Summary Of the Markets Today:

- The Dow closed down 252 points or 0.76%,

- Nasdaq closed down 1.76%,

- S&P 500 closed down 1.18%, (Low 4,128: 4,200 = critical support level)

- Gold $1,994 down $0.50,

- WTI crude oil settled at $83 down $2.03,

- 10-year U.S. Treasury 4.851% down 0.104 points,

- USD Index $106.67 up $0.140,

- Bitcoin $34,060 down $727,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic released its monthly Loan Performance Insights Report for August 2023 showing that 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.2 percentage point decrease compared with 2.8% in August 2022 and a 0.1 percentage point decrease from July 2023. Molly Boesel, principal economist at CoreLogic added:

U.S. mortgage performance remained strong in August, supported by a robust job market and a healthy economy. However, this thriving job market comes at a time when interest rates are quickly rising, which is keeping many potential homebuyers from being able to secure a mortgage.

The advance estimate of 3Q2023 Real gross domestic product (GDP) increased at an annual rate of 4.9 percent In the second quarter, real GDP increased 2.1 percent. This is a quarter-over-quarter analysis that is intended to show an exaggerated view of economic acceleration. We analyze real GDP on a year-over-year basis to get a clearer view of growth – and it shows the real economy grew at 2.9% year-over-year – up from last quarter’s 2.4%. The economy is expanding which is good news. The increase in real GDP reflected increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, and residential fixed investment which were partly offset by a decrease in nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. The implicit price deflator which shows inflation in GDP modestly declined to 3.2% from last quarter’s 3.5% (red line on the graph below).

Inflation adjusted new orders for manufactured durable goods in September 2023 increased to 1.0% year-over-year growth from -3.5% in August. This entire increase came from civilian aircraft which makes durable goods a weak sector if one ignores aircraft.

In the week ending October 21, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 207,500, an increase of 1,250 from the previous week’s revised average. The previous week’s average was revised up by 500 from 205,750 to 206,250.

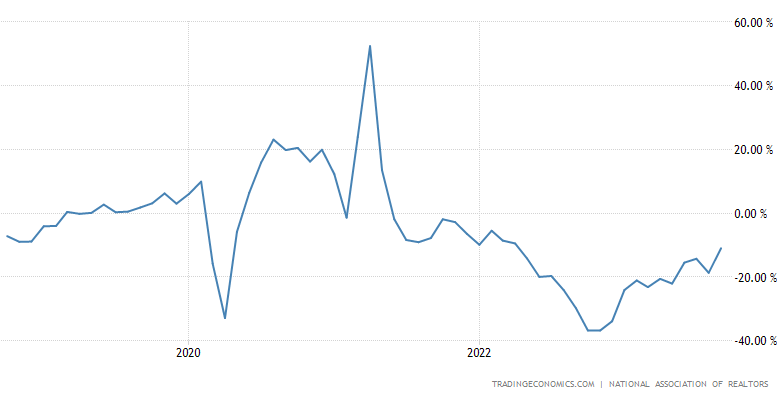

Pending home sales declined 11.0% year-over-year in September 2023, with pending contracts remaining at historically low levels due to the highest mortgage rates in 20 years. Lawrence Yun, NAR chief economist noted:

Furthermore, inventory remains tight, which hinders [existing home} sales but keeps home prices elevated. Because of homebuilders’ ability to create more inventory, new-home sales could be higher this year despite increasing mortgage rates. This underscores the importance of increased inventory in helping to get the overall housing market moving.

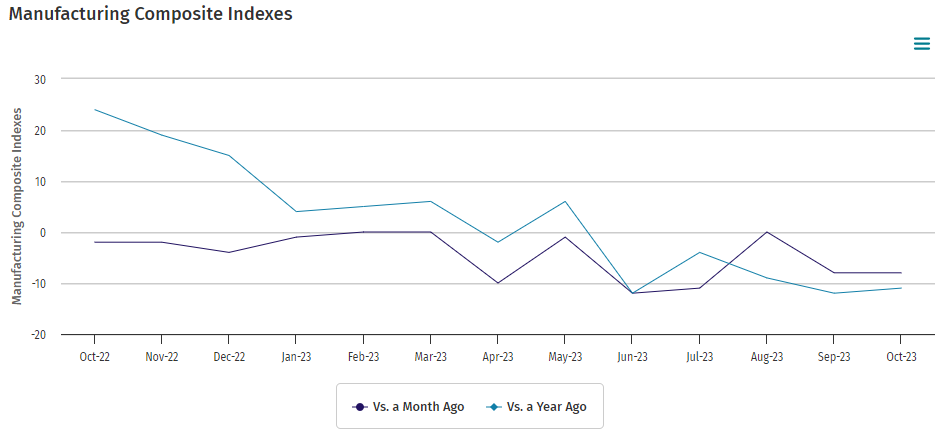

The Kansas City Fed’s manufacturing activity continued to decline in October 2023, and expectations for future activity stayed mostly flat. The month-over-month composite index was -8 in October, unchanged from September and down from 0 in August.

Here is a summary of headlines we are reading today:

- Plastic Waste Becomes Clean Hydrogen Goldmine

- Warren Buffett Snaps Up More Occidental Petroleum

- American Small Reactor Development Suffers From Short Sellers

- Volkswagen’s Q3 Earnings Slump Amid Supply Chain Woes

- Siemens Energy Shares Crash 37% As It Reports Wind Turbine Quality Issues

- Higher Refining Output Lifts Sinopec’s Profit By

- Nasdaq tumbles 1.7% Thursday, descending further into correction territory: Live updates

- Bitcoin mining stocks are rallying, but some are poised for a fall if the cryptocurrency hits this key level

- U.S. GDP grew at a 4.9% annual pace in the third quarter, better than expected

- Futures Movers: Oil prices settle at lowest in 2 weeks as volatility tied to Middle East risks prevails

- Earnings Results: Hasbro’s stock is having its worst month since the 1980s as toys sales tumble

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Plastic Waste Becomes Clean Hydrogen GoldmineA study focused on turning waste plastics into high-value graphene just unlocked a new way of producing hydrogen that could transform the nascent industry and, on a grander scale, positively alter projected decarbonization pathways. The breakthrough could be a win-win for the environment, recycling plastic waste – of which the world has approximately 6.3 billion tons – while providing high-yield hydrogen gas which can be used as clean fuel, all while producing graphene as an end product which makes the whole process economically… Read more at: https://oilprice.com/Energy/Energy-General/Plastic-Waste-Becomes-Clean-Hydrogen-Goldmine.html |

|

Researchers Boost Hydrogen Fuel Cell Efficiency With Ionic MaterialsA Ulsan National Institute of Science and Technology(UNIST) research team has made a groundbreaking advancement in improving the efficiency of hydrogen fuel cells, which are gaining significant attention as eco-friendly next-generation energy sources. The study findings were published ahead of their official publication in the online version of Angewandte Chemie International Edition. This work was selected for the back cover of the journal. Led by Professor Myoung Soo Lah in the Department of Chemistry at UNIST, the team successfully developed… Read more at: https://oilprice.com/Energy/Energy-General/Researchers-Boost-Hydrogen-Fuel-Cell-Efficiency-With-Ionic-Materials.html |

|

Warren Buffett Snaps Up More Occidental PetroleumBerkshire Hathaway (BRKA: BRKB) has expanded its stake in Occidental Petroleum (OXY) with a purchase of another 3.9 million shares this week, according to a Securities and Exchange Commission regulatory filing. Warren Buffett’s holding company now owns 25.8% of the Houston-based oil company, for a value of more than $14 billion, after purchasing 1,686,368 shares at a weighted average price of $62.7969 on October 23, 1,195,400 shares on October 24 at $62.6863, and 1,040,067 on October 25 at $63.0483. Buffett received approval to purchase… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Warren-Buffett-Snaps-Up-More-Occidental-Petroleum.html |

|

London Metal Exchange Explores New Nickel Contract PossibilitiesVia Metal Miner According to an official with the bourse, the London Metal Exchange (LME) is not ruling out the prospect of introducing contracts connected with Category II nickel. This comes despite the incident with the LME nickel contract back in March 2022. “We are focusing on the contract as we have it,” said Robin Martin, the bourse’s business development director. “But that is not to say we are not open to doing things around Class II.” Martin made the comments on Oct. 9 at the London Metals Seminar, which… Read more at: https://oilprice.com/Energy/Energy-General/London-Metal-Exchange-Explores-New-Nickel-Contract-Possibilities.html |

|

TotalEnergies: Qatar’s Future LNG Cargoes Could Be Diverted Away From EuropeTotalEnergies and Qatar could divert to other countries LNG cargoes bound for France after 2026 for 27 years, according to the chief executive of the French supermajor. Earlier this month, QatarEnergy and TotalEnergies signed two long-term LNG agreements under which Qatar will supply up to 3.5 million tons per year of LNG to France for 27 years beginning in 2026. Under the deal, the LNG will be delivered on an ex-ship basis to the Fos Cavaou LNG receiving terminal in southern France. TotalEnergies is a minority partner in Qatar’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Qatars-Future-LNG-Cargoes-Could-Be-Diverted-Away-From-Europe.html |

|

American Small Reactor Development Suffers From Short SellersNuScale is America’s contender in the race to build a commercial, nuclear small modular reactor (SMR). The company has two buyers for its product lined up. But the stock’s price seems to say that there is trouble ahead, especially after the recent release of a negative research report by a small short selling firm, Iceberg Research. Peak to trough the shares have fallen about 75% and since their initial $10 a share public offering via a merger with a special purpose acquisition company (SPAC) in May 2022 the shares (ticker SMR) have… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/American-Small-Reactor-Development-Suffers-From-Short-Sellers.html |

|

ConocoPhillips Reportedly Considering Merger Deal For Permian’s CrownRockAs merger-mania in the American shale patch continues to gain momentum, ConocoPhillips is now said to be considering an offer for Permian basin producer CrownRock LP, Reuters reports, citing unnamed sources. Privately-held CrownRock is valued between $10 billion and $15 billion, according to Reuters sources, and ConocoPhillips has expressed interest in the sale, as have a host of other producers, including Marathon Oil, Devon Energy, Continental Resources and Diamondback Energy. None of the companies mentioned has confirmed the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-Reportedly-Considering-Merger-Deal-For-Permians-CrownRock.html |

|

Volkswagen’s Q3 Earnings Slump Amid Supply Chain WoesVolkswagen Group has said it “cannot be satisfied” with its profitability, as it missed third quarter targets due to hedging losses and supply chain disruption. Profits declined seven percent in the first nine months of the year, to sit at €16.2bn (£14.1bn). The German carmaker attributed the development to “negative valuation effects” from commodity hedging, which led to a €2.5bn loss in the third quarter, and lowered its full-year profit margin forecast. That was despite sales volumes rising eight percent… Read more at: https://oilprice.com/Energy/Energy-General/Volkswagens-Q3-Earnings-Slump-Amid-Supply-Chain-Woes.html |

|

Repsol Boosts Renewables Business As Lower Oil Prices Drag Profits DownSpanish energy group Repsol reported on Thursday a 14% lower net income for January to September, due to lower crude oil and gas prices than in the year-ago period, while it strengthened its renewable energy portfolio. Repsol’s net income for the first nine months of 2023 was $2.93 billion (2.785 billion euros), down by 14% year-on-year. Adjusted income, which specifically measures the performance of the businesses, was fell by 19% to $4 billion (3.816 billion euros), with a lower decline than the drop in oil and natural gas prices… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Repsol-Boosts-Renewables-Business-As-Lower-Oil-Prices-Drag-Profits-Down.html |

|

Siemens Energy Shares Crash 37% As It Reports Wind Turbine Quality IssuesSiemens Energy shares in Germany crashed on Thursday after the company warned its wind turbine business is grappling with quality issues and offshore ramp-up challenges. The company said it’s evaluating various measures to strengthen its balance sheet and is discussing state guarantees with the German government. This comes as a financial crisis in offshore wind energy is brewing. Siemens Energy said the wind business Siemens Gamesa “is working through the quality issues and is addressing the offshore ramp up challenges as… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Siemens-Energy-Shares-Crash-37-As-Wind-Turbine-Business-Grapples-With-Quality-I.html |

|

Profit At China’s Top Wind Firm Slumps 98%Lower prices for turbines amid a price war in China have resulted in a 98% plunge in the net profit of the top Chinese wind turbine maker, Xinjiang Goldwind Science & Technology Co. While investments in renewable energy projects in China are booming, intensified competition has led to a race to the bottom for wind turbine prices—a race that has dented profits at the biggest Chinese manufacturer. Goldwind booked $1.28 million in net income for the third quarter of 2023, down by a massive 98% compared to the same period of 2022, a company… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Profit-At-Chinas-Top-Wind-Firm-Slumps-98-As-Headwinds-Abound.html |

|

Ford And UAW Near Historic Deal After Six-Week StrikeThe United Automobile Workers and Ford Motor Company reached a tentative agreement on a new four-year labor contract on Wednesday night. This comes six weeks after UAW initiated strikes targeting Detroit’s Big Three automakers. UAW provided details about the “record contract” with Ford: The agreement grants 25% in base wage increases through April 2028, and will cumulatively raise the top wage by over 30% to more than $40 an hour, and raise the starting wage by 68%, to over $28 an hour. The lowest-paid workers at Ford will see a raise of more than… Read more at: https://oilprice.com/Energy/Energy-General/Ford-And-UAW-Near-Historic-Deal-After-Six-Week-Strike.html |

|

TotalEnergies Q3 Profit Tops Estimates As Oil Prices RiseFrench energy major TotalEnergies (NYSE: TTE) reported on Thursday a third-quarter net income above expectations, thanks to higher oil prices and stronger refining margins in the summer. TotalEnergies’ adjusted net income stood at $6.5 billion for the third quarter, down by 37% on the year, but up by 30% sequentially, and above an analyst consensus estimate of $6.18 billion. Oil and gas production rose and, coupled with the “good availability of European refining assets,” boosted operating income at TotalEnergies’ upstream… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Q3-Profit-Tops-Estimates-As-Oil-Prices-Rise.html |

|

U.S. Refiner Valero Beats Q3 Earnings Estimates On Strong SalesValero Energy (NYSE: VLO), the second largest U.S. refiner by capacity, reported on Thursday higher-than-expected profits for the third quarter of 2023, amid continued strong product demand in America. Valero booked a net income attributable to Valero stockholders of $2.6 billion, or $7.49 per share, for the third quarter of 2023. This compares to $2.8 billion, or $7.19 per share, for the third quarter of 2022. The analyst consensus had expected $7.47 earnings per share for the third quarter of 2023. Valero’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Refiner-Valero-Beats-Q3-Earnings-Estimates-On-Strong-Sales.html |

|

Higher Refining Output Lifts Sinopec’s Profit By 34% In Q3China Petroleum & Chemical Corporation, or Sinopec, said on Thursday that it booked an increase of 34% in its net profit for the third quarter thanks to strong fuel sales and higher rates of crude oil processing. The world’s top refiner by capacity, Sinopec, reported a net profit of ($2.44 billion (17.86 billion Chinese yuan) for July to September, the company said in a filing quoted by Reuters. Revenues at Sinopec increased by 4.2% in the third quarter, compared to the same period of 2022. Sinopec’s refining throughput… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Higher-Refining-Output-Lifts-Sinopecs-Profit-By-34-In-Q3.html |

|

Amazon reports better-than-expected results, as revenue jumps 13%Amazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/10/26/amazon-amzn-q3-earnings-report-2023.html |

|

Nasdaq tumbles 1.7% Thursday, descending further into correction territory: Live updatesThe major averages are coming off of Wednesday’s notable losses. Read more at: https://www.cnbc.com/2023/10/25/stock-market-today-live-updates.html |

|

Ford is set to report earnings on the heels of its tentative deal with the UAWFord will report earnings less than 24 hours after reaching a tentative deal with the UAW to end costly strikes. Read more at: https://www.cnbc.com/2023/10/26/ford-motor-f-earnings-q3-2023.html |

|

Biden hails hot GDP report, but voters don’t see the rosy picture Wall Street does“I never believed we would need a recession to bring inflation down,” said President Joe Biden, after a new GDP report showed 5% growth last quarter. Read more at: https://www.cnbc.com/2023/10/26/biden-hails-gdp-report-but-voters-dont-see-the-same-upside-as-wall-street.html |

|

Chipotle Mexican Grill is about to report earnings. Here’s what to expectThe burrito chain Chipotle recently raised prices for the first time in over a year, citing inflation. Read more at: https://www.cnbc.com/2023/10/26/chipotle-mexican-grill-cmg-q3-2023-earnings.html |

|

Bitcoin mining stocks are rallying, but some are poised for a fall if the cryptocurrency hits this key levelSome mining stocks could be in trouble if bitcoin doesn’t reach $50,000 by the second quarter of 2024. Read more at: https://www.cnbc.com/2023/10/26/bitcoin-mining-stocks-are-poised-for-a-fall-if-the-cryptocurrency-hits-this-key-level.html |

|

U.S. GDP grew at a 4.9% annual pace in the third quarter, better than expectedGDP was expected to increase at a 4.7% annualized pace in the third quarter, according to a Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2023/10/26/us-gdp-grew-at-a-4point9percent-annual-pace-in-the-third-quarter-better-than-expected.html |

|

Sam Bankman-Fried testifies in his own trial without jurors present: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Dave Weisberger of CoinRoutes reacts to the ETF anticipation-driven rally Read more at: https://www.cnbc.com/video/2023/10/26/sam-bankman-fried-testifies-without-jurors-present-crypto-world.html |

|

Israel-Hamas war live updates: Nine Arab countries condemn the targeting of civilians in Gaza; Israel launches overnight raidThe Israel Defense Forces said they conducted an overnight raid in northern Gaza, “as part of preparations for the next stages of combat.” Read more at: https://www.cnbc.com/2023/10/26/israel-hamas-war-updates-and-latest-news-on-gaza-conflict.html |

|

Maine communities locked down after gunman kills 18; manhunt underwayNo suspect has yet been named, but a person of interest, Robert Card, was identified — he’s considered armed and dangerous Read more at: https://www.cnbc.com/2023/10/26/shootings-in-lewiston-maine.html |

|

Google Maps just got another update, here’s what’s newGoogle Maps announced some new features Thursday to allow users to get more specific recommendations and navigate with more precision. Read more at: https://www.cnbc.com/2023/10/26/google-maps-rolls-out-expanded-search-for-activities-ev-charging.html |

|

Halloween candy is getting more expensive—these are the 10 states where prices have gone up the mostWhile residents of Hawaii can expect to pay 7.7% more for candy in 2023 than they did in 2022, Pennsylvania shoppers will be paying 13.15% more. Read more at: https://www.cnbc.com/2023/10/26/the-10-states-where-halloween-candy-prices-have-increased-the-most.html |

|

Tech stocks suffer two-day selloff as investors find ‘wrinkle or two’ in Alphabet, Meta earningsDespite better-than-expected results from Alphabet and Meta, investors dumped the stocks and rest of the tech sector over the past two days Read more at: https://www.cnbc.com/2023/10/26/tech-stocks-suffer-steep-two-day-drop-after-google-meta-earnings.html |

|

Whoops! Biden Adviser Jake Sullivan Scrubs Gaza Brag From ‘Foreign Affairs’ EssayBiden National Security Adviser Jake Sullivan just made a fool of himself – boasting in an essay published Wednesday for Foreign Affairs that the Biden administration had “de-escalated crises in Gaza,” and that their “foreign policy for a changed world” is leading to a “freer and more stable world.”

“The Israeli-Palestinian situation is tense, particularly in the West Bank,” Sullivan wrote, “but in the face of serious frictions, we have de-escalated crises in Gaza and restored direct diplomacy between the parties after years of its absence.” Then Hamas attacked Israel sparking a war, causing Sullivan to scramble and eliminate much of the above from the online edition of the article. The print edition, however, still contains the embarrassing boasts, according to the Read more at: https://www.zerohedge.com/geopolitical/whoops-biden-adviser-jake-sullivan-scrubs-gaza-brag-foreign-affairs-essay |

|

Pentagon Sending 900 More Troops To Bolster Anti-Iran Defenses Ahead Of Gaza OffensiveUpdate(1520ET): In the Pentagon’s latest move to bolster US defenses in the Middle East against the ‘Iran threat’ – given the increased instances of Tehran proxies attacking US troop installations in Iraq and Syria over the last week – some 900 more Americans soldiers will be dispatched to the region. A CBS correspondent has cited Pentagon Press Secretary, Gen. Patrick Ryder, who says 900 US troops have deployed or in process of deploying to bolster missile defense in CENTCOM’s mideast region of operations. They are expected to man Patriot, THAAD and Avenger missile systems. Earlier this week US defense officials said these extra missile batteries are being deployed to the theatre ahead of an expected Israeli ground offensive in Gaza. The CBS reporter noted “This comes as Iranian-backed groups continue to attack US miliary in Iraq and Syria.” Fears are growing that a major IDF push into the Gaza Strip would unleash broader retaliation strikes on US bases in the region. This could include Hezbollah, which operates both in Lebanon and Syria. Israel’s “preparation” strikes for the “next stage of war” – according to its officials – have continued to grow in intensity…

|

|

Eventbrite Bars Riley Gaines PromotionAuthored by Jonathan Turley, We have previously discussed platforms like GoFundMe barring conservative groups and causes after cancel campaigns by activists to cut off financial support for opposing groups. The latest such controversy concerns Riley Gaines who was barred from using the ticketing company Eventbrite for an upcoming event on promoting biological women in sports.

As in the past, the free speech objections made to such censorship is not due to any affiliation or support for the underlying causes. Rather it is an attack on free speech values by platforms that should remain neutral on questions that divide us. These companies can facilitate national debates by allowing citizens to associate and speak on these issues. While Gaines has become a lightening rod for the controversy o … Read more at: https://www.zerohedge.com/political/eventbrite-bars-riley-gaines-promotion |

|

Zuck’s Money Pit: Metaverse Bet Bleeds BillionsMark Zuckerberg may be certain that the future of his company lies in the metaverse, but to many, it continues to look like a giant money pit. As Statista’s Felix Richter details below, in the first nine months of 2023, the company’s Reality Labs division, i.e. its forays into AR, VR and metaverse-related software, recorded an operating loss of $11.5 billion, which shows the company might be on course to break its own negative record of $13.7 billion in 2022. That’s on top of a $10.2 billion loss in 2021, $6.6 billion in 2020 and $4.5 billion in 2019, bringing the total wager for Zuckerberg’s big bet close to $50 billion over a period of four years.

You will find more infographics at Statista Discussing the metaverse in a call with investors last year, Zuckerberg defended his long-term vision:

|

|

FTX: Jury sent home in ‘King of Crypto’ fraud trialFormer crypto boss Sam Bankman-Fried was expected speak in his own defence on Thursday. Read more at: https://www.bbc.co.uk/news/business-67221161?at_medium=RSS&at_campaign=KARANGA |

|

Regulator reveals water firms with worst financesThames Water is among firms being closely monitored due to concerns over their performance. Read more at: https://www.bbc.co.uk/news/business-67225011?at_medium=RSS&at_campaign=KARANGA |

|

Rainy summer hits ice cream sales, says Magnum makerUnilever, which also owns Ben & Jerry’s, says sales were down after poor weather in Europe Read more at: https://www.bbc.co.uk/news/business-67226253?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How investors should trade Prism Johnson, Adani Wilmar and V-Mart on FridaySectorally, selling was seen in auto, metals, oil & gas, and consumer durable stocks while buying was seen in utilities and power stocks Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-investors-should-trade-prism-johnson-adani-wilmar-and-v-mart-on-friday/articleshow/104729583.cms |

|

Pharma Q2 Preview: Cipla to see steady qtr; higher profit growth for DRLCipla could deliver healthy growth of 5% in the Indian business in the second quarter, but the US business is likely to witness pressure on account of lower Albuterol Sulphate sales. Revenue for the quarter is likely to grow at 13% year-on-year (YoY), according to an average estimate of three brokerages, and net profit for the same period is expected to rise around 19% YoY. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/pharma-q2-preview-cipla-to-see-steady-quarter-higher-profit-and-revenue-growth-for-dr-reddys/articleshow/104728015.cms |

|

Market in turmoil, yet 4 smallcap stocks hit 52-week highsThe 52-week high holds particular significance for traders and investors, serving as a vital technical indicator to evaluate a stock’s current value and anticipate potential price fluctuations Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-in-turmoil-yet-4-smallcap-stocks-hit-52-week-highs/slideshow/104731502.cms |

|

The Ratings Game: Morgan Stanley’s new CEO Ted Pick has ‘big shoes to fill’ as he faces challenging markets, analyst saysTed Pick is walking into a difficult job, analyst says, as Morgan Stanley’s outgoing CEO James Gorman becomes executive chair in a move being closely watched on Wall Street. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7289-4630B742F425%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices settle at lowest in 2 weeks as volatility tied to Middle East risks prevailsCrude-oil futures end at their lowest in two weeks Thursday following their first gain in four sessions. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7289-52E333669175%7D&siteid=rss&rss=1 |

|

Earnings Results: Hasbro’s stock is having its worst month since the 1980s as toys sales tumbleHasbro’s stock was having its worst month in four decades, as a weakening toy market led to disappointing third-quarter results and full-year outlook. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7289-CE4432A7D249%7D&siteid=rss&rss=1 |