Uzbekistan are naturally rich in the uranium that France depends on to keep its nuclear-heavy energy industry running, and Macron is highly invested in diversifying the country’s uranium supply chains in order to ensure that turbulent global geopolitics don’t leave his country in the dark. As global support for nuclear power… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/France-Races-To-Diversify-Its-Uranium-Supply-Away-From-Russia.html |

|

OPEC Is Upbeat On Oil Demand Ahead Of Key Policy MeetingDespite the ongoing concerns about the state of the global economy, OPEC continues to hold an upbeat view on world oil demand, OPEC Secretary General Haitham Al Ghais said on Tuesday. “The economy, despite the challenges, is still doing quite well,” Al Ghais told the Argus European Crude Conference in London, as carried by Bloomberg. “We are positive on demand, we’re still quite robust on demand.” Al Ghais was the keynote speaker at the conference and expressed optimism about global oil demand less than three weeks… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Is-Upbeat-On-Oil-Demand-Ahead-Of-Key-Policy-Meeting.html |

|

Saudi Aramco Pledges Billions In Dividends Despite Profit DropAramco will pay out almost £30bn in dividends for the third quarter, boosting 90 percent owner Saudi Arabia’s coffers Saudi Aramco (Aramco) has sustained hefty payouts to its investors, including the country’s government which owns 90 percent of the oil giant, despite a sharp slide in profits. The world’s largest fossil fuel producer posted a 24 percent year-on-year dip in third quarter net profit, falling from $42.4bn (£34.4bn) to $32.6bn (£26.5bn).This follows lower oil production levels, with the country slashing… Read more at: https://oilprice.com/Energy/Crude-Oil/Saudi-Aramco-Pledges-Billions-In-Dividends-Despite-Profit-Drop.html |

|

China To Tighten Regulation Of Oil, Natural Gas, And Power MonopoliesChina plans to tighten regulation of monopolies in the oil and gas and power sectors, among other vital industries, a commission of the Communist party has decided. The meeting of the commission, which is focused on economic reforms, has decided that the oil and gas and power industries, as well as railways and other sectors, could be easily monopolized but are crucial to the Chinese economy led by state-controlled companies, Chinese state media reported on Tuesday. China has also recently signaled it would further tighten control… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-To-Tighten-Regulation-Of-Oil-Natural-Gas-And-Power-Monopolies.html |

|

Nigeria Launches New Crude Grade To Compete In EuropeNNPC Ltd, Nigeria’s state-controlled oil company, has launched a new low-sulfur crude grade, called Nembe, which it plans to sell primarily on the European market, an NNPC executive told Reuters on Tuesday. The Nembe crude grade is similar to other very popular blends of Africa’s largest oil producer, such as Forcados, Egina, and Bonga, the executive director of crude and condensate at NNPC Trading, Maryamu Idris, told the Argus European Crude Conference in London. Nembe could compete with crudes from Brazil and Azerbaijan on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Launches-New-Crude-Grade-To-Compete-In-Europe.html |

|

Saudi Aramco Q3 Profit Slips 23% As Oil Prices And Production FallSaudi Aramco reported on Tuesday a 23.2% annual decline in its third-quarter net income as lower oil prices and lower oil sales weighed on profits and cash flows. Aramco booked a net income of $32.6 billion for the third quarter of 2023, down from a net income of $42.4 billion for the same period of 2022, the world’s largest oil firm by market capitalization and production said today. “The decrease principally reflects the impact of lower crude oil prices and volumes sold,” Saudi Aramco said in a statement. The Saudi… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Q3-Profit-Slips-23-As-Oil-Prices-And-Production-Fall.html |

|

S&P 500, Nasdaq finish higher to clinch longest winning streaks since November 2021: Live updatesOn Tuesday, the tech-heavy Nasdaq notched its eighth-straight positive session. Read more at: https://www.cnbc.com/2023/11/06/stock-market-today-live-updates.html |

|

Microsoft closes at all-time high on fresh OpenAI-related optimismAnalysts see Microsoft benefiting from software developers taking advantage of tools from OpenAI, the Office software maker’s strategic partner. Read more at: https://www.cnbc.com/2023/11/07/microsoft-closes-at-all-time-high-on-fresh-openai-related-optimism.html |

|

Credit card balances spiked in the third quarter to a $1.08 trillion record. Here’s how we got hereStrong consumer spending boosted credit card balances to a new record high in the third quarter, according to the Federal Reserve Bank of New York. Read more at: https://www.cnbc.com/2023/11/07/credit-card-balances-jump-to-1point08-trillion-record-how-we-got-here.html |

|

U.S. crude oil prices fall below $78 a barrel to their lowest since JulyWTI fell $3.45, or 4.3%, settling at $77.37 a barrel, while Brent fell $3.57, or 4.2%, settling at $81.61, both their lowest prices since July. Read more at: https://www.cnbc.com/2023/11/07/us-crude-oil-prices-fall-below-78-a-barrel-to-their-lowest-since-july.html |

|

How the cost of homebuying and selling will change after landmark court loss over real estate commissions$100 billion in residential real estate commissions paid by American homebuyers and sellers every year is up for grabs as legal pressures mount. Read more at: https://www.cnbc.com/2023/11/07/homebuying-and-real-estate-commissions-are-about-to-change-in-big-way.html |

|

Goldman double upgrades this under-the-radar cloud stock with nearly 40% upsideShares of this cloud service provider are attractively priced, the firm said. Read more at: https://www.cnbc.com/2023/11/07/goldman-double-upgrades-this-under-the-radar-cloud-stock-with-nearly-40percent-upside.html |

|

Salesforce CEO says Dreamforce is staying in San Francisco after reaching deal with mayorMarc Benioff had threatened to take his major marketing event outside of San Francisco, but now it will stay around for at least one more year. Read more at: https://www.cnbc.com/2023/11/07/salesforce-will-keep-dreamforce-conference-in-san-francisco-next-year.html |

|

Israel-Hamas war live updates: Israeli military says it hit Hezbollah position in Lebanon; Gaza City residents flee following IDF evacuation orderIsraeli attacks on Gaza have killed more than 10,000 Palestinians since Oct. 7, according to the Hamas-run Palestinian Health Ministry. Read more at: https://www.cnbc.com/2023/11/07/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Yellen: Republicans’ IRS funding cut would hurt customer service goalsTreasury Secretary Janet Yellen on Tuesday announced IRS goals for the 2024 tax filing season. Here’s what taxpayers can expect. Read more at: https://www.cnbc.com/2023/11/07/yellen-gops-irs-funding-cut-would-hurt-customer-service-goals.html |

|

Meta failed to act to protect teens, second whistleblower testifiesArturo Bejar described his fruitless efforts to flag the extent of harmful effects its platforms could have on teens to top leadership at the company. Read more at: https://www.cnbc.com/2023/11/07/meta-failed-to-act-to-protect-teens-second-whistleblower-testifies.html |

|

Gen Z, millennials have a much harder time ‘adulting’ than their parents did, CNBC/Generation Lab survey findsWhile Gen Zers and millennials are perceived as having a hard time meeting financial milestones, “glimmers of optimism” stand out, according to a new report. Read more at: https://www.cnbc.com/2023/11/07/gen-z-millennials-have-a-harder-time-adulting-than-their-parents.html |

|

Stellantis’ new Ram pickup is an EV — with a gas-powered generator in case the battery runs outThe new Ram pickup can operate as an EV until the battery dies and an onboard generator — powered by a 3.6-liter V6 engine — kicks on to power the vehicle. Read more at: https://www.cnbc.com/2023/11/07/new-ram-pickup-ev-has-gas-powered-electric-generator.html |

|

Datadog stock surges 28% after cloud company beats estimates, revises guidance upDatadog stock surged nearly 30% after upping its guidance and beating estimates on the top and bottom lines. Read more at: https://www.cnbc.com/2023/11/07/datadog-stock-surges-after-earnings-strong-guidance.html |

|

“Earthquakes”, “Golden Paths”, & “Everything’s Booming”: FedSpeak Sparks Bond, Bitcoin, & Big-Tech GainsAnother quiet macro day was relatively catalyst-free – even with an armada of Fed Speakers – since all pretty much sang from the hymn-sheet – data-dependent, job not done, inflation still too high, rates high(er) for long(er), no cuts on the agenda:

|

|

Zelensky Nixes ‘Surprise’ Israel Visit After Plans LeakedUkraine’s President Volodymyr Zelensky had a planned trip to Israel in the works in order to express solidarity, and after he admitted that the Gaza war is taking away the “focus” from the Ukraine war. But he wanted it to be an unannounced “surprise” in anticipation of the media coverage. Now that trip is in doubt, after news of his arrival leaked over the weekend. The visit was expected this week, but reports began emerging Saturday which prematurely made it public.

The Times of Israel on Tuesday confirmed that—

|

|

Credit Card Debt Grinds To A Halt As Average APR Hits New Record HighAfter several months of wild swings in US household debt, moments ago the Federal Reserve published the latest data consumer credit data which showed that in September, total debt increased by just $9.1 billion, which while an improvement from last month’s -$15.8 billion, the result of last month’s revision to student loans, was not only a miss to consensus estimates of $9.5 billion, but also a clear slowdown from recent months when the monthly increase was in the $20/$30BN range.

Looking at the composition, both revolving and non-revolving credit were weak. Starting with the former, in September, credit card debt rose by just $3.1 billion, which with the exception of June’s freak negative revolving credit print, was the lowest monthly increase since the covid crisis. Read more at: https://www.zerohedge.com/markets/growth-credit-card-debt-grinds-halt-average-apr-hits-new-record-high |

|

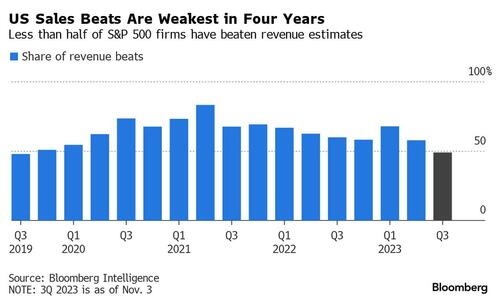

Worst Sales Beats Since 2019 Expose Weak US ConsumerBy Sagarika Jaisinghani and Farah Elbahrawy, Bloomberg Markets Live reporters and analysts Corporate America is delivering the bleakest sales reports in four years this earnings season, a sign that weakening consumer demand is limiting companies’ ability to raise prices further. With more than 80% of S&P 500 firms having reported, less than half have beaten revenue estimates for the third quarter — the lowest share since the same period in 2019, according to data compiled by Bloomberg Intelligence. The pace of sales growth globally has also moderated to “the lower end of their pre-pandemic ranges,” Deutsche Bank Group AG strategists said.

That’s overshadowed a surprise increase in quarterly earnings so far, with investors instead focusing on a long list of revenue warnings from the likes of Apple Inc. and Estée Lauder Cos. In Europe, too, the season has been characterized by high-profile cuts including from Remy Cointreau SA. … Read more at: https://www.zerohedge.com/markets/worst-sales-beats-2019-expose-weak-us-consumer |

|

‘I blew the whistle on Meta, now I won’t work again’Former senior staffer Arturo Béjar claims Instagram is not doing enough to protect teens from sexual harassment. Read more at: https://www.bbc.co.uk/news/technology-67343550?at_medium=RSS&at_campaign=KARANGA |

|

Coca-Cola and Nestle accused of misleading eco claimsConsumer bodies say firms make misleading claims about plastic water bottles being “100% recycled”. Read more at: https://www.bbc.co.uk/news/business-67343893?at_medium=RSS&at_campaign=KARANGA |

|

Delay to law on e-scooters criticisedNo mention of legislation on e-scooters in the King’s Speech but trials will be extended to 2026. Read more at: https://www.bbc.co.uk/news/technology-67335275?at_medium=RSS&at_campaign=KARANGA |

|

Eye On Earnings: What to expect from United Spirits, Lupin, BHELMore than 500 companies are scheduled to release the earnings for the quarter and half-year ended September on Wednesday. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/eye-on-earnings-what-to-expect-from-united-spirits-lupin-bhel/articleshow/105046677.cms |

|

Tech View: Nifty looks confused after 3-day rally. Here’s what traders should do on WednesdayAt the higher levels, the market could encounter strong resistance around 19500-19600 levels in the short term. Immediate support is placed at 19320 levels, said Nagaraj Shetti of HDFC Securities. On the derivative front, the strike of 19500 saw the highest call open interest (OI) while the strikes of 19450 saw the addition of the highest call OI indicating immediate resistance. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-looks-confused-after-3-day-rally-heres-what-traders-should-do-on-wednesday/articleshow/105042893.cms |

|

Shree Cement Q2 Results: Profit more than doubles to Rs 447 crore; revenue up 19% YoYRevenue from operations in the reporting second quarter jumped 19% year-on-year (YoY) to Rs 4,800 crore, compared with Rs 4,038 crore in the year-ago quarter. Operating profit or EBITDA for the quarter jumped 64% YoY to Rs 886 crore. The total sales volume increased 10% year-on-year to 8.2 million tonnes in the July-September period. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/shree-cement-q2-results-profit-more-than-doubles-to-rs-447-crore-revenue-up-19-yoy/articleshow/105039762.cms |

|

Economic Report: U.S. consumer credit rebounds in SeptemberTotal consumer credit rose $9.1 billion in September, up from a $15.8 billion drop in the prior month, the Federal Reserve said Tuesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7293-603498B08306%7D&siteid=rss&rss=1 |

|

Why Warren Buffett has done more to educate investors than any other corporate executiveAs Buffett lands on the MarketWatch 50 list of the most influential people in markets, his biggest legacy may be how he’s schooled others about investing. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727E-7881F55FAAC5%7D&siteid=rss&rss=1 |

|

The Margin: New York Mets owner Steve Cohen proposes $8 billion complex next to Citi FieldCohen, the founder of Point72 Asset Management, purchased the Mets for a record $2.4 billion in 2020 Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7293-DA9B0D2DAE2B%7D&siteid=rss&rss=1 |

Image via APThis then elicited comment from Israeli officials: “If President Zelensky comes, he will be welcomed with open arms,” an official said on Sunday.

Image via APThis then elicited comment from Israeli officials: “If President Zelensky comes, he will be welcomed with open arms,” an official said on Sunday.