Summary Of the Markets Today:

- The Dow closed down 181 points or 0.52%,

- Nasdaq closed down 1.15%,

- S&P 500 closed down 0.76%,

- Gold $1,923 down $12.20,

- WTI crude oil settled at $79 down $1.79,

- 10-year U.S. Treasury 4.270% up 0.047 points,

- USD Index $103.49 up $0.28,

- Bitcoin $29,100 down $55,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In July 2023, total industrial production declined 0.2% year-over-year. Components manufacturing declined 0.7% year-over-year, mining was up 2.9% year-over-year, whilst utilities declined 0.9% year-over-year. Capacity utilization moved up to 79.3 percent in July, a rate that is 0.4 percentage points below its long-run (1972–2022) average. Overall, industrial production remains in a recession and is little changed over the last 5 months.

Privately‐owned housing units authorized by building permits in July 2023 were 13.0% below July 2022. Housing starts were up 5.9% year-over-year. Housing completions were down 11.8 % year-over-year. It appears new housing is beginning to break out of its recession.

Today, the Federal Reserve released the minutes for the FOMC meeting which ended on 26 July 2023. Interesting statements in the minutes:

… tighter credit conditions for households and businesses were likely to weigh on economic activity, hiring, and inflation. However, participants agreed that the extent of these effects remained uncertain. Against this background, the Committee remained highly attentive to inflation risks.

… Participants commented that monetary policy tightening appeared to be working broadly as intended and that a continued gradual slowing in real GDP growth would help reduce demand–supply imbalances in the economy. Participants assessed that the ongoing tightening of credit conditions in the banking sector, as evidenced in the most recent surveys of banks, also would likely weigh on economic activity in coming quarters.

… Participants judged that, over coming quarters, firms would reduce the pace of their investment spending and hiring in response to tight financial conditions and the slowing of economic activity.

… They noted evidence that labor demand was easing—including declines in job openings, lower quits rates, more part-time work, slower growth in hours worked, higher unemployment insurance claims, and more moderate rates of nominal wage growth. In addition, they remarked on indications of increasing labor supply, including a further rise in the prime-age participation rate to a post-pandemic high.

… Participants cited a number of tentative signs that inflation pressures could be abating. These signs included some softening in core goods prices, lower online prices, evidence that firms were raising prices by smaller amounts than previously, slower increases in shelter prices, and recent declines in survey estimates of shorter-term inflation expectations and of inflation uncertainty.

… With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy. Some participants commented that even though economic activity had been resilient and the labor market had remained strong, there continued to be downside risks to economic activity and upside risks to the unemployment rate; these included the possibility that the macroeconomic effects of the tightening in financial conditions since the beginning of last year could prove more substantial than anticipated. A number of participants judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two sided, and it was important that the Committee’s decisions balance the risk of an inadvertent overtightening of policy against the cost of an insufficient tightening.

Here is a summary of headlines we are reading today:

- U.S. Gas Prices Hit Year High As Market Tightens

- Energy Transfer LP To Acquire Crestwood Equity Partners In $7B Deal

- Lula Aide Signals It’s Okay For Petrobras To Pursue Amazon Drilling

- Tesla Reignites Price War With More Cuts In China

- Fed officials see ‘upside risks’ to inflation possibly leading to more rate hikes, minutes show

- Aldi to acquire Winn-Dixie and Harveys Supermarket stores in Southern expansion

- Appeals court imposes restrictions on abortion pill, but drug will stay on the market for now

- Target Pride backlash adds to sales woes as culture wars rage in corporate America

- FOMC Minutes Signal Hawkish Fed Fears “Significant Upside Risks To Inflation”

- Inflation slows to 6.8% but flights and hotels keep prices high

- Movers & Shakers: Intel and Tower Semiconductor shares fall, Target’s stock gains, and more stocks on the move

- Bond Report: 10-year Treasury yield ends at 15-year high after Fed’s July minutes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UK Wind Projects To Get A Modern RefitWind turbines are routinely regarded as an energy source of the future, as debates spin over its upcoming role in the country’s supply mix. Yet, they are also a story of our past, with wind turbines stretching across our coastlines and nestling in our sunlit uplands for decades, with the first swirly structure being hoisted in 1887 by a pioneering Scottish engineer wanting to light up his holiday home, before a growing pipeline slowly emerged over the following century. The UK now has a 28GW bedrock of wind, both on land and sea, a robust… Read more at: https://oilprice.com/Energy/Energy-General/UK-Wind-Projects-To-Get-A-Modern-Refit.html |

|

U.S. Gas Prices Hit Year High As Market TightensU.S. gasoline prices have surged to their highest level this year, continuing their relentless climb. National average gas prices in the United States have inched up to $3.873 per gallon from $3.564 a month ago, while a gallon of diesel now averages $4.338 from $3.851 a month ago. In California and Washington, prices have surged above $5 a gallon. Strong demand and a series of refinery outages are largely to blame for the recent rise, while tightening markets have also been pushing crude prices up. Delta’s 185,000-barrel-per-day refinery in Trainer… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gas-Prices-Hit-Year-High-As-Market-Tightens.html |

|

Cost-Effective Catalyst To Supercharge Green Hydrogen ProductionAn Argonne National Laboratory team has developed a new catalyst composed of elements abundant in the Earth. It could make possible the low-cost and energy-efficient production of hydrogen for use in transportation and industrial applications. A multi-institutional team led by the U.S. Department of Energy’s (DOE) Argonne National Laboratory has developed a low-cost catalyst for a process that yields clean hydrogen from water. Other contributors include DOE’s Sandia National Laboratories and Lawrence Berkeley National Laboratory, as… Read more at: https://oilprice.com/Energy/Energy-General/Cost-Effective-Catalyst-To-Supercharge-Green-Hydrogen-Production.html |

|

Hungary Takes On EU In Sanctions ShowdownBefore heading off on their summer break, the ambassadors of the 27 EU member states agreed to review some of the individual sanctions on the mainly Russian people and companies that the bloc deems to have undermined Ukraine’s territorial integrity. Since the February 2022 invasion of Ukraine, the bloc has slapped asset freezes and visa bans on more than 1,800 individuals and entities, including Russian President Vladimir Putin, Foreign Minister Sergei Lavrov, and many oligarchs and businessmen close to the Kremlin. The rollover of these sanctions… Read more at: https://oilprice.com/Geopolitics/International/Hungary-Takes-On-EU-In-Sanctions-Showdown.html |

|

Energy Transfer LP To Acquire Crestwood Equity Partners In $7B DealNatural gas pipeline operator Energy Transfer LP (NYSE:ET) has announced it will acquire midstream energy company Crestwood Equity Partners LP (NYSE:CEQP) in an all-stock deal valued at ~$7.1B, including the assumption of $3.3B of debt. The merger will help expand Energy Tranfer’s natural gas and crude oil transportation network, give it exposure to the Powder River basin and extend its presence in the Williston and Delaware basins. Crestwood’s assets spread across the three basins, and include about 2 billion cubic feet per day of gas-gathering… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Transfer-LP-To-Acquire-Crestwood-Equity-Partners-In-7B-Deal.html |

|

Turkmenistan’s Pivot Westward Threatens Russia’s Gas DominanceA big shift is brewing for Caspian Basin energy exports. In a diplomatic about-face, Turkmenistan has signaled its readiness to develop a Trans-Caspian pipeline that potentially could increase natural gas deliveries to the European Union. The westward shift in Ashgabat’s export intentions is not expected to impact Turkmenistan’s ability to fulfill existing exportcommitments to China. The Central Asian state is believed to have more than enough reserves to send large volumes of gas eastward and westward. The Turkmen announcement,… Read more at: https://oilprice.com/Energy/Energy-General/Turkmenistans-Pivot-Westward-Threatens-Russias-Gas-Dominance.html |

|

Investors Boost Bullish Bets On European Natural Gas PricesOver the past week, portfolio managers have boosted their bullish bets on the benchmark European natural gas futures as supply concerns mounted with a potential strike at Australian LNG export facilities, adding to flow disruptions from Norway where some of the gas infrastructure is under maintenance. The position of the fund managers in European natural gas futures turned into a net long – the difference between bullish and bearish bets – for the first time this year and for the first time since October 2022, according to Wednesday… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Investors-Boost-Bullish-Bets-On-European-Natural-Gas-Prices.html |

|

What’s Standing In The Way Of Glencore’s Tie-Up With Teck Resources?Via Metal Miner Glencore continues to express interest in a tie-up with base metals producer Teck Resources. Recently, the multinational commodity trader and mining company proposed steps to address the Canadian firm’s concerns over carbon exposure as a result of any merger. The main source of contention for the deal is Teck’s coking coal operation. “Glencore is fully committed to ensuring that a transaction with Teck would benefit Canada and is open to working with Teck to identify a comprehensive suite of commitments… Read more at: https://oilprice.com/Energy/Coal/Whats-Standing-In-The-Way-Of-Glencores-Tie-Up-With-Teck-Resources.html |

|

Lula Aide Signals It’s Okay For Petrobras To Pursue Amazon DrillingThere isn’t a discrepancy in Brazil’s efforts to advance the energy transition and its state oil company Petrobras pursuing drilling in domestic frontier areas, the chief of staff of Brazilian President Luiz Inacio Lula da Silva said on Wednesday. Petrobras is looking to drill for oil and gas in the Amazon region. On the other hand, Brazil under Lula wants to accelerate the energy transition but it needs money to do that. “There is no contradiction. You indicate where you want to get and then you’ll need resources… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lula-Aide-Signals-Its-Okay-For-Petrobras-To-Pursue-Amazon-Drilling.html |

|

Oil Gives Up Gains Despite Large Crude DrawCrude oil prices moved slightly lower today after the Energy Information Administration reported an inventory decline of 6 million barrels for the week to August 11. That change compared with a build of 5.9 million barrels for the previous week, which in turn followed the biggest inventory draw in years, at 17 million barrels for the last week of July. A day earlier, the American Petroleum Institute estimated crude oil inventories had shed 6.2 million barrels in the week to August 11. In fuels, the EIA estimated mixed changes… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Gives-Up-Gains-Despite-Large-Crude-Draw.html |

|

Tesla Reignites Price War With More Cuts In ChinaTesla shares are slumping nearly 2% in pre-market trading on Wednesday after the automaker continued to cut prices – this time by as much as 6.9% for its Model S and Model X vehicles in China. The company posted on Weibo that its Model S price was being cut 6.7% to 754,900 yuan ($103,477) from 808,900 yuan prior. The company’s Model X is priced 6.9% lower at 836,900 yuan, down from 898,900, according to Reuters. This follows cuts the automaker made on Monday to its Model Y, which continued to keep Wall Street’s focus on the automaker’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Reignites-Price-War-With-More-Cuts-In-China.html |

|

Indonesia Delays $20 Billion Climate PlanDue to disagreements over policy, the cost of funding, and legal hurdles, Indonesia, the largest economy in Southeast Asia, is delaying the start of a $20 billion climate investment plan as part of a deal signed with the United States and other wealthy nations last year. The investment plan, in its draft, is not expected to be launched until later this year, because it would need unspecified “additional data” to be included, Indonesia said on Wednesday, as carried by Bloomberg. At the end of last year, Indonesia, the world’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indonesia-Delays-20-Billion-Climate-Plan.html |

|

Saudi Arabia’s Crude Oil Exports Slump To 21-Month Low In JuneSaudi Arabia’s crude oil exports dropped in June to the lowest level in 21 months, the latest data by the Joint Organizations Data Initiative (JODI) showed on Wednesday. The Kingdom, the world’s top crude oil exporter, shipped 6.80 million barrels per day (bpd) of crude in June, down by 124,000 bpd compared to May, according to JODI, which compiles self-reported data from many countries. In May, Saudi Arabia’s oil exports plunged below 7 million bpd for the first time this year as the Kingdom and several other large OPEC+ producers… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabias-Crude-Oil-Exports-Slump-To-21-Month-Low-In-June.html |

|

Germany Sees Natural Gas Prices Remaining High For YearsGermany expects natural gas prices to remain high until at least 2027, the government said on Wednesday in a report on the measures to mitigate high energy costs for households. Since the beginning of this year, when the so-called price brake was introduced, the federal government has paid a total of $19.6 billion (18 billion euros) to help vulnerable customers. The energy price relief is working, the government said, adding that the measures have helped to lower energy prices for consumers and curb inflation. Natural gas prices could rise in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Sees-Natural-Gas-Prices-Remaining-High-For-Years.html |

|

China’s Oil Imports From Iran Set To Hit Decade-High In AugustChina is expected to import as much as 1.5 million barrels per day (bpd) of crude oil from Iran in August, the highest since 2013, per estimates from data intelligence firm Kpler cited by Bloomberg. During the period January to July 2023, China received on average 917,000 bpd of oil from Iran, according to Kpler’s estimates. The world’s largest crude oil importer, China, has been ramping up purchases of cheaper Iranian crude this year as competition with India for cheap Russian crude supply has intensified. Earlier this year,… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Oil-Imports-From-Iran-Set-To-Hit-Decade-High-In-August.html |

|

Fed officials see ‘upside risks’ to inflation possibly leading to more rate hikes, minutes showThe Federal Reserve on Wednesday released minutes from its July 25-26 policy meeting. Read more at: https://www.cnbc.com/2023/08/16/fed-meeting-minutes-signal-coming-rate-moves.html |

|

‘Barbie’ beats Batman, becomes Warner Bros.’ highest-grossing domestic release“Barbie” has topped $537 million, making it the highest-grossing domestic movie in Warner Bros. Discovery’s 100-year history. Read more at: https://www.cnbc.com/2023/08/16/barbie-tops-the-dark-knight-domestic-box-office-gross.html |

|

Aldi to acquire Winn-Dixie and Harveys Supermarket stores in Southern expansionThe German grocer has entered into an agreement to buy about 400 store locations from Winn-Dixie and Harveys Supermarket. Read more at: https://www.cnbc.com/2023/08/16/aldi-to-acquire-winn-dixie-and-harveys-supermarket-stores.html |

|

DA seeks March 4 trial date for Trump Georgia election caseFulton County District Attorney Fani Willis proposed a March 4 trial date for her case against former President Donald Trump. Read more at: https://www.cnbc.com/2023/08/16/da-seeks-march-4-trial-date-for-trump-georgia-election-case.html |

|

Hedge funds bought these Chinese technology stocks in the second quarterBig investors took a selective approach to China-based technology stocks in the second quarter, recent regulatory filings suggest. Read more at: https://www.cnbc.com/2023/08/16/hedge-funds-bought-these-chinese-technology-stocks-in-the-second-quarter.html |

|

Coinbase gets approval to offer crypto futures to U.S. retail investors: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Circle’s Chief Strategy Officer Dante Disparte discusses recent regulatory advancements for digital assets in the U.S. and what he thinks will happen next. Read more at: https://www.cnbc.com/video/2023/08/16/coinbase-gets-approval-crypto-futures-us-retail-investors-cnbc-crypto-world.html |

|

Appeals court imposes restrictions on abortion pill, but drug will stay on the market for nowThe order by the U.S. 5th Circuit Court of Appeals is almost certain to be appealed to the Supreme Court. Read more at: https://www.cnbc.com/2023/08/16/abortion-pill-appeals-court-ruling-on-mifepristone.html |

|

Target Pride backlash adds to sales woes as culture wars rage in corporate AmericaAs Target reported earnings, CEO Brian Cornell defended the company’s decision to pull some merchandise, but said it will continue to celebrate Pride month. Read more at: https://www.cnbc.com/2023/08/16/target-pride-backlash-hurts-sales-in-second-quarter-earnings.html |

|

Cava and Sweetgreen see delivery orders fall as customers pick up their own foodDelivery orders are usually more expensive due to added fees and even higher menu prices. Read more at: https://www.cnbc.com/2023/08/16/cava-sweetgreen-delivery-orders-fall-as-customers-pick-up-food.html |

|

Most Americans say Trump should face charges over 2020 election, poll findsThe poll was conducted just before Trump was hit with his latest indictment on charges of trying to reverse his loss to Biden in Georgia’s 2020 election. Read more at: https://www.cnbc.com/2023/08/16/trump-should-face-election-charges-most-americans-agree-poll.html |

|

Roundabouts are safer than traffic lights. So why are there so few in the U.S.?Research shows roundabouts reduce crashes, clear congestion and can save cities money. But they’ve met resistance in the U.S. Read more at: https://www.cnbc.com/2023/08/16/why-roundabouts-are-so-uncommon-in-the-us.html |

|

As recession fears fade, we may be experiencing a ‘richcession’ instead — here’s what that means for youSome economists say the country is already experiencing a “richcession,” rather than a broad contraction to come later. Read more at: https://www.cnbc.com/2023/08/16/rather-than-a-recession-we-could-be-in-a-richcession-instead.html |

|

Vietnamese EV maker VinFast is now worth more than Ford and GM after Nasdaq debutOn Tuesday, the Vietnamese electric vehicle maker listed on Nasdaq following the completion of its merger. Read more at: https://www.cnbc.com/2023/08/16/ev-maker-vinfast-is-now-worth-more-than-the-likes-of-ford-and-gm.html |

|

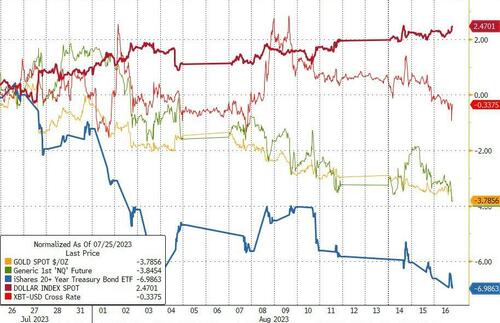

FOMC Minutes Signal Hawkish Fed Fears “Significant Upside Risks To Inflation”Since the last FOMC meeting (on July 26, when The Fed delivered the expected 25bps hike and almost unchanged statement), the dollar has rallied aggressively while bonds, bullion, and big-tech have been battered. Bitcoin is basically unch…

Source: Bloomberg Most notably, in equity-land, after an initial rise, we have seen cyclicals underperform defensives since the last FOMC meeting…

Source: Bloomberg Read more at: https://www.zerohedge.com/markets/fomc-minutes-signal-hawkish-fed-fears-significant-upside-risks-inflation |

|

The Great American BlunderAuthored by James Rickards via DailyReckoning.com, From a geopolitical perspective, the U.S. today has never been weaker than since the post-Vietnam era. Remember the images of U.S. helicopters taking off from its South Vietnamese embassy in 1975, loaded with refugees trying to escape the country? It was a national humiliation. So was the disastrous U.S. withdrawal from Afghanistan in 2022. Desperate Afghans, eager to escape Taliban rule, clung to American transports leaving Kabul. It might represent an even greater national humiliation. In both cases, U.S. weakness was on full display for the world to see. Its defeat in Vietnam led to Soviet geopolitical gains throughout the world. U.S. credibility around the world was restored during the 1980s as Reagan rebuilt the U.S. military into a powerful force. U.S. geopolitical power peaked after its dramatic victory in the First Gulf War in 1991. But the U.S. proceeded to squander that power in the wake of 9/11, with strategic failures in Iraq and Afghanistan. Meanwhile, for the past 20 years, the U.S. focused on fighting terrorists that have limited combat capability, not serious rivals like Russia with significant conventional forces. Read more at: https://www.zerohedge.com/markets/great-american-blunder |

|

At Least 17 Niger Soldiers Killed In Attack Near Mali BorderAt a moment of boiling tensions across Africa’s Sahel region related to the recent coup events in Niger, a major terror attack along the Niger-Mali border has left at least 17 Niger soldiers dead. A late Tuesday statement from Niger’s defense ministry described that “a detachment of the Nigerien Armed Forces (FAN) moving between Boni and Torodi was the victim of a terrorist ambush near the town of Koutougou [52km southwest of Torodi].”

The Niger Armed Forces say that its soldiers were ambushed while traveling between Boni and Torodi near Koutougou by over 100 jihadists riding on some 50 motorcycles. While initially the group of attackers weren’t … Read more at: https://www.zerohedge.com/geopolitical/least-17-niger-soldiers-killed-attack-near-mali-border |

|

“We Made This Bed, Now We Have To Lie In It” – John Rubino Warns New BRICS Currency Is “Bad For The Dollar”Via Greg Hunter’s USAWatchdog.com, Analyst and financial writer John Rubino has a new warning about the fate of the U.S. dollar with the announcement next week (Aug 22–24) of the new BRICS (Brazil, Russia, India, China and South Africa) currency.

There has been lots of speculation about it. Will it work? Is it gold backed? Will it immediately replace the U.S. dollar? 30 countries in all have signed onto the BRICS currency experiment. Rubino contends, “No matter what shape it takes, the new BRICS currency is bad for the dollar…”

|

|

Inflation slows to 6.8% but flights and hotels keep prices highLower energy prices are behind the slowdown but price rises in other areas mean some expect more interest rate hikes. Read more at: https://www.bbc.co.uk/news/business-66509365?at_medium=RSS&at_campaign=KARANGA |

|

Target sales suffer after Pride month backlashBoss Brian Cornell says firm will apply what it had “learned” from the controversy. Read more at: https://www.bbc.co.uk/news/business-66524497?at_medium=RSS&at_campaign=KARANGA |

|

UK rents rise at highest rates since 2016Prices paid by UK renters rose by 5.3% on average in the year to July – the highest level seen since 2016. Read more at: https://www.bbc.co.uk/news/business-66521015?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will D-Street action on ThursdayA small positive candle formed on the daily chart with minor upper and lower shadows. Technically, this indicates a side-by-side bull candle type pattern Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-d-street-action-on-thursday/articleshow/102779431.cms |

|

GQG, other investors pick up 8.1% in Adani Power in $1.1 billion dealWorldwide Emerging Market Holding, part of the promoter group, offloaded 1.2% stake. Another promoter entity Afro Asia Trade and Investments sold its entire stake in the deal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gqg-partners-likely-picked-up-stake-in-adani-power-via-block-deal-report/articleshow/102775223.cms |

|

IndiGo’s Gangwal family offloads 2.9% stake in Rs 2,800 crore dealRakesh Gangwal and his wife, Shobha Gangwal, held about 13.23% and 2.99%, respectively, in IndiGo at the end of June quarter, while their Chinkerpoo Family Trust holds a 13.5% stake, according to exchange data Read more at: https://economictimes.indiatimes.com/markets/stocks/news/indigos-gangwal-family-offloads-2-9-stake-in-rs-2800-crore-deal/articleshow/102777498.cms |

|

Movers & Shakers: Intel and Tower Semiconductor shares fall, Target’s stock gains, and more stocks on the moveHere are some of Wednesday’s notable stock moves. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724A-BAA02427373B%7D&siteid=rss&rss=1 |

|

Bond Report: 10-year Treasury yield ends at 15-year high after Fed’s July minutesLong-dated Treasury yields rise for a fifth straight session after the release of minutes from the Federal Reserve’s last meeting. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724A-F09C589305C2%7D&siteid=rss&rss=1 |

|

Housing market has hit ‘rock bottom,’ says Redfin CEO Glenn KelmanThis is turning out to be a long, cool summer — at least where the housing market is concerned. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-724B-991A19467E7A%7D&siteid=rss&rss=1 |

Image source: AFPAn additional 20 soldiers were wounded, and later evacuated to hospitals in the capital of Niamey. The army said that over 100 attackers were “neutralized”.

Image source: AFPAn additional 20 soldiers were wounded, and later evacuated to hospitals in the capital of Niamey. The army said that over 100 attackers were “neutralized”.