Summary Of the Markets Today:

- The Dow closed down 199 points or 0.57%,

- Nasdaq closed down 1.06%,

- S&P 500 closed down 0.70%,

- Gold $1,942 down $10.90,

- WTI crude oil settled at $88 up $0.95,

- 10-year U.S. Treasury 4.298% up 0.030 points,

- USD Index $104.84 up $0.040,

- Bitcoin $25,656 down $29,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The July 2023 increase in the U.S. International Trade in Goods and Services Deficit increased 2.0% to $65 billion. Inflation-adjusted imports were down 0.3% year-over-year with exports growing 4.4% year-over-year. Declines in imports normally signal a weak to recessionary U.S. economy.

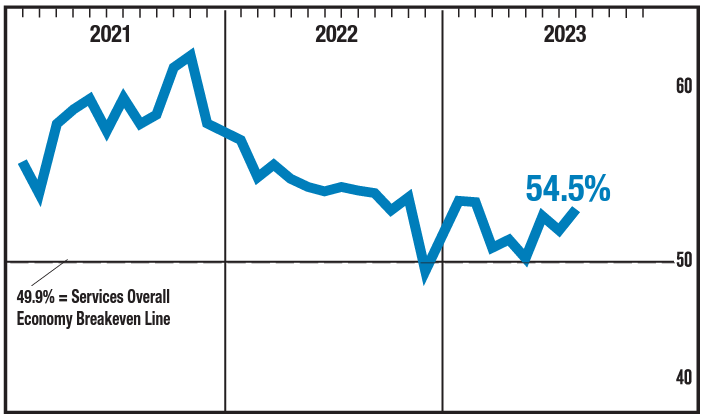

In August, the ISM Services PMI registered 54.5 percent, 1.8 percentage points higher than July’s reading of 52.7 percent. The Business Activity sub-index registered 57.3 percent, a 0.2-percentage point increase compared to the reading of 57.1 percent in July. The New Orders sub-index expanded in August for the eighth consecutive month after contracting in December for the first time since May 2020; the figure of 57.5 percent is 2.5 percentage points higher than the July reading of 55 percent. These numbers are normally indicative of an economy transitioning from weak to normal growth.

According to the 06 September 2023 Beige Book:

Contacts from most Districts indicated economic growth was modest during July and August. Consumer spending on tourism was stronger than expected, surging during what most contacts considered the last stage of pent-up demand for leisure travel from the pandemic era. But other retail spending continued to slow, especially on non-essential items. Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending. New auto sales did expand in many Districts, but contacts noted this had more to do with better availability of inventory rather than increased consumer demand. Manufacturing contacts in several Districts also noted that supply chain delays improved, and that they were better able to meet existing orders. New orders were stable or declined in most Districts, and backlogs shortened as demand for manufactured goods waned. One sector where supply did not become more available was single-family housing. Nearly all Districts reported the inventory of homes for sale remained constrained. Accordingly, new construction activity picked up for single-family housing. But multiple Districts noted that construction of affordable housing units was increasingly challenged by higher financing costs and rising insurance premiums. Bankers from different Districts had mixed experiences with growth in loan demand. Most indicated that consumer loan balances rose, and some Districts reported higher delinquencies on consumer credit lines. Agriculture conditions were somewhat mixed, but reports of drought and higher input costs were widespread. Energy activity was mostly unchanged during the final months of the summer.

Here is a summary of headlines we are reading today:

- Soaring Fuel Costs Trigger Airline Warnings

- Cybersecurity In Focus Ahead Of Berlin NATO Conference

- New Report Reveals Costly Shift In Green Energy Landscape

- G7 Price Cap Limits Russian Oil Revenue, But Moscow Has No Shortage Of Buyers

- Data Centers Are Poaching Texas Oil Workers

- Dow tumbles nearly 200 points, Nasdaq falls a third straight day as Fed rate hike fears return: Live updates

- Ukraine drone supplier AeroVironment soars more than 20%, heads for best day in more than 2 years

- Nasdaq just posted its worst month since December. How the smart money played it

- Apple buying Disney would be a storybook ending for Iger, but fairy tales aren’t real

- Ryanair boss calls air traffic chaos report rubbish

- Bond Report: 2-year Treasury yield ends at one-week high after ISM services-sector report

- In One Chart: A recession could be nine months away, according to this telltale gauge

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

MIT Unveils Next-Gen Carbon Capture TechnologyCurrently when CO2 is trapped before it escapes into the atmosphere, the process requires a large amount of energy and equipment. Now MIT researchers have designed a capture system using an electrochemical cell that can easily grab and release CO2. The device operates at room temperature and requires less energy than conventional, amine-based carbon-capture systems. The researchers reported in ACS Central Science that the design is a capture system using an electrochemical cell that can easily grab and release CO2. The device operates at… Read more at: https://oilprice.com/Energy/Energy-General/MIT-Unveils-Next-Gen-Carbon-Capture-Technology.html |

|

Schlumberger To Grow Revenue By $5B This Year, And Again In 2024Giant oilfield services company Schlumberger Ltd (NYSE:SLB) will grow its revenue by $5B in the current year and by a similar amount in 2024 thanks to a recent resurgence in offshore and international drilling. Previously, the company had forecast it would grow its topline by $4.2 billion. SLB also expects to grow EBITDA by $1.5 billion in the current year. Deepwater production remains the fastest-growing upstream oil and gas segment with production set to increase by 60% by 2030. Ultra-deepwater production is set to continue growing at breakneck… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Schlumberger-To-Grow-Revenue-By-5B-This-Year-And-Again-In-2024.html |

|

Turkmenistan And Uzbekistan Boost Energy Trade With Massive Gas DealIt is customary for Central Asian leaders to exchange pleasantries among themselves whenever one of their countries is marking a day of independence or some other major holiday. But the warmth that Turkmen President Serdar Berdymukhamedov conveyed in his message to his Uzbek counterpart, Shavkat Mirziyoyev, for September 1 was more than mere formality. It is hard to think which two nations in the region are at present enjoying as rosy a relationship as these two. As the data suggests, this cordial state of affairs is very much a legacy of… Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistan-And-Uzbekistan-Boost-Energy-Trade-With-Massive-Gas-Deal.html |

|

Soaring Fuel Costs Trigger Airline WarningsAirlines are warning of a disappointing third quarter in the wake of higher fuel costs courtesy of rising crude oil prices. Southwest Airlines said its August bookings were at the low end of what it expected, and cut its expectations for revenue per seat mile. United Airlines and Alaska Air Group issued warnings of their own, as higher fuel costs came thanks to tightening supplies. According to an SEC filing by United Airlines, the cost of jet fuel has risen more than 20% since mid-July, with Q3 fuel costs averaging between $2.95 and $3.05 per… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Soaring-Fuel-Costs-Trigger-Airline-Warnings.html |

|

Cybersecurity In Focus Ahead Of Berlin NATO ConferenceAfter an eventful summit in Vilnius in July, NATO will return in the next few months to “bread and butter” issues. That means various military exercises, at least two ministerial meetings in Brussels before the end of the year (one for the bloc’s defense ministers, the other for its foreign ministers) and possibly welcoming a new member, Sweden. There was an agreement between Stockholm and Ankara at the Vilnius summit that appeared to pave the way for Swedish membership. But the ratification process still hasn’t begun in either Turkey or Hungary,… Read more at: https://oilprice.com/Geopolitics/International/Cybersecurity-In-Focus-Ahead-Of-Berlin-NATO-Conference.html |

|

China’s Sinopec Says Peak Gasoline Demand Already PassedChina’s EV boom has prompted oil giant Sinopec to adjust its oil demand forecasts, saying peak domestic gasoline demand has already passed and it’s going to be downhill from here. If accurate, the repercussions will be global considering China has for long been the biggest growth market for refined oil products. According to CNEV Post, Chinese new car buyers are now choosing “new energy vehicles” (battery-electric and plug-in hybrid cars) at a rate of 37.8%, up from just 5.4% in 2020. Whereas Scandinavian countries like Norway (87.8%),… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Sinopec-Says-Peak-Gasoline-Demand-Already-Passed.html |

|

Tata’s Sustainability Shift Could Revolutionize UK SteelVia Metal Miner The British government and Tata Steel remain in discussion regarding the future of the Port Talbot steel manufacturing plant. Recently, the government said they may pledge a substantial £500 million (approx. U.S. $629 million) in financial support for the South Wales facility. This may be in addition to Tata Steel India’s planned investment of £700 million in the same unit, in conjunction with their commitment to construct an electric arc furnace. According to the Hindu BusinessLine, Tata Steel responded… Read more at: https://oilprice.com/Energy/Energy-General/Tatas-Sustainability-Shift-Could-Revolutionize-UK-Steel.html |

|

Exports From Khafji Oilfield To Restart After Halt Due To FireThe Khafji oilfield shared by Saudi Arabia and Kuwait is set to resume oil exports of around 110,000 barrels per day (bpd) in the coming week, after nearly a month of suspension due to a fire, a source with knowledge of the matter told Bloomberg on Wednesday. The Khafji oilfield is shared by two of the biggest oil producers in the Middle East, Saudi Arabia and Kuwait. The field is in the so-called Partitioned Neutral Zone (PNZ) and hasn’t exported crude since August 10, when a fire erupted. Last month, Khafji Joint Operations… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exports-From-Khafji-Oilfield-To-Restart-After-Halt-Due-To-Fire.html |

|

New Report Reveals Costly Shift In Green Energy LandscapeSubsidies have not been enough to make Biden’s energy projects profitable. The Coming Green Energy Bailout Taxpayers will soon be on the hook for The Coming Green Energy Bailout The Inflation Reduction Act (IRA) includes hundreds of billions of dollars in subsidies for green energy, yet now renewable developers want utility rate-payers in New York and other states to bail them out. According to a report late last month by the New York State Energy Research and Development Authority (Nyserda), large offshore wind developers are asking for… Read more at: https://oilprice.com/Energy/Energy-General/New-Report-Reveals-Costly-Shift-In-Green-Energy-Landscape.html |

|

G7 Price Cap Limits Russian Oil Revenue, But Moscow Has No Shortage Of BuyersPrice caps on Russian oil and gas have managed to drive down oil revenues and keep prices in check for consumers, experts have suggested, even though the country still has no shortage of buyers for its supplies. Callum Macpherson, head of commodities at Investec, told City A.M. the sanctions and cap mechanism unveiled by the G7 this year has achieved their aim of limiting oil revenues from Russia, without unduly inflating oil prices amid OPEC supply cuts. He said: “The sanctions have not led to a significant curtailment in Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/G7-Price-Cap-Limits-Russian-Oil-Revenue-But-Moscow-Has-No-Shortage-Of-Buyers.html |

|

Oil Takes A Breather After OPEC+ Fueled RallyOil prices on Tuesday jumped nearly 3% to the highest since November after OPEC+ heavyweights Saudi Arabia and Russia announced an extension of their respective production cuts. Brent crude futures for October delivery climbed 2.2% to $91.08 a barrel, while front-month Nymex crude oil futures for October rose 2.7% to $88.02 a barrel, before giving up some of those gains later on Wednesday. At 11:06 a.m. ET on Wednesday, Brent was trading at $89.47, down 0.63% on the day, while WTI was trading at $86.28, down 0.47%. Crude prices… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Takes-A-Breather-After-OPEC-Fueled-Rally.html |

|

Data Centers Are Poaching Texas Oil WorkersRecruiters for technology firms are targeting energy industry workers in Texas, offering better pay, career advancement, and better working conditions. While employment in the oil and gas industry has recovered from the pandemic lows, the overall number of workers in the Texas oil patch has dropped over the past six years. At the same time, the number of jobs in the tech industry has jumped by nearly 40% since 2018, per data from the Texas Workforce Commission cited by Bloomberg. The computing, engineering, and data center sectors look… Read more at: https://oilprice.com/Energy/Energy-General/Data-Centers-Are-Poaching-Texas-Oil-Workers.html |

|

IMF Expects Saudi Arabia’s Non-Oil Growth To Maintain MomentumDespite the extension of the oil production cuts, Saudi Arabia is set to keep the growth momentum in its non-oil sector, which accounts for around 60% of GDP, a senior economist at the International Monetary Fund (IMF) told Bloomberg in an interview. On Tuesday, Saudi Arabia said it would extend its 1 million barrels per day (bpd) cut through December. The move reinforces “the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets,” the Kingdom says. The cuts, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IMF-Expects-Saudi-Arabias-Non-Oil-Growth-To-Maintain-Momentum.html |

|

U.S. Set To Escalate Energy Trade Dispute With MexicoThe U.S. Administration has asked oil and gas firms and renewable energy companies to document how Mexico’s recent energy policies have hampered their business and investments in the U.S.’s neighbor to the south, sources with knowledge of the plans have told Reuters. The Biden Administration and U.S. energy companies have been frustrated by Mexico’s protectionist policies in the energy sector, which have denied permits to American companies to operate in Mexico while the country has awarded contracts and permits to the local state-owned… Read more at: https://oilprice.com/Energy/Energy-General/US-Set-To-Escalate-Energy-Trade-Dispute-With-Mexico.html |

|

G20 To Pursue More Renewables And Carbon CaptureThe G20 group plans to commit to tripling renewable capacity by 2030 but also give more room for fossil fuel development by seeking increased use of carbon capture technology, sources with knowledge of the talks have told Bloomberg. At the G20 summit in India, the group of 20 nations, which includes top oil and gas producers the United States, Saudi Arabia, and Russia, as well as major energy importers such as China, India, Japan, and South Korea, plans to call for increased efforts to deploy carbon capture and other technologies that would reduce… Read more at: https://oilprice.com/Latest-Energy-News/World-News/G20-To-Pursue-More-Renewables-And-Carbon-Capture.html |

|

Dow tumbles nearly 200 points, Nasdaq falls a third straight day as Fed rate hike fears return: Live updatesStocks fell Wednesday, continuing the sluggish start to September, as concerns mounted that the Federal Reserve may not be done hiking interest rates. Read more at: https://www.cnbc.com/2023/09/05/stock-market-today-live-updates.html |

|

Apple and Arm sign deal for chip technology that goes beyond 2040Apple has secured access to a core piece of intellectual property, the Arm architecture, used in its iPhone and Mac chips, for the foreseeable future. Read more at: https://www.cnbc.com/2023/09/06/apple-and-arm-sign-deal-for-chip-technology-that-goes-beyond-2040.html |

|

Disney’s wildest ride: Iger, Chapek and the making of an epic succession messHere’s the inside story of the executive chaos at Disney over the past few years — and how it could shape the fate of the iconic entertainment company. Read more at: https://www.cnbc.com/2023/09/06/disney-succession-mess-iger-chapek.html |

|

Ukraine drone supplier AeroVironment soars more than 20%, heads for best day in more than 2 yearsDrone manufacturer AeroVironment’s shares rallied more than 25% on Wednesday on the back of better-than-expected fiscal first-quarter results. Read more at: https://www.cnbc.com/2023/09/06/ukraine-drone-supplier-aerovironment-soars-more-than-20percent-heads-for-best-day-in-more-than-2-years.html |

|

Nasdaq just posted its worst month since December. How the smart money played itInvestors on the hunt for technology bargains may want to study how experienced hands took advantage of the Nasdaq’s worst month this year. Read more at: https://www.cnbc.com/2023/09/06/nasdaqs-august-was-lousy-how-the-smart-money-played-it.html |

|

Prosecutors will seek Hunter Biden indictment before Sept. 29, court filing saysHunter Biden, the son of President Joe Biden, already has been charge with two counts of failure to pay federal income taxes. Read more at: https://www.cnbc.com/2023/09/06/prosecutors-will-seek-hunter-biden-indictment-before-sept-29-court-filing-says.html |

|

McConnell vows to finish Senate term despite health scares, GOP concernsMcConnell on two separate occasions this summer appeared to briefly freeze up and lose the ability to speak during press events. Read more at: https://www.cnbc.com/2023/09/06/mcconnell-vows-to-finish-senate-term-despite-health-scares-gop-concerns.html |

|

Roku stock jumps after company says it will lay off 10% of workforceRoku said in a regulatory filing Wednesday that it will be laying off 10% of its workforce, or 360 people, as it raised its guidance for the third quarter. Read more at: https://www.cnbc.com/2023/09/06/roku-to-lay-off-10percent-of-workforce-stock-jumps.html |

|

Trump uses Facebook to fund presidential run, two years after Meta banned himDonald Trump’s return to Facebook has helped his campaign to raise a ton of money throughout his legal struggles, including since his arrest in Georgia. Read more at: https://www.cnbc.com/2023/09/06/metas-facebook-provides-trump-a-fundraising-lifeline-.html |

|

Coinbase creates new crypto lending service for U.S. institutional clients: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Anatoly Yakovenko, the co-founder of Solana and CEO at Solana Labs, explains what Visa tapping Solana and USDC to boost cross-border payments means for the network. Read more at: https://www.cnbc.com/video/2023/09/06/coinbase-creates-new-crypto-lending-service-us-institutional-clients-cnbc-crypto-world.html |

|

Apple buying Disney would be a storybook ending for Iger, but fairy tales aren’t realDisney CEO Bob Iger may want to eventually sell Disney to Apple, but it’s unclear if Apple wants to buy Disney. Read more at: https://www.cnbc.com/2023/09/06/apple-disney-merger-iger.html |

|

NFL games are shifting away from traditional TV. Are you ready to stream some football?The NFL season, which kicks off Thursday, will see more games exclusively on streaming services as media companies invest more outside of traditional TV. Read more at: https://www.cnbc.com/2023/09/06/football-nfl-shift-toward-streaming-away-from-regular-tv.html |

|

Stock tracking World Series favorite Atlanta Braves can rally more than 30%, Rosenblatt saysRosenblatt has a buy rating on the stock. Read more at: https://www.cnbc.com/2023/09/06/stock-tracking-world-series-favorite-atlanta-braves-can-rally-more-than-30percent-rosenblatt-says.html |

|

Blinken To Unveil $1BN More In US Taxpayer Aid, Poses With Puppy, In Surprise Kyiv VisitUS Secretary of State Antony Blinken made a surprise visit to Ukraine on Wednesday at a moment of waning Western faith in the ability of the counteroffensive to make any breakthroughs. It marks the highest level visit by an American official since last February President Biden visited Kyiv for the first time. Like with prior trips, Blinken came bearing gifts, announcing over $1 billion in new US aid – while Moscow has charged that Washington will fund Kyiv until the “last Ukrainian”. But Blinken’s message is: “We want to make sure that Ukraine has what it needs, not only to succeed in the counteroffensive, but has what it needs for the long term, to make sure that it has a strong deterrent,” he told reporters.

Blinken poses with puppy: the US top diplomat holds a mine-detection dog during a visit to the children’s hospital in Kyiv on September 8. via ReutersThe trip and announcement seems to confirm that the Zelensky … Read more at: https://www.zerohedge.com/geopolitical/blinken-unveils-1bn-more-us-taxpayer-aid-poses-puppy-surprise-kyiv-visit |

|

“The Curse Of Interesting Times”: Brent Breaks Out While Gas Gets NervousBy Joe DeLaura, Senior Energy Strategist at Rabobank A surprise Saudi Arabian announcement at 9:00 AM ET, September 5, pushed Brent crude up over $90 for the first time since November and set a new high for the year. The extension of the current voluntary 1m barrel-per-day cut through December will continue to prop up a fundamentally strong market. Saudia Arabia will keep their output at about 9 million barrels a day, while a separate announcement by Russia also extended their export cuts of 300,000 bpd for the same duration. In contrast rig counts are falling in the US while production is ticking up strangely, mainly due to drilled-but incomplete wells being finished off. Front spreads are strongly backwardated as refineries run crude at high capacity to try and rebuild depleted downstream products inventories. It’s the perfect bull market from a real, physical world perspective.

The major bearish case comes from worsening economic data from China and other large economies. China is shifting into a slow … Read more at: https://www.zerohedge.com/markets/curse-interesting-times-brent-breaks-out-while-gas-gets-nervous |

|

Biden DHS Advisory Member Sues To Keep Trump Off Ballot Using 14th AmendmentA watchdog group founded by an advisor to Biden’s Department of Homeland Security is suing to keep former President Donald Trump from the 2024 ballot in Colorado, citing the 14th Amendment and Trump’s alleged role in the Jan. 6 Capitol riot.

In an amazing feat of coincidental timing (we’re sure), just days after Rep. Adam Schiff (D-CA) laid out an argument for disqualification on MSNBC, the group, Citizens for Responsibility and Ethics in Washington (CREW), filed a lawsuit on Wednesday under Section 3 of the 14th Amendment. CREW is headed up by Noah Bookbinder, who was appointed to the DHS’s Advisory Council in March of 2022 by Secretary Alejandro Mayorkas (Another quid-pro-Joe?). Read more at: https://www.zerohedge.com/political/biden-dhs-advisory-member-sues-keep-trump-ballot-using-14th-amendment |

|

“It’s Working” – G7 Has No Immediate Plans To Review Its Failing Russian Oil Price CapAuthored by Tsvetana Paraskova via OilPrice.com,

Despite the fact that Russia’s oil is now trading above the G7 price cap due to the oil rally in recent weeks, the group of the world’s top economies and its allies have shelved the regular reviews of the price ceiling, Reuters reported on Wednesday, quoting sources familiar with the matter. Read more at: https://www.zerohedge.com/energy/g7-has-no-immediate-plans-review-its-russian-oil-price-cap |

|

Ryanair boss calls air traffic chaos report rubbishThe UK’s air traffic control system shut itself down after software confusion over an unusual flight path. Read more at: https://www.bbc.co.uk/news/business-66723586?at_medium=RSS&at_campaign=KARANGA |

|

Bank of England boss says interest rates close to peakAndrew Bailey tells ministers rates may be reaching a peak, but adds that they may still rise. Read more at: https://www.bbc.co.uk/news/business-66733193?at_medium=RSS&at_campaign=KARANGA |

|

Wilko shops set to close next week namedStaff being made redundant were told of the news this morning, with shops closing next week. Read more at: https://www.bbc.co.uk/news/business-66728619?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of the Market: 10 things that will decide D-Street action on ThursdayFag-end buying helped the BSE Sensex climb 100 points to settle at 65,880.52. During the day, it had declined 292 points to 65,488.03 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-the-market-10-things-that-will-decide-d-street-action-on-thursday/articleshow/103441715.cms |

|

SAMHI Hotels IPO to open on September 14; fresh issue size revised to Rs 1,200 croreUnder the OFS, Blue Chandra Pte will offload 84.2 lakh shares, Goldman Sachs will sell up to 49.31 lakh equity shares and GTI Capital Alpha will give up 1.4 lakh shares. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/samhi-hotels-ipo-to-open-on-september-14-fresh-issue-size-revised-to-rs-1200-crore/articleshow/103439863.cms |

|

Tech View: Bullish crossover in RSI highlights Nifty’s strength. What traders should do on ThursdayThe short-term trend of Nifty continues to be positive. One may expect further upside in the coming sessions and any dips down to the support of 19,500 is likely to be a buy-on-dips opportunity. The next upside levels to be watched are around 19,800, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-bullish-crossover-in-rsi-highlights-niftys-strength-what-traders-should-do-on-thursday/articleshow/103437602.cms |

|

Bond Report: 2-year Treasury yield ends at one-week high after ISM services-sector reportTreasury yields jump to among the highest levels of this year on Wednesday after data shows the U.S. economy’s services sector continued to expand in August. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-725B-D7D00FC04DB3%7D&siteid=rss&rss=1 |

|

Key Words: Intel gets surprise data-center tailwind as it looks toward ‘meaningful’ AI growth next yearThe coming year could be one of stabilization for Intel as it begins to recognize material gains from AI spending. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-725C-64DB7F4F38E4%7D&siteid=rss&rss=1 |

|

In One Chart: A recession could be nine months away, according to this telltale gaugeHistory shows it takes an average of 589 days for a recession to start after a key part of the Treasury yield curve inverts, according to Bespoke Investment Group. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7252-62654F0AD292%7D&siteid=rss&rss=1 |