Summary Of the Markets Today:

- The Dow closed down 135 points or 0.41%,

- Nasdaq closed down 0.63%,

- S&P 500 closed down 0.61%,

- Gold $1,982 up $5.40,

- WTI crude oil settled at $68 down $1.58,

- 10-year U.S. Treasury 3.631% down 0.065 points,

- USD Index $104.22 up $0.05,

- Bitcoin $27,015 down $840,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of job openings edged up to 10.1 million on the last business day of April 2023. Over the month, the number of hires changed little at 6.1 million. Total separations decreased to 5.7 million. The trend lines for jobs growth are declining after peaking in March 2022.

The Summary of Commentary on Current Economic Conditions (known as the Beige Book) shows economic activity was little changed overall in April and early May. It was summarized as follows:

Four Districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality. Education and healthcare organizations saw steady activity on balance. Manufacturing activity was flat to up in most Districts, and supply chain issues continued to improve. Demand for transportation services was down, especially in trucking, where contacts reported there was a “freight recession.” Residential real estate activity picked up in most Districts despite continued low inventories of homes for sale. Commercial construction and real estate activity decreased overall, with the office segment continuing to be a weak spot. Outlooks for farm income fell in most districts, and energy activity was flat to down amidst lower natural gas prices. Financial conditions were stable or somewhat tighter in most Districts. Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels. High inflation and the end of Covid-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing.

Here is a summary of headlines we are reading today:

- Argentina’s Vaca Muerta Shale Play Could Produce 1 Million Bpd In 2030

- Colombia’s President May Have To Rethink His Oil And Gas Exploration Ban

- American Offshore Wind Gets Gulf Of Mexico Green Light

- Reuters Survey: OPEC Output Down 460,00 BPD This Month

- Goldman And Others See Rising Odds Of Another OPEC+ Output Cut

- Gasoline Prices Tick Up For The Summer

- Singapore Detains Record Number Of Oil Tankers As Shadow Fleet Expands

- Stocks slip as investors look to House vote on the debt ceiling, Nasdaq pops nearly 6% in May: Live updates

- Debt ceiling bill poised to pass the House as Senate aims for a Friday vote

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Argentina’s Vaca Muerta Shale Play Could Produce 1 Million Bpd In 2030Crude oil production from Argentina’s burgeoning shale patch, Vaca Muerta, could surge in the coming years and top 1 million barrels per day (bpd) by the end of the decade – but only if takeaway capacity and rig availability do not limit growth. Rystad Energy’s modeling shows that if production is relatively unimpeded, oil output could realistically grow from 291,000 bpd in February 2023 to more than 1 million bpd in the second half of 2030. The forecast growth could lift Vaca Muerta’s profile and position it as a leading… Read more at: https://oilprice.com/Energy/Crude-Oil/Argentinas-Vaca-Muerta-Shale-Play-Could-Produce-1-Million-Bpd-In-2030.html |

|

Colombia’s President May Have To Rethink His Oil And Gas Exploration BanColombia’s economically crucial energy patch is facing a grave crisis due to its shortage of proven oil and natural gas reserves coupled with leftist President Gustavo Petro’s plan to end awarding new exploration contracts. The Andean country’s hydrocarbon sector was hit particularly hard by the 2020 COVID-19 pandemic and has yet to recover. March 2023 oil production of 771,732 barrels a day was significantly less than the 884,876 barrels per day pumped for the same month four years earlier. Latest developments indicate Colombia’s… Read more at: https://oilprice.com/Energy/Energy-General/Colombias-President-May-Have-To-Rethink-His-Oil-And-Gas-Exploration-Ban.html |

|

Visualizing All New Renewables Projects In The U.S. In 2023Renewable energy, in particular solar power, is set to shine in 2023. This year, the U.S. plans to get over 80% of its new energy installations from sources like battery, solar, and wind. Visual Capitalist’s Alan Kennedy created the map below, using data from EIA, to highlight planned U.S. renewable energy and battery storage installations by state for 2023. Texas and California Leading in Renewable Energy Nearly every state in the U.S. has plans to produce new clean energy in 2023, but it’s not a surprise to see the two most… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Visualizing-All-New-Renewables-Projects-In-The-US-In-2023.html |

|

American Offshore Wind Gets Gulf Of Mexico Green LightThe U.S. Bureau of Ocean Energy Management (BOEM) has given the Gulf of Mexico the environmental green light for offshore wind energy development on the outer continental shelf’s federal territory, paving the way for offshore wind projects across 30 million acres. According to the BOEM, there will be no significant environmental impact associated with offshore wind projects in the Gulf of Mexico, based on an environmental assessment that considers biology, archeology, geology and geophysics. “We will continue to work closely with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/American-Offshore-Wind-Gets-Gulf-Of-Mexico-Green-Light.html |

|

UK Activist To Battle UK Government In Court Over Newly Approved Coal MineClimate activists are set for a courtroom showdown with the government over a newly-approved coal mine in West Cumbria after a date was set by the High Court for two legal challenges later this year. The challenges from Friends of the Earth and South Lakes Action on Climate Change (SLACC) will take place in the autumn, over three days between 24 and 26 October. The ‘rolled-up’ hearing is in practice the same as a trial, in that the court is expected to allow each claimant to argue its case in full. Friends of the Earth’s lawyer,… Read more at: https://oilprice.com/Energy/Coal/UK-Activist-To-Battle-UK-Government-In-Court-Over-Newly-Approved-Coal-Mine.html |

|

Reuters Survey: OPEC Output Down 460,000 BPD This MonthA Reuters survey on Wednesday shows a drop in OPEC oil output for May following voluntary production cuts by OPEC+ said to help support the market. According to the survey, OPEC production was down 460,000 barrels per day from April, and down more than 1.5 million bpd from September, though increases by some OPEC+ members counterbalanced that drop in output. Six OPEC members in May voluntarily agreed to cut 1.04 million bpd in addition to the already-existing 1.27 million bpd. The survey comes after Moscow stated last week that OPEC+ would not… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Reuters-Survey-OPEC-Output-Down-46000-BPD-This-Month.html |

|

Rosneft Q1 Profit Soars As Russian Oil Output Cuts Remain InvisibleRussian state-run oil giant Rosneft saw its first-quarter 2023 net profit rise by over 45% to around $4 billion, beating analyst expectations as production increases despite Moscow’s 500,000 barrel-per-day output cuts that started three months ago. In addition to a 45.5% jump in net profit, Rosneft, headed by Igor Sechin, said it saw EBITDA rise for the quarter by 25.1%, though revenue was down 1.1%. Analyst expectations based on Interfax polling were lower for net profit, revenue and EBITDA.Rosneft noted that Q1 oil production increased… Read more at: https://oilprice.com/Energy/Crude-Oil/Rosneft-Q1-Profit-Soars-As-Russian-Oil-Output-Cuts-Remain-Invisible.html |

|

Consortium To Invest $9 Billion In Indonesia’s Mining And Battery IndustriesA consortium of companies, including mining giant Glencore, is poised to invest $9 billion in the mining and battery-manufacturing sectors in Indonesia, Investment Minister Bahlil Lahadalia said on Wednesday. “The investment is about $9 billion if it is according to plans. If we can speed it up we’ll do it,” Reuters quoted the minister as saying, as Indonesia looks to attract foreign firms to invest in the production of batteries for electric vehicles. The $9-billion investment will go into an industrial park on the island Sulawesi, and is expected… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Consortium-To-Invest-9-Billion-In-Indonesias-Mining-And-Battery-Industries.html |

|

Goldman And Others See Rising Odds Of Another OPEC+ Output CutIf it was Russia’s intention to send oil tumbling after its oil minister last week said that OPEC+ has no intentions of cutting production, in the process inviting another round of shorts and bearish CTAs, well… mission accomplished: on Wednesday oil tumbled more than 3% following the latest dismal Chinese PMI data, and followed a 4.4% drop on Tuesday the black gold is now on pace for its worst month since November 2021. But the real driver behind the latest dump is the reversal of last week’s speculation that an OPEC+ cut may be coming… Read more at: https://oilprice.com/Energy/Crude-Oil/Goldman-And-Others-Sees-Rising-Odds-Of-Another-OPEC-Output-Cut.html |

|

Gas Leak Forces Equinor To Shut Major LNG Export TerminalIn another blow to the only LNG export facility in Europe’s top gas producer, Norway, energy major Equinor on Wednesday shut down the Hammerfest LNG plant due to a gas leak. The Hammerfest plant was evacuated, and no injuries of personnel have been reported, a spokesperson for Equinor told Reuters, confirming a police report on the incident earlier in the day. “The leak has been identified and work is ongoing to establish the extent of it,” local police said early on Wednesday. The local fire department also responded to the incident,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gas-Leak-Forces-Equinor-To-Shut-Major-LNG-Export-Terminal.html |

|

Gasoline Prices Tick Up For The SummerGasoline prices are on the rise—increasing from a week ago by 2.7 cents on average in the United States, Gas Buddy said in a note on Tuesday. The nation’s average price for a gallon of gasoline is now $3.55, GasBuddy data shows. Meanwhile, diesel prices have fallen by 4.9 cents per gallon over the last week, to $3.91 per gallon. “Gasoline prices have drifted higher in the last week due to some relatively minor refinery kinks and low gasoline supply, but it may not be a trend that lasts too much longer,” GasBuddy’s… Read more at: https://oilprice.com/Energy/Energy-General/Gasoline-Prices-Tick-Up-For-The-Summer.html |

|

TotalEnergies Plans Synthetic Natural Gas Plant In The U.S.France-based supermajor TotalEnergies plans to build a large-scale plant to produce synthetic natural gas in the United States—a project which will benefit from tax credits in the Inflation Reduction Act. The announcement from one of Europe’s biggest oil and gas firms on Wednesday is a fresh blow to the European Union’s ambitions to lead in green energy technologies. The EU unveiled earlier this year its Green Deal Industrial Plan to boost the competitiveness of Europe’s net-zero industry. But both the EU and the UK have struggled… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Plans-Synthetic-Natural-Gas-Plant-In-The-US.html |

|

European Natural Gas Prices Fall On Weak Global DemandBenchmark natural gas prices in Europe fell early on Wednesday as global demand for LNG is subdued, European inventories are higher than usual, and renewable energy output has increased in recent days. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, are trading at around $26.70 (25 euros) per megawatt-hour (MWh), their lowest level in two years. Prices have dropped by as much as 65% since the start of this year and by 90% since the August 2022 record-high of over $320 (300 euros) per MWh. Weak demand from the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Natural-Gas-Prices-Fall-On-Weak-Global-Demand.html |

|

Oil Prices Extend Losses On Weak Economic Data From ChinaOil prices slumped by another 3% early on Wednesday, extending the 4% losses from Tuesday after manufacturing data from China disappointed and the U.S. dollar strengthened. As of 7:27 a.m. EDT on Wednesday, the U.S. benchmark, WTI Crude, had plunged below $68 per barrel, at $67.48, down by 2.89%. WTI crude oil futures sank below $70 a barrel on Tuesday amid concerns about opposition to the U.S debt ceiling deal. The international benchmark, Brent Crude, was down by 2.64% early on Wednesday at $71.61. WTI and Brent were on track to post a seventh… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Extend-Losses-On-Weak-Economic-Data-From-China.html |

|

Singapore Detains Record Number Of Oil Tankers As Shadow Fleet ExpandsSingapore, a major hub for oil transportation and storage, has detained this year a record-high number of oil and chemicals tankers that have failed to pass inspection—more than the number of detained tankers in the whole decade to 2019. As old tankers are increasingly used by Russia to ship its crude oil and products without Western insurance, the crackdown on vessels without all safety features in place has intensified in Asia in recent months. Asia is now the top destination for Russian crude oil after the EU embargo and the G7 price cap… Read more at: https://oilprice.com/Energy/Energy-General/Singapore-Detains-Record-Number-Of-Oil-Tankers-As-Shadow-Fleet-Expands.html |

|

Stocks slip as investors look to House vote on the debt ceiling, Nasdaq pops nearly 6% in May: Live updatesStocks fell Wednesday as investors kept an eye on the federal debt ceiling debate in Washington in the final trading day of May. Read more at: https://www.cnbc.com/2023/05/30/stock-market-today-live-updates.html |

|

Debt ceiling bill poised to pass the House as Senate aims for a Friday voteLeaders of both parties are working to tamp down opposition to the debt ceiling bill, which is expected to get a vote in the full House Wednesday. Read more at: https://www.cnbc.com/2023/05/31/debt-ceiling-bill-house-vote.html |

|

Amazon to pay over $30 million in FTC settlements over Ring, Alexa privacy violationsAmazon settled two lawsuits with the FTC on Wednesday over alleged privacy lapses in its Alexa and Ring units. Read more at: https://www.cnbc.com/2023/05/31/ftc-sues-amazon-over-ring-doorbell-privacy-violations.html |

|

The ‘great resignation’ — a trend that defined the pandemic-era labor market — seems to be overThe rate at which workers quit their jobs has declined to pre-pandemic levels as the labor market has gradually cooled. Read more at: https://www.cnbc.com/2023/05/31/great-resignation-trend-defining-pandemic-era-labor-market-seems-over.html |

|

OpenAI is pursuing a new way to fight A.I. ‘hallucinations’AI hallucinations occur when models like OpenAI’s ChatGPT or Google’s Bard fabricate information entirely. Read more at: https://www.cnbc.com/2023/05/31/openai-is-pursuing-a-new-way-to-fight-ai-hallucinations.html |

|

Bank of America ranks the biggest A.I. winners in software stocks. Here are its top picksAs investors search for winners in the artificial intelligence boom, several software stocks stand out, according to Bank of America. Read more at: https://www.cnbc.com/2023/05/31/bank-of-america-ranks-the-biggest-ai-winners-in-software-stocks.html |

|

Mike Pence is set to launch his presidential campaign next weekThe former vice president will kick off his 2024 bid with a campaign video and a speech in Des Moines, Iowa. Read more at: https://www.cnbc.com/2023/05/31/mike-pence-is-set-to-launch-his-presidential-campaign-next-week.html |

|

Ukraine war live updates: Drones attack Russian oil refineries; Germany closes Russian consulates in retaliatory moveThe strikes come just a day after rare drone attacks in Moscow that damaged buildings but caused no deaths. Read more at: https://www.cnbc.com/2023/05/31/russia-ukraine-live-updates.html |

|

Ex-SEC official warns influencers against promoting crypto, and Bybit exits Canada: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Rene Reinsberg, co-founder of Celo and president of the Celo Foundation, weighs in on where crypto markets are headed and discusses the impact of global regulatory developments. Read more at: https://www.cnbc.com/video/2023/05/31/ex-sec-warns-influencers-against-boosting-crypto-bybit-exits-canada-crypto-world.html |

|

Amazon workers plan to walk out over ‘lack of trust’ in leadershipEmployees are walking out to highlight a “lack of trust in company leadership’s decision-making,” the group said. Read more at: https://www.cnbc.com/2023/05/31/amazon-workers-plan-to-walk-out-over-lack-of-trust-in-leadership.html |

|

Not just shoplifting: Here’s why companies say retail theft is such a big dealShrink, retail theft, and organized retail theft are often cited by retailers as a reason for lower profits, but the terms are distinctly different. Read more at: https://www.cnbc.com/2023/05/31/what-are-retail-shrink-and-organized-retail-crime.html |

|

These home improvement projects pay off most — major kitchen and bath remodelings don’t make the cutThe top home projects promising the greatest returns in resale value are not the ones you would expect. Read more at: https://www.cnbc.com/2023/05/31/the-most-popular-home-projects-are-not-the-ones-with-the-best-return.html |

|

Debt ceiling deal: Opposition grows to end student loan reliefA measure in the proposed debt ceiling deal that would terminate the student loan payment pause is facing heavy opposition from advocates and progressives. Read more at: https://www.cnbc.com/2023/05/31/debt-ceiling-deal-opposition-grows-to-ending-student-loan-relief.html |

|

As Oil Plunges, OPEC Bans Mainstream Media Groups From Vienna MeetingUpdate (1400ET): The Financial Times reports that OPEC has barred several media groups from attending its crucial production meeting in Vienna this weekend, in a move officials said was driven by Saudi Arabia Reporters from Reuters, Bloomberg News, and Dow Jones, the publisher of The Wall Street Journal, have been denied invites to Opec’s Vienna headquarters, according to people familiar with the matter. The ban is unusual and no reason has been given for excluding the media groups, but people familiar with the decision said it had been instigated by Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman.

Are they readying a surprise cut announcement and don’t want any leaks? * * * If it was Russia’s intention to send oil tumbling after its oil minister last week said that Read more at: https://www.zerohedge.com/markets/oil-plunges-goldman-and-others-sees-rising-odds-another-opec-output-cut |

|

Billionaire Jamie Dimon Hints At Run For Public Office; Bill Ackman Endorses Him For PresidentJPMorgan’s CEO may be getting swept up in the Jeffrey Epstein scandal, but for a billionaire like Jamie Dimon, whose catch phrase is “that’s why I’m richer than you” and may as well be “that’s why I will always be freer than you”, all that will be needed to avoid long-term “legal complications” will be a check with several zeroes on it… or maybe some political immunity. Which may be why the head of the largest US bank is already hinting that after he is done gobbling up all the small and regional banks and gets tired of running JPM, he is considering running for public office. “I love my country, and maybe one day I’ll serve my country in one capacity or another,” he said in a Bloomberg Television interview, when asked if he’s ever considered a public office position. His comments, made at the bank’s annual Global China Summit in Shanghai on Wednesday, come as the US gears up for its 2024 presidential race. For now, he’s focused on his job running the largest US bank, a role he’s “quite happy” in. “I love what I do,” he said. JPMorgan does “a great job for helping Americans, for helping countries around the world.” Dimon also reiterated his view that “business can be a force for good,” and said he’s an American patriot who would follow the US government: “Everyone knows I am a patriot,” he said. “I am a r … Read more at: https://www.zerohedge.com/political/billionaire-jamie-dimon-hints-run-public-office-bill-ackman-endorses-him-president |

|

Southwest Pilot Climbs Through Airplane Windshield After Being Locked Out Of CockpitThis weekend, a pilot for Southwest got a taste of what can only be described as the true Southwest flying experience, when he was forced to board his plane through the cockpit window, after he wound up accidentally locked out of the cockpit. Passenger Matt Rexroad, who was flying to Sacramento from San Diego, told CBS: “It’s certainly something you don’t see every day and I fly a lot of miles and I’ve never seen anything like that.” He said that while waiting at the gate, the gate agent announced there was “an issue with the flight deck door”, according to CBS. They told passengers that the plane would be delayed and that someone would need to open the cockpit from the inside.

He then says he looked out his gate’s window and saw that “this pilot, to his credit, crawled t … Read more at: https://www.zerohedge.com/markets/southwest-pilot-climbs-through-airplane-windshield-after-being-locked-out-cockpit |

|

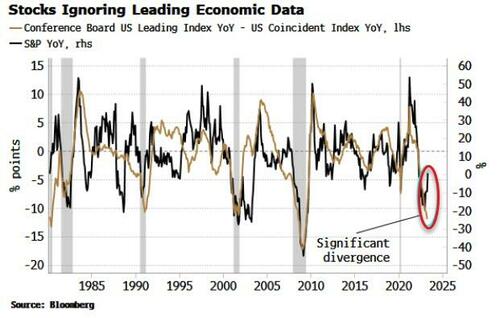

Watch Yield Curve For When Stocks Begin To Price Recession RiskAuthored by Simon White, Bloomberg macro strategist, US large-cap indices are currently diverging from recessionary leading economic data. However, a decisive steepening in the yield curve leaves growth stocks and therefore the overall index facing lower prices. Leading economic data has been signalling a recession for several months. Typically stocks closely follow the ratio between leading and coincident economic data. As the chart below shows, equities have recently emphatically diverged from the ratio, indicating they are supremely indifferent to very high US recession risk.

What gives? Much of the recent outperformance of the S&P has been driven by a tiny number of tech stocks. The top five S&P stocks’ mean return this year is over 60% versus 0% for the average return of the remaining 498 stocks. Read more at: https://www.zerohedge.com/markets/watch-yield-curve-when-stocks-begin-price-recession-risk |

|

Steak, coffee, and cheese locked up as shoplifting risesShoplifting offenses have returned to pre-pandemic levels as the cost of living soars. Read more at: https://www.bbc.co.uk/news/business-65764513?at_medium=RSS&at_campaign=KARANGA |

|

CBI boss admits vote on plans to change ‘critical’Rain Newton-Smith says a vote on the CBI’s plans to change is “critical” for its future. Read more at: https://www.bbc.co.uk/news/business-65756123?at_medium=RSS&at_campaign=KARANGA |

|

Diddy says Diageo neglected his tequila due to raceThe artist says the business relationship with the drinks giant was “tainted by racial prejudices”. Read more at: https://www.bbc.co.uk/news/business-65770119?at_medium=RSS&at_campaign=KARANGA |

|

Rajesh Gopinathan bids farewell to TCS: Look, how the IT giant moved under his tenureHe will be succeeded by K. Krithivasan, currently the global head of BFSI Business Group at TCS Read more at: https://economictimes.indiatimes.com/markets/web-stories/rajesh-gopinathan-bids-farewell-to-tcs-look-how-the-it-giant-moved-under-his-6-year-tenure/articleshow/100651873.cms |

|

Adani to raise $3.5 bn from share sale in three group cosAdani may raise $3bn in a share sale to institutional buyers as it looks to make a comeback following a report of accounting fraud and stock price manipulation by a US short seller. Gautam Adani’s group may raise up to $1bn through Adani Green Energy alone, with Adani Enterprises and Adani Transmission also approved to raise funds. The fundraising could be completed by the second quarter as the group seeks to fund expansion projects. Investors from Europe and the Middle East are said to have expressed strong interest. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-to-raise-3-5-bn-from-share-sale-in-three-group-cos/articleshow/100657014.cms |

|

Sebi mulls mandating additional disclosure for high-risk FPIsThe proposals are designed to prevent circumvention of minimum public shareholding requirements and misuse of the FPI route to guard against risks of an opportunistic takeover. The move follows SEBI’s difficulty in identifying the beneficial owners of some foreign portfolio investments in Adani stocks, since the existing regulations are lax in identifying their true ownership. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-mulls-mandating-additional-disclosure-for-high-risk-fpis/articleshow/100658398.cms |

|

Key Words: ‘There is no other China, there is only one China’: Nvidia CEO warns of ‘enormous damage’ if China chip war escalates.“If we are deprived of the Chinese market, we don’t have a contingency for that,” Nvidia CEO Jensen Huang said recently. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FF-6036CC785A39%7D&siteid=rss&rss=1 |

|

Fix My Portfolio: ‘I wish my name was on somebody’s list who wanted to give money away’: How do I get the financial help I need?Readers want to know how they can get somebody to alleviate their financial woes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FE-72C9FA8ED68D%7D&siteid=rss&rss=1 |

|

Citi to pursue IPO of Banamex business, resume ‘modest level’ of stock repurchasesCitigroup said Wednesday it will pursue an IPO of its “Banamex” consumer, small business and middle-market banking operations in Mexico. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FF-5B9A14A69542%7D&siteid=rss&rss=1 |