Summary Of the Markets Today:

- The Dow closed down 291 points or 0.84%,

- Nasdaq closed down 1.17%,

- S&P 500 closed down 0.77%,

- Gold $1,919 down $8.80,

- WTI crude oil settled at $80 up $0.70,

- 10-year U.S. Treasury 4.288% up 0.030 points,

- USD Index $103.43 up $0.001,

- Bitcoin $27,870 down $1,212,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

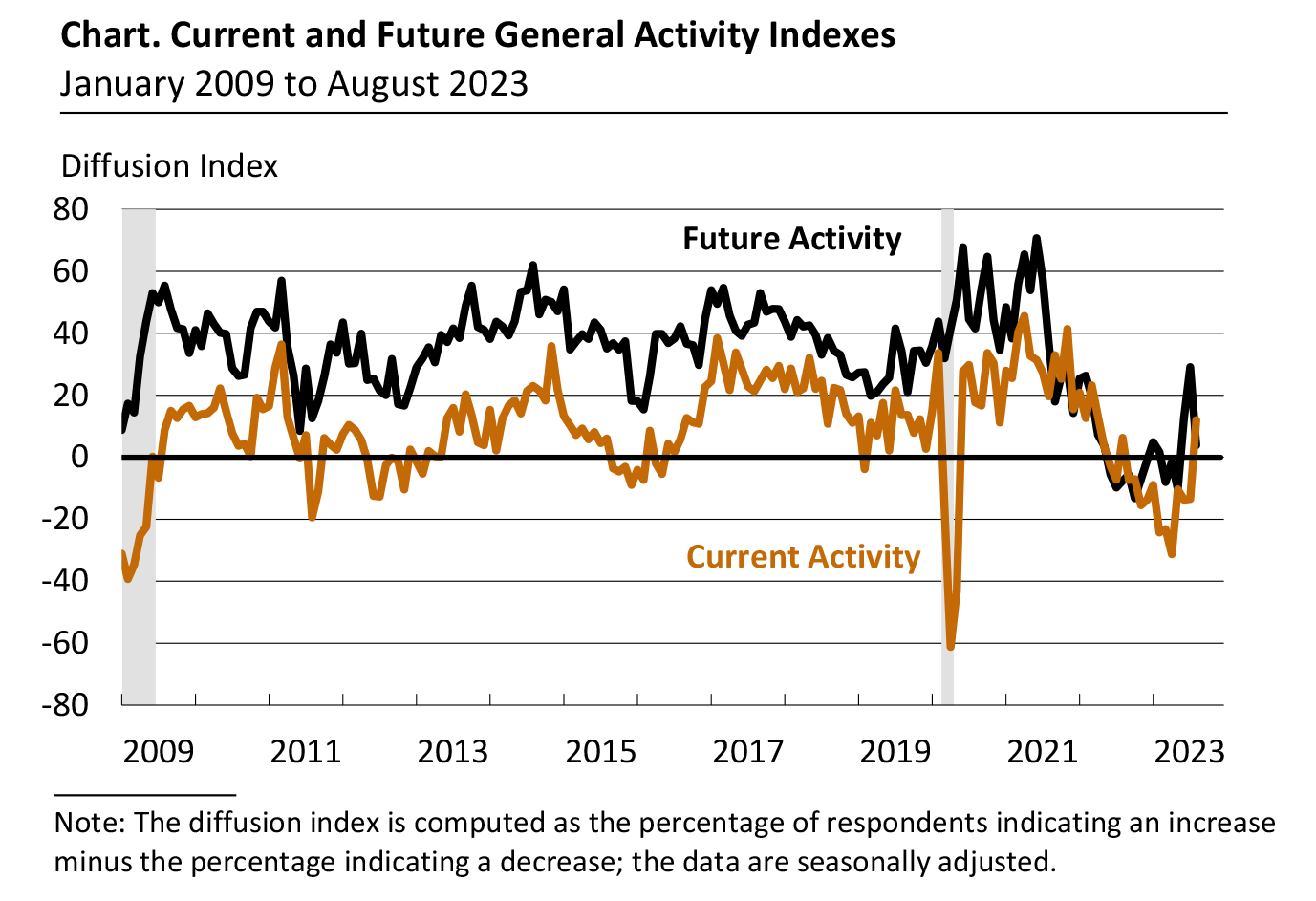

Manufacturing activity in the region expanded overall according to the August 2023 Philly Fed Manufacturing Business Outlook Survey. The survey’s indicators for general activity, new orders, and shipments were all positive for the first time since May 2022. This is in sharp contrast to other regional surveys which show manufacturing in a recession.

In the week ending August 12, the advance figure for seasonally adjusted unemployment initial claims 4-week moving average was 234,250, an increase of 2,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 231,000 to 231,500.

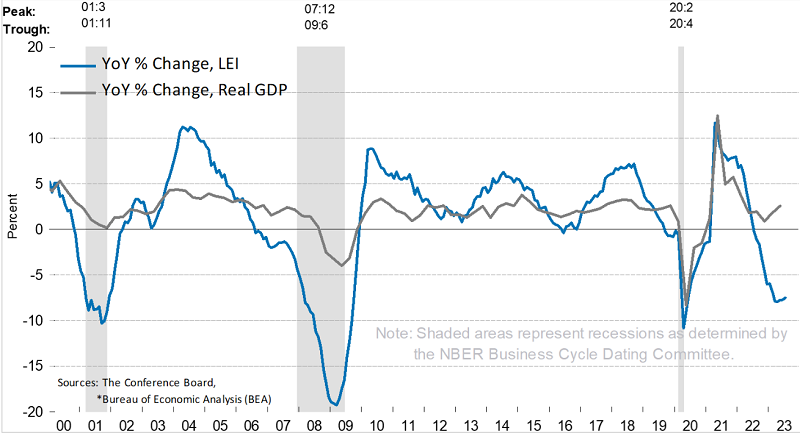

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.4 percent in July 2023 to 105.8 (2016=100), following a decline of 0.7 percent in June. The LEI is down 4.0 percent over the six-month period between January and July 2023—a slight deterioration from its 3.7 percent contraction over the previous six months (July 2022 to January 2023). Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The US LEI—which tracks where the economy is heading—fell for the sixteenth consecutive month in July, signaling the outlook remains highly uncertain. On the other hand, the coincident index (CEI)—which tracks where economic activity stands right now—has continued to grow slowly but inconsistently, with three of the past six months not changing and the rest increasing. As such, the CEI is signaling that we are currently still in a favorable growth environment. However, in July, weak new orders, high-interest rates, a dip in consumer perceptions of the outlook for business conditions, and decreasing hours worked in manufacturing fueled the leading indicator’s 0.4 percent decline. The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead. The Conference Board now forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan.

Here is a summary of headlines we are reading today:

- Saudi Aramco Tops Profit Chart, Leaving Tech Titans In Its Wake

- Citigroup Says To Short Oil After Summer Is Over

- Turkey’s Appetite For Gold Increases As Lira Plummets

- Brazil Looks To Introduce Emissions Cap

- WoodMac: Fivefold Annual Jump In Global Offshore Wind Is “Unrealistic”

- Former Tesla Employees Raise $26 Billion For New Energy Startups

- Dow tumbles nearly 300 points as stocks fall for a third straight day and yields pop: Live updates

- Three ways Walmart and Target are diverging as consumers watch their wallets

- House Republicans subpoena Citibank over info shared with FBI after Jan. 6

- 10-year yield rises to highest level since October 2022

- ‘Streamflation’ Bites As Searches To Cancel Hulu And Disney+ Erupt Nationwide

- Bond Report: 10- and 30-year Treasury yields end at their highest levels since 2007 and 2011

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Offshore Wind Red Tape Costing UK Tax Payers £1.5 Billion Per YearBill payers are being left £1.5bn worse off per year due to Treasury red tape blocking new offshore wind projects, according to new research from the Energy and Climate Intelligence Unit (ECIU). The climate body warns that Treasury rules that constrain the number of contracted farms allotted at offshore wind auctions will constrain the number of projects being approved and keep bills higher. Offshore wind projects are secured through bidding processes – known as allocation rounds – where projects are given income guarantees known… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Offshore-Wind-Red-Tape-Costing-UK-Tax-Payers-15-Billion-Per-Year.html |

|

U.S. Sanctions Lebanese Environmental Activist Aiding HezbollahThe United States has imposed sanctions on Lebanese environmental organization Green Without Borders (GWB) accusing it of being an arm of the Hezbollah terror group. The U.S. Treasury Department’s Office of Foreign Assets Control has designated GWB and its leader, Zuhair Subhi Nahla, for providing support and cover to Hezbollah in southern Lebanon along the Blue Line “while operating under the guise of environmental activism.” According to the Treasury Department, Hezbollah operatives man GWB outposts and provide cover for Hezbollah’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Sanctions-Lebanese-Environmental-Activist-Aiding-Hezbollah.html |

|

Saudi Aramco Tops Profit Chart, Leaving Tech Titans In Its WakeAccording to the Forbes Global 2000, Saudi state oil enterprise Saudi Aramco is once again the world’s most profitable company – this time with a big lead over second-placed Apple as oil and gas prices skyrocketed as part of the global energy crisis in the aftermath of the Russian invasion of Ukraine. As Statista’s Katharina Buchholz reports, there are now three oil and gas giants among the top 8 most profitable companies in the world – up from just one in 2019. You will find more infographics at Statista Saudi Aramco had already… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Aramco-Tops-Profit-Chart-Leaving-Tech-Titans-In-Its-Wake.html |

|

Citigroup Says To Short Oil After Summer Is OverCitigroup is advising traders to short oil and oil products after the summer is over, after which the current oil price rally will be over. A hurricane—and only a hurricane—is the one thing that could change the fatter supply outlook for the post-summer months. Citigroup’s commodity research team warned traders that global oil demand typically peaks in August—but it went a step further, casting doubt on recent forecasts of tighter global crude oil supply from agencies including the Energy Information Administration (EIA),… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Citigroup-Says-To-Short-Oil-After-Summer-Is-Over.html |

|

Turkey’s Appetite For Gold Increases As Lira PlummetsVia SchiffGold.com, Turkey’s love affair with gold has had a major impact on global gold flows, especially through the first half of 2023. Turks have historically held a lot of gold, both in jewelry and investment form. The country ranks as the fifth-largest gold market in the world. But with recent economic turmoil in the country demand for gold has exploded. According to the World Gold Council, Turkish demand for gold bars and gold coins increased five-fold during the second quarter of this year, pushing total demand to a record 98 tons… Read more at: https://oilprice.com/Metals/Gold/Turkeys-Appetite-For-Gold-Increases-As-Lira-Plummets.html |

|

Brazil Looks To Introduce Emissions CapThe Brazilian government is considering an emissions cap and protection for indigenous communities involved in carbon offsetting as part of a new carbon market, Rafael Dubeux, a senior coordinator of the country’s energy transition plan, told Reuters in an interview. Brazilian President Luiz Inacio Lula da Silva and his administration are looking to accelerate an “ecological and energy transformation” after Lula’s predecessor, former president Jair Bolsonaro, presided over record deforestation in the Amazon. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazil-Looks-To-Introduce-Emissions-Cap.html |

|

Standard Chartered: All-Time-High Demand Will Push Oil To $100U.S. oil futures slipped below $81/bbl on Tuesday after weak economic data out of China prompted surprise interest rate cuts by the People’s Bank of China. China’s industrial production rose 3.7% in July compared to a year ago, well below the 4.4% increase analysts had predicted while real estate investment in July accelerated to a 8.5%Y/Y decline. Thankfully,oil-specific data came in much more positive, with refiners processing 14.93M bbl/day of crude oil in July, up 31% Y/Y and 40,000 bbl/day higher than the June figure. China… Read more at: https://oilprice.com/Energy/Crude-Oil/Standard-Chartered-All-Time-High-Demand-Will-Push-Oil-To-100.html |

|

WoodMac: Fivefold Annual Jump In Global Offshore Wind Is “Unrealistic”Governments’ collective target to have offshore wind capacity jump fivefold annually by 2030 is unrealistic and would require $27 billion of secured investment by 2026 if it is to meet that growth in annual installations, excluding China, by the end of the decade, Wood Mackenzie said in a new report on Thursday. Governments in the U.S. and Europe plan to significantly increase offshore wind capacity to boost green energy and reduce dependence on foreign fossil fuel sources. The Biden Administration alone targets to build 30 gigawatts (GW)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WoodMac-Fivefold-Annual-Jump-In-Global-Offshore-Wind-Is-Unrealistic.html |

|

UN Official Calls For Immediate Relief In Nagorno-Karabakh??A senior UN official told the United Nations Security Council on August 16 that the delivery of humanitarian relief to Nagorno-Karabakh by the International Committee of the Red Cross (ICRC) must be allowed to resume through any available routes. Edem Wosornu said the ICRC is doing everything it can but can only cover the most urgent needs. “Other impartial humanitarian relief must also be allowed to reach civilians who need it, and a sustainable solution for safe and regular transit of people and goods must be found,” Wosornu said.Wosornu spoke… Read more at: https://oilprice.com/Geopolitics/International/UN-Official-Calls-For-Immediate-Relief-In-Nagorno-Karabakh.html |

|

China Seeks More Secrecy In Its Energy Sector To Protect National SecurityChina needs to exercise extreme discretion and protect the secrecy of its energy sector to safeguard its national security against unfriendly foreign forces, a top Chinese energy official said on Wednesday. “It is necessary to increase propaganda around ensuring confidentiality, give full play to the traditions of confidentiality in nuclear, petroleum and other energy industries, organize and hold various activities, actively foster a culture of protecting secrets and extreme discretion,” Zhang Jianhua, the director of China’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Seeks-More-Secrecy-In-Its-Energy-Sector-To-Protect-National-Interests.html |

|

India And The UAE Close First Oil Deal In RupeesAuthored by Michael Maharrey via SchiffGold.com, In another blow to dollar dominance, India and the United Arab Emirates settled an oil trade without converting local currencies to dollars for the first time on Monday, as India’s top refiner made a payment for oil in rupees. Indian Oil Corp. bought a million barrels of oil from Abu Dhabi National Oil Company in a dollar-free transaction. The oil sale was the first after the two countries entered a Memorandum of Understanding (MoU) in July. The deal established the Local Currency Settlement… Read more at: https://oilprice.com/Energy/Crude-Oil/India-And-The-UAE-Close-First-Oil-Deal-In-Rupees.html |

|

UK’s Truck Fleet Faces Pressure To Go GreenThe mission to get the UK’s fleet of trucks to go green is failing to take off, new figures have revealed, due to ongoing concerns about the lack of available electric or hydrogen charging points throughout the country. Heavy Goods Vehicles (HGVs) currently produce nearly 20 per cent of all transport emissions in the UK, despite making up only 1.5 per cent of vehicles on the road. New figures out today show that despite the boom in electric car sales over the last few years, the country’s fleet of lorries is failing to go green. Electric… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UKs-Truck-Fleet-Faces-Pressure-To-Go-Green.html |

|

Former Tesla Employees Raise $26 Billion For New Energy StartupsFormer executives at Tesla, who have seen the early-day struggles of the world’s most famous EV brand, have raised more than $26 billion after leaving Tesla to develop their own green energy startups. More than 30 startups have been either launched or led by ex-Tesla managers, and those firms have raised billions from investors in the past decade, according to an analysis of The Wall Street Journal based on data from PitchBook. Executives who have co-founded Tesla, worked on its first-ever vehicle, Roadster, or presided over… Read more at: https://oilprice.com/Energy/Energy-General/Former-Tesla-Employees-Raise-26-Billion-For-New-Energy-Startups.html |

|

China Likely Tapped Its Crude Inventories In JulyChinese refiners likely tapped their crude stockpiles in July as crude processing ramped up while imports slumped from the previous month, estimates by Reuters columnist Clyde Russell based on official Chinese data showed on Wednesday. Before July, China was estimated to have been stockpiling crude, and accelerating the pace of building inventories. Cheap Russian oil helped China accelerate the pace of stockpiling crude in June to the largest monthly additions to inventories in three years, Reuters’ Russell estimated last month. In July,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Likely-Tapped-Its-Crude-Inventories-In-July.html |

|

Kurdistan Oilfield Restarted Despite Ongoing Export HaltNorwegian oil and gas operator DNO ASA said on Wednesday that oil production from its Tawke field in Kurdistan had been restarted following a four-month shut-in triggered by the closure of the Iraq-Turkey Pipeline export route. The export route remains closed and “there is no light at the end of the export pipeline,” DNO said today. DNO restarted oil production last month to conduct well integrity tests and synchronize reservoir models but has continued production in response to strong demand for Tawke oil. Field output currently… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistan-Oilfield-Restarted-Despite-Ongoing-Export-Halt.html |

|

Dow tumbles nearly 300 points as stocks fall for a third straight day and yields pop: Live updatesStocks dropped Thursday as investors digested the Federal Reserve’s latest commentary that future rate hikes are not out of the picture. Read more at: https://www.cnbc.com/2023/08/16/stock-market-today-live-updates.html |

|

Three ways Walmart and Target are diverging as consumers watch their walletsThe two big-box retailers’ fiscal second-quarter results had sharp differences, even as economic factors shape consumer spending. Read more at: https://www.cnbc.com/2023/08/17/walmart-and-target-earnings-key-trends-for-retailers.html |

|

House Republicans subpoena Citibank over info shared with FBI after Jan. 6The subpoena comes after a voluntary request to several financial institutions for the information. Read more at: https://www.cnbc.com/2023/08/17/house-republicans-subpoena-citibank-over-data-shared-after-jan-6.html |

|

Weight loss drugs are priced substantially higher in the U.S. than in other countries, analysis saysThe KFF analysis comes as many U.S. health insurers balk at the extreme cost of weight loss drugs and drop the medications from their plans. Read more at: https://www.cnbc.com/2023/08/17/weight-loss-drugs-cost-more-in-us-kff-says.html |

|

CVS stock plunges after Blue Shield of California drops retailer’s pharmacy services to save on drug costsBlue Shield’s announcement hints at the potential for health insurers to abandon the traditional pharmacy benefit management system. Read more at: https://www.cnbc.com/2023/08/17/cvs-stock-blue-shield-of-california-drops-pbm-services.html |

|

This biotech stock is a cancer-fighting ‘powerhouse’ with nearly 50% upside, says JefferiesThe firm initiated coverage on an “oncology powerhouse” with a rich portfolio. Read more at: https://www.cnbc.com/2023/08/17/this-cancer-fighting-biotech-stock-has-nearly-50percent-upside-says-jefferies.html |

|

10-year yield rises to highest level since October 2022U.S. Treasury yields were mixed Thursday as investors digested minutes from the Fed’s latest meeting and weighed the outlook for inflation and interest rates. Read more at: https://www.cnbc.com/2023/08/17/us-treasury-yields-nvestors-digest-fed-meeting-minutes.html |

|

SpaceX reportedly turned a profit in the first quarterThe rare look at SpaceX’s financials offers a clue into how the company is faring while it ramps up Starlink and races to get the Starship rocket flying. Read more at: https://www.cnbc.com/2023/08/17/spacex-reported-a-profit-in-the-first-quarter-wsj-says.html |

|

‘Defend Trump’: Pro-DeSantis group’s memo reveals possible debate strategyThe memo’s goals for DeSantis: Attack Biden, defend Trump from Chris Christie’s criticism and “hammer” Vivek Ramaswamy. Read more at: https://www.cnbc.com/2023/08/17/defend-trump-desantis-groups-memo-reveals-possible-debate-strategy.html |

|

Genesis and FTX settle for $175 million bankruptcy claim, court docs say: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World takes a deep dive into spot bitcoin ETF’s and what the approval could mean for the crypto industry and investors. Read more at: https://www.cnbc.com/video/2023/08/17/genesis-ftx-reach-deal-175-million-bankruptcy-claim-crypto-world.html |

|

He paid for the first date. When she didn’t want a second, he asked for his money backSome women say they’ve had a date ask for his money back after they explained they didn’t want to go out again. Read more at: https://www.cnbc.com/2023/08/17/he-paid-for-the-first-date-and-he-asked-for-his-money-back.html |

|

Here’s why Americans can’t stop living paycheck to paycheckWith well over half of Americans living paycheck to paycheck, many are failing to meet some of their modest financial goals. Read more at: https://www.cnbc.com/2023/08/17/heres-why-americans-cant-stop-living-paycheck-to-paycheck.html |

|

Looming auto workers strike could cost $5 billion in just 10 days, new analysis saysA work stoppage by nearly 150,000 UAW workers would result in an economic loss of more than $5 billion after 10 days, according to Anderson Economic Group. Read more at: https://www.cnbc.com/2023/08/17/uaw-strike-cost-aeg-analysis.html |

|

How Far West Are The BRICS?Via The Automatic Earth blog, A topic we can have nice discussions about ahead of next week’s BRICS+++ meeting in South Africa. As I said recently, BRICS have momentum, and they can’t stop that, not even China could if they wanted. The desire to create a space NOT controlled by US/EU/NATO is just too great. That said, the tentative “bloc” has plenty issues to solve. How do all the 50+ or so countries who want to join, end up satisfied with their place in the order? If they establish a currency, will it be gold based? And what will that mean for countries who don’t have much gold but still want to join? I think they will announce a schedule next week for Pakistan, Argentina, Indonesia, Saudi Arabia, Iran, Nigeria, the real “big brothers”, to join, in some capacity, and take it from there. That would add another 1-2 billion people to their team of already 3.5 billion. And then we will talk about PPP GDP. Andrew has his thoughts, just as valuable. Andrew Korybko: “Alt-Media Was In Shock After The BRICS Bank Confirmed That It Complies With Western Sanctions” last month, and now the Alt-Media Community (AMC) just got hit with two more truth bombs after other leading officials confirmed that it doesn’t want to de-dollarize and is … Read more at: https://www.zerohedge.com/geopolitical/how-far-west-are-brics |

|

‘Streamflation’ Bites As Searches To Cancel Hulu And Disney+ Erupt NationwideThis fall, Disney+ and Hulu will hike prices on their ad-free plans. Disney+’s monthly subscription will jump from $11 to $14, while Hulu’s will go from $15 to $18. For those who have been counting, Disney+ now costs twice as much as it did versus its 2019 launch. In other words, entertainment giants have unleashed ‘streamflation’ on their respective customer bases. So with Disney+ and Hulu price hikes expected on Oct. 12, we want to see how heavily indebted consumers with personal savings dwindling and student loan payments restarting have reacted to streamflation. The results are not great: Google Trends reveal “Cancel Disney Plus” and “Cancel Hulu” searches have erupted nationwide: Cancel Disney Plus Read more at: https://www.zerohedge.com/markets/streamflation-bites-searches-cancel-hulu-and-disney-erupt-nationwide |

|

“A Monopoly In Expressing Its Views”: D.C. Circuit Hands Down Major Free Speech Victory For Pro-Life GroupAuthored by Jonathan Turley, The U.S. Court of Appeals for the D.C. Circuit has handed down a major victory for free speech against the District of Columbia. In Frederick Douglass Foundation v. District of Columbia, Judge Neomi Rao reversed district court judge James E. Boasberg who dismissed the challenge by pro-life protesters who alleged that they were treated differently from Black Lives Matter (BLM) protesters. The selective enforcement of city ordinances gave what Judge Rao called “a monopoly in expressing its views . . . the antithesis of constitutional guarantees.” Read more at: https://www.zerohedge.com/political/monopoly-expressing-its-views-dc-circuit-hands-down-major-free-speech-victory-pro-life |

|

Russia Flaunts NATO “Trophies” At Moscow Annual Army ExpoRussia is showing off some captured US and Western supplied hardware taken from the battlefield in Ukraine at the Moscow annual Army International Military-Technical Forum. Among these are items that appear in mint condition. The forum, more commonly dubbed Army 2023, features Russia’s leading defense companies displaying their latest defense tech among some 1,500 total unique military items. This ranges from stealth jets, to battlefield medical equipment, to military grade earth-movers.

Below, for example, is an American armored personnel carrier, seen in the foreground, and a British armored vehicle in the center. Read more at: https://www.zerohedge.com/military/russia-flaunts-trophies-moscow-annual-army-expo |

|

World Cup final: Government supports relaxed alcohol laws for SundayThe government supports pubs trade body who wants to serve alcohol on Sunday from 10:00 BST. Read more at: https://www.bbc.co.uk/news/business-66532694?at_medium=RSS&at_campaign=KARANGA |

|

Cash, cars and homes seized in $735m Singapore anti-money laundering raidsThe operation was part of one of the city-state’s biggest ever anti-money laundering investigations. Read more at: https://www.bbc.co.uk/news/business-66529632?at_medium=RSS&at_campaign=KARANGA |

|

Housing Benefit freeze leaves renters ‘£200 short’ every monthPeople on housing benefit say there are hardly any homes available to rent at prices they can afford. Read more at: https://www.bbc.co.uk/news/uk-england-wiltshire-66524739?at_medium=RSS&at_campaign=KARANGA |

|

7 Nifty50 stocks that saw over 5% EPS upgrades post Q1 nosSeven Nifty constituents saw earnings per share (EPS) upgrades of over 5% for FY24 following their Q1 earnings. EPS is an important financial measure, which indicates the profitability of a company. It is calculated by dividing the company’s net income by its total number of outstanding shares. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. The higher the earnings per share of a company, the better its profitability. (Data Source: ACE Equity) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/high-hopes-7-nifty50-stocks-saw-over-5-eps-upgrades-post-q1-results/profitability-check/articleshow/102798811.cms |

|

NSE Indices changes criteria to calculate price-to-book value for indicesThe changes in the criteria will take effect from September 29, NSE Indices said. NSE Indices has also revised the eligibility criteria for inclusion of stocks in several sectoral/market cap indices Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-indices-changes-criteria-to-calculate-price-to-book-value-for-indices/articleshow/102811020.cms |

|

Tech View: Nifty charts hint at non-directional nature. What traders should do on FridayThe negative chart pattern like lower tops and bottoms is active on the daily chart and the market has not shown any decisive upside bounce so far.India VIX was up by 0.99% from 12.12 to 12.24 levels. Volatility rose above 12.5 during the day and has been rising from the last few sessions Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-non-directional-nature-what-traders-should-do-on-friday/articleshow/102806810.cms |

|

Bond Report: 10- and 30-year Treasury yields end at their highest levels since 2007 and 2011Long-dated U.S. yields continue to rise on Thursday as real or inflation-adjusted rates also climbed. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724C-29E111CDDCA3%7D&siteid=rss&rss=1 |

|

The Margin: Michael Oher case: What’s the difference between conservatorship and adoption?Oher, whose story was featured in “The Blind Side,” says he was never adopted, but was put in a conservatorship instead. Here’s the difference between the two legal terms. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724A-6F113195610D%7D&siteid=rss&rss=1 |

|

Where Should I Retire?: This Ecuadorean city in the Andes has perfect weather — and you can retire there for as little as $1,500 a month“If the place you live in doesn’t delight and amaze you every day, you’re doing it wrong. And that’s how I feel about Cuenca,” says Saralee Squires. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7EE4-2D98A0C23C5D%7D&siteid=rss&rss=1 |

Display at Moscow annual Army International Military-Technical Forum, via TASS.But this year for the first time Russia’s military showed off a large amount of seized “war trophies” — including captured and destroyed armored vehicles from NATO countries.

Display at Moscow annual Army International Military-Technical Forum, via TASS.But this year for the first time Russia’s military showed off a large amount of seized “war trophies” — including captured and destroyed armored vehicles from NATO countries.