Summary Of the Markets Today:

- The Dow closed up 565 points or 1.70%,

- Nasdaq closed up 1.78%,

- S&P 500 closed up 1.89%, High 4,319: 4,200 = critical resistance level)

- Gold $1,992 up $4.30,

- WTI crude oil settled at $82 up $1.98,

- 10-year U.S. Treasury 4.672% down 0.119 points,

- USD Index $106.14 down $0.750,

- Bitcoin $35,016 up $450,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In October 2023, 43% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, according to NFIB’s monthly jobs report. The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 23%. NFIB Chief Economist Bill Dunkelberg added:

The labor market has not eased up much on Main Street. Labor demand is still strong and small business owners are working hard to maintain competitive compensation to retain workers and fill critical open positions. Labor quality is still a top problem among small businesses.

Preliminary nonfarm business sector labor productivity increased 2.2% year-over-year in the third quarter of 2023. On the other hand, unit labor costs increased 1.9% year-over-year. I am not a believer in the methodology used – and just passing along the information.

In the week ending October 28, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 210,000, an increase of 2,000 from the previous week’s revised average. The previous week’s average was revised up by 500 from 207,500 to 208,000.

Here is a summary of headlines we are reading today:

- Rare Earth Prices Stabilize As Global Production Dynamics Shift

- U.S. Coal Exports To Europe Soar Despite Energy Transition

- New Roofing Materials Offer An Eco-Friendly Answer To Air Conditioning

- Exxon Completes $4.9 Billion Denbury Acquisition

- Europe’s Wind Energy Giants Brace For Massive Losses And Writedowns

- Dow jumps more than 550 points for best day since June as bond yields recede: Live updates

- Jeff Bezos urged Amazon to flood search results with junk ads, FTC alleges

- Why Target Date Funds Fail Investors: A $3 Trillion Delusion

- The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%

- The Fed: Fed maintains freeze on interest rates as it fine-tunes fight against inflation

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rare Earth Prices Stabilize As Global Production Dynamics ShiftVia Metal Miner The Rare Earths MMI (Monthly Metals Index) recently began to cool down following two months of bullish momentum. Altogether, the index dropped by about 3.39%. Many components of the index traded sideways, while some others, like praseodymium neodymium oxide, declined. That said, the index still holds the potential to move back up in the remainder of Q4. Meanwhile, the Myanmar mining ban could still cause rare earth buyers to stockpile as other nations, such as Vietnam, plan to step up their rare earth game. While China, the world’s… Read more at: https://oilprice.com/Metals/Commodities/Rare-Earth-Prices-Stabilize-As-Global-Production-Dynamics-Shift.html |

|

Venezuelan Oil Exports Fall, Politics Threatens Sanctions ReliefFollowing a six-month easing of sanctions by Washington on Venezuelan oil, the country’s oil exports fell for October, and signs of political interference are now threatening to reverse the sanctions deal. According to Reuters, Venezuela’s October exports dropped by 19% to fewer than 700,000 barrels per day in October, after exporting over 8210,000 bpd in September, based on data from state-run oil company PDVSA and tanker tracking. Internal politics now threatens to scupper the six-month temporary lifting of sanctions,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuelan-Oil-Exports-Fall-Politics-Threatens-Sanctions-Relief.html |

|

Kazakh Fuel Export Ban Triggers Crisis In TajikistanIn the second-largest Tajik city, taxi drivers are complaining of a slowdown in trade as their customers struggle to pay the higher fares linked to a sudden car-fuel shortage that is putting pressure on food prices. “Fuel prices have gone up, but we need to work and earn a living. It’s hard for passengers to endure,” a Khujand-based taxi driver told RFE/RL’s Tajik Service.“We propose the [new] fare to the passenger. If he agrees to the proposed amount, good; if not, then we part ways,” he said.The story was the same… Read more at: https://oilprice.com/Energy/Energy-General/Kazakh-Fuel-Export-Ban-Triggers-Crisis-In-Tajikistan.html |

|

U.S. Coal Exports To Europe Soar Despite Energy TransitionIn the 12 months since the European Union sanctioned Russian coal in the third-quarter of 2022, U.S. coal exports to Europe have increased 22%, adding 5.7 million short tons (MMst) in a year, according to the Energy Information Administration (EIA). In a Thursday data release, the EIA said Europe received one-third of Russia’s total coal exports in 2021, totalling 84.6 MMst, prior to the invasion of Ukraine. Sanctions were implemented in April 2022, exempting pre-existing contracts, which expired in August 2022. The United States,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Coal-Exports-To-Europe-Soar-Despite-Energy-Transition.html |

|

Europe’s Rapid Renewable Shift May Depend On Chinese MaterialsAfter decades of globalization and free-trade-oriented energy policies, the West is taking pains to separate itself from Eastern energy markets. The impetus of the market fracture came early last year, when Russia illegally invaded Ukraine and inadvertently kicked off an all-out energy war with Europe. The global energy crisis that followed was a wake-up call for the West, which realized that it allowed itself to become dangerously reliant on a small number of streams of energy production, several of which are headed by volatile and authoritarian… Read more at: https://oilprice.com/Energy/Energy-General/Europes-Rapid-Renewable-Shift-May-Depend-On-Chinese-Materials.html |

|

Russia’s Lukoil To Double Oil Output At Iraqi Field West Qurna 2 To 800,000 BpdLukoil has extended its development and production contract for Iraq’s West Qurna 2 oilfield, aiming to gradually double oil output to 800,000 barrels per day (bpd), the Russian oil company said on Thursday. Lukoil signed the agreements with representatives of Iraq’s Basra Oil Company in Baghdad. The deal extends the service contract with 10 years to 2045 and provides for better conditions, the Russian oil giant said. The agreement also entails investments into further development of the project, and “gradual… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Lukoil-To-Double-Oil-Output-At-Iraqi-Field-West-Qurna-2-To-800000-Bpd.html |

|

New Roofing Materials Offer An Eco-Friendly Answer To Air ConditioningResearchers from McGill University, UCLA and Princeton have found in a new study the use of roof materials that radiate heat into the cold universe, even under direct sunlight, and how to combine them with temperature-driven ventilation could cool a home. The need for cool living environments is becoming more urgent. But air conditioning is a major contributor to global warming since units use potent greenhouse gases and lots of energy. Now, researchers from McGill University, UCLA and Princeton have found in a new study an inexpensive, sustainable… Read more at: https://oilprice.com/Energy/Energy-General/New-Roofing-Materials-Offer-An-Eco-Friendly-Answer-To-Air-Conditioning.html |

|

Exxon Completes $4.9 Billion Denbury AcquisitionExxonMobil said on Thursday it had completed the acquisition of carbon solutions provider Denbury in an all-stock transaction valued at $4.9 billion, which makes the U.S. supermajor the holder of the largest owned and operated CO2 pipeline network in the U.S. The deal, first announced in July this year, obtained Denbury shareholder approval earlier this week. The combination will further expand ExxonMobil’s ability to provide large-scale emission-reduction services to industrial customers, the company said in its Q3… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Completes-49-Billion-Denbury-Acquisition.html |

|

How Permian Innovations Propelled U.S. Crude Production To New HeightsWith core OPEC+ cartel members Russia and Saudi Arabia doing everything in their power to throttle oil output and push the price of oil higher, the US is again emerging as not only a thorn in OPEC’s side but as the marginal producer of world oil. According to EIA data, US crude oil production hit an all-time high in August, as production surpassed pre-covid levels. US field production of crude oil reached 404.6 million barrels during the month of August, new EIA data showed, for an average of 13.05 million barrels per day, breaking the previous… Read more at: https://oilprice.com/Energy/Crude-Oil/How-Permian-Innovations-Propelled-US-Crude-Production-To-New-Heights.html |

|

Chevron Negotiates 15-Year LNG Supply Deals With European BuyersU.S. supermajor Chevron is in talks to supply LNG to Europe in deals of up to 15 years as European buyers have moved from spot and short-term supply to longer-term deliveries after the Russian invasion of Ukraine, a Chevron executive has told Reuters. “European customers want medium-term deals in the up to 15 years space and we’re working on some commercial deals,” Colin Parfitt, head of Chevron’s trading, shipping and pipeline operations, told Reuters. Before the Russian invasion of Ukraine and the halt of most Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Negotiates-15-Year-LNG-Supply-Deals-With-European-Buyers.html |

|

Europe’s Wind Energy Giants Brace For Massive Losses And WritedownsThe malaise spreading through the renewable energy industry that started in late October when we reported that shares of Israel-based SolarEdge Technologies Inc. (NASDAQ:SEDG) suffered their biggest crash in the company’s public history has now spread to the European wind energy sector, too. It’s all about soaring costs and supply chain woes–all of which prompted SolarEdge to warn that Q3 revenues, gross margin and operating income would all come in below the low end of the company’s prior… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Europes-Wind-Energy-Giants-Brace-For-Massive-Losses-And-Writedowns.html |

|

ConocoPhillips Raises Dividend As It Beats Q3 Profit EstimatesConocoPhillips (NYSE: COP) raised its quarterly dividend by 14% as record oil and gas production resulted in higher-than-expected earnings for the third quarter. ConocoPhillips reported on Thursday adjusted earnings of $2.6 billion, or $2.16 per share, for the third quarter, beating the $2.10 EPS analyst consensus estimates compiled by The Wall Street Journal. The earnings were lower than in the third quarter of 2022 when oil and gas companies posted record profits amid soaring crude oil and natural gas prices. ConocoPhillips’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-Raises-Dividend-As-It-Beats-Q3-Profit-Estimates.html |

|

Biden’s Wind Revolution Faces Setback As Major Projects HaltedPresident Biden’s ‘wind revolution’ is blowing down as the world’s largest offshore wind farm developer abandoned two major US projects due to supply chain and interest rate impacts and recorded impairment charges well above previous forecasts. Orsted A/S announced, “US offshore wind projects have experienced further negative developments from adverse impacts relating to supply chains, increased interest rates, and the lack of an OREC (Offshore Renewable Energy Certificate) adjustment on Sunrise Wind,” which has forced it to cease the development… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Bidens-Wind-Revolution-Faces-Setback-As-Major-Projects-Halted.html |

|

Lower Natural Gas Prices Drag Cheniere’s Revenue Down In Q3Lower natural gas prices and lower sales sent Cheniere Energy’s (NYSEAMERICAN: LNG) revenue falling by 53% in the third quarter of the year, the top U.S. LNG exporter said on Thursday. Cheniere’s revenues came in at $4.159 billion for the third quarter, compared to $8.852 billion for the same period of 2022. Revenues for the nine months to September slumped by 36%, to $15.571 billion, from $24.343 billion for the first nine months of 2022. Consolidated adjusted EBITDA also fell year-over-year for both the third quarter and the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lower-Natural-Gas-Prices-Drag-Chenieres-Revenue-Down-In-Q3.html |

|

Traders Buy Middle East Crude At Premiums Amid Rising Geopolitical RiskCrude traders have been paying premiums for oil cargoes from the Middle East loading next year as geopolitical risks spiked in the past month, Reuters reported on Thursday, citing trading sources. The Hamas-Israel war has increased not only the volatility in crude oil prices but also the risk of a wider conflict, leading to traders willing to pay up for crude supply from Oman and Abu Dhabi in their annual deals that were mostly concluded by late October, according to Reuters’ sources. Some of the Oman cargoes and Abu Dhabi’s Murban… Read more at: https://oilprice.com/Energy/Energy-General/Traders-Buy-Middle-East-Crude-At-Premiums-Amid-Rising-Geopolitical-Risk.html |

|

Dow jumps more than 550 points for best day since June as bond yields recede: Live updatesStocks gained Thursday as Treasury yields fell, with investors betting the Federal Reserve could be done raising rates for 2023. Read more at: https://www.cnbc.com/2023/11/01/stock-market-today-live-updates.html |

|

Apple set to report fourth-quarter earnings after the bellThe quarter will include about a week of iPhone 15 sales. Investors are closely watching to see if sales suggest a strong product “cycle” over the next year. Read more at: https://www.cnbc.com/2023/11/02/apple-aapl-earnings-report-q4-2023.html |

|

Wall Street titans help to fuel Ivy League donor revoltBillionaire Marc Rowan is calling on wealthy donors to Ivy League universities to pause contributions to protest the schools’ responses to the Israel-Hamas war. Read more at: https://www.cnbc.com/2023/11/02/wall-street-titans-help-to-fuel-ivy-league-donor-revolt-.html |

|

Jurors in Sam Bankman-Fried criminal trial begin deliberationsJury deliberation begins in criminal fraud trial of Sam Bankman-Fried Read more at: https://www.cnbc.com/2023/11/02/jurors-in-sam-bankman-fried-criminal-trial-begin-deliberations.html |

|

Here’s where billionaire investor Jeffrey Gundlach sees income opportunities as recession risk loomsIn the view of one bond market whale, “T-bill and chill” is officially on its way out. Read more at: https://www.cnbc.com/2023/11/02/where-billionaire-investor-gundlach-sees-opportunities-in-bonds.html |

|

Jeff Bezos urged Amazon to flood search results with junk ads, FTC allegesAmazon’s ads strategy helped pump its profits while steering shoppers to higher-priced goods, the agency alleges. Read more at: https://www.cnbc.com/2023/11/02/jeff-bezos-urged-amazon-to-flood-search-results-with-junk-ads-ftc.html |

|

Media stocks pop as Roku rally lifts the sectorWall Street celebrated Roku’s third quarter-report, in which the company reported strong trends in content distribution and advertising. Read more at: https://www.cnbc.com/2023/11/02/media-stocks-pop-as-roku-rally-lifts-the-sector.html |

|

National Association of Realtors CEO quits earlier than expected after federal lawsuit lossThe National Association of Realtors announced its CEO stepped down days after a federal jury ruled that the group artificially inflated commissions. Read more at: https://www.cnbc.com/2023/11/02/national-association-of-realtors-ceo-quits-after-lawsuit-loss.html |

|

Israel-Hamas war live updates: Situation in Gaza Strip is now ‘desperate,’ UN relief agency says; Egypt works to expand evacuationsEvacuation efforts to get foreign nationals out of the Gaza Strip continue, with Egypt workingt for 7,000 civilians to cross into its territory. Read more at: https://www.cnbc.com/2023/11/02/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Deliberations begin in Sam Bankman-Fried fraud trial: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Zack Shapiro, managing partner at the crypto-focused law firm Rains, weighs in on the trial of Sam Bankman-Fried as jury deliberations are underway. Read more at: https://www.cnbc.com/video/2023/11/02/jury-begins-deliberations-in-sam-bankman-fried-trial-cnbc-crypto-world.html |

|

FedEx CEO warned of ‘worldwide recession’ a year ago. Here’s what he sees nowFedEx CEO Raj Subramaniam warned last fall of worldwide recession amid weak results. Hasn’t happened, but he says some of his calls remain correct. Read more at: https://www.cnbc.com/2023/11/02/fedex-ceo-warned-of-global-recession-year-ago-heres-what-he-sees-now.html |

|

The ‘biggest threat to global order since the 1930s’ is underway and every CEO is talking about itIt’s not just JPMorgan’s Jamie Dimon. Across corporate America, fears are rising this is the gravest threat to the global order since the run-up to WWII. Read more at: https://www.cnbc.com/2023/11/02/biggest-global-threat-since-1930s-looms-and-every-ceo-talking-about-it.html |

|

Deal-hungry shoppers will squeeze holiday sales growth to pre-pandemic levels, retail group saysThe NRF’s CEO expects higher wages and job security to give shoppers confidence to spring for gifts and decorations. But he acknowledged challenges. Read more at: https://www.cnbc.com/2023/11/02/nrf-2023-holiday-sales-forecast.html |

|

Why Target Date Funds Fail Investors: A $3 Trillion DelusionAuthored by Michael Lebowitz via RealInvestmentAdvice.com, Morningstar estimates that as of 2022, there is nearly $3 trillion invested in target date mutual funds. Per Morningstar: Target date strategies remain the investment vehicle of choice for retirement savers. Whether retirement savers in target date funds know it or not, and we presume most don’t, they are mindlessly investing their wealth. The allocations between stocks and bonds in these funds are not based on risk or reward but solely on the calendar. Managing target date funds requires zero investment expertise, yet mutual fund and ETF managers rake in hundreds of millions of dollars a year in management fees. The volatile market environment helps us appreciate why target date funds are foolish. What Are Target Date Funds?

Target Funds are passive mutual funds run by simple algorithms. To be frank, the word algorithm makes their investment process seem more complicate … Read more at: https://www.zerohedge.com/personal-finance/why-target-date-funds-fail-investors-3-trillion-delusion |

|

Joe Biden Snagged Another $40K In ‘Laundered’ Chinese Money From Brother’s CEFC Payment: ComerRemember when Democrats insisted that Trump was compromised by Russia because of some alleged loan he had in the early 90’s according to ‘several sources with knowledge’ (who never materialized)? The same Democrats – and the same media, are of course dead silent over what’s now grown to $240,000 in laundered Chinese that ended up in Joe Biden’s pocket via his brother. We know, we know – huge shock.

On Wednesday, the House Oversight Committee revealed that President Biden received $40,000 in Chinese funds which were “laundered” through his brother, James Biden, in a “complicated financial transaction” marked as a ‘loan,’ which took place just weeks after Hunter Biden threatened the Chinese with his father’s wrath in a July 30, 2017 text message to a CEFC China Energy empl … Read more at: https://www.zerohedge.com/political/joe-biden-snagged-another-40k-laundered-chinese-money-brothers-cefc-payment-comer |

|

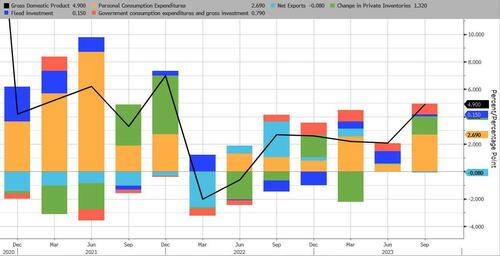

The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%Remember when we mocked the BEA’s recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably “growth” factors as surging inventories and government consumption…

… and said prepare for Bidenomics to collapse in Q4? Well it just did, and not once but twice. First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis.” Translation: the econo … Read more at: https://www.zerohedge.com/markets/partys-over-atlanta-fed-slashes-q4-gdp-estimate-23-12 |

|

Watch Live: Fed Chair Powell Tries Not To Break AnythingNo change in policy rates… as expected; and a barely-changed statement, mean all eyes will be on Fed Chair Powell for the nuance leaning hawkish or dovish.

With money markets and many Fed officials believing that the Fed is done with rate-hikes, Powell will not want to rock the boat of the central bank “proceeding carefully” to let cumulative tightening continue to work through as inflation trends lower and the labor market rebalances. His recent comments at The Economic Club of New York suggested ‘satisfaction’ with current policy settings… with the ubiquitous caveat that they are ‘data dependent’. Powell will be treading very carefully as, given the addition of the term “financial conditions” means anything less than the right amount of hawkishness will prompt the kind of reflexive gains in bonds and stocks that will reverse the tightening of financial conditions that he has been quietly comfortably allowing. < … Read more at: https://www.zerohedge.com/markets/watchlive-fed-chair-powell-tries-not-break-anything |

|

Bank holds interest rates and warns it’s too early to cutThe UK is expected to see zero growth until 2025, but the Bank says it’s too early to cut interest rates. Read more at: https://www.bbc.co.uk/news/business-67286913?at_medium=RSS&at_campaign=KARANGA |

|

New mothers faced energy meter force-fittingsThe first warrants granted for months to force-fit prepayment meters wrongly included new mothers’ homes. Read more at: https://www.bbc.co.uk/news/business-67302061?at_medium=RSS&at_campaign=KARANGA |

|

Sainsbury’s gains ground in battle with Aldi and LidlThe supermarket says customers who used to shop only at the discounters are now coming to Sainsbury’s too. Read more at: https://www.bbc.co.uk/news/business-67300940?at_medium=RSS&at_campaign=KARANGA |

|

These 9 commodity stocks hit 52-week high on ThursdayDuring Thursday’s trading session, the Sensex benchmark index experienced a substantial surge of roughly 490 points, concluding the day at 64,081. Amid this surge, 9 stocks included in the BSE commodities index reached their highest prices within the past 52 weeks. The 52-week high holds special importance for traders and investors as it serves as a crucial technical gauge for assessing a stock’s present value and forecasting potential price fluctuations. It signifies the highest price at which a stock has traded during the preceding year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/9-commodity-stocks-hit-52-week-high-on-thursday-surge-up-to-25-in-a-month/notching-up/slideshow/104921242.cms |

|

Nifty forms high wave type candle. What traders should do on FridayThe short-term uptrend status of Nifty remains intact and there is a possibility of Nifty moving towards 19200-19300 levels again in the coming sessions before consolidating again from the highs, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-high-wave-type-candle-what-traders-should-do-on-friday/articleshow/104920364.cms |

|

Key macro events in November that may move the marketsMacro events, Fed, BoE, macro events in November, China Consumer Price Index, India IIP data Read more at: https://economictimes.indiatimes.com/markets/web-stories/key-macro-events-in-november-that-may-move-the-markets/slideshow/104915644.cms |

|

The Fed: Fed maintains freeze on interest rates as it fine-tunes fight against inflationThe Federal Reserve on Wednesday held interest rates steady, but kept alive the possibility of further rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728D-6E0627B67BC0%7D&siteid=rss&rss=1 |

|

Earnings Results: DoorDash shares rally after earnings beat, helped by expansion beyond restaurantsOnline delivery app DoorDash Inc. on Wednesday reported third-quarter results that beat expectations. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728E-BA6F6F16DAD6%7D&siteid=rss&rss=1 |

|

Earnings Results: EA’s stock rises on improved bottom line, revenue beatEA reported fiscal second-quarter net income of $399 million, or $1.47 a share, compared with net income of $299 million, or $1.07 a share, a year ago. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728B-6673B401F1BF%7D&siteid=rss&rss=1 |