Summary Of the Markets Today:

- The Dow closed up 154 points or 0.47%,

- Nasdaq closed up 1.28%,

- S&P 500 closed up 0.99%,

- Gold $1,996 up $13.50,

- WTI crude oil settled at $70 up $1.96,

- 10-year U.S. Treasury 3.605% down 0.032 points,

- USD Index $103.55 down $0.78,

- Bitcoin $26,864 down $209,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

ADP National Employment Report from the ADP Research Institute shows private employers created 278,000 jobs in May 2023 and annual pay was up 6.5 percent year-over-year. Job growth is strong while pay growth continues to slow. But gains in private employment were fragmented last month, with leisure and hospitality, natural resources, and construction taking the lead whilst manufacturing and finance lost jobs. Strong employment gains will allow the Federal Reserve to continue to raise interest rates. Nela Richardson, ADP’s chief economist stated:

This is the second month we’ve seen a full percentage point decline in pay growth for job changers. Pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring.

According to NFIB’s monthly jobs report, 44% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down one point from April but still 20 points higher than the 49-year average reading. The percentage of owners reporting labor quality as their top small business operating problem remains elevated at 24% and 10% of owners reported labor costs as their single most important problem. NFIB Chief Economist Bill Dunkelberg stated:

The labor force participation rate remains below pre-COVID levels, which is contributing to the shortage of workers available to fill open positions. Small businesses have a record high level of job openings currently and are working hard to fill their open positions.

Construction spending during April 2023 was estimated at a seasonally adjusted annual rate of 7.2% above April 2022. However, when the spending is adjusted for inflation – spending declined 3.4% year-over-year. This is a sign of a weak economy.

In the week ending May 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 229,500, a decrease of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 231,750 to 232,000.

Nonfarm business sector labor productivity decreased by 0.8% from the first quarter one year ago whilst labor costs increased by 3.8% in the same period. Whenever labor costs rise faster than productivity – it is not only inflationary but makes the country less competitive.

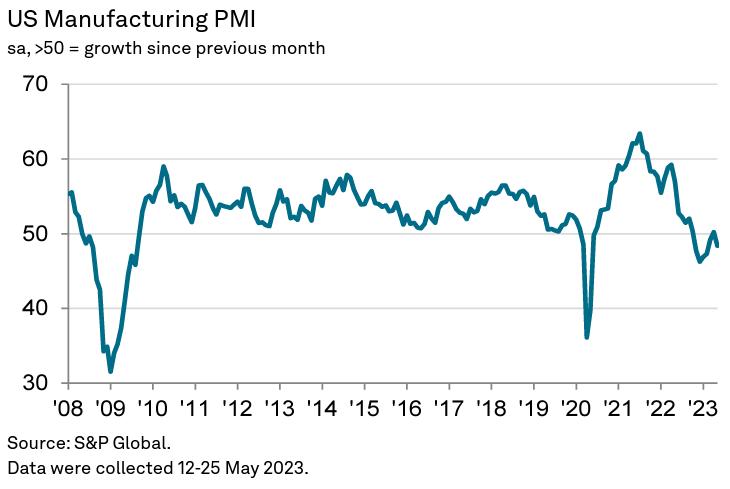

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index™ (PMI™) posted 48.4 in May, down from 50.2 in April, but broadly in line with the earlier released ‘flash’ estimate of 48.5. The latest figure indicated the fastest deterioration in operating conditions since February. Contributing to the latest overall decline was a renewed and solid fall in new orders at manufacturing firms in May. The decrease was the sharpest in three months. Lower new sales were often attributed to sufficient inventory levels at customers and previous hikes in selling prices which served to dampen demand conditions. F

The May Manufacturing PMI® registered 46.9%, 0.2 percentage point lower than the 47.1 percent recorded in April. Regarding the overall economy, this figure indicates a sixth month of contraction after a 30-month period of expansion.

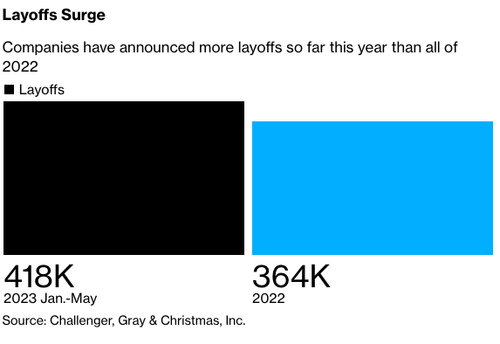

U.S.-based employers announced 80,089 job cuts in May, a 20% increase from the 66,995 cuts announced one month prior. It is 287% higher than the 20,712 cuts announced in the same month in 2022. So far this year, companies have announced plans to cut 417,500 jobs, a 315% increase from the 100,694 cuts announced in the same period last year. It is the highest January-May total since 2020.

Here is a summary of headlines we are reading today:

- The Grid Needs A $20 Trillion Upgrade To Support Energy Transition

- Copper Prices Trounced By Falling Demand

- WTI Screams Back Up Past $70 Despite Crude Inventory Builds

- Natural Gas Prices Plunge Further Amid Rise In U.S. Stockpiles

- Why Apple’s VR headset could succeed where every similar product has failed

- Defense spending levels threaten to delay Senate plan to fast-track debt ceiling bill

- Stocks jump Thursday, Nasdaq pops 1% as traders cheer advancement of debt ceiling bill: Live updates

- Bitcoin suffers worst month of 2023, Circle cuts U.S. bonds on debt ceiling doubt: CNBC Crypto World

- Wage hikes may have been a key driver of inflation. They may now be fueling mass layoffs

- Planned Layoffs Are Up Fourfold So Far This Year

- Dell stock jumps after early earnings release shows largest sales decline on record, but still beats expectations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Grid Needs A $20 Trillion Upgrade To Support Energy TransitionFor the energy transition to happen, the world needs massive grid overhauls. This message has been overlooked for years as wind and solar stole the limelight, but now it’s back on the agenda. Because no transition from baseload, dispatchable power generation to distributed, intermittent generation is possible without a massive grid overhaul. Back in 2020, BloombergNEF estimated the cost of that overhaul at $14 trillion over the thirty years between 2020 and 2050. That’s how much it would cost to build the millions of miles… Read more at: https://oilprice.com/Energy/Energy-General/The-Grid-Needs-A-20-Trillion-Upgrade-To-Support-Energy-Transition.html |

|

South Africa Could Ease Blackouts By Burning Heavy Fuel OilSouth Africa’s chronic 10-hours-per-day blackouts could finally have a solution that won’t sit well with energy transitioners—burning heavy fuel oil. South Africa’s Electricity Minister, Kgosientsho Ramokgopa, has announced that the country will start an emergency procurement program. The program will negotiate power purchase agreements and will last for five years. Some of the power will come from natural gas from Turkey’s Karpowership through an existing agreement. At least 1,200 MW of the 2,000 MW needed will be… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Could-Ease-Blackouts-By-Burning-Heavy-Fuel-Oil.html |

|

Five Niche Commodities Reflecting China’s Faltering Economic ReboundChina’s economic recovery from draconian zero-Covid controls is faltering. Investors had very high hopes earlier this year that the world’s second-largest economy would roar back to life and help offset weakness in the global economy. However, six months later, those same hopes have faded into disappointment. One of the most immediate warning signs investors are losing faith in the recovery narrative is that the Hang Seng China Enterprises Index fell into bear market territory Tuesday, down about 20% from its Jan. 27 peak. While equities… Read more at: https://oilprice.com/Metals/Commodities/Five-Niche-Commodities-Reflecting-Chinas-Faltering-Economic-Rebound.html |

|

Europe’s 11th Russian Sanctions Package Could Be Coming SoonThe next revision of Europe’s Russian sanctions could be coming as soon as next week, although the measures won’t be as strong as originally intended, people familiar with the negotiations told Reuters. The European Commission had plans to tighten up the loopholes in the existing sanctions and put out its proposal last month. The members of the coalition were expected to be signed off on sometime between May 19 and 21, but the proposal to beef up sanctions against Russia wasn’t without dissension, prompting additional negotiations… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-11th-Russian-Sanctions-Package-Could-Be-Coming-Soon.html |

|

Copper Prices Trounced By Falling DemandBy Stuart Burns via AGMetalminer.com At least that’s what the Financial Times reported Goldman Sachs saying this week with regard to the price of copper. The bank also revised its forecast for the average copper price to $8,698 per metric ton, down from $9,750. According to a NASDAQ post, copper prices touched a six-month low this week as speculators increased short positions. The move was in response to worries about recessionary trends in Europe and weakness in the Chinese manufacturing sector. Analysts do not currently expect… Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-Trounced-By-Falling-Demand.html |

|

WTI Screams Back Up Past $70 Despite Crude Inventory BuildsCrude oil prices turned around on Thursday, erasing most of the week’s earlier losses despite the latest EIA report that indicated crude oil inventories rose more than expected. WTI was sent back up above the $70 threshold to $70.96—a $2.87 (+4.22%) rise on the day. The Brent crude oil benchmark had risen $2.58 (3.55%) per barrel to $75.18. While it hasn’t erased all of the week’s losses, it has recouped more than half. This week has been a rollercoaster for crude oil prices, first sent spiraling downward at the beginning… Read more at: https://oilprice.com/Energy/Oil-Prices/WTI-Screams-Back-Up-Past-70-Despite-Crude-Inventory-Builds.html |

|

Chinese Government Encourages Tesla To Expand Business In ShanghaiTesla’s relationship with China continues to look cozy heading into the second half of 2023, with Shanghai party chief Chen Jining reportedly encouraging Elon Musk to expand his business in China. At the conclusion of a trip through China for Musk, on Thursday Bloomberg reported in a wrap-up that Musk was told to expand his investment and businesses in Shanghai, citing an official government statement. The city is reportedly seeking “deepening cooperation with Tesla on electric vehicles and energy storage sector”. Tesla… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Government-Encourages-Tesla-To-Expand-Business-In-Shanghai.html |

|

Natural Gas Prices Plunge Further Amid Rise In U.S. StockpilesU.S. natural gas stockpiles gained 110 billion cubic feet for the week ended May 26, putting more downward pressure on prices, particularly as storage is now 557 billion cubic feet higher than at this time last year, and well above the five-year average. The increase in natural gas stockpiles was largely in line with analyst expectations, though slightly lower than the consensus estimate of 113 Bcf. Steady production and only modest demand continue to set natural gas prices up for further decline in the coming quarter, which will affect Q2 earnings… Read more at: https://oilprice.com/Energy/Natural-Gas/Natural-Gas-Prices-Plunge-Further-Amid-Rise-In-US-Stockpiles.html |

|

Oil Jumps As EIA Reports Surprise Crude BuildCrude oil prices moved higher moments before the Energy Information Administration reported an inventory build of 4.5 million barrels for the week to May 26. At 459.7 million barrels, crude oil inventories in the U.S. are around 2% below the five-year average for this time of the year. Last week’s change compares with a substantial draw of 12.5 million barrels for the previous week, which caused prices to jump but only for a short while. This week, the American Petroleum Institute surprised markets with a large inventory build… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Jumps-As-EIA-Reports-Surprise-Crude-Build.html |

|

Iraq’s Crude Oil Exports Stay Flat As Kurdistan Saga ContinuesIraq, OPEC’s second-largest oil producer, exported on average 3.3 million barrels per day (bpd) of oil in May, flat compared to April, according to the Iraqi oil ministry. Iraq’s revenues from oil stood at $7.3 billion last month, as sales were made at an average of $71.30 per barrel, the ministry said in a statement carried by Reuters. Iraq is currently exporting oil only via its southern oil export terminals, with around 450,000 bpd of exports from the northern fields and from the semi-autonomous region of Kurdistan still shut in… Read more at: https://oilprice.com/Energy/Energy-General/Iraqs-Crude-Oil-Exports-Stay-Flat-As-Kurdistan-Saga-Continues.html |

|

Petrobras Set To Raise Investments In Low-Carbon Energy ProjectsThe board of directors of Petrobras has approved new guidelines in the strategic plan through 2028 to allocate more capital expenditures to low-carbon projects, the Brazilian state-owned oil firm said on Thursday. Under the new strategic guidelines, Petrobras will allocate between 2024 and 2028 between 6% and 15% of its capex to low-carbon energy projects, compared to 6% of capex going to low-emission projects in the 2023-2027 strategic plan. The final approval of the new strategic plan and allocation for low-carbon projects will take place… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Set-To-Raise-Investments-In-Low-Carbon-Energy-Projects.html |

|

Tesla Of The Sea? How EV Tech Is Revolutionizing BoatingThe electric vehicle boom isn’t just about passenger cars and trucks, it’s also about the millions of speedboats and other recreational boats whose pollution has, at times, caused more damage than the Exxon Valdez oil spill. And it’s all about the battery, just as it has been with the EV market, and Vision Marine Technologies Inc (NASDAQ:VMAR) is a company investors should keep an eye on as their proprietary technology looks to turn the boating market upside down. It has successfully developed the world’s most powerful… Read more at: https://oilprice.com/Energy/Energy-General/Tesla-Of-The-Sea-How-EV-Tech-Is-Revolutionizing-Boating.html |

|

Qatar Signs Long-Term LNG Supply Deal With BangladeshQatarEnergy has signed an agreement to supply liquefied natural gas (LNG) to Bangladesh’s state firm PetroBangla for 15 years beginning in 2026, Saad al-Kaabi, chief executive at the Qatari state company said on Thursday. LNG buyers are looking for long-term supply to secure gas from Qatar’s massive expansion projects to insulate themselves from volatile spot prices. Bangladesh, in particular, was one of the South Asian economies most hit by the soaring LNG spot prices and withdrew from the spot market last year, alongside other buyers such as… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Signs-Long-Term-LNG-Supply-Deal-With-Bangladesh.html |

|

Petrobras Looks To Grow Oil Production Outside BrazilBrazilian state-held oil firm Petrobras is considering growing its oil reserves and production with projects abroad after a major drilling project at home was denied due to environmental concerns, Reuters reported on Thursday, quoting sources familiar with the company’s plans. Petrobras, which hasn’t made a large domestic discovery in more than a decade, could decide on a U-turn in its exploration policy and look to grow outside Brazil instead of focusing domestically and shrinking its foreign presence as it has done over the past decade.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Looks-To-Grow-Oil-Production-Outside-Brazil.html |

|

OPEC+ Unlikely To Announce Additional Oil Output CutsThe OPEC+ group is not expected to announce another round of oil production cuts when ministers meet this weekend, OPEC+ sources told Reuters on Thursday. OPEC and its allies from several non-OPEC producers led by Russia are heading to the June 4 meeting amid market speculation whether the OPEC+ alliance will wrong-foot the short sellers again by announcing deeper oil production cuts. Oil prices have slumped to the low-$70s Brent in recent days, which analysts believe is not enough for Saudi Arabia and other Middle Eastern producers to balance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Unlikely-To-Announce-Additional-Oil-Output-Cuts.html |

|

Why Apple’s VR headset could succeed where every similar product has failedOn Monday, Apple is expected to announce its first new major product line since it unveiled the Apple Watch in 2014. Read more at: https://www.cnbc.com/2023/06/01/why-apples-headset-could-become-the-first-vr-success-story.html |

|

Defense spending levels threaten to delay Senate plan to fast-track debt ceiling billA battle over defense spending levels threatened to delay Senate plans to fast-track the Fiscal Responsibility Act to a vote. Read more at: https://www.cnbc.com/2023/06/01/debt-ceiling-bill-updates.html |

|

Here’s what to watch out for in Friday’s jobs report for MayEconomists surveyed by Dow Jones expect job growth in May of 190,000, a decline from 253,000 in April. Read more at: https://www.cnbc.com/2023/06/01/heres-what-to-watch-out-for-in-fridays-jobs-report-for-may.html |

|

Stocks jump Thursday, Nasdaq pops 1% as traders cheer advancement of debt ceiling bill: Live updatesStocks rose after the debt ceiling deal passed the House vote. Read more at: https://www.cnbc.com/2023/05/31/stock-market-today-live-updates.html |

|

Microsoft signs deal for A.I. computing power with Nvidia-backed CoreWeave that could be worth billionsMicrosoft is seeing so much demand for its cloud infrastructure for artificial intelligence workloads that it’s signing up a startup to help provide capacity. Read more at: https://www.cnbc.com/2023/06/01/microsoft-inks-deal-with-coreweave-to-meet-openai-cloud-demand.html |

|

NYU’s Damodaran says he sold half his Nvidia stake for one simple reasonAswath Damodaran sold half his Nvidia stock after its recent share surge for one simple reason. Read more at: https://www.cnbc.com/2023/06/01/nyus-damodaran-says-he-cant-hold-this-chip-stock-as-a-value-investor.html |

|

Bitcoin suffers worst month of 2023, Circle cuts U.S. bonds on debt ceiling doubt: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bruce Rodgers of LM Funding America discusses the bitcoin mining energy use tax and regulation in Washington. Read more at: https://www.cnbc.com/video/2023/06/01/bitcoin-worst-month-2023-circle-cuts-bonds-debt-ceiling-doubt-crypto-world.html |

|

Senate votes to repeal Biden’s student loan forgiveness plan. White House warns Biden will vetoA GOP-led effort to overturn President Joe Biden’s sweeping student loan forgiveness plan passed the Senate on Thursday. Biden is expected to veto the action. Read more at: https://www.cnbc.com/2023/06/01/senate-votes-to-repeal-bidens-student-loan-forgiveness-plan-white-house-warns-biden-will-veto.html |

|

Ukraine war live updates: Russia says it repelled another attack on its soil; UK PM says Ukraine’s rightful place is in NATORussia’s overnight strike on Kyiv was the 18th attack on the capital since the start of May. Read more at: https://www.cnbc.com/2023/06/01/russia-ukraine-live-updates.html |

|

Trump plans 2024 fundraising swing from Georgia to his N.J. golf course as he calls on his bundlers to raise up to $1 millionDonald Trump is planning for a 2024 fundraising swing that will include an event at his golf course in New Jersey. Read more at: https://www.cnbc.com/2023/06/01/trump-plans-2024-fundraising-swing-with-event-at-his-golf-course.html |

|

Here’s why Diddy is suing Diageo over his vodka and tequila brandsThe rapper and entrepreneur claimed that the company typecast his brands as “urban” and favored other celebrity brands like George Clooney’s Casamigos. Read more at: https://www.cnbc.com/2023/06/01/diddy-suing-diageo-over-vodka-tequila-brands.html |

|

Wage hikes may have been a key driver of inflation. They may now be fueling mass layoffsAfter two years of inflation potentially fueled by wage growth, we’re seeing layoffs increase by nearly 400% since last year. Read more at: https://www.cnbc.com/2023/06/01/main-driver-of-inflation-wage-hikes.html |

|

‘Uber crowded’ trades from professional investors are crushing the market, Jefferies saysProfessional investors’ high-conviction bets have paid off this year, significantly beating the S&P 500, according to Jefferies. Read more at: https://www.cnbc.com/2023/06/01/uber-crowded-trades-from-professional-investors-crushing-the-market.html |

|

Zelensky Miffed Over NATO Inaction, Demands Membership & Security Guarantees ‘Now’Ukrainian President Volodymyr Zelensky is letting his frustration and impatience over the question of entering the NATO military alliance be known. “Our future is in the European Union. Ukraine is also ready to be part of NATO. We are waiting for NATO to be ready to accept Ukraine,” he said Thursday to journalists just ahead of a summit of the European Political Community in Chisinau, Moldova. At the summit, he demanded that Ukraine receive security guarantees “now” and emphasized the best way to ensure this is acceptance into NATO. But the idea of ‘security guarantees’ has also long been under discussion, with French President Emmanuel Macron on Wednesday having explained that the country could be give “something between the security provided to Israel and full-fledged membership.”

Read more at: https://www.zerohedge.com/geopolitical/zelensky-miffed-over-nato-inaction-demands-membership-security-guarantees-now |

|

“I Am The Enforcer” – EU’s Ministry Of Truth Threatens Google, Twitter, And Facebook With ‘Stress Tests’Authored by Mike Shedlock via MishTalk.com, EU’s Thierry Breton tells US Big Tech corporations that he’s “The Enforcer” against disinformation…

Stress Test for Truth Coming UpThe Enforcer is coming after US technology companies demanding a stress test on the truth. No, this isn’t The Onion. Politico reports EU’s Breton Wants to ‘Stress Test’ Silicon Valley Giants.

|

|

Planned Layoffs Are Up Fourfold So Far This YearCompanies announced a staggering 417,500 planned layoffs for the first five months of 2023. This is a massive acceleration and more than four times the job cuts compared to last year, according to Bloomberg, citing a report from outplacement firm Challenger, Gray & Christmas. Disregarding early 2020, when Covid impacted the labor market, the total number of planned job cuts through May is the highest since 2009.

Challenger found most layoffs occurred in the tech industry, announcing 136,800 cuts for the first five months. That came close to eclipsing the full year of 2001 when the tech industry hemorrhaged 168,400. Read more at: https://www.zerohedge.com/markets/planned-layoffs-are-fourfold-so-far-year |

|

Supreme Court Deals Blow To Unions, Rules Company Can Sue For Damage Caused By StrikeAuthored by Matthew Vadum via The Epoch Times, In an 8-1 ruling, the U.S. Supreme Court on June 1 decided that a union’s deliberate destruction of company property as a pressure tactic in a labor dispute is not protected by federal law.

Labor activists have said that endangering and destroying company property during a dispute is fair game that has long been protected by the law, but companies like the petitioner in this case—Glacier Northwest a ready-mix concrete company headquartered in Seattle—pushed back. Glacier Northwest does business as CalPortland. The new ruling will allow companies to sue striking unions to hold them accountable for damage caused during labor actions. The U.S. Supreme Court’s decision ( Read more at: https://www.zerohedge.com/political/supreme-court-deals-blow-unions-rules-company-can-sue-damage-caused-strike |

|

Train strikes: How rail walkouts on Friday will affect youWhat you need to know about the walkout by RMT train staff by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-65777124?at_medium=RSS&at_campaign=KARANGA |

|

Scandal-hit CBI to cut jobs as it fights for survivalThe business group, which employs about 337 people, says it needs to cut its wage bill by a third. Read more at: https://www.bbc.co.uk/news/business-65778636?at_medium=RSS&at_campaign=KARANGA |

|

House prices fall at fastest pace in nearly 14 years, says NationwideNationwide says prices in the year to May fell 3.4% and higher mortgage rates could last longer. Read more at: https://www.bbc.co.uk/news/business-65774620?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on FridayIndian benchmark indices Sensex and Nifty ended lower in a highly volatile trade on Thursday due to selling in banking, metal, and energy counters amid a mixed trend in global markets. The 30-share BSE Sensex declined by 194 points to settle at 62,428.54, marking the second consecutive day of losses. While investors turned cautious about inflationary pressure in the US after raising the US debt ceiling, the domestic market displayed better than estimated Q4 earnings growth and 7.2% GDP growth in FY23. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-friday/articleshow/100684817.cms |

|

3 stocks hint at bullish trends as RSI inches higherRSI or the relative strength index computes the ratio of the recent upward traction in the stock price movement relative to its absolute price movement. Read more at: https://economictimes.indiatimes.com/markets/web-stories/3-stocks-hint-at-bullish-trends-as-rsi-inches-higher/articleshow/100669997.cms |

|

9 midcap stocks ideas from KIE that can offer 12-40% returnsKotak Institutional Equities (KIE) has added Aavas Financiers, KIMS and Sun TV Network to its model midcap portfolio while removing Max Healthcare. Read more at: https://economictimes.indiatimes.com/markets/web-stories/9-midcap-stocks-ideas-from-kie-that-can-offer-12-40-returns/articleshow/100678374.cms |

|

The Moneyist: ‘How to travel for free’: I spent $500 hosting my friend for a week. Should she have paid for food and utilities?‘She binged on food, mainly junk food, and I had to foot the cost.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7206-D090DC46D34C%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘I’m 63 and desperately hate my work’: Should I pay off my mortgage, claim Social Security and quit my job?“I’d like to start over, maybe start a business, and live out my days doing something I like.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7204-FFA0F257E159%7D&siteid=rss&rss=1 |

|

Dell stock jumps after early earnings release shows largest sales decline on record, but still beats expectationsDell’s earnings and revenue plunged in the fiscal first quarter but easily beat expectations amid the largest downturn for PC sales ever recorded. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7208-03EB0632E5C6%7D&siteid=rss&rss=1 |

Via The Washington Post

Via The Washington Post