Today ends a shorter week for Wall Street as it heads into the Easter weekend, ending the trading week at the closing bell. In addition, the U.S. stock markets will be closed tomorrow for Good Friday.

The equities open higher this morning only to slip downward with NASDAQ sharply off session highs. Bank earnings share Wall Street’s fall today, inflation fears, and the Ukraine war continues to shake investors. Now, investors are digesting a flurry of mixed quarterly reports from Wells Fargo (WFC), Goldman Sachs (G.S.), Morgan Stanley (M.S.), and Citigroup (C).

This morning’s financial report showed Initial Jobless Claims 09/APR rose to 185K from 167K. Moreover, the Michigan Consumer Sentiment Prel APR rose to 65.7 from 59.4. Adding to this are the super-high gas prices and the highest inflation in forty years that held back consumer spending as March retail sales slowed from their February levels.

A summary of headlines we are reading today:

- How Will Chinas New Lockdowns Impact Commodity Prices?

- Sustainable Recovery Spending Could Be Derailed By Commodity Price Spikes Following Ukraine War

- Retail Sales Rose 0.5% In March Amid Inflation Jump; Import Prices Hit 11-Year High

- Morgan Stanley Earnings Top Estimates Fueled By Trading Revenue Gains

The Fed Just Disengaged Its Volatility Suppression Machine - The Ratings Game: Elon Musk Says Twitter Shareholders Should ‘Love’ His Buyout Offer, But Wall Street Doesn’t Seem To Agree

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia Pulls The Nuclear Card, Warns Sweden And Finland Not To Join NATOAs expected in the wake of Finland’s announcement early this week that it could decide to apply for NATO membership “within weeks” – Russia has upped the ante by threatening nuclear escalation if that should happen. Sky News has cited the Thursday words of deputy chairman of Russia’s Security Council, Dmitry Medvedev, as follows: Russia has said there will be “no more talk of a nuclear-free Baltic” if Sweden and Finland join NATO. Such a development would more than double the length of the military alliance’s land borders with Russia, Moscow Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Pulls-The-Nuclear-Card-Warns-Sweden-And-Finland-Not-To-Join-NATO.html |

|

Emerging Oil Producers Could Get A Boost As The West Pivots Away From RussiaNew oil regions that have attracted the attention of oil majors looking for greater longevity in their operations and cheap, low-carbon oil prospects could receive an additional boost in response to the Russian invasion of Ukraine. As governments rush to source alternative oil and gas supplies, the rapid development of promising new oil regions could provide the long-term supply needed to reduce the global reliance on Russia. Sanctions on Russia are invigorating interest in new oil regions as energy firms look to develop alternative operations Read more at: https://oilprice.com/Energy/Energy-General/Emerging-Oil-Producers-Could-Get-A-Boost-As-The-West-Pivots-Away-From-Russia.html |

|

EU Set To Discuss Joint Gas Buying In Bid To Cut Russian RelianceThe leaders of the European Union member states are expected to discuss at their summit at the end of May the idea of jointly buying natural gas to avoid competing with each other for non-Russian supply as the EU seeks to cut its dependence on Moscow, Bloomberg reported on Thursday, citing sources with knowledge of the plans. Since the Russian invasion of Ukraine at the end of February, the EU has been seeking to lower its dependence on Russian natural gas, which met around 40 percent of the blocs demand before the war. The European Commission Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Set-To-Discuss-Joint-Gas-Buying-In-Bid-To-Cut-Russian-Reliance.html |

|

Yergin: Europe Gears Up To Sanction Russian Energy SuppliesEurope could start to sanction Russian energy supplies, energy historian Daniel Yergin has told Bloomberg Television on Thursday. “I think we’re going to start to see sanctions,” Yergin said. The EU has been seriously mulling sanctions on Russian energy supply since the EU condemned the killing of unarmed civilians in Bucha by Russian forces while retreating from Ukrainian towns. While the EU has managed to sanction coal and has committed to weaning itself off Russian oil by the end of the year, the EU cannot so easily disentangle itself from Russian Read more at: https://oilprice.com/Energy/Energy-General/Yergin-Europe-Gears-Up-To-Sanctions-Russian-Energy-Supplies.html |

|

Russias Invasion Of Ukraine Has Left Kazakhstan On EdgeIn the space of only a few months, Kazakhstan has seen a major outburst of violent civil unrest within its own borders and then an invasion of Ukraine launched by its neighbor to the north, Russia. It is against this backdrop that the government has, despite a sharp projected drop in the rate of economic growth, decided to substantially increase its defense outlays. On April 7, Deputy Finance Minister Tatyana Savelyeva presented a three-year budget to the parliament that envisioned an additional 441 billion tenge (around $1 billion) in spending Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Invasion-Of-Ukraine-Has-Left-Kazakhstan-On-Edge.html |

|

How Will Chinas New Lockdowns Impact Commodity Prices?Russias invasion of Ukraine has sent shock waves throughout global metals markets. However, its important to remember that the most consistent longer-term driver of metal prices is Chinese demand. Thats why its surprising to see how little attention has been paid to the worlds largest consumer and producer of metals in recent months. Its understandable for global news networks to focus on the atrocities uncovered in Ukrainian cities. It also makes sense to counter such reports with more encouraging news, Read more at: https://oilprice.com/Energy/Energy-General/How-Will-Chinas-New-Lockdowns-Impact-Commodity-Prices.html |

|

American Airlines pilots’ union sues carrier over request to help with training on days offAirlines are racing to hire and train pilots as travel demand surges. Read more at: https://www.cnbc.com/2022/04/14/american-airlines-pilots-union-sues-carrier-over-requests-to-help-with-training-on-days-off.html |

|

Worried about rising inflation? With nearly risk free I bonds soon to pay 9.62%, here’s what you need to knowI bonds, an inflation-protected and nearly risk-free investment, may soon pay an estimated 9.62% return. Here’s what to know before purchasing. Read more at: https://www.cnbc.com/2022/04/14/fretting-about-rising-inflation-i-bonds-may-soon-pay-9point62percent.html |

|

Here’s why health savings accounts may contribute to inequalityCertain demographic groups are using health savings accounts in a way that may reinforce and exacerbate existing health inequities, according to a new report. Read more at: https://www.cnbc.com/2022/04/14/heres-why-health-savings-accounts-may-contribute-to-inequality.html |

|

Stocks making the biggest moves midday: Twitter, Tesla, Goldman Sachs, IBM and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/04/14/stocks-making-the-biggest-moves-midday-twitter-tesla-and-more.html |

|

Sustainable recovery spending could be derailed by commodity price spikes following Ukraine warConcerns related to both the energy transition and energy security have been heightened by Russia’s invasion of Ukraine. Read more at: https://www.cnbc.com/2022/04/14/ukraine-war-sees-some-countries-focus-on-food-fuel-not-clean-energy.html |

|

Peloton is raising subscription fees while cutting prices for its Bikes and other equipmentEffective June 1, the price of Peloton’s all-access subscription plan in the United States will go up to $44 per month, from $39. Read more at: https://www.cnbc.com/2022/04/14/peloton-raises-subscription-fees-cuts-prices-for-bikes-treads.html |

|

Retail sales rose 0.5% in March amid inflation jump; import prices hit 11-year highRetail sales were expected to increase 0.6% in March, according to Dow Jones estimates. Read more at: https://www.cnbc.com/2022/04/14/retail-sales-rose-0point5percent-in-march-amid-inflation-jump-import-prices-hit-11-year-high.html |

|

How companies like Amazon, Nike and FedEx avoid paying federal taxesThe U.S. tax code allows some of the biggest company names in the country to not pay any federal corporate income taxes, costing the government billions. Read more at: https://www.cnbc.com/2022/04/14/how-companies-like-amazon-nike-and-fedex-avoid-paying-federal-taxes-.html |

|

Baby strollers, Ferris wheels and BTS: More tourists are bringing their kids to Las VegasLas Vegas has experienced a dramatic rise in the number of people bringing children with them to their Sin City vacations. Read more at: https://www.cnbc.com/2022/04/14/bts-and-babies-in-las-vegas-more-parents-bringing-kids-to-sin-city.html |

|

Chinese EV maker Nio says it’s gradually resuming production after Covid haltNio said it is gradually resuming production several hours’ drive west of Shanghai, after halting production Saturday due to Covid. Read more at: https://www.cnbc.com/2022/04/14/chinese-ev-maker-nio-says-its-gradually-resuming-production-after-covid-halt.html |

|

Lamborghini customers are now waiting more than 12 months for a car, CEO saysThe wait time for a new Lamborghini SUV or super-car is now over 12 months, the automaker’s CEO told CNBC. Read more at: https://www.cnbc.com/2022/04/14/lamborghini-customers-waiting-more-than-12-months-for-a-car-ceo-says.html |

|

“F**k You” Money“F**k You” MoneyAuthored by Jack Raines via Young Money, In a 2018 Esquire interview, essayist and statistician Nassim Taleb gave the following description for the optimal amount of wealth:

This runs counter to the generally accepted idea of “f*ck you” money. Read more at: https://www.zerohedge.com/personal-finance/fk-you-money |

|

Russia Confirms Sinking Of Its Black Sea Flagship MoskvaRussia Confirms Sinking Of Its Black Sea Flagship MoskvaUpdate(1607ET): In an afternoon briefing the Pentagon had said Russia’s Moskva warship was still battling a fire, and likely being towed to port after an emergency evacuation of the over 500 crewmembers. Now the Russian Defense Ministry is for the first time confirming that its Moskva missile cruise ship has sunk, according to RIA. Crucially, the Russians are still denying that Ukraine struck the ship with one more more Neptune anti-ship missiles, as Ukraine’s southern military command is saying. Here’s the statement from RIA:

Strangely, given that this has been among the most closely filmed wars of modern times, there’s so far been nothing in the way of verified footage of either the alleged missile strike, explosions and fire on board, or even the ship’s evacuation and it being towed toward Sevastopol.

|

|

“It’s A Shitshow Of Illiquidity Everywhere” – Market Mayhem Strikes Ahead Of Long Weekend“It’s A Shitshow Of Illiquidity Everywhere” – Market Mayhem Strikes Ahead Of Long WeekendOne quick glance across your screens today and you would think WW3 actually started or Biden died or some such epochal event… but no. Instead, amid some modest softness in retail sales and surging sentiment, the magnitude of movements in bond yields, bitcoin, big-tech & bank stocks, and the dollar appears to have been driven more by positioning and panic than any fundamentals. As one trader – who has traded for more than one business cycle – put it so eloquently to us on MSG:

Even the much more ‘well spoken’ Mohamed El-Erian doesn’t know what to make of the vol…

|

|

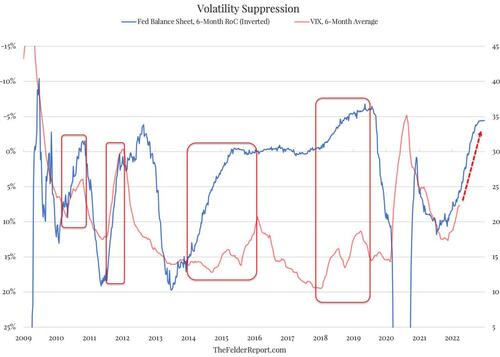

The Fed Just Disengaged Its Volatility Suppression MachineThe Fed Just Disengaged Its Volatility Suppression MachineAuthored by Jesse Felder via TheFelderReport.com, The Fed minutes released last week revealed the central bank intends to start reducing its balance sheet by as much as $95 billion per month beginning in May. Investors ought to pay very close attention to this development because, for a very long time now, the Fed has effectively used its asset purchase program to suppress volatility across a variety of markets including the equity market. When the Fed has removed this volatility dampening system in the past, it has regularly led to a series of rolling ructions in the broad stock market. The most recent of these was the 2018-2020 period which began with the Volmageddon episode and ended with the Covid crash upon which the Fed reengaged its volatility suppression program in a massive way.

Considering the fact that the magnitude of these ructions has grown with … Read more at: https://www.zerohedge.com/markets/fed-just-disengaged-its-volatility-suppression-machine |

|

Elon Musk makes offer to buy TwitterThe boss of Tesla claims he wants to unlock the social media platform’s “extraordinary potential”. Read more at: https://www.bbc.co.uk/news/business-61104231?at_medium=RSS&at_campaign=KARANGA |

|

Operation Brock: M20 traffic controls scaled back ahead of EasterTwo junctions are reopening on Friday with more due to reopen overnight, National Highways says. Read more at: https://www.bbc.co.uk/news/uk-england-kent-61113985?at_medium=RSS&at_campaign=KARANGA |

|

Beauty firm L’Occitane keeps Russian stores openThe French cosmetics firm will keep its shops in Russia open but says it is “firmly committed” to Ukraine. Read more at: https://www.bbc.co.uk/news/business-61096823?at_medium=RSS&at_campaign=KARANGA |

|

Reduce weightage in IT stocks, says HSBC Global; cuts price targets for TCS, InfosysAfter providing investors with a massive 40 per cent return in 2021-22, the Nifty IT index is down 5.4 per cent so far this year, and earnings of the two largest companies, TCS and Infosys, have done little to stem the slide. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/reduce-weightage-in-it-stocks-says-hsbc-global-cuts-price-targets-for-tcs-infosys/articleshow/90847968.cms |

|

ETMarkets Smart Take: Impact of commodity prices may not fully reflect in Q4FY22, says Parag Thakkar of ICICI Pru AMC“Given that the market valuation is no longer cheap, I would say that the number of bargains available in the market is less.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-smart-take-impact-of-commodity-prices-may-not-fully-reflect-in-q4fy22-but-in-q1fy23-parag-thakkar-of-icici-prudential-amc/articleshow/90845193.cms |

|

Global risks, weak IT a drag on stocks, but take heart from Bank Nifty, says this analystFor the week ahead, stock markets could see fresh declines as investors react to disappointing fourth-quarter results by IT heavyweight Infosys, Bhamre said. Index heavyweight HDFC Bank is also set to declare earnings on Saturday, which would drive stock prices. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/global-risks-weak-it-a-drag-on-stocks-but-take-heart-from-bank-nifty-says-this-analyst/articleshow/90838050.cms |

|

The Ratings Game: Elon Musk says Twitter shareholders should ‘love’ his buyout offer, but Wall Street doesn’t seem to agreeWall Street analysts and investors don’t seem to “love” Elon Musk’s buyout offer for Twitter Inc. as much as Musk believes they should. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7BFC-97A64DE3F338%7D&siteid=rss&rss=1 |

|

: Here’s how Elon Musk’s buyout offer for Twitter stacks up to what he paid for his stakeElon Musk’s buyout bid for Twitter Inc. represents a nice premium over the price he paid for the large block of shares he already owns, but it might come as a disappointment to those who invested in the social media company just five months ago. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7BF9-821D8EEC890B%7D&siteid=rss&rss=1 |

|

Washington Watch: Biden talks up domestic manufacturing’s role in fighting inflation, but some economists aren’t buying itPresident Joe Biden speaks at North Carolina A&T on making more in America and bringing down prices, while some economists express doubts about his plan. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7BED-24E1C3CD8777%7D&siteid=rss&rss=1 |