Summary Of the Markets Today:

The red was flashing on the stock market tickers today. It is finally dawning that high interest rates, a government shutdown, the potential economy (and industry) killing wage demands by the UAW, and many other smaller economic issues will continue to weigh heavier on corporate profits – and may end up contributing to a recession.

- The Dow closed down 388 points or 1.14%,

- Nasdaq closed down 1.57%,

- S&P 500 closed down 1.47%,

- Gold $1918 down $18.10,

- WTI crude oil settled at $91 up $0.93,

- 10-year U.S. Treasury 4.55% up 0.008 points,

- USD index $106.18 up $0.18,

- Bitcoin $26,246 down $50

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The S&P CoreLogic Case-Shiller 20-City Composite home price index posted a year-over-year increase of 0.1%, improving from a loss of -1.2% in the previous month. CoreLogic Chief Economist Dr. Selma Hepp commented:

Home price gains across the country have generally been solid. Lower-priced homes are seeing stronger recovery given the lack of affordable inventory and more demand pressure put on that segment.

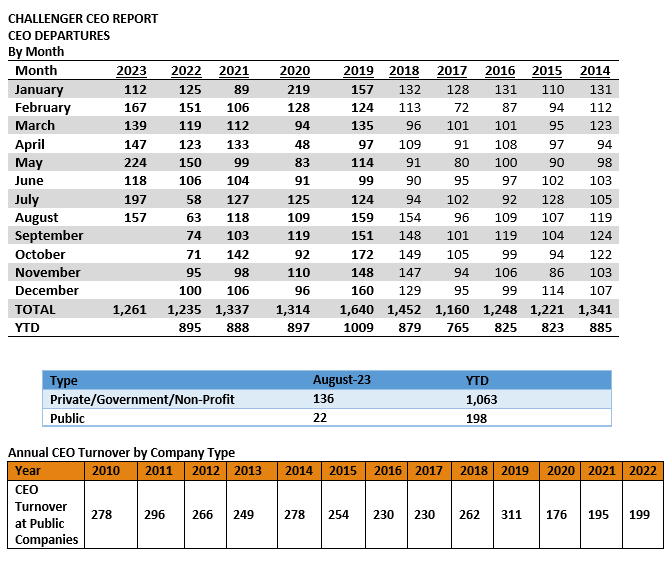

The number of CEO changes at U.S. companies remained high in August 2023 as 157 CEOs left their posts in the month. It is down 20% from the 197 CEO changes announced in July, and up 149% from the 63 CEOs who left their posts in August 2022, according to a report released Tuesday by global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

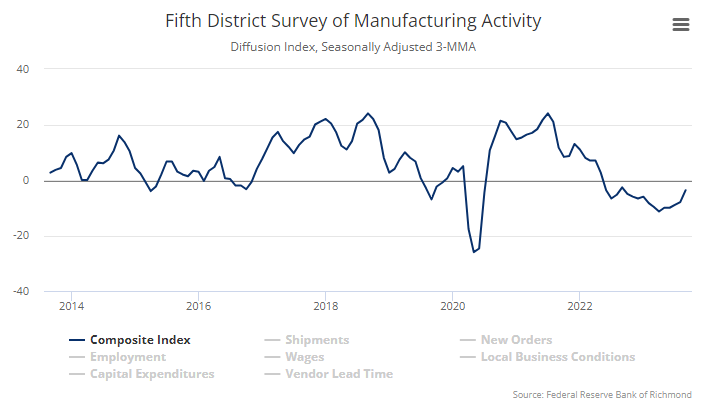

The Richmond Fed Manufacturing Index improved in September 2023. The composite manufacturing index increased from −7 in August to 5 in September. Each of its three component indexes — shipments, new orders, and employment — increased. As several of the other regional Fed manufacturing surveys broke into expansion this month – could manufacturing be coming out of its recession?

Sales of new single‐family houses in August 2023 were up 5.8% year-over-year (significantly lower than the previous month). The median sales price of new houses sold in August 2023 was $430,300. The seasonally‐adjusted estimate of new houses for sale at the end of August was 436,000. This represents a supply of 7.8 months at the current sales rate. Still, if one considers the high mortgage rates, new home sales are stronger than one would expect.

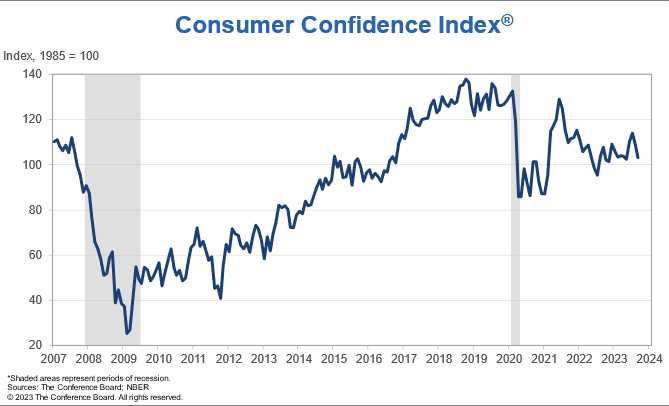

The Conference Board Consumer Confidence Index declined again in September 2023 to 103.0 (1985=100), down from an upwardly revised 108.7 in August. Dana Peterson, Chief Economist at The Conference Board stated:

Consumer confidence fell again in September 2023, marking two consecutive months of decline. September’s disappointing headline number reflected another decline in the Expectations Index, as the Present Situation Index was little changed. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular. Consumers also expressed concerns about the political situation and higher interest rates. The decline in consumer confidence was evident across all age groups, and notably among consumers with household incomes of $50,000 or more.

Here is a summary of headlines we are reading today:

- Hydrogen Economy Gets A Boost With Advanced Catalyst

- Copper Prices Stuck As Stockpiles Skyrocket

- Study Says EU Could Scale Blue Hydrogen Faster Than Green Alternative

- Russia’s Crude Oil Exports Drop Amid Terminal Maintenance

- Oil Prices Under Pressure As U.S. Dollar Strengthens

- IEA: Net Zero Still Achievable If The World Slashes Fossil Fuel Demand

- Ford Halts Construction At $3.5-Billion EV Battery Plant In Michigan

- Target says it will close nine stores in major cities, citing violence and theft

- The Looming Economic Cauldron

- Musk Warns Biden-Backed 40% UAW Pay-Hike Risks Big 3 Bankruptcy (Again)

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Suriname’s Oil Boom Finally Gets The Green LightAfter a flurry of oil discoveries in Suriname’s offshore waters since 2020, it was believed the impoverished former Dutch colony, among the poorest countries in South America, would shortly join neighboring Guyana to benefit from an oil boom of epic proportions. By 2022, those hopes were dashed by the decision of TotalEnergies and APA Corporation to delay the long-awaited multi-billion-dollar final investment decision, or FID, for 1.4-million-acre Block 58, where the partners have made five commercial oil discoveries. This… Read more at: https://oilprice.com/Energy/Energy-General/Surinames-Oil-Boom-Finally-Gets-The-Green-Light.html |

|

Hydrogen Economy Gets A Boost With Advanced CatalystGwangju Institute of Science and Technology (GIST) researchers have developed a new tantalum oxide-supported iridium catalyst that significantly boosts the oxygen evolution reaction speed. The study paper was published in the Journal of Power Sources. The study was co-authored by Dr. Chaekyung Baik, a post-doctoral researcher at Korea Institute of Science and Technology (KIST). Proton exchange membrane water electrolyzers converts surplus electric energy into transportable hydrogen energy as a clean energy solution. However, slow oxygen evolution… Read more at: https://oilprice.com/Energy/Energy-General/Hydrogen-Economy-Gets-A-Boost-With-Advanced-Catalyst.html |

|

Copper Prices Stuck As Stockpiles SkyrocketVia Metal Miner The Copper Monthly Metals Index (MMI) moved sideways from August to September, dropping just 1.36%. Copper prices continue to trade sideways within a tight range. Amid a lack of bullish or bearish momentum, prices have failed to establish a breakout. Following a 3.34% decline throughout August, prices slid merely 0.53% during the first three weeks of September. LME Inventories Tripled Since July, Offer No Support to Copper Prices Today As copper prices remain trapped within an increasingly narrow range, rising LME inventories offer… Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-Stuck-As-Stockpiles-Skyrocket.html |

|

Tesla’s China Exports Under EU Review In Electric Vehicle Subsidy InvestigationTesla’s Chinese exports can expect to be included in the EU’s recently announced investigation into Chinese subsidiaries in the EV market, according to EU executive vice-president Valdis Dombrovskis. Dombrovskis said this week that there was “sufficient prima facie evidence” to support the probe, FT reported on Tuesday morning. We had previously written about the EU’s investigation and Beijing’s response via The Global Times. In an interview this week, responding specifically to whether or not Tesla… Read more at: https://oilprice.com/Energy/Energy-General/Teslas-China-Exports-Under-EU-Review-In-Electric-Vehicle-Subsidy-Investigation.html |

|

Study Says EU Could Scale Blue Hydrogen Faster Than Green AlternativeBlue hydrogen, the one made by reforming natural gas using carbon capture, would be a more cost-effective solution for the EU compared to the so-called green hydrogen made from water electrolysis using renewable electricity, environmental organization Clean Air Task Force (CATF) said in a new report on Tuesday. The European Union’s renewables strategy includes the ambition to produce 10 million tons and import 10 million tons of renewable hydrogen in the EU by the end of this decade. The EU’s target remains challenging… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Study-Says-EU-Could-Scale-Blue-Hydrogen-Faster-Than-Green-Alternative.html |

|

Decade-Low Stocks At Cushing May Send Oil Prices Even HigherCrude prices will likely get a fresh boost this week, as stockpiles at the key US storage hub in Cushing, Oklahoma, risk collapsing to the lowest level (aka “tank-bottoms”) in almost a decade. Such a move would embolden those aiming for a return of $100 oil by year-end. Cushing storage tanks Cushing matters. Being the delivery point for the WTI futures contract, the rise and fall of the holdings is among the market’s most closely followed trends. So far in 3Q, inventories have slumped by ~47% to 22.9m barrels. That’s… Read more at: https://oilprice.com/Energy/Crude-Oil/Decade-Low-Stocks-At-Cushing-May-Send-Oil-Prices-Even-Higher.html |

|

Energy Transfer LP Shuts Ruptured Oil Pipeline In PermianEnergy Transfer LP shuttered its Centurion Pipeline on Monday after it was struck by a road worker, the pipeline company said in an email to Bloomberg. Energy Transfer LP acquired the pipeline earlier this year when it acquired the previous owner, Lotus Midstream for $1.4 billion. The Centurion Pipeline runs from New Mexico, ending in Cushing, Oklahoma, with laterals that extend to Crane, McCamey, and Colorado City in Texas. As of Monday afternoon, Energy Transfer LP was working “as quickly as possible to stop” the oil leaking from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Transfer-LP-Shuts-Ruptured-Oil-Pipeline-In-Permian.html |

|

Achieving Paris Climate Goals With An Altered Energy Mix By 2040Energy stands as the cornerstone of global economic prosperity. Out of total primary energy consumption (TPEC), fossil fuels have long played a dominant role in the development of our societies, as indicated in Figure-1 for the year 2022. In that year, fossil fuels accounted for a staggering 82% of total primary energy consumption. Breaking this down, we find that oil led the way at 32%, closely followed by coal at 27%, natural gas at 23%, and hydro and renewable sources each at 7%, with nuclear bringing up the rear at 4%. While fossil fuels have… Read more at: https://oilprice.com/Energy/Energy-General/Achieving-Paris-Climate-Goals-With-An-Altered-Energy-Mix-By-2040.html |

|

Russia’s Crude Oil Exports Drop Amid Terminal MaintenanceDue to port maintenance works, Russian crude oil exports by sea dipped by around 100,000 barrels per day (bpd) to 3 million bpd last week and by 100,000 bpd to 3.2 million bpd in the four weeks to September 24, tanker-tracking data monitored by Bloomberg showed on Tuesday. Last week, the oil export terminal at Primorsk on the Baltic Sea stopped shipping cargoes for four days due to maintenance works, and this halt offset recovering export volumes out of the Kozmino port in Russia’s Far East. Kozmino crude export flows rebounded last week… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Exports-Drop-Amid-Terminal-Maintenance.html |

|

Oil Prices Under Pressure As U.S. Dollar StrengthensOil prices are under pressure as the U.S. dollar continues to strengthen and fears of a higher-for-longer interest rate weight on demand expectations.Chart of the Week- In its latest 2023 Net Zero Roadmap, the International Energy Agency softened its stance on upstream projects, changing its 2021 wording of “no new oil and gas fields” to a more nuanced “no new long-lead-time upstream projects”.- Setting the stage for COP28 in Dubai from November 30 to December 12, the IEA has hailed electricity as the new oil, calling on all countries… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-As-US-Dollar-Strengthens.html |

|

IEA Says No New Major Fossil Fuel Projects Needed In Net Zero ScenarioThe world would not need any new long lead-time conventional oil and gas projects or coal mines approved after 2023 as the surge in clean energy deployment could lead to peak fossil fuel demand this decade, the International Energy Agency (IEA) said in its updated Net Zero Roadmap on Tuesday. The new report, an update on the first such publication from 2021, takes into account the developments in the energy sector in the past two years, including the energy crisis, the Russian invasion of Ukraine, the drive for energy security, and the surge in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Says-No-New-Major-Fossil-Fuel-Projects-Needed-In-Net-Zero-Scenario.html |

|

China Considers New Fees To Compensate Utilities For Building Coal PlantsChina is mulling over imposing capacity fees on industrial and commercial users from 2024 to compensate local utilities for the coal-fired power capacity they have built in recent years, Bloomberg reported on Tuesday, quoting a draft of the plan it had seen. Industrial and commercial power users would be charged an additional capacity fee on top of their electricity bills if the plan is adopted. The Chinese National Development and Reform Commission (NDRC) has been circulating the proposal to electricity providers for feedback, according to Bloomberg. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Considers-New-Fees-To-Compensate-Utilities-For-Building-Coal-Plants.html |

|

IEA: Net Zero Still Achievable If The World Slashes Fossil Fuel DemandThe world could curb the rise in global temperatures if a huge ramp-up of clean energy capacity slashes fossil fuel demand by 25% by 2030, the International Energy Agency (IEA) said on Tuesday in an updated edition of its Net Zero Roadmap report from 2021. The initial report was criticized by major fossil fuel producers and exporters for suggesting that in the IEA’s pathway to net-zero emissions by 2050, the world would not need new oil and gas projects beyond those sanctioned as of 2021. Two years after the first report, the… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Net-Zero-Still-Achievable-If-The-World-Slashes-Fossil-Fuel-Demand.html |

|

Court Upholds Order To Expand Oil And Gas Lease Sale In The Gulf Of MexicoThe 5th U.S. Circuit Court of Appeals in New Orleans has upheld a lower court’s order that the U.S. Administration should hold an expanded oil and gas lease sale in the Gulf of Mexico as initially intended but gave the Department of the Interior a few more weeks until November 8 to hold the auction. At the end of August, the federal government reduced the area to be offered in the upcoming Gulf of Mexico oil and gas lease sale by 9% to safeguard the habitat of a rare whale species. But the American Petroleum Institute (API), U.S. supermajor… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Upholds-Order-To-Expand-Oil-And-Gas-Lease-Sale-In-The-Gulf-Of-Mexico.html |

|

Ford Halts Construction At $3.5-Billion EV Battery Plant In MichiganFord Motor Company has announced it is halting construction works at a planned $3.5-billion EV battery factory in Michigan until it is confident the plant can be run competitively. Ford’s announcement comes amid a strike by the United Auto Workers (UAW) union and concerns in Congress over the alliance of one of Detroit’s Big Three with the biggest Chinese and global battery maker, Contemporary Amperex Technology Co., Limited (CATL). In February this year, Ford said it had picked Marshall, Michigan, to invest $3.5 billion to build the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ford-Halts-Construction-At-35-Billion-EV-Battery-Plant-In-Michigan.html |

|

Dow sheds nearly 400 points in worst day since March as economic worries return: Live updatesSeptember’s selling pressures took hold of Wall Street following gains seen in the previous session. Read more at: https://www.cnbc.com/2023/09/25/stock-market-today-live-updates.html |

|

Biden stands with striking UAW autoworkers in Michigan, supports big pay raisePresident Joe Biden joined striking UAW members on the picket line outside Detroit and urged strikers to continue their fight until they reach a fair deal. Read more at: https://www.cnbc.com/2023/09/26/biden-stands-with-striking-uaw-autoworkers-in-michigan.html |

|

Apple’s Eddy Cue defends default search contract with Google as best option for consumersApple’s head of services testified in federal court Tuesday about the company’s agreement to make Google the default search engine on iPhones in the U.S. Read more at: https://www.cnbc.com/2023/09/26/apples-eddy-cue-defends-default-search-contract-with-google-in-trial.html |

|

Target says it will close nine stores in major cities, citing violence and theftIt’s the latest move related to theft for Target, which has been outspoken about the industrywide problem of organized retail crime. Read more at: https://www.cnbc.com/2023/09/26/target-says-it-will-close-nine-stores-citing-violence-and-theft-.html |

|

FTC and 17 states sue Amazon on antitrust chargesThe lawsuit is a major milestone for FTC Chair Lina Khan, who rose to prominence for her 2017 Yale Law Journal note, “Amazon’s Antitrust Paradox.” Read more at: https://www.cnbc.com/2023/09/26/ftc-and-17-states-sue-amazon-on-antitrust-charges.html |

|

Fed’s Neel Kashkari sees 40% chance of ‘meaningfully higher’ interest ratesKashkari thinks there’s nearly a 50-50 chance that interest rates will need to move significantly higher to bring down inflation. Read more at: https://www.cnbc.com/2023/09/26/feds-kashkari-sees-40percent-chance-of-meaningfully-higher-interest-rates.html |

|

The crypto industry is not dead yet. BlackRock is about to revive it, says BernsteinIf you think crypto is dead, think again, says Bernstein’s digital assets analyst. Read more at: https://www.cnbc.com/2023/09/26/blackrock-is-about-to-revive-the-crypto-industry-bernstein-says.html |

|

Miami man pleads guilty to selling adulterated, misbranded HIV drugs across U.S.The misbranded HIV drugs, which included Truvada and Biktarvy, were distributed to pharmacies across the U.S. and dispensed to unsuspecting patients. Read more at: https://www.cnbc.com/2023/09/26/miami-man-pleads-guilty-to-selling-misbranded-hiv-drugs.html |

|

JPMorgan’s Chase UK bank to block crypto transactions over scam fears: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Andy Bromberg of Beam discusses the latest in crypto prices and payments. Read more at: https://www.cnbc.com/video/2023/09/26/jpmorgan-chase-uk-bank-block-crypto-transactions-scam-crypto-world.html |

|

Biden calls on Congress to fund government as Moody’s and Wells Fargo warn of shutdown impactPresident Joe Biden asked Congress to avoid a government shutdown due to lack of funds. The U.S. credit rating and dollar could be affected otherwise. Read more at: https://www.cnbc.com/2023/09/26/biden-asks-congress-to-fund-government-wells-fargo-warns-on-shutdown.html |

|

Grammy’s CEO: ‘We’re not going to award AI creativity’ unless it falls under these two categoriesAI-generated music can go viral on social media, but it won’t win a Grammy unless it falls into one of two categories, says Recording Academy CEO Harvey Mason Jr. Read more at: https://www.cnbc.com/2023/09/26/grammys-ceo-how-ai-assisted-music-can-become-eligible-for-an-award.html |

|

Travelers say Tampa International is the best large airport in North America for the second year in a rowJ.D. Power ranked large airports in North America based on customer satisfaction. Tampa International Airport took the top spot for the second year in a row. Read more at: https://www.cnbc.com/2023/09/26/10-best-large-airports-in-north-america-2023-traveler-satisfaction.html |

|

Underground climate change: How heat is trapped under the surface, threatening buildingsSubways and buildings emit heat directly into the sublayers of the ground, which can deform the ground and cause city structures and infrastructure to crack. Read more at: https://www.cnbc.com/2023/09/26/underground-climate-change-how-heat-is-trapped-under-the-surface-threatening-buildings.html |

|

The Looming Economic CauldronAuthored by Steve Cortes via American Greatness, The current confluence of economic conundrums elevates risks massively for the prosperity of Americans, especially those of modest means.

These unprecedented, concurring economic contradictions flow directly from the dire mistakes of the 2020 virus panic. The seismic policy errors of the lockdown era have since been exacerbated by Joe Biden and aligned collaborationist Republicans, to create an economic cauldron into the end of 2023. What are these conundrums?

Conundrum #1: Rate Rise as Economy SlowsOn that first point, just last week, the Federal Res … Read more at: https://www.zerohedge.com/personal-finance/looming-economic-cauldron |

|

Musk Warns Biden-Backed 40% UAW Pay-Hike Risks Big 3 Bankruptcy (Again)Update (1450ET): Elon Musk is correct. The risk of UAW’s 40% pay hike for its 150,000 members at the “Big Three” US automakers – General Motors, Ford, and Chrysler – could send them spiraling into bankruptcy once again. Musk said while responding to our post, “They want a 40% pay raise *and* a 32-hour workweek. Sure way to drive GM, Ford, and Chrysler bankrupt in the fast lane.”

The last time the automotive industry was in a crisis was when Biden was vice president. During that time, automakers received a bailout from then-President Obama. Even the corporate press has had to admit that Tesla benefits from the union chaos in Detroit. * * * Update (1335ET): A reporter asked Biden: “Mr. President, should the UAW get a 40% [pay] increase?” The president responded: “Yes.” Here is the moment when President Biden expressed agreement that the UAW’s demands for a 40% pay hike over a new four-year contract with automakers should be considered. Read more at: https://www.zerohedge.com/political/watch-live-president-biden-set-join-uaw-strike-picket-line |

|

When Shelter Becomes A Speculative Asset, Society UnravelsAuthored by Charles Hugh Smith via OfTwoMinds blog, Does anyone really believe that the renunciation of massive, sustained stimulus of speculation in housing would leave housing valuations unchanged because valuations are solely the result of “shortages”?

Let’s begin by stipulating that speculation (i.e. gambling) is part of human nature. The role of regulations and policy is to limit the damage that gambling inevitably inflicts when “sure things” cliff-dive into losses. In other words, where the speculative frenzy and money flows matters. When the South Sea Bubble expanded circa 1713-1720, this flood tide of speculative capital did not distort the cost of shelter and bread in England; it was limited to a purely financial marketplace of shares in the company. When the bubble imploded in 1720, the losses fell mostly on wealthy investors l … Read more at: https://www.zerohedge.com/personal-finance/when-shelter-becomes-speculative-asset-society-unravels |

|

Canada’s Speaker Resigns After Honoring Nazi Now-Wanted For Extradition By Polish MinisterBy Polish MinisterUpdate (1420ET): The Speaker of Canada’s House of Commons, Anthony Rota, has resigned after leading Parliament in praising a Ukrainian man who moved to Canada after fighting for a Nazi unit.

“I must step down as your Speaker,” Rota said, adding “I reiterate my profound regret.”

Read more at: https://www.zerohedge.com/political/polish-minister-has-taken-steps-extradite-ukrainian-nazi-veteran-honored-trudeau-govt |

|

Amazon: US accuses online giant of illegal monopolyThe Federal Trade Commission alleges Amazon uses “unfair” and “illegal” strategies to keep power. Read more at: https://www.bbc.co.uk/news/business-66920137?at_medium=RSS&at_campaign=KARANGA |

|

Joe Biden makes history by joining UAW picket lineMr Biden joins striking workers in Michigan, telling them they “deserve” wage raises and concessions. Read more at: https://www.bbc.co.uk/news/world-us-canada-66926060?at_medium=RSS&at_campaign=KARANGA |

|

Disinformation most active on X, formerly known as Twitter, EU saysA European Commission report says the network has the most disinformation of six large social networks. Read more at: https://www.bbc.co.uk/news/technology-66926080?at_medium=RSS&at_campaign=KARANGA |

|

Stocks ripe for buying till 2024 polls: Three sectors in spotlight“We are researching the insurance sector. Some of the businesses seem to be looking at earnings coming back to an extent and so that is one space I am looking at. Among others, engineering and the capital goods sector continues to be very interesting and pharma looks very interesting once more.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/from-now-till-2024-elections-a-very-good-time-to-buy-look-at-these-3-sectors-abhishek-basumallick/articleshow/103957282.cms |

|

Alibaba will spin off its logistics arm Cainiao in an IPO in Hong KongAlibaba said in a filing that it had submitted a spin-off proposal to the Hong Kong Stock Exchange, and that it has received confirmation to proceed Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/alibaba-will-spin-off-its-logistics-arm-cainiao-in-an-ipo-in-hong-kong/articleshow/103969063.cms |

|

Aditya Birla Capital infuses Rs 750 crore into arm AB Finance to fund growth plansAditya Birla Finance’s assets under management (AUM) as of June 30, stood at Rs 85,891 crore, up 49% from the year-ago period. The fund infusion by the Aditya Birla Group company comes just a day after Bajaj Finance said its board will meet on October 5 to consider raising funds through preferential issue of shares or a qualified institutional placement Read more at: https://economictimes.indiatimes.com/markets/stocks/news/aditya-birla-capital-infuses-rs-750-crore-into-arm-ab-finance-to-fund-growth-plans/articleshow/103968354.cms |

|

Market Snapshot: Dow falls over 400 points as long-term Treasury yields near highest levels in a dozen yearsU.S. stocks are sharply lower Tuesday, led by technology stocks, as long-term Treasury yields remained near their highest levels in a dozen years or more, the dollar climbed for a 5th day to a ten month high, and consumer confidence slumped. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-726D-4865D1F8BEC8%7D&siteid=rss&rss=1 |

|

Amazon sued by FTC, which alleges the company is ‘exploiting its monopoly power’The FTC filed an antitrust lawsuit against Amazon on Tuesday, the highest-profile case yet in the agency’s attempt to rein in Big Tech. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7244-145031FE1D48%7D&siteid=rss&rss=1 |

|

Market Extra: Something unusual is happening in copper markets that hasn’t been seen in 30 yearsSomething unusual is happening in the market for copper that hasn’t been seen in nearly 30 years. Some see it as yet another sign that the global economy could be headed for a rough patch. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-726D-DADEF47882BD%7D&siteid=rss&rss=1 |