Summary Of the Markets Today:

- The Dow closed down 35 points or 0.11%,

- Nasdaq closed up 1.71%,

- S&P 500 closed up 0.88%,

- Gold $1,940 down $24.40,

- WTI crude oil settled at $72 down $2.41,

- 10-year U.S. Treasury 3.823% up 0.104 points,

- USD Index $104.25 up $0.36,

- Bitcoin $26,486 up $229,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

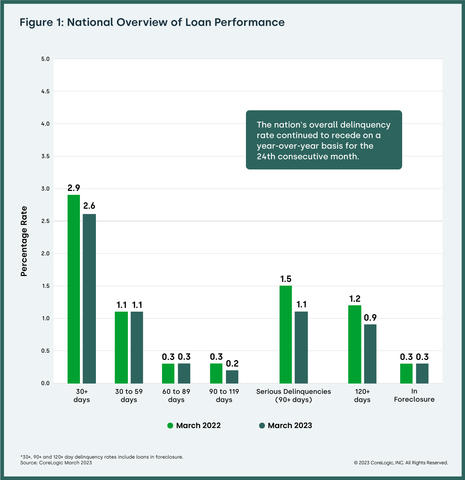

Overall US Mortgage Delinquency Rate Drops to All-Time Low in March according to CoreLogic. For the month of March, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.3 percentage point decrease compared with 2.9% in March 2022 and a 0.4 percentage point decrease compared with 3% in February 2023.

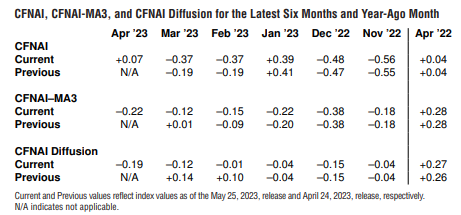

Although the Chicago Fed National Activity Index for April improved, it is the 3-month moving average that is used for economic forecasting. The index’s three-month moving average, CFNAI-MA3, decreased to –0.22 in April from –0.12 in March. This index is the best of the coincident indicators – and generally, the trend lines are used for forecasting. Since the trend is down, it indicates the economy is slowing but the level indicates it is not close to recession levels.

Real GDP increased at an annual rate of 1.3% in the first quarter of 2023 – up from the advance estimate of 1.1%. This was down from an increase of 2.6% in the fourth quarter of 2022. The slowdown in GDP growth was due to a number of factors, including:

-

- A decline in inventory investment.

- A slowdown in business investment.

- A smaller decrease in housing investment.

- An upturn in exports.

- Imports also turned up.

Note that the growth from the quarter one year ago is 1.6% – up from last quarter’s 0.9% (blue line on graph below). The inflation price index was 5.4% (down from last quarter’s 6.4% – red line on graph below). This continues to show inflation is moderating (but not very fast).

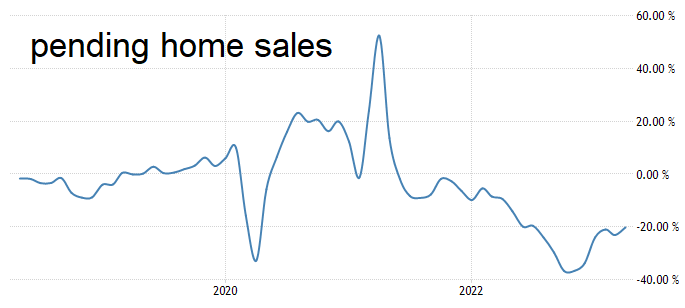

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – remained at 78.9 in April, posting no change from the previous month. Year over year, pending transactions dropped by 20.3%.

In the week ending May 20, the advance figure for seasonally adjusted initial unemployment claims was 229,000, an increase of 4,000 from the previous week’s revised level. The previous week’s level was revised down by 17,000 from 242,000 to 225,000. The 4-week moving average was 231,750, unchanged from the previous week’s revised average. The previous week’s average was revised down by 12,500 from 244,250 to 231,750.

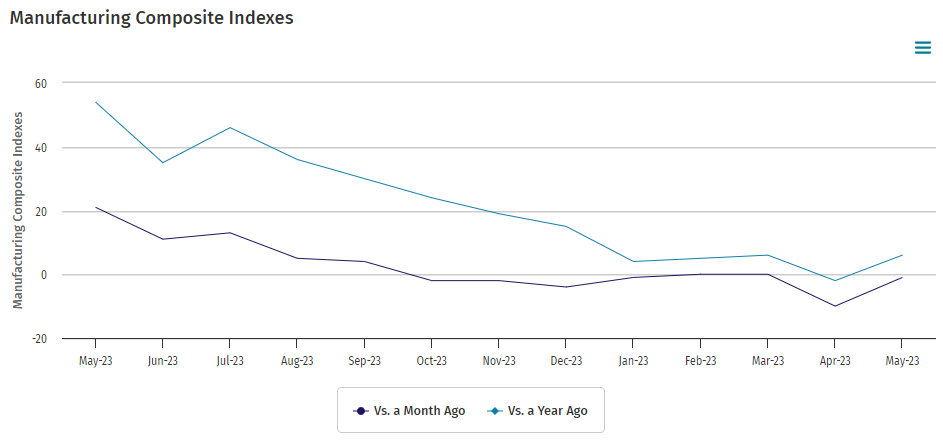

Kansas City Fed manufacturing activity remained mostly steady in May 2023. The month-over-month composite index was -1 in May, up from -10 in April and down from 0 in March. Manufacturing appears very weak across all of the Federal Reserve districts.

Here is a summary of headlines we are reading today:

- Finnish Nuclear Power Plant Cuts Output After Prices Go Negative

- Aker BP Makes Big Oil Discovery In The North Sea

- Billionaire Mining Investor Says Copper Price Plunge Won’t Last

- Solar Power Investment Is Set To Eclipse That Of Oil Production In 2023

- Debt ceiling talks enter crunch time as negotiators get closer to a deal

- Nasdaq closes about 1.7% higher Thursday as Nvidia’s surge powers tech rally: Live updates

- Nasdaq closes about 1.7% higher Thursday as Nvidia’s surge powers tech rally: Live updates

- Ukraine war live updates: Ukraine set to get F-16 fighter jets; Russian mercenaries pull out of Bakhmut

- Almost Two Thirds Of Americans View Media As “Truly The Enemy Of The People”; New Poll Finds

- Market Snapshot: Dow struggles for direction, S&P 500 and Nasdaq jump as debt-ceiling talks drag on

- Bond Report: Two-year Treasury yield rises for 11th straight session on higher chance of June, July Fed rate hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Finnish Nuclear Power Plant Cuts Output After Prices Go NegativeAs we detailed in early May, the transition from testing to regular output last month saw Finland’s first nuclear power-plant drive electricity prices dramatically lower. As yle reports, the Olkiluoto 3 nuclear reactor in Eurajoki, southwest Finland, started regular electricity production in mid-April, about 14 years behind schedule. Since then prices for power in Finland have continued to plunge as the efficiency of the plant flooded the grid with ‘new’ energy. So much in fact that early on Wednesday of last week,… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Finnish-Nuclear-Power-Plant-Cuts-Output-After-Prices-Go-Negative.html |

|

Lithium Market Faces Turbulent YearsBy Sohrab Darabshaw via AGMetalminer.com Lithium, a crucial component in electric vehicles (EVs), seems to be the metal of the season. Indeed, over the past month, the market has seen loads of fresh developments around lithium pricing. Lithium mining and lithium battery usage have also been effected. Moreover, sector experts anticipate that lithium prices will continue to be volatile over the next two years. A primary factor in this prediction is the increased flow of investment intended to boost lithium mining capacity. Meanwhile,… Read more at: https://oilprice.com/Energy/Energy-General/Lithium-Market-Faces-Turbulent-Years.html |

|

Top Russian Miner Now Receives Half Of Its Revenue In AsiaThe US and its G7 partners have slapped more than 300 economic sanctions on Russia since the invasion of Ukraine over a year ago. Initially, Washington and Brussels pitched the idea of sanctions as a strategy to paralyze Moscow. However, Western sanctions have backfired as Russian companies are redrawing commodity flows from the West to Asia. The latest example of global supply chains being rejiggered comes from Russia’s biggest miner MMC Norilsk Nickel PJSC. Bloomberg said the miner recorded 45% of revenue from Asia for the first… Read more at: https://oilprice.com/Energy/Energy-General/Top-Russian-Miner-Now-Receives-Half-Of-Its-Revenue-In-Asia.html |

|

Aker BP Makes Big Oil Discovery In The North SeaNorway’s Aker BP (NYSE:BP) (OTCQX:AKRBF) has made a much bigger-than-expected oil discovery in the Yggdrasil area of the North Sea, the energy company reported on Thursday. Preliminary estimates indicate a gross recoverable volume of 40 million-90 million barrels of oil equivalent (boe), much higher than the company’s earlier projection of between 18 million and 45 million boe. The discovery will significantly enhance Aker BP’s resource base for the Yggdrasil development, which previously was estimated at 650M gross boe. The oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aker-BP-Makes-Big-Oil-Discovery-In-The-North-Sea.html |

|

Japan Court Dismisses Citizens’ Concerns, Paves Way For Nuclear Power RestartOn Wednesday, a district court in Japan dismissed residents’ calls to halt the restart of a nuclear reactor. This represents a victory for the Pacific island nation, grappling with soaring energy costs fueled by the prolonged war in Ukraine. The Japan Times reports Sendai District Court in northeastern Japan has ruled Tohoku Electric Power can restart the No. 2 unit of the Onagawa plant early next year. It will become the first unit to restart since the nuclear power plant was idled after the devastating 2011 earthquake and tsunami that… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Japan-Court-Dismisses-Citizens-Concerns-Paves-Way-For-Nuclear-Power-Restart.html |

|

Revamped Soviet-Era Pipelines To Ship Russian Gas To UzbekistanOn April 27, at the Tashkent Investment Forum, Uzbekistani Energy Minister Jurabek Mirzamakhmudov announced that Russia would begin supplying his country with natural gas via its Soviet-era pipelines (TASS, April 28; The Diplomat, May 9). In truth, Moscow is on the hunt for new customers after its gas deliveries to Europe have been slashed by Western sanctions coming as a result of the Kremlin’s war against Ukraine. Russia used to deliver roughly 140 billion cubic meters (bcm) to Europe annually, its most lucrative export market; however,… Read more at: https://oilprice.com/Energy/Natural-Gas/Revamped-Soviet-Era-Pipelines-To-Ship-Russian-Gas-To-Uzbekistan.html |

|

UK Energy Market Regulator To Allow Suppliers To Boost Profit MarginsAfter dozens of UK energy firms went bankrupt during the energy crisis, Britain’s energy market regulator on Thursday proposed amendments to the profit margins companies are allowed to make, which could boost margins by 27%. The UK has a so-called Energy Price Cap in place, which protects households from excessively high bills by capping the price that providers can pass on to them, but which additionally burdens energy providers. According to the consultation proposed on Thursday by the regulator Ofgem, a hybrid allowance is proposed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Energy-Market-Regulator-To-Allow-Suppliers-To-Boost-Profit-Margins.html |

|

Will OPEC+ Surprise The Market With Another Output Cut?Oil short sellers have been issued a warning: watch out for more “ouching”. Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, issued the threat earlier this week in his latest lashing out at oil’s short sellers. Saudi Arabia’s energy minister is arguably holding the reins of OPEC, which could decide to cut crude oil production again, sending prices soaring in what would surely be a painful outcome to many speculators and short sellers out there. “I keep advising them (referencing oil speculators) that… Read more at: https://oilprice.com/Energy/Crude-Oil/Will-OPEC-Surprise-The-Market-With-Another-Output-Cut.html |

|

The U.S. Holds Its First Oil And Gas Lease Sale Since IRA Was PassedThe U.S. Department of the Interior is holding on Thursday the first lease sales for oil and gas drilling rights since the Inflation Reduction Act (IRA) came into effect. The IRA included congressional direction on oil and gas leasing through the Act if federal rights of way are offered for renewable energy projects. The Bureau of Ocean Energy Management (BOEM) and Bureau of Land Management (BLM) have taken steps to comply with the provision that the Interior should carry out some lease sales. On Thursday, a modest lease sale of parcels in New… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Holds-Its-First-Oil-And-Gas-Lease-Sale-Since-IRA-Was-Passed.html |

|

Billionaire Mining Investor Says Copper Price Plunge Won’t LastRobert Friedland, billionaire mining investor and founder of Canadian mining company Ivanhoe Mines, is unconcerned with the recent plunge in copper prices as medium and long-term demand for the metal is set to soar. Copper prices fell below the threshold of $8,000 per ton on Wednesday, as underwhelming Chinese economic data has weighed on the market and investor sentiment. In May alone, copper prices have fallen by 8% so far, while money managers have turned increasingly bearish on copper in recent weeks. For the first time since the height of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Billionaire-Mining-Investor-Says-Copper-Price-Plunge-Wont-Last.html |

|

Russia’s Deputy Prime Minister Sees Brent Oil Price Above $80 At Year-EndBrent Crude prices are set to be slightly higher than $80 per barrel at the end of this year, thanks to rising demand in the summer and production reductions from OPEC+, Russian Deputy Prime Minister Alexander Novak told Izvestiya in an interview published on Thursday. Early on Thursday, Brent was trading at $77.21, down by 1.47% on the day. According to Novak, Russia’s task is not inflating oil prices but balancing the market. Russia warned in February that it would cut its crude oil production by 500,000 bpd due to EU import bans… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Deputy-Prime-Minister-Sees-Brent-Oil-Price-Above-80-At-Year-End.html |

|

Finland’s Electricity Prices Fall Below ZeroSurging hydroelectric power, new nuclear reactors online, and an influx of solar and wind capacity additions sent electricity prices in Finland below zero on Wednesday, in a stark reversal from last year when residents were warned of shortages after Russia cut off pipeline gas supply to its EU neighbor. “The average price for the day is now slightly, but nevertheless, on the negative side. Yes, it is historic,” Jukka Ruusunen, chief executive officer of grid operator Fingrid, told local news outlet Yle. Abundant meltwater is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Finlands-Electricity-Prices-Fall-Below-Zero.html |

|

UK Energy Rationing Damaged The Health And Wellbeing Of ConsumersAmid soaring energy prices and growing fuel poverty, UK households rationed heat this past winter, which resulted in 57% of those rationing heat suffering from deteriorating health and wellbeing, the UK government’s advisory body Committee on Fuel Poverty said in a new report. Last winter, energy use was massively rationed across the UK. According to Citizens Advice, in 2022, the number of people unable to top up their prepayment meter was more than the previous ten years combined, the committee sponsored by the Department for Energy Security… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Energy-Rationing-Damaged-The-Health-And-Wellbeing-Of-Consumers.html |

|

Solar Power Investment Is Set To Eclipse That Of Oil Production In 2023Investment in solar power generation is set to eclipse investment in oil production in 2023, for the first time ever, as the tide in global energy is turning, the International Energy Agency (IEA) said in its World Energy Investment report published on Thursday. The energy crisis and policy actions sent global investment in low-carbon energy sources soaring to a record $1.1 trillion in 2022, with the money spent on the energy transition equaling for the first time investment in the supply of fossil fuels, research firm BloombergNEF… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Solar-Power-Investment-Is-Set-To-Eclipse-That-Of-Oil-Production-In-2023.html |

|

Oil Prices Stuck Between Debt Ceiling Uncertainty And More OPEC+ CutsCrude oil prices began to trade on Thursday with little change from Wednesday’s close as opposing forces kept them stable. On the one hand, fear of a U.S. debt default is driving bearish sentiment and the respective trade behavior, which is pressuring prices. On the other hand, the Saudi Energy Minister suggested earlier this week OPEC+ might cut more output unless short sellers behave, and that lent oil some upward pressure. “Speculators, like in any market they are there to stay, I keep advising them that they will be ouching, they did… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Stuck-Between-Debt-Ceiling-Uncertainty-And-More-OPEC-Cuts.html |

|

Debt ceiling talks enter crunch time as negotiators get closer to a dealPresident Joe Biden sounded a cautiously optimistic note that debt ceiling talks would yield a deal. Read more at: https://www.cnbc.com/2023/05/25/debt-ceiling-negotiations-biden-republicans.html |

|

How the A.I. explosion could save the market and maybe the economyWhether it’s personalized shopping or self-driving cars, AI will become a factor in virtually everyone’s lives. Read more at: https://www.cnbc.com/2023/05/25/how-the-ai-explosion-could-save-the-market-and-maybe-the-economy.html |

|

Nasdaq closes about 1.7% higher Thursday as Nvidia’s surge powers tech rally: Live updatesThe S&P 500 and Nasdaq Composite jumped Thursday as investors cheered the latest quarterly results from Nvidia. Read more at: https://www.cnbc.com/2023/05/24/stock-market-today-live-updates.html |

|

Microsoft is sprinkling OpenAI everywhere to try and keep software makers interested in its platformsThis week Microsoft gave developers a slew of new tools to take advantage of artificial intelligence, thanks to a broad alliance with startup OpenAI. Read more at: https://www.cnbc.com/2023/05/25/microsoft-sprinkles-openai-everywhere-to-retain-software-partners.html |

|

Nvidia’s blowout earnings lift AMD while other chipmakers such as Intel fallNvidia’s stock performance has been a boon for some names but has sent shares of conventional CPU manufacturers such as Intel down in Thursday trading. Read more at: https://www.cnbc.com/2023/05/25/nvidia-earnings-lift-amd-while-other-chipmakers-like-intel-fall.html |

|

Nvidia shares are up more than 25%. Here’s how to play the stock even as it’s skyrocketingEven as Nvidia shares surge on Thursday, several top Wall Street strategists encourage investors to own the stock. Read more at: https://www.cnbc.com/2023/05/25/nvda-how-to-play-the-stock-even-as-its-skyrocketing.html |

|

A.I. cryptocurrencies jump after Nvidia reports booming artificial intelligence demandAI-themed cryptocurrencies got a lift on Thursday from excitement around Nvidia and its increasing demand for chips that power AI applications. Read more at: https://www.cnbc.com/2023/05/25/ai-cryptocurrencies-jump-after-nvidia-reports-booming-demand.html |

|

Do Kwon’s bail revoked in Montenegro, and study finds crypto hacks fell 70% in Q1: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ari Redbord of TRM Labs discusses new research on why crypto hacks have fallen in the first quarter of 2023. Read more at: https://www.cnbc.com/video/2023/05/25/do-kwon-bail-revoked-crypto-hacks-fall-70percent-crypto-world.html |

|

JPMorgan Chase says Jeffrey Epstein paid tuition for kids of U.S. Virgin Islands governorThe U.S. Virgin Islands alleges in a lawsuit that JPMorgan Chase facilitated sex trafficking by Jeffrey Epstein, a predator who lived in the American territory. Read more at: https://www.cnbc.com/2023/05/25/jpmorgan-jeffrey-epstein-paid-tuition-for-kids-of-virgin-islands-governor.html |

|

Ukraine war live updates: Ukraine set to get F-16 fighter jets; Russian mercenaries pull out of BakhmutRussian President Vladimir Putin said Moscow wants to work with other countries to achieve a fair world order as Russia’s invasion of Ukraine continues. Read more at: https://www.cnbc.com/2023/05/25/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

DirecTV reaches deal to provide NFL ‘Sunday Ticket’ to bars and restaurantsDirecTV gave up NFL Sunday Ticket residential rights for next season, but it will continue to be the commercial provider for the package. Read more at: https://www.cnbc.com/2023/05/25/directv-nfl-sunday-ticket-bars-restaurants.html |

|

‘I’m not sure history has ever seen this before’: Top CEOs on what they expect next from the economyTop CEOs at the CNBC CEO Council Summit say if recession is ahead, infrastructure and Inflation Reduction Act spending will make it a unique one. Read more at: https://www.cnbc.com/2023/05/24/not-sure-history-has-ever-seen-this-before-top-ceos-on-the-economy.html |

|

Here’s the ‘most likely scenario’ for when student loan payments could restart — and how to prepareBorrowers may be down to their last few months without a student loan payment. Here’s how to prepare for bills to resume. Read more at: https://www.cnbc.com/2023/05/25/student-loan-payments-are-likely-to-restart-soon-heres-how-to-prepare.html |

|

Almost Two-Thirds Of Americans View Media As “Truly The Enemy Of The People”; New Poll FindsAuthored by Steve Watson via Summit News, A new Rasmussen poll has found that almost two-thirds of Americans believe the media is “truly the enemy of the people”.

The survey found that a total of 59 percent of likely voters either strongly or somewhat agree with the statement. Among Republicans, the belief is even more prevalent at 77 percent. Only a slim majority of Democrats disagree.

|

|

Backlash & Boycott-Calls Hit North Face After Ad Featuring Drag Queen Inviting Everyone To ‘Come Out’A North Face advertisement featuring a drag queen in rainbow-themed outdoor sports gear has sparked backlash after going viral online. The popular outdoor apparel company has learned nothing from mounting customer boycotts against Bud Light and Target in recent weeks. “Hi, it’s me, Pattie Gonia, a real-life homosexual,” drag queen and self-described environmentalist and community organizer Pattie Gonia said in The North Face ad, adding, “Today I’m here with the North Face. We are here to invite you to come out … in nature with us!”

“We like to call this little tour, the Summer of Pride. This tour has everything: hiking, community, art, lesbians, lesbians making art. Last year we gay sashayed across the nation and celebrated pride,” the drag queen continued. Read more at: https://www.zerohedge.com/markets/north-face-features-drag-queen-inviting-everyone-come-out-receives-backlash-and-boycott |

|

Wages Going Up For Good: Catch-Up And BlowbackAuthored by Charles Hugh Smith via OfTwoMinds blog, Blowback has its own dynamics, as we’ll learn in the decade ahead. One of the most durable expectations in the financial sphere is that inflation will drop sharply in a recession and the Federal Reserve will lower interest rates back to near-zero. There is a good reason to doubt this: rising wages. Yes, we all hear about the millions of human workers who will shortly be replaced by AI–wonderful for corporate profits!–but few pundits bother looking at long cycles in interest rates and inflation, and even fewer pay any attention to the absurdly extreme asymmetry of labor and capital. As I’ve often noted here, labor’s share of the economy has fallen for 45 years. Only recently did it reverse slightly. It’s not yet clear if this was a brief false-breakout or a change in trend, but there are good reasons to expect a secular, cyclical reversal that lasts years or even a decade. Read more at: https://www.zerohedge.com/personal-finance/wages-going-good-catch-and-blowback |

|

Oil Trader Andurand Losing 46% In Worst Year EverThis year’s slide in oil has been painful to commodity bulls, and none more so than famed oil hedge fund manager Pierre Andurand whose already bad year is getting worse. Bloomberg reports that after dropping another 9.4% in May, his main Andurand Commodities Discretionary Enhanced Fund has extended this year’s slump to almost 46%, making this the worst-ever phase of losses for the strategy, which has lost money every month this year. Still, the brutal 2023 follow three consecutive years of impressive gains including a record 154% jump in 2020.

While Bloomberg notes that it’s “not clear what led to the drop this month for the fund” that Andurand, who previously predicted that oil prices will hit $140, it is safe to assume that the continuous drop in oil has not helped. Oil has tumbled 12% since mid-April in London, as initial exuberance in the market following surprise supply cutbacks by the OPEC+ coalition fizzled, replaced by fears over the global economy. Prices stagnated in May, with expectations that rebounding dem … Read more at: https://www.zerohedge.com/markets/oil-trader-andurand-losing-46-worst-year-ever |

|

Nationwide building society to raise mortgage ratesBritain’s biggest building society says it is putting up rates due to the current economic climate. Read more at: https://www.bbc.co.uk/news/business-65713905?at_medium=RSS&at_campaign=KARANGA |

|

British Airways cancels 40 flights due to another IT issueThe carrier says it is trying to resolve “technical issues” that have affected flights at Heathrow. Read more at: https://www.bbc.co.uk/news/business-65713903?at_medium=RSS&at_campaign=KARANGA |

|

Energy bills set to stay high despite price cap cutHouseholds will see bills fall in July, but experts say costs will remain far higher than two years ago. Read more at: https://www.bbc.co.uk/news/business-65695752?at_medium=RSS&at_campaign=KARANGA |

|

Wipro, Voda Idea among top 11 bearish bets of D-Street analystsFor more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/wipro-voda-idea-among-top-11-bearish-bets-of-d-street-analysts/articleshow/100509183.cms |

|

Stock screener: 8 multibagger smallcaps with consistent EBITDA margin over 15%At least 37 BSE-listed Indian companies have maintained their EBITDA margin over 15% in every quarter of FY23 and have seen their stock prices rise by over 50% in the past year, revealing eight small-cap multibaggers. These include Mold-Tek Technologies, with steady growth and operating margin expansion; Elecon Engineering Company, with a 25% ROCE and better earnings quality; and Nitta Gelatin India, boasting a global presence and relatively low valuation. The screener avoided financial stocks and firms with market caps under INR500 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/stock-screener-8-multibagger-smallcaps-with-consistent-ebitda-margin-over-15/articleshow/100492266.cms |

|

Market Snapshot: Dow struggles for direction, S&P 500 and Nasdaq jump as debt-ceiling talks drag onThe Dow briefly erases a 213-point floss Thursday, but was struggling for direction as the Nasdaq and S&P 500 jumped and U.S. debt-ceiling talks drag on in Congress. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7200-B79BD6053BC1%7D&siteid=rss&rss=1 |

|

Bond Report: Two-year Treasury yield rises for 11th straight session on higher chance of June, July Fed rate hikesThe policy-sensitive 2-year Treasury yield leads an advance on Thursday as traders price in greater chances of more Federal Reserve interest rate hikes through July. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7200-B87EBA886054%7D&siteid=rss&rss=1 |

|

Distributed Ledger: Could bitcoin and gold be haven buys as debt-ceiling fears mount? Here’s what recent trading patterns suggest.The latest Distributed Ledger column from MarketWatch: a weekly look at the most important moves and news in crypto. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7201-9AAF4FA25230%7D&siteid=rss&rss=1 |