Summary Of the Markets Today:

- The Dow closed up 146 points or 0.43%,

- Nasdaq closed up 0.83%,

- S&P 500 closed up 0.69%,

- Gold $1,956 down $13.40,

- WTI crude oil settled at $69 up $2.06,

- 10-year U.S. Treasury 3.829% up 0.064 points,

- USD Index $103.31 down $0.34,

- Bitcoin $25,874 up $54,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Pundits believe the Federal Reserve will pass on raising the federal funds rate tomorrow because year-over-year inflation has now fallen to 4.0% year-over-year (blue line on the graph below) according to today’s consumer price index for All Urban Consumers (CPI-U) data for May 2023. Note that the CPI-U less food and energy index rose 5.3% year-over-year (red line on the graph below). Actually, food is up 6.7% year-over-year – and it is energy (think gas and oils) which is DOWN 11.7% year-over-year. It is energy driving the decline in the CPI, and this pundit would keep raising the federal funds rate (green boxed line on the graph below) until a sizeable decline in the CPI-U less food and energy is observed. The Fed believes there is a lag between raising rates and the effect on inflation of raising those rates – there is a lag but not a significant one when labor compensation is rising at a fast clip also. CoreLogic Chief Economist Selma Hepp added:

While the Fed is unlikely to steer away from the communicated path and will most likely keep the rates steady on Wednesday, Tuesday’s CPI report suggests that inflation pressures persist and the Fed will consider another hike next month. The likelihood of another hike or two has also increased given lack of credit crunch the Fed was expecting from the banking sector. As a result, mortgage rates, while still on a gradual decline, are likely to remain higher through the remainder of year.

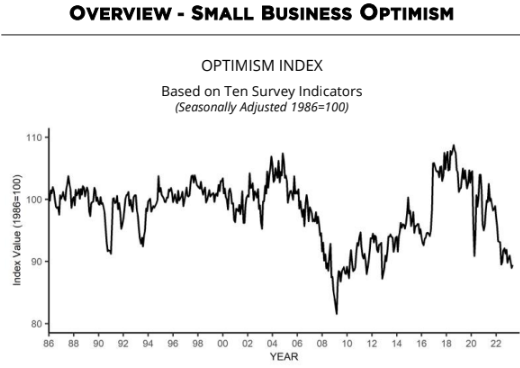

The NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, which is the 17th consecutive month below the 49-year average of 98. The last time the Index was at or above the average was in December 2021. Small business owners expecting better business conditions over the next six months declined one point from April to a net negative 50%. Twenty-five percent of owners reported that inflation was their single most important problem in operating their business, up two points from last month and followed by labor quality at 24%. Bill Dunkelberg, NFIB Chief Economist stated:

Overall, small business owners are expressing concerns for future business conditions. Supply chain disruptions and labor shortages will continue to limit the ability of many small firms to meet the demand for their products and services, while less severe than last year’s experience.

Here is a summary of headlines we are reading today:

- China At The Forefront Of Nuclear Weapon Expansion

- May Inflation Comes In Lower Than Expected

- Oil Markets On Edge Ahead Of Fed Meeting

- Oil Soars Nearly 4% Ahead Of Fed Rate Decision

- Pay rise surprise leads to forecasts of higher interest rates

- Mortgages: New squeeze on landlords will hit renters too

- Ahead of Market: 10 things that will decide D-Street action on Wednesday

- Should you be worried if your crypto is in Binance.US or Coinbase?

- NerdWallet: ‘What if I live too long?’ Five things to know about taking Social Security at 62.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia’s Year-Round Arctic Trade Route InitiativeWestern sanctions and changes in climate are impelling Moscow to realize a dream dating back three centuries to the time of Tsar Peter the Great—an all-water route from the Barents Sea to the Pacific through Russia’s coastal Arctic waters. During a Kremlin video conference on May 17, Russian President Vladimir Putin stressed to participants that the Northern Sea Route (NSR) had become “extremely important” to Russia as climate change created more opportunities for shipping along the Arctic route, the shortest maritime link… Read more at: https://oilprice.com/Geopolitics/International/Russias-Year-Round-Arctic-Trade-Route-Initiative.html |

|

3 Freeport LNG Trains Back Online Amid Volatile Natural Gas PricesTen months after its shutdown, Freeport LNG trains are back online for its Quintana Island, Texas, facility, enabling the restoration of deliveries to major companies with liquified natural gas offtake agreements, including giant BP and French TotalEnergies, Hart Energy reports exclusively. Freeport LNG export facility handles 15 million tonnes per annum, making it one of the largest in the world, and the second largest in the United States. Responsible for some 20% of total LNG exports from the U.S., Freeport generated $35 billion in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/3-Freeport-LNG-Trains-Back-Online-Amid-Volatile-Natural-Gas-Prices.html |

|

China At The Forefront Of Nuclear Weapon ExpansionReleased today, the latest figures from SIPRI reveal an annual increase in the global number of stockpiled nuclear warheads. As Statista’s Martin Armstrong shows in the infographic below, China is at the forefront of this upwards tick, adding an estimated 60 weapons to its collection of deployed or stored nukes between January 2022 and January 2023. You will find more infographics at Statista As detailed by SIPRI, “China is in the middle of a significant modernization and expansion of its nuclear arsenal. Its nuclear stockpile… Read more at: https://oilprice.com/Geopolitics/International/China-At-The-Forefront-Of-Nuclear-Weapon-Expansion.html |

|

May Inflation Comes In Lower Than ExpectedU.S. consumer prices climbed a paltry 0.1% in the month of May, smaller than the 0.4% increase the previous month as falling fuel and electricity prices eased inflationary pressure. The Consumer Price Index(CPI) increased 4.0% Y/Y, also an improvement from the previous month’s 4.9%Y/Y increase. Economists polled by Reuters had forecast at least a 0.2% M/M CPI increase and a 4.1% gain on a year-on-year basis. Gasoline prices fell 5.6% while utility gas also cost less. However, food prices increased 0.2% in large part due to an increase… Read more at: https://oilprice.com/Latest-Energy-News/World-News/May-Inflation-Comes-In-Lower-Than-Expected.html |

|

EU Steel Consumption Predicted To Surge In 2024Via AG Metal Miner A recent European Steel Association (Eurofer) report said that apparent steel consumption within the European Union is likely to improve by 5.4% in 2024. That said, the organization indicated that this figure depends on there being more favorable developments in the bloc’s industrial outlook. Either way, steel prices will likely see some impact from this potential increase. “However, the overall evolution of steel demand remains subject to high uncertainty,” Eurofer warned in its May 3 report. “[This]… Read more at: https://oilprice.com/Metals/Commodities/EU-Steel-Consumption-Predicted-To-Surge-In-2024.html |

|

NATO Conducts Largest Air Drills EverGermany is playing host to what NATO is touting as the largest air drills in the alliance’s history, which has been four years in preparation. Dubbed Air Defender 23, the drills kicked off on Monday and will go to June 23, and involve up to 250 aircraft engaging in operations launched from across six military bases. In total, 25 countries are taking part, with the United States sending 100 of its aircraft across the Atlantic for the major exercise. Large swathes of airspace over parts of Germany will be intermittently closed to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/NATO-Conducts-Largest-Air-Drills-Ever.html |

|

The New Playbook For U.S. Shale: More For Shareholders, Less Output GrowthThe last two energy crises that threatened hundreds of energy companies with bankruptcy have rewritten the O&G playbook. At the height of the shale boom, the U.S. Shale Patch expanded production aggressively and also made numerous aggressive tactical or cyclical acquisitions. However, the 2020 oil price crash that sent oil prices into negative territory has seen energy companies adopt a more restrained, strategic, and environment-focused approach in their spending. U.S. shale drillers have abandoned their trigger-happy drilling… Read more at: https://oilprice.com/Energy/Energy-General/The-New-Playbook-For-US-Shale-More-For-Shareholders-Less-Output-Growth.html |

|

Drunk Russian Captain Crashes Oil TankerTwo oil tankers have collided in the Irkutsk region in Russia’s thanks to a captain operating under the influence of alcohol, causing oil spillage into a local river. According to Irkutsk governor Igor Kobzev, it’s still unclear how much fuel spilled into the Lena River, the world’s 11th longest, but said one tanker that sustained significant damage was carrying 138 metric tons of gasoline. The governor estimates that as many as 60 to 90 tons of fuel could spill into the river. “At the moment, the oil slick has passed a number of settlements.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drunk-Russian-Captain-Crashes-Oil-Tanker.html |

|

Oil Markets On Edge Ahead Of Fed MeetingOil prices have bounced back after Monday’s $3 per barrel decline, but markets remain on edge ahead of the latest Fed meeting. Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, Global Energy Alert is an absolute must-read. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Chart of the Week Europe’s Industrial Gas Demand Just Won’t Come Back – Even though European natural gas prices have… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Markets-On-Edge-Ahead-Of-Fed-Meeting.html |

|

Centrica’s Profits Soar, But CEO Pay Raises EyebrowsBritish Gas owner Centrica has announced that the operating profits for its retail arm will be “significantly higher than in previous years,” as it seeks to win a shareholder showdown at its AGM today. The FTSE 100 firm has posted a bullish trading update ahead of a heated series of votes with shareholders over executive pay, where bosses will bear the brunt of an investor revolt over chief executive Chris O’Shea’s proposed £4.5m pay packet. The energy giant expects a hike in profits due to reductions in debt-related… Read more at: https://oilprice.com/Energy/Energy-General/Centricas-Profits-Soar-But-CEO-Pay-Raises-Eyebrows.html |

|

Oil Soars Nearly 4% Ahead Of Fed Rate DecisionThe oil markets continue to be volatile and unpredictable, with WTI and Brent crude making significant gains on Tuesday’s morning session just a day after prices took a big plunge on growing Wall Street bearishness. At 10:13 a.m. EST, Brent crude for July delivery was trading at $74.50/barrel, good for a 3.7% gain, while WTI crude for July delivery climbed by a similar margin to trade at $69.67 per barrel. Citing rising supply and waning demand, Goldman Sachs cut its year-end WTI crude outlook to $81/bbl from $89 and its Brent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Soars-Nearly-4-Ahead-Of-Fed-Rate-Decision.html |

|

Oil Traders Ignore Saudi Warning To ‘Watch Out’Despite last week’s Saudi announcement of a unilateral oil production cut of 1 million barrels per day (bpd) in July, oil prices ended the week with a second consecutive weekly loss as market participants continued to be focused on signals of weaker-than-expected demand instead of tighter supply. Oil traders and speculators seem to have so far largely ignored not only the Saudi attempt to further tighten the market this summer, but also the warning of Saudi Energy Minister, Prince Abdulaziz bin Salman, from the end of May,… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Traders-Ignore-Saudi-Warning-To-Watch-Out.html |

|

OPEC Warns Of Growing Economic Uncertainty But Reaffirms Oil Demand OutlookOPEC on Tuesday kept its oil demand growth forecast for 2023 mostly unchanged from last month but warned of increased economic uncertainties ahead due to high interest rates and persistent inflation. OPEC sees global oil demand growth at 2.35 million barrels per day (bpd) this year in its closely-watched Monthly Oil Market Report (MOMR) out on Tuesday, essentially unchanged from the 2.33 million bpd estimate in last month’s report. The overwhelming part of the growth will come from non-OECD economies, where oil demand is set to rise… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Warns-Of-Growing-Economic-Uncertainty-But-Reaffirms-Oil-Demand-Outlook.html |

|

Europe’s Natural Gas Prices Drop After Volatile WeekEurope’s benchmark natural gas prices fell for a second day in a row on Tuesday amid tepid industrial demand and comfortable inventories. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, fell by 5.6% to $31.64 (29.295 euros) per megawatt-hour (MWh) as of 10:37 a.m. GMT on Tuesday. Prices extended Monday’s losses following a rise last week, which was triggered by supply challenges with maintenance at Norwegian gas fields and a French LNG import terminal. Last week, European gas prices… Read more at: https://oilprice.com/Energy/Energy-General/Europes-Natural-Gas-Prices-Drop-After-Volatile-Week.html |

|

Deadly Cyclone In India Halts Fuel Exports And Operations At Offshore RigsA severe cyclone off India’s western coast has suspended oil product exports from one port and halted operations at offshore oil platforms and other ports as authorities are evacuating people from coastal areas where the tropical cyclone Biparjoy in the Arabian Sea has already claimed seven lives. Biparjoy is expected to make landfall on Thursday between Mandvi in India’s western state of Gujarat and Karachi in Pakistan. Many offshore oil and gas platforms are located off Gujarat, which is also home to several major ports. Most of those… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Deadly-Cyclone-In-India-Halts-Fuel-Exports-And-Operations-At-Offshore-Rigs.html |

|

Karine Jean-Pierre’s “Mega MAGA Republicans” Remarks Violated Hatch Act Says WatchdogAuthored by Caden Pearsen via The Epoch Times, White House press secretary Karine Jean-Pierre was found to have violated the Hatch Act during official press briefings last year.

The U.S. Office of Special Counsel (OSC) concluded that her comments regarding “mega MAGA Republican officials” and her derogatory statements about the Republican Party were in violation of the Hatch Act, which aims to prevent federal employees from engaging in political activities that could interfere with elections. The OSC’s investigation found that Jean-Pierre had repeatedly used the phrase “MAGA Republicans” in official press briefings, and her statements were deemed to be an inappropriate attempt to influence the vote.

|

|

Musk’s Refusal To Pay Twitter HQ Rent Adds To Goldman’s Growing CRE Loan DelinquenciesAmong all the property owners putting the screws to Goldman Sachs’ commercial loans, you wouldn’t expect Elon Musk to top the list, especially given Tesla’s close working relationship with Goldman. But business is business, it appears… Among Goldman’s “surge” in commercial real estate loan delinquencies in the first quarter was Elon Musk’s refusal to pay rent at Twitter, FT reported this week. The report noted that the value of loans to CRE borrowers behind on their payments was up an astonishing 612% in the first quarter, to $840 million, according to reports filed by Goldman’s licensed banking entity. The commercial real estate sector has been a powder keg waiting to implode since the end of Covid. Analysts have predicted that heading into the second half of this year, when portfolio/property marks are updated, a cascade of selling and deleveraging in the now barren commercial office space industry could be in store.

Read more at: https://www.zerohedge.com/markets/musks-refusal-pay-twitters-rent-adds-pressure-goldmans-growing-cre-loan-delinquencies |

|

Poland Urges NATO Response To Russia Sending Nukes to BelarusAuthored by Dave DeCamp via AntiWar.com, Polish President Andrzej Duda said Monday that NATO must respond to Russia deploying nuclear weapons to Belarus. “I absolutely believe that such a situation demands an unequivocal response from NATO,” Duda said at a joint press conference in Paris with French President Emmanuel Macron and German Chancellor Olaf Scholz, according to Bloomberg.

In October 2022, Duda said he was discussing the idea with Washington:

|

|

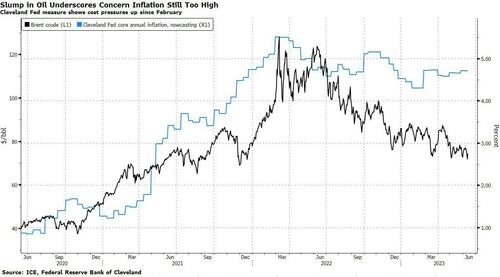

Sliding Oil, Sticky Inflation Spell Danger For Exuberant StocksBy Garfield Reynolds, Bloomberg Markets Live reporter and strategist US equities’ rally to the highest in more than a year has been at least partly driven by sustained expectations that moderating inflation will soon bring the Federal Reserve’s tightening cycle to an end. That ignores the potential that slowing inflation signals a significantly weaker economic outlook than what’s being priced in. The rally seemingly shows no fear that Tuesday’s US CPI readings could come in hot enough to provoke a fresh hawkish tack from the Fed. But in many ways, the concern should be more about the medium term. The Cleveland Fed’s nowcast for PCE core inflation — the gauge itself being the indicator that policymakers focus on — has actually climbed since February when it hit the lowest since 2021. And that’s come even as crude oil declined despite OPEC+ output cuts.

That makes for a toxic mix for growth. Inflation readings that are strong enough to keep the Fed biased towa … Read more at: https://www.zerohedge.com/markets/sliding-oil-sticky-inflation-spell-danger-exuberant-stocks |

|

Pay rise surprise leads to forecasts of higher interest ratesWages rise at their fastest rate in 20 years, excluding the pandemic, but still lag behind the cost of living. Read more at: https://www.bbc.co.uk/news/business-65876822?at_medium=RSS&at_campaign=KARANGA |

|

Mortgages: New squeeze on landlords will hit renters tooHigh mortgage costs mean landlords face a “turning point”, a firm warns, leading to fewer homes to rent. Read more at: https://www.bbc.co.uk/news/business-65890391?at_medium=RSS&at_campaign=KARANGA |

|

Sainsbury’s and Asda told not to block rival storesThe supermarkets are accused of stopping rivals opening nearby, potentially reducing consumer choice. Read more at: https://www.bbc.co.uk/news/business-65889328?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on WednesdayThe benchmark Sensex rose by 418 points to settle at a six-month high, driven by optimistic domestic macroeconomic data and gains in global markets. Buying in index majors Reliance Industries and ITC also added to the positive mood in equities. Additionally, the Nifty closed above the 17,700 mark. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-wednesday/articleshow/100973454.cms |

|

Top Guns! RIL, LIC & 6 other Indian companies among 400 global heavyweightsMukesh Ambani’s Reliance Industries climbed eight spots to the 45th rank, the highest for an Indian company on Forbes’ latest Global 2000 list of public companies Read more at: https://economictimes.indiatimes.com/markets/web-stories/top-guns-ril-lic-amp-6-other-indian-companies-among-400-global-heavyweights/articleshow/100972879.cms |

|

These 9 commodity stocks touch their new 52-week high; do you own any?During Tuesday’s trading session, the Sensex benchmark index witnessed a rise of 418 points, closing at a notable 63,143 level. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-9-commodity-stocks-touch-their-new-52-week-high-do-you-own-any/articleshow/100974713.cms |

|

Should you be worried if your crypto is in Binance.US or Coinbase?The answer boils down to the risk a person can stomach, experts say. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7211-9E2EBAC2B033%7D&siteid=rss&rss=1 |

|

NerdWallet: ‘What if I live too long?’ Five things to know about taking Social Security at 62.There’s a lot to know about claiming Social Security early. If you keep working, you could get even less, and your decision can affect your spouse, too. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-720F-3CB2002A478B%7D&siteid=rss&rss=1 |

|

Grain processor Bunge to combine with Glencore-backed Viterra to create global agribusiness leaderBunge Ltd. has agreed to combine with Rotterdam-based Viterra Ltd. in a cash-and-stock deal valued at about $18 billion, including debt. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7211-73126776FD11%7D&siteid=rss&rss=1 |

Via FlickrDuda didn’t specify what kind of response he had in mind, but he has previously said Poland wants to host US nuclear weapons.

Via FlickrDuda didn’t specify what kind of response he had in mind, but he has previously said Poland wants to host US nuclear weapons.