Summary Of the Markets Today:

- The Dow closed up 250 points or 0.73%,

- Nasdaq closed up 0.94%,

- S&P 500 closed up 0.67%,

- Gold $1,942 down $5.20,

- WTI crude oil settled at $80 up $1.00,

- 10-year U.S. Treasury 4.239% up 0.004 points,

- USD Index $104.14 up $0.160,

- Bitcoin $25,650 down $70,

- Baker Hughes Rig Count: U.S. -10 to 632 Canada +1 to 190

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

According to CoreLogic, annual single-family home rent growth eased for the 14th consecutive month in June 2023, registering a 3.3% gain, which remains in close range of the pre-pandemic growth rate. Lower-priced rentals continue to see more demand and thus greater annual gains than their higher-priced counterparts, a trend that is partially due to declining affordability and one that has been increasingly exacerbated by inflation. Molly Boesel, principal economist for CoreLogic stated:

Annual single-family rent growth has returned to its long-term, pre-pandemic rate, but increases for attached properties were one-and-a half-times that of detached properties in June; this is historically not the case, as both housing types tend to rise at the same pace. However, while rent growth for attached properties lagged that of detached properties in 2020 and 2021, it has outpaced the latter in 2022 to 2023. Rent growth for attached homes is projected to continue to exceed that of detached properties as the market balances.

Fed Chair Jerome Powell’s remarks at the Jackson Hole Symposium delivered reinforcement of past comments regarding inflation and the outlook for interest rate policy. He said, “It is the Fed’s job to bring inflation down to our 2 percent goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

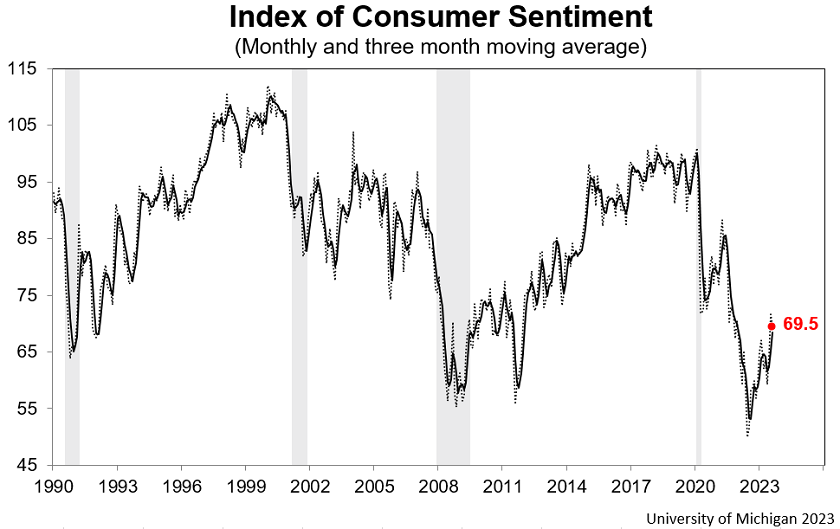

After rising sharply for the past several months, the University of Michigan consumer sentiment moved sideways in August with a small decline that is not statistically different from July. Sentiment reached its second highest reading in 21 months and is now about 39% above the all-time historic low reached in June of 2022. While buying conditions for durables and expectations over living conditions both improved, the long-run economic outlook fell back about 12% this month but remains higher than just two months ago. Consumers weighed a combination of positive and negative factors in the economy, which led to differing offsetting trends across demographic groups. Consumers perceive that the rapid improvements in the economy from the past three months have moderated, particularly with inflation, and they are tentative about the outlook ahead.

Here is a summary of headlines we are reading today:

- Permian Rig Count Drops Amid Rising U.S. Crude Production

- Walmart Drones Set To Take Flight In Dallas

- Bullish Fundamentals Limit The Downside For Oil Prices

- Canada’s Oil Production Continues To Surge

- S&P, Nasdaq close higher, snapping 3-week losing streak as Wall Street shakes off rate hike fears: Live updates

- Fed Chair Powell calls inflation ‘too high’ and warns that ‘we are prepared to raise rates further’

- Stocks making the biggest moves midday: Nordstrom, Hasbro, Hawaiian Electric, Affirm and more

- Wegovy helps reduce heart failure symptoms in obese people, study says

- Tesla Investors Set For $12,000 Payout Each Over Musk’s “Funding Secured” Tweet

- US faces more interest rate rises to cool inflation

- Treasury selloff drives key 5-year yield to highest since 2008

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UK Energy Bills To Stay Elevated Until 2030, Predicts Cornwall InsightEnergy bills will remain high this winter and well above normal levels, despite market watchdog Ofgem confirming a minor reduction in the price cap. The energy price cap has been slashed from £2,074 per year to £1,923 in the latest update from Ofgem, a seven per cent quarter-on-quarter decline. However, this is well above pre-crisis conventions of £1,000-£1,200 per year before rebounding post-pandemic demand saw the collapse of 30 suppliers and record gas prices caused energy bills to climb to all-time highs. Jonathan Brearley,… Read more at: https://oilprice.com/Energy/Energy-General/UK-Energy-Bills-To-Stay-Elevated-Until-2030-Predicts-Cornwall-Insight.html |

|

Will Precious Metals Rebound?Via Metal Miner The Global Precious Metals MMI did not deviate far from its ongoing sideways trend. Indeed, since April, the index has continued to stay within a tight trading range without much movement up or down. Moreover, precious metal prices, including those for gold and silver, remain relatively high when looking at their respective price ranges over the past five years. Overall, the index moved up 2.82% between July and August. It’s true that further drops in prices could very well happen. However, if any type of worsening financial… Read more at: https://oilprice.com/Metals/Gold/Will-Precious-Metals-Rebound.html |

|

Permian Rig Count Drops Amid Rising U.S. Crude ProductionThe total number of active drilling rigs in the United States fell by 10 this week, according to new data from Baker Hughes published Friday. The total rig count fell to 632 this week. So far this year, Baker Hughes has estimated a loss of 133 active drilling rigs. The number of oil rigs fell by 8 this week to 512, down by 93 from a year ago. The number of gas rigs fell by 2 to 115, a loss of 43 active gas rigs from a year ago. Miscellaneous rigs remained the same. The rig count in the Permian Basin fell by 7 to 320, while rigs in the… Read more at: https://oilprice.com/Energy/Crude-Oil/Permian-Rig-Count-Drops-Amid-Rising-US-Crude-Production.html |

|

The Market Thinks There Will Be A Sanctions-Easing Deal With IranProspects of reviving the Iran nuclear deal have swung dramatically, from near-certain in March 2022 to almost nil by the end of the year and somewhere in the middle currently. Although prospects of a deal being signed any time soon appear dim, relations between Washington and Tehran have warmed up considerably, with the Biden administration unblocking frozen assets and possibly even allowing Iran’s enrichment of uranium. The U.S. administration might not admit it openly, but it has looked the other way and allowed Iran oil sales to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Market-Thinks-There-Will-Be-A-Sanctions-Easing-Deal-With-Iran.html |

|

UK Households To Pay Lower Energy Bills In Q4 2023UK energy markets regulator Ofgem lowered on Friday the country’s energy price cap for the fourth quarter of 2023, which means that millions of households will see their energy bills fall at the start of the upcoming heating season. The UK has a so-called Energy Price Cap in place, which protects households from high bills by capping the price that providers can pass on to them. The cap was raised a few times last year after wholesale energy prices, especially the price of natural gas, surged in the spring and summer… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Households-To-Pay-Lower-Energy-Bills-In-Q4-2023.html |

|

Gunvor Sees Oil Trading Profit Fall Amid Lower Volatility, Bribery FineSwiss trader Gunvor has seen profits fall in the first half of this year, and has more than doubled its provision for an expected fine in its ongoing bribery case. The global energy trader has increased the amount set aside to cover the fine to $450 million up from $200 million set aside in 2022. A former Gunvor employee pled guilty in 2021 to a scheme to bribe Ecuadorian government officials in a bid to win business. Gunvor also saw its first-half net profit slip to $803 million from $841 million for last year’s corresponding… Read more at: https://oilprice.com/Energy/Energy-General/Gunvor-Sees-Oil-Trading-Profit-Fall-Amid-Lower-Volatility-Bribery-Fine.html |

|

Walmart Drones Set To Take Flight In DallasWalmart announced its drone delivery service at two Dallas, Texas, stores is about to take flight in the coming months and serve upwards of 60,000 homes. The mega-retailer, with thousands of stores nationwide, hopes to expand its drone delivery network, currently operating in 36 stores in seven states, as a move to reduce the time and cost of delivering goods to customers on the last mile. “Working with Wing directly aligns with our passion for finding innovative and eco-friendly last-mile delivery solutions to get customers the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Walmart-Drones-Set-To-Take-Flight-In-Dallas.html |

|

Equinor Boosts Oil And Gas Production With New Expansion ProjectEquinor has started production at Statfjord Øst, which is expected to boost production by a total of 26 million barrels of oil equivalents from the project, the Norwegian energy major said on Friday. Equinor has been looking to extend the life of various producing oil and gas fields on the Norwegian Continental Shelf by maximizing oil and gas recovery rates and tying the new wells to existing infrastructure—a lower-cost solution to boosting output than building infrastructure from scratch. The new North Sea project, which started up… Read more at: https://oilprice.com/Energy/Crude-Oil/Equinor-Boosts-Oil-And-Gas-Production-With-New-Expansion-Project.html |

|

India Claims Not To Be Overly Dependent On Russian Crude OilIndia does not depend too much for its oil imports on any supplier, not even Russia, Indian Minister of Petroleum and Natural Gas, Hardeep Singh Puri has told CNBC in a recent interview. India, the world’s third-largest crude importer, buys from abroad more than 80% of the crude oil it consumes. Over the past year and a half, the country has significantly raised its imports of cheaper Russian crude oil, which is banned in the West. “India doesn’t get over-dependent on anyone,” Singh Puri told CNBC when asked about his view… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Claims-Not-To-Be-Overly-Dependent-On-Russian-Crude-Oil.html |

|

Bullish Fundamentals Limit The Downside For Oil PricesOil prices are on track for a weekly loss due to the prospect of new oil flows entering the market, but bullish fundamentals are helping to stop any significant drop.Friday, August 25, 2023The prospect of Kurdish oil exports returning to the market and rumors of a US-Venezuela rapprochement have weighed heavily on oil prices this week, but healthy US crude inventory draws and lower-than-expected product stock levels in Europe have countered some of that downward pressure. Unless the US Federal Reserve’s Jackson Hole meeting today… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Fundamentals-Limit-The-Downside-For-Oil-Prices.html |

|

Saudi Arabia Weighs China Bid To Build Nuclear Power PlantSaudi Arabia is considering a bid from a Chinese state firm to build a nuclear power plant, which could give the Kingdom leverage in possible talks for U.S. assistance for establishing a civil nuclear industry, The Wall Street Journal reported on Friday, quoting Saudi officials with knowledge of the matter. Saudi Arabia has been actively seeking help with expertise in nuclear energy to develop its own civil nuclear generation capacity. The U.S. has been an obvious first choice among potential partners, but Washington has taken a cautious approach.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Weighs-China-Bid-To-Build-Nuclear-Power-Plant.html |

|

Canada’s Oil Production Continues To Surge1. Australia’s LNG Strike Keeps Gas Markets on Tenterhooks- European gas prices have been seesawing this week on the back of Australia’s industrial action saga, peaking at €43 per MWh mid-week ($15/mmBtu) only to fall back to €35/MWh after Woodside Energy announced a tentative deal with unions. – Unions of offshore workers across Australia’s LNG liquefaction platforms have been demanding higher pay and better working conditions, however so far only Woodside (ASX:WDS) reached an in-principle agreement with them. – Workers… Read more at: https://oilprice.com/Energy/Energy-General/Canadas-Oil-Production-Continues-To-Surge.html |

|

Oil Faces Headwinds Despite Bullish FundamentalsOctober West Texas Intermediate Crude oil futures posted a volatile trade on Thursday on top of a bearish weekly performance. The price action reflected a myriad of factors from economic data to geopolitical shifts. Demand Worries from Economic Data Concerns about global economic health cast a shadow over oil prices. Weak figures from major economies, including Japan’s shrinking factory activity, declining business activity in the Eurozone, and Britain’s potential economic contraction, have heightened demand anxieties. Even in the U.S., economic… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Faces-Headwinds-Despite-Bullish-Fundamentals.html |

|

A Glimmer Of Hope For Stability In LibyaPolitics, Geopolitics & Conflict General Khalifa Haftar, the commander of the Libyan National Army (LNA), is in the process of rounding up supporters of the former Ghaddafi regime in Sirte ahead of the September 1st anniversary of Ghaddafi’s coup. Previously allied (as recently as 2019 when Haftar attempted and failed to take Tripoli), they are now enemies, with Ghaddafi’s son, Saif, having competing presidential ambitions with Haftar. This is all happening against a complicated backdrop of what appears to be progress towards stability… Read more at: https://oilprice.com/Energy/Energy-General/A-Glimmer-Of-Hope-For-Stability-In-Libya.html |

|

An Alternative Way To Play The AI BoomThe world of stock analysts and commentators, as seen in the financial media, has been abuzz this week with one big story. The Fed are conducting their annual get together at Jackson Hole, there are some worrying stories of economic issues out of China, and there is a curious sudden problem with, or at least admission of “shrinkage”, aka massive theft, in retail. These and countless other stories are getting mentioned, but the media has been dominated this week by one story…the build up to, release of, and analysis of, Nvidia… Read more at: https://oilprice.com/Energy/Energy-General/An-Alternative-Way-To-Play-The-AI-Boom.html |

|

S&P, Nasdaq close higher, snapping 3-week losing streak as Wall Street shakes off rate hike fears: Live updatesStocks rallied as Wall Street reacted to Jerome Powell’s speech in Jackson Hole, Wyoming. Read more at: https://www.cnbc.com/2023/08/24/stock-futures-are-little-changed-as-investors-await-powells-jackson-hole-speech-live-updates.html |

|

Instacart files to go public on Nasdaq to try and unfreeze tech IPO marketFollowing a 20-month drought in venture-backed tech IPOs, Instacart filed on Friday to go public on the Nasdaq. Read more at: https://www.cnbc.com/2023/08/25/instacart-files-to-go-public-on-nasdaq-to-unfreeze-tech-ipo-market.html |

|

Fed Chair Powell calls inflation ‘too high’ and warns that ‘we are prepared to raise rates further’Federal Chair Jerome Powell called for more vigilance in the fight against inflation, warning that additional interest rate increases could be yet to come. Read more at: https://www.cnbc.com/2023/08/25/fed-chair-powell-calls-inflation-too-high-and-warns-that-we-are-prepared-to-raise-rates-further.html |

|

Hawaii calls for tourists to visit Maui as unemployment claims surge after deadly wildfiresWest Maui is off limits to visitors due to the wildfires but the rest of the island is open for business, Hawaii state officials said. Read more at: https://www.cnbc.com/2023/08/25/hawaii-calls-for-tourists-to-visit-maui-as-unemployment-claims-surge.html |

|

Tesla Autopilot safety probe by federal vehicle regulators nears completionNHTSA initiated a safety probe of Tesla’s driver assistance systems — now marketed in the U.S. as Autopilot, Full Self-Driving and FSD Beta options — in 2021. Read more at: https://www.cnbc.com/2023/08/25/tesla-autopilot-safety-probe-by-nhtsa-nearing-completion.html |

|

These high-quality AI stocks are poised to outperform, Trivariate Research saysThe Wall Street firm processed over 180,000 earnings call transcripts and company presentations to identify the presence of artificial intelligence keywords. Read more at: https://www.cnbc.com/2023/08/25/these-high-quality-ai-stocks-are-poised-to-outperform-trivariate-research-says.html |

|

Mastercard to wind down Binance-branded card partnership: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Jamil Nazarali, CEO of EDX Markets, provides an update for the platform that’s drawn the backing of big-names in finance, including Charles Schwab and Citadel. Read more at: https://www.cnbc.com/video/2023/08/25/mastercard-wind-down-binance-branded-card-partnership-cnbc-crypto-world.html |

|

Stocks making the biggest moves midday: Nordstrom, Hasbro, Hawaiian Electric, Affirm and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2023/08/25/stocks-making-the-biggest-moves-midday.html |

|

Affirm shares rocket 30% after better-than-expected results and strong guidanceAffirm shares jumped Friday, a day after it reported a beat on the top and bottom lines. Read more at: https://www.cnbc.com/2023/08/25/affirm-afrm-earnings-report-q4-2023.html |

|

R. Kelly and Universal Music Group must pay over $500,000 in music royalties to his victims, judge rulesThe judge signed an order stating that the music corporation must turn over funds satisfying Kelly’s debt of $507,234.05. Read more at: https://www.cnbc.com/2023/08/25/r-kelly-and-universal-music-group-must-pay-over-500000-in-music-royalties-to-his-victims-judge-rules.html |

|

Watches of Switzerland shares plunge by a quarter after Rolex buys retailer BuchererThe Watches of Switzerland Group lost a quarter of its value on Friday after luxury watchmaker Rolex announced a deal to buy watch retailer Bucherer. Read more at: https://www.cnbc.com/2023/08/25/watches-of-switzerland-shares-plunge-by-a-quarter-after-rolex-buys-retailer-bucherer.html |

|

Wegovy helps reduce heart failure symptoms in obese people, study saysThe trial results add to Wegovy’s growing list of potential health benefits beyond shedding unwanted pounds. Read more at: https://www.cnbc.com/2023/08/25/wegovy-helps-reduce-heart-failure-symptoms-obese-people-study.html |

|

Tesla Investors Set For $12,000 Payout Each Over Musk’s “Funding Secured” TweetBy Tsvetana Paraskova of OilPrice.com, The U.S. Securities and Exchange Commission has asked a judge to approve a plan to distribute to investors the $40 million Tesla and Elon Musk have agreed to pay to settle a case over Musk’s infamous tweet from 2018 that he had secured funding to take the EV car manufacturer private.

The SEC filed a request with a judge this week to pay out $41.5 million to 3,350 eligible claimants who had sued Musk for the “funding secured” tweet. That’s around $12,400 per investor, on average. The judge in the case has said he would endorse the SEC proposal for payments to the investor claimants on September 1 if Musk or Tesla do not object to the plan. Investors in Tesla have sued Musk for misleading a … Read more at: https://www.zerohedge.com/markets/tesla-investors-set-12000-payout-each-over-musks-funding-secured-tweet |

|

Truckers Are Accepting Rates 15-25% Below Their CostsAuthored by Mike Shedlock via MishTalk.com, A friend of mine in the shipping business has comments on a trucking article he sent. Let’s tune in…

Truck image courtesy of Produce News Truck Rates Abysmal, But Some lanes ActiveProduce News reports Truck Rates Abysmal, But Some lanes Active

|

|

A Third Of US Investors Are Open To Trusting AI Financial AdviceAuthored by Jesse Coghlan via CoinTelegraph.com, Around one in three United States investors would be open to following AI-generated financial advice without verifying it with another source, according to a recent survey.

On Aug. 22, the Certified Financial Planner Board of Standards released the results of a poll that surveyed over 1,100 adults in early July. Only 31% of the respondents had actually received financial planning advice from AI, with 80% recorded some level of satisfaction with the experience. Older respondents were more likely to be satisfied with the experience compared to those under 45 years of age. However, nearly a third of all surveyed respondents, whether they have tried it or not, indicated they’d be comfortable taking advice without verifying it. Read more at: https://www.zerohedge.com/technology/third-us-investors-are-open-trusting-ai-financial-advice |

|

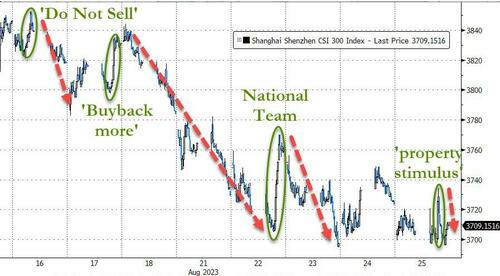

“Nothing’s Working” – China’s Latest ‘Stimulus’-Driven-Rally Lasted Just 30 MinsChina’s problems are growing… and their ability to ‘fix’ it seems to be fading fast. Having strong-armed funds into ‘not selling’ stock last week, then strongly-suggesting that companies escalate their share buyback programs (and then bullying banks into buying yuan to support the currency against the green back), and then clearly stepping with a ‘National Team’ panic bid (that didn’t work) Beijing was faced with the reality that nothing was working with Chinese stocks tumbling still. Most problematically, the half-lifes of these interventions is shrinking rapidly…

And as Bloomberg reports, overnight saw the shortest dur … Read more at: https://www.zerohedge.com/markets/nothings-working-chinas-latest-stimulus-driven-rally-lasted-just-30-mins |

|

Energy bills drop slightly for winter but will remain highA new price cap by regulator Ofgem means a typical home will pay £1,923 a year from October for energy. Read more at: https://www.bbc.co.uk/news/business-66607005?at_medium=RSS&at_campaign=KARANGA |

|

US faces more interest rate rises to cool inflationFederal Reserve chairman Jerome Powell said the pace of price increases remained “too high”. Read more at: https://www.bbc.co.uk/news/business-66618199?at_medium=RSS&at_campaign=KARANGA |

|

Renters’ rights violations to be investigatedThe UK’s competition authority said some landlords may not be following consumer protection rules. Read more at: https://www.bbc.co.uk/news/business-66614278?at_medium=RSS&at_campaign=KARANGA |

|

Treasury selloff drives key 5-year yield to highest since 2008The moves were relatively muted, given the recent volatility in the bond market. But they underscored the growing conviction that the Fed is likely to keep monetary policy tight to prevent the resilient economy from reigniting inflation. Read more at: https://economictimes.indiatimes.com/markets/bonds/treasury-selloff-drives-key-5-year-yield-to-highest-since-2008/articleshow/103070925.cms |

|

JSW Steel to pick up 20%-40% stake in Teck’s coal unit: ReportIndia’s biggest steel producer intends to bid for 20% to 40% of Elk Valley Resources Ltd., a unit of the Canadian company, Jindal said. JSW, along with some Japanese and South Korean mills, is planning to buy a stake in the asset and a combined offer could value the unit at $8 billion, he said Read more at: https://economictimes.indiatimes.com/markets/stocks/news/jsw-steel-to-pick-up-20-40-stake-in-tecks-coal-unit-report/articleshow/103071273.cms |

|

Sebi warns brokers against unregulated financial influencersThe Securities and Exchange Board of India (Sebi) said in a consultation paper that influencers not registered with the relevant financial sector regulator might not have the requisite qualifications or expertise on the subject. Read more at: https://economictimes.indiatimes.com/tech/technology/sebi-proposes-brokers-stay-away-from-unregulated-financial-influencers/articleshow/103070767.cms |

|

Metals Stocks: Gold logs first weekly win after four straight lossesGold prices declined on Friday as the U.S. dollar powered higher after Federal Reserve Chair Jerome Powell left the door open to more interest-rate hikes later this year in his speech in Jackson Hole, Wyo. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7254-0569DBD5A156%7D&siteid=rss&rss=1 |

|

‘I have a pension; they don’t’: Why United Auto Workers are fighting to end a two-tier system for wages and benefitsUnited Auto Workers members at the Big Three automakers voted to authorize a strike if no deal is reached. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724F-C8EB11B0DA8F%7D&siteid=rss&rss=1 |

|

Key Words: What do remote workers have in common with the moon landing? Economist Robert Shiller explains.Shiller, a Nobel Prize-winning professor of economics at Yale University, predicts a ‘revolution’ by workers over remote work. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7254-57563DD61D54%7D&siteid=rss&rss=1 |