Summary Of the Markets Today:

- The Dow closed down 77 points or 0.22%,

- Nasdaq closed down 1.53%,

- S&P 500 closed down 0.94%,

- Gold $1,955 up $1.50,

- WTI crude oil settled at $90 down $0.93,

- 10-year U.S. Treasury 4.379% up 0.012 points,

- USD Index $105.40 up $0.200,

- Bitcoin $26,971 down $188,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Today the Federal Reserve decided NOT to raise the federal funds rate (blue dotted line on the graph below). Their meeting statement said in part:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated. The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.

In a follow-up news conference, Fed Chair Powells stated:

We’re in a position to proceed carefully in determining the extent of additional policy firming. We want to see convincing evidence that we have reached the appropriate [federal funds rate] level, and we’re seeing progress and we welcome that. But, you know, we need to see more progress before we’ll be willing to reach that conclusion.

Here is a summary of headlines we are reading today:

- Despite Oil’s Rally, Fed Holds Off On Rate Hike

- Electric Dream On Pause? UK’s Fuel Car Ban Faces Delay

- Tandem Solar Cells Poised To Revolutionize Energy Market

- Oil Jumps As Crude Inventories Draw

- California Truckers Race To Buy Diesel Rigs Ahead Of New Zero-Emission Rule

- Fed declines to hike, but points to rates staying higher for longer

- Stocks slide as Fed signals it’s not done hiking rates, Nasdaq falls 1.5%: Live updates

- Here’s what changed in the new Fed statement

- U.S. will again offer free at-home Covid tests starting Monday

- Weekly mortgage demand increases, driven by a strange surge in refinancing

- Wall Street Reacts To The Fed’s “Confused” 2024 Hawkish Shock

- JPM Markets Desk: “Sentiment Is Turning Very Negative On The US Consumer”

- ond Report: 2-year Treasury yield ends at fresh 17-year high after Fed decision, Powell’s remarks

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Venezuela Is Not A Solution To Colombia’s Natural Gas CrisisAfter entering office on August 7th, 2023, Colombia’s leftist President, Gustavo Petr, implemented his plan to cease issuing new hydrocarbon exploration contracts and ban the controversial extraction technique of hydraulic fracturing. It is feared those policies will destroy Colombia’s energy security and spark a crisis that will roil the Anden country’s hydrocarbon-dependent economy. In an effort to offset those risks, Petro secured a contract with Venezuela to import natural gas from Colombia’s neighbor. While… Read more at: https://oilprice.com/Energy/Natural-Gas/Venezuela-Is-Not-A-Solution-To-Colombias-Natural-Gas-Crisis.html |

|

Despite Oil’s Rally, Fed Holds Off On Rate HikeThe U.S. Federal Reserve on Wednesday decided to hold interest rates steady for September, indicating next year may see fewer rate cuts that analysts had earlier anticipated. Still, amid inflation that remains elevated despite a fairly strong economy, the Fed has signaled there may be another rate hike later this year. Wednesday decision means the benchmark short-term interest rate will remain at 5.25% to 5.5%, a 22-year high. This is only the second time since March 2022 that the Fed meetings have concluded without another rate… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Despite-Oils-Rally-Fed-Holds-Off-On-Rate-Hike.html |

|

Historic UAW Strike Spells Uncertainty For Steel PricesVia Metal Miner The Raw Steels Monthly Metals Index (MMI) moved sideways, with a 2.83% decline from August to September as steel prices dropped almost across the board. Indeed, flat-rolled steel prices continued their downtrends throughout August. Amid uninterrupted week-over-week declines, HRC prices saw the largest drop, falling 10.3% throughout the month. By mid-September, prices reached their lowest level since January 2023. This pushes them closer to their last major low in December 2022 in the mid-$600 per short ton range. UAW Strike… Read more at: https://oilprice.com/Metals/Commodities/Historic-UAW-Strike-Spells-Uncertainty-For-Steel-Prices.html |

|

Turkmenistan Eyes Role As Central Asian Transit HubThat many more train and trucks laden with goods should be rumbling through Turkmenistan – heading north, south, west and east – is a core tenet of the government’s vision for the economic future of the country. Projects past and present attest to that. In December 2014, the leaders of Iran, Kazakhstan and Turkmenistan inaugurated a railroad linking their three countries. In January 2019, work began on construction of a 640-kilometer highway running from the border with Uzbekistan to the capital, Ashgabat.… Read more at: https://oilprice.com/Geopolitics/International/Turkmenistan-Eyes-Role-As-Central-Asian-Transit-Hub.html |

|

Russia Sends First Ever Cargo Of CPC Crude To UAERussian oil major Lukoil and independent producer CenGeo have sent CPC blend to United Arab Emirates’ national oil company ADNOC, marking the first time ever the UAE has purchased the crude blend from Russia, Reuters said in an exclusive report. In early August, Lukoil supplied 123,000 tonnes of CPC Blend oil on Delta Hellas tanker also to Ruwais terminal, although ADNOC has declined to comment on the purchase. CPC Blend is crude oil transported in the common stream via the Caspian Pipeline Consortium pipeline system. The UAE sometimes imports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Sends-First-Ever-Cargo-Of-CPC-Crude-To-UAE.html |

|

Electric Dream On Pause? UK’s Fuel Car Ban Faces DelayLeading car manufacturers have urged the government to give clarity on its proposed row back on banning petrol and diesel cars, saying they’ve invested hundreds of millions to meet targets. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), said the policy change will cause “concern” among car makers. It has been widely reported that the ban on the sale of new petrol and diesel cars and vans will be pushed back from 2030 to 2035. Mr Hawes told BBC Radio 4’s Today programme that high demand… Read more at: https://oilprice.com/Energy/Gas-Prices/Electric-Dream-On-Pause-UKs-Fuel-Car-Ban-Faces-Delay.html |

|

2024 European Gas Prices Could Be Disappointing: WoodMacEuropean gas prices could be significantly lower than forecast for next summer, according to Wood Mackenzie, which cited lower demand from power plants and sufficient gas in storage. According to Wood Mackenzie, Europe is in a good position with gas in storage heading into the 2023/2024 winter—more than is typical for this time of year. These high inventories are now mingling with lower demand for gas from power generation as nuclear power rises and inflationary-induced economic hardships crimp industrial and household consumption. And it… Read more at: https://oilprice.com/Latest-Energy-News/World-News/2024-European-Gas-Prices-Could-Be-Disappointing-WoodMac.html |

|

Tandem Solar Cells Poised To Revolutionize Energy MarketKaunas University of Technology researchers report in a new paper on the improvements of silicon-perovskite tandem cells. In the ongoing quest for more efficient solar cells, the new most current published record from Kaunas University for tandem perovskite solar cells is now at 32.5 percent. Dr Artiom Magomedov, a researcher at Kaunas University of Technology, Lithuania remarked, “There is a kind of race going on among research teams around the world. In the last year, the solar cell efficiency record has been broken three or four times,… Read more at: https://oilprice.com/Energy/Energy-General/Tandem-Solar-Cells-Poised-To-Revolutionize-Energy-Market.html |

|

Saudi’s ADES Prices IPO At Over $4 Billion ValuationSaudi Arabia’s PIF-backed oil and gas driller ADES Holding has set the final price for its initial public offering (IPO) at the top-end of the set range, implying a valuation of 15.242 billion riyals ($4.06 billion). Last week, Reuters reported that the IPO was expected to be priced at around 13.50 riyals a share, again the top-end of a previously announced range. The IPO, the second on the Saudi Exchange this year, is expected to raise ~$1.22 billion from the sale of more than 338.7 million existing and new shares,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudis-ADES-Prices-IPO-At-Over-4-Billion-Valuation.html |

|

Negotiations Break Down Between Chevron And Australian LNG WorkersAustralia’s Fair Work Commission is set to decide on Friday whether to halt the strikes at Chevron’s two LNG export facilities in Australia after the latest talks between the U.S. supermajor and trade unions failed on Wednesday. “The ongoing lack of agreement reinforces our view that there is no reasonable prospect of agreement between the parties,” a spokesperson for Chevron told Reuters today. The workers have stepped up their industrial action that began earlier last week, and plan further escalations in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Negotiations-Break-Down-Between-Chevron-And-Australian-LNG-Workers.html |

|

Oil Jumps As Crude Inventories DrawCrude oil prices moved higher today after the Energy Information Administration reported an inventory decline of 2.1 million barrels for the week to September 15. That compared with a build of some 4 million barrels for the previous week. Meanwhile, the American Petroleum Institute estimated crude oil stocks in the U.S. had fallen yet again, by 5.25 million barrels, in the week to September 15. That was twice the draw analysts had expected the API to report. As oil prices took a pause from their recent rally amid a profit-taking wave, the EIA also… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Jumps-As-Crude-Inventories-Draw.html |

|

India And U.S. Strengthen Energy TiesIndia and the U.S. are expected to deepen their partnership across several areas, including energy, following a G20 summit. In an attempt to counter Chinese dominance, the countries’ leaders are focused on strengthening their relationship to support India’s economy, boost trade, and accelerate the global green transition. This follows several previous discussions between the two powers focused on enhancing their collaboration on energy, particularly clean energy and related technologies. At the G20 summit held in Delhi, India this month,… Read more at: https://oilprice.com/Energy/Energy-General/India-And-US-Strengthen-Energy-Ties.html |

|

California Truckers Race To Buy Diesel Rigs Ahead Of New Zero-Emission RuleLogistics and trucking companies in California are rushing to buy diesel-powered rigs ahead of a new state mandate that will require from January 1, 2024 trucks bought after that date and serve Californian ports be zero-emission vehicles. Executives at trucking companies in the U.S. state with the strictest vehicle pollution standards tell The Wall Street Journal that they prefer to buy diesel rigs now to buying electric trucks next year at triple the price of a diesel heavy-duty vehicle and facing possible issues with not enough charging stations.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-Truckers-Race-To-Buy-Diesel-Rigs-Ahead-Of-New-Zero-Emission-Rule.html |

|

Chinese Fuel Oil Imports Continue To Dip From Decade-HighSoaring prices and recovering imports of diluted bitumen led to a second consecutive month of lower fuel oil imports into China compared to the previous month, according to official Chinese data. China’s fuel oil imports dropped by 8% from July to 1.4 million metric tons in August, per the data from the Chinese General Administration of Customs released on Wednesday and quoted by Reuters. Still, fuel oil imports in August more than doubled compared to the same month of 2022. The July imports of fuel oil into China plunged by 44% compared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Fuel-Oil-Imports-Continue-To-Dip-From-Decade-High.html |

|

Exxon Lobbies To Have Gas-Produced Hydrogen Included In IRA Tax CreditsExxonMobil is lobbying the Biden Administration to have hydrogen derived from natural gas with carbon capture – the so-called blue hydrogen – be eligible for the generous tax credits under the Inflation Reduction Act (IRA), Bloomberg reported on Wednesday, citing an internal company memo it had seen. The IRA, passed in August last year, has nearly $370 billion in climate and clean energy provisions, including investment and production credits for solar, wind, storage, hydrogen, and critical minerals, funding for energy research, and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Lobbies-To-Have-Gas-Produced-Hydrogen-Included-In-IRA-Tax-Credits.html |

|

Fed declines to hike, but points to rates staying higher for longerThe Federal Reserve on Wednesday released its decision on interest rates and updates on the economy. Read more at: https://www.cnbc.com/2023/09/20/fed-rate-decision-september-2023-.html |

|

Stocks slide as Fed signals it’s not done hiking rates, Nasdaq falls 1.5%: Live updatesThe central bank is expected to hold rates steady, but investors will closely watch the summary of economic projections and the comments from Fed Chair Powell. Read more at: https://www.cnbc.com/2023/09/19/stock-market-today-live-updates.html |

|

GM and Stellantis just laid off more than 2,000 additional workers because of the UAW’s strikeThe UAW’s strike is already affecting other GM and Stellantis factories, where nearly 2,400 workers were laid off Wednesday. Read more at: https://www.cnbc.com/2023/09/20/gm-stla-layoffs-uaw-strike-2023.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on July 26. Read more at: https://www.cnbc.com/2023/09/20/heres-what-changed-in-the-new-fed-statement.html |

|

Trump protester turned conspiracy target Ray Epps pleads guilty to Jan. 6 disorderly conductEpps, who traveled to Washington, D.C., to protest former President Donald Trump’s 2020 election loss, has become the face of a right-wing conspiracy theory. Read more at: https://www.cnbc.com/2023/09/20/trump-protester-ray-epps-pleads-guilty-to-jan-6-crime.html |

|

Business travel spending is recovering quicker than expected. These are the stocks to buy right nowGlobal business travel spending will surpass pre-Covid levels in 2024, two years earlier than originally forecast, per the Global Business Travel Association. Read more at: https://www.cnbc.com/2023/09/20/business-travel-spending-is-recovering-quickly-heres-who-benefits.html |

|

U.S. will again offer free at-home Covid tests starting MondayAmericans will soon be able to use COVIDTests.gov to request four free tests, the Biden administration said in a release. Read more at: https://www.cnbc.com/2023/09/20/us-will-again-offer-free-at-home-covid-tests-starting-monday.html |

|

Klaviyo jumps 23% in NYSE debut after software vendor priced IPO at $30Software developer Klaviyo debuted on the New York Stock Exchange on Wednesday, a day after Instacart started trading on the Nasdaq Read more at: https://www.cnbc.com/2023/09/20/klaviyo-shares-open-at-36point75-in-nyse-debut.html |

|

Biden administration forgives $37 million in student debt for defrauded borrowersThe Biden administration announced it would cancel nearly $37 million in student debt for over 1,200 students who attended the University of Phoenix. Read more at: https://www.cnbc.com/2023/09/20/biden-administration-forgives-37-million-in-university-of-phoenix-student-debt.html |

|

Former Deutsche Bank investment banker pleads guilty to crypto fraud: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Brian Mosoff, CEO of Ether Capital, weighs in on a new upgrade for Ethereum’s network, which aims to slow down the pace of staking to avoid a surge in gas fees. He also discusses what factors could drive ether’s next prolonged rally. Read more at: https://www.cnbc.com/video/2023/09/20/former-deutsche-bank-investment-banker-pleads-guilty-crypto-fraud-cnbc-crypto-world.html |

|

The Federal Reserve leaves rates unchanged. Here’s how it impacts your moneyAt the end of its two-day meeting Wednesday, the Fed said it would skip a rate hike in September. But it won’t get any less expensive to borrow. Read more at: https://www.cnbc.com/2023/09/20/federal-reserve-leaves-rates-unchanged-how-that-affects-your-money.html |

|

Weekly mortgage demand increases, driven by a strange surge in refinancingMortgage demand rose last week despite another increase in interest rates. Read more at: https://www.cnbc.com/2023/09/20/weekly-mortgage-demand-rises-driven-by-a-strange-surge-in-refinancing.html |

|

China’s macro backdrop has investors worried. Here are some stocks that could be safe from any weaknessA lackluster economic backdrop in China shouldn’t keep Wall Street from buying opportunities in the world’s second largest economy, some investors say. Read more at: https://www.cnbc.com/2023/09/20/china-is-worrying-investors-these-stocks-could-be-safe-havens-.html |

|

Thousands Of Armenians Rush To Airport, Fearing Genocide, As Ceasefire Announced In Nagorno-KarabakhAfter an intense full day of fighting between Azerbaijan forces and ethnic Armenian separatists in the contested Nagorno-Karabakh enclave, an agreement for full ceasefire has been reached. Nagorno-Karabakh officials said it lost at least 32 civilians and soldiers following a Tuesday of intense gunfire, artillery, and strikes on civilian neighborhoods, particularly focused on the breakaway region’s chief city of Stepanakert. At least 200 have been wounded.

Prime Minister Nikol Pashinyan said Armenia was not involved in reaching the ceasefire agreement, which is expected to be implemented with the coordination of Russian peacekeeping forces. He emphasized in a statement, “we have numerously said that Armenia doesn’t have an army in Nagorno-Karabakh since August 2021.” He further confirmed, “the in … Read more at: https://www.zerohedge.com/geopolitical/thousands-armenians-rush-airport-fearing-genocide-ceasefire-announced-nagorno-karabakh |

|

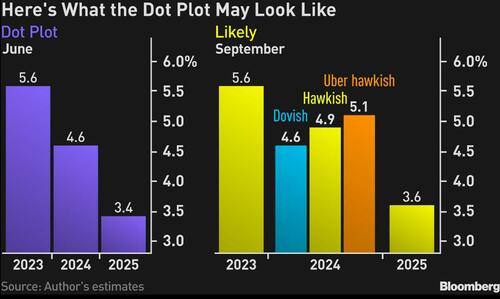

Wall Street Reacts To The Fed’s “Confused” 2024 Hawkish ShockIn our FOMC preview, we said that the only thing that will matter today was the Fed’s 2024 median dot…

… and that’s precisely what happened: with a statement that was a carbon copy of July, the real shocker today was the much more hawkish outlook for 2024. Indeed, as Bloomberg notes, when comparing the 2024 dots with the previous projection, one can clearly see a hawkish shift. The most frequent, (aka mode) projection from June was 4.375% (6 dots). Now, it’s between 4.875% and 5.375%. It’s a shift of as much as 100 bps. Read more at: https://www.zerohedge.com/markets/wall-street-reacts-feds-confused-2024-hawkish-shock |

|

JPM Markets Desk: “Sentiment Is Turning Very Negative On The US Consumer”Two weeks after bursting the AI bubble, JPM’s truthy trading desk (not to be confused with the bank’s flip-flopping sellside propaganda) has taken the hammer to the myth of a “resurgent” US consumer. Here is JPM consumer trader Brian Heavey with some truth bombs that will quickly make persona non grata to the Biden department of bullshit.

|

|

Watch Live: Garland Grilled Over Ray Epps, Hunter Biden Influence PeddlingUpdate (1250ET): AG Merrick Garland had few answers during a barrage of hard-hitting questions from Republicans, ranging from January 6th to investigating his boss, Joe Biden and family. At one point, Rep. Thomas Massie (R-KY) asked Garland why January 6th instigator Ray Epps was only charged with a misdemeanor, while the DOJ is “sending grandmas to prison.” “You’re putting people away for 20 years for merely filming. Some weren’t even there but you got the guy on video saying go into the Capitol, he’s at the sight of first breach, and it’s an indictment on a misdemeanor,” he said. To which Garland uncomfortably shifted in his seat and delivered a canned answer on Epps ‘not being employed by the FBI.’

|

|

Warning petrol ban delay may hit electric car salesCar makers have raised concerns over the move to delay the ban on new petrol and diesel sales to 2035. Read more at: https://www.bbc.co.uk/news/business-66863966?at_medium=RSS&at_campaign=KARANGA |

|

Less rentals homes due to energy policy uncertaintyLandlords say the uncertain directions of travel from the government is impacting investment choices Read more at: https://www.bbc.co.uk/news/business-66872114?at_medium=RSS&at_campaign=KARANGA |

|

Fed holds interest rates steady – for nowThe US central bank signals it could raise its key interest rate again this year Read more at: https://www.bbc.co.uk/news/business-66869039?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How Blue Star, SJVN and Alembic Pharma are looking on charts for Thursday’s tradeStocks that were in focus on Wednesday include names like Blue Star that gained over 13% to hit a new high, SJVN that rose nearly 7%, and Alembic Pharma which hit a fresh 52-week high, pared gains and closed with a loss of over 1% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-blue-star-sjvn-and-alembic-pharma-are-looking-on-charts-for-thursdays-trade/articleshow/103811214.cms |

|

4 FMCG stocks touched their 52-week high, gaining up to 45% in a monthIn Wednesday’s trading session, the Sensex experienced a decline of approximately 796 points, ultimately settling at 66,800. Despite this significant market downturn, four stocks from the BSE FMCG index managed to attain their highest prices in the past 52 weeks. The 52-week high is of great importance to certain traders and investors because it serves as a crucial technical gauge for assessing a stock’s present worth and predicting possible price fluctuations. This figure denotes the peak price at which a stock was traded throughout the preceding year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/4-fmcg-stocks-touched-their-52-week-high-gaining-up-to-45-in-a-month/new-highs/slideshow/103812460.cms |

|

Tech View: Nifty hinting at short-term top reversal. What traders should do on ThursdayHaving moved below the immediate support of the 10-day EMA at 19,940 levels now, the market is expected to slide down to the lower 20-day EMA around 19,780 levels in the coming sessions, according to analysts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-hinting-at-short-term-top-reversal-what-traders-should-do-on-thursday/articleshow/103813202.cms |

|

The return-to-office battle just hit a tipping point that gave companies a winCompanies’ push to bring more workers back into the office is showing initial signs of working, according to one important indicator. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7268-E6A39A27524F%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield ends at fresh 17-year high after Fed decision, Powell’s remarksThe 2-year yield ends at another 17-year high after Federal Reserve Chairman Jerome Powell indicates officials are not necessarily done with interest rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7268-2DE6F4DFD6F1%7D&siteid=rss&rss=1 |

|

Climate change leaves us at ‘gates of hell,’ says U.N.’s Guterres at event that pushes aside mega-polluters U.S., ChinaHead of the U.N. says the world is approaching the “gates of hell” as climate change intensifies, in remarks made at a yearly climate-ambition summit. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7268-B1BE4D21B734%7D&siteid=rss&rss=1 |