Summary Of the Markets Today:

- The Dow closed up 212 points or 0.63%,

- Nasdaq closed up 1.65%,

- S&P 500 closed up 1.15%,

- Gold $1,924 down $10.00,

- WTI crude oil settled at $68 down $1.71,

- 10-year U.S. Treasury 3.762% up 0.041 points,

- USD Index $102.47 down $0.22,

- Bitcoin $30,673 up $394,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The CoreLogic S&P Case-Shiller 20-city composite index was down 1.7% year-over-year. Compared with the 2006 peak, the 20-city composite is up by 49%. Adjusted for inflation, which continues to remain concerningly elevated, the 20-city index showed a 3% increase compared with its 2006 high point. The latest CoreLogic’s latest Home Price Index projects that home prices nationally will average a 4% increase in 2023 compared with the previous year.

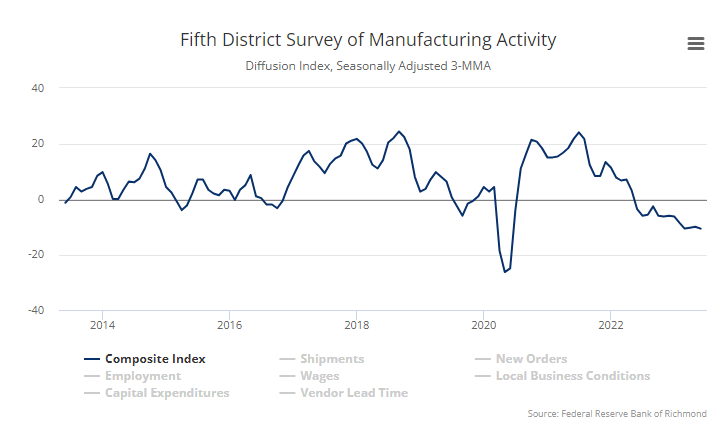

The Richmond Fed manufacturing activity remained relatively flat in June, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index rose from −15 in May to −7 in June. Two of its three component indexes — shipments and new orders — also improved but remained below zero. Manufacturing in the US remains in a recession.

New orders for manufactured durable goods in May were up 5.4% year-over-year (3.6% inflation-adjusted). Before one thinks this is a strong report – this monthly increase was almost totally due to Boeing’s new orders – and does not show a broad-based improvement in this sector.

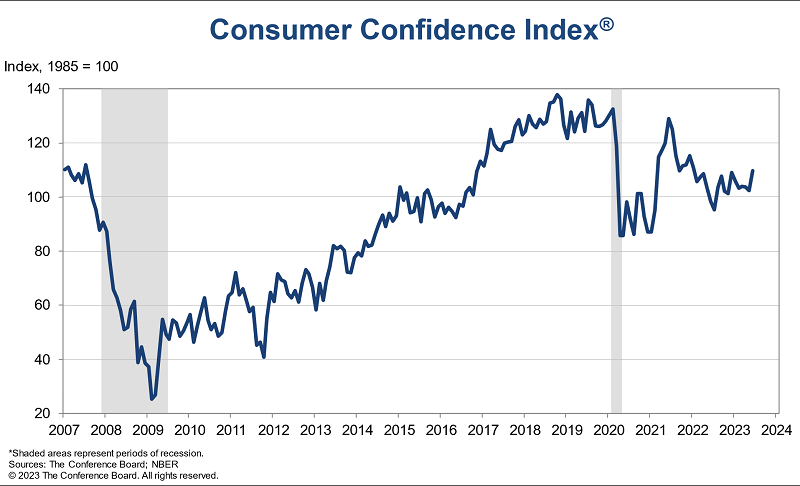

US Consumer Confidence Improved Substantially in June to 109.7, up from 102.5 in May. Dana Peterson, Chief Economist at The Conference Board stated:

Consumer confidence improved in June to its highest level since January 2022, reflecting improved current conditions and a pop in expectations. Greater confidence was most evident among consumers under age 35, and consumers earning incomes over $35,000. Nonetheless, the expectations gauge continued to signal consumers anticipating a recession at some point over the next 6 to 12 months.

Sales of new single‐family houses in May 2023 were 25.9% above May 2022. The median sales price of new houses sold in May 2023 was $416,300 – down 7.6% year-over-year. The average sales price was $487,300. Not a surprise that when you sell a cheaper house – the sales volumes increase.

Here is a summary of headlines we are reading today:

- Fuel From Thin Air: A Technological Feat Or Economic Folly?

- Copper Can Go Up 10 Times, Warns Billionaire Mine-Owner

- Russia Asks For Same Oil Deal Chevron Has In Venezuela

- The Hidden Costs Of The IEA’s Net Zero Vision

- Russia’s Crude Oil Exports Dip By Nearly 1 Million Bpd

- S&P 500, Nasdaq rally more than 1% as tech leads turnaround, Dow closes 200 points higher: Live updates

- Morgan Stanley Sees First Negative Payroll Print In August Or September

- Banking: UBS cutting half of Credit Suisse staff and about 35,000 or 30% of combined staff after merger: Bloomberg

- ‘This is a game-changer’: Ahead of Amazon Prime Day, a new law makes it harder for online sellers to hawk fake or stolen products

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Fuel From Thin Air: A Technological Feat Or Economic Folly?Every few years, a company announces that it is attempting to commercialize the production of fuel from air and water. To be clear, there are no technical barriers against doing this. Indeed, carbon can be extracted from air, and hydrogen can be produced from water. Together, those building blocks can be reacted to make fuel — or any number of products. I could easily devise a scheme to produce acetaminophen from air and water. I have addressed these schemes many times over the years. In fact, more than a decade ago, I addressed essentially… Read more at: https://oilprice.com/Energy/Energy-General/Fuel-From-Thin-Air-A-Technological-Feat-Or-Economic-Folly.html |

|

Post-Brexit Tariffs And EV Chain Woes Threaten UK CarmakersFailure to bolster the supply chains for electric cars, coupled with looming post-Brexit tariffs, could cost the UK’s car industry over £100bn in growth, a leading industry group has warned. A potential 10-fold increase in the production of electric cars worth £106 billion is as it stake, according to a new report from the Society of Motor Manufacturers and Traders’ (SMMT). Unless the government invests in British manufacturing plants, helps to scale up their EV supply chains and reworks the incoming export tariffs created… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Post-Brexit-Tariffs-And-EV-Chain-Woes-Threaten-UK-Carmakers.html |

|

Copper Can Go Up 10 Times, Warns Billionaire Mine-OwnerWe have all seen news headlines for lithium, cobalt, nickel, and other rare-earth metals needed for electric vehicle batteries and the entire electricity infrastructure. The Biden administration has announced a series of moves to secure America’s ‘supply chain for critical minerals.’ Rarely discussed, however, is copper, one essential metal at the heart of the energy transition. In an interview on Monday, billionaire mining investor Robert Friedland told Bloomberg TV that the mining industry is failing to increase supply ahead of ‘accelerating… Read more at: https://oilprice.com/Metals/Commodities/Copper-Can-Go-Up-10-Times-Warns-Billionaire-Mine-Owner.html |

|

Turkey Continues To Challenge Sweden’s NATO MembershipThe saga of Sweden’s NATO accession is now likely entering its endgame. Having applied to join the military alliance together with Finland in the wake of Russia’s full-scale invasion of Ukraine in February 2022, many initially expected a quick accession. But it has turned out to be more complicated than first anticipated. Turkey signaled that it needed to see progress from Helsinki — but notably Sweden — in areas such as fighting terrorism, lifting of an arms embargo on Ankara, and fulfilling Turkish extradition requests. While the trio… Read more at: https://oilprice.com/Geopolitics/Africa/Turkey-Continues-To-Challenge-Swedens-NATO-Membership.html |

|

Uzbekistan’s Commercial Ties With Russia Draw EU SanctionsThe latest set of European Union sanctions aimed at exerting pressure on Russia includes two companies based in Uzbekistan among the list of entities seen lending support to the ongoing invasion of Ukraine. Their inclusion among the 87 companies added on June 23 to an ever-growing list of enterprises found by the EU to be enabling the Russian military-industrial complex comes a few months after they were featured in a similar list drawn up by the U.S. government. In April, the U.S. Department of Commerce described the activities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Uzbekistans-Commercial-Ties-With-Russia-Draw-EU-Sanctions.html |

|

Russia Asks For Same Oil Deal Chevron Has In VenezuelaRussia has asked Venezuela’s state-run oil company for a deal very similar to the one Chevron has for controlling crude oil exports for its JV’s there, Reuters’ sources said anonymously on Tuesday. Rosneft’s parent company, Roszarubezhneft, has asked Venezuela for a deal that would allow it to market the crude oil and fuel oil produced by its joint ventures in Venezuela, the sources said—this would be similar to the deal Chevron has struck with the South American oil company. As it stands today, the crude oil from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Asks-For-Same-Oil-Deal-Chevron-Has-In-Venezuela.html |

|

The Hidden Costs Of The IEA’s Net Zero VisionThe IEA has allowed itself to be used as a tool for climate policy extremism… Two years ago, efforts by climate activists and Environmental, Social, and Governance (ESG) investors to block investment in oil and gas production by Western companies appeared to have received a seal of approval from no less an authority than the International Energy Agency (IEA), when it published Net Zero by 2050: A Roadmap for the Global Energy Sector. As a result, attempts to achieve net zero carbon emissions (NZE) by 2050 became central to the “E”… Read more at: https://oilprice.com/Energy/Energy-General/The-Hidden-Costs-Of-The-IEAs-Net-Zero-Vision.html |

|

LNG Exports Have Sent U.S. Natural Gas Demand Surging This DecadeRising exports of LNG from the U.S. Gulf Coast drove a 43% surge in U.S. natural gas demand in the decade to 2022, the U.S. Energy Information Administration (EIA) said on Tuesday. Demand for natural gas in America – including for domestic consumption and gross exports – jumped by 43%, or by 34.5 billion cubic feet per day (Bcf/d), between 2012 and 2022, as demand in Texas and Louisiana soared by 116%. Texas and Louisiana saw their combined natural gas demand jump by 16 Bcf/d—a surge that was largely driven by the higher… Read more at: https://oilprice.com/Latest-Energy-News/World-News/LNG-Exports-Have-Sent-US-Natural-Gas-Demand-Surging-This-Decade.html |

|

EU’s Net-Zero Goal Hits India’s Aluminum Sector HardVia AG Metal Miner The EU’s implementation of the Cross-Border Adjustment Mechanism (CBAM) poses a significant challenge to India’s aluminum industry and the global price of aluminum. The move stems from the EU’s eagerness to tackle carbon and achieve net-zero emissions by 2050. However, as one of the leading low-cost aluminum producers, India faces a considerable setback due to CBAM. Indeed, the subcontinent produces 4.1 million tons of primary aluminum annually, exporting roughly 56%. India’s annual… Read more at: https://oilprice.com/Metals/Commodities/EUs-Net-Zero-Goal-Hits-Indias-Aluminum-Sector-Hard.html |

|

Russia’s Urals Oil Price Is Still Below The G7 CapThe price of Russia’s flagship crude grade, Urals, continues to average below the $60 per barrel price cap set by the G7, but a large difference in export and import prices suggests that the actual trade in Russian crude is murkier than it seems at first glance. The price cap on Russian crude imposed by the EU, the G7, and Australia came into effect on December 5. Under it, buyers paying $60 or less per barrel of Russia’s crude will have full access to all EU and G7 insurance and financing services associated with transporting Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Urals-Oil-Price-Is-Still-Below-The-G7-Cap.html |

|

Demand Concerns Keep Oil Prices Under PressureOil prices fell on Tuesday morning as markets continued to focus on sluggish U.S. demand despite geopolitical uncertainty in Russia and promises of more robust economic stimulus measures from China.Chart of the Week- The review of OPEC+ production quotas at the oil group’s Vienna meeting earlier this month will consolidate the control of Middle Eastern powerhouses, to the detriment of African countries that have struggled to maintain output. – The five largest oil producers of OPEC+ (Saudi Arabia, Russia, Iraq, UAE, and Kuwait) all have… Read more at: https://oilprice.com/Energy/Energy-General/Demand-Concerns-Keep-Oil-Prices-Under-Pressure.html |

|

Heat Wave Pushes ERCOT To The BrinkIt’s extremely hot in Texas this afternoon. As of 1630 local time Monday, the Electric Reliability Council of Texas, the state’s grid manager, reported electricity demand hit a record high of 80,200 megawatts as millions of people cranked up their air conditioners to escape triple-digit temperatures. The previous record for demand was 80,148 megawatts last July. “That marked the 11th time last summer electricity demand broke the all-time record, and was the first time Texas had exceeded 80,000 megawatts,” the Houston Chronicle said. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Heat-Wave-Pushes-ERCOT-To-The-Brink.html |

|

Why Clean Energy Stocks Lost Out Last WeekOver the past decade, the green and socially-responsible investments, aka ESG (Environmental, Social, and Governance) investing, has emerged as one of the biggest investment megatrends in modern times. For years, trillions of dollars in new global funds flowed into the market each year, with UBS predicting that carbon-reducing tech would hit $60 trillion of investment by 2040.U.S. Unfortunately, the ESG boom now appears to be languishing in investment purgatory. After peaking at $17.1 trillion in 2020, ESG assets in the United States dropped… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Why-Clean-Energy-Stocks-Lost-Out-Last-Week.html |

|

Indian Refiner Plans Maintenance In August And SeptemberIndian state-owned refiner Bharat Petroleum Corporation Limited (BPCL) plans maintenance at units of two of its refineries in August and September, a spokesman for the company told Reuters on Tuesday. BPCL will shut down for maintenance half of the crude processing capacity at its refinery in Mumbai for one month beginning on September 21, the spokesman said. The Mumbai refinery operated by the state-held refiner has a capacity to process 240,000 barrels per day (bpd) of crude. BPCL will shut a crude unit with a capacity of 120,000 bpd at the facility,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-Refiner-Plans-Maintenance-In-August-And-September.html |

|

Russia’s Crude Oil Exports Dip By Nearly 1 Million BpdRussian crude oil exports by sea plunged by as much as 980,000 barrels per day (bpd) in the week to June 25, although the dip was much more likely due to maintenance at a key export terminal rather than the promised cut in Russia’s crude oil production. Weekly crude shipments from Russia’s export terminals fell by nearly 1 million bpd to 2.55 million bpd in the week ending June 25, tanker-tracking data monitored by Bloomberg showed on Tuesday. Crude oil shipments fell by around 263,000 bpd on a four-week average basis in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Exports-Dip-By-Nearly-1-Million-Bpd.html |

|

The Inform Act takes effect today — here’s how it aims to target organized retail theftThe Inform Act, a bipartisan bill targeting organized retail theft that takes effect Tuesday, requires online marketplaces to disclose the identity of sellers. Read more at: https://www.cnbc.com/2023/06/27/the-inform-act-takes-effect-targeting-organized-retail-theft.html |

|

S&P 500, Nasdaq rally more than 1% as tech leads turnaround, Dow closes 200 points higher: Live updatesThe Dow Jones Industrial Average rose on Tuesday for the first positive session in seven and Wall Street readied for the end of the first half. Read more at: https://www.cnbc.com/2023/06/26/stock-market-today-live-updates.html |

|

Google distances itself from planned drag performance after employee petitionGoogle has distanced itself from a planned drag show after some employees signed a petition opposing the Pride event. Read more at: https://www.cnbc.com/2023/06/27/google-distances-itself-from-drag-performance-after-employee-petition.html |

|

Unity shares rise 15% after company announces A.I. marketplaceAI companies will be able to distribute their software to game makers and charge for it through Unity’s Asset Store. Read more at: https://www.cnbc.com/2023/06/27/unity-stock-up-12percent-after-company-announces-ai-marketplace.html |

|

The demand for senior housing is about to explode. These stocks will reap the benefitsThe population is aging at a rapid pace, yet supply of senior housing has slowed. Read more at: https://www.cnbc.com/2023/06/27/the-demand-for-senior-housing-is-about-to-explode-these-stocks-will-benefits-.html |

|

BitGo CEO discusses Go Network launch, and report shows FTX owed customers $8.7 billion: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, BitGo CEO Mike Belshe spoke exclusively with Crypto World about the launch of its Go Network and the problem with crypto market structure to date. Read more at: https://www.cnbc.com/video/2023/06/27/bitgo-ceo-discusses-go-network-launch-report-shows-ftx-owed-customers-billions-cnbc-crypto-world.html |

|

Severe weather, FAA shortfalls kick off rocky start to summer air travelUnited’s CEO blamed FAA staffing shortages for worsening flight disruptions over the weekend. Read more at: https://www.cnbc.com/2023/06/27/summer-air-travel-severe-weather-faa-shortfalls-kick-off-rocky-start.html |

|

More than $200 billion in Covid loans potentially stolen by fraudsters, watchdog saysMore than $200 billion in Covid aid disbursed by the Small Business Administration may have been stolen, a federal watchdog said. Read more at: https://www.cnbc.com/2023/06/27/fraudsters-stole-200-billion-in-covid-loans-watchdog.html |

|

Ukraine war live updates: U.S. sanctions Wagner boss Prigozhin; Putin thanks Russian army for preventing ‘civil war’Russian President Vladimir Putin’s comments were his first since the rebellion by the Wagner group private militia was brought to a halt. Read more at: https://www.cnbc.com/2023/06/27/russia-ukraine-war-updates-for-tuesday-june-27-2023.html |

|

Chicago business executive and philanthropist Jim Crown killed in Colorado racetrack crashJim Crown, a Chicago executive and philanthropist, died Sunday in a car crash on a racing track in Colorado. Read more at: https://www.cnbc.com/2023/06/27/chicago-business-executive-and-philanthropist-jim-crown-killed-in-colorado-racetrack-crash.html |

|

Airbnb is offering a free stay at Barbie’s Malibu Dreamhouse—here’s how to bookThe all-pink listing is hosted by Ken — played by Ryan Gosling in the upcoming film — and looks like the iconic Barbie playset come to life. Read more at: https://www.cnbc.com/2023/06/27/airbnb-is-offering-a-free-stay-at-barbies-malibu-dreamhouse.html |

|

‘Enormously costly’ business loan fraud drove inflation in home prices in certain markets, research suggestsCovid-era PPP loan fraud may have contributed to home price inflation in certain U.S. markets, research suggests. Read more at: https://www.cnbc.com/2023/06/26/ppp-loan-fraud-drove-home-price-inflation-in-certain-markets.html |

|

Cash is all the rage as yields pop, but stocks are the way to go long term, BofA saysToday’s pile of cash will be tomorrow’s market fodder for equities, notes Bank of America’s Lauren Sanfilippo. Read more at: https://www.cnbc.com/2023/06/27/cash-is-all-the-rage-as-yields-pop-but-stocks-are-the-way-to-go-long-term-bofa-says.html |

|

Ford Lays Off Hundreds Of EngineersFord is now the latest U.S. company to announce sweeping layoffs, with Bloomberg reporting this week that the auto manufacturer plans to lay off “hundreds of salaried workers” that are primarily engineers. Monetary policy continues to work wonders. The layoffs are part of a plan to boost profits and lower operating costs as the company shifts toward EVs, the report says. And after all, who needs engineers when you can adopt Tesla’s technology like Ford announced it would be doing with charging standards just weeks ago? The cuts will be to engineers in EVs, traditional combustion engine models and commercial vehicles, the company said. The layoffs will number in the hundreds, despite CEO Jim Farley claiming earlier this year the company would need 25% more engineers than rivals to produce its EVs. The company expects to lose $3 billion in 2023 on its EV business but hopes for 8% returns on battery-powered models by the end of 2026. Ford plans on building 2 million EVs per year by that point. Read more at: https://www.zerohedge.com/markets/ford-lays-hundreds-engineers |

|

Watch: Biden Trans ‘Health’ Official Says Gender-Affirming Care For Kids Is ‘Literally Suicide Prevention’Authored by Steve Watson via Summit News, ‘Admiral’ Rachel Levine, The Biden administration’s transgender Assistant Secretary for Health, has declared that “gender-affirming care” (blocking puberty, removing genitals, or adding fake genitals) is necessary to keep people, including children, mentally healthy and to stop them from killing themselves.

Yes, really. “It’s such an important issue for our youth and adults,” Levine stated in the video produced by the U.S. Department of Health and Human Services, adding “We often say that gender-affirming care is health care—gender-affirming care is mental health care—and gender-affirming care is literally suicide-prevention care.” Read more at: https://www.zerohedge.com/political/watch-biden-trans-health-official-says-gender-affirming-care-literally-suicide-prevention |

|

Morgan Stanley Sees First Negative Payroll Print In August Or SeptemberJust a few weeks after Morgan Stanely declared that the Fed’s hiking cycle was over, this morning the bank’s chief economist Ellen Zentener pulled a sudden U-turn and conceded that “the bar for a July hike is significantly lower than we had initially expected and have added a 25bp hike to our policy path. The revision is a level shift upward to 5.375% fed funds end-23, and 4.375% end-24.” And in a conclusion that will infuriate her chief equity strategist Mike Wilson, who as noted yesterday, expects stocks to tumble in the second half to fresh cycle lows (i.e., around 3,600) as a hard landing recession slams stock earnings, Zentner said that she continues to see “a soft landing staving off rate cuts to next year.” Yet in a typical sellside plot twist, Zentner’s assessment is hardly the bullish take a superficial read of her notes suggest: after all, by now it is common knowledge that the Fed’s aggressive rate hikes have just one purpose – to accelerate the recession and contain the inflation the Fed’s policies triggered in 2020/21. In this context, Morgan Stanley adding another rate hike to its forecast after previously calling it a day on the Fed’s hiking calendar, means that the bank now expects the economy to enter stall speed that much faster. Zentner confirmed as much, writing over the weekend that a question that has come up in all of the bank’s client meetings last week was “when do they expect to see the first negative payroll print”? In response, she says that she now forecasts a significant slowdown in monthly nonfarm payroll (NFP) growth this year that falls below … Read more at: https://www.zerohedge.com/markets/morgan-stanley-sees-first-negative-payroll-print-august-or-september |

|

Gold’s Steady Migration From West To EastAuthored by Michael Maharrey via SchiffGold.com, There has been a steady migration of gold from West to East over the last three decades.

When the World Gold Council published its first Gold Demand Trends report 30 years ago, Asian demand made up 45% of the world’s total. Today, the Asian share of global gold demand is approaching 60%. China and India have driven this migration of gold East. The World Gold Council describes the two countries as “super consumers” of gold. Thirty years ago, China and India accounted for about 20% of annual consumer gold demand. Today, the two countries make up nearly 50% of gold demand. Read more at: https://www.zerohedge.com/commodities/golds-steady-migration-west-east |

|

Thames Water boss quits after sewage spillsSarah Bentley steps down weeks after giving up her bonus over the company’s poor performance. Read more at: https://www.bbc.co.uk/news/business-66035897?at_medium=RSS&at_campaign=KARANGA |

|

Drinks giant Diageo ends ‘broken’ Diddy partnershipThe move comes after pop star Diddy accused the firm of neglecting his tequila brand because of his race. Read more at: https://www.bbc.co.uk/news/business-66036749?at_medium=RSS&at_campaign=KARANGA |

|

Boots to close 300 UK pharmacies over the next yearThe US-owned chain says it will “consolidate” stores in close proximity to each other. Read more at: https://www.bbc.co.uk/news/business-66032556?at_medium=RSS&at_campaign=KARANGA |

|

HDFC Bank’s $173 billion merger with its parent creates a ‘lucrative’ arbitrage trade in IndiaDomestic equity mutual fund managers in India have reportedly purchased a net $570m worth of HDFC shares ahead of its merger with parent company Housing Development Finance Corp. in a “lucrative” arbitrage trade, according to Prime Database. Capitalising on the share-swap ratio upon completion, fund managers hope the merger will enable them to purchase shares at a discount to HDFC Bank’s current price. The merger is effective from 1 July, with HDFC Bank absorbing the parent company. HDFC shares rose by around 2.3% on 9 June. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hdfc-banks-173-billion-merger-with-its-parent-creates-a-lucrative-arbitrage-trade-in-india/articleshow/101308392.cms |

|

Federal Bank pauses $244 million unit stake sale: ReportFederal Bank has put on hold the sale of a stake in its subsidiary, Fedbank Financial Services, as it is unable to reach a consensus with potential investors over the unit’s valuation. The bank had hoped to raise as much as INR20bn ($275m) from the sale. Federal Bank has also decided to focus on a fundraising of up to INR40bn instead. Fedbank Financial Services, which filed a draft IPO prospectus in February, may pursue a listing in the coming year, according to Federal Bank CEO Shyam Srinivasan. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/federal-bank-pauses-244-million-unit-stake-sale-report/articleshow/101307904.cms |

|

HDFC buys additional 0.7% stake in HDFC Life through open market transactionsHDFC has purchased an additional 0.7% stake in HDFC Life through open market transactions. The deal was executed at an average price of Rs 667. HDFC already owns around 48.65% stake in the subsidiary. Once HDFC twins merger is complete, HDFC Bank will be 100% owned by public shareholders, with HDFC holding only 41% stake in the bank. HDFC shareholders will receive 42 shares of HDFC Bank for every 25 shares they hold. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hdfc-buys-additional-0-7-stake-in-hdfc-life-through-open-market-transactions/articleshow/101316092.cms |

|

Banking: UBS cutting half of Credit Suisse staff and about 35,000 or 30% of combined staff after merger: BloombergJob reductions will come from layoffs and attrition in London, New York and parts of Asia as UBS digests Credit Suisse after emergency takeover. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-721D-D52036F5BC6A%7D&siteid=rss&rss=1 |

|

The Ratings Game: Carnival’s stock rallies to reverse almost all of its ‘perplexing’ post-earnings selloffCarnival’s stock rallied Tuesday to take back nearly everything it lost in the previous session’s “perplexing” post-earnings selloff. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-721D-C26E7741E2F0%7D&siteid=rss&rss=1 |

|

‘This is a game-changer’: Ahead of Amazon Prime Day, a new law makes it harder for online sellers to hawk fake or stolen products“The only people opposing this may be thieves,” said Teresa Murray, director of the consumer watchdog office at U.S. PIRG. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-721D-A8CF13A84087%7D&siteid=rss&rss=1 |