Summary Of the Markets Today:

- The Dow closed up 210 points or 0.62%,

- Nasdaq closed up 0.18%,

- S&P 500 closed up 0.24%,

- Gold $1,931 down $1.30,

- WTI crude oil settled at $73 down $0.64,

- 10-year U.S. Treasury 4.006% down 0.042 points,

- USD Index $101.97 down $0.31,

- Bitcoin $30,926 up $683,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

May 2023 sales of merchant wholesalers were down 4.0% from the revised May 2022 level. Total inventories of merchant wholesalers were up 3.7% from the revised May 2022 level. The May inventories/sales ratio for merchant wholesalers was 1.41 – the May 2022 ratio was 1.30. Overall, it seems sales are worsening in this sector. It is hard to see the overall economic situation just looking at wholesale sales as there is a myriad of dynamic forces at play – and many are not economic such as supply chain changes.

Here is a summary of headlines we are reading today:

- China’s Metal Export Restrictions Leave Traders Scrambling

- UAE Will Not Make Voluntary Oil Production Cuts

- Norway Makes Biggest Hydrocarbon Discovery In 10 Years

- Iraq Inks Long-Awaited $27 Billion Energy Deal With TotalEnergies

- The American banking landscape is on the cusp of a seismic shift. Expect more pain to come

- Home prices are hitting new highs again, as high rates put the squeeze on supply

- Dow closes 200 points higher Monday to snap 3-day losing streak: Live updates

- Bonds Bid As Hawkish ‘High(er) For Long(er)’ FedSpeak Spooks Growth Stocks

- Bond Report: 2-year Treasury yield slips to almost two-week low ahead of Wednesday’s CPI data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Soaring Energy Costs Force Key Zinc Mine To Pause OperationsVia AG Metal Miner Plummeting zinc metal prices and rising energy costs recently prompted Boliden to place its Tara zinc mine on care and maintenance until further notice. “The business is currently cash flow negative due to a combination of factors,” the Swedish metals producer said. Officials went on to specify that these operational challenges included “a decline in the price of zinc, high energy prices, and general cost inflation.” Tara is an underground mine about 60 kilometers northwest of Dublin, Ireland. Zinc prices… Read more at: https://oilprice.com/Metals/Commodities/Soaring-Energy-Costs-Force-Key-Zinc-Mine-To-Pause-Operations.html |

|

Armenian-Azerbaijani Peace Talks Hit A Snag In WashingtonVia the Jamestown Foundation From June 27 to 29, the second round of the United States–mediated negotiations between the foreign ministers of Armenia and Azerbaijan was held in Washington (State.gov, June 29; see EDM, May 8). The statements from both sides following the talks and that of US Secretary of State Antony Blinken noted that the ministers agreed on more articles for the peace treaty and reached a mutual understanding on the draft agreement (State.gov, June 29; Mfa.gov.az; News.am, June 30). However, all three statements emphasized… Read more at: https://oilprice.com/Geopolitics/International/Armenian-Azerbaijani-Peace-Talks-Hit-A-Snag-In-Washington.html |

|

China’s Metal Export Restrictions Leave Traders ScramblingBeijing is furious with the Biden administration mulling over a broader semiconductor chip export ban and, in response, decided last week to announce export restrictions on two metals, gallium and germanium, which are heavily imported by Western countries for semiconductor production. The timing of the announcement is one to ponder about. It came days before US Treasury Secretary Janet Yellen’s China visit on Thursday. It appears Chinese officials are playing a complex game of chess with the Biden administration as their dominance over rare… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Metal-Export-Restrictions-Leave-Traders-Scrambling.html |

|

Secretive Indian Company Linked To Russian Oil Disappears Amid ScrutinyA secretive Indian company that rose to infamy for its role in shipping Russian oil has disappeared suddenly and mysteriously, Bloomberg has reported. Mumbai-based Gatik Ship Management, which was able to amass 60 oil carriers for transporting Russian oil, has cut its fleet to just four ships as companies that are helping trade in Russian commodities come under increasing scrutiny. A May report by the Center for Research on Energy and Clean Air (CREA) titled Laundromat: How the price cap coalition whitewashes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Secretive-Indian-Company-Linked-To-Russian-Oil-Disappears-Amid-Scrutiny.html |

|

Climate Change Threatens Outdated InfrastructureWe humans now face an era of climate that is uncharted for the size and complexity of the human community. Our roads, rails, ports, buildings, electric grid, water systems and food systems are not designed for this new climate. For example, we continue to build infrastructure based on data for rainfall that does not reflect the dramatic changes that are taking place in rainfall patterns and amounts. In fact, practically all the standards for building our infrastructure to withstand rain, snow, wind, flood and heat are out of date. In addition,… Read more at: https://oilprice.com/The-Environment/Global-Warming/Climate-Change-Threatens-Outdated-Infrastructure.html |

|

Idle Refineries Could Complicate Russia’s Oil Export CutsRussia will have more refining capacity offline this month than initially planned, Reuters has estimated, which could mean that Moscow may not deliver the 500,000-bpd crude oil export cut it has promised for August. Some big Russian refineries have extended their respective periods of maintenance into July, which resulted in higher-than-anticipated idle refining capacity this month, according to industry sources and estimates from Reuters. Early last week, Russia’s Deputy Prime Minister Alexander Novak said that Russia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Idle-Refineries-Could-Complicate-Russias-Oil-Export-Cuts.html |

|

UAE Will Not Make Voluntary Oil Production CutsThe United Arab Emirates has announced that it will not join Saudi Arabia in making voluntary oil production cuts, claiming that the cuts by the Saudis are enough to balance the markets. This is hardly surprising considering that the UAE has in the past argued that it should be allowed to pump more than its current OPEC quota. The UAE has plans to ramp up its crude production capacity to five million barrels per day (bpd) by 2027, well above OPEC’s quota of 3 mb/d. A week ago, for the second month running, Saudi Arabia extended… Read more at: https://oilprice.com/Energy/Crude-Oil/UAE-Will-Not-Make-Voluntary-Oil-Production-Cuts.html |

|

UK’s Largest Water Supplier Raises £750M In Race To Avoid CollapseDebt-laden Thames Water has secured an extra £750m of equity funding from shareholders, as the firm races to avoid nationalisation. The UK’s largest water supplier – which provides water to over 15m customers – insisted it “maintains a strong liquidity position,” this morning, as ministers and watchdog Ofwat continue to discuss bringing it under public ownership. In an attempt to shore up its balance sheet amid a £14bn debt pile, the crisis-hit firm has been making desperate attempts to raise additional… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UKs-Largest-Water-Supplier-Raises-750M-In-Race-To-Avoid-Collapse.html |

|

Biden: War Must End Before Ukraine Can Join NATOU.S. President Joe Biden, who is scheduled to attend an important NATO summit later this week, said in an interview prior to his departure that Ukraine is not ready for membership in the alliance, asserting that the war with Russia must end before an invitation can be issued. In an interview broadcast on CNN on July 9 — the same day Biden departed for Europe on a three-country tour — the president said that, although it was still too early to bring Ukraine into the alliance, the United States and its allies in NATO would continue to provide Kyiv… Read more at: https://oilprice.com/Geopolitics/International/Biden-War-Must-End-Before-Ukraine-Can-Join-NATO.html |

|

Norway Makes Biggest Hydrocarbon Discovery In 10 YearsNorwegian oil and gas operator, DNO ASA, has made a significant gas and condensate discovery on the Carmen prospect in the Norwegian North Sea. Preliminary evaluation of comprehensive data indicates gross recoverable resources in the range of 120-230, making Carmen ranks as the largest discovery on the Norwegian Continental Shelf since 2013. “Norway is the gift that keeps on giving. Carmen proves there are important discoveries still to be made and Norway’s oldest oil company, DNO, will be part of this next chapter… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Makes-Biggest-Hydrocarbon-Discovery-In-10-Years.html |

|

Spain’s Natural Gas Imports From Russia More Than Doubled In MaySpain’s imports of natural gas from Russia more than doubled in May compared to a year earlier and Russia accounted for 27.9% of Spain’s gas imports, second only to Algeria, data from the Spanish Energy Ministry showed on Monday. Spain imported the equivalent of 9,663 gigawatt-hours (GWh) of natural gas from Russia in May, which was a 121.8% surge compared to the same month last year. In May 2023, Spain’s total natural gas imports dropped by 5.4% year on year. LNG accounted for 71.4% of imports and pipeline deliveries made up… Read more at: https://oilprice.com/Energy/Energy-General/Spains-Natural-Gas-Imports-From-Russia-More-Than-Doubled-In-May.html |

|

Labor Shortages Could Hinder The U.S. LNG BoomHiring and keeping construction workers and operators for the next wave of U.S. LNG export facilities could be a challenge and raise the costs of the projects, Paul Marsden, president of the Energy global business unit at one of the top contractors in the industry, Bechtel, has told Reuters. “Labor has grown as an inflationary concern for everyone in the industry. We need to actively forecast and manage labor availability and supply chain like never before,” Marsden told Reuters in an interview published on Monday. Contractors… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Labor-Shortages-Could-Hinder-The-US-LNG-Boom.html |

|

Renault Says A ‘Chinese Storm’ Is Coming For Europe’s EV IndustryEurope’s electric vehicle industry faces pressure from imports of vehicles from China, which dominates the supply chain for raw materials for batteries, Jean-Dominique Senard, chairman of France’s automaker Renault, told Reuters in an interview this weekend. “When I talk about a Chinese storm, I’m talking about the strong pressure today related to Chinese (electric) vehicle imports into Europe,” Senard told Reuters. “We are capable of making electric vehicles, but we are fighting to ensure the safety of our supplies.”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Renault-Says-A-Chinese-Storm-Is-Coming-For-Europes-EV-Industry.html |

|

Iraq Inks Long-Awaited $27 Billion Energy Deal With TotalEnergiesThe government of Iraq and TotalEnergies earlier today signed a long-awaited deal worth $27 billion that should see Iraq’s oil production grow and boost its reliance on domestic gas for power generation. The deal also involves the development of low-carbon energy in Iraq, Reuters reported. The deal dates back to 2021 when TotalEnergies signed multi-energy agreements in Iraq for the construction of a new gas network and treatment units, the construction of a large-scale seawater treatment unit, and the construction of a 1-gigawatt photovoltaic… Read more at: https://oilprice.com/Energy/Energy-General/Iraq-Inks-Long-Awaited-27-Billion-Energy-Deal-With-TotalEnergies.html |

|

TotalEnergies Begins Production At Giant Gas Field In AzerbaijanTotalEnergies and its joint venture partner SOCAR began natural gas production from the Absheron gas and condensate field in the Caspian Sea in Azerbaijan, the French supermajor said on Monday. The first phase of the development of the Absheron field has a production capacity of 4 million cubic meters of gas per day and 12,000 barrels a day of condensate. The gas will be sold on the domestic market in Azerbaijan, which could free more gas from other Azerbaijani fields for exports, analysts say. TotalEnergies and the State Oil Company of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Begins-Production-At-Giant-Gas-Field-In-Azerbaijan.html |

|

The American banking landscape is on the cusp of a seismic shift. Expect more pain to comeWhat is coming will likely be the most significant shift in the American banking landscape since the 2008 financial crisis. Bank earnings kick off Friday. Read more at: https://www.cnbc.com/2023/07/10/american-banks-face-more-pain-huge-shift.html |

|

Home prices are hitting new highs again, as high rates put the squeeze on supplyAfter falling for much of last year, home prices nationally are setting new highs in some markets. Read more at: https://www.cnbc.com/2023/07/10/home-prices-hit-new-highs-driven-by-tighter-supply.html |

|

Twitter traffic is ‘tanking’ as Meta’s Threads hits 100 million usersUser traffic on Twitter has slowed since the launch of Threads, which has already surpassed 100 million sign-ups since its debut last week. Read more at: https://www.cnbc.com/2023/07/10/twitter-traffic-is-nosediving-as-metas-threads-hits-100-million-users.html |

|

Dow closes 200 points higher Monday to snap 3-day losing streak: Live updatesStocks ticked up as investors prepared for a slate of inflation data later in the week and braced for the start of the second-quarter earnings season. Read more at: https://www.cnbc.com/2023/07/09/stock-futures-are-flat-ahead-of-a-key-inflation-data-week-for-wall-street-and-the-kickoff-of-second-quarter-earnings-season.html |

|

Morgan Stanley says we are entering a golden age of technology because of A.I. and gives some top stocks to play itMorgan Stanley offered up some of its top ways to play future waves of the growing artificial intelligence market. Read more at: https://www.cnbc.com/2023/07/10/morgan-stanley-shares-way-to-play-ai-as-we-enter-a-golden-age-.html |

|

PGA Tour defends LIV Golf deal ahead of Senate hearingThe PGA Tour defended its proposed deal with LIV Golf, while its board goes through a shake-up with the resignation of former AT&T chief Randall Stephenson. Read more at: https://www.cnbc.com/2023/07/10/pga-tour-defends-liv-golf-deal-before-senate-hearing.html |

|

U.S. apparel trade group calls to recall Canadian Parliament as ports strike enters 10th dayTrade associations both in the United States and Canada warn the impact will inflate prices and cause weeks of delays in product arrivals. Read more at: https://www.cnbc.com/2023/07/10/aafa-recall-canadian-parliament-amid-ports-strike.html |

|

MATIC jumps 3%, and SEC says Coinbase knew it could have violated law before suit: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Muneeb Ali of Trust Machines, weighs in on the impact for the crypto industry as finance titans like BlackRock and Fidelity have pushed for spot bitcoin ETFs. Read more at: https://www.cnbc.com/video/2023/07/10/polygon-jumps-sec-coinbase-knew-could-have-violated-law-before-suit.html |

|

MLB All-Star Game, baseball cards, are first big test of Fanatics livestream shopping experienceThe MLB All-Star Game festivities will feature a beta test of Fanatics’ new livestream shopping platform featuring sports card collectors. Read more at: https://www.cnbc.com/2023/07/10/mlb-all-star-game-is-first-big-test-of-fanatics-livestream-shopping.html |

|

Ukraine war live updates: Sweden set to join NATO with Turkey’s approval; Putin met with Prigozhin days after mutinyThe war in Ukraine has now passed the 500-day mark, and NATO allies are set to discuss the conflict’s progress at a Vilnius summit later this week. Read more at: https://www.cnbc.com/2023/07/10/russia-ukraine-live-updates.html |

|

See images of the floods plaguing New York and New EnglandTorrential downpours pounded the U.S. Northeast on Monday, threatening catastrophic flooding across the region Read more at: https://www.cnbc.com/2023/07/10/see-images-of-the-floods-plaguing-new-york-and-new-england.html |

|

‘Barbenheimer’ is coming: AMC says it has already sold 20,000 same-day tickets for the ‘Barbie’ and ‘Oppenheimer’ double featureWith a combined runtime of 5 hours and 9 minutes, not including trailers, double feature will require a substantial time commitment from fans. Read more at: https://www.cnbc.com/2023/07/10/amc-has-sold-20000-barbie-and-oppenheimer-double-feature-tickets.html |

|

Bearer of rare ‘One Ring’ card from ‘Lord of the Rings’ lore could fetch $2 million and face hefty tax billAn ultra-rare “One Ring” serialized “Magic: The Gathering” card was reportedly found by an individual in Canada. If sold, they’d likely owe a big tax on profits. Read more at: https://www.cnbc.com/2023/07/10/one-ring-magic-card-could-fetch-2-million-and-a-big-tax-bill.html |

|

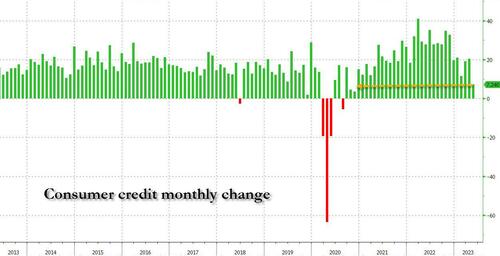

Bonds Bid As Hawkish ‘High(er) For Long(er)’ FedSpeak Spooks Growth StocksA quiet-ish day on the macro front today as the ‘main events’ lie ahead of us but Wholesale Sales disappointedly declined and Consumer Credit rose dramatically less than expected. However, a murder of Fed Speakers certainly made clear how they feel, all singing from the same hymn-sheet – ‘High(er) For Long(er)’ it is:

Small Caps ripped at the cash open as big-tech tumbled – with Nasdaq rebalancing plans weighing on the S&P and Nasdaq. Late-day melt-up dragged Nasdaq barely green… Read more at: https://www.zerohedge.com/markets/bonds-bid-hawkish-higher-longer-fedspeak-spooks-growth-stocks |

|

Shocking Drop In Auto Loans Results In Weakest Consumer Credit Print Since 2020Last month, when both revolving credit (i.e., credit card debt) and interest charged on credit cards hit a record high, we said that this trajectory was unsustainable and it was only a matter of time before the debt-funded US consumer hit a brick wall. One month later, the brick wall is finally here, because according to the Fed’s just released consumer credit report, in May US consumer credit grew by a paltry $7.24BN, down more than 50% from the downward revised $20.3BN in April…

…. and a huge miss to the consensus forecast of $20 billion. In fact, this was the 4th miss in the past 6 months. Read more at: https://www.zerohedge.com/economics/shocking-drop-auto-loans-results-weakest-consumer-credit-print-2020 |

|

Turkey Suddenly Agrees To Advance Sweden’s NATO BidUpdate (1531ET): Stoltenberg confirms the massive news–there will be a 32nd member state added to NATO, as we now await Russia’s sure-to-be deeply unhappy and frustrated response. Prior Moscow declarations related to Sweden’s potential move into NATO had involved measures to strengthen Russian defensive positions along the Scandinavian border region, specifically the Finnish border as well as in the region of the far-northern, remote arctic border area with Sweden.

What’s clear is that the ‘unintended consequences’ resulting from the Ukraine conflict have continued to spiral, and things are escalating by the day and week. … Read more at: https://www.zerohedge.com/geopolitical/erdogan-demands-clear-path-turkeys-eu-membership-swedens-nato-candidacy |

|

Judge Denies Biden Request To Keep Meddling In Social MediaA federal judge in Louisiana denied a request by the Biden DOJ to delay an order he issued last week which bans federal agencies from communicating with social media companies.

U.S. District Judge Terry A. Doughty (YouTube) Judge Terry Doughty refused to pause his July 4 nationwide injunction, as well as an alternative request for a seven-day pause while it petitions the 5th US Circuit Court of Appeals. In his Monday ruling, Doughty defended his order against the DOJ’s claims that it’s overly broad and unclear in terms of what types of communications are no longer allowed. Doughty wrote that the government isn’t entitled to a delay in enforcing his order because they were likely to lose on the merits of the case, and slammed the DOJ for failing to ide … Read more at: https://www.zerohedge.com/political/judge-denies-biden-request-keep-meddling-social-media |

|

Bank of England: We must see job through to cut inflationAndrew Bailey is to tell an audience at Mansion House that it is “crucial” inflation falls back to 2%. Read more at: https://www.bbc.co.uk/news/business-66152690?at_medium=RSS&at_campaign=KARANGA |

|

Easyjet cancels 1,700 flights from July to SeptemberThe airline axes flights to and from Gatwick airport as schools head towards the summer break. Read more at: https://www.bbc.co.uk/news/business-66153416?at_medium=RSS&at_campaign=KARANGA |

|

Boeing plane crash: Coroner rules Britons unlawfully killedA coroner has ruled the three Britons who died in the 2019 crash in Ethiopia were killed unlawfully. Read more at: https://www.bbc.co.uk/news/business-66158507?at_medium=RSS&at_campaign=KARANGA |

|

Utkarsh Small Finance Bank IPO to open on July 12. 10 things to know about the public offerIncorporated in 2016, Utkarsh commenced operations in 2017 and its product suite includes a range of deposit products, including saving accounts, salary accounts, current accounts, recurring and fixed deposits and locker facilities. It also had the second highest provision coverage ratio among SFBs in fiscal 2023. Its operations are focused in rural and semi-urban areas and as of March 2023, it had 3.59 million customers majorly located in rural and semi urban areas Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/utkarsh-small-finance-bank-ipo-to-open-on-july-12-10-things-to-know-about-the-public-offer/articleshow/101646038.cms |

|

BSE unveils new logo on the occasion of 149th foundation dayBSE celebrated its 149th foundation day and launched a new logo expressing prosperity, vibrance, growth, new beginnings, trust, and responsibility. The blue color in the logo signifies knowledge, integrity, and trustworthiness, which BSE has built up over 149 years, while the flame color ranges from deep red to deep orange and transforming itself into bright yellow Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bse-unveils-new-logo-on-the-occasion-of-149th-foundation-day/articleshow/101645853.cms |

|

A $7.5 billion futures trade has a tepid start post shift to IndiaThe trading of Indian stock futures on the NSE International Exchange at GIFT City in Gujarat, which was formerly traded on the Singapore Exchange, has struggled. The average number of contracts for GIFT Nifty was 32,934 in the week up to July 7. This is lower than SGX Nifty’s 60,884 future contracts traded in April, May and June on SGX. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/a-7-5-billion-futures-trade-has-a-tepid-start-post-shift-to-india/articleshow/101635848.cms |

|

Crypto: Bitcoin to reach $50,000 by year-end, but top $100,000 by end of 2024, says Standard Chartered strategistBitcoin’s price is likely to reach $50,000 by the end of this year and has upside above $100,000 by the end of 2024, according to Geoff Kendrick, head of crypto research at Standard Chartered Bank. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7228-2249079D5B56%7D&siteid=rss&rss=1 |

|

As money-market funds swell, critics say fat yields are taxpayer subsidizedMoney-market funds are attracting investor interest like never before, but regulators worry that they are riskier than many investors realize. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7227-A447920BB831%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield slips to almost two-week low ahead of Wednesday’s CPI data2- through 10-year Treasury yields end lower on expectations that the next major U.S. inflation report may show signs of easing price pressures. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7227-73C25D4377FE%7D&siteid=rss&rss=1 |