Headlines:

Traders Are Now Betting On $200 Oil By The End Of The Month

Gas Prices In Europe Skyrocket Again As Supply Risks Grow

World Is Facing A ‘Game Changer’ As Russia’s War Roils Energy Markets, Says Opec’s Barkindo

“The Market Is Totally Dysfunctional” – Traders Concerned Russian CDS Won’t Pay Out In Event Of Default

Carnage Everywhere As Market “Begins To Break”

What soaring crude prices mean for the U.S. stock market, amid talk of Russian oil sanctions

NASDAQ Composite entered a bear market, and the DOW slid over 800 points as the market sell-off continued on the uncertainty of the Russia-Ukraine war affecting the Global economy. WTI tops 200 for the first time in 13 years as Biden considers banning Russian oil. Gold rises higher, posting the highest finish (1996) since August 2020 as investors shun Bitcoin in favor of other precious metals.

Sanction fears send palladium prices soaring and topping a record $3,400 an ounce overnight on Russian embargo fears. The June palladium futures pulled back slightly early on Monday after further weighing the extent of potential supply chain disruptions. However, the most expensive precious metal has still gained some 70% since the beginning of the year.

The proposed ban on Russian products in the EU threatened already broken supply chains and heaped further inflationary pressure on economies worldwide. Even the Russian tankers at sea are fretting over the ‘big unknown’ over who will buy their floating oil reserves.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russias Invasion Of Ukraine Will Benefit ChinaRussias war with Ukraine has, for the time being, saved the Communist Party of China (CPC) and therefore the Peoples Republic of China (PRC). The isolation of Russia as part of the US-led global information warfare campaign has completed the process of driving Russia back into the arms of Beijing. This was occurring at a time when the economy of the PRC was imploding and the CPC, under General-Secretary Xi Jinping, was attempting to retain global power while essentially ring-fencing its economy from outside influence. Read more at: https://oilprice.com/Energy/Energy-General/Russias-Invasion-Of-Ukraine-Will-Benefit-China.html |

|

China Scrambles To Ensure Energy Security As Commodities SoarChina plans to increase its crude oil, natural gas, and coal production, boost reserves of energy commodities, and keep stable imports to ensure its energy security amid skyrocketing commodities prices, the top Chinese economic planner said on Monday. “Since the beginning of this year, under the combined influence of multiple factors such as the Covid-19 pandemic, the monetary policy shift of major economies, and especially the escalation of geopolitical conflicts, the international commodity price situation has become more severe, complex and Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Scrambles-To-Ensure-Energy-Security-As-Commodities-Soar.html |

|

Will Venezuela Exploit Russias Isolation To Revive Its Oil Industry?Russias invasion of Ukraine may offer Venezuela the chance its been looking for to convince Biden to reduce or drop U.S. sanctions on its oil industry. As countries around the world introduce sanctions on Russia and oil majors pull out of Russian operations, there will be an inevitable dip in the worlds oil supply. The question is how this supply shortage can be met in the short term as worldwide demand remains high. Venezuela recently appealed to Wall Street for support as it attempts to convince U.S. President Biden to lift Read more at: https://oilprice.com/Energy/Energy-General/Will-Venezuela-Exploit-Russias-Isolation-To-Revive-Its-Oil-Industry.html |

|

Traders Are Now Betting On $200 Oil By The End Of The MonthWhen some options traders bet in September 2021 that oil could reach $200 a barrel oil by the end of this year, those headlines were mostly in the oddly enough category. Now that prices hit $130 early on Monday, $200 oil by the end of March is not so unthinkable, as even major investment banks predict that a Russian oil ban would easily send prices to $150 and possibly to $200. And now options traders have significantly increased bets that oil could hit $200 as early as this month. Traders would profit from those call Read more at: https://oilprice.com/Latest-Energy-News/World-News/Traders-Are-Now-Betting-On-200-Oil-By-The-End-Of-The-Month.html |

|

Gas Prices In Europe Skyrocket Again As Supply Risks GrowEuropean natural gas futures soared Monday after reports the Biden administration was considering curbs on Russian crude imports sent shock waves across commodity markets. Brent surged to $137/bbl and quickly pared gains to trade near $125/bbl around 0630 ET. The focus is European natgas futures, Dutch gas, which jumped as high as 64% to 335 euros a megawatt-hour — the equivalent of around $600 a barrel of oil. Chaotic energy markets came after the US Secretary of State Antony Blinken told NBC this past weekend that the Biden administration Read more at: https://oilprice.com/Energy/Natural-Gas/Gas-Prices-In-Europe-Skyrocket-Again-As-Supply-Risks-Grow.html |

|

Sanction Fears Send Palladium Prices SoaringAfter topping a record $3,400 an ounce overnight on Russian embargo fears, June palladium futures pulled back slightly early on Monday after further weighing the extent of potential supply chain disruptionsbut the most expensive of precious metals has still gained some 70% since the beginning of the year. Early on Monday, palladium prices surpassed $3,440 an ounce, up from $1,900 at the start of the New Year, before paring some of those gains to around $2,977 by 1:00pm EST. Source: Apmex News that the U.S. is considering energy Read more at: https://oilprice.com/Metals/Commodities/Sanction-Fears-Send-Palladium-Prices-Soaring.html |

|

U.S. far from normal with Covid deaths 10 times higher than seasonal respiratory viruses, report saysCovid is still causing an “intolerable” level of death that is far higher than the toll of common seasonal viruses, according to a new report. Read more at: https://www.cnbc.com/2022/03/07/us-far-from-normal-with-covid-deaths-10-times-higher-than-flu-rsv-report.html |

|

NFL suspends Atlanta Falcons receiver Calvin Ridley for 2022 season for betting on gamesThe NFL suspended Atlanta Falcons wide receiver Calvin Ridley through the 2022 season for betting on games, Roger Goodell announced. Read more at: https://www.cnbc.com/2022/03/07/nfl-suspends-atlanta-falcons-calvin-ridley-for-2022-season-for-betting-on-games.html |

|

World is facing a ‘game changer’ as Russia’s war roils energy markets, says OPEC’s BarkindoBarkindo’s comments come as the energy industry is roiled after Russia invaded Ukraine, prompting supply concerns and sending prices to record highs. Read more at: https://www.cnbc.com/2022/03/07/world-is-facing-a-game-changer-as-russias-war-roils-energy-markets-says-opecs-barkindo.html |

|

Used-car prices are still sky-high — but they may be easingWholesale used-car prices fell in February, but they will likely remain high for a while longer. Read more at: https://www.cnbc.com/2022/03/07/used-car-prices-are-still-sky-high-but-they-may-be-easing.html |

|

Joint vs. separate accounts: How couples choose to handle finances could impact their financial successAbout 43% of couples who are married, in a civil partnership or living together only have joint accounts, according to a new survey. Read more at: https://www.cnbc.com/2022/03/07/joint-vs-separate-accounts-how-couples-choose-to-handle-money.html |

|

Should you super fund a 529 college savings plan? Here’s what experts sayIt’s possible to kick-start your 529 college savings plan with a larger, upfront contribution. Here’s what to know about this strategy. Read more at: https://www.cnbc.com/2022/03/07/should-you-super-fund-a-529-college-savings-plan-what-experts-say.html |

|

Stocks making the biggest moves midday: Bed Bath & Beyond, United, PVH and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/03/07/stocks-making-the-biggest-moves-midday-bed-bath-beyond-united-pvh-and-more.html |

|

McDonald’s, quiet on the Ukraine war, has more exposure to Russia than other U.S. fast-food chainsU.S. fast-food chains have limited exposure to Russia and Ukraine, but McDonald’s is under the most pressure, according to Bank of America Securities. Read more at: https://www.cnbc.com/2022/03/07/ukraine-news-mcdonalds-declines-to-comment-on-war-has-exposure-in-russia.html |

|

Michael Kors-parent Capri Holdings ditches CEO succession plan; shares fallJust months after he took on the role, Joshua Schulman will step down as CEO of the Michael Kors brand. He was slated to become Capri’s CEO later this year. Read more at: https://www.cnbc.com/2022/03/07/capri-holdings-shares-fall-after-michael-kors-parent-ditches-ceo-succession-plan.html |

|

Secretary of State Blinken tells NATO ally Lithuania ‘an attack on one is an attack on all’Blinken said there has been no decision on putting U.S. troops permanently in the Baltics amid concerns Russia will expand its attack beyond Ukraine. Read more at: https://www.cnbc.com/2022/03/07/us-will-defend-nato-baltic-states-against-russia-blinken-says.html |

|

Hold onto your wallets, gas prices are heading to an all-time record high. Here are a few ways to protect yourselfWith gas prices at a 14-year high, it’s hard to imagine paying even more at the pump. And yet, prices are heading higher, experts say. Read more at: https://www.cnbc.com/2022/03/07/gas-prices-are-heading-to-a-new-all-time-record.html |

|

Levi Strauss, a symbol of freedom in the Soviet era, suspends sales in Russia amid Ukraine warThe apparel company will also donate more than $300,000 to nonprofit organizations aiding Eastern European refugees. Read more at: https://www.cnbc.com/2022/03/07/ukraine-news-levi-strauss-suspends-sales-in-russia.html |

|

Moderna reaches preliminary agreement to build Covid vaccine manufacturing plant in AfricaModerna could fill Covid vaccine doses at the Kenya facility as early as 2023 subject to demand, according to the company. Read more at: https://www.cnbc.com/2022/03/07/moderna-reaches-preliminary-agreement-to-build-covid-vaccine-manufacturing-plant-in-africa.html |

|

Carnage Everywhere As Market “Begins To Break”Carnage Everywhere As Market “Begins To Break”There is no other way to describe today’s market carnage than a market in turmoil where things are rapidly breaking as commodity collateral is suddenly sparking contagion and liquidations. With S&P futures a one way elevator lower after a modest rip higher on Ukraine ceasefire optimism early in the session, sending spoos more than 120 points lower from session highs of 4,320, closing below 4,200 and down 2.9% to its worst close since October 2020…

… everything is in the red, with the exception of the defensive utility sector and of course energy which is basking in the glow of a historic move in the commodity space. Read more at: https://www.zerohedge.com/markets/carnage-everywhere-market-begins-break |

|

“The Market Is Totally Dysfunctional” – Traders Concerned Russian CDS Won’t Pay Out In Event Of Default“The Market Is Totally Dysfunctional” – Traders Concerned Russian CDS Won’t Pay Out In Event Of DefaultSince the start of Russia’s invasion of Ukraine, the financial press has been filled with stories about investors who are on the losing end of the historic selloff in Russian assets. There’s the Kentucky pension fund that lost millions on its position in Sberbank (Russia’s largest bank, which has decided to pull its European business due to sanctions, but was ironically excluded from the SWIFT “selective” ban), and the Russian trader who toasted to “the death of the stock market” during a Russian TV interview.

All because Russian equities have fallen by an absurd amount: the Dow Jones Russia GDR Index, an index designed to track the top Russian GDRs that trade on the LSE, plunged a mind-numbing 97% in just Read more at: https://www.zerohedge.com/markets/traders-concerned-russian-cds-wont-pay-out-even-if-default-occurs |

|

Will ‘Victory Gardens’ Make Comeback As Global Food Crisis Worsens?Will ‘Victory Gardens’ Make Comeback As Global Food Crisis Worsens?Spring in the northern hemisphere is two weeks away, and interest in planting gardens could rise as the breadbasket of Europe was choked off by the Russian invasions of Ukraine, jeopardizing global food exports resulting in skyrocketing prices. Even before the turmoil in Ukraine, American households were under pressure due to soaring food and gas prices. The invasion just made things a lot worse as commodity prices jumped the most last week since the stagflationary period of the mid-1970s. New UN global food price, released on Friday, showed global food prices in February surpassed a previous record set in 2011. About a quarter of the international wheat trade, about a fifth of corn, and 12% of all calories traded globally come from Ukraine and Russia. Food exports in the region have been halted due to conflict and sanctions. This leaves us with a shrinking global food supply that may further price increases. Since spring is just weeks away, Americans will be in for a shock at the supermarket as the latest round of food inflation makes it to the store shelves. To mitigate the impact of grocery bills tearing apart household finances — … Read more at: https://www.zerohedge.com/commodities/will-victory-gardens-make-comeback-global-food-crisis-worsens |

|

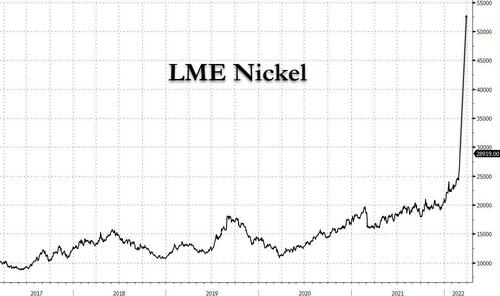

Nomura: Stuff Is Beginning To BreakNomura: Stuff Is Beginning To BreakOne look at today’s absolutely bananas explosion in LME Nickel prices which soared 82% in one day to a record $52,700…

… shows that commodities inflation panic was in full-swing earlier overnight, where war-related price-shocks are trading through what Nomura’s Charlie McElligott writes was “escape velocity” on likely stop-outs from “Shorts” (think commodity producers and traders who were short futures to hedge prices, similar to the margin call experienced by Peabody), and with the market seemingly realizing there is little that CB monetary policy can do to control it. Picking up on Zoltan Pozsar’s latest comments about a fractured commodity market, where “toxic” Russian commodities are no longer deemed viable collateral, potentially setting the stage for the next liquidity crisis, McElligott writes that “one doesn’t need to stretch their imagination too far to see how a commodities trading house that is long underlyin … Read more at: https://www.zerohedge.com/markets/nomura-stuff-beginning-break |

|

McDonald’s and Coca-Cola boycott calls grow over RussiaFood and drink giants have been criticised on social media for failing to speak out on Ukraine’s invasion. Read more at: https://www.bbc.co.uk/news/business-60649214?at_medium=RSS&at_campaign=KARANGA |

|

Oligarch who said sanctions wouldn’t help frozen out of firmInvestment firm LetterOne said Mikhail Fridman’s shareholdings had been “frozen indefinitely”. Read more at: https://www.bbc.co.uk/news/business-60645278?at_medium=RSS&at_campaign=KARANGA |

|

Ukraine conflict: Petrol at fresh record as oil and gas prices soarInvestors fear a global economic shock, with rising fuel bills causing more pain for households. Read more at: https://www.bbc.co.uk/news/business-60642786?at_medium=RSS&at_campaign=KARANGA |

|

Trade setup: Not the time not to take any directional bias for granted; cautious view advisedFor Tuesday and the rest of the week, Monday’s low point of 15,711 will be crucial to watch. If Nifty has to avoid further weakness, it will have to keep its head above 15,700 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-not-the-time-not-to-take-any-directional-bias-for-granted-cautious-view-advised/articleshow/90056660.cms |

|

Day Trading Guide: 2 stock recommendations for TuesdayBreaking below 33,000, Bank Nifty continued to trend lower. Stability at current levels could attract minor recovery. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/day-trading-guide-2-stock-recommendations-for-tuesday/articleshow/90055212.cms |

|

Market movers: That sinking feeling? Some stocks are bucking the trendOil and Natural Gas Corporation, which drills oil wells, has been on investors’ radar for some time now. The stock on Monday climbed further 13 per cent. Since the war broke out in Europe, the stock has risen 20 per cent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-that-sinking-feeling-some-stocks-are-bucking-the-trend/articleshow/90054433.cms |

|

The Tell: What soaring crude prices mean for the U.S. stock market, amid talk of Russian oil sanctionsSoaring oil prices aren’t the drag they used to be on the economy, but history shows sudden price shocks can still pose a danger to equities, says Capital Economics. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A46-004951BDB1F1%7D&siteid=rss&rss=1 |

|

Economic Report: Consumer credit grows in January at slowest pace in a yearThe amount of credit consumers took out in January grew by a scant $6.8 billion — the smallest increase in a year — signaling that households sharply reduced borrowing early in 2022. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A47-FE256479DD92%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘Her husband claims he knows nothing about it’: My late sister said I was named in her will. But her husband has not provided it. What now?‘He seems to be having a hard time letting go of her money that she wanted someone else to have after she passed.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A0C-BCF59D271555%7D&siteid=rss&rss=1 |