Summary Of the Markets Today:

- The Dow closed up 317 points or 0.93%,

- Nasdaq closed up 0.55%,

- S&P 500 closed up 0.67%,

- Gold $1,937 up $5.80,

- WTI crude oil settled at $75 up $1.93,

- 10-year U.S. Treasury 3.985% down 0.022 points,

- USD Index $101.70 down $0.27,

- Bitcoin $30,582 up $237,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

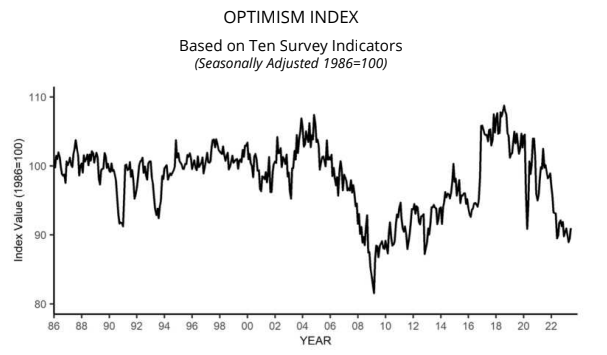

NFIB’s Small Business Optimism Index increased 1.6 points in June to 91.0, however, it is the 18th consecutive month below the 49-year average of 98. Inflation and labor quality are tied as the top small business concerns with 24% of owners reporting each as their single most important problem. The net percent of owners raising average selling prices decreased three points to a net 29% seasonally adjusted, still a very inflationary level but trending down. This is the lowest reading since March 2021. NFIB Chief Economist Bill Dunkelberg stated:

Halfway through the year, small business owners remain very pessimistic about future business conditions and their sales prospects. Inflation and labor shortages continue to be great challenges for small businesses. Owners are still raising selling prices at an inflationary level to try to pass on higher inventory, labor, and energy costs.

Here is a summary of headlines we are reading today:

- Goldman Sachs’ Currie: Oil’s Rally Is Unloved

- China Shaking Up Its Power, Oil, And Gas Markets

- Brent Breaches $79 On OPEC’s Production Cut Pledges

- Russia’s Crude Oil Exports Start To Show Signs Of Decline

- OPEC Expects Global Energy Demand To Jump By 23% By 2045

- Dow closes 300 points higher Tuesday as key consumer inflation report looms: Live updates

- This is why miners are selling their bitcoin at levels not seen since 2019

- Bank of America fined $150 million for consumer abuses including fake accounts, bogus fees

- The ‘Bitcoin Family’ has a special algorithm that tracks moon cycles — and it’s helped them gain 50% since the bear market bottom

- Futures Movers: Crude oil ends higher, Brent at highest since April, with U.S. supply data ahead

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Politics Of The Strategic Petroleum Reserve: A Comprehensive ReviewThe U.S. Strategic Petroleum Reserve (SPR) was established in December 1975 in the wake of the 1973 OPEC oil embargo. The law establishing the SPR said it was designed “to reduce the impact of severe energy supply interruptions” such as that caused by the embargo. The U.S. government began to fill the reserve in the late 1970s. At its high point in 2010, the level reach 727 million barrels. At present, it stands at 347 million barrels, the lowest level since August 1983. President Trump has repeatedly claimed that he “filled up”… Read more at: https://oilprice.com/Energy/Crude-Oil/The-Politics-Of-The-Strategic-Petroleum-Reserve-A-Comprehensive-Review.html |

|

Regulators Delay Approval For UK’s Largest Undeveloped Oil And Gas FieldApproval for Rosebank, the UK’s largest undeveloped oil and gas field, has been delayed again by regulators amid growing concerns over the project’s net zero requirements. Concerns relate to whether it will meet electrification requirements – which are key for reaching net zero and decarbonizing the energy grid. City A.M. understands the site, which was set to be green-lit by Offshore Petroleum Regulator for Environment and Decommissioning and the North Sea Transition Authority before parliamentary recess later this month, will… Read more at: https://oilprice.com/Energy/Crude-Oil/Regulators-Delay-Approval-For-UKs-Largest-Undeveloped-Oil-And-Gas-Field.html |

|

Goldman Sachs’ Currie: Oil’s Rally Is UnlovedThe OPEC+ production cuts are beginning to impact oil prices, Goldman Sachs’ Jeff Currie told CNBC on Tuesday. “What we’ve been waiting for for six months is finally beginning to play out,” Currie said when asked if we’re starting to see the beginnings of the bull case for oil. “Inventories in oil are drawing, Chinese demand is back to 15.9 million barrels per day, time spreads are tightening—all indications of a bull structure,” Currie said on Tuesday. However, Currie said, “Investors are entirely absent,” adding that this is an “unloved… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Currie-Oils-Rally-Is-Unloved.html |

|

Copper Prices Vulnerable As Global Manufacturing SlowsVia AG Metal Miner The Copper Monthly Metals Index (MMI) moved sideways, increasing by a modest 1.09% from June to July. Copper prices appear sideways after last month’s rally faltered. After June 22, prices began to retrace but found a bottom by the end of the month. They then enjoyed a modest rise during the first week of July. The current price direction does not support a strong enough trend to either side, which leaves the market uncertain and prone to volatility in the short term. However, at the start of the month, current… Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-Vulnerable-As-Global-Manufacturing-Slows.html |

|

China Shaking Up Its Power, Oil, And Gas MarketsChina approved on Tuesday proposals that would transform its oil, gas, and power markets, CCTV has reported. Under the proposals, China will construct a new power system intended to be “economically efficient, flexible and intelligent in supply and demand coordination,” the Chinese Communist Party’s commission for deepening reports said. Currently, China’s power grid is built on fixed, long-term power trading agreements, which has caused hydro-dependent provinces such as Sichuan to export power beyond its borders during… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Shaking-Up-Its-Power-Oil-And-Gas-Markets.html |

|

New Gas Discovery Boosts Azerbaijan’s Energy AspirationsAzerbaijan’s promise to double its annual gas exports to Europe by 2027 may be a step closer to realization with the news that BP has found new gas reservoirs beneath its existing Azeri–Chirag–Gunashli oil field (ACG) in the Caspian Sea. BP has confirmed to Eurasianet that the appraisal well it drilled to a depth of 4,500 meters below the ACG field has identified “deep-lying gas reservoirs” and that production could start as early as next year. The company did not state the size of the reserves it had identified or how much gas it expected… Read more at: https://oilprice.com/Energy/Natural-Gas/New-Gas-Discovery-Boosts-Azerbaijans-Energy-Aspirations.html |

|

Brent Breaches $79 On OPEC’s Production Cut PledgesOil prices climbed on Tuesday as the oil markets began to believe the narrative that oil could tighten in the second half of the year. Brent crude oil climbed above $79 per barrel on Tuesday, the highest price in months for the international oil benchmark, although still off last year’s prices by about $20 per barrel. WTI prices reached $74.52 per barrel on Tuesday, an increase of $1.60 (+2.19%) per barrel. Last week, Saudi Arabia announced that it was extending its 1 million bpd production cut into the month of August. It originally had voluntarily… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Breaches-79-On-OPECs-Production-Cut-Pledges.html |

|

Oil And Gas Well Intervention Spending Set To SkyrocketAs oil and gas production companies look for efficient and cost-effective methods of increasing their output, the well-intervention market is set to get a healthy boost. Spending on interventions – a way to extract additional resources from an existing well instead of drilling a new one – is projected to jump by almost 20% this year and total $58 billion. Rystad Energy’s modeling shows this is just the start of a surge in the coming years as the focus on efficiency intensifies. The intervention rate – how many oil and gas… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-And-Gas-Well-Intervention-Spending-Set-To-Skyrocket.html |

|

Sugar-Based Flow Battery Could Accelerate The Energy TransitionA next-generation flow battery design using a dissolved simple sugar has shown great promise in boosting the capacity and longevity of battery energy storage, which, if scaled, could revolutionize electrical grid energy storage. The flow battery maintained its capacity to store and release energy for more than a year of continuous charge and discharge, according to an experiment conducted by a research team from the Department of Energy’s Pacific Northwest National Laboratory. The sugar additive showed a surprise promising role as it was… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sugar-Based-Flow-Battery-Could-Accelerate-The-Energy-Transition.html |

|

UK’s Centrica Pens $8 Billion Mega Deal To Secure LNG From The U.S.British Gas owner Centrica has signed a £6.2bn ($8bn) mega deal with US fossil fuel producer Delta Midstream, in a welcome boost for the UK’s power supplies. The agreement IS for 1m tonnes per annum of liquefied natural gas (LNG) for 15 years, and means Centrica will take delivery of around 14 LNG cargoes per year. This could provide enough energy to heat five per cent of UK homes on an annual basis. Supplies will be shipped from Delfin Deepwater Port, located 40 miles off the coast of Louisiana, with first operations expected to commence… Read more at: https://oilprice.com/Energy/Natural-Gas/UKs-Centrica-Pens-8-Billion-Mega-Deal-To-Secure-LNG-From-The-US.html |

|

Russia’s Crude Oil Exports Start To Show Signs Of DeclineAfter months of high crude oil exports by sea, Russian shipments have started to show the first signs of a decline as they dropped below the levels from February, the baseline for Russia’s oil production cut of 500,000 barrels per day (bpd) that Moscow says began in March. Russian crude oil exports by sea dropped by 205,000 bpd to 3.21 million bpd on a four-week average basis in the four weeks to July 9, tanker-tracking data monitored by Bloomberg showed on Tuesday. The latest four-week average export volumes fell below the 3.38… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Exports-Start-To-Show-Signs-Of-Decline.html |

|

Turkey Clears Roadblock For Sweden’s Induction Into NATOOn July 10, on the eve of the NATO summit in Vilnius, Turkish President Recep Tayyip Erdogan signaled that Ankara was ready to ratify Sweden’s NATO accession protocol, potentially putting an end to a saga that has dragged on for over a year. Finland and Sweden, which were previously nonaligned militarily, applied for membership of the alliance in May 2022 following Russia’s full-scale invasion of Ukraine in February. Then in June 2022, at a summit in Madrid, NATO invited both countries to join, conditional on the ratification of every member… Read more at: https://oilprice.com/Geopolitics/International/Turkey-Clears-Roadblock-For-Swedens-Induction-Into-NATO.html |

|

A New Natural Gas Pipeline In The Barents Sea Could Cut Europe’s Reliance On LNGA possible new pipeline from the Barents Sea to carry natural gas from Norway’s Arctic gas platforms to Europe could ease the continent’s dependence on LNG imports, Wood Mackenzie said in a new report this week. Norway has become the single biggest supplier of natural gas to Europe after Russia cut off most pipeline deliveries last year following the invasion of Ukraine. But the only route for the natural gas produced in the Barents Sea to markets is via Equinor’s LNG export facility at Hammerfest. There are no direct links from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Barents-Sea-Gas-Pipeline-Could-Cut-Europes-Reliance-On-LNG.html |

|

OPEC Expects Global Energy Demand To Jump By 23% By 2045Global primary energy demand is expected to surge by 23% by 2045, OPEC’s Secretary General Haitham Al Ghais said on Tuesday, adding that all sources will be needed to meet that growing demand. “Global primary energy demand is forecast to increase by a significant 23% in the period up to 2045, which means we will need all forms of energy,” Al Ghais said at a petroleum conference in Nigeria, as carried by Reuters. Oil will continue to play an important role in the future of the energy mix, OPEC and its secretary general have said… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Expects-Global-Energy-Demand-To-Jump-By-23-By-2045.html |

|

Bullish Sentiment Is Slowly Building In Oil MarketsOil prices have been slowly moving higher in recent weeks as bullish sentiment begins to build on the back of Saudi Arabia’s supply cut and Russia’s pledge to cut its oil exports.Chart of the Week- China’s attempts to boost domestic industrial production are increasingly showing the limits of government stimulus despite international agencies such as OPEC or IEA continuing to bet on strong Chinese demand growth in H2 2023. – The year-on-year growth of broad money, known as M2 supply, has risen to 11.6% in most recent data readings, the… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Is-Slowly-Building-In-Oil-Markets.html |

|

Microsoft-Activision deal moves closer as judge denies FTC injunction requestThe U.S. government can now bring the judge’s decision to the U.S. Court of Appeals for the 9th Circuit. Read more at: https://www.cnbc.com/2023/07/11/microsoft-activision-deal-moves-closer-as-judge-denies-ftc-injunction.html |

|

Dow closes 300 points higher Tuesday as key consumer inflation report looms: Live updatesU.S. stocks rose Tuesday, after the major averages snapped a three-day decline, as traders awaited key inflation data slated for release later in the week. Read more at: https://www.cnbc.com/2023/07/10/stock-market-today-live-updates.html |

|

‘After the war, they will be a member’: Russia’s neighbors back Ukraine’s NATO bid at summitThe leaders of Europe’s Baltic states on Tuesday rallied behind Ukraine’s NATO membership bid. Read more at: https://www.cnbc.com/2023/07/11/russia-ukraine-war-baltic-leaders-back-kyivs-nato-bid-at-summit.html |

|

With a world-class workforce and a booming economy, North Carolina repeats as America’s Top State for Business in 2023North Carolina is again America’s Top State for Business, led by a strong economy and workforce, earning the rare repeat No. 1 finish in the annual rankings. Read more at: https://www.cnbc.com/2023/07/11/north-carolina-is-top-state-for-business-led-by-workforce-economy-.html |

|

This is why miners are selling their bitcoin at levels not seen since 2019Recent data shows a major increase in the amount of bitcoin moved by miners from the mining pool to crypto exchanges. Read more at: https://www.cnbc.com/2023/07/11/this-is-why-miners-are-selling-their-bitcoin-at-levels-not-seen-since-2019.html |

|

Jeff Bezos’ Blue Origin rocket engine explodes during testingIt’s a destructive setback with potential ramifications for the company’s customer United Launch Alliance as well as Blue Origin’s own rocket New Glenn. Read more at: https://www.cnbc.com/2023/07/11/jeff-bezos-blue-origin-be-4-rocket-engine-explodes-during-testing.html |

|

Bank of America fined $150 million for consumer abuses including fake accounts, bogus feesThe announcement is the latest sign that some of the practices exposed by the Wells Fargo fake accounts scandal in 2016 weren’t confined to that bank. Read more at: https://www.cnbc.com/2023/07/11/bank-of-america-fined-fake-accounts-bogus-fees.html |

|

Coinbase shares rise amid bitcoin ETF optimism, and U.K. cracks down on crypto ATMs: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Sachin Jaitly of Morgan Creek Capital Management breaks down the trend of governments around the globe holding crypto. Read more at: https://www.cnbc.com/video/2023/07/11/coinbase-rise-bitcoin-etf-optimism-uk-cracks-down-atms-crypto-world.html |

|

Ukraine war live updates: NATO says Ukraine can join when conditions are met; Zelenskyy slams ‘absurd’ lack of timelineUkrainian President Volodymyr Zelenskyy lashed out at NATO Tuesday for its lack of a timeline giving specific details for his country’s future NATO membership. Read more at: https://www.cnbc.com/2023/07/11/russia-ukraine-live-updates.html |

|

Tesla settles class-action Solar Roof lawsuit for $6 millionTesla has agreed to pay around $6 million to settle Solar Roof class-action lawsuit. Read more at: https://www.cnbc.com/2023/07/11/tesla-settles-class-action-solar-roof-lawsuit-for-6-million.html |

|

The ‘Bitcoin Family’ has a special algorithm that tracks moon cycles — and it’s helped them gain 50% since the bear market bottomDidi Taihuttu’s custom-built indicator considers a mix of inputs, including directional trading data and moon cycles. Read more at: https://www.cnbc.com/2023/07/11/bitcoin-family-has-a-trading-algorithm-that-tracks-moon-cycles-.html |

|

Flooding threatens Vermont’s capital as crews rescue more than 100A storm that dumped up to two months of rain in two days in Vermont and the Northeast brought more flooding Tuesday to communities marooned by water. Read more at: https://www.cnbc.com/2023/07/11/flooding-threatens-vermonts-capital-as-crews-rescue-more-than-100.html |

|

Lucid, Activision, EA, Uber: Here’s where Saudi Arabia’s sovereign wealth fund has investedThe largest public market bets by Saudi Arabia’s secretive PIF include experiential-focused firms such as Live Nation, and gaming bets such as Electronic Arts. Read more at: https://www.cnbc.com/2023/07/11/activision-ea-uber-heres-where-saudi-arabias-pif-has-invested.html |

|

Toyota Calls Biden’s EPA Plan To Boost EV Sales “Unrealistic”In a recent letter addressed to the head of the Environmental Protection Agency, Toyota Motor North America, Inc. criticized the agency’s proposed new tailpipe emission standards, deeming them “unrealistic” and warning that they could spark a shortage of critical minerals. Toyota sent a letter to EPA administrator Michael Regan with comments on the agency’s tailpipe emission limits for vehicles produced in 2027 and beyond. The proposed rule calls for more electric vehicles to be sold, accounting for 67% of new light-duty vehicle sales and 46% of new medium-duty vehicle sales in model year 2032. Currently, EVs and plug-in hybrids are approximately 10% of the market. Toyota said explosive growth in EV vehicle production to meet new government standards would spark many “challenges, including the scarcity of minerals to make batteries, the fact that these minerals are not mined or refined in the US, the inadequate infrastructure and the high cost of battery-electric vehicles.” The carmaker stressed that it shares the Biden administration’s goal to decarbonize transportation and is committed to vehicle electrification in America. “Our environmental track record speaks for itself. We have sold over 20 million electrified vehicles globally since the introduction of the Prius in 1997,” it said. Toyota said it will produce a new EV SUV at Toyota Motor Manufacturing Kentucky in 2025, with batteries sourced from the Toyota Battery Manufacturing North Carolina plant. And it added it was “committed” to achieving carbon neutrality in 2050 over the entire life cycle of our vehicles. Toyota provides further con … Read more at: https://www.zerohedge.com/technology/toyota-calls-bidens-epa-plan-boost-ev-sales-unrealistic |

|

MSNBC’s ‘Fitness=Fascism’ Article Resurfaces As Rogan And Musk Tweet It OutAuthored by Steve Watson via Summit News, An MSNBC article from last year that seriously argued being fit and healthy its a ‘gateway drug’ to becoming a ‘Neo-Nazi’ has resurfaced after both Joe Rogan and Elon Musk tweeted about how insane it is.

MSNBC ‘columnist‘ Cynthia Miller-Idriss created the ludicrous piece in March of 2022, claiming “the far right has taken advantage of pandemic at-home fitness trends to expand its decade-plus radicalization of physical mixed martial arts.” The writer also pointed to a separate report that claimed “a network of online ‘fascist fitness’ chat groups on the encrypted pl … Read more at: https://www.zerohedge.com/medical/msnbcs-fitnessfascism-article-resurfaces-rogan-and-musk-tweet-it-out |

|

Peter Schiff: Bond Bear Will Maul Stocks And The DollarVia SchiffGold.com, Stocks and bonds had a tough week last week. In his podcast, Peter Schiff talked about the market moves in the context of Fed rhetoric and the jobs reports. He concluded that we could be heading toward another big leg down in bonds, and this bond bear will maul stocks and the dollar.

Peter said called last week “decisive” and “telling” in the markets. The stock market and the bond market both showed weakness, along with the dollar. But gold finished last week with a small gain.

Read more at: https://www.zerohedge.com/markets/peter-schiff-bond-bear-will-maul-stocks-and-dollar |

|

Stellar 3Y Auction Stops Through With Lowest Dealer Award On RecordIf there were some concerns that the week’s first coupon auction would be a disappointment due to today’s risk-on sentiment and lack of concessions into the 1 pm auction block, they were promptly blown away moments ago when the Treasury announced results from today’s sale of $40BN in three-year paper, which were nothing short of stellar. Stopping at a high yield of 4.534%, this was more than 30bps higher than last month’s 4.202% and not far below the current cycle high of 4.641% reached in March (just before yields collapsed following the March banking crisis). The auction also stopped through the When Issued 4.536% by 0.2bps, the 4th stop through in the past five auctions (last month the auction tailed by 0.2bps). The Bid to Cover jumped to 2.882 from 2.696, and was also above the 6-auction average of 2.686. The internals were also solid, with Indirects awarded 69.4%, up from 61.5% in June, and not just well above the recent average of 64.5% but just shy of the all time high. And with Directs awarded 19.8%, below last month’s 21.7% but above the 6-auction average of 18.6%, that left Dealers holding on to 10.8%, which was the lowest on record. Read more at: https://www.zerohedge.com/markets/stellar-3y-auction-stops-through-lowest-dealer-award-record |

|

Bank of America fined for junk fees and fake accountsBank of America is ordered to pay $150m (£116m) in penalties after an investigation by US regulators. Read more at: https://www.bbc.co.uk/news/business-66167474?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail workers end long-running row over payThe deal to end the dispute comes after 115,000 postal workers held 18 days of strikes last year. Read more at: https://www.bbc.co.uk/news/technology-66170432?at_medium=RSS&at_campaign=KARANGA |

|

Nutmeg co-founder Nick Hungerford dies aged 43, months after setting up charityNick Hungerford was inspired by his young daughter to set up a charity to support bereaved children. Read more at: https://www.bbc.co.uk/news/business-66169828?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How Mazagon Dock, Bharat Dynamics and Polycab are looking on charts for WednesdaySector-wise, buying was seen in telecom, capital goods, consumer durables, and power stocks while selling was visible in metals and banks. Mazagon Dock Shipbuilders up 10%; Bharat Dynamics sees spike of nearly 14%, and Polycab India closes with gains of over 6% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-mazagon-dock-bharat-dynamics-and-polycab-are-looking-on-charts-for-wednesday/articleshow/101671244.cms |

|

Wipro’s Thierry Delaporte among top 6 highest-paid IT CEOs in India. Check full listHere’s a look at the highest-paid directors in the IT Consulting & Software industry. Read more at: https://economictimes.indiatimes.com/markets/web-stories/wipros-thierry-delaporte-among-top-6-highest-paid-it-ceos-in-india-check-full-list/articleshow/101664199.cms |

|

Utkarsh Small Finance Bank IPO to open on Wednesday. What GMP signals ahead of subscription?The company has fixed a price band of Rs 23-25 per share for the IPO, which is entirely a fresh issue of shares of Rs 500 crore. About 75% of the offer is reserved for qualified institutional buyers (QIBs), 15% for non-institutional investors (NIIs) and the rest 10% for retail investors, who can bid for a minimum of 600 shares in one lot and in multiples thereafter Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/utkarsh-small-finance-bank-ipo-to-open-on-wednesday-what-gmp-signals-ahead-of-subscription/articleshow/101674615.cms |

|

Futures Movers: Crude oil ends higher, Brent at highest since April, with U.S. supply data aheadOil futures traded slightly higher on Tuesday as investors awaited U.S. supply data and an update on U.S. inflation in June due Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7228-8B07AACE9A5F%7D&siteid=rss&rss=1 |

|

Bank of America ordered to pay $250 million for fake accounts, junk fees and withheld credit-card rewardsBank of America to pay $100 million to consumers and $150 million to the Office of the Comptroller of the Currency and the Consumer Financial Protection Board. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7228-A1A85FF1AC09%7D&siteid=rss&rss=1 |

|

Living With Climate Change: Cities generate dangerous underground heat. It could be an energy source instead.Underground climate change poses a ‘silent hazard’ for slowly sinking buildings in Chicago and other cities, researchers at Northwestern University find. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7228-BE00AA6FB2C0%7D&siteid=rss&rss=1 |