Summary Of the Markets Today:

- The Dow closed up 222 points or 0.66%,

- Nasdaq closed up 1.38%,

- S&P 500 closed up 0.94%,

- Gold $1,999 up $5.40,

- WTI crude oil settled at $81 down $1.49,

- 10-year U.S. Treasury 4.570% down 0.099 points,

- USD Index $105.11 down $1.020,

- Bitcoin $34,492 down 1.20%,

- Baker Hughes Rig Count: U.S. -7 to 618 Canada unchanged at 196

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

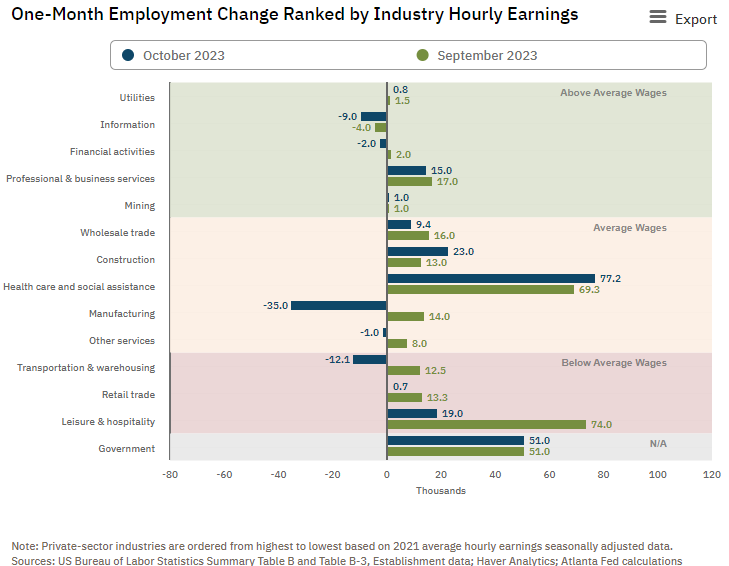

Total nonfarm payroll employment in the establishment survey increased by 150,000 in October 2023, and the unemployment rate (determined by the household survey) changed little to 3.9%. An employment gain of 150,000 is generally considered the minimum employment growth needed to support population growth. Job gains occurred in health care, government, and social assistance. Employment declined by 33,200 in manufacturing due to strike activity which is over now – so the real employment growth of the establishment survey should be +183,200. BUT the household survey says employment declined by 348,000 in October. This is a significant disconnect between the household and establishment surveys – and quite honestly, both numbers should be considered suspect. As far as the unemployment rate is concerned – the household survey says an additional 146,000 people were considered unemployed – and this is completely disconnected from the weekly BLS initial unemployment report which shows only 100,000 unemployment growth in October. Stepping back by analyzing year-over-year changes, regardless of data-gathering issues this month, employment growth continues to trend lower. The bigger surprise is that employment growth was 1.9% year-over-year (red line on the graph below) whilst weekly hours worked only gained 0.9% year-over-year (blue line on the graph below). The weak growth of hours worked suggests a very soft labor market.

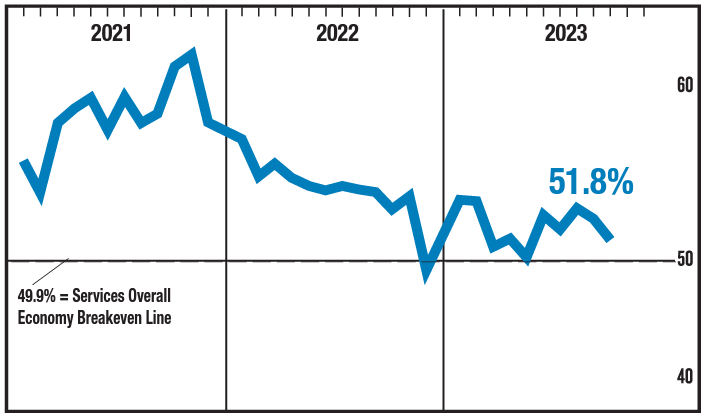

In October 2023, the ISM Services PMI registered 51.8%, 1.8 percentage points lower than the September reading of 53.6 percent. The Business Activity Index registered 54.1%, a 4.7-percentage point decrease compared to the reading of 58.8% in September. The bottom line here is that any number under 55% COULD be indicative of an impending recession.

Here is a summary of headlines we are reading today:

- Canada’s Trans Mountain Pipeline Faces New Delays

- U.S. Rig Count Takes A Dive

- Copper’s Shifting Significance: From Economic Health To Green Energy

- Solar Stocks Shaken By High Interest Rates And Supply Chain Issues

- Dow pops more than 200 points on Friday to cap the best week for stocks so far this year: Live updates

- UAW has Tesla, Toyota in its sights after contract wins at Detroit automakers

- Wall Street will try to maintain momentum next week after a strong start to November

- The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%

- Maersk cuts 10,000 jobs as shipping demand falls

- Earnings Results: DoorDash shares rally after earnings beat, helped by expansion beyond restaurants

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

What The U.S. Could Learn From European Power InfrastructureA great deal of energy infrastructure has failed worldwide when confronted with extreme weather events due to the unpreparedness of many countries for the effects of storms, wildfires, flooding and other severe weather. With these types of disasters expected to happen more often, energy companies are exploring potential ways to weatherproof their infrastructure to protect it and keep people with power in critical moments. For several years, people have criticised the poor state of U.S. energy infrastructure. A lack of funding and cohesion… Read more at: https://oilprice.com/Energy/Energy-General/What-The-US-Could-Learn-From-European-Power-Infrastructure.html |

|

Canada’s Trans Mountain Pipeline Faces New DelaysCanada’s energy regulator ordered Trans Mountain Corp to stop work on the Trans Mountain pipeline in a wetland area in British Columbia, according to a notice on Canada Energy Regulator’s website that cited non-compliance with environmental and safety regulations, adding to years of delays and piling on top of an already wealth of environmental opposition. CER ordered the work stoppage, citing “damaged and down amphibian exclusion fencing….including dewatering hoses strung overtop and pulling fence into wetland,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadas-Trans-Mountain-Pipeline-Faces-New-Delays.html |

|

Argentina’s Energy Crisis Escalates As Fuel Prices SkyrocketIn a world where some commentators speculate that there is a glut of energy and distillate products as a result of high oil prices, sliding China demand and a looming global recession, Argentina will take the under: as La Nacion reports, on Wednesday refiners and retailers hiked prices between 7.6% and 9.6%, amid what is shaping up as a historic energy crisis. In recent days Argentina has been rocked by an unprecedented shortage of gasoline, with drivers running the gauntlet to find scarce supplies of gas to fill their tanks amid what Reuters… Read more at: https://oilprice.com/Energy/Gas-Prices/Argentinas-Energy-Crisis-Escalates-As-Fuel-Prices-Skyrocket.html |

|

Economy Minister Confident Germany Could Phase Out Coal By 2030Germany continues to target phasing out coal by 2030, German Economy Minister Robert Habeck of the Green party told Bloomberg TV in an interview on Friday. Germany has decided to accelerate the coal phase-out to 2030, from an earlier planned date of 2038, but Europe’s largest economy has reactivated some mothballed coal-fired power plants since last year when Russian natural gas supply ceased. Earlier this week, Habeck’s coalition partner and finance minister, Christian Lindner, questioned the 2030 coal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Economy-Minister-Confident-Germany-Could-Phase-Out-Coal-By-2030.html |

|

U.S. Rig Count Takes A DiveThe total number of active drilling rigs in the United States fell by 7 this week after climbing by 1 last week, according to new data that Baker Hughes published Friday, with the number of active oil rigs plunging to their lowest level since January 28 of last year. The total rig count fell to 618 this week. So far this year, Baker Hughes has estimated a loss of 161 active drilling rigs. This week’s count is 457 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs fell by 8 to 496, down by… Read more at: https://oilprice.com/Energy/Energy-General/US-Rig-Count-Takes-A-Dive.html |

|

Higher Profit-Based Tax Doubles Russia’s Oil And Gas RevenuesRussia’s oil and gas revenues jumped in October, due to a cyclical surge in the profit-based tax, and more than doubled from September to $17.6 billion (1.635 trillion Russian rubles), data from the Russian finance ministry showed on Friday. For September, the total Russian revenues from oil and gas stood at $8 billion (739 billion rubles). The profit-based tax jumped in September and October, boosting revenues. The budget proceeds for Russia last month were also lifted by 27.5% compared to October 2022 as the government did not… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Higher-Profit-Based-Tax-Doubles-Russias-Oil-And-Gas-Revenues.html |

|

Copper’s Shifting Significance: From Economic Health To Green EnergyIn a recent Buttonwood column for the Economist, John O’Sullivan laid out a case for retiring the nickname “Dr. Copper” for the ubiquitous red metal. The piece articulates a convincing argument that the relationship between copper and the wider economy, which has traditionally meant the metal’s price serves as a global industrial bellwether, is becoming outdated as the electric transition gathers pace. As we enter the final months of a year which has, thus far, failed to deliver the copper price increases that many were… Read more at: https://oilprice.com/Metals/Commodities/Coppers-Shifting-Significance-From-Economic-Health-To-Green-Energy.html |

|

India’s October Coal Production Jumps 19%India’s coal production jumped by 18.59% to 78.65 million tons in October compared to the same month last year, data from the Indian Ministry of Coal showed on Friday. Between April and October, the first seven months of the Indian fiscal year 2023/2024, Indian coal production also rose, by 13.05% year-on-year to 507 million tons, according to the data. Coal India, the giant producer accounting for 80% of the country’s coal output, saw its production rise by 15.36% year-over-year in October, and by 11.95% between April and October.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-October-Coal-Production-Jumps-19.html |

|

U.S. Forges First Link Of Lithium Supply Chain In West AfricaLast year, the U.S. federal government began talking about building supply chains for the energy transition. Many saw this as a better-late-than-never moment after China had essentially cornered every transition-related market. Others saw it as an opportunity. The Ewoyaa lithium project in Ghana is one example of how a company grabbed that opportunity. The first lithium mine in the Western African country is expected to become one of the first links in the nascent U.S. transition supply chain when it starts producing. “Our investment in Ewoyaa… Read more at: https://oilprice.com/Energy/Energy-General/US-Forges-First-Link-Of-Lithium-Supply-Chain-In-West-Africa.html |

|

Russian Diesel Shipments Drop 11% In October Due To The Export BanThe temporary ban on exports of Russian diesel and heavy refinery maintenance reduced Russia’s diesel exports by sea by 11% in October compared to September, according to data from LSEG and trade sources cited by Reuters. On September 21, Russia surprised the markets by announcing a temporary ban on exports of gasoline and diesel to stabilize domestic fuel prices amid soaring crude prices and a weak Russian ruble. Diesel and gasoline exports were temporarily banned to all countries except for four former Soviet states—Belarus,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Diesel-Shipments-Drop-11-In-October-Due-To-The-Export-Ban.html |

|

Solar Stocks Shaken By High-Interest Rates And Supply Chain IssuesThe renewable energy industry is in full collapse mode this week. First, Orsted A/S, the world’s largest offshore wind farm developer, abandoned two major US projects due to supply chain and interest rate impacts, and now solar stocks are being clubbed like a baby seal in US premarket trading on Thursday after solar equipment-makers SolarEdge and Sunrun reported dismal guidance amid waning demand. Let’s start with solar equipment maker SolarEdge Technologies. The company said current quarter revenues are expected between $300 million to $350… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Solar-Stocks-Shaken-By-High-Interest-Rates-And-Supply-Chain-Issues.html |

|

Oil Prices Climb As Interest Rates Remain UnchangedAfter falling for the first three days of the week, oil prices have started to recover after both the Federal Reserve and Bank of England decided not to hike interest rates.Friday, November 3rd, 2023Sometimes no action is the best action. That was certainly the case for oil markets this week when it came to interest rate hikes. After falling for three straight days, oil prices received some much-needed support from federal banks. With neither the Federal Reserve nor the Bank of England hiking interest rates this week, Brent jumped back to… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-As-Interest-Rates-Remain-Unchanged.html |

|

China Reluctant To Sign Long-Term U.S. LNG Supply Deals Amid Trade SpatChina doesn’t welcome the signing of more long-term LNG supply deals between Chinese state-owned natural gas giants and U.S. exporters as the tensions between the world’s top two economies and energy consumers escalate, Energy Intelligence reports, citing industry sources in China. The Chinese authorities have sent the state-held gas majors the recommendation discouraging them from signing up for more long-term LNG supply from the United States. The recommendation does not include purchases of LNG from the U.S. on the spot market, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Reluctant-To-Sign-Long-Term-US-LNG-Supply-Deals-Amid-Trade-Spat.html |

|

The Houthi Missile Threat To IsraelIsrael shot down a Houthi missile over the Red Sea on Monday, employing its Arrow aerial defense system. This follows the US Navy’s shooting down of Houthi missiles fired toward Israel on October 18. The question now is whether the Houthis are ready to jump into the fray as Hamas allies and risk a full-on return to the Yemen battlefield of the Saudis. Such a move would threaten the Saudi-Iran rapprochement. There has been some escalation of Houthi activity in Yemen since the Hamas attack on Israel on October 7, particularly with the… Read more at: https://oilprice.com/Energy/Energy-General/The-Houthi-Missile-Threat-To-Israel.html |

|

Why Oil Prices Are Likely To Climb From HereOne of the things that has always appealed to me about the energy sector from a trading and investing perspective is that it usually isn’t correlated with the US stock market. I have natural exposure there with my retirement and other investments, as I’m sure most of you do too, and having an interest in something that moves independent of equities not only smooths out the bumps along the way but also reduces the temptation to make bad mistakes, like selling at or near the bottom of a drop when the pressure mounts. If I am making money… Read more at: https://oilprice.com/Energy/Energy-General/Why-Oil-Prices-Are-Likely-To-Climb-From-Here.html |

|

Dow pops more than 200 points on Friday to cap the best week for stocks so far this year: Live updatesStocks ended the week with sizable gains. Read more at: https://www.cnbc.com/2023/11/02/stock-market-today-live-updates.html |

|

Here’s where the jobs are for October 2023 — in one chartHiring in health care and government were two bright spots in a relatively weak October jobs report. Read more at: https://www.cnbc.com/2023/11/03/heres-where-the-jobs-are-for-october-2023-in-one-chart.html |

|

Bad news for the economy is good news for the stock market … as long as it doesn’t get too badBad news is good news, as long as it isn’t too bad. Read more at: https://www.cnbc.com/2023/11/03/bad-news-for-the-economy-is-good-news-for-the-stock-market-as-long-as-it-doesnt-get-too-bad.html |

|

UAW has Tesla, Toyota in its sights after contract wins at Detroit automakersFain plans to use record contracts recently won with GM, Ford and Stellantis to assist in the union’s embattled organizing efforts elsewhere. Read more at: https://www.cnbc.com/2023/11/03/tesla-toyota-in-uaws-sights-for-organizing-after-big-3-wins.html |

|

Wall Street will try to maintain momentum next week after a strong start to NovemberInvestors can take a breath next week after kicking off the month with strong gains, as Treasury yields tumbled from their highs. Read more at: https://www.cnbc.com/2023/11/03/wall-street-tries-to-push-rally-next-week-after-strong-november-start.html |

|

Amazon founder Jeff Bezos is leaving Seattle for MiamiAmazon founder Jeff Bezos announced late Thursday that he plans to leave Seattle and move to Miami. Read more at: https://www.cnbc.com/2023/11/03/amazon-founder-jeff-bezos-is-leaving-seattle-for-miami.html |

|

Customers grapple with deposit delays at big banks. What it means for youCustomers at several big banks on Friday wrestled with direct deposit delays, stemming from an industry-wide processing issue. Read more at: https://www.cnbc.com/2023/11/03/customers-grapple-with-deposit-delays-at-big-banks.html |

|

Judge in Trump NY fraud trial extends gag order to lawyers, says office has received ‘hundreds’ of threats since trial startedJudge Arthur Engoron had previously imposed a similar gag order on Trump, after the former president sent a social media post attacking the judge’s clerk. Read more at: https://www.cnbc.com/2023/11/03/judge-in-trump-ny-fraud-trial-extends-gag-order-to-lawyers-says-office-has-received-hundreds-of-threats-since-trial-started.html |

|

Israel-Hamas war live updates: Hezbollah refrains from call for regional war; Netanyahu rejects cease-fire before hostage releaseU.S. Secretary of State Antony Blinken’s visit to Israel comes as clashes between the Israeli Defense Forces and Hamas continue in Gaza. Read more at: https://www.cnbc.com/2023/11/03/israel-hamas-war-live-updates-.html |

|

Paramount Global stock up double digits for second straight dayParamount Global posted higher revenue and profit, as well as improving results for its streaming business. Read more at: https://www.cnbc.com/2023/11/03/paramount-global-para-stock-jumps-second-straight-day.html |

|

Canned tuna is a $40 billion industry. But it’s facing some existential threatsShifting consumer preferences, market consolidation, sustainability and a nearly decade-long price-fixing scandal all dinged tuna’s popularity among Americans. Read more at: https://www.cnbc.com/2023/11/03/canned-tuna-industry-faces-existential-threats.html |

|

Panama Canal drought hits new crisis level with nearly half of vessel traffic targeted for cutsAs the Panama Canal deals with an ongoing drought and the worst El Nino in recent history, more than 40% of vessel traffic will be cut by February. Read more at: https://www.cnbc.com/2023/11/03/panama-canal-drought-hits-new-crisis-level-amid-severe-el-nino.html |

|

What’s next after Sam Bankman-Fried’s conviction in fraud trial: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Paul Tuchmann of Wiggin and Dana provides legal insight into the swift verdict in the trial of Sam Bankman-Fried. Crypto World also spoke with trial attorney and crypto trader James Koutoulas about the implications of the guilty verdict on the digital asset industry. Read more at: https://www.cnbc.com/video/2023/11/03/whats-next-after-sam-bankman-frieds-conviction-in-fraud-trial-cnbc-crypto-world.html |

|

Why Target Date Funds Fail Investors: A $3 Trillion DelusionAuthored by Michael Lebowitz via RealInvestmentAdvice.com, Morningstar estimates that as of 2022, there is nearly $3 trillion invested in target date mutual funds. Per Morningstar: Target date strategies remain the investment vehicle of choice for retirement savers. Whether retirement savers in target date funds know it or not, and we presume most don’t, they are mindlessly investing their wealth. The allocations between stocks and bonds in these funds are not based on risk or reward but solely on the calendar. Managing target date funds requires zero investment expertise, yet mutual fund and ETF managers rake in hundreds of millions of dollars a year in management fees. The volatile market environment helps us appreciate why target date funds are foolish. What Are Target Date Funds?

Target Funds are passive mutual funds run by simple algorithms. To be frank, the word algorithm makes their investment process seem more complicate … Read more at: https://www.zerohedge.com/personal-finance/why-target-date-funds-fail-investors-3-trillion-delusion |

|

Joe Biden Snagged Another $40K In ‘Laundered’ Chinese Money From Brother’s CEFC Payment: ComerRemember when Democrats insisted that Trump was compromised by Russia because of some alleged loan he had in the early 90’s according to ‘several sources with knowledge’ (who never materialized)? The same Democrats – and the same media, are of course dead silent over what’s now grown to $240,000 in laundered Chinese that ended up in Joe Biden’s pocket via his brother. We know, we know – huge shock.

On Wednesday, the House Oversight Committee revealed that President Biden received $40,000 in Chinese funds which were “laundered” through his brother, James Biden, in a “complicated financial transaction” marked as a ‘loan,’ which took place just weeks after Hunter Biden threatened the Chinese with his father’s wrath in a July 30, 2017 text message to a CEFC China Energy empl … Read more at: https://www.zerohedge.com/political/joe-biden-snagged-another-40k-laundered-chinese-money-brothers-cefc-payment-comer |

|

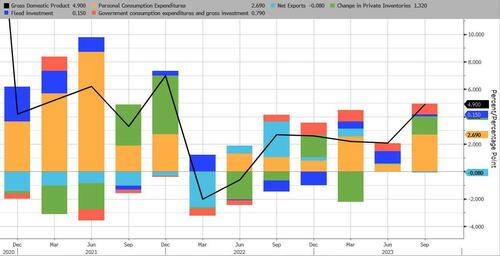

The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%Remember when we mocked the BEA’s recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably “growth” factors as surging inventories and government consumption…

… and said prepare for Bidenomics to collapse in Q4? Well it just did, and not once but twice. First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis.” Translation: the econo … Read more at: https://www.zerohedge.com/markets/partys-over-atlanta-fed-slashes-q4-gdp-estimate-23-12 |

|

Watch Live: Fed Chair Powell Tries Not To Break AnythingNo change in policy rates… as expected; and a barely-changed statement, mean all eyes will be on Fed Chair Powell for the nuance leaning hawkish or dovish.

With money markets and many Fed officials believing that the Fed is done with rate-hikes, Powell will not want to rock the boat of the central bank “proceeding carefully” to let cumulative tightening continue to work through as inflation trends lower and the labor market rebalances. His recent comments at The Economic Club of New York suggested ‘satisfaction’ with current policy settings… with the ubiquitous caveat that they are ‘data dependent’. Powell will be treading very carefully as, given the addition of the term “financial conditions” means anything less than the right amount of hawkishness will prompt the kind of reflexive gains in bonds and stocks that will reverse the tightening of financial conditions that he has been quietly comfortably allowing. < … Read more at: https://www.zerohedge.com/markets/watchlive-fed-chair-powell-tries-not-break-anything |

|

Everyone got duped by Sam Bankman-Fried’s big gambleThe disheveled former wunderkind fooled Silicon Valley and stole billions from customers, a court found. Read more at: https://www.bbc.co.uk/news/world-us-canada-67302950?at_medium=RSS&at_campaign=KARANGA |

|

‘Crypto King’ Sam Bankman-Fried faces decades in jail after guilty verdictSam Bankman-Fried’s guilty verdict concludes a stunning fall from grace for the 31-year-old former billionaire. Read more at: https://www.bbc.co.uk/news/business-67281759?at_medium=RSS&at_campaign=KARANGA |

|

Maersk cuts 10,000 jobs as shipping demand fallsOne of the world’s largest export firms reported a huge drop in profits as freight costs have plunged. Read more at: https://www.bbc.co.uk/news/business-67307248?at_medium=RSS&at_campaign=KARANGA |

|

Zomato m-cap crosses Rs 1 lakh crore markZomato stock which closed nearly 10% higher at Rs 117.90, also crossed a market cap of Rs 1 lakh crore. At the close, its overall market cap stood at Rs 1.01 lakh crore. The results infused a strong buying interest in the counter as 17.36 shares traded on the NSE minutes before the market closing time. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zomato-shares-surge-10-to-52-week-high-m-cap-crosses-rs-1-lakh-crore-mark/articleshow/104941457.cms |

|

Blinkit turns contribution positive in Q2; GOV rises 86% YoYThe quick commerce company bounced back with a 29% quarter-on-quarter gross order value (GOV), growth following tepid growth in Q1FY24, due to temporary disruptions in the business. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/blinkit-turns-contribution-positive-in-q2-gov-rises-86-yoy/articleshow/104946310.cms |

|

CA Rudramurthy on why FII short covering will take market to new highs“I feel the bottom has already been made. All the bad news is already in the price. Now we are getting global market support as well. Historically, 10 out of 11 times from November to the pre-election which is coming somewhere in May-June 2024, the six-month period has always given a rally of about 10% to 30%.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/ca-rudramurthy-on-why-fii-short-covering-will-take-market-to-new-highs/articleshow/104940201.cms |

|

The Fed: Fed maintains freeze on interest rates as it fine-tunes fight against inflationThe Federal Reserve on Wednesday held interest rates steady, but kept alive the possibility of further rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728D-6E0627B67BC0%7D&siteid=rss&rss=1 |

|

Earnings Results: DoorDash shares rally after earnings beat, helped by expansion beyond restaurantsOnline delivery app DoorDash Inc. on Wednesday reported third-quarter results that beat expectations. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728E-BA6F6F16DAD6%7D&siteid=rss&rss=1 |

|

Earnings Results: EA’s stock rises on improved bottom line, revenue beatEA reported fiscal second-quarter net income of $399 million, or $1.47 a share, compared with net income of $299 million, or $1.07 a share, a year ago. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728B-6673B401F1BF%7D&siteid=rss&rss=1 |