Summary Of the Markets Today:

- The Dow closed down 233 points or 0.68%,

- Nasdaq closed up 0.39%,

- S&P 500 closed up 0.08%,

- Gold $1,960 up $1.00,

- WTI crude oil settled at $69 down $0.72,

- 10-year U.S. Treasury 3.800% down 0.041 points,

- USD Index $103.06 down $0.28,

- Bitcoin $25,853 up $21,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Federal Reserve did what the market expected holding the federal funds rate steady stating in part:

… the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Their forward-looking words on what happens next:

;;; In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The bottom line is that this statement really gives you no clues on the future of the federal funds rate. However, Fed Chair Powell’s press conference did indicate future rate hikes as well as well as dot-plots which show 2 more increases. Further, Chair Powell said he doesn’t see a rate cut until inflation comes down meaningfully and significantly, and that can take a couple of years.

Inflation seems to have been tamed as the producer price index (PPI) has fallen from 2.3% in April to 1.1% in May 2023. The PPI less foods and energy declined from 3.3% to 2.8% in May.

Here is a summary of headlines we are reading today:

- Rystad Sees Major Jump In Battery Storage Capacity Through 2030

- Polysilicon Price Surge: A Challenge For Emerging Solar Markets

- Oil Moves Lower After EIA Confirms Large Crude Build

- JP Morgan Slashes Oil Price Forecast To $81 This Year

- Shell To Raise Dividend By 15% As It Doubles Down On Oil And Gas

- Fed recap: Breaking down the market’s reaction to the Fed’s pause and all of Powell’s key comments

- S&P 500 closes little changed after Fed leaves rates unchanged, signals more hikes are coming: Live updates

- Treasury yields waver as traders weigh latest Fed decision and potential moves going forward

- Stocks & Gold Slump After Hawkish Fed Sends Rate-Hike Odds Soaring

- The Fed: Fed skips June interest-rate hike, but points to two more increases this year

- Futures Movers: Oil settles lower as an ‘adjustment’ contributes to a nearly 8 million-barrel weekly U.S. crude supply climb

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Chinese Military Equipment Found Its Way Into The Ukraine WarIt’s been a constant since Moscow’s full-scale invasion of Ukraine in 2022, but Chinese parts and components — as well as drones and some weapons — are finding their way onto the battlefield and helping Russia’s military. Finding Perspective: The issue was pushed back into the spotlight following a video posted to Telegram by Chechen leader Ramzan Kadyrov showcasing an array of new military equipment, including eight Chinese-made unarmed armored personnel carriers. The vehicles appeared to be a multipurpose model called the Tiger or China Tiger… Read more at: https://oilprice.com/Geopolitics/International/How-Chinese-Military-Equipment-Found-Its-Way-Into-The-Ukraine-War.html |

|

Infrastructure Projects Provide Support Amid Falling Steel PricesVia AG Metal MIner The Construction MMI (Monthly Metals Index) stayed within a tight range, but dropped more than in the previous three months. Overall, the index fell by 5.04% month-on-month. Meanwhile, steel prices continued to slide, which brought noticeable bearish pressure to the index. However, within the first couple weeks of June, H-beam steel and steel rebar prices began to rise again. While bar fuel surcharges managed to increase, they did not add any noticeable support to the index between May 1 – June… Read more at: https://oilprice.com/Metals/Commodities/Infrastructure-Projects-Provide-Support-Amid-Falling-Steel-Prices.html |

|

Rystad Sees Major Jump In Battery Storage Capacity Through 2030The era of battery energy storage applications may just be beginning, but annual capacity additions will snowball in the coming years as storage becomes crucial to the world’s energy landscape. Rystad Energy modeling projects that annual battery storage installations will surpass 400 gigawatt-hours (GWh) by 2030, representing a ten-fold increase in current yearly additions. Battery energy storage systems (BESS) are a configuration of interconnected batteries designed to store a surplus of electrical energy and release it for upcoming… Read more at: https://oilprice.com/Energy/Energy-General/Rystad-Sees-Major-Jump-In-Battery-Storage-Capacity-Through-2030.html |

|

Turkmenistan’s Natural Gas Ambitions Threatened By Instability In AfghanistanWith Turkmenistan’s dream to see construction of the trans-Afghan TAPI natural gas pipeline, the devil is in the details. Or the footnotes, to be more precise. A United Nations report on the current situation in Afghanistan published earlier this month conveys a generally troubling picture, not just for Turkmenistan, but the region as a whole. Under Taliban rule, the country has reverted to the exclusionary policies that prevailed in the 1990s. The self-styled Islamic Emirate has moreover retained its historic connections with militant… Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistans-Natural-Gas-Ambitions-Threatened-By-Instability-In-Afghanistan.html |

|

Polysilicon Price Surge: A Challenge For Emerging Solar MarketsWith high energy prices and supply chain disruptions creating shortages of key renewable energy components and materials, emerging markets are reassessing how to build out utility-scale solar power to accelerate their energy transitions. After more than a decade of decline, the cost of solar photovoltaic (PV) panels has risen around the world, due primarily to the increasing cost of solar-grade polysilicon in China. A key component in PV panels, polysilicon spot market prices rose from less than $7 per kg in July 2020 to $39 in August 2022. Though… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Polysilicon-Price-Surge-A-Challenge-For-Emerging-Solar-Markets.html |

|

Young Drivers Pay The Price As Insurance Rates SkyrocketYoung car owners are paying an extra £300 to drive a car this year as a result of insurers hiking up premium prices, new research shows. Analysis from Compare the Market shows that young motorists between 17-24 are now paying £2,559 to drive a car for a year, compared with £2,263 in 2022 a “substantial” 13 percent increase. Compare the Market said that “as a result of the increase in premiums, car insurance now represents 57 percent of the total car running costs for young drivers.” It follows increasing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Young-Drivers-Pay-The-Price-As-Insurance-Rates-Skyrocket.html |

|

Oil Moves Lower After EIA Confirms Large Crude BuildCrude oil prices inched lower today after the Energy Information Administration reported an estimated inventory build of 7.9 million barrels for the week to June 9. This compared with a modest inventory draw of half a million barrels for the previous week and an estimated build of just over 1 million barrels for the week to June 9 as reported on Tuesday by the American Petroleum Institute. Analyst expectations for the weekly change ranged from a draw of 2.5 million barrels to a build of 2 million barrels. In fuels, inventory changes were also positive… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Lower-After-EIA-Confirms-Large-Crude-Build.html |

|

IEA: Global Oil Demand Will Peak Before The End Of The DecadeThe Paris-based International Energy Agency (IEA) has predicted that global oil demand will peak before the end of the current decade as the transition to renewable energy gathers momentum. According to the IEA, global oil demand will rise by another 6% from 2022-28 to hit 105.7 million barrels per day. The agency expects demand growth for oil to slump to just 400,000 barrels per day in 2028, way below the growth of 2.4 million barrels per day forecast for 2023. The energy agency has also predicted that global demand for oil used in transportation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Global-Oil-Demand-Will-Peak-Before-The-End-Of-The-Decade.html |

|

Tesla’s New Charging Standard Makes Competition Near-ImpossibleNow that Ford and GM are joining forces with Tesla on charging infrastructure, the industry tide seems to be turning to one accepted standard: Tesla’s North American Charging Standard (NACS) port. Brilliantly using an analog to the old Blu-ray vs HD DVD wars of days past, The Verge highlights how Tesla is shouldering its way to the front of the line when it comes to EV charging protocols. Combined with Ford and GM, Tesla’s standard now makes up 72% of the U.S. market. Its closest competitor, the CCS, gets the ill fated comparison to… Read more at: https://oilprice.com/Energy/Energy-General/Teslas-New-Charging-Standard-Makes-Competition-Near-Impossible.html |

|

JP Morgan Slashes Oil Price Forecast To $81 This YearJP Morgan has significantly reduced its forecast for Brent Crude prices for this year to $81 per barrel, down from $90 a barrel expected earlier, Forexlive reports. As early as February this year, JP Morgan said that Brent Crude prices were not expected to reach $100 per barrel in 2023 unless a major geopolitical event rattles markets again. Russian crude oil production is expected to recover by June, while high price levels would prevent the U.S. from repurchasing crude to refill the Strategic Petroleum Reserve (SPR), the Wall Street bank said… Read more at: https://oilprice.com/Latest-Energy-News/World-News/JP-Morgan-Slashes-Oil-Price-Forecast-To-81-This-Year.html |

|

Shell To Raise Dividend By 15% As It Doubles Down On Oil And GasShell plans to raise its dividend by 15%, effective from the second quarter 2023 interim dividend, as the UK-based oil and gas supermajor pledged on Wednesday to grow its gas business and extend its position in the upstream. Back in 2021, Shell said that its oil production peaked in 2019 and is set for a continual decline over the next three decades as it looks toward the renewables side of the business. However, the post-Covid rebound in oil and gas demand and the Russian invasion of Ukraine with the subsequent major dislocation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-To-Raise-Dividend-By-15-As-It-Doubles-Down-On-Oil-And-Gas.html |

|

China Boosts Crude Oil Import Quotas By 20% From Last YearChinese authorities have issued a third batch of crude oil import quotas to refiners for 2023, with overall allowances up by 20% in the first half of this year compared to the same period of 2022. China issued 62.28 million tons of import quotas to private refiners – those that need government authorization to import crude unlike state-held oil refining giants – in the latest batch, Reuters reported on Wednesday, quoting documents and sources. With the latest batch for 2023, the total crude import allowances for Chinese… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Boosts-Crude-Oil-Import-Quotas-By-20-From-Last-Year.html |

|

Apache Halts Drilling In The UK North SeaApache Corporation is halting drilling in the UK North Sea, cutting jobs in Britain, after the latest change to the UK Energy Profits Levy, commonly referred to as the windfall tax. The U.S.-based corporation, which is one of the top ten producers of oil and gas in the UK North Sea, has said that the windfall tax and the challenging regulatory environment are making its UK operations less competitive. Apache has also confirmed the suspension of drilling activities will lead to job losses in its UK division. “We are reassessing our investments,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Apache-Halts-Drilling-In-The-UK-North-Sea.html |

|

Oil Prices Rise Ahead Of Fed Interest Rate DecisionSlowing inflation in the United States and China’s determination to jump-start a struggling economy after the reopening pushed oil prices higher early on Wednesday as the market awaits Fed’s rate decision and the weekly report on U.S. oil inventories. As of early morning European trade on Wednesday, the U.S. benchmark, WTI Crude, was up by 1.12% at $70.20. The international benchmark, Brent Crude, was trading at $75.20, up by 1.22% on the day. Oil prices were slightly higher early on Wednesday in Europe despite an estimate from the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Rise-Ahead-Of-Fed-Interest-Rate-Decision.html |

|

Biden Administration Looks To Add 12 Million Barrels To The SPR This YearThe federal government plans to buy some 12 million barrels as part of efforts to refill the strategic petroleum reserve after drawing down more than 200 million barrels from it last year. This is according to an unnamed source that spoke to Reuters and that also suggested total purchases this year could exceed 12 million barrels. Earlier this month, the Department of Energy announced it had bought 3 million barrels of crude for the strategic petroleum reserve and planned to buy another 3 million. “These 3 million barrels are being purchased for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-Looks-To-Add-12-Million-Barrels-To-The-SPR-This-Year.html |

|

Fed recap: Breaking down the market’s reaction to the Fed’s pause and all of Powell’s key commentsThe Federal Reserve announced on Wednesday afternoon that it would skip a rate hike in June. Read more at: https://www.cnbc.com/2023/06/14/live-updates-fed-decision-june-2023.html |

|

S&P 500 closes little changed after Fed leaves rates unchanged, signals more hikes are coming: Live updatesAs traders were expecting, the Fed kept interest rates unchanged at a target range of 5%-5.25% on Wednesday afternoon. Read more at: https://www.cnbc.com/2023/06/13/stock-market-today-live-updates.html |

|

Why economists say it’s a near certainty that housing inflation will soon fallThe consumer price index will soon reflect easing price trends in U.S. housing, economists said. Read more at: https://www.cnbc.com/2023/06/14/housing-inflation-will-almost-surely-fall-soon-say-economists.html |

|

Trump post-arraignment donor dinner was full of crab cakes, burgers and rageDonald Trump met with his small group of wealthy supporters Tuesday night after being arraigned, as these select financiers rallied to his cause. Read more at: https://www.cnbc.com/2023/06/14/trump-rages-against-indictment-expensive-donor-dinner.html |

|

Oracle says it’s seeing ‘exploding AI demand’ and Deutsche Bank touts one stock as a big beneficiaryThe bank expects shares to rise nearly 8% over the next year. Read more at: https://www.cnbc.com/2023/06/14/oracle-says-its-seeing-exploding-ai-demand-and-deutsche-bank-touts-one-stock-as-a-big-beneficiary.html |

|

Treasury yields waver as traders weigh latest Fed decision and potential moves going forwardThe 2-year Treasury yields oscillated Wednesday after the Fed skipped a rate hike, but announced two more would come later this year. Read more at: https://www.cnbc.com/2023/06/14/treasury-yields-dip-ahead-of-fed-announcement.html |

|

Bitcoin moves higher after Fed decision, and Binance addresses emergency fund: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bittrex Global CEO Oliver Linch weighs in on the recent SEC charges against several crypto companies, including Bittrex, and what the regulatory crackdown means for the industry as a whole. Read more at: https://www.cnbc.com/video/2023/06/14/bitcoin-jumps-binance-emergency-fund-fluctuation-post-sec-charges-cnbc-crypto-world.html |

|

Attorney General Garland defends special counsel in first comments about Trump indictmentThe remarks were Garland’s first public comments about the federal indictment against Trump, who faces 37 counts related to his handling of classified records. Read more at: https://www.cnbc.com/2023/06/14/trump-indictment-merrick-garland-jack-smith.html |

|

Ukraine war live updates: Ukraine facing ‘extremely fierce’ battles and ‘partial success’ in counteroffensive; Putin says it’s failingRussian President Vladimir Putin claimed Ukraine’s counteroffensive is failing, saying Kyiv has failed to achieve any success. Read more at: https://www.cnbc.com/2023/06/14/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Diablo IV crosses $666 million in sales in five days, a record for Activision BlizzardThe record-breaking sales provide some solace as the company faces a pending battle with the Federal Trade Commission over a planned acquisition by Microsoft. Read more at: https://www.cnbc.com/2023/06/14/diablo-iv-666-million-in-sales-breaks-blizzard-record.html |

|

Golden Knights’ Stanley Cup win cements Las Vegas as a big-time sports cityThe Vegas Golden Knights won the Stanley Cup after just six seasons in existence. Read more at: https://www.cnbc.com/2023/06/14/golden-knights-win-stanley-cup-vegas-sports-city.html |

|

Here’s how the Federal Reserve’s pause in interest rate hikes affects your moneyAt the end of its two-day meeting Wednesday, the Fed said it would skip a rate hike in June. Read more at: https://www.cnbc.com/2023/06/14/what-the-federal-reserves-rate-hike-pause-means-for-your-money.html |

|

Bud Light loses spot as top-selling U.S. beer in May in the wake of boycott fightBud Light sales have sagged following a conservative boycott over its partnership with trans social media influencer Dylan Mulvaney. Read more at: https://www.cnbc.com/2023/06/14/bud-light-beer-sales-trail-modelo-in-may-following-anti-lgbtq-backlash.html |

|

The Great Dollar ParadoxAuthored by James Rickards via DailyReckoning.com, The de-dollarization story is everywhere.

You see it in publications from The New York Times to The Economist and in financial media including CNBC, Fox Business and Bloomberg. The idea is that countries around the world are preparing to ditch the dollar. This takes many forms including efforts by China to pay for imported oil from Saudi Arabia and the UAE with yuan and a major bilateral agreement between China and Brazil that allows each country to pay for exports from the other using their local currencies. Russia got in the act by agreeing to receive rupees for oil delivered to India and paying for imports from China with rubles. All these efforts will be converging and coming to a head in late August when the BRICS (Brazil, Russia, India, China, South Africa and other invited countries) meet to announce a new BRICS+ currency linked to gold. With all of that goi … Read more at: https://www.zerohedge.com/geopolitical/great-dollar-paradox |

|

After Biden ‘Promised’ Sweden Will ‘Soon’ Enter NATO, Erdogan Remains DefiantTo listen to the words of either the Biden administration or NATO Secretary General Jens Stoltenberg one could easily think that Sweden’s accession into NATO is a ‘done deal’. Sweden itself is saying there is “strong support” for Sweden’s membership going into the July 11-12 major annual summit of NATO heads of state in Vilnius, Lithuania. But as Al Jazeera highlights in a fresh report, there’s only one voice that matters at this point – the one holding onto the veto: “Western officials had hoped Erdogan would soften his position on the diplomatically charged issue after he secured a hard-fought re-election last month.” It remains that Erdogan has signaled no change of heart on the issue, even after Stockholm has taken pains to bow to Ankara’s demands. Read more at: https://www.zerohedge.com/geopolitical/after-biden-promised-sweden-will-soon-enter-nato-erdogan-remains-defiant |

|

Creator Of Conservative Chatbot Powered By ChatGPT Says OpenAI Tried To Censor ContentAuthored by Bryan Jung via The Epoch Times, The creators of a conservative chatbot powered by OpenAI’s ChatGPT announced that they shut down the chatbot because of pressure from OpenAI to censor the bot’s responses.

The conservative chatbot, named GIPPR in honor of the late President Ronald Reagan, debuted in May and is part of TUSK, a pro-free speech and anti-censorship web browser. GIPPR is a modified version of OpenAI’s ChatGPT and provides users with answers from a conservative perspective. The creators of GIPPR said they were forced to sever ties with OpenAI, after they were told that their chatbot failed to “conform to their requirements for what can or cannot be said.” TUSK founder and CEO Jeff Bermant said in a statement to Read more at: https://www.zerohedge.com/technology/creator-conservative-chatbot-powered-chatgpt-says-openai-tried-censor-content |

|

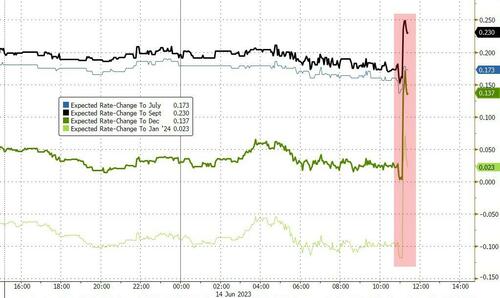

Stocks & Gold Slump After Hawkish Fed Sends Rate-Hike Odds SoaringThe hawkish pause – signaled by the dot-plot – prompted a kneejerk surge in rate-change expectations with July now pricing in a 70% chance of a hike and September a 95% chance of a hike as December and January have now priced out any rate-cuts…

Source: Bloomberg Stocks immediately tumbled, led by Small Caps…

Gold was also dumped on the hawkish signal… Read more at: https://www.zerohedge.com/markets/stocks-gold-slump-after-hawkish-fed-sends-rate-hike-odds-soaring |

|

US holds interest rates steady in first since 2022But the Federal Reserve also said it expected to push rates higher before the end of the year. Read more at: https://www.bbc.co.uk/news/business-65896598?at_medium=RSS&at_campaign=KARANGA |

|

Vodafone Three deal to create UK’s largest mobile firmThe deal is yet to be approved by regulators, which will look at whether it will push up customer prices. Read more at: https://www.bbc.co.uk/news/business-65842845?at_medium=RSS&at_campaign=KARANGA |

|

UK has no alternative to Bank interest rate rises to calm inflation – HuntChancellor says he “unstintingly” supports the Bank of England to “do what it takes” to cut inflation. Read more at: https://www.bbc.co.uk/news/business-65891838?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on ThursdayIndian equity indices closed near record highs on June 16, helped along by a possible rate pause by the US Federal Reserve, favourable WPI inflation data and upbeat global investments. While metal pack led gains, sectors including private banking and financial services saw selling pressure. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-thursday/articleshow/100999516.cms |

|

CreditSights recommends a ‘buy’ for Vedanta Resources for offshore bondsCreditSights, owned by Fitch Ratings, has recommended investors buy bonds of Vedanta Resources (VRL) with a high-risk appetite and a possible sharp sell-off nature. However, it also expects VRL to handle its debt maturities in the next 12 months and anticipates the rally in bond prices by 10-15 points. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/creditsights-recommends-a-buy-for-vedanta-resources-for-offshore-bonds/articleshow/101000409.cms |

|

Zurich Insurance eyes $400 million stake in Kotak General InsuranceZurich Insurance is reportedly in early-stage talks to acquire up to a 51% stake of Kotak General Insurance for roughly $400m, marking its first big gamble on the growing South Asian insurance market. The potential acquisition is valuing the Indian firm at around $800m, according to anonymous sources. Zurich, one of Europe’s largest insurers, has reportedly expressed an interest in either a 49% or majority stake in Kotak. India’s general insurance market grew 11% in 2021-22, hitting $26.7bn, and is largely considered vastly underpenetrated, with non-life insurance penetration barely hitting 1%, compared with the global average of 4.1%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zurich-insurance-eyes-400-million-stake-in-kotak-general-insurance/articleshow/100999020.cms |

|

Bond Report: Two-year Treasury yield at three-month high after Fed sees more 2023 rate hikesThe 2-year Treasury yield inches higher on Wednesday after Federal Reserve officials indicate more rate hikes are on the way this year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7212-A3CE00BCB919%7D&siteid=rss&rss=1 |

|

The Fed: Fed skips June interest-rate hike, but points to two more increases this yearThe Federal Reserve held interest rates steady Wednesday and pointed to two more 25-basis-point rate hikes this year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7212-6319791430CB%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil settles lower as an ‘adjustment’ contributes to a nearly 8 million-barrel weekly U.S. crude supply climbOil futures settle lower on Wednesday after official U.S. data reveal across-the-board weekly increases in petroleum supplies, with an “adjustment” to the data contributing to a nearly 8 million-barrel rise in crude stockpiles. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7212-BAAFCC3AA5FC%7D&siteid=rss&rss=1 |