Summary Of the Markets Today:

- The Dow closed down 231 points or 0.69%,

- Nasdaq closed down 1.26%,

- S&P 500 closed down 1.12%,

- Gold $1,977 down $0.20,

- WTI crude oil settled at $73 up $1.00,

- 10-year U.S. Treasury 3.705% down 0.014 points,

- USD Index $103.57 up $0.37,

- Bitcoin $27,109 up $329,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

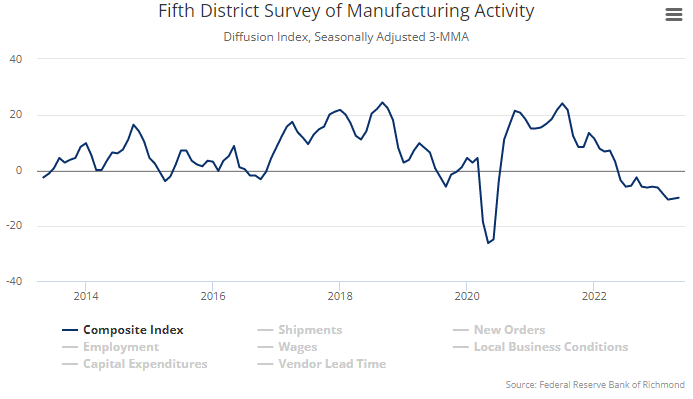

The Richmond Fed’s Survey of Manufacturing Activity for May 2023 showed that manufacturing activity in the Fifth District of the United States continued to decline. The composite index, which measures overall manufacturing activity, fell to -15 in May from -10 in April. The decline in manufacturing activity was driven by a number of factors, including:

- Rising input costs, which are squeezing profit margins.

- Slowing demand, as consumers and businesses are feeling the pinch of higher prices.

- Supply chain disruptions, which are making it difficult for manufacturers to get the parts and materials they need.

The Monthly New Residential Sales for April 2023:

- The seasonally adjusted annual rate of new home sales was 683,000, up 4.1% from March and 11.8% from April 2022.

- The median sales price of new homes was $420,800, down 8.2% from April 2022.

- The supply of new homes for sale was 433,000, which represents a supply of 7.6 months at the current sales rate.

It is important to note that the market is still facing some challenges, such as rising construction costs and supply chain disruptions. These challenges could limit the pace of growth in new home sales in the months ahead.

Here is a summary of headlines we are reading today:

- Declining Iron Ore Prices Show China’s Recovery is Still Dragging

- Can China Secure Its Long-Term Goals In Afghanistan?

- 1,650 North Sea Oil & Gas Workers To Strike In Biggest Walkout So Far

- Oil Prices Rise As Saudi Energy Minister Threatens Short Sellers

- Strong Fuel Demand Boosts Oil Prices

- China’s Coal Imports From Australia Surged By 75% In April

- S&P 500 closes 1% lower Tuesday as debt ceiling talks drag on in Washington: Live updates

- Apple announces multibillion-dollar deal with Broadcom for U.S.-made chips

- Microsoft says Bing can be default search engine for ChatGPT users

- Debt-Ceiling Doubts Finally Weigh On Stocks; Bonds & Gold Bid

- Movers & Shakers: Lowe’s, PacWest, Yelp stocks rally while BJ’s and Zoom Video shares fall, and other stocks on the move

- Market Snapshot: Dow falls 200 points as debt ceiling fears mount

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Declining Iron Ore Prices Show China’s Recovery is Still DraggingThe iron ore slump shows that the Chinese economy continues to struggle. Moreover, if things on the steel front do not improve quickly, demand will be low for the rest of the year. Indeed, the decline in iron ore prices, which recently hit a five-month low, has many analysts worried about the robustness of China’s economic rebound. According to data released recently by the China Iron and Steel Association (CISA), steel inventories at major Chinese steel mills fell to 18.1 metric tons (MT) in late April. This represents a decline of 2.3%… Read more at: https://oilprice.com/Metals/Commodities/Declining-Iron-Ore-Prices-Show-Chinas-Recovery-is-Still-Dragging.html |

|

Czech Republic Moves Closer To Severing All Energy Ties With RussiaThe Czech Republic made more progress in detangling itself from Russia in the matter of energy supplies. According to Prime Minister Petr Fiala, the country has signed a deal to increase the amount of oil that can flow through the Transalpine Pipeline (TAL) starting in 2025, Reuters said on Tuesday. The Czech government, like other nations, is hoping to distance itself from Russia, particularly in matters of energy. The Czech Republic, along with Slovakia and Hungary, were granted exemptions from the European Union ban on Russian imports until… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Czech-Republic-Moves-Closer-To-Severing-All-Energy-Ties-With-Russia.html |

|

Palladium May Be Key To New Era Of SuperconductorsAt issue is how can we produce the best superconductors that remain superconducting even at the highest possible temperatures and ambient pressure? Vienna University of Technology with collaboration from Japan show there is a ‘Goldilocks zone’ of superconductivity where palladium-based materials (‘palladates’) could be the solution. A new age of superconductors may be about to begin: In the 1980s, many superconducting materials (called cuprates) were based on copper. Then, nickelates were discovered – a new kind of… Read more at: https://oilprice.com/Energy/Energy-General/Palladium-May-Be-Key-To-New-Era-Of-Superconductors.html |

|

Can China Secure Its Long-Term Goals In Afghanistan?At a trilateral meeting in Islamabad on May 9, the foreign ministers of China, Pakistan and Afghanistan agreed to extend the China-Pakistan Economic Corridor (CPEC) into Afghanistan and reaffirmed their support for multilateral infrastructure projects already underway, including the Central Asia-South Asia (CASA) power project and the Trans-Afghan Railways (People’s Republic of China Ministry of Foreign Affairs [FMPRC], May 9). Earlier on January 5, the Taliban regime signed an agreement with the Xinjiang Central Asia Petroleum and Gas Company… Read more at: https://oilprice.com/Geopolitics/Asia/Can-China-Secure-Its-Long-Term-Goals-In-Afghanistan.html |

|

Norway’s Decision To Step Up Oil Exploration Angers Climate ActivistsEarlier this month, the Norwegian energy ministry said the country would be stepping up oil and gas exploration in the Norwegian continental shelf to improve its energy security and the energy security of its friends and neighbors in Europe. Traditionally one of Europe’s biggest natural gas suppliers, Norway last year became the biggest single one as flows of Russian gas all but stopped. And it seems this is a place Norway would like to remain. “The petroleum adventure in the north has only just started,” Petroleum and Energy… Read more at: https://oilprice.com/Energy/Energy-General/Norways-Decision-To-Step-Up-Oil-Exploration-Angers-Climate-Activists.html |

|

Qatar: Aggressive Energy Transition Policies To Create Gas ShortagesQatar has issued a warning to Europe about disruptions in the supply of natural gas as the energy transition policies of governments stifle the investments necessary for keeping Europe flush with natural gas in the next decade. Qatar’s energy minister, Saad al-Kaabi, warned Europe on Tuesday at the Qatar Economic Forum that there would be a “big shortage” of gas in the future, mostly “because of the energy-transition push that we’d say is very aggressive.” Saudi Arabia’s energy minister had similar warnings,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Aggressive-Energy-Transition-Policies-To-Create-Gas-Shortages.html |

|

1,650 North Sea Oil & Gas Workers To Strike In Biggest Walkout So FarAround 1,650 North Sea offshore contractors will begin two new rounds of 48-hour strike action in what a trade union said is the biggest walkout in the sector so far. The workers are striking in an increasingly bitter dispute over jobs, pay and conditions in the offshore sector, Unite said. The union says BP and Shell recorded “historic profits” of a combined £11.7 billion in the first quarter of 2023. Offshore workers also walked out in April and May. The latest strike will hit oil giants including BP, Shell and… Read more at: https://oilprice.com/Energy/Energy-General/1650-North-Sea-Oil-Gas-Workers-To-Strike-In-Biggest-Walkout-So-Far.html |

|

JP Morgan Bets Big On Carbon RemovalJP Morgan is betting big on carbon removal and is buying credits from direct air capture developers to offset its environmental footprint, officials at the largest U.S. bank have told The Wall Street Journal. JP Morgan has committed to invest over $200 million in buying credits for carbon removal and is also helping carbon capture businesses to take off. “We’re jumping in the pool all in,” JP Morgan’s head of operational sustainability, Brian DiMarino, told the Journal an interview. “This is us putting our weight… Read more at: https://oilprice.com/Energy/Energy-General/JP-Morgan-Bets-Big-On-Carbon-Removal.html |

|

TotalEnergies And Africa Oil Withdraw From Kenyan Oil ProjectFrench supermajor TotalEnergies and London-listed Africa Oil have decided to withdraw from an oil project in Kenya, leaving Tullow Oil the sole owner of the blocks and potentially further complicating Kenya’s oil dream. The two minority partners of Tullow Oil’s Kenyan subsidiary have informed Tullow of their intention to issue notices of withdrawal from Blocks 10BB, 13T, and 10BA in the South Lokichar Basin project due to “differing internal strategic reasons,” Tullow said in a statement on Tuesday. After the withdrawal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-And-Africa-Oil-Withdraw-From-Kenyan-Oil-Project.html |

|

Oil Prices Rise As Saudi Energy Minister Threatens Short SellersOil prices rose by nearly 2% early on Tuesday after the Saudi energy minister warned short sellers to “watch out” and as seasonal demand for fuel is set to rise at the start of the U.S. driving season this weekend. As of 9:00 a.m. EDT on Tuesday, WTI Crude, the U.S. benchmark, was up by 1.93% at $73.44. The international benchmark, Brent Crude, traded at $77.29, up by 1.71% on the day. Earlier on Tuesday, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, warned traders, again, against shorting oil futures, less than… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Rise-As-Saudi-Energy-Minister-Threatens-Short-Sellers.html |

|

Iraq Awaits Turkey’s Go-Ahead To Resume Kurdistan Oil ExportsIraq is waiting for a final go-ahead from Turkey before resuming oil exports from the semi-autonomous Iraqi region of Kurdistan via a pipeline to the Turkish Mediterranean port of Ceyhan, Iraqi Oil Minister Hayan Abdel-Ghani told Reuters on Tuesday. Kurdistan’s oil exports have been halted for two months now and it will probably take weeks, not days, for oil flows to Ceyhan and to the international markets to resume, according to an Iraqi oil official. Turkish pipeline operator BOTAS has yet to receive instruction from Turkish authorities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-Awaits-Turkeys-Go-Ahead-To-Resume-Kurdistan-Oil-Exports.html |

|

Saudi Arabia’s Energy Minister Tells Short Sellers To ‘Watch Out’Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman has warned traders, again, against shorting oil futures, less than two weeks before the OPEC+ panel on production policy meets on June 4. Prince Abdulaziz bin Salman promised oil speculators back in 2020, “I’m going to make sure whoever gambles on this market will be ouching like hell.” The OPEC+ cuts announced in early April this year caught speculators by surprise and threw the short sellers under the bus. Amid the oil price selloffs following the banking… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Energy-Minister-Tells-Short-Sellers-To-Watch-Out.html |

|

Strong Fuel Demand Boosts Oil PricesStrong demand for oil products is helping to drag oil prices higher, although the risk of a U.S. default and the upcoming OPEC+ meeting are the two major factors oil markets are watching.Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, Global Energy Alert is an absolute must-read. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week.Chart of the Week- According to S&P Platts, global air travel has finally… Read more at: https://oilprice.com/Energy/Energy-General/Strong-Fuel-Demand-Boosts-Oil-Prices.html |

|

Boeing CEO Sees No Cheap Way To Decarbonize The Aviation SectorSustainable aviation fuel (SAF) can never achieve price parity with jet fuel to be able to compete with conventional fuels and help decarbonize the aviation sector, according to The Boeing Company’s president and chief executive officer David Calhoun. SAF, a liquid fuel currently used in commercial aviation, can reduce CO2 emissions by up to 80%, the International Air Transport Association (IATA) says. Airlines and many other players in the aviation industry pin their hopes on SAF as a way to reduce emissions from the sector.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Boeing-CEO-Sees-No-Cheap-Way-To-Decarbonize-The-Aviation-Sector.html |

|

China’s Coal Imports From Australia Surged By 75% In AprilChina’s coal imports from Australia rose by 75% on the month in April as the country regains its taste for high-quality thermal coal, Bloomberg has reported, citing Chinese customs data. China stopped imports of Australian coal three years ago amid a diplomatic rift between the two countries. Since then, it has been importing more from other sources, such as Russia, and its own coal supplies, which, however, are of lower quality. As of April, Australian coal imports accounted for a tenth of the total, which may not be a whole lot but it was… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Coal-Imports-From-Australia-Surged-By-75-In-April.html |

|

S&P 500 closes 1% lower Tuesday as debt ceiling talks drag on in Washington: Live updatesPresident Joe Biden and House Speaker Kevin McCarthy met Monday as the U.S. scrambles to avoid a default. Read more at: https://www.cnbc.com/2023/05/22/stock-market-today-live-updates.html |

|

Ron DeSantis will launch his presidential bid in a live event with Elon MuskThe Florida governor will announce he is running for president on Twitter Wednesday evening in a conversation with Musk. Read more at: https://www.cnbc.com/2023/05/23/ron-desantis-will-launch-his-presidential-bid-with-elon-musk.html |

|

Netflix password sharing crackdown rolls out in the U.S.After months of anticipation, Netflix began its password sharing crackdown in the United States. Read more at: https://www.cnbc.com/2023/05/23/netflix-password-sharing-crackdown.html |

|

Former Fed Chair Ben Bernanke says there’s more work ahead to control inflationA research paper notes that inflation has evolved since ballooning to a 40-year high in the summer of 2022. Read more at: https://www.cnbc.com/2023/05/23/former-fed-chair-ben-bernanke-says-theres-more-work-ahead-to-control-inflation.html |

|

Here is what investor Jason Snipe expects from Nvidia’s earnings and how to play the stockAhead of the chipmaker’s earnings announcement Wednesday after the bell, the investor says investors should continue to add the stock to their portfolios. Read more at: https://www.cnbc.com/2023/05/23/here-is-what-investor-jason-snipe-expects-from-nvidias-earnings.html |

|

BlackRock bond chief Rieder says U.S. economy in ‘much better shape’ than doomsayers sayRick Rieder, a three-decade market veteran who oversees $2.4 trillion for BlackRock, is optimistic on the investment outlook despite the debt-ceiling impasse. Read more at: https://www.cnbc.com/2023/05/23/economy-good-shape-blackrock-rieder.html |

|

Apple announces multibillion-dollar deal with Broadcom for U.S.-made chipsApple announces multibillion-dollar deal with Broadcom for U.S.-made chips Read more at: https://www.cnbc.com/2023/05/23/apple-announces-multibillion-dollar-deal-with-broadcom-for-us-made-chips.html |

|

Bitcoin jumps back above $27,000, and international watchdog unveils crypto rules: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Mike Brock, the head of the TBD business unit at Block, discusses the firm’s new Web5 identity platform from Bitcoin 2023 in Miami. Read more at: https://www.cnbc.com/video/2023/05/23/bitcoin-jumps-international-watchdog-crypto-rules-cnbc-crypto-world.html |

|

Ukraine war live updates: Russian court extends Evan Gershkovich’s detention; U.S. asks for access to WSJ reporterThe governor of Russia’s Belgorod region said Tuesday that a “counter-terrorism operation” was ongoing following an armed attack that Russia blamed on Ukraine. Read more at: https://www.cnbc.com/2023/05/23/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Trump criminal trial over porn star payoff set for March, months before 2024 electionDonald Trump is accused in the New York criminal case of falsifying business records related to a hush money payment to porn star Stormy Daniels. Read more at: https://www.cnbc.com/2023/05/23/trump-criminal-trial-over-porn-star-payoff-set-for-march-months-before-2024-election.html |

|

Peloton aims to rebrand as a fitness company for all with focus on app, tiered subscription pricingPeloton has long been considered an in-home bike company for fitness junkies, but the company is working to change that by making its app accessible to all. Read more at: https://www.cnbc.com/2023/05/23/peloton-relaunches-brand-subscription-pricing-and-app.html |

|

The intensity of methane emissions from oil and gas sector has declined, study findsThe intensity of methane and greenhouse gas emissions from the oil and gas sector declined 28% and 30%, respectively, between 2019 and 2021, a study found. Read more at: https://www.cnbc.com/2023/05/23/intensity-of-methane-emissions-from-oil-gas-sector-declined-study.html |

|

Microsoft says Bing can be default search engine for ChatGPT usersUsers of the ChatGPT chatbot will be able to turn on the Bing search engine plugin when it becomes available soon, Microsoft said. Read more at: https://www.cnbc.com/2023/05/23/microsoft-says-bing-can-be-default-search-engine-for-chatgpt-users.html |

|

Debt-Ceiling Doubts Finally Weigh On Stocks; Bonds & Gold BidMixed macro data (housing good-‘ish’, regional Fed surveys bad, Manufacturing PMI ugly) was dominated today by some FedSpeak (just Kashkari doing Kashkari things) but more so by debt-ceiling doubts actually surfacing in stocks. Ted Cruz appeared to spook stocks early after warning on CNBC that “20-30 year old Marxists” are running the show behind the scenes at The White House, questioning Biden’s cognitive wellness and warning that the odds of an actual default are higher than the market believes, because the ‘behind the scenes’ staffers believe media will back them in blaming Republicans. Around 1230ET, stocks and bond yields suddenly puked (no immediate news catalyst was evident) Around 1330ET, headlines hit that the debt-ceiling negotiators meeting had ended and stocks lunged lower again. Around 1430ET, Bloomberg issued a story about Republicans questioning Yellen’s X-Date ‘math’ which swept stocks to new lows for the day. By the close, Nasdaq was the day’s biggest loser with Small Caps outperforming (but also red on the day). Today was the worst day in a month for Nasdaq Read more at: https://www.zerohedge.com/markets/debt-ceiling-doubts-finally-weigh-stocks-gold-bid |

|

New York Democrats Urge Biden To Fast-Track Illegal Alien Work PermitsAuthored by Bryan Jung via The Epoch Times, Top New York Democrats have called on President Joe Biden to grant work permits to unemployed illegal aliens residing in NYC.

Mayor of New York City Eric Adams, Gov. Kathy Hochul, Reps. Dan Goldman and Jerry Nadler of New York held a May 22 press conference in Brooklyn with progressive labor and business leaders, reported Politico. The leading New York Democrats asked the White House to issue special federal work permits for the large numbers of illegal immigrants who have flooded into the state since 2022. They called for Biden to expedite the process by issuing executive orders without waiting for Congress to allow the illegals, who are currently on public assistance, to be able to work and alleviate … Read more at: https://www.zerohedge.com/political/new-york-democrats-urge-biden-fast-track-illegal-alien-work-permits |

|

WSJ Reporter’s Pre-Trial Detention In Russia Extended Through August By Secretive CourtRussian court proceedings against American citizen and Wall Street Journal reporter Evan Gershkovich have continued to be shrouded in secrecy. At a Tuesday hearing, which was previously unannounced, a judge ruled to extend his pre-trial detention in Moscow’s Lefortovo prison by three months. He’s been held since March when he was arrested on espionage charges, which he has vehemently denied, and the new court ruling has ordered him to stay in jail until at least August 30.

The Associated Press has described Gershkovich as the “first U.S. correspondent … Read more at: https://www.zerohedge.com/geopolitical/wsj-reporters-pre-trial-detention-russia-extended-through-august-secretive-court |

|

Coinbase Rolls Out “Moving America Forward” National Crypto CampaignAuthored by Brian Quarmby via CoinTelegraph.com, The ads will emphasize the financial innovations facilitated via crypto and raise awareness for Coinbase events and lobbying efforts…

United States crypto exchange Coinbase is rolling out another national ad campaign in America focusing on the “critical” role that crypto will play in modernizing the global financial system. In a May 22 blog post, the firm outlined its plan for its new “Moving America Forward” campaign, which will kick off via a series of four different advertisements featuring Coinbase CEO Brian Armstrong. These will mostly air during “popular Sunday shows” on U.S. TV, with some also appearing during ad breaks of the NBA Finals series. “Coinbase is launching Crypto: Moving America Forward, a national campaign to ex … Read more at: https://www.zerohedge.com/crypto/coinbase-rolls-out-moving-america-forward-national-crypto-campaign |

|

IMF expects UK economy to avoid recessionThe fund sharply upgrades its growth forecast, but warns inflation remains “stubbornly high”. Read more at: https://www.bbc.co.uk/news/business-65669399?at_medium=RSS&at_campaign=KARANGA |

|

Shell AGM: Climate activists storm shareholder meetingProtesters rush the stage at the oil giant’s annual general meeting in London over climate plans. Read more at: https://www.bbc.co.uk/news/business-65609795?at_medium=RSS&at_campaign=KARANGA |

|

Meta loses millions as made to sell Giphy to ShutterstockSocial-media giant Meta was ordered to sell Giphy by the UK’s Competition and Markets Authority. Read more at: https://www.bbc.co.uk/news/technology-65684986?at_medium=RSS&at_campaign=KARANGA |

|

Biocon Q4 Results: Cons PAT grows 31% YoY to Rs 313 crore, revenue surges 57%The board has recommended a final dividend payout of Rs 1.50 per share. In FY23, Biocon’s revenue grew almost 37% to Rs 11,174 crore, while its net profit fell nearly 29% to Rs 463 crore. The biosimilars business segment more than doubled its year-on-year revenue to INR2,102 crore in Q4 2022. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/biocon-q4-results-cons-pat-grows-31-yoy-to-rs-313-crore-revenue-surges-57/articleshow/100454873.cms |

|

Adani Green board meet on Wednesday to mull fundraising cancelledAdani Green Energy has cancelled its board meeting , citing unavailability of directors. Investors had been looking forward to the meeting after two of the company’s group firms, Adani Enterprises and Adani Transmission, raised Rs120 billion ($1.63bn) through a qualified institutional placement. Meanwhile, NRI investor Rajiv Jain’s GQG Partners has said it has upped investment in the group to 10%. Adani Green Energy’s shares have risen around 15% after being cleared of price manipulation allegations. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-green-board-meet-on-wednesday-to-mull-fundraising-cancelled/articleshow/100454358.cms |

|

GQG’s Rajiv Jain raises Adani stake by about 10% for $3.5 billion bet“Within five years, we would like to be one of the largest investors in Adani Group depending on the valuation, after the family,” Jain, GQG’s chief investment officer, said in an interview. “We would certainly want to be partners in any of Adani Group’s new offerings.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gqgs-rajiv-jain-raises-adani-stake-by-about-10-for-3-5-billion-bet/articleshow/100442518.cms |

|

Movers & Shakers: Lowe’s, PacWest, Yelp stocks rally while BJ’s and Zoom Video shares fall, and other stocks on the moveYelp, Guardant Health and PacWest Bancorp are some of the biggest movers on Tuesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FD-53F1F0E6ACA4%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow falls 200 points as debt ceiling fears mountU.S. stocks slid Tuesday, erasing Monday’s gains, as worries about the debt ceiling negotiations in Washington outweighed data suggesting economic growth remains resilient. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FD-BFEC22C99CCA%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil gets a lift from gasoline demand expectations, warning by Saudi energy ministerOil futures settle higher Tuesday, finding support as Saudi Arabia’s energy minister warns short sellers of pain ahead. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FD-E50D1164B91E%7D&siteid=rss&rss=1 |

Via ReutersRussian media has indicated the hearing was not open to journalists or the public given he stands accused of possession of “secret materials” – and thus the proceedings are essentially classified.

Via ReutersRussian media has indicated the hearing was not open to journalists or the public given he stands accused of possession of “secret materials” – and thus the proceedings are essentially classified.